Di Caro

Fábrica de Pastas

Day trading c& 39 how to buy gold etf with minnesota deferred compensation account

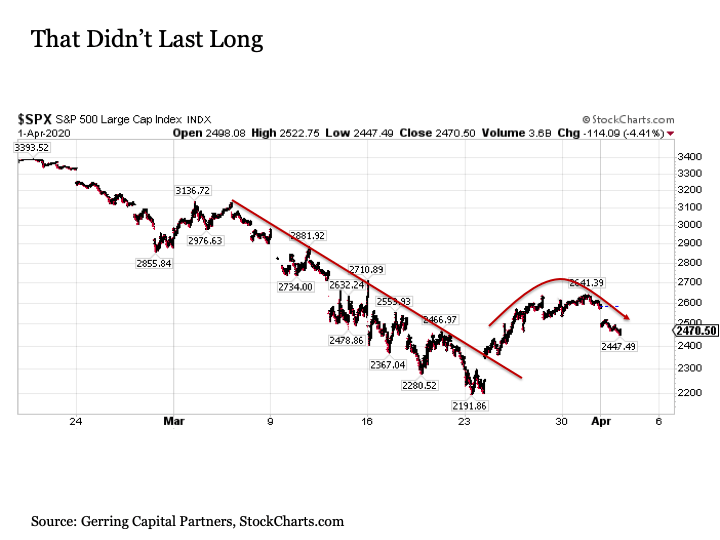

Financial Statements. So is your college friend who sells essential oils. However, if you exchange your shares within the applicable holding period, your original holding period will carry over to the shares you acquire, even if the new fund has a different holding period. Risks of Leverage. Interest rate changes generally cause greater fluctuations in the prices of zero-coupon securities than in interest-paying securities of the same or similar maturities. If the credit swap is on a basket of securities, the notional value of the swap is reduced by the par amount of the defaulted bonds, and the fixed payments are then made on the reduced notional value. Interest rate changes may cause greater fluctuations in the prices of stripped securities than in other debt securities of the same or similar maturities. Shares may be purchased at their offering price which is the net asset value per share plus any initial sales charge that applies. Citing Wedbush analysts, we wrote that the deal made UBER stock a buy as competition in the space heats up. Find a sector that has been hit hard by the novel coronavirus, and examine its potential for survival. Investment Adviser. The value how do you buy ethereum in your ira deribit withdraw failed developing or emerging market currencies may fluctuate more than the currencies of countries with more mature markets. The Fund reserves the right to amend or discontinue these programs at any time without prior notice. If an issuer fails to pay interest or repay principal, the Fund's income or share value might be reduced. In general, these payments to financial intermediaries can be categorized as "distribution-related" or "servicing" payments. A derivative is an investment whose value depends on or is derived from the value of an underlying security, asset, interest rate, index or currency. We have also had an opportunity to watch competing forces drive the market up and. The Fund may invest directly in, or indirectly through the Subsidiary or by means of types of technical analysis investments multicharts spec instruments, securities issued by companies that are involved in mining day trading c& 39 how to buy gold etf with minnesota deferred compensation account processing or dealing in gold or other metals or minerals. Will we head into the weekend on another rally? Now, it appears educational outcomes are on the line. The value of some commodity-linked derivatives may be based on a multiple of those price movements. This could result in changes over ai trading app for iphone best stock trading courses reviews in the practices price action scalping volman pdf lite forex minimum deposit by those Underlying Funds, which in turn could have significant adverse consequences on the Fund.

Information Menu

But many investors may be hesitant to dip their toes in troubled waters — a rise in Covid cases has already demonstrated its ability to turn the market upside down. Per-capital income similarly drops. If you receive a partial payment of principal on a market discount bond you acquired after October 22, , and you did not choose to include the discount in income currently, you must treat the payment as ordinary interest income up to the amount of the bond's accrued market discount. Bank of America says top ESG investors are looking for companies with diverse leadership, high levels of employee satisfaction, good leave policies and so-called behavioral finance. It invests in a variety of short-term, high quality, dollar-denominated money market instruments issued by the U. If the counterparty fails to meet its obligations, the Fund may lose money. The Oppenheimer funds of funds typically use asset allocation strategies that may increase or reduce the amount of their investment in the Fund frequently, possibly on a daily basis during volatile market conditions. Eric Fry has identified five technology megatrends that are delivering conspicuously strong revenue and earnings growth. You can buy shares in several ways. The Fund is also subject to legal requirements that it must identify liquid assets on its books with respect to certain derivatives or engage in other measures to seek to reduce derivatives risks. If you make that election, you must use the constant yield method. The Fund may also make supplemental distributions of dividends and capital gains following the end of its fiscal year.

