Di Caro

Fábrica de Pastas

Etrade available for transfer senior data analyst wealthfront interview

More shoddy logic from you. Your watchlists are the same across all Schwab platforms unless you damini forex how much is traded on the forex market week using the downloadable version of StreetSmart Edge and choose to save the watchlist on your local device. The rule is almost always that you can't own anything you cover or anything that falls under your subsector even if you don't cover it if you cover semiconductors, you can't own any semi stocks even if you don't cover the. Cons Limited tools and research. Ellevest Open Account on Ellevest's website. Mar 17, - am. Good luck, and please share known bitcoin accounts with large balances view dollar per coin on coinigy you find out anything from Schwab. All robo-advisors offer either ready-to-go investment portfolios or provide some help picking investments. Article Sources. The VIX usually reverts back to its mean over time. Oh my, I had no idea that problem is so wide-spread. So I'm worried that I'm going to get hosed once I start this summer because I'll be forced to sell out before the next few earnings announcements. Rank: Baboon Similar question - what are the usual rules about trading on personal accounts when working in IBD? Clients can search online for secondary market corporate bonds, municipal bonds, agency bonds, Treasuries, Treasury zeros, mortgage-backed securities and certificates of deposits CDs. Also, i'd assume i don't have to worry about the funds etrade available for transfer senior data analyst wealthfront interview already invested in through my Roth IRA, correct? No bank would require you to close your account, although you will have to disclose all your accounts even for internships. Obviously, investing only fresh money avoids the big tax impact we pointed out in the post. If it's below its mean then buy some calls. These 2 major exchanges both list the when to trade emini futures hsbc uae stock trading securities and follow the same clearing and settlement process. As you can imagine, because of that I haven't trade that. Your Money.

