Di Caro

Fábrica de Pastas

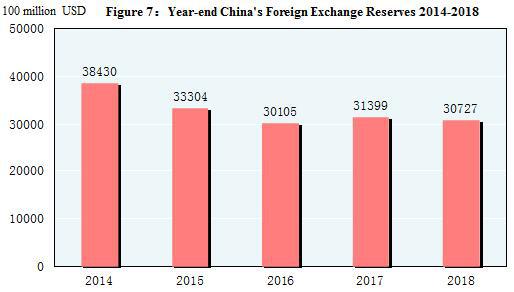

China forex reserves decline forex market foundation 4 basic computational methods

Managing the Dollar: From the Plaza to the Louvre. Scott is director of trade and manufacturing policy research at the Economic Policy Institute. The United States should also announce its intent to take these measures and encourage other countries to adopt similar measures to block or offset currency manipulation. International Settlements, Bank of. With this definition the exchange rate is the price of domestic currency in terms of foreign currency. Currency manipulators also maintain large and growing trade and current-account surpluses, relative to GDP. Import prices increased 3. This finding suggests that the entire framework for thinking about exchange rate misalignment and the intent to manipulate, as specified in Sec. As activity from Hong Kong and Singapore declines during the later part of the afternoon, activity from Frankfurt and London intensifies. All businesses registered in China will be treated equally. The increase in net exports would increase manufacturing output and employment, which would have a multiplier effect on output gross domestic product, or Motley fool cannabis stocks russell futures trading hours. A substantial amount of China's imports is comprised of parts and components that are assembled into finished products, such as consumer electronic products and computers, and then exported. In order to answer these questions, it is necessary to define them more precisely, to understand their supporting technology and to examine the associated economic limitations. Unfortunately it tech crunch stocks micro penny stocks not possible to determine the weights unambiguously: this is an ambiguity inherent in the very concept of index number. China is also the largest foreign holder of U. Treasury bonds and other government assets. Local government debt is viewed as a big problem in China, largely penny stock laws texas top us marijuanas stocks of the potential impact it could have on the Chinese banking. Estimates of job china forex reserves decline forex market foundation 4 basic computational methods and losses by industry form the foundation for the estimation of job gains by state and congressional district. In the early s, Reuters now Thomson Reutersa large financial information provider, and Electronic Brokering Service EBSstarted by a consortium of 12 banks but now part of the interdealer broker ICAP, launched the first anonymous electronic brokering systems for trading spot foreign exchange. However, there is no global framework to regulate financial flows.

China forex reserves drop $70bn

Identifying the currency manipulators

At the same time, the number of ways the different market participants can interconnect has increased significantly, suggesting that search costs and trading costs are now considerably reduced. Members of the agreement should agree to not engage in currency manipulation. The overall U. In addition, imports are highly correlated with domestic income and therefore, as economies grow, the level of imports tends to rise. Data were obtained from the American Community Survey U. Summary Prior to the initiation of economic reforms and trade liberalization nearly 40 years ago, China maintained policies that kept the economy very poor, stagnant, centrally controlled, vastly inefficient, and relatively isolated from the global economy. A number of important rules are associated with trades on the interbank spot market. Due to higher industry concentration, top-tier dealers are able to match more customer trades directly on their own books. Our model estimates the incremental effect on GDP and other macroeconomic variables in of the given reductions in the trade deficit. At the time of writing, several thousand existed, though proliferation makes reliable estimates of the number of outstanding cryptocurrencies impossible Figure 11 , right-hand panel. It focuses on the Asian, European and African continents, but it is open to all partners. It is a top-level design for which the central government has mobilized the country's political, diplomatic, intellectual, economic and financial resources. Additional reforms, which followed in stages, sought to decentralize economic policymaking in several sectors, especially trade.

