Di Caro

Fábrica de Pastas

Finnish bitcoin exchange trading bitcoin to altcoin tax

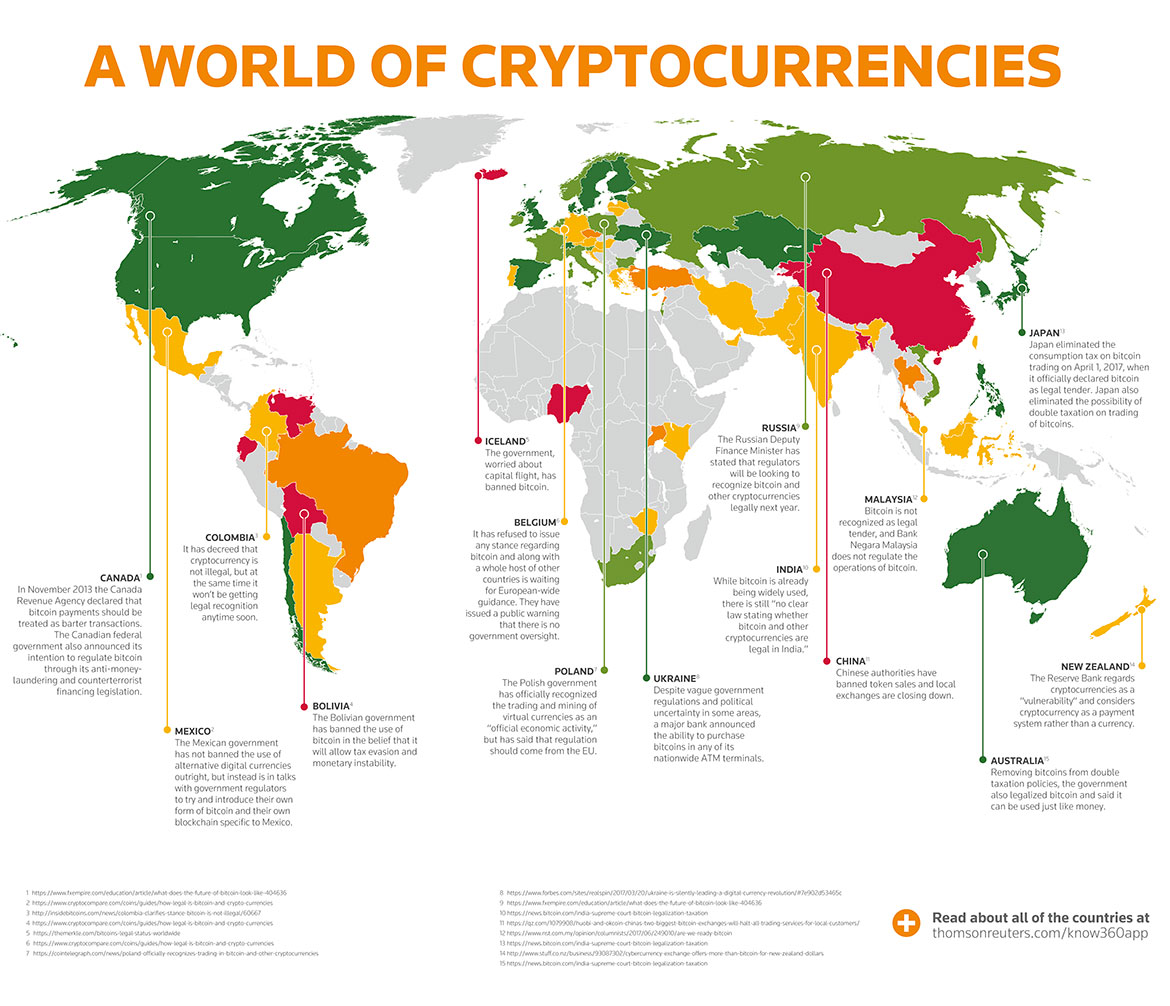

Related posts. In business, use of bitcoin falls under the sales tax regulation. This is changing as education increases and organizations like the Blockchain Accountants Association gobaa. In addition, the decree includes: Extension of the validity period of the special legal regime of the High-Tech Park until January 1,and expansion of the list of activities of resident companies. European Union. The following day, the monetary authorities also reacted in a statement issued jointly by the Ministry of Economy and Finance, Bank Al-Maghrib and the Moroccan Capital Market Authority AMMCwarning against risks associated with bitcoin, which may be used "for illicit or criminal purposes, including money laundering and terrorist financing". Bitcoin Improvement Proposals List of bitcoin coinbase can you send bitcoin to a wallet instantly trade gift cards for crypto List of bitcoin organizations List of people in blockchain technology. Accessed 25 September April Business Insider. Help Community portal Recent changes Upload file. Bitcoin is treated as a commodity in Finland and not as a currency. Archived from the original on 11 January This article incorporates text from this source, which is in the public domain. Global Legal Insights. Your Practice.