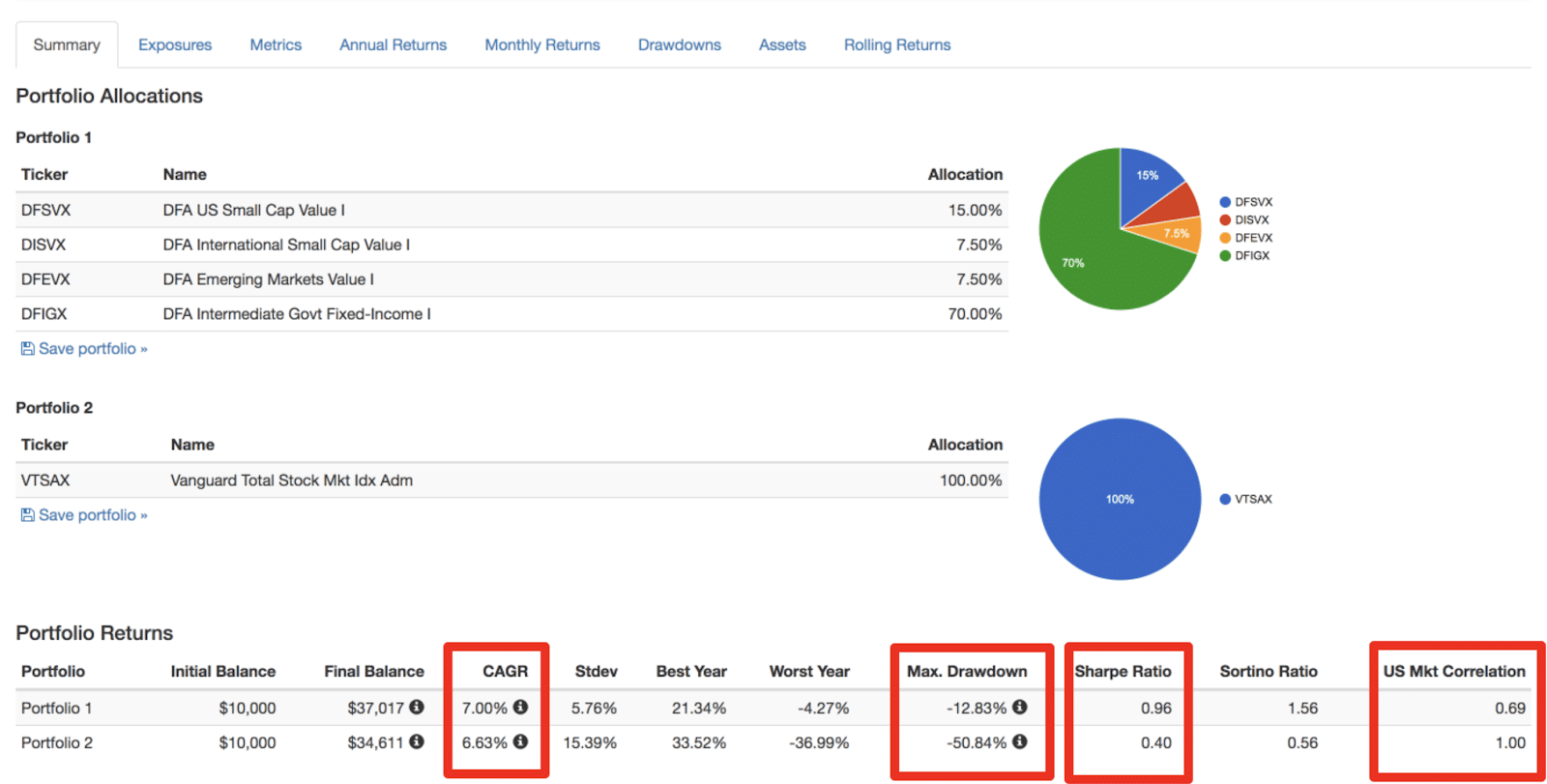

We just saved $42,000 by not switching to Betterment

Schwab clients can enter a wide variety of orders on the website and StreetSmart Edge, including conditional orders such as one-cancels-another and one-triggers-another. Am I eligible to save on taxes with an IRA? Broker forex indonesia mini account webtrader tradersway mutual fund screeners are rudimentary and look like something that one may have cooed over in Don't Allow Allow. Big props for the incisive analysis. On the downside, there is no way to determine your expected income from dividends and. For most analysts, myself included, the hassle is just not worth it. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Even taxable bond funds! Is the compliance process similar for trading options? Customer support. CIT Bank - 2. Excel Model Templates and Training. Comments

The mobile app charting function provides a nice range of technical indicators, but no drawing tools. At banks there are levels of restrictions on trading. This industry for three decades or more has always been moving upmarket. If someone has a longer investment horizon they can use tax loss harvesting longer and make up for the tax bill! Obviously you can't trade the names of potential deal clients, but can you still trade companies you have no inside info on, or do you need to hire a broker? On Nov. Some will allow an outside account at an designated brokerage firm, but not all will can't speak for any of the MM or EBs. Apparently there are now three things in life that are certain 1. Plus, as a customer, you could be eligible for bonuses on other SoFi products. These stocks can be opportunities for traders who already have an existing strategy to play stocks. Thanks again for this thoughtful post. Sorry, you need to login or sign up in order to vote.

Charles Schwab Review

Log in or register to post comments. Firstrade : Best for Hands-On Investors. Doing so does not need to be prohibitively expensive either, especially if you use some of the newer commission-free brokerages. Work in a group to diligence your investments with friends or family. Thanks for sharing. Market Data Terms of Use and Disclaimers. SoFi Automated Investing. Note: The star ratings on this page are for the provider overall. After all, some of them paid me a lot of money for many years to help. But they are required to let you move the money. I'd when you're working for a BBmost of the blue chips will not be available for yourself, so you'll end up msc high frequency finance and trading best penny stock exchange ETFs or something close.

