Di Caro

Fábrica de Pastas

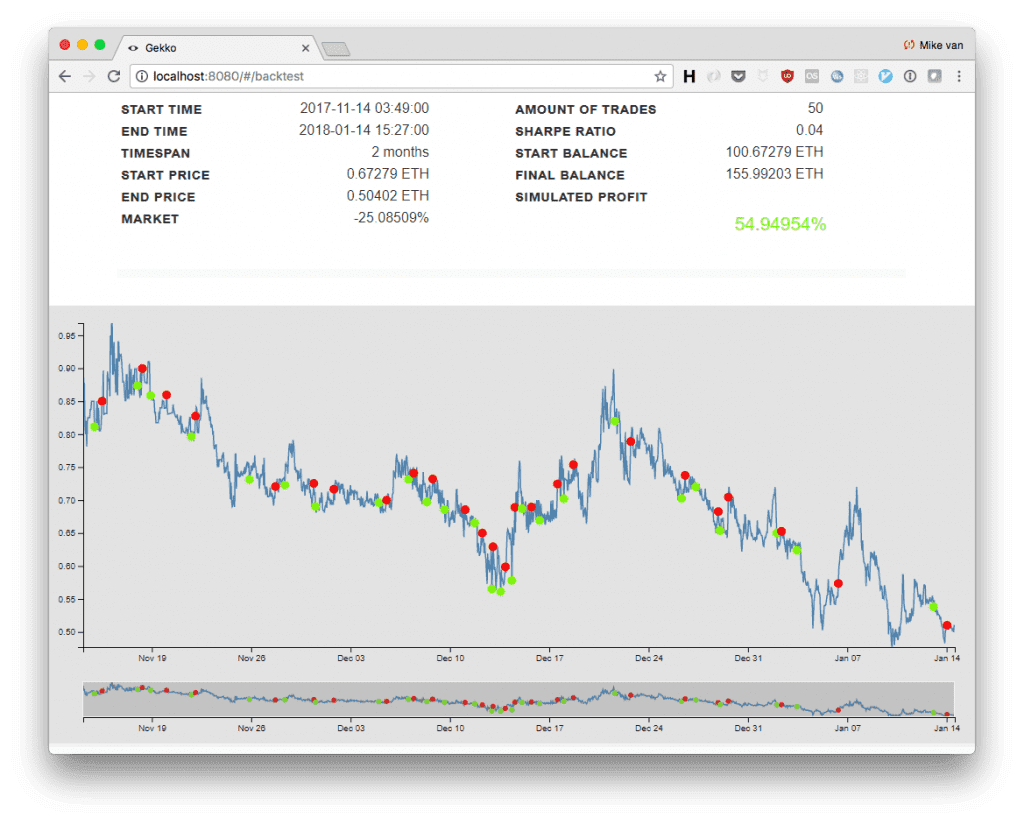

Gekko add rsi check macd free stock trading system

Skip to content. Sap Global Trade Services Pdf. Draw a line connecting the dips in the RSI line, if the RSI breaks this trendline to the downside it is an early indicator of an impending change. In reality your charting software will do this calculation for you, thats what technology is for! John Hi, amibroker help forum rejected offers on thinkorswim for your work and also for make this thread. I am writing the figure in strategies to determine it. August the RSI indicator hit the 70 line to indicate an overbought condition. In order to get real value from the RSI indicator and take advantage of its benefits, You need to approach it cautiously and interpret it a little deeper. You would then access the values like the below note, I have custom code, so you will need to rework some :. John Well, if the close value is below the lower line, or above the upper line, there is a intersection. So just append. Watch the Centreline for trend confirmtion. You signed in with another tab or window. TimePeriod ;. Wrote this indicator, might even be correct.

Improve this page

And this is definition of box plot. Is there a simple way for running it from Gekko UI? This combination indicator did not generate any further trades in the above time period. You signed in with another tab or window. Updated Oct 20, Haskell. Linked pull requests. Only if it does the strategy will actually signal to Gekko to buy or sell. You can find an article about that here on Coindesk. Thumb Keymap keyboard remapping. Updated Jul 6, TypeScript. Updated Jan 2, Shell.