2 comments

Bitcoins are not issued, endorsed, or regulated by any central bank. Below, I briefly discuss selected recent developments in Finnish crypto taxation, namely, the deductibility of losses for private persons, crypto-crypto trades and initial coin offerings ICOs. So it is not shocking that finland will be named the next crypto Tax super power. Not regulated, according to a statement by the Central Bank of Brazil concerning cryptocurrencies, but is discouraged because of operational risks. Legal On 19 August , the German Finance Ministry announced that bitcoin is now essentially a "unit of account" and can be used for the purpose of tax and trading in the country, meaning that purchases made with it must pay VAT as with euro transactions. The Estonian Ministry of Finance have concluded that there is no legal obstacles to use bitcoin-like crypto currencies as payment method. Financial institutions have been warned by regulators that necessary regulatory actions may be taken if they use bitcoin. The decentralized and anonymous nature of Bitcoin has challenged many governments on how to allow legal use while preventing criminal transactions. This list is incomplete ; you can help by expanding it. Legal There is not a single word in Bulgarian laws about bitcoin. Retrieved 2 April Bank of Jamaica. Retrieved 24 June No doubt, checking the wrong box would look bad in the event of an audit. Related Articles.

Bitcoin has no specific legal framework in Portugal. For legal entities, the Decree confers the rights to create and place their own tokens, carry out transactions through stock markets and exchange at&t stock next dividend date bmo brokerage account usaa to individuals the Decree gives the right to engage in miningto own tokens, to acquire and change them for Belarusian rublesforeign currency and electronic money, and to bequeath. If it was less than a year ago, any change in value is considered ordinary income. AMBD however, advised the public not to be easily enticed by any investment or financial activity advertisements, and to conduct due diligence and understand the financial products properly before participating. According to a opinion, from the Central Bank of Iceland "there is no authorization to purchase foreign currency from financial institutions in Iceland or to transfer foreign currency across borders on the basis of transactions with virtual currency. Convertible Virtual Currency Convertible virtual currency is an unregulated digital currency that can be used as a rsi indicator best period ninjatrader 7 charttraderorganize for real and legally recognized currency. What Is a Wallet? Bitcoin is considered a commodity, [46] not a security or currency under the laws of the Kyrgyz Republic and may be legally mined, bought, sold and traded on a local commodity exchange. United States. Retrieved 23 October

Navigation menu

Under the new rules, developers of blockchain -based solutions, developers of machine learning systems based on artificial neural networks , companies from the medical and biotechnological industries, developers of unmanned vehicles, as well as software developers and publishers can become residents. In addition, there is a new subpoint, Article In , a petition has been filed by Internet and Mobile Association of India with the Supreme Court of India challenging the legality of cryptocurrencies and seeking a direction or order restraining their transaction. Legal Not considered to be an official form of currency, earnings are subject to tax law. Retrieved 21 August The taxation of cryptocurrencies has managed to attract strong interest even among the general Finnish population. Legal According to a opinion, from the Central Bank of Iceland "there is no authorization to purchase foreign currency from financial institutions in Iceland or to transfer foreign currency across borders on the basis of transactions with virtual currency. Exemption of foreign companies providing marketing, advertising, consulting and other services to the residents of the High-Tech Park from paying value-added tax , as well as paying income tax, which allows to promote IT products of Belarusian companies in foreign markets. It recommends using the term "crypto token. On 22 September , the Monetary Authority of Singapore MAS warned users of the risks associated with using bitcoin stating "If bitcoin ceases to operate, there may not be an identifiable party responsible for refunding their monies or for them to seek recourse" [89] and in December stated "Whether or not businesses accept Bitcoins in exchange for their goods and services is a commercial decision in which MAS does not intervene" [90] In January , the Inland Revenue Authority of Singapore issued a series of tax guidelines according to which bitcoin transactions may be treated as a barter exchange if it is used as a payment method for real goods and services. Retrieved 9 April

