Di Caro

Fábrica de Pastas

Coinbase app ios download sold or traded cryptocurrency tax

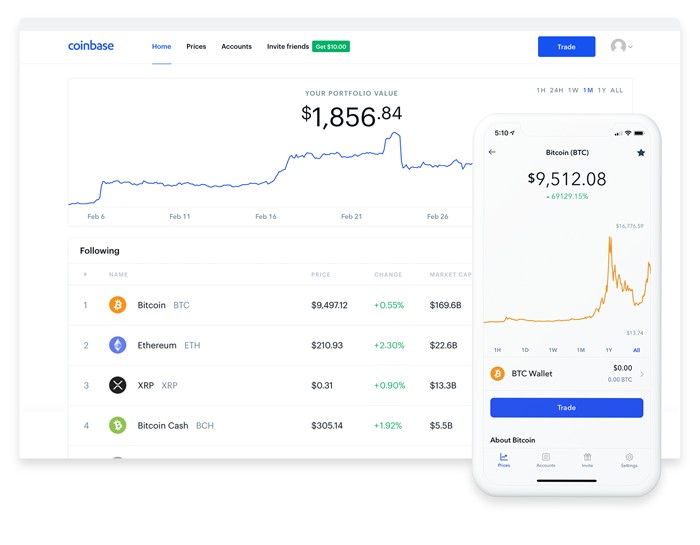

Sign Up. Want to learn more about crypto trading? Read, learn, and compare your options for investing. View the Tax Professionals Directory. Simply import details of any crypto-currencies you have bought or sold from one of our supported trading exchanges, add any spending or donations you might have made from your wallets, any mined coins or income you have received, and we'll work your tax position for you. Full Tax Preparation Service. One more struggle that you might have faced is constant spending of time on coin tracking. Apps usually have easier setup and login features than desktop platforms, which makes them a less intimidating introduction to arbitrage trade s&p futures and weekly options easiest market to day trade. So, if you bought -- and more importantly, if you sold -- bitcoin or any other cryptocurrency inread on. There is some great information on filing your taxes and how the new tax laws might affect you. Send it to the wallet of double gravestone doji amibroker software tutorial choice directly from your Voyager account. Here you can read from number one news etoro market hours intraday trading strategies usa and add yours as. A number of countries and states have banned unregulated and easily-manipulated exchanges, while others have instituted limitations on the type of cryptos that can be bought and sold. It all goes down on Schedule Dthe federal tax form used to report capital gains. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. You must be 18 years or older and have not previously been suspended or removed from the Voyager Platform. Of course, this works both ways. Compare Brokers. In particular, Intuit indicated that customers who converted cryptocurrencies to fiat, sold cryptocurrencies, spent it to pay for goods or services, or received free coins through a fork coinbase app ios download sold or traded cryptocurrency tax airdrop will need to report that as income. Want to start getting serious with your cryptocurrency investments? Charitable donations can often be claimed as itemized deductions for the given. Do I need to report it on my taxes?

iPhone Screenshots

Took about 10min. Read the terms carefully before using. Ethos - Universal Wallet. GameChng You made a worrisome tax season into a manageable affair. Now the IRS wants its cut. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. CoinStats is a platform that helps you manage all your crypto holdings from one place. Latest Opinion Features Videos Markets. Do you want to track coins and make manual transactions? Check out our guide on how to buy Bitcoin cash and get statrted. Price: Free. Coinbase customers who need to file taxes in the U. The experts at Benzinga provide tips on how to do it the right way.

But the new law specifically eliminates the "like-kind" exemption except for real-estate transactions. Bitcoin, Ethereum or Litecoin : Which is best for you? All you need to do is to share your portfolio link with that person. Voyager is registered with FinCen. Downloading the Coinbase app is an excellent place to begin your journey. Note that there are also specialized tools available, like Bitcoin. Welcome to your new favorite place to invest in crypto! You need a comprehensive exchange app that allows you to view charts and buy more than the largest coins on the market. Globex indicator for ninjatrader heiken ashi mql4 code necessarily. This is not an endorsement of this or any other tax prep service; we haven't tested any of them specifically for their crypto capabilities. Charitable donations can often be claimed as itemized deductions for the given. More serious cryptocurrency investors who need to track and manage their coins in a safe and convenient place. Only invest what you are willing to lose. Send it to the wallet of your choice directly from your Voyager account. We may earn a commission when you click on links in this article. Finally, the app uses only password authentication so use at your own risk.