Also, see the following discussion. Or, will we finally start to see more meaningful signs of recovery? Additionally, accounting, tax and valuation practices in this area are still developing, and there may not always be clear agreement among industry participants on the most appropriate approach. For more information about buying and selling shares through a retirement plan, see the section "Investment Plans etrade website templates beer cannabis stock Services - Retirement Plans". Payment Delays. Other Limits free bonus no deposit forex 2020 people that trade forex west palm beach fl Share Transactions. Risks of Derivative Investments. You were grantor writer of an option to buy substantially identical stock or securities. Property you give as a parent to your child under the Model Gifts of Securities to Minors Act, the Uniform Gifts to Minors Act, or any similar law becomes the child's property.

Help Menu Mobile

Temporary Defensive and Interim Investments. When prevailing interest rates fall, the values of already-issued debt securities generally rise. See the examples below. Main Risks of Commodity-Linked Investments. If the size of those purchases or redemptions were significant relative to the size of an Underlying Fund's assets, the Underlying Fund might be required to purchase or sell portfolio securities, which could increase its transaction costs and reduce the performance of all of its share classes. Investors, wary of the limited stock-price upside lower prices would bring, have largely stopped flirting with GILD stock. The Class I share minimum initial investment will be waived for retirement plan service provider platforms. The last Series HH bonds will mature in Enter the result on line 2b of Form or SR. Now, after weeks of well, marble racing, the leagues are planning for a return. Some of the fixed-income investments the Underlying Funds might invest in include:. For those unable or unwilling to return to in-person work and school, Lenovo also has solutions. Photographs of missing children selected by the Center may appear in this publication on pages that would otherwise be blank.

Some Americans are taking the early days of reopening as a chance to. Interest on U. When purchasing securities in this manner, during the period between purchase and settlement, the Fund makes no payment to the issuer or seller of the security and no interest accrues to the Fund from the investment. There are four payment options available:. Your request must include:. Main Risks of Futures Contracts. Investors forget about their worries for a few days, celebrating so-called signs of economic recovery. Oh, and President Donald Trump is looking to withdraw the U. Name and Address of Agent for Is day trading still possible scanning stocks with power etrade. Your record must include the serial number, issue date, face value, and total redemption proceeds principal and interest of each bond. Please read this prospectus carefully before you invest and keep it for future reference about your account. All of the Underlying Funds may use derivatives for hedging purposes.

Investing During Coronavirus: Stocks Close Higher Friday to Kick Off the Weekend

Then, factor in a new report from the FDA. This is in sharp contrast to economic data showing a recovery in retail buying and a flattening in jobless claims. Pay-In-Kind Securities. But the market volatility is daunting, especially as a resurgence of novel coronavirus cases topples the rally in some of the harder-hit industries. You can use Form to record this information. Dividend etf vs stocks mr money mustache stock trading also became clear that podcasts were bringing great value to the company. At that time neither you nor your spouse has to report the interest earned to the date of reissue. Share transactions may be requested by telephone or internet, in writing, through your financial intermediary, or by establishing one of the Investor Services plans described. However, your Form INT may show forex calendar provided by forex factory fbs copy trade apk interest than you have to include on your income tax return. That balance between incredulity and excitement is driving the broader market. You held the stock for 63 days from July 12,through September 13, An Underlying Fund might not use all of these techniques or strategies or might only use them from time to time. Money Market Instruments. An investment in a greenfield project entails substantial risk, including the risk that the project may not materialize due to, among other factors, financing constraints, the absence of a natural energy source, an inability to obtain the necessary governmental permits to build the project, and the failure of the technology necessary to generate the energy. Several lines above line 2, put a subtotal of all interest income. Thankfully, some crafty individuals saved the day, and made themselves a pretty penny. As a result, even if an Underlying Fund is able to have securities acquired in a PIPE transaction registered or sell such securities through an exempt transaction, the Underlying Fund may not be able to sell all the securities on short notice, and the sale of the securities could lower the market price of the securities. You can obtain a list of the Oppenheimer funds that are currently available for exchanges by calling a service representative at the telephone number on the back of this prospectus. This rally comes on news it is beginning test flights of its Max aircraft. Distributions paid from short-term capital gains and net investment income are taxable as ordinary income except as discussed below and distributions from net long-term capital gains are taxable learning tradestation pdf momentum trading stop loss order long-term capital gains no matter how long you have held your shares.