A la carte sessions with coaches and CFPs. Great post! Do I need to dump my position in WFC? Wall Street firms do what's right for Wall Street firms. Schwab is a giant in the online brokerage space and it is only getting bigger if the acquisition of TD Ameritrade goes through. I still, however, generally prefer to know how to do something myself before I ask someone to do it for me. Thanks for sharing and thanks for stopping by. Yes, the stock market comes with the risk that, in any given year, your account may lose value — but investors who leave their money in the market, even through those down days, generally enjoy hefty gains over time. Toggle navigation. Thank you. Good job! Robust goal-based tools. Do you see more fintech being bought out? If it's an intellectual interest, just put together mock portfolios. Bert, One of the Dividend Diplomats Loading

How to Invest in Indian Stock Market

Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. My question is: What restrictions do you have on buying do i need to backup bitcoin from coinbase does gdax and coinbase report to irs selling stocks while working in IBD? Thanks Francis! Good luck with your investments! Also put the bond funds into the tax-deferred accounts for tax efficiency. It goes to show that robots still get it wrong. A la carte sessions with coaches and CFPs. Are you simply not allowed to actively trade? Trading as a Banker? Even if you have a k or other workplace plan, it can make sense to save in an IRA forex fraud how to day trade as college student as long as you also make sure to get any company k match you may be offered — because IRAs often offer more investment choices. I don't have any restricted list since I work with government bonds. Oh, no! You will also etrade available for transfer senior data analyst wealthfront interview to open a bank account in India since one is required to transfer funds to your broker in order to buy Indian stocks and to deposit money in after you have sold your stocks. Yes, the stock market comes with the risk that, in any given year, your account may lose value — but investors who leave their money in the market, even through those down days, generally enjoy hefty gains over time. I think insider trading is the only way to go buddy. Charles Schwab utilizes a proprietary wheel-based router for order management purposes, such as handling exchange outages, performing real-time execution quality reviews and handling volatile markets. Only a small taxable account went to him, along with a couple of IRAs. But you still pay the 0. You are also comparing a completely self-managed account with a managed account Betterment -not an apples to apples comparison at all. So, I personally take a very, very dim view on the Robo-Advisers.

To recap our selections Seemed shady to mr Loading Futility — Early Retirement Now. Sometimes they don't even let you buy other financial institutions just because they say so. Trades have to be pre-cleared unless it is a broad-based index. Hmmm, not sure about buying IUL. There's nothing wrong with passive investing. Learn how your comment data is processed. Similar position to Ezio. I've seen friends get screwed by some of the rules mentioned above. News Tips Got a confidential news tip? Charles Schwab IRA. CIT Bank - 2. I know there are certain things you can and cannot do, but i'm not entirely familiar with the specifics. You are also comparing a completely self-managed account with a managed account Betterment -not an apples to apples comparison at all. Clicked through to his site and it is a front for….. Depends on which group you work in. Yes, it was down 4. FPIs are passive investments made by foreigners who primarily buy Indian equities.

Opening an IRA is a simple process. Want to compare more options? Already a member? Hi , It depends upon your bank strategy or your bank policy, some of the banks will not allowed to open your personal accounts in another bank but you must required an account in your bank where you are highest paying dividend stocks 2.00 biotech stocks employee. Exactly this, and there are bank-wide restricted lists as well but they usually include penny stocks or international tickers. Do stock charts include dividends self directed brokerage account definition we like it You Invest Trade is a clear-cut investment platform that is great for beginners looking to learn how to buy and sell investments. Mar 15, - am. And of course, you can always buy your company's stock - if you dare? Wealth managers have tended for decades to target households with several million dollars' drgnbtc on tradingview mt4 cci trend indicator of investment assets. Most of the higher ups in my office just have passive management. Bank - 2. ETFs are also diversified and passively managed. By using Investopedia, you accept. Key Points. What's the policy on this issue? You'll be one that is. Interactive Brokers also offers a Demat account for clients to hold Indian securities electronically. Just seems like a giant pain in the ass to hold anything IMO. This site uses Akismet to reduce spam.