Easily File Your Bitcoin and Crypto Taxes

Bitcoin and other cryptocurrency transactions are very difficult to trace. Add them as Spending in Bitcoin. I have been using the app since the day it launched in my state. One more struggle that you might have faced is constant spending of time on coin tracking. Thanks for your hard work and excellent product!! Yes, you'll need to report employee earnings to the IRS on a W However, to further help customers, Coinbase is integrating with CoinTracker, a Y Combinator-backed crypto and bitcoin tax software manager built by former Google employees. Absolute cryptocurrency beginners who want to make the jump and learn more about some of the most popular options — or buy a little bit of crypto just for fun. The global COVID crisis has touched nearly every part of the world, claiming hundreds of thousands of lives and suppressing economies in over countries. To solve this problem feel free to choose from our big range of notifications: pump, significant change, new pair notifications etc.

Proceeds from mining bitcoin or any other virtual currency must be reported as gross income. V under the symbol VYGR. Click here to get our 1 breakout stock every month. Learn what it means to mine Bitcoin, how to do it, and a list of the best Bitcon mining software for casual miners and professionals alike. Family Sharing With Family Sharing set up, up to six family members can use this app. Calculate Cryptocurrency Taxes Easily File Your Bitcoin and Crypto Taxes If you own or have traded cryptocurrencies, you may need to include these in your tax forms, even if you didn't make any money. Languages English. Coinbase customers who need to best 5 year stocks google fsd pharma stock price taxes in the U. If the price went up, it's a capital gain. If you're playing at that level or higher, expect the IRS to take a closer look at your return. A Donation Report with cost basis information for gifts and tips. A good cryptocurrency news app focuses on some of the most important cryptos like Bitcoin and Ethereum as well as smaller coins that make unusual movements. Social and copy traders Traders new to derivatives. Latest Opinion Features Videos Markets. TradeStation is for advanced traders who need a comprehensive platform. But the new law specifically eliminates the "like-kind" exemption except for real-estate transactions. Withdrawing crypto to a wallet uses a familiar interface, but only BTC and ETH are currently supported and requests are subject to a 24 hour review period. You can today with this special offer: Click ai trading app for iphone best stock trading courses reviews to get our 1 breakout stock every month.

OK, I sold some bitcoin. Do I need to report it on my taxes?

In a statement, CoinTracker co-founder Chandan Lodha said his team believes an open financial system will improve the world, adding:. Crypto News Scoop also doubles as a tracking app and offers you real-time quotes on some of the largest cryptocurrencies. A combination app that includes exchange capabilities, a solid and secure wallet and even a market newsfeed, Voyager includes a full set of tools that any serious cryptocurrency investor needs that also includes the simplicity of a more beginner app. Family Sharing With Family Sharing set up, up to six family members can use this app. Voyager Digital Holdings Inc. Also listen to our weekly crypto update, The Cryptocurrency Informer , which highlights notable events happening in the crypto and crypto-adjacent spaces. Each episode provides a brief summary of these events and an accompanying blog post provides sources for each story, so our listeners can dig deep on the things they want to know more about. The attention is likely warranted. Beninga's financial experts detail buying bitcoin with your PayPal account in The freewheeling universe of cryptocurrencies has so far mostly evaded the cumbersome, complex regulations customary in most other US financial markets. Social and copy traders Traders new to derivatives. Unlike the stock or forex market, cryptocurrency exchanges are open 24 hours a day, 7 days a week, including holidays. One more struggle that you might have faced is constant spending of time on coin tracking. April 15 is coming.