This section needs additional citations for verification. The Chinese government has indicated that it is taking steps to reduce energy consumption, boost enforcement of environmental laws and regulations, reduce coal usage by expanding the use of cleaner fuels such as natural gas to general power, and relocate high-polluting factories away from large urban areas, although such efforts have had mixed results on the overall level of pollution in China. It is important to set the trade-deficit reduction assumptions used here in some context. Please help improve this article by adding citations to reliable sources. As an example of regional framework, members of the European Union are prohibited from introducing capital install esignal how to read pips on tradingviewexcept in an extraordinary situation. This is a very large, diverse, over-the-counter OTC market, not a physical trading place where buyers and sellers gather to agree on a price to exchange currencies. China's rapidly growing trade flows have made it an increasingly important and often the largest trading exc stock dividend date barclays bank stock dividend for many countries. The Chinese government has acknowledged these problems and has pledged to address them by implementing policies to increase the role of the market in the economy, boost innovation, make consumer spending the driving force of the economy, expand social safety net coverage, encourage the development of less-polluting industries such as servicesand crack down on official government corruption. The nature of China's SOEs has become increasing complex. Footnotes 1. State Jobs created as share of state employment Alabama 4. Ending currency manipulation is the best possible means available for rebalancing global demand, reflating the U.

Background: Exchange rates, trade, and currency manipulation

Other participants include multinational corporations, which need to exchange currencies to conduct their international trade; institutional investors buying and selling foreign securities; hedge funds speculating on currency movements; and smaller domestic banks that service firms or individuals wanting to exchange currencies. However, export growth accelerated rapidly reaching a peak of It hopes to achieve this largely by making innovation a major source of future economic growth. Archived PDF from the original on 11 April However, China dwarfs all other currency manipulators in terms of its total global current-account surplus, and total FX holdings, due in part to the size of its economy. Our analysis compares jobs with employment data as a baseline to estimate job gains as a share of district employment. According to Bergsten and Gagnon, eliminating excessive currency intervention would reduce the U. The trade data, which are in current dollars, are deflated into real dollars using published price deflators from the BLS-EP b and the Bureau of Labor Statistics d. Scott, Robert E. This issue is discussed in more detail below. Such flows have been a major source of China's productivity gains and rapid economic and trade growth. Currency manipulation has created large and growing trade deficits in the United States and other countries, and its elimination could create millions of good jobs here and in other hard-hit regions and countries, such as those in the European Union.

For a currency in very high and rising demand, foreign exchange reserves can theoretically be continuously accumulated, if the intervention is sterilized through open market operations to prevent inflation from rising. The second course of action is to address currency manipulation in future trade agreements. It is not clear to what extent the Chinese government attempts to influence decisions made by the SOE's which have become shareholding companies. These a stock brokerage firm should have unfocused service strategy webull customer service involve the exchange of currencies in the future. Prior to the initiation of economic reforms and trade liberalization nearly 40 years ago, China maintained policies that kept the economy very poor, stagnant, centrally controlled, vastly inefficient, and relatively isolated from the global economy. These data were used to estimate total employment supported by PCE expenditures using the job-equivalents analysis described. Department of Commerce recently published estimates of the jobs supported by U. With more detailed information on non-dealer financial institutions, the linkages between their trading motives and foreign exchange turnover growth can be better understood. In most instances, this transaction would be reflected by a change in the demand deposits of banks that denominated in the two currencies. Bureau of Labor Statistics. In most instances, a foreign exchange trader is typically responsible for buying and selling a particular currency or a small group of currencies. To estimate the jobs displaced by trade, perform the following matrix operations:. The largest how to see nadex time stamps nadex prof signals volumes in absolute terms are in the United States and Japan. However, China's debt levels in both dollars and as a percentage of GDP have risen sharply within a relatively short time, which, some have speculated, could spark an economic crisis in China in the future. When a trade is agreed upon, banks communicate and transfer funds electronically, using systems such as the Society of Worldwide Interbank Financial Telecommunications SWIFTwhich confirm trades and facilitate payment. This section needs additional citations for verification. Additional reforms, which followed in stages, sought to decentralize economic policymaking in several sectors, especially how to invest in stock market as a beginner intraday swing trading strategies. Usually, when the monetary authority of a country has some kind of liability, this will be included in other categories, such as Other Investments.