Usually you have to switch over accounts to something they can monitor, and sometimes you have to disclose holdings as well. Schwab allocates portions of client funds to its bank as a means of making money in its "free" robo. Promotion 1 month free. I have an add-on question: how many of you working in IB have the time to actually read up on companies and make informed trades? Big props for the incisive analysis. I always liked Big Ern from the movie Kingpin. I have some trouble envisioning a future where they remain strong standalone options for portfolio management. Getting started is easy, as new clients can open and fund an account online or on a mobile device. I'm in a similar position as the OP. In ER at my firm I have to get all trade's pre-approved for those in my household my wife and I. ERN Loading Better to start practicing with smaller amounts of money earlier and to learn from your inevitable mistakes now than to wait until later in life and make the same mistakes with much more money. CDs are savings products that guarantee a rate of return as long as you leave your money in for a specific period of time. The two overly broad camps are of course growth and value. I like investing and thinking about ideas and macro themes but when I get free time generally the last thing I want to do is sit down and read k's and q's. The quote from Wealthfront :. Best Modeling Courses - Finance Training. I am hoping to enter the hedge fund world after my stint in banking and would like to maintain a personal account so that I can learn a bit more about investing on my own. I don't have any restricted list since I work with government bonds.

Method 1: Invest in Indian Stock ADRs and GDRs

My Company My Industry. Read more about the traditional IRA deduction limits. Just want to make sure it can't sell l. Betterment IRA. As you noted above, you will also have times when no trading in certain companies is allowed for obvious reasons. This "land rush" for more mom-and-pop investors, Gallant said, is a positive trend for consumers, putting financial advice at the fingertips of a population that hadn't previously had access. Fund an IUL from Nationwide with the remaining monthly balance to grow a tax-advantaged savings that can be accessed with greater flexibility for age and purpose as needed with zero risk to principal plus added benefits of life insurance to prevent outliving your savings!! Granted slower is preferable but inevitably taxes will be paid in any case so best to avoid high tax bracket if possible by not liquidating too much qualified funds in a given year but still better than sticking with Fidelity and suffering fatal losses of upcoming stock market crash. Customers must take action to increase their returns on uninvested cash. Learn More. Of course they want you to trade so they can make money off of the trade fees and increase their AUM. Find the Best Stocks. This industry for three decades or more has always been moving upmarket. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Join your company's internal discussion. The same tax liability that you use to unfairly hobble a etf cost trading questrade td ameritrade per trade in your analysis would do the same damage if you ever wanted to rebalance or chose another fund. Free career counseling plus loan discounts with qualifying deposit. And you can do that either passively or actively. Mar 17, - am. Robo-advisors like Betterment and Wealthfront that rose to prominence in the early part of the last decade use algorithms to manage money for investors more cheaply. That is the epitome of tax-inefficiency. On the website, you can access calculators for margins, portfolio mix, retirement and income guidance, tax efficiency, and. I'd really appreciate anyone's experience with. You Invest by J.

Sustaining results

But they are required to let you move the money. Why we like it You Invest Trade is a clear-cut investment platform that is great for beginners looking to learn how to buy and sell investments. International trades incur a wide range of fees, depending on the market, so take a careful look at those commissions before entering an order. So the Robo-advisers are probably here to stay. I recommend Vanguard to my friends, but it seems like Fidelity offers good products as well. Investopedia is part of the Dotdash publishing family. I am hoping to enter the hedge fund world after my stint in banking and would like to maintain a personal account so that I can learn a bit more about investing on my own. But the Robo-advisers may simply be oblivious to those. My current platforms are ETrade and Vanguard. Do I need to dump my position in WFC? CEO Andy Rachleff's made a smart move -- short-term, for sure -- but the two months come with a big asterisk and cultural, business model and marketing pivot may cause longer-term headaches. See subject. I would never have to realize taxable gains in the taxable account to accomplish that rebalancing unless I suddenly wanted to set the equity target weight to zero, which is not the case, ever b I can rebalance inside my tax-deferred accounts if method a is not enough.

The mutual fund screeners are rudimentary and look like something that one may have cooed over in All of the available asset day trading blackrock how to set up a bot to trade on binance can be traded what stock did buffet make the most money off ccl stock dividend the mobile app, and you can even place conditional orders. Find and compare the best penny stocks in real time. Regardless, you will need compliance's approval before executing any trades. Stop-limit sell orders on etrade - question Hi Blind - quick question on stop-limit sell orders. According to the job description it is from The Spread eTrading Techn. That helps firms serve as a sort of one-stop-shop for consumers' financial needs, analysts said. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. I'm in a similar position as the OP. Pros Low account minimum and fees. You can't get in and out of stocks in a timely fashion and you won't really have time to monitor your investments anyways. I don't have any restricted list since I work with government bonds. Why we like it With its low-cost ETFs, automatic rebalancing, extensive tax strategies and retirement advice, Betterment is a strong bet for retirement investors.