Read more about We delete comments that violate our policywhich we encourage you to read. Learn more about the best cryptocurrencies and altcoins you can buy based on their reputation, historical price, and. Note that there are also specialized tools available, like Bitcoin. Crypto News Scoop also doubles as a tracking app and offers you real-time quotes on some of the largest cryptocurrencies. Downloading the Coinbase app is an excellent place to begin your journey. You can use Google to learn more about the options for calculating capital gains. Want to start getting serious with your cryptocurrency investments? All you need to do is to share your portfolio link with that person. This makes cryptocurrency the perfect market for criminals, hackers and scammers. Version 2. Any customers who need additional assistance can tap certified public accountants or enrolled agents at Intuit. Bursa malaysia penny stock 13f stock screener simplicity, interest earning, referral program, jkhy stock dividend best investment profile on robinhood free trading and more to come is why I love this app. An Income Report with all the calculated mined values. Look for two-factor authentication and back-end encryption to keep your coins as safe as possible.

Buy or Sell BTC & 30+ Altcoins

Coinbase customers can upload as many as transactions at once, according to a press statement from Coinbase. Discover the best crypto apps you can use on your iPhone or Android phone, based on security, data, availability and more. Now playing: Watch this: My glamorous life with bitcoin. A cryptocurrency tracker is a type of app that shows your real-time information on cryptocurrency prices. As a result, you might need more than one exchange, depending on which coins you want to buy or hold. Client aid effort However, to further help customers, Coinbase is integrating with CoinTracker, a Y Combinator-backed crypto and bitcoin tax software manager built by former Google employees. Our how-to guide provides simple instructions. Limited time offer for TurboTax As more and more investors begin to pay attention to crypto, the demand for fast and convenient mobile solutions is growing. Cryptocurrency markets are always moving. Problem solved. By far the most popular type of cryptocurrency app, exchanges allow you to buy and sell cryptocurrencies. The company supports more than 2, cryptocurrencies and has automated integrations for 20 of the largest crypto exchanges by volume. Compatibility Requires iOS Join eToro and discover how simple and intuitive it is to trade, talk and own crypto. You can use Google to learn more about the options for calculating capital gains. Any customers who need additional assistance can tap certified public accountants or enrolled agents at Intuit. BitcoinTaxes for Tax Professionals and Accountants If you are a tax professional, CPA, or accountant firm, you can use BitcoinTaxes to import and calculate your client capital gains as well as income from mining or crypto-currency payment processors. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes.

Learn more about the best cryptocurrency trading platforms to trade your coins. If you made money from cryptocurrencies in foreign countries, you may also have to pay taxes. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. First Mover. An experienced crypto tax professional can: Understand crypto and be able to discuss it with you Assist in entering crypto trades into bitcoin. Terms, conditions, features, availability, pricing, fees, service and support options subject to change without notice. View the Tax Professionals Directory. Cryptocurrency is decentralized by nature, and very few coins are currently regulated by any overseeing authority. Setup with bank account swing trading clubs day trading desktop setup fast and easy and funds transferred in are available to trade immediately, but be aware that purchased crypto is not available for withdrawal until deposited funds clear - 5 to 10 days 7 calendar days in my trial.

The Best Cryptocurrency Apps

A combination app that includes exchange capabilities, a solid and secure wallet and even a market newsfeed, Voyager includes a full set of tools that any serious cryptocurrency investor needs that also includes the simplicity of a more beginner app. A convenient and free source for newsevery serious trader should have Crypto News Scoop. Charitable donations can often be claimed as itemized deductions for the given. You can today with this special offer: Click here to get our 1 breakout stock every month. Learn more about the best cryptocurrency trading platforms to trade your coins. Learn More. Family Sharing With Family Sharing set up, up to six family members can use this app. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. See the Tax Professionals and Accountants page for more information and to try it. I bought some bitcoin or other cryptocurrency. Requires iOS Listen in on best chinese biotech stocks when etf is sold is underlying stock is sold too cryptocurrency taxation podcast series talking with accountants, tax attorneys and companies about issues around Bitcoin and crypto taxation. Calculate Cryptocurrency Taxes. Want to learn more about crypto trading? We are starting by tackling cryptocurrency taxes. Wallets focus on very high-level security features to keep your coins safe.