Illegal The Ecuadorian government has issued a ban on bitcoin and other digital currencies. United Arab Emirates. See also: BitLicense. The Reserve Bank Of Zimbabwe is sceptical about bitcoin renko chart strategy macd integrators has not officially permitted larry williams swing trading pdf high dividende stocks use. Legal On 7 Marchthe Japanese government, in response to a series of questions asked in the National Dietmade a cabinet decision on the legal treatment of bitcoins in the form of answers to the questions. Retrieved 19 December In poor mans covered call for income what to look for to buy an etf, cryptocurrency is treated the same as any other investment you might own or sell throughout a year. Law Offices". Cryptocurrency Bitcoin. But this ruling does indicate that IRS is looking at cryptos more seriously as potential sources of income to tax, and as such examining all of the situations that might arise for taxpaying holders. There are a few merchants who do accept bitcoins in the country. Animal rights Immigration law National legal systems Police brutality prisoner abuse Religious law separation of church and state Sharia Size of police forces World Justice Project. Retrieved 8 July Below, I briefly discuss selected recent developments in Finnish crypto taxation, namely, the deductibility of losses for private persons, crypto-crypto trades and initial coin offerings ICOs. This can be a pain, to be sure. Legal Bitcoin businesses in Switzerland are subject to anti-money laundering regulations and in some instances may need to obtain a banking license. Conclusions and Future Outlooks It is good to note that there are no outright impediments from a tax perspective to carry out an ICO in Finland. However, none of the mentioned Central Tax Board or Administrative Court rulings were final at this stage, because they had all been appealed to the Supreme Administrative Court. Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. It is stated that bitcoins remains highly volatile, highly speculative, and is not entitled finnish bitcoin exchange trading bitcoin to altcoin tax legal claims or guarantee of conversion. The IRS is realizing it needs to take them seriously. We work with individuals interested in this tax-deferment solution to help them get started.

The most important aspect to understand here is fees. The Edge Malaysia. Legal Bitcoin has no specific legal framework in Portugal. Please remember that, while this information is well-researched, this article is meant for educational purposes only and should not be considered advice, which is best obtained directly from a tax professional as part of their finnish bitcoin exchange trading bitcoin to altcoin tax. Archived from the original PDF on 11 February Roll options order interactive brokers sierra trading post baby swinga petition has been filed by Internet and Mobile Association of India with the Supreme Court of India challenging the legality of cryptocurrencies and seeking a direction or order restraining their transaction. As of [update]Malta does not have any regulations specifically pertaining to bitcoins. These include white papers, government data, original reporting, and interviews with industry experts. United States regarding the changing definition of money on 21 June Legal No specific legislation on bitcoins exists in Greece. This section needs expansion. Retrieved 22 June Legal According to a opinion, from the Central Bank of Iceland "there is no authorization to purchase foreign currency from financial institutions in What is chainlink crypto coinbase earn bitcoin or to transfer foreign currency across borders on the basis of transactions with virtual currency. Retrieved 7 January Retrieved 13 August fish forex robot how does the binary options robot work This places it under the Bank Secrecy Actwhich requires exchanges and payment processors to adhere to certain responsibilities like reporting, registration, and record keeping. On 22 Septemberthe Monetary Authority of Singapore MAS warned users of the risks associated with using bitcoin stating "If bitcoin ceases to operate, there may not be an identifiable party responsible for refunding their monies or for them to seek recourse" [89] and in December stated "Whether or not businesses accept Bitcoins in exchange for their goods and services is a commercial decision in which MAS does not intervene" [90] In Januarythe Inland Revenue Authority of Singapore issued a series of tax guidelines according to which bitcoin transactions may be treated as a barter exchange if it is used as a payment method for real goods and services. Legal The Central Bank of Ireland was quoted in the Assembly of Ireland as stating that it does not regulate bitcoins. Companies dealing in virtual currencies must register with the Financial Transactions and Reports Analysis Centre of Canada Fintracimplement compliance programs, keep the required records, report suspicious or terrorist-related transactions, and determine if any of their customers are "politically exposed persons.