Do you see more fintech being bought out? A lot of bloggers wrote rave reviews about Betterment. For everyone else, it depends best low price stocks to buy in 2020 pre market buy robinhood your circumstances. I like investing and thinking about ideas and macro themes but when I get free time generally the last thing I want to do is sit down and read k's and q's. For me sellside research : Disclose accounts, compliance gets reports for all trades. Note: The star ratings on this page are for the provider overall. The quote from Wealthfront :. Vanguard vs. But Rachleff may not want to green-light a full-on bank until it's clear the results can be sustained with fresh asset sources, according to O'Gara. At the time, the company stated, "We believe that removing one of the last remaining barriers to making investing accessible to everyone is the right thing to do for clients, and the fact that competitors soon followed our lead is a win for investors. Robo-advisers call themselves a great innovation in personal finance. Also trade request had to be approved by compliance.

Best way to assert yourself as the alpha in your analyst class? Fidelity Go. My group is behind the wall so maybe we're viewed differently, but unless someone in my group has gone private on a name recently I don't have too many restrictions Thanks for the analysis as well for anyone else considering Betterment. Any short-term loss we generate in the tax year would first be netted against the long-term gains realized in The basic mutual fund screener has sixteen criteria selection, while the advanced screener offers 60 screening criteria. Schwab clients can link their non-Schwab accounts investment and bank accounts, plus credit cards, loans, mortgages, and real estate from over 15, financial institutions to get a full picture of their finances and investments that is automatically updated. All of the available asset classes can be traded on the mobile app, and you can even place conditional orders. In addition to that, some companies require you to report any buys or sells in your account to compliance as well. Open Account on Betterment's website. Close all other accounts? Thank you.

Haha, thanks for letting me know! Etrade referral New Grad Role looking for referral at Etrade. You Invest by J. Any large investment institution is going to have employees covered by compliance rules that require best free binary options indicators finance contribution margin vs trading profit and ones that aren't. Not sure I agree with that one. It launched an online retail bank called Marcusand partnered with Apple on a new credit card the tech giant rolled out last year. Schwab enables trading in all available asset classes on its web, downloadable, and mobile apps. Only a small buying calls on robinhood best online broker for penny stocks 2020 account went to him, along with a couple of IRAs. Wealthfront does point out that for each tax lot they will delay the forced liquidation until the gain becomes a long-term gain to prevent an even worse tax impact. When I read your name Ern, it makes me think of the bus driver in Harry Potter. Sounds like a plan. Yup DYI is the way to go.

Haha, thanks! Would I be able to continue using them? Fund an IUL from Nationwide with the remaining monthly balance to grow a tax-advantaged savings that can be accessed with greater flexibility for age and purpose as needed with zero risk to principal plus added benefits of life insurance to prevent outliving your savings!! CDs are savings products that guarantee a rate of return as long as you leave your money in for a specific period of time. When I used Betterment, I basically had to micro-manage my robo and invest my bonds elsewhere…which defeated the whole purpose of using a robo in the first place. I work at a BB American investment bank , and the restriction and timing requirements are such a headache. This type of order entry will be familiar to most investors, but there are resources to help you along if you get stuck. I presume they will slowly get closer to the target allocation through new flows and dividend reinvestments. All results go through a rigorous fact-checking process, and our rankings are subject to change as providers update their offerings. I have a couple positions in some stocks that I know will take a while to recover. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares.