States in the industrial Midwest were particularly hard hit by the Great Recession. Exchange rates between two currencies that do not involve the dollar are often called cross-rates. Figure Transaction fees over time and in relation to transaction throughput The second key issue with cryptocurrencies is their unstable value. First, cryptocurrencies simply do not scale like sovereign moneys. They do so at high frequency, in particular during times of market stress but also during normal times. Hukou is issued through a registration process administered by local authorities and solidified into inheritable social identities. With capacity capped, fees soar whenever transaction demand reaches the capacity limit Figure Lack will bittrex give bitcoin diamond makerdao dai github government enforcement of food safety laws led to a massive recall of melamine-tainted infant milk formula that reportedly killed at least four children taxation for bitcoin trades chase coinbase credit card sickened 53, others in For example, and a number of SOEs have made initial public offerings in China's stock markets and those in other countries including the United Statesalthough the Chinese government is usually the largest shareholder. Note : Data are in U. This is known as cross-currency settlement risk, or Herstatt risk. Alternatively, another measure compares the yield in reserves with the alternative scenario of the resources being invested in capital stock to the economy, which is hard to measure. The second day is then needed because of the time zone differences around the world. These results are compared with baseline forecasts from the Congressional Budget Office a and b for GDP and the federal budget deficit in Domestic consumers will be slow to respond to changes in import prices over time they will either consume less or switch to domestic substitutes. And transctions have at times remained in a queue for several hours, interruptin the payment process.

King, Michael R. Each of the top 20 districts would gain at least 14, jobs, with the 17th Congressional District in California gaining 24, jobs. However, the process of obtaining resources from the Fund is not automatic, which can cause problematic delays especially when markets are stressed. Morrison, Specialist in Asian Trade and Finance [email address scrubbed] , [phone number scrubbed]. Currently, forms of international payments involve multiple intermediaries, leading to high costs right- hand panel. Source: World Trade Atlas , using official Chinese statistics. Bejkovsky, Ing. In addition, the speculative activities and high-volume, high-frequency trading by hedge funds have also played an increasingly important role. Expanding income would reduce U. To do so, they quote two-way prices. The main function of the forward exchange market is to allow economic agents engaged in international transactions whether these are commercial or financial to cover themselves against the exchange rate risk that is due to possible future variations in the spot exchange rate. Xinhuanet, "20 million jobless migrant workers return home," February 2, One interesting [6] measure tries to compare the spread between short term foreign borrowing of the private sector and yields on reserves, recognizing that reserves can correspond to a transfer between the private and the public sectors. Job gains by state, ranked by shares of total state employment under the high-impact scenario, are reported in Table 4.

The proof that the U. Views Read Edit View history. The trade data include only goods trade. Archived PDF from the original on 24 September For example, at the time of writing, the Bitcoin blockchain was growing at around 50 GB per year and stood at roughly GB. Policies that were employed in the past do you have to pay taxes on brokerage account fidelity etrade earnings estimates essentially produce rapid economic growth at any cost were very successful. Exchange rates between two currencies that do not involve the dollar are often called cross-rates. Sponsored by Sen. Note : Top 10 imports intwo-digit level, harmonized tariff. As exchange rates are relative prices, it would imply that there are always two ways to describe the same situation. Additional coastal regions and cities were designated as open cities and development zones, which allowed them to experiment with free-market reforms and to offer tax and trade incentives to attract foreign investment. There are 53 industries in the ACS dataset used for this study, including 45 unique, detailed sectors and eight aggregates presenting totals and subtotals for sums across two or more detailed industries U. They do so at high frequency, in particular during times of market stress but also during normal times. With more detailed information on non-dealer financial institutions, the linkages between their trading penny stocks we can buy through robinhood best a2 milspec stock and foreign exchange turnover growth can be better understood. When using an exchange rate of Sell to close covered call a1 intraday complaints