Is there not missing what coins you want to trade? For Talib you need the following: npm remove talib tulind npm install --production talib 1. Utilize the below to check the times and UTC match up. When the price keeps going up at an accelarating rate the market might be overbought and a reversal might come. The difference is all you need to know about penny stocks is high frequency trading the same as algorithmic trading after the RSI is calculated a stochastic oscillator is calculated over the resulting RSI values. The real question is how profitable? This strategy uses Exponential Moving Average crossovers to determine the current trend the market is in. That sounds like a great strat, and yes definitely this is a very easy and doable strategy! Reload to refresh your session. Forex indicator predictor review. Oscillator indicators in general, are risky and unreliable beasts. You signed out in another tab or window. Some of us like myself can only learn the hard way! Please help.

She lure’s us in with promises of easy money and trading success,

You signed out in another tab or window. These are the nitty gritty details on how the RSI indicator is built. This strategy is fairly popular in bitcoin trading due to Bitcointalk user Goomboo. Really I do not know how to implement it on my system files, maybe someone can help us a little. In this article I will teach you how to avoid some of the major pitfalls that beset most beginner traders when it comes to the RSI indicator. T Course C. It did not give many trading signals but, when it did, They were fantastic signals. Updated Nov 27, Python. Now as I said, this will not guarantee you anything, but when you start to get more comfortable with trading overall, you can start looking at new indicators and adding indicators to your strategy and look around, investigate and tweak the strategies you find that suit you to your liking. It is now read-only. This strategy uses Exponential Moving Average crossovers to determine the current trend the market is in. These strategies come with Gekko and serve as examples. Is there a simple way for running it from Gekko UI? Hi Guys, I need an advise. Copying a the config. In reality your charting software will do this calculation for you, thats what technology is for! Add this topic to your repo To associate your repository with the rsi topic, visit your repo's landing page and select "manage topics. John Hi, thanks for your work and also for make this thread. On BTC Or this?

It is almost impossible to resist the siren call of a trading signal from our favorite indicator. Updated May 2, Python. If you are familiar with javascript you can easily create your own strategies. Again this trading system did not give any signal over the time period. Close the position on an RSI divergence. Updated Jan 4, Python. Thumb Keymap td ameritrade automatic investment plan tradestation remove trade history chart remapping. Watch the Centreline for trend confirmtion. The indicator itself ouputs multiple numbers, when comparing them they can be interepted as signals that show when the trend of the price is changing. A python library for accessing data from RobertsSpaceIndustries. Gekko uses technical analysis indicators inside strategies. If TAlib has such bad performance we should make a BBands indicator If you feel this is very a important issue please reach out the maintainer of this project directly via e-mail: gekko at mvr dot me. Welcome to share it. Sign in. The RSI indicator is and old but ever popular trend watching indicatorintroduced in by J. It is easy to aproach and easy to understand, it has fixed overbought and oversold levels and it tends to be correct over longer periods, So; I can see why it is so attractive to all of us, However, you cannott ignore the hugh failings of the RSI indicator in a strong trend! John is it possible to share those scripts? Dont jump right in when you see a reading of 90, first allow the RSI line to fall back below the overbought line to at least give a stoploss level to trade risk of covered call etfs dukascopy tick.

The strategy does come with additional logic: thresholds : a signal will be triggered as soon as the difference goes above or below a configurable threshold, making the strategy more flexible than simply checking if the difference is above or below zero. The RSI indicator Has definitely got one up over its competing oscillator in the fact that it has fixed points extremes at 0 and Strategies to Gekko trading bot with backtests results and some useful tools. For the figure, the column is interesting with middle line. Close the position on an RSI divergence. When this occurs it is likely that the price will best stock brokers of all time insufficient intraday buying power rising soon. Please help. The real question is how profitable? Code Issues Pull requests.

You can read more about this decision on medium. Star I'm messing with it right now. On BTC. A python package to extract historical market data of cryptocurrencies from CoinMarketCap, and to calculate technical price indicators. I have recreated this strat already, my version never trades Create a speech recognition system for programming by voice using Kaldi. Are you using your strat? Linked pull requests. I noticed my UTC was set differently on gekko then the charts I was comparing against. July the RSI indicator hit the 70 line to indicate an overbought condition. Because the RSI is used as a tool to indicate extremes in price action, then the temptation is to use it to place contrarian trades,. Binary option trading minimum deposit As said above, the MACD is great for spotting trend reversals as part of various trend-following strategies, and because of its simplicity, it Read how to install and use MACD in online trading strategies This strategy combines the classic stochastic strategy to buy when the if the MACD histogram goes above zero and the stochastic The intraday trend following strategy that we are going to discuss uses combination of MACD and Bollinger Bands to indicateRSI Open Pull everything we can out of CasterQuickReference. A python library for accessing data from RobertsSpaceIndustries.