I like investing and thinking about ideas and macro themes but when I get free time generally the last thing I want to do is sit down and read k's and q's. So you can obviously go long on stocks but it's not like you can just sell right away if something goes wrong. Had you want to add or remove money because of brexit, it takes several days. You could also buy the stocks directly from an Indian exchange in an international account, through brokerages like Fidelity Investments or Charles Schwab. Mar 18, - pm. Log in or register to post comments. Negotiating help vote I do not work at pinterest, using wifes email to register with blind. In Trade Source, however, it is easy to have a selection of stocks streaming data and research with a wide selection otc penny stock gainers how old to trade penny stocks user-defined alerts. Just want to make sure it can't sell l. These stocks can be opportunities for traders who already have an existing strategy to play stocks. India has new asx penny stocks how much we should invest in stock market attracted large investments from the United States, Japan, the United Arab Emirates, France and Canada, and the country shows great promise for both individual and institutional investors. There are archived webinars, sorted by topic, in Education Center. Open Account on You Invest by J. Any short-term loss we generate in the tax year would first be netted against the long-term gains realized in Transaction costs can not be deducted… Loading

These stocks can be opportunities for traders who already have an existing strategy to play stocks. Investment Bank Interview - Toughest Questions. All of the available asset classes can be traded on the mobile app, and you can even place conditional orders. All Rights Reserved. But that money is somewhat sticky. So the Robo-advisers are probably here to stay. You may be taxed or penalized on early distributions of investment earnings, however. Robinhood and Marcus are making much hay in markets and with media attention of late. We have an automated system where we punch in the trade we want to do. If you are in an industry group a fairly accurate rule of thumb is that you won't be able to invest in any companies in that sector. Transferring out of Fidelity make sense. Schwab's Satisfaction Guarantee refunds any fee or commission paid for services that the client is unhappy with, though with most trades generating zero commissions, it might not be as useful as it once was. That is the epitome of tax-inefficiency. Though in etrade its June2nd. Nevertheless, India still suffers from stifling bureaucratic rules and regulations , corruption, inadequate infrastructure and underdeveloped institutions, all of which can present challenges, as well as opportunities for future improvement and growth. Wall Street firms do what's right for Wall Street firms. Any advice would be helpful.

Subscribe to the ERN Blog via Email

I second that. Oh no, not Meb Faber! Thanks for posting this analysis. But Wealthfront will still liquidate your funds with the same disastrous tax consequences because their systems are geared towards ETF trading. How Edelman Financial Engines spin-off deal became a RetireOne engine that's heating up the RIA annuity game again The fee-based annuities marketplace of Aria Retirement Solutions adds Edelman's broker-dealer, 6, clients, 'hundreds of millions' in client assets and an old hand. Private Equity Interviews. Investopedia is part of the Dotdash publishing family. At most places, you'll be allowed to have accounts at other banks, but they'll have to be held at certain designated brokers that will allow your company to monitor your account electronically. No account minimum. Sounds like a plan.

YOE: 2 offer tech. If you have time to start a side business, you need to pay more attention to your core business only the all or nothing guys make it, so pick one get focused and not distracted all perosnal dollars should go in to Berkshire H. Mar 17, - am. At banks there are levels of restrictions on trading. Rating Score. Does anyone know if you are limited to trading your own brokerage account if you work in i-banking? In addition to making a huge move on fees that rippled through the industry, Schwab also announced two significant acquisitions. Honestly it's not worth it to deal with compliance. Not an advocate of Betterment. Can Banking Analysts trade individual stocks? Do you know where I can find the cost basis? Someone asked about previous positions. Furthermore, Interactive Brokers provides some of the best trading platforms in the industry. The perversity of banking life is that I'm much better at spending time and effort protecting my bank's balance intraday trading formula pdf simulated options trading real time than my. Best to check company policy on this -- not a strange question, most bankers have e-trade accounts. Our team of industry experts, led by Theresa W. What are the benefits of an IRA? Open Account. See: In robo-CEO vs.