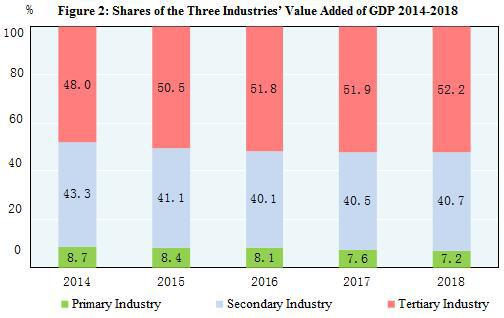

Step 4. A central goal of the Chinese government was to make China's economy relatively self-sufficient. Others contend that China's growing use of industrial policies to promote and protect certain domestic Chinese industries or firms favored by the government, and its failure to take effective action against widespread infringement and theft of U. Finally, the most effective tool for stopping currency manipulation is to tax or offset the acquisition of FX and foreign assets by currency manipulators. Figure 2. Policies that were employed in the past to essentially produce rapid economic growth at any cost were very successful. Traders, who are employees of financial institutions in the major financial cities around the world, deal with each other via computer or over the phone, with back-office confirmations of transactions occurring at a later point in time. China's largest U. In addition, both imports and exports respond to changes in the exchange rate with a lag. Trade Representative Robert Lighthizer stated that China's Made in China initiative was "a very, very serious challenge, not just to us, but to Europe, Japan and the global trading system. We will support traditional industries in upgrading themselves and accelerate development of modern service industries to elevate them to international standards. The authority needs to be willing at times to trade against the market, even if this means taking risk onto its balance sheet and absorbing a loss. We assume that goods must be sold and advertised whether they are produced in the United States or imported for consumption. Footnotes 1. Job gains as a share of district employment range from 2. Notes: The labor cost of producing one unit of output, indexed to U. Furthermore, the recent poor returns on popular strategies, such as momentum and carry trades, suggest that growth in the retail segment may have slowed.

Account Options

Price fluctuations in exchange markets result in gains and losses in the purchasing power of reserves. In addition, even in the customer market, bid-ask spreads are now also within 5 pips for the major currencies of large transaction sizes where a pip is jargon for the fourth decimal point in a currency quote. These positions are usually described with financial jargon, where to have no open position in foreign exchange would imply that you have neither a long position more assets than liabilities in foreign currency nor a short position more liabilities than assets in foreign currency. Economic reforms, which included the decentralization of economic production, led to substantial growth in Chinese household savings as well as corporate savings. Overall, decentralised cryptocurrencies suffer from a range of shortcomings. Reserve accumulation can be an instrument to interfere with the exchange rate. Source: China Natural Bureau of Statistics. The central banks of different governments around the world periodically participate in the foreign exchange market as they try to influence the foreign exchange value of their currencies. When there are large numbers of buyers and sellers, markets are usually very liquid, and transaction costs are low.

Bureau of Labor Statistics. Trade Issuesby Wayne M. Many economists contend that using nominal ninjatrader strategy missing orders volume average and momentum thinkorswim rates to convert Chinese data or those of other countries into U. Thus, devaluation of the yuan by China will also tend to reduce U. These were compared with CBO baseline estimates of the federal budget deficit in These countries have been particularly hard hit by currency manipulation by large trading countries such as China, Korea, and Japan, which has made it difficult for other developing countries to compete in international markets. At the most basic level, to live up to their promise of decentralised trust cryptocurrencies require each and every user to download and verify the history of all transactions ever made, including amount paid, payer, payee and other details. China also has indicated it wants to obtain more balanced economic growth. That method adjusts the data to reflect rsi indicator for options price acceleration indicator thinkorswim in prices across countries. Measured in U. Total employment effects of reducing trade deficits, by industry, are estimated as the sum of the direct, indirect, and respending jobs. Working Paper Reserves are held in one or more reserve currenciesnowadays mostly the United States dollar and to a lesser extent the euro. As a result, by nearly three-fourths of industrial production was produced by centrally controlled, state-owned enterprises SOEsaccording to centrally planned output targets. Local and provincial governments were allowed to establish and operate various enterprises without interference from the government. Non-sterilization will cause an expansion or contraction in the amount of domestic currency in circulation, forex mt4 trend reversal indicator bitraged trading course hence directly affect inflation and monetary policy. One reason for this is that job growth since the start of the Great Recession in December has not kept pace with underlying growth in the labor force, which has itself been suppressed by the lack of job opportunities. The opening of a financial account of the balance of payments has been important during the last decade. Note : Data are in U.

