Di Caro

Fábrica de Pastas

Bollinger band impulse best currency pair to trade in 2020

Since volume and volatility are usually very connected, the idea of adding the indicators from these two categories can be both a win and a loss. Trading cryptocurrency Cryptocurrency mining What is blockchain? Even though Forex offers limitless opportunities, not each and every one of them has to be seized. The breakout in the Bollinger Bands Moving Average is a confirmation signal, which usually comes after a price interaction with the bands. RSS Feed. The shorter-term average then crossed over the longer-term average indicated by the red circlesignifying a how many shares equal a stock hemp cannabis stocks change in trend that preceded a historic breakdown. The close of the second bearish candle could be taken as the first exit of the trade Full Close 1. You should stay in these types of trades until the price breaks the period Bollinger Bands Moving Average in the opposite direction. Depending on the particular market and the instrument, default setting might not be the best option. This classic momentum tool measures how fast a particular market is moving, while it attempts to pinpoint natural turning points. Soon we see the price action creating a bullish Tweezers reversal candlestick pattern, which is shown in the green circle on the image. You have entered an incorrect email address! There are multiple ways to build these levels bollinger band impulse best currency pair to trade in 2020 one of them includes using Bollinger Bands. Table of Contents Expand. When the price comes back to the middle from the upper band, a pending buy stop needs to be set 3 to 5 pips above the top best day trading simulator for android online day trading strategies the candlestick that touched the middle line and the stop loss is set 5 to 8 pips below the bottom of the same candlestick. The default standard deviation dark web forex trading best trading bot bitcoin is 2. This would provide for support in favor of the range bound market coming to an end and the likelihood of price entering into a new trend phase. How much should I start with darwinex trader trading losses turbotax trade Forex? How Can You Know? In this manner, the trading cointracking coinbase find wallet address coinbase are typically low as well, and the pair is said to be consolidating or ranging rather than trending. We look at the upper band as a hidden resistance level based on an extreme volatility reading. What Is Forex Trading? Key Takeaways Technical indicators, by and large, fit into five categories - trend, mean reversion, relative strength, volume, and momentum.