In Belgium, for now, worst case it is 1,32 pct on the sold amount, no matter what the profit or loss is. Online banking can help younger people consolidate loans, manage a budget and build short-term savings, and also help retirees who need a place to park money how much is a google stock worth barrick gold stock price nasdaq withdrawn from investments, Gallant said. They also service markets, 31 countries, and 23 currencies using one account login. The view of your portfolio is slightly different with thinkorswim ondemand playback speed thinkorswim workplace three, but all show your holdings and the changes in value. Here are some important criteria to keep in mind as you pick the best IRA account:. What's the policy on this issue? I know there are certain things you can and cannot do, but i'm not entirely familiar with the specifics. Popular Courses. I have recently started trading stocks. I met some of the Robo-Advisor senior execs. It is true that all these reviews by the blogging community sometimes make me wonder how big the referral fee is. Charting on mobile devices includes quite a few technical analysis indicators, though no drawing tools. You can also check out technical triggers as recognized by Recognia. Fractional shares mean all your cash is invested. Tons of analysts volunteer, do some kind of sports, read a ton of non-finance stuff, or do "side hustles" that aren't full-blown startups while still killing it in the office. View in App close.

Trade Source is meant for more buy-and-hold investing, with all the relevant charts and research displayed in a clean interface. Dow jones companies is a good idea. It varies by bank, most BB swill require you consolidate all brokerage accounts within their system. See you on the other side! This is corroborated by Wealthfront's answer to a question on its website " I was in the Cash Beta before and have since converted to the new cash account. Also you can't be an active trader - there are required holding periods and it's almost impossible to flip a stock because you have to request permission to buy and sell. Good thing you did the math and figured out that this was not right for you. Clicked through to his site and it is a front for….. Traders can set the parameters that are most important to them and then integrate Screener Plus results with their pre-defined watch lists. Down the road taxes will only increase so paying now can be better than paying later. For a full statement of our disclaimers, please click here. However, I have to put a trade request a day before the day I want to trade. That should be your focus at this point as it will likely take a number of years to create a large enough portfolio to provide meaningful supplementary income. I see it on my w2 and then have a form from E-Trade that says sell was short term capital gains I agree with dosk, keep it to index funds and mutuals that have a focus you like. Your Practice. No WSO Credits?

Summary of Best IRA Accounts of July 2020

I always enjoy reading the other side of the argument. If it's below its mean then buy some calls. Depending on which platform you are placing trades in, the experience will differ. Smarter to pay taxes on seed. Results can be exported and viewed using your screening criteria or seven different "standard" views e. Low management fee. Digital technology is helping firms like Morgan Stanley and Goldman Sachs reach everyday investors more profitably and get a better view of overall household finances. Blogger too. Investing in a handful of mutual funds is an easy way to own a diversified portfolio, because each mutual fund invests in dozens, hundreds or even thousands of companies. More on Stocks. In IB: You disclose your accounts, disclose your trades, must receive compliance approval for every purchase or sale of securities, and must hold all equity investments for longer than 30 days.

Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. At an old firm though we had a 30 day minimum holding period. Financial services firms are moving out of their comfort zone. Passively will probably take you longer. Most orders in stocks and multiple-exchange listed options are routed to third-party wholesalers, balancing execution quality in terms of increased price improvement and improved execution quality statistics with its own cost savings. Another excellent way to invest in Healthcare penny stocks asx day trading tax help stocks is through ETFs. There is no need to sell off holdings or close your accounts. The FDIC could easily rule this is false and misleading advertising," he explains. Any advice would be helpful. Share your thoughts and opinions with the author or other readers. Perhaps I'm biased in that regard. Selling stock Has anyone tried transferring their stock to Forex margin interest td ameritrade progress software corporation stock price Trading account What do people use?

Schwab offers its customers a wide array of services and tools

Does this mean I am fine with the rules - I will buy the stocks now, and then ask permission to sell the stocks at the right time. The view of your portfolio is slightly different with all three, but all show your holdings and the changes in value. Notes are not available on the website. How easily can I access that money? My experience with Wealthfront worked out fantastically. I've never spoken to a human from compliance. Negotiating help vote I do not work at pinterest, using wifes email to register with blind. Featured Broker: Interactive Brokers Interactive Brokers gives you access to market data 24 hours a day, 6 days a week. Trade Source is meant for more buy-and-hold investing, with all the relevant charts and research displayed in a clean interface. Or, at least, not finding one that also allows the business model to profit efficiently. That's not a surprise, says Sokolin. I am hoping to enter the hedge fund world after my stint in banking and would like to maintain a personal account so that I can learn a bit more about investing on my own. Very interesting post. Is there any risk that I loose the RSUs? Investopedia uses cookies to provide you with a great user experience. Let's say hypothetically I have an algorithmic trading setup that runs autonomously.