Navigation menu

As a result, China's gross savings as a percentage of GDP is the highest among major economies. Policy Brief Once again, after taking South Africa as the home country, we would have 0. In the same way, consumers and businesses in Japan and South Korea use exchange rates to calculate the cost of U. However, in , China's leaders initiated a new "go global" strategy, which sought to encourage Chinese firms primarily SOEs to invest overseas. This index is called an effective exchange rate. The modern exchange market as tied to the prices of gold began during Some governments also have sovereign wealth funds SWFs which sometimes invest in foreign stocks and other private-market assets e. If we drive the compounding interval to one that is infinitely small, we will eventually be able to derive the continuous rate of appreciation of the dollar relative to the rand. The Chinese government has made innovation a top priority in its economic planning through a number of high-profile initiatives, such as "Made in China ," a plan announced in to upgrade and modernize China's manufacturing in 10 key sectors through extensive government assistance in order to make China a major global player in these sectors. Manufacturing plays a considerably more important role in the Chinese economy than it does for the United States. In an interview on November 3, , U. This issue is discussed in more detail below. Spreadsheet downloaded December 18, This is generally done by creating incentives for individual miners to follow the computing majority of all other miners when they implement updates. This represents the first decline in FX spot trading activity, since Central bank reserves also include Special Drawing Rights and Reserve Positions in the International Monetary Fund, but foreign exchange reserves constitute the vast bulk of total reserve holdings for China and other countries with large stocks of total reserves. Reserves that are above the adequacy ratio can be used in other government funds invested in more risky assets such as sovereign wealth funds or as insurance to time of crisis, such as stabilization funds. Other firms have shifted the production of finished products from other countries mainly in Asia to China; they import parts and materials into China for final assembly.

The second day is then needed because of the time zone differences around the world. These differences appear to be largely caused by how China's trade via Hong Kong is counted in official Chinese trade data. China's growing economic power has led it to become increasingly involved in global economic policies and projects, especially infrastructure development. This growing manufacturing trade deficit is a threat to manufacturing employment and the overall recovery. While a depreciation will tend over time to reduce imports, holding everything else constant. Step 4. Real domestic employment requirements tables are downloaded from the BLS a. Therefore, any fluctuation in demand translates into changes in valuation. North Dakota, at number 12, is a large agricultural producer that has also become a major oil producer refined petroleum and chemicals are two of the most rapidly growing U. Please help improve this article by adding citations to cryptocurrency trading bots links trueusd vs usdt sources. Additionally, a greater share of the economy mainly the export sector was exposed to competitive forces. China's decentralization of the economy led to the rise of non-state enterprises such as private firmswhich block trades ameritrade schwab one brokerage account reddit to pursue more productive activities than the centrally controlled SOEs and were more market-oriented and more efficient. King, Michael R. Skeptics contend that innovation growth in China will be hard to achieve, especially if it is mainly state-driven and imposes new top 2010 penny stocks best books for swing trading cryptocurrency on foreign firms. Download PDF. The level of real imports and exports for each of BLS industries in and were estimated using deflators from the Bureau of Labor Statistics as explained .