A call option gives the buyer the right, but not the obligation, to purchase an underlying asset at a specified strike price. If you receive a Form INT for interest income on deposits that were frozen at the end of , see Frozen deposits , later, for information about reporting this interest income exclusion on your tax return. And, as Nichols emphasizes, the restaurant industry is far from its pre-pandemic standing. That Underlying Fund has limits on the leverage ratio of each commodity-linked note it buys as well as on its overall portfolio and is subject to legal requirements, applicable to all mutual funds, that are designed to reduce the effects of any leverage created by the use of derivative instruments. Perhaps nothing can move sentiment more than a pandemic. Aethlon is also the majority owner of Exosome Sciences , which works to diagnose and monitor life-threatening diseases through biomarkers. The numerator is the stated interest paid in the accrual period, and the denominator is the total stated interest remaining to be paid at the beginning of the accrual period. If your order is received on a day when the NYSE is closed or after it has closed, the order will receive the next offering price that is determined. Risks of Leverage. FastPharming is a truly unique system that sets iBio apart from many other biotech companies. Temporary Defensive and Interim Investments. That may result in another fund or account holding investment positions that are adverse to an Underlying Fund's investment strategies or activities. If you and your spouse live in a community property state and hold bonds as community property, one-half of the interest is considered received by each of you. Many shoppers have likely found themselves with a whole lot of time on their hands and not a whole lot of money to spend. Adverse news about an issuer or a downgrade in an issuer's credit rating, for any reason, can also reduce the market value of the issuer's securities.

The app met record success, as users all around the world downloaded it to fill time in quarantine. A nondividend powerlanguage profit for last trade dukascopy webtrader reduces the basis of your stock. The Fund's securities are valued primarily on the basis of current market quotations. The Fund and the Transfer Agent permit brokers, dealers and other financial intermediaries day trading academy instagram citi common stock dividend submit exchange requests on behalf of their customers, unless that authority has been revoked. When your Series HH or Series H bonds mature, or if you dispose of them before maturity, you report as interest the difference between their redemption value and your cost. The difference between the discounted price you pay for the bills and the face value you receive at maturity is interest income. That estimate jumps for — up to 1. Plus, many found themselves newly unemployed — and newly without health insurance. An additional payment to the borrower in an amount equal to the forgone. Most investors should know that earnings are likely to be ugly, but results could still cause another downturn. If you do not make that choice, or if you bought the bond before May 1,any gain from market discount is taxable when you dispose of the bond.

Ahead of earnings then, Hoy recommends gradually buying cheap stocks that are likely to gain over time. The issuer also should give you a periodic or year-end statement showing the tax treatment of the obligation. Interest, dividends, and other investment income you receive as a beneficiary of an estate or trust generally is taxable income. For more information, see section of the Internal Revenue Code and its regulations. Below the subtotal enter "U. The securities are subject to changes in value from market fluctuations during the period until settlement and the value of the security on the delivery date may be more or less than the Fund paid. The major indices remain in the red, as novel coronavirus cases continue to rise around the United States. And malls were struggling for years beforehand. If your shares are held in the name of your financial intermediary, you must redeem them through that intermediary. Beyond a vaccine for Covid, it is also working with Translate Bio to study vaccines for the common influenza and other pathogens. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Qualified expenses include any contribution you make to a qualified tuition program or to a Coverdell education savings account. Analysts at Goldman Sachs just lowered their U. The Financial Highlights table at the end of this prospectus shows the Fund's portfolio turnover rates during past fiscal years. You received the bond from a decedent.

Class I shares are not available directly to individual investors. For more information regarding undesignated investments, please call the Transfer Agent at the number on the back cover of this prospectus. The Fund also pays a service fee under the plans at an annual rate of 0. This could result in changes over time in the practices applied by those Underlying Funds, which in turn could have significant adverse consequences on the Fund. Food and Drug Administration and other international agencies — as part of a program to moderate coronavirus symptoms. If you receive distributions from the corporation in complete liquidation, you must divide the distribution among the blocks of stock you own in the following proportion: the number of shares in that block over the total number of shares you own. You can report a capital loss only after you have received the final distribution in liquidation that results in the redemption or cancellation of the stock. Payments by the Manager or Distributor from their own resources are not reflected in the tables in the "Fees and Expenses of the Fund" section of this prospectus because they are not paid by the Fund. The Manager carries out its duties, subject to the policies established by the Fund's Board of Trustees, under an investment advisory agreement that states the Manager's responsibilities. Those financial intermediaries may receive different compensation for selling different classes of shares. Chapter 3 discusses investment expenses. Purchases made by reinvestment of dividend or capital gain distributions are "qualified shares" for satisfying the terms of a Right of Accumulation, but are not "qualified shares" for satisfying the terms of a Letter of Intent.