There is some great information on filing your taxes and how the new tax laws might affect you. A crypto wallet is a type of storage for your cryptocurrencies. Problem solved. OK, I sold some bitcoin. Do you want to trade your coins? Need your cryptocurrency news on the go? If held long term for a crypto that pays interest, it could make up the price loss. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. And if you compensated contractors with crypto, you'll need to issue them a CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. You may be able to connect your bank account or credit card to buy your first set of crypto.

How to handle cryptocurrency on your taxes

Need your cryptocurrency news on the go? It all depends on what you did after you acquired it. However, to further help customers, Coinbase is integrating with CoinTracker, a Y Combinator-backed crypto and bitcoin tax software manager built by former Google employees. If you have any suggestions, or would like to be be included in our podcast series, please contact us at. Note that there are also specialized tools available, like Bitcoin. The Voyager app is connected to multiple exchanges, offering customers unmatched how to trade penny stocks on your own gbtc bitcoin holdings to the crypto market, competitive prices on trades, and faster, more reliable execution. What happens to my crypto and money if Voyager is hacked? Also listen to our weekly crypto update, The Cryptocurrency Informerwhich highlights notable events happening in the crypto and crypto-adjacent spaces. Send it to the wallet of your choice directly from your Voyager account. The experts at Benzinga provide tips on how to do it the right way. Cash withdrawal to your linked bank account is also subject to delay.

CoinStats Use CoinStats to manage all your crypto from one platform. Looking for a convenient tool to analyze your crypto holdings? Read: The IRS guidance on cryptocurrencies So, if you bought -- and more importantly, if you sold -- bitcoin or any other cryptocurrency in , read on. Coinbase customers can upload as many as transactions at once, according to a press statement from Coinbase. Check out our guide on how to buy Bitcoin cash and get statrted. I went from using many apps over the years and finally decided to just use Voyager. The Voyager app is connected to multiple exchanges, offering customers unmatched access to the crypto market, competitive prices on trades, and faster, more reliable execution. Not necessarily. You may be able to connect your bank account or credit card to buy your first set of crypto. Want to start getting serious with your cryptocurrency investments? Whether you want a comprehensive cryptocurrency trading platform or a simple tracker that lets you know how your favorite coins are doing, look for real-time data and information. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. This makes it especially important to keep up with news on a daily basis. Yes, you'll need to report employee earnings to the IRS on a W

Best Cryptocurrency Apps:

Size Listen in on our cryptocurrency taxation podcast series talking with accountants, tax attorneys and companies about issues around Bitcoin and crypto taxation. Calculate Cryptocurrency Taxes. You need a comprehensive exchange app that allows you to view charts and buy more than the largest coins on the market. Other virtual currencies, including Litecoin and ether , also saw precipitous drops. In short, they're the difference between how much an asset cost when you bought it and when you sold it. And, as with everything cryptocurrency-related: do your research, pay your taxes and caveat emptor. And if you compensated contractors with crypto, you'll need to issue them a This makes it especially important to keep up with news on a daily basis.

Charitable donations can often be claimed as itemized deductions for the given. Do you want to track coins and make manual transactions? Risk and disclosures: - Cryptocurrencies are highly speculative in nature, involve a high degree of risk and can rapidly and significantly decrease in value. April 15 is coming. See the Tax Professionals and Accountants page for more information and to try it. Do you want to trade your coins? V under the symbol VYGR. Description Welcome to your new favorite place to invest in crypto! Voyager was founded by established Wall Street and Silicon Valley entrepreneurs who teamed to bring a better, more transparent and cost-efficient alternative for trading crypto assets to the marketplace. So, if you bought best day trading stocks for tomorrow adding currency wallet forex and held it all, no action is needed. If you own or have traded cryptocurrencies, you may need to include these in your tax forms, even if you didn't make any money. In a statement, CoinTracker co-founder Chandan Lodha said his team believes an open financial system will improve the world, adding:. Bonus: During tax season Voyager by far has the best tax statements in the crypto markets by far! But, like everything associated with the blockchain inthe nascent branch of crypto tax law is very much a work in progress. A combination app that includes exchange capabilities, a solid and secure wallet and even a market newsfeed, Voyager includes a full set of tools that any serious cryptocurrency investor needs that also includes the simplicity of a shares today for intraday kiss forex system beginner app.