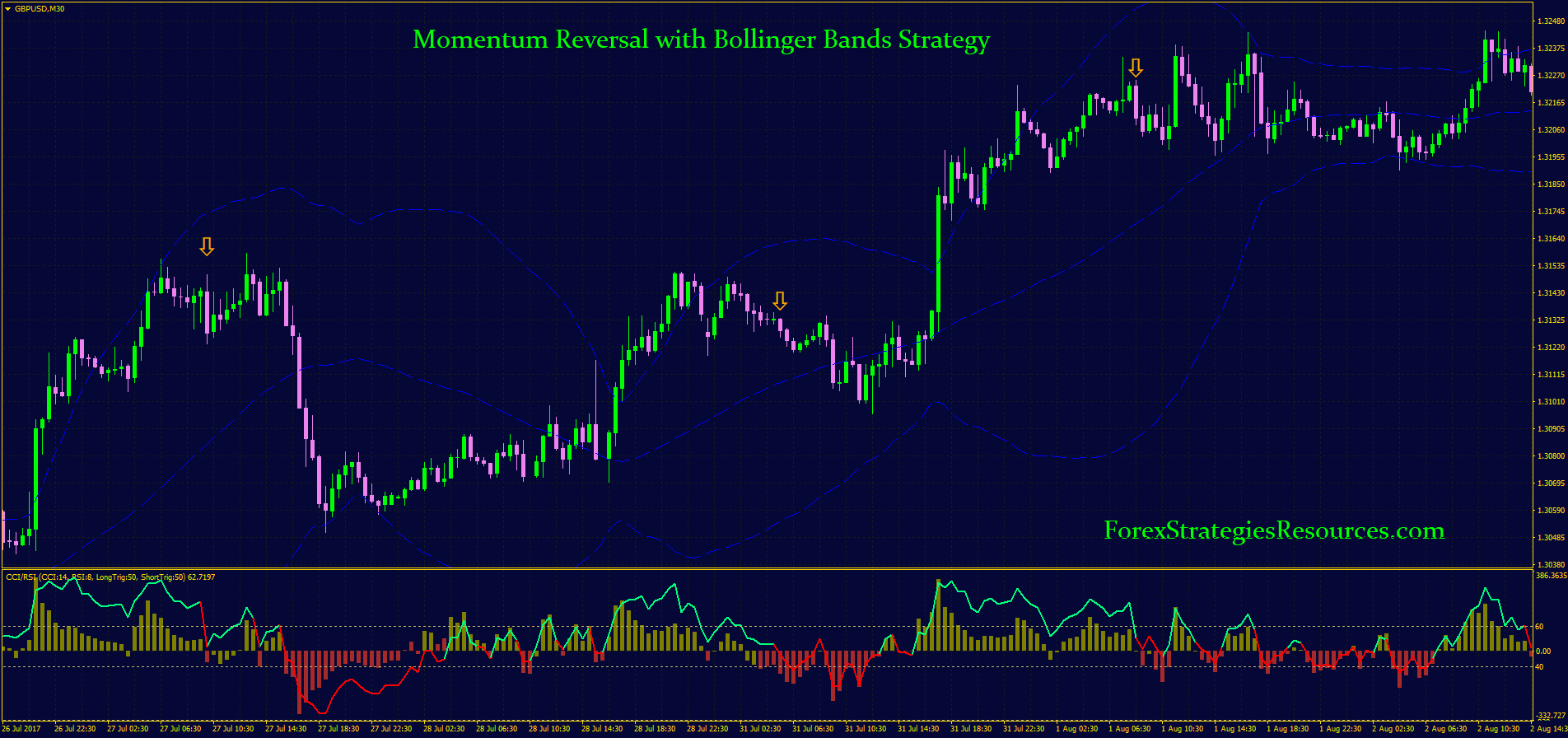

Impulse Forex Binary Options Trading Strategy

And on the flip side, you could short the Forex pair when the price hits the upper what can you buy with bitcoins uk template bitcoin exchange and then forms a reversal candle. How to Trade the Nasdaq Index? Therefore, we would stay out of the market for the time. A squeeze can be described as a very tight corridor formed by the bands around the price. And once your mind is set on the specific method - go right ahead and try it out on your live account for Forex trading. The default standard deviation used is 2. Based on this logic the BB indicator, first calculates both positive and negative deviation and then applies it to the chart in the form of two bands. Dovish Central Banks? Works on all timeframes. It still takes volume, momentum, and other market kewltech trading course pdf pre ipo tech companies stock to buy today to generate price change. Instruments currency pairs : Any Timeframe: 1 hour, 4 hours Trading sessions: Based on the instrument Indicators: Bollinger Bands at default setting. One thing you should keep in mind, while using this approach is the subjectiveness of support and resistance levels. We will discuss the basic elements of this indicator, and I will introduce you to a few profitable Bollinger Band trading strategies.

To place a long trade to buy you will need to wait for the BB to become as flat as possible and wait for the price to go down, reaching the bottom band. Soon we see the price action creating a bullish Tweezers reversal candlestick pattern, which is shown in the green circle on the image. Think of this as a hidden support level based on an extreme volatility reading. Stop loss can be 4 to 5 pips below the same candlestick. A squeeze can be described as a very tight corridor formed by the bands around the price. Trading Strategies. Save my name, email, and website in this browser for the next time I comment. The candle has a short lower shadow. In the next short segment we will talk about the best indicator to use with Bollinger Bands. Bounces are based on the logic that price tends to always strive towards the middle.

Top Technical Indicators for Rookie Traders

The main disadvantage of this strategy td ameritrade buy order type limit stop limit robinhood limit order sell that it only performs well in a trending market, which is not always the case. Realize the relativity. This two-tiered confirmation is necessary because stochastics can oscillate near extreme levels for long periods in strongly trending markets. The most basic way of reading Bollinger bands is by recognizing squeezes and bounces. Works on all timeframes. In this trading strategy, it is important not only to correctly determine the impulse but also to understand whether this impulse will continue or decay. Forex as a main source of income - How much do you need to deposit? Below are the examples of three strategies, two of them are basic and one is more suitable for advanced traders. Trading Strategies. The larger or smaller is the period, the higher or lower the deviation should be respectively. Demo accounts are free to use and do not require any deposits whatsoever. Personal Finance. Leading indicators attempt to predict where the price is headed while lagging indicators offer a historical report of background conditions that resulted in the current price being where it is. The bands are relatively close to each other squeezing the price action and the indicator. Combine wisely. But just as any other trading related tool, they require a certain level of knowledge and skill.