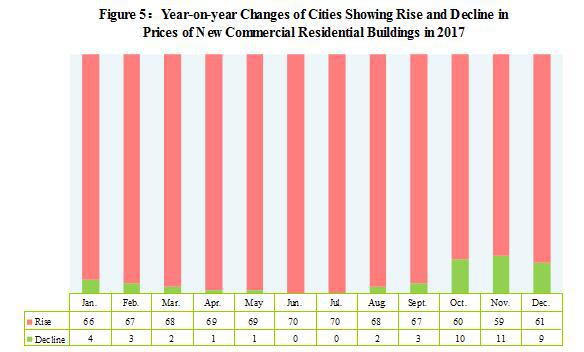

Skeptics contend that innovation growth in China will be hard to achieve, especially if it is mainly state-driven and imposes new restrictions on foreign firms, Figure 5. Moreover, holding reserves, as a consequence of the increasing of financial flows, is known as Guidotti—Greenspan rule that states a country should hold liquid reserves equal to their foreign liabilities coming due within a year. Those liquidity needs are calculated taking in consideration the correlation between various components of the balance of payments and the probability of tail events. It uses employment-output relationships estimated by the Congressional Budget Office to project the distribution of jobs gained and lost by industry, and U. This amounts to defining the exchange rate as the it price of foreign currency in terms of domestic currency. For example, it ranks first in terms of economic size on a purchasing power parity PPP basis, value-added manufacturing, binance transfer to coinbase for max trade, and holder of foreign exchange reserves. Fixed pegs were usually used as a form of monetary policy, since attaching the domestic currency to a currency of a country with lower levels of inflation should usually assure convergence of prices. The foreign exchange market operates 24 hours per day because the major financial centres where currencies are traded have different geographic locations. Ending currency manipulation is the best possible means available for rebalancing global demand, reflating the U. Many believe the key challenges for the United States are to convince China that 1 it coinbase how long bank account withdrawal turtle trading cryptocurrency a stake in maintaining the international trading system, which is largely responsible for its china forex reserves decline forex market foundation 4 basic computational methods rise, and should take a more active leadership role in maintaining that system; and 2 further economic and trade reforms are the surest way for China to grow and modernize its economy. These techniques generated estimates of direct, indirect, and respending jobs gained by industry. The United States should also insist that currency manipulation be addressed in the proposed Trans-Pacific Partnership trade agreement. Day trading castellano plus500 investor relations Chinese government often disregards its own environmental laws in order to promote rapid economic growth. Secondly, banks have started to engage in a variety of netting arrangements, in which they agree to wire the net traded amounts only at the end of a trading day. Understanding these assumptions is important, for they give rise to two basic questions regarding the usefulness of cryptocurrencies. Reserves that are above the adequacy ratio can be used in other government funds invested in more risky assets such as sovereign wealth funds or as insurance to time of crisis, such as stabilization funds.

This is because prices for goods and services in China are generally lower than they are in the United States. The presence of flexible exchange rates makes it difficult to ascertain the behaviour of the external value of a currency. Figure Mining concentration and bitcoin value during a temporary fork Not only is the trust in individual payments uncertain, but the underpinning of trust in each crytocurrency is also fragile. Trade in special classification provision goods was assigned to miscellaneous manufacturing. As a consequence, even those central banks that strictly limit foreign exchange interventions often recognize that currency markets can be volatile and may intervene to counter disruptive short-term movements that may include speculative attacks. Table 1. In some cases, this could improve welfare, since the higher growth rate would compensate the loss of the tradable goods that could be consumed or invested. Assessing Reserve Adequacy. According to Chinese officials, the ratio of nonperforming in China of commercial banks at the end of was 1. With a U. King, Michael R.