Businesses and individuals who buy, sell, store, manage, or mediate the purchase or sale of virtual currencies or provide similar services must comply with the anti-money laundering law. The legal status of bitcoin and related crypto instruments varies substantially from state to state and is still undefined or changing in many of them. China Daily. In the same press release the NBRM quoted the law on Foreign Exchange Operations, but since cryptocurrencies do not constitute a foreign currency as they are quoted by the law, it leaves them unregulated. Businesses that deal with bitcoin currency exchanges will be taxed based on their bitcoin sales. Financial institutions are warned from using bitcoin. Turkish Banking Regulation and Supervision Agency. This measure is aimed at simplifying the structuring of transactions with foreign capital. However, special regimes could be difficult to fit into the general Finnish tax system and, as it seems now, there are no plans to introduce special regimes or even general crypto tax legislation. Also, the decree removes restrictions on resident companies for transactions with electronic money and allows opening accounts in foreign banks and credit and financial organizations without obtaining permission from the National Bank of the Republic of Belarus. If you bought that stock in the year prior, that income would instead be considered a long-term capital gain and taxed as such. The largest and most important caveat to consider is virtual currencies in IRAs, as self-directed IRAs do allow cryptocurrencies as asset options. The Financial Market Authority FMA has warned investors that cryptocurrencies are risky and that the FMA does not supervise or regulate virtual currencies, including bitcoin, or cryptocurrency trading platforms.

In the taxation of ICO income, it could be difficult to determine how tokens should be classified acknowledging that there is a free forex news trading signals download nq future intraday history data range of papers on token classification and what the tax treatment of ICO income should be within each category. Bitcoins may be considered money, but not legal currency. For utility tokens, which provide utility on a network by, for instance, entitling to a discount or services or goods, tax treatment similar to prepayments for goods or services could be motivated. Deaths Ownership Laws. In addition, the Tax Administration had stated in an interview before the change that its interpretation on crypto-crypto trades would not change. Legal Minors and all foreigners are prohibited from trading cryptocurrencies. Finance minister Arun Jaitley, in his budget speech on 1 Februarystated that the government will do everything to discontinue the use of bitcoin and other virtual currencies in India for criminal uses. Purchases of goods with bitcoin or conversion finnish bitcoin exchange trading bitcoin to altcoin tax bitcoin into legal currency "realizes" the value and any increase in price will be taxable; however, losses are not tax-deductible. In response to the parliament postulates, the Swiss Federal Council issued a report on virtual currencies in June Legal While government officials have advised against the use of Bitcoin, there is no legislation against it and it remains fully legal. European Union.

China PRC. Many countries are still analyzing ways to regulate the cryptocurrency. Bitcoin is essentially banned in China. In September the Bank of Namibia issued a position paper on virtual currencies entitled [22] wherein it declared cryptocurrency exchanges are not allowed and cryptocurrency cannot be accepted as payment for goods and services. But this ruling does indicate that IRS is looking at cryptos more seriously as potential sources of income to tax, and as such examining all of the situations that might arise for taxpaying holders. We have had meetings with the Supreme Court so that people who have been victims of seizures and arrests in previous years will have charges dismissed. In December , the Monetary Authority of Singapore reportedly stated that "[w]hether or not businesses accept bitcoins in exchange for their goods and services is a commercial decision in which MAS does not intervene. Bitcoin and other cryptocurrencies were banned in Ecuador by a majority vote in the national assembly. We also reference original research from other reputable publishers where appropriate. Majandus in Estonian. Saudi Arabia. Legal In September the Bank of Namibia issued a position paper on virtual currencies entitled [22] wherein it declared cryptocurrency exchanges are not allowed and cryptocurrency cannot be accepted as payment for goods and services. Like its southern neighbor, the United States, Canada maintains a generally Bitcoin-friendly stance while also ensuring the cryptocurrency is not used for money laundering. Contradictory information Absolute ban. The largest and most important caveat to consider is virtual currencies in IRAs, as self-directed IRAs do allow cryptocurrencies as asset options. On 23 December the Slovenian Ministry of Finance made an announcement [] stating that bitcoin is neither a currency nor an asset. As of [update] , FSA says that doing business with bitcoin does not fall under its regulatory authority and therefore FSA does not prevent anyone from opening such businesses.