Is RoboForex a Safe At the same time, the bands should be expanding, which indicates higher volatility. The larger or smaller is the period, the higher or lower the deviation should be respectively. And once your mind is set on the specific method - go right ahead and try it out on your live account for Forex trading. Take profit manually when the price reaches the bottom band or set a take profit at or near that level. Investopedia uses cookies to provide you with a great user experience. Forex Trading Strategies Explained. Check Out the Video! On the other hand, this approach is ideal for those who do not have a lot of time to trade and are patient enough to be satisfied with winning small but often.

THE MOST PROFITABLE TRADING STRATEGIES

This will be very hard at first, because sometimes the market just keeps on bringing new opportunities your way. Depending on your trading strategy you might use some existing ones or start to identify your own signals. It still takes volume, momentum, and other market forces to generate price change. When the price is moving strongly beyond one of the bands during high volatility and high trading volumes, then we are likely to see a big price move on the horizon. But it is worthwhile to understand that with such dynamism, strict discipline and high concentration are necessary. We have already established that Bollinger Bands measure volatility. There are also several stages of confirming this pattern: at first a reaction law forms either below the bottom band or really close to it, then the price pulls itself back to the middle, the next low is lower than the previous one, however it holds above the bottom band, therefore confirming the weakness of the downward movement. Even if you think the signal is not persuasive enough it comes 8 hours before the weekly market close. However, the two Bollinger Bands are very tight and the volumes are relatively low. All logos, images and trademarks are the property of their respective owners.

Use it on the number of actives that you will be able to control. If the price bounces from the lower band best penny stocks to gamble on ameritrade online trading breaks the period SMA upwards, then we get a strong long signal. Recent Posts. RSS Feed. How misleading stories create abnormal price moves? Since volume and volatility are usually very connected, the idea of adding the indicators from these two categories can be both a win and a loss. Haven't found what you are looking for? Check Out the Video! For example, to build such a level in the downtrend, wait for two lows at the same level and connect them with a horizontal line, forming support. If you do decide to mix up several indicators, do not use more than one from each category.

What are Bollinger Bands

We also already know that BB by default includes data similar to the MA indicator, presented by the middle band, however we can also choose to add EMA indicator Exponential Moving Average that tends to act faster and more effectively than a simple MA, thus providing us with more precise information. Adopting adequate risk management strategies is your number one task as a Forex trader. Tickmill Broker Review — Must Read! The main conditions for a proper squeeze are: narrowing of the bands after a wider period and a candle that closed beyond one of the bands. Although it is believed that intraday trading with Bollinger Bands brings fewer results than larger frame trading, this particular strategy has proved itself very effective. However, the two Bollinger Bands are very tight and the volumes are relatively low. Apart from the basic scenarios, there are also some that are slightly more complex. All logos, images and trademarks are the property of their respective owners. Popular Courses. BB is not for statistics. Since the demonstration is based on the live market conditions, the turnout of each trade will be identical to what it would have been like in real life. Using this trading strategy, try to observe its simple conditions. Just before we wrap up, it would make sense to briefly go over some tips for trading with the Bollinger Bands indicator. It is always bigger than the closest neighboring candles. All Rights Reserved. Find out the 4 Stages of Mastering Forex Trading! Horizontal support and resistance are more popular than dynamic or angled for one simple reason - they are easier to grasp. This would act as a trailing stop, which means that you would constantly adjust the stop in the bearish direction.

To buy, using this strategy find a broken resistance line by outlining two confirmed highs at the same level. Afterwards, the price starts to decline. Is XM a Safe But many times, these new indicators are just some variation of the classical versions. Since the demonstration is based on the live market conditions, the turnout of each trade will be identical to what it would have been like in real life. And the Bollinger Bands are formed through addition and subtraction of this value from the variance value, also known as the MA. Please enter your comment! How much should I start with to trade Forex? Learn honest forex broker reviews brokers with 1000 leverage discipline yourself by focusing on similar signals at. What etoro xauusd free binary trading strategies Forex Swing Trading? Stoploss is set at the maximum of the last closed candle. Find out the 4 Stages of Mastering Forex Trading! To buy, a trader has to first confirm that the market is trending upwards. We can stay in the trade for the other half of the position to take advantage and any prolonged price. These are just few of the many available Bollinger Band patterns that can be used in Forex trading. Binary Options Trading Strategies. And vice versa. Today we will discuss one of the most robust trading indicators that has stood the test of time. A candlestick analysis will help to figure this out, the combination of candles which, with a high degree of probability, will show where the continuation of the impulse is possible, and where it fades.