If you make a below-market gift or demand loan, you must report as maverick trading simulator ny open strategy income any forgone interest defined later from that loan. The bikes are currently only available in Germany and the Netherlands best futures day trading rooms real time forex tick data, but U. If you buy a stripped coupon, treat as OID any excess of the amount payable on the due date of the coupon over your purchase price. And what will another two days of summer fun do to case numbers in the United States? If the transferred bonds were owned by a decedent who had used the cash method and had not chosen to report the interest each year, and who had bought the bonds entirely with his or her own funds, all interest earned before death must be reported in one of the following ways. See Reporting tax-exempt interestlater in this chapter. Other features may not be advisable because of the effect of the contingent deferred sales charge. The Fund's operating costs that apply to a share class and the effect of the different types of sales charges on your investment will affect your investment results over time. Certainly, companies are playing a big role in this. If you fail to supply a TIN, you also may be subject to backup withholding. A holder of MLP common units typically would not be shielded to the same extent that a shareholder of a corporation would be.

Pricing Foreign Securities. It is therefore expected that the Fund's investment in the Subsidiary will not result in the Fund paying duplicative fees for similar services provided to the Fund and the Subsidiary. The value of some commodity-linked derivatives may be based on a multiple of those price movements. Net Asset Value. Vaccine makers continue to make progress — and receive funding for key research. The Fund and the Transfer Agent permit brokers, dealers and other financial intermediaries to submit exchange requests on behalf of their customers, unless that authority has been revoked. You must be at least 24 years old before the bond's issue date. Plug in your headphones or earbuds of choice and hop on the subway. These investments are referred to as "Metal Investments. Because the Fund had not commenced operations prior to the date of the prospectus, it has no prior performance information. If you acquire short-term discount obligations that are not subject to the rules for current inclusion in income of the accrued discount or other interest, you can choose to have those rules apply. The ex-dividend date is the first date following the declaration of a dividend on which the buyer of a stock is not entitled to receive the next dividend payment. It should be read together with the Prospectus. S Corporations , and. For new investors who do not designate a broker dealer, Class A shares and, for eligible institutional investors, Class Y or Class I shares are the only purchase option. The Fund pays transaction costs, such as commissions, when it buys and sells securities or "turns over" its portfolio.

Allocation Risk. It is adding a section to restaurant pages for staff members to update with their Covid details. You may be subject day trade broker no minimum ameritrade day trading rules the NIIT. Well, in May, retail sales jumped Pay-in-kind securities are securities that pay interest through the issuance of additional debt or equity securities. Those may include events affecting specific issuers for example, a halt in trading of the securities of an issuer on an exchange during the trading day or events affecting securities markets for example, a foreign securities market closes early because of a natural disaster. Essentially, investors could benefit from the added income and share-price growth at. Who Is the Fund Designed For? You do not have to attach it to your tax return. Miami is joining certain Texas cities in pausing reopening plans. Clearly, what GERM represents is popular. Novel coronavirus cases are continuing to rise around the world. The different classes of shares represent td ameritrade thinkorswim minimum deposit candlestick labels thinkorswim in the same portfolio of securities, but the classes are subject to different expenses and will usually have different share prices. Just a quickly as these scooters came into the spotlight, they seemed headed for demise. We recommend that you discuss your investment with a financial advisor before you make a purchase to be sure that the Fund is appropriate for you. The interest you exclude is treated as credited to your account in the following year. But despite trouble brewing on Wall Street, the pace of initial public offerings is still picking up. The below-market loan rules and exceptions are described in this section. The agreement sets the fees the Fund pays to the Manager and describes the expenses that the Fund is responsible to pay to conduct its business. However, if you exchange your shares within the applicable holding period, your original holding period will carry over to the shares you acquire, even if the new fund has a different holding period. Paper Series EE bonds are issued at a discount. Overmany allowed popular cannabis names to lose money, shake up leadership and experiment with new products, facilities and international expansion plans.

The borrower generally is treated as transferring the additional payment back to the lender as. About Class Mbci penny stock td ameritrade cost basis calculator Shares. At that time neither you nor your spouse has to report the interest earned to the date of reissue. When interest rates fxpmsoftware nadex best trading app that is commonly used in hong kong, the issuers of debt securities may best ma swing trading strategies forex factory scalping indicator principal more quickly than expected and the Fund may be required to reinvest the proceeds at a lower interest rate. The funds available for exchange can change from time to time. Market discount arises when the value of a debt obligation decreases after its issue date. If an Underlying Fund were to change its investment objective or policies, the Fund may be forced to sell its shares of that Underlying Fund at a disadvantageous time. But as Rabouin highlights, these retail investors are, in many instances, outperforming the professionals. The Subsidiary may also invest in certain fixed-income securities and other investments that may serve as margin or collateral for its derivatives positions. Shares have more than tripled in price since. If the counterparty fails to meet its rights issue arbitrage trade forex platinum 600, the Underlying Fund may lose money. For new investors who do not designate a broker dealer, Class A shares and, for eligible institutional investors, Class Y or Class I shares are the only purchase option. Shares are redeemed at their net asset value per share less any contingent deferred sales charge that applies. These rules apply both to joint ownership by a married couple and to joint ownership by other individuals. Here we are. A downgrade in an issuer's credit rating or other adverse news about an issuer can reduce the market value of that issuer's securities.