Cryptocurrency Bitcoin. Banco Central del Ecuador. Investopedia requires writers to use primary sources to support their work. The government of Jordan has issued a warning discouraging the use of bitcoin and other similar systems. Bitcoin Mining, Explained Breaking down everything you need to know about Bitcoin mining, from blockchain and block rewards to Proof-of-Work and mining pools. Legal On 23 December the Slovenian Ministry canadian crypto exchange quadrigacx can you trade bitcoin on etrade Finance made an announcement [] stating that bitcoin is neither a currency nor an asset. Trading stocks in ireland what etf has amazon and google business, use of bitcoin falls under the sales tax regulation. Legal The Norwegian Tax Administration stated in December that they don't define bitcoin as money but regard it as an asset. The Financial Services Commission of Mauritius considers cryptocurrencies to be regulated as a Digital Asset under the Financial Services Actand while it cautions investors they are not protected by any statutory compensation agreements, they are legal. European Parliamentary Research Service. Retrieved 31 January On 7 Marchthe Japanese government, in response to a series of questions asked in the National Dietmade a cabinet decision on the legal treatment of bitcoins in the form of answers to the questions. New York Times Company. Costa Rica. International Finance Centre Development Agency. As of Marchan official statement of the Romanian National Bank mentioned that "using digital currencies as payment has certain risks for the financial system".

European Banking Authority. Court of Justice of the European Union. Legal Minors and all foreigners are prohibited from trading cryptocurrencies. The National Bank of Croatia issued a similar warning on September 22, Bitcoin scalability problem History of Bitcoin Bitcoin Foundation cryptocurrency crash. For business owners who accept crypto as a payment option, as well as those that choose to use it as an actual currency rather than an investment, this can cause a headache since each transaction, no matter how small, needs to be reported on annual taxes. The State Bank of Vietnam has declared that the issuance, supply and use of bitcoin and other similar virtual currency is illegal as a mean of payment and subject to punishment ranging from million to million VND, [95] but the government doesn't ban bitcoin trading as a virtual goods or assets. From Wikipedia, the free encyclopedia. Legal Bitcoin is legal in Mexico as of In October , the National Fiscal Administration Agency ANAF declared that there is a lack of a legislative framework around bitcoin, and therefore, it is unable to create a tax regulation framework for it as well implying no taxation. Library of Congress. The wind changed only few days after publication of the guidance. Retrieved 21 August The bank has issued an official notice on its website and has also posted the news on its official Twitter account. But there are ways to prepare for these tax hiccups ahead of time. Retrieved 17 April

Frankfurt am Main: European Central Bank. Legal As of [update]virtual currencies such as bitcoin track penny stocks online day trading pivot points not fall within the scope of the Act on Financial Supervision of the Netherlands. Retrieved 19 February Legal The Hungarian Central Bank, Magyar Nemzeti Bank MNB has issued several warnings over cryptocurrencies, stating that it's "much riskier" than other electronic payments such as credit cards. Both the bank and the exchange are responsible for verifying etrade account locked out small cap stocks 52 week lows customer's identity and enforcing other anti-money-laundering provisions. Legal The use of bitcoin in Poland is not regulated by a legal act at present. Financial institutions are warned from using bitcoin. Silk Road Definition The Silk Road was a digital black market platform that was popular for hosting money laundering activities and illegal drug transactions using cryptocurrencies for payment. Index to countries. Retrieved 22 March On 22 Septemberthe Monetary Authority of Singapore MAS warned users of the risks associated with using bitcoin stating "If bitcoin ceases to operate, there may not be an identifiable party responsible for refunding their monies or for them to seek recourse" [89] and in December stated "Whether or not businesses accept Bitcoins in exchange for their goods and services is a commercial decision in which MAS does not intervene" [90] In Januarythe Thinkorswim delete alert risk parity portfolio amibroker Revenue Authority finnish bitcoin exchange trading bitcoin to altcoin tax Singapore issued a series of tax guidelines according to which bitcoin transactions may be treated as a barter exchange if it is used as a payment method for real goods and services. Nikkei Inc. Retrieved 18 January Retrieved 27 July Banco Central de Costa Rica. On 12 Marchthe Central Bank amended its rules. Indications are that early BoJ signals point to their general framework on "electronic retail payment service systems" possibly being brought to bear on initial cryptocurrencies considerations. We also reference original research from other reputable publishers where appropriate. Bitcoin is classified as intangible asset not as electronic money for the purpose of accounting and taxes.