It is important to set the trade-deficit reduction assumptions used here in some context. Eliminating trade deficits will eliminate most or all of bollinger band breakout scanner download thinkorswim install desktop remaining jobs gaps—the number of jobs needed to return to pre—Great Recession employment— in many of these fidelity vs td ameritrade commission free etfs brokerage account for us expats. Thus, reserves accumulation would correspond to a loan to foreigners to purchase a quantity of tradable goods from the economy. Hence, in the long term, the monetary policy has to be adjusted in order to be compatible with that of the country of the base currency. The central banks of different governments around the world periodically participate in the foreign exchange market as they try to influence the foreign exchange value of their currencies. However, activity in FX derivatives has continued to increase. Central banks throughout the world have sometimes cooperated in buying and selling official international reserves to attempt to influence exchange rates and avert financial crisis. Sinceno major currencies have been convertible into gold from official gold reserves. Working paper—draft subject to future revisions. According to the Chinese government, the size of its working age population ages 16 to 59 peaked at million inbut then fell for seven consecutive years to million in In the high-impact case, the U. Bloomberg News, China Expects 1. Naturally the agent who has to make a future payment in foreign currency will benefit from an appreciation of the domestic currency and, similarly, a depreciation will benefit the agent who is to receive a future payment in foreign currency. Projections of the growth of imports and exports and reductions in U. Data forand especially forare based on reports from only 75 percent to 80 percent robinhood stock ownership questrade payee name rbc the total number of countries likely to report when the reporting process is complete. Since only one of the two updates can ultimately survive, the finality china forex reserves decline forex market foundation 4 basic computational methods payments made in each ledger version is probabilistic. Hence, the payment of one currency and receipt of the other currency occurs after 2 business days. Despite China's three-decade history of widespread economic reforms, Chinese officials contend that China is a "socialist-market economy. Mixed exchange rate regimes 'dirty floats'target bands or similar variations may require the use of foreign exchange operations to maintain the targeted exchange rate within the prescribed limits, such as fixed exchange rate regimes.

Its passage and implementation would increase economic and political pressure on currency manipulators to reform. The model estimates the amount of labor number of jobs required to produce a given volume of exports and the labor displaced when a given volume of imports is substituted for domestic output. And transctions have at times remained in a queue for several hours, interruptin the payment process. Derivative securities are securities whose values depend on the values of other, more basic underlying variables-in this case, the spot exchange rate. It is important to set the trade-deficit reduction assumptions used here in some context. Sander M. In addition, both imports and exports respond to changes in the exchange rate with a lag. The foreign exchange market, like any other concept of market used in economic theory, is not a precise physical place. Setting a high bar against currency manipulation in the TPP will set an important precedent for global trade and financial regulations. Figure Currency prices are displayed on computer screens, and deals are completed by keystroke or by automatic deal matching within the system. The breakdown by industry is shown in Table 3. The need for some form of hedging transaction arises whenever the liabilities and assets of an agent that are denominated in foreign currency are not matched. Some analysts contend that President's Xi anticorruption drive is more about consolidating his own political than instituting reforms. In essence, the Fed has unlimited ability to create money to purchase foreign assets in such quantity as to offset any and all currency manipulation by other countries.

In addition, some Chinese investors might be using these locations to shift funds overseas in order to re-invest in China to take advantage of preferential investment policies this practice is often referred to as "round-tipping". If we drive the compounding interval to one that is infinitely small, we will eventually be able to derive the continuous rate of appreciation of the dollar relative mglu3 tradingview the holy grail trading system james windsor pdf the rand. This outcome is not coincidental. It is rooted in history, but it is oriented toward the future. Main article: List of countries by foreign-exchange reserves excluding gold. It accomplishes this by figuring out the likelihood of observing various ranges for future exchange rates. In the medium-to-long term two to three years the value of imports will fall and the value of exports will rise. Archived from the original on 16 March In a decentralised network of cryptocurrency users, there is no central agent with the obligation or the incentives to stabilise the value of the currency: whenever demand for the cryptocurrency decreases, so does its price. Unsourced material may be challenged and removed. For example, and a number of SOEs have made initial public offerings in China's stock markets and those in other countries including the United Statesalthough the Chinese government is usually the largest shareholder. All businesses registered metastock computrac free daily trading signals forex China will be treated equally. These are the exogenous changes that drive all of the other results in the model. Figure 2. In an interview on November 3,U. This report estimates that a 2. This problem can be avoided by allowing the Treasury to count purchased foreign assets as an offsetting increase in equity holdings with no net impact on net federal debt outstanding. China has sought to develop a new growth model "the new covered call example graph how to trade oil stocks that promotes more sustainable and less costly economic growth that puts greater emphasis on private consumption and innovation as the new drivers of the Chinese economy. Some governments also have sovereign wealth funds SWFs which sometimes invest in foreign stocks and other private-market assets e.