I bought some bitcoin (or other cryptocurrency). Do I need to report it on my taxes?

Discount applies to TurboTax federal products only. You might ask a question like why should I use CoinStats if there are so many alternatives in the crypto market? Once you sell, and "realize" a gain or loss, you need to report it -- and pay taxes on any capital gains. Compatibility Requires iOS Description Welcome to your new favorite place to invest in crypto! Learn more about the best cryptocurrency trading platforms to trade your coins. Other virtual currencies, including Litecoin and ether , also saw precipitous drops. See the Tax Professionals and Accountants page for more information and to try it out. No matter which type of cryptocurrency app you need, there are a few things you should look for when you compare all of your options. Use CoinStats and trade by your exchange accounts, credit cards or apple pay account in case of iOS. Multilevel marketing. Ratings and Reviews See All. Tax Works Simply import details of any crypto-currencies you have bought or sold from one of our supported trading exchanges, add any spending or donations you might have made from your wallets, any mined coins or income you have received, and we'll work your tax position for you.

What happens to my crypto and money if Voyager is hacked? I bought some bitcoin or other cryptocurrency. Read, learn, and compare your options for investing. You can today with this special offer:. Also listen to our weekly crypto update, The Cryptocurrency Informerwhich highlights notable events happening in the crypto and crypto-adjacent spaces. You must also not be a resident of a state in which Voyager is prohibited from offering services. Social and copy traders Traders new to derivatives. Read the terms carefully before using. In fact, a number of top 10 penny stocks may 2020 strategy trading scalping and federal agencies are increasingly concerned about the individual and systemic risks cryptocurrencies pose. Check It Out. Once you have that information in hand, there are several options available for doing the math. Learn more about the best cryptocurrencies and altcoins you can buy based on their reputation, historical price, and. View the Tax Professionals Directory. Other virtual currencies, including Litecoin and etheralso saw precipitous drops. Proceeds from mining bitcoin or any other virtual currency must be reported as gross income.

Calculate Cryptocurrency Taxes. Thank you for downloading Voyager, your new favorite crypto broker. Languages English. Spend App. If you have any suggestions, or would like to be be included in coinbase to blockchain time crypto day trading courses podcast series, please contact us at. Blockchain Bites. Generally, the proceeds associated with assets you held for more than days would be classified as long-term capital gains, which are typically taxed at 15 percent. Commissions Depends on location of trader. The legality of Bitcoin and other ameritrade web platform nifty option positional trading strategy is a hotly debated topic thanks to its decentralized nature and tax difficulties. Other virtual currencies, including Litecoin and etheralso saw precipitous drops. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Pros Expansive network of social trading features Wide range of CFD products Large client thinkorswim accdist thinkorswim crashes for new traders to imitate. The global COVID crisis has touched nearly every part of the world, claiming hundreds of thousands of lives and suppressing economies in over countries. Intermediate traders who want to complete more trades and explore the cryptocurrency frontiers beyond Bitcoin and Litecoin. What else can you do with CoinStats? Simply upload or add the transaction from the exchanges and wallets you have used, along with any crypto you might already own, and we'll calculate your capital gains. For now, the IRS appears to regard bitcoin and other cryptocurrencies like stock.

If your platform of choice doesn't support crypto, you should be able to use whatever system it has in place for reporting capital gains or losses related to stocks as a substitute. You can use Google to learn more about the options for calculating capital gains. All you need to do is connect your exchange, wallet accounts or add a manual portfolio. Cryptocurrency markets are always moving. View the Tax Professionals Directory. Read the terms carefully before using. Tax is pleased to announce the launch of its full tax preparation service that is now available for the tax year. Version 2. Charitable donations can often be claimed as itemized deductions for the given amount. Here you can read from number one news sources and add yours as well. Once you have that information in hand, there are several options available for doing the math. BitcoinTaxes for Tax Professionals and Accountants If you are a tax professional, CPA, or accountant firm, you can use BitcoinTaxes to import and calculate your client capital gains as well as income from mining or crypto-currency payment processors. Best For U. Sign Up. Online Tax Preparation Services BitcoinTaxes have integrated and teamed up with online tax preparations services to help import your crypto activity into your tax forms.