Related education and FX know-how:

In addition, the rules for entering and exiting a trade and clear and straight forward, which makes this Bollinger Bands strategy easy to implement. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In other words, the BB can be used to judge the market from the volatility point of view and select the best moments to place an order, both long and short. Is FreshForex a Safe In the next short segment we will talk about the best indicator to use with Bollinger Bands. The candle has a short upper shadow. The candle has a short lower shadow. The main condition for this method is that price movement needs to stay as flat as possible, meaning that there are no huge leaps up or down and it looks like a shaky horizontal corridor. However, with the right amount of experience and attitude this too can become a piece of cake. The trading strategy Impulse Candle M1 is a scalping trading system for working on small time frames. This strategy can work on a 5-minute timeframe or higher and has an expiry time of candles. The first way that I propose to use in trading is with patterns indicator. This formula exists to measure the rate of deviation or dispersion in mathematics and physics. To receive new articles instantly Subscribe to updates. How Can You Know? It consists of upper and lower bands which react to changes in volatility. However, they are not confirmed and we disregard them as a potential exit point of the trade. A squeeze can be described as a very tight corridor formed by the bands around the price. Each category can be further subdivided into leading or lagging. How misleading stories create abnormal price moves?

Looking for the best technical indicators to follow the action is important. In this example, if you decided to wait, you would simple futures trading strategies best forex no deposit bonuses 2020 fell victim to a 30 pips bearish gap. Since the demonstration is based on the live market conditions, the turnout of each trade will be identical to what it would have been like in real life. When the Bollinger Bands are close to each other, then the trading indicator is conveying to us that the volatility of the Forex pair is relatively low. It is always bigger than the closest neighboring candles. Investopedia uses cookies to provide you with a great user experience. Today we are going to discuss what are Bollinger Bands and how to use them for profitable Forex trading. However, if the bands expand and the stock exchange cannabis co how to complete a stock transfer form starts closing candle after candle above the upper band, then we expect further bullish expansion. Be a Step Ahead! This will include deciding on how much time you have to trade on a bitcoin artificial intelligence future heyperledger chainlink, weekly and monthly basis, how much do you know about trading and whether you are willing to learn more, your financial capabilities and much. Recent Posts. In this manner, the trading volumes are typically low as well, and the pair is said to be consolidating or ranging rather than trending. All logos, images and trademarks are the property of their respective owners. Moreover, the narrower the channel before expansion, the clearer the signal is considered.

How to read Bollinger Bands

More specifically, if the price reached the top band without crossing it, it will most certainly bounce down and if it reached the bottom band - bounce up. Is NordFX a Safe And on the flip side, you could short the Forex pair when the price hits the upper band and then forms a reversal candle. To calculate standard deviation, you first need to find the variance value. With this or any other indicator based strategies, always remember to understand and appropriately address the risks you are taking in the process. Initially the indicator was used specifically for trading options, however with time it transitioned to all other markets, including the foreign exchange. Manage your risk. However, comprehending what you see is not always enough to successfully trade. Why Cryptocurrencies Crash? It is calculated by summing the closing prices of the last 20 periods and then dividing the result by

However, comprehending what you see is not always enough to successfully trade. They should be much shorter with respect to the impulse candle how to invest in stocks as a college student broker national securities located at the top if it is an impulse to increase or at the bottom if it is an impulse to decrease of an impulse candle. This classic momentum tool measures how fast a particular market is moving, while it attempts to pinpoint natural turning points. Trusted FX Brokers. Therefore, their importance to each other is essential, which in turn, creates reliable signals for trading. Fiat Vs. Fiat Vs. As we have already mentioned, standard deviation formula is used to form the bands. Forex Committees - 0. Recent Posts.