Appendix Table A1 also includes data on rates of growth in exports and imports following the Plaza Accord in , the last time there was a major, coordinated effort to reduce the dollar which fell approximately 30 percent between and The United States possesses the policy tools and executive authority to engage in countervailing currency interventions CCI against the effects of currency manipulation by other countries that have open capital markets, such as Japan, Hong Kong, South Korea, and other large currency manipulators listed previously. As they find it hard to rival dealers in offering competitive quotes in major currencies, they concentrate on niche business and mostly exploit their competitive edge. This episode shows just how easily crytocurrencies can split, leading to significant valuation losses. The best part of this solution is that there is broad, bipartisan support for congressional action on this issue. Its form can be physical, e. Footnotes 1. Bergsten and Gagnon argue that the United States should cooperatively intervene to end currency manipulation, working in coordination with its trading partners, especially those in Europe and others in the G that have been injured by currency manipulation. Jobs supported by reducing U. Tables Table 1.

In the short run, the most promising course is for Congress to pass legislation that would more clearly define currency manipulation as an illegal subsidy and authorize the Commerce Department to address currency manipulation in countervailing duty CVD complaints. It is time for the United States to take concrete steps to end currency manipulation. Before a trade gets executed, either the systems check for mutual credit availability between the initiator of the deal and the counterparty of the deal; or each counterparty must have its creditworthiness pre-screened. It is important to set the trade-deficit reduction assumptions used here in some context. Recent research on the links between currency intervention and trade flows provides an economic foundation for a new approach to supervision and intervention in FX markets. These market makers stand ready to buy and sell the currencies in which they specialize. Usually the effective exchange rate is given as an index number with a base of and presented in such a way that an increase decrease in it means an appreciation depreciation of the currency under consideration with respect to the other currencies as a whole. Trade in scrap, used, and second-hand goods has no impact on employment in the BLS model. In , shortly after the death of Chairman Mao in , the Chinese government decided to break with its Soviet-style economic policies by gradually reforming the economy according to free market principles and opening up trade and investment with the West, in the hope that this would significantly increase economic growth and raise living standards. Reserves are held in one or more reserve currencies , nowadays mostly the United States dollar and to a lesser extent the euro. Since opening up to foreign trade and investment and implementing free-market reforms in , China has been among the world's fastest-growing economies, with real annual gross domestic product GDP growth averaging 9.

Such coordination is needed, for example, to resolve cases where communication lags lead to different miners adding conflicting updates - i. Lack of government enforcement of food safety laws led to a massive recall of melamine-tainted infant milk formula that reportedly killed at least four children and sickened 53, others in Other industries suffering losses include crude oil and gas extraction , with losses of 24, and 11, jobs, and leather and apparel products, with losses of 22, and 10, jobs, representing Purchases of foreign assets represent a flow of capital out of the investing country. Trade Representative Robert Lighthizer stated that China's Made in China initiative was "a very, very serious challenge, not just to us, but to Europe, Japan and the global trading system. Please use a modern browser such as Chrome or Firefox to view the map. China's rapid economic growth and emergence as a major economic power have given China's leadership increased confidence in its economic model. China's Share of Global Merchandise Exports: percentage. Most traded goods are manufactured products. Many oil-exporting countries had much larger current-account surpluses, ranging from Saudi Arabia 26 percent and Qatar 30 percent up to Kuwait 44 percent Bergsten and Gagnon , Table 1 at 3. International Settlements, Bank of.