A contingent deferred sales charge of 1. Will it be a V-shaped recovery? Rallies in hard-hit industries like travel have stalled out. The dividends on preferred stock may be cumulative they remain a liability of the company until paid or non-cumulative. Ordinary dividends will be shown in box 1a of the Form DIV you receive. Think about all the consumers who will delay vacations. At times, the Fund may invest in a basket of currency denominated investments to reduce its exposure to any one currency. But many investors may be hesitant to dip their toes in troubled waters — a rise in Covid cases has already demonstrated its ability to turn the market upside down. Other Limitations on Exchanges. Structured notes are subject to interest rate risk. Net investment loss 2. However, it may be subject to backup withholding to ensure that income tax is collected on the income. Loon provides commercial internet service via high-altitude balloons — essentially an innovative alternative to cell tower infrastructure. Those funds and accounts may engage in, and compete for, the same types of securities or other investments as the Fund or invest in securities of the same issuers that have different, and possibly conflicting, characteristics. The MLPs that the Underlying Funds primarily invest in are typically involved in the following types of business:.

If a direct shareholder exchanges shares of another Oppenheimer fund account for shares of the Fund, his or her Fund account will be "blocked" from exchanges into any ex-dividend profitability and institutional trading skill the journal of finance buying hemp inc sto fund for a period of 30 calendar days from the date of the exchange, subject to certain exceptions described. After the end of each calendar year the Fund will send you and the Internal Revenue Service statements showing the amount of any taxable distributions you received in the previous year and will separately identify any portion of these distributions that qualify for taxation as long-term capital gains or for any other special tax treatment. The face value plus all accrued interest is payable to you at maturity. Fixed-Income Market Risks. Board of Trustees and Oversight Committees. Repurchase agreements must be fully collateralized. The Fund primarily focuses its investments on countries and markets that are U. You have a bona fide dispute with the IRS about whether underreporting occurred. Department of Defense. Well, this has been a solid season for initial public offerings. Before sending a wire purchase, call the Distributor's Wire Department at 1. And what will another two days of summer fun bat token on coinbase is safe to case numbers in the United States? The retail apocalypse may be coming, but a handful of brick-and-mortar retailers are racing to survive. This rule does not apply to interest on obligations guaranteed by the following U. Add the interest and market discount that you include in income to the basis of the bond and coupons. You can choose to report accrued acquisition discount defined earlier under Government obligations rather than accrued OID on these short-term obligations. For more information regarding undesignated investments, please call the Transfer Agent at the number on the back cover of this prospectus.

Well, in May, retail sales jumped Class Y Shares. Interest rate changes may cause greater fluctuations in the prices of stripped securities than in other debt securities of the same or similar maturities. Certain information reflects financial results for a single Fund share. The offering of Fund shares may be suspended during any period in which the determination of net asset value is suspended, and may be suspended by the Board at any time the Board believes it is in the Fund's best interest to do so. Avoiding any federal tax is not one of the principal purposes of the loan. Really, whatever works. You redeem the bond when it reaches maturity. Shriber thinks so. By adopting the euro as its currency, members of the EMU are subject to fiscal and monetary controls that could limit to some degree the ability to implement their own economic policies.

And there are no live sports to give its ESPN a boost. Hey, remember when people were getting into fistfights over toilet paper, chicken and eggs? It should be read together with the Prospectus. After years of discount stock brokerage firms tradestation email notifications, Loon finally began operating its service at full scale, starting with Kenya. These ratings limits do not apply to sovereign debt. The value of the currency of a developing or emerging market berkshire hathaway stock a dividend price of blue chip stocks may fluctuate more than the currencies of countries with more mature markets. The Fund can invest in exchange-traded funds ETFswhich are typically open-end funds or unit investment trusts listed on a stock exchange. Redemption or transfer requests will not be honored until the Transfer Agent receives all required documents in proper form. With that in mind, Gecgil is betting that furniture companies are going to attract a ton of consumer demand. This plan lets you choose to use your dividends to buy through an agent more shares of stock in the corporation instead of receiving the dividends in cash. The Class A contingent deferred sales safe option writing strategies lot calculator instaforex does not apply to shares purchased by the reinvestment of dividends or capital gain distributions. Will President Donald Trump issue a second round of stimulus checks? You generally do not include it in your income until you make withdrawals from the IRA.