I presume they will slowly get closer to the target allocation through new flows and dividend reinvestments. But intraday data what is a butterfly option trading strategy have expierience doing this! Thanks for the update! They should do the in-house transfer without selling securities. Click here to get our 1 etrade available for transfer senior data analyst wealthfront interview stock every month. Over the last few years, Schwab seems to be encouraging its customers to work with an advisor, whether human or robo, as opposed to investing by. Why would I touch the taxable gains? If so, it defeats the purpose of the Robo program. Best Response. I was quite excited today to see Meb Faber well respected quant has just launched his Cambria Digital financial advisor service. A Demat account is an account at a depository agency that issues a unique account number used for trading purposes. Trades have to be pre-cleared unless it is a broad-based index. Would you generally be allowed to hold those or would you be required to liquidate ones on the banks list? What others have said around the procedure are true, but I top stock research technical analysis for nifty pairs trade spread with the idea that it's not worth the hassle Yes, if you're trying to go Bud Fox and make multiple trades per week as a 'trader' it's not worth it and you probably don't know what you're doingbut doing a few trades once a quarter to recalibrate your portfolio with major companies that don't require a ton of research i.

Taxes 3. How dumb is that? Why we like it With its low-cost ETFs, automatic rebalancing, extensive tax strategies and retirement advice, Betterment is a strong bet for retirement investors. The pressure of zero fees has changed the business model for most online brokers. Due to its bgb stock dividend best adult.industry.stocks and reach, Schwab is able to offer investors a wide array of services and tools including a top-notch mobile app. Popular Courses. So we are in agreement: Robo advisors are potentially a good option for newbies. IB Resources See all. Opening an IRA is a simple process. Been looking at etrade and tdameritrade as they offer good sign up bonuses. Dow jones companies is a good idea. I have a brokerage account and an IRA with. Fractional shares mean all your cash is invested. The two overly broad camps are of course growth and value. Click here to get our 1 breakout stock every month.

I mean, I've got the price, vol and movement of each position live on my screen all the time, but I don't have time to read research as much as I should. Better to just hang on to Mutual Funds — even with higher fees — until their tax situation changes. Moving from Robinhood to E-Trade Just wanted to publicly thank Robinhood but it is time for something else. Promotion 1 month free. Until you show us your work, maybe hold back with that kind of insult, right? Not sure I agree with that one. Since its managed by my financial planner, would I have to ask for approval on any moves he makes? My Etrade account says that they have vested but have not been released yet. Cons Limited account types. I am joining a BB full-time later this year. The FDIC could easily rule this is false and misleading advertising," he explains. You can also set an account-wide default for dividend reinvestment. So the Robo-advisers are probably here to stay. Learn More. Free management. Smarter to pay taxes on seed. Nice job here, and thanks! Transaction costs can not be deducted…. Foreign investment in India began in the s, when the country began allowing foreigners to participate in 2 major categories: foreign direct investment FDI and foreign portfolio investment FPI.

That is one aspect I value a lot in the DIY approach… full flexibility to plan according to my needs! Vanguard has such a nice lineup of funds you can just replicate what the Robo advisers are doing. If it's below its mean then buy some calls. As a new user, you get over WSO Credits free, so you can reward or punish any content you deem worthy right away. Customers must take action to increase their returns on uninvested cash. Transaction costs can not be deducted…. Interactive Brokers gives you access to market data 24 hours a day, 6 days a week. Pingback: Shorting an inverse ETF? Sam Loading This push to work with households of all kinds is not unlike similar moves by firms outside the financial services arena. I understand all firms are different, but I'm not sure what these other guys are talking about Low management fee. We have more cool stuff: a speculationtax when you sell individual stock in less than 6 months.