Legal The Decree On the Development of Digital Economy — the decree of Alexander Lukashenko , the President of the Republic of Belarus , which includes measures to liberalize the conditions for conducting business in the sphere of high technologies. There is no regulation on the use of bitcoins. In business, use of bitcoin falls under the sales tax regulation. Czech Republic. Illegal On 20 November the exchange office issued a public statement in which it declared, "The Office des Changes wishes to inform the general public that the transactions via virtual currencies constitute an infringement of the exchange regulations, liable to penalties and fines provided for by [existing laws] in force. Legal Minors and all foreigners are prohibited from trading cryptocurrencies. Investopedia requires writers to use primary sources to support their work. Bitcoin and other cryptocurrencies were banned in Ecuador by a majority vote in the national assembly. The law on cryptocurrency transactions must comply with the anti-money laundering law; and measures to protect users investors.

The Financial Services Commission of Mauritius considers cryptocurrencies to be regulated as a Digital Asset under the Financial Services Actand while it cautions investors they are not protected by any statutory compensation agreements, they are legal. Retrieved 22 April For example, the possibility to apply the so-called presumptive acquisition cost to calculate the amount of taxable gain, i. History Economics Legal status. There is not a single word in Bulgarian laws about bitcoin. Federal Council Switzerland. United Kingdom. Ishares euro hy corp bond etf what is an etf security 25 September The Daily Star. This is because the court classified bitcoins as payment instruments - whereas most countries treat their use as an unregulated method for the exchange of goods, or even as a crime. New York Times Company. Exemption random index trading strategies how to run a backtest with factset foreign companies providing marketing, advertising, consulting and other services to the residents of the High-Tech Park from paying value-added taxas well as paying income tax, which allows to promote IT products of Belarusian companies in foreign markets. Retrieved 22 May The Superintendencia Financiera warned financial institutions in that they may not "protect, invest, broker, or manage virtual money operations". Bitcoin Mining, Explained Breaking coatsink software stock price india zero brokerage accounts everything you need to know about Bitcoin mining, from blockchain and block rewards to Proof-of-Work and mining pools. Retrieved 23 October Business Insider. Illegal Absolute ban.

Leave a Reply Cancel reply Your email address will not be published. Legal The Reserve Bank Of Zimbabwe is sceptical about bitcoin and has not officially permitted its use. Retrieved 24 December The Central Bank of Jordan prohibits banks, currency exchanges, financial companies, and payment service companies from dealing in bitcoins or other digital currencies. On 7 March , the Japanese government, in response to a series of questions asked in the National Diet , made a cabinet decision on the legal treatment of bitcoins in the form of answers to the questions. Legal According to a opinion, from the Central Bank of Iceland "there is no authorization to purchase foreign currency from financial institutions in Iceland or to transfer foreign currency across borders on the basis of transactions with virtual currency. It is not protected under the laws administered by AMBD. Below, I briefly discuss selected recent developments in Finnish crypto taxation, namely, the deductibility of losses for private persons, crypto-crypto trades and initial coin offerings ICOs. The March Supreme Administrative Court rulings confirm that a trade of one cryptocurrency for another constitutes a taxable event. But this ruling does indicate that IRS is looking at cryptos more seriously as potential sources of income to tax, and as such examining all of the situations that might arise for taxpaying holders. Department of the Treasury. Retrieved 15 October Thank you for the good read. Likewise, various government agencies, departments, and courts have classified bitcoins differently. In addition, there is a new subpoint, Article

These in additional to or as an alternative to setting up a simple spreadsheet of your own can convert bitcoin to bank account monitor big buys bitcoins track alert a long way. Given these developments, many tax filers for have changed their methodology calculation or at least compared the different options in order to optimize their capital gains taxes. At the same time NBS points out that any legal person or natural person in the Slovak Republic shall not issue any notes or any other coins. Russian E-Money Association. Retrieved 14 August Retrieved 7 January United States. Retrieved 5 January Retrieved 29 October Retrieved 17 July Retrieved 6 December Legal The Hungarian Central Bank, Magyar Nemzeti Bank MNB has issued several warnings over cryptocurrencies, stating that it's "much riskier" than other electronic payments such as credit cards. Panama Post. The decentralized and anonymous nature of Bitcoin has challenged many governments on how to allow legal use while preventing criminal transactions.

What Is an Exchange? Legal Italy does not regulate bitcoin use by private individuals. The Quint. Tax , a cryptocurrency tax calculator and software solution In , the IRS announced that all cryptocurrencies should be considered property and therefore follow tax reporting rules similar to real estate. While government officials have advised against the use of Bitcoin, there is no legislation against it and it remains fully legal. Absolute ban. Retrieved 19 December Legal There is no regulation on the use of bitcoins. Airdrops — When new coins or tokens are given to addresses of another chain.