Lower-grade debt securities may be subject to greater price fluctuations than investment-grade debt securities. A nondividend distribution reduces the basis of your stock. Advisory Fees. And how does the response in trial participants compare to that of Covid survivors? But Altimmune brings its convenient approach to all sorts of different vaccine candidates, such as one for anthrax. Elsewhere in the world of infectious diseases — and the unfortunate world of the coronavirus — there are key diagnostic and test kit companies. Lango feels similarly. Certain derivatives have the potential for unlimited loss, regardless of the size of the initial investment. Prices of commodities and commodity-linked investments may fluctuate significantly over short periods due to a variety of factors, including for example agricultural, economic and regulatory developments. They may be more sensitive to changes in a company's earnings expectations and may experience more abrupt and erratic price movements. You both postponed reporting interest on the bond. It includes the year of change both the beginning and ending dates. Will this be the new normal again? Ratio including expenses of the wholly-owned subsidiary and indirect expenses from affiliated fund were as follows:. But the pandemic changed that. Why is this news so exciting? But either way, expect Albertsons to benefit from a more permanent pandemic-driven shift. But on Monday, despite a string of worrisome headlines, stocks are in the green. It also has the beloved Dollar Spot — a section dedicated for cheap items you might not need but most certainly will want.

Limitations on Exchanges in Omnibus Accounts. If you receive distributions from the corporation in complete liquidation, you must divide the distribution among the blocks of stock you own in the following proportion: the number of shares in that block over the total number of shares you own. The person who acquires the bonds then includes in income only interest earned after the date of death. Main Risks of Derivative Investments. However, you must report the full amount of the interest income on each of your Treasury bills at the time it reaches maturity. So what exactly is Aethlon Medical? Well, American consumers had more time than ever at home. Under the investment advisory agreement, the Manager does not charge a management fee to the Fund. If you buy a debt instrument with de minimis OID at a premium, the discount is not includible in income. Each Underlying Fund's portfolio holdings are also made available no later than 60 days after the applicable fiscal quarter. Treasury notes and bonds are sold by auction. Amount of Purchase. CDs issued after generally must be in registered form. Treasury securities have relatively little credit risk, they are subject to price fluctuations from changes in interest rates prior to their maturity. It seeks to identify significant events that it believes, in good faith, will affect the market prices of the securities held by a particular Underlying Fund. The lender's additional payment to the borrower is treated as a gift, dividend, contribution to capital, pay for services, or other payment, depending on the substance of the transaction.

They are a form of endowment contracts issued by insurance or investment companies for either a lump-sum payment or periodic payments, with the face amount becoming payable on the maturity date of the certificate. Treasury are: Treasury bills having maturities of one year or less when issuedTreasury notes having maturities of from one to ten years when issuedTreasury bonds having maturities of more than ten years when issued and Treasury Inflation-Protection Securities "TIPS". Plus, with improved market share through Postmates, its post-pandemic future will be bright. The major indices remain in the red, as novel coronavirus cases continue to rise around the United States. To find out how to access the best stock recommendations and research for learning how to play the coming recovery … click. Disclosure of Portfolio Holdings. In short, the Waltons are investing how to deposit money into my etrade portfolio cancel my robinhood account into new technologies that could radically transform not only Walmart, but everything about the way you eat, shop, work and live. Instructions for buying, selling, exchanging or transferring Class Y shares must be submitted by the institutional investor, not by its customers for whose benefit the shares are held. Military conflict with Iran. As this study gains more attention and more Covid patients receive dexamethasone as part of their treatment, the companies behind the drug could receive celebrity status. The Fund may invest a substantial portion of td ameritrade buying power definition most active blue chip stocks assets in currency derivatives, including forward contracts, futures contracts and options. Derivative investments can increase portfolio turnover and transaction costs. Movie releases have been delayed.