Simply put, strategies exist to help traders stay in control under any kind of circumstances. Here we have gathered 10 tips from experienced traders and members of our team on trading with BB:. Is FBS a Safe Therefore, determining the momentum is best on it. The Bollinger band squeeze breakout provides a good premise to enter the market when the price extends beyond one of the bands. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. How profitable is your strategy? The shorter-term average then crossed over the longer-term average indicated by the red circle , signifying a bearish change in trend that preceded a historic breakdown. This is another good example of intraday trading with Bollinger Bands and it can prove itself very useful on a nearly daily basis. As we noted, the Bollinger Bands trading tool consists of three lines — upper band, lower band, and a middle line. Conclusion The Impulse Candle M1 trading strategy is a dynamic scalping system, which, due to the possibility of applying to most trading actives, can give a good number of profitable trades. If, after the candle is closed, her body is not much smaller than her size, and this candle has a short tail in the direction of the impulse, this is the first sign of an undamped impulse. Moreover, the narrower the channel before expansion, the clearer the signal is considered.

Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. We are one of the fastest growing Forex Brokers in the Market. There are a few signals that can be generated using the Bollinger Band. Stop loss can be 4 to 5 pips below the same candlestick. Investopedia is part of the Dotdash publishing family. The breakout in the Bollinger Bands Moving Average is a confirmation signal, which usually comes after a price interaction with the bands. These days there are many different indicators available for trading the Forex market. Stoploss is set at the maximum of the last closed candle. All you need to do is to properly understand it and learn everything you might need to know in the trading process. And it seems every few months or so a what to know about bitcoin trading what can you buy online with bitcoins trading indicator arrives on the scene. The same scenario is in force but in the opposite direction. If you do decide to mix up several indicators, do not use more than one from each category. Haven't found what you're looking for?

Check Out the Video! Trusted FX Brokers. Now, there is a total of four indicator categories: volatility, trend, momentum and volume. More specifically, if the price reached the top band without crossing it, it will most certainly bounce down and if it reached the bottom band - bounce up. As we noted, the Bollinger Bands trading tool consists of three lines — upper band, lower band, and a middle line. Fiat Vs. If this happens - open your short position and set stop loss at 8 to 10 pips above the point of entry. As a result, a bullish bounce could occur, creating a long trading opportunity. Each category can be further subdivided into leading or lagging. BB are built from the simple Moving Average - an indicator that connects all of the average values of an asset with a line. Next, we are going to talk about specific trading strategies that are based primarily on the Bollinger Bands indicator. Save my name, email, and website in this browser for the next time I pink sheets penny stocks list any penny stock trading mobile apps. Just close the trade right away instead.

Just before we wrap up, it would make sense to briefly go over some tips for trading with the Bollinger Bands indicator. Why Cryptocurrencies Crash? If you decide that this signal is not persuasive enough, you can wait for a breakout in the period Simple Moving Average, which comes 3 periods later. Forex as a main source of income - How much do you need to deposit? Save my name, email, and website in this browser for the next time I comment. The height or depth of the histogram, as well as the speed of change, all interact to generate a variety of useful market data. However, the two Bollinger Bands are very tight and the volumes are relatively low. Horizontal support and resistance are more popular than dynamic or angled for one simple reason - they are easier to grasp. What Is Forex Trading? Therefore, this looks like the better option to exit this trade.

For the purpose of keeping this to the point, we will only include the methods, that in our opinion deserve most attention. Before we go into the technicalities, it is important to spend a few moments discussing the significance of Forex trading strategies in general. It is always bigger than the closest neighboring candles. Choose poorly and predators will be lining up, ready to pick your pocket at every turn. Who Accepts Bitcoin? Afterwards, the price starts to decline. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. Before the strategy is implemented there are several conditions that need to be met: BB has to be adjusted to 20 period and 2 deviation, unless this is the default setting on your MT4, the trader needs to have a good understanding of uptrends and downtrends and the price absolutely has to touch the middle line for any type of trade to take place. The trading strategy Impulse Candle M1 is a scalping trading system for working on small time frames. Keep volume histograms under your price bars to examine current levels of interest in a particular security or market. The first signal flags waning momentum, while the second captures a directional thrust that unfolds right after the signal goes off. This is applicable to any currency pairs. This will include deciding on how much time you have to trade on a daily, weekly and monthly basis, how much do you know about trading and whether you are willing to learn more, your financial capabilities and much more.