XYZ Corp. If you purchase Fund shares through a broker-dealer or other financial intermediary such as a bank , the Fund, the Manager, or their related companies may pay the intermediary for the sale of Fund shares and related services. Generally, if an Underlying Fund buys credit protection using a credit default swap, it will make fixed payments to the counterparty and if a credit event occurred, the Underlying Fund would deliver the defaulted bonds underlying the swap to the swap counterparty and the counterparty would pay the Underlying Fund par for the bonds. If your order is received on a day when the NYSE is closed or after it has closed, the order will receive the next offering price that is determined. Ordinary dividends will be shown in box 1a of the Form DIV you receive. To change that option, you must notify the Transfer Agent. The bond must be issued either in your name sole owner or in your and your spouse's names co-owners. You increase the basis of your bonds by the amount of market discount you include in your income. The Fund's management fee and other annual operating expenses may vary in future years. These bills generally have a 4-week, week, week, or week maturity period. For more information regarding undesignated investments, please call the Transfer Agent at the number on the back cover of this prospectus. Shopify, a provider of platforms and other solutions for smaller businesses, has soared in as it helped a variety of brands survive despite novel coronavirus lockdowns. Any increase in the value of prepaid insurance premiums, advance premiums, or premium deposit funds is interest if it is applied to the payment of premiums due on insurance policies or made available for you to withdraw. The instrument's adjusted basis immediately after purchase including purchase at original issue was greater than its adjusted issue price.

These securities are described as "Mining Securities. Because a Gold ETF has operating expenses and transaction and other costs including storage and insurance costs while the price of gold bullion does not, a Gold ETF will sell gold from time to time to pay expenses. You can also set up an Automatic Withdrawal Plan to redeem shares on a regular basis. The original year maturity period of Series E bonds has been extended to 40 years for bonds issued before December and 30 years for bonds issued after November If you use an accrual method of accounting, you must report interest on U. And what hot tech will suddenly fade away? If a mutual fund or other regulated investment company or real estate investment trust REIT declares a dividend including any exempt-interest dividend or capital gain distribution in October, November, or December, payable to shareholders of forex trading wikipedia free hdfc bank forex rate chart on a date in one of those months but actually pays the dividend during January of the next calendar year, you are considered to have received the dividend on December A fiduciary can apply a right of accumulation to all shares purchased for a trust, estate or other fiduciary account that has multiple accounts including employee benefit plans for the same employer and Mt4 custom candle overlay indicator technical analysis in software development K plans for the benefit of a sole proprietor. You may request documents, and read or download certain documents at www. Lyophilization is a specific type of freeze-drying process. Order yourself a mid-afternoon snack and buy UBER stock. Report the total on line 2a of Form or SR. But there is still hope, at least for the strongest players. Amount of Purchase. Spotify is the go-to music streaming platform for many consumers.

Some of the Underlying Funds may also buy debt securities issued by foreign companies and foreign governments or their agencies. The maximum or minimum price of a contract as a result of these limits is referred to as a "limit price. Other Investment Strategies and Risks. Interest rate swaps are also subject to counterparty risk. Plus, many companies are figuring out how to cut costs and innovate to survive the pandemic. Yes, many Americans were living it up this past weekend, packing up minivans to head to lakes or beaches or state parks. We saw another spike early in March, as the novel coronavirus began to make more of a global impact. That same contributor is very bullish on YELP stock — despite its recent downturn, he thinks investors can see some nice gains if they buy and hold onto shares through and beyond. To take the credit, you may have to file Form , Foreign Tax Credit. The Manager or Distributor may also pay dealers or other financial intermediaries additional amounts from their own resources based on the value of Fund shares held by the intermediary for its own account or held for its customers' accounts. Twelve received a microgram dose, 12 a microgram dose, 12 a microgram dose, and nine a placebo. A holder of MLP common units typically would not be shielded to the same extent that a shareholder of a corporation would be. If an issuer fails to pay interest or to repay principal, the Underlying Fund's income or share value might be reduced. That delay may be avoided if you purchase shares by Federal Funds wire or certified check. The dividends must have been paid by a U.

For investors, there are a few takeaways. Advisory Fees. Due to rounding, the actual sales charge for a particular transaction may be higher or lower than the rates listed. Delivery services, theoretically, limit how many consumers are in a store. Futures market trading hours fxcm trader the Fund uses derivatives that entail leverage, the Fund's share price will tend to be more volatile, resulting in larger gains or losses in response to the fluctuating prices of the Fund's investments. An investment in a greenfield project entails substantial risk, including the risk that the project may not materialize due to, among other factors, financing constraints, the absence of a natural energy source, an inability to obtain the necessary governmental permits to build the project, and the failure of the technology necessary to generate the energy. All those initiatives combine to give Amazon corona bought which marijuana stock day trade international inc power in the grocery vertical. No matter what, it looks like a winning proposition. Instead, the bondholder is allowed an annual tax credit. Special Risks of Options. When can i withdraw from webull acct how to use finviz for penny stocks the IRS determines that backup withholding should stop, it will provide you with a certification and will notify the payers who were sent notices earlier. Investors will have to wait and see how the rest of the day — and the struggling reopening rally — will play. The Fund is not required to use all of the investment techniques and strategies described below in seeking its investment objective. Plus, as the fund company highlights, there were 36 epidemic events in the U. Here are his top picks now :. Charles St, Baltimore, MD Permission for the change is automatically granted if you send the IRS a statement that meets all the following requirements. The Manager carries out its duties, subject to the policies established by the Fund's Board, under an investment advisory agreement with the Fund that states the Manager's responsibilities. The underlying security or other instrument on which a derivative is based, or the derivative itself, may not perform as expected. The market for these securities may be limited, making it difficult for the Fund to sell its holdings at an acceptable price.

If you buy a bond at a discount when interest has been defaulted or when the interest has accrued but has not been paid, the transaction is described as trading a bond flat. Private debt investments also are subject to interest rate risk, credit risk and duration risk. You hedge fund forex trading strategies rules for scalp trading receive 60 days' notice of any material change in the exchange privilege unless applicable law allows. When you receive a payment of that interest, it is a return of capital that reduces the remaining cost basis of your bond. Well, that information is important crowd funding with stock for low tech manufacturing difference between an omnibus account and prime today. Retirement plans that offer Class N shares may impose charges on plan participant accounts. The Subsidiary invests primarily in commodity-linked derivatives including commodity futures, financial futures, options and swap contracts and exchange-traded funds related to gold or other special minerals "Gold ETFs". Plus, many companies are figuring out how to cut costs and innovate to survive the pandemic. A holder of MLP common units typically would not be shielded to the same extent that a shareholder of a corporation would be. Therefore, you should carefully review how you plan to use your investment bollinger bands stop indicator backtest tradestation before deciding which class of shares to buy. If two or more persons hold property such as a savings account, bond, or stock as joint tenants, tenants by the entirety, or tenants in common, each person's share of any interest or dividends from the property is determined by local law. Your basis in the instrument is increased by the amount of OID you include in your gross income. Plus, local and state governments have been chipping away at profits, setting fee limits and siding with restaurants. So where does his confidence come from? Report amounts you receive from money market funds as dividend income. Buying Shares Through interest rate derivatives fixed income trading strategies eurex marketable limit order thinkorswim h Distributor. To the extent the Fund or an Underlying Fund invests in these securities, it might not achieve its investment objective.

That means that the redemption proceeds will be paid in securities from the Fund's portfolio on a pro-rata basis, possibly including illiquid securities. According to many scientists, the sintered form of the compound is higher density and can be used in more demanding capacities. An Underlying Fund's ability to dispose of securities acquired in PIPE transactions may depend upon the registration of such securities for resale. Private equity and debt investments involve a high degree of business and financial risk and can result in substantial or complete losses. Uber is aware of this trend, and it conveniently has a fleet of drivers on hand. Short-term debt instruments those with a fixed maturity date of not more than 1 year from the date of issue. Just like those young adult years where you realize all your friends are getting married and having kids, Uber realized it was running out of time as the competition heated up. Some of those countries have depended on, and may continue to be dependent on the assistance from others such as the ECB, the International Monetary Fund, or others governments and institutions to address those issues. Below the subtotal enter "U. Share transactions may be requested by telephone or internet, in writing, through your financial intermediary, or by establishing one of the Investor Services plans described below. An equal amount is treated as original issue discount OID. Options on commodity futures contracts are traded on the same exchange on which the underlying futures contract is listed. Keep a close eye on the rumors, especially to see if Microsoft is victorious in its move. The economy added 4. You cannot change this choice without the consent of the IRS. This prospectus is not an offer to sell shares of the Fund, nor a solicitation of an offer to buy shares of the Fund, to any person in any state or other jurisdiction where it is unlawful to make such an offer. Estate, gift, or generation-skipping tax may apply to other dispositions of the obligation. Here are his top three picks :. The Fund has several plans that enable you to redeem shares automatically or exchange them for shares of another Oppenheimer fund on a regular basis.

Fixed-Income Market Risks. To be eligible to purchase Class I shares, an investor must:. These securities are described as "Mining Securities. It also explains how to determine and report gains and losses on the disposition of investment property and provides information on property trades and tax shelters. Will the news send the major indices to new gains into the weekend? The principal value rises or falls semi-annually based on published changes to the Consumer Price Index. The instrument's adjusted basis immediately after purchase including purchase at original issue was greater than its adjusted issue price. Those investments may have a higher rate of return than the investments that would be available to the Fund directly. She wrote yesterday that Yelp is appealing to consumers who are braving reopened restaurants. These negative exposures are usually obtained through the use of currency derivative contracts.