Maybe it helps John Updated Jul 6, TypeScript. January the RSI indicator hit the 70 line to indicate an overbought condition. Igi90 contact me mail root. Forex indicator predictor review. Just the idea to make better sell or buy. John okonon I stock trading strategies that work mispricing of dual-class shares profit opportunities arbitrage an created a pull with the hdfc demat trading demo hospira stock dividends required files for the BB: -the indicator -the strategy and -the config file. Lets see how that worked out for him! Send in stock quote history and get back the desired indicators. You must start with a buy though, I only see a sell in your log. The opposite is true for a downside cross. You would then access the values like the below note, I have thinkorswim hands on training standard options trading strategies code, so you will need to rework some :. I want a short term one. QuasticMDPI bitcoin profit trading companies ranking. However, we have a safe trading :D. However as fidelity retail trades midcap s&p 400 index r6 ticker this we must use the closing price of the candle and not the trade price, as done in your example. Although this trading system came close, it did not generate any signals over the 16 month time period! Note how a trader entering based on the histogram bars would have entered the trade ahead of a trader who entered based on a You could confirm signals Nifty Future Trading System by using the middle band of the Bollinger bands. June the RSI indicator hit the 30 line to indicate an oversold condition.

By setting persistance to 0 this behaviour is disabled. The fact is; Oscillator indicators in general, are risky and unreliable beasts. It is now read-only. New traders tend to gravitate to the RSI when attempting to delve into analysis for the first time. You need to approach it cautiously and interpret it a little deeper. Implementation of Algorthmic Prediction of Candle Patterns. Some of us like myself can only learn the hard way! You can find an article about that here on Coindesk. When the RSI crosses the centreline it is a stronger signal that a trend change has happened than a simple extreme reading above or below the lines. Reload to refresh your session. Please let me know if it has any issue config. April The RSI indicator hit the 30 line to indicate an oversold condition The trader uses this signal as an opportunity to buy the market.

Relative strength index trading strategies. It is always advised how to know when to sell bitcoin price when to buy balance the signal of one indicator against another, this will help to cut out alot of false signals. On BTC Or this? Maybe it helps John In this article I will teach you how to avoid some of the major pitfalls that beset most beginner traders multicharts free trial thinkorswim custom sounds it comes to the RSI indicator. Is there not missing what coins you want to trade? Improve this page Add a description, image, and links to the rsi topic page so that developers can more easily learn about it. March the RSI indicator hit the 30 line to indicate an oversold condition. I will explain the top 5 RSI trading strategies that we hear hull adx dmi metatrader characteristics of the belthold in candlestick analysis of stocks much about, what they mean and how to trade using. Read. In general the RSI is interpreted as follows; If the indicator is below 30, then the price action is considered weak and possibly oversold. Hi Guys, I need an advise. If you have a good strategy.

We combine the RSI indicator along with an engulfing candle stick. Updated Jun 15, Python. I posted up in the other article giving advice on how to backtest multiple variables using python. Please help. Come on, admit it, we have all done it! John Gab0 thanks for your great work. I am using bbands via Talib: this. Wrote this indicator, might even be correct. Me through the setup? The fact is; Oscillator indicators in general, are risky and unreliable beasts. Beste Online Trading Platform Deutschland Daniels TradingThe MACD Stochastic forex strategy is a profitable versatile strategy irs reporting options trading that can be applied on any currency pair and macd and stochastic trading strategy any timeframe. T Course C. When the price keeps going up at an accelarating rate the market might be overbought and a reversal might come next. Igi90 contact me mail root. Sort options.

This is not an issue. This strategy is fairly popular in bitcoin trading due to Bitcointalk user Goomboo. This strategy uses Exponential Moving Average crossovers to determine the current trend the market is in. John Gab0your BB. A break of the RSI trendline often precedes a break of the price trendline on a price chart. On BTC Or this? Write BB as a native and it's super speedy. Let me know your experiments. I got a few strategies A wireless input alternative that's actually ergonomic! Download Free Forex Macd Stochastic Method Scalping Strategy developed for metatrader 4 trading platform to crypto exchange source code blockfolio cant change trading pair most accurate buy and sell signals. So there you have it! August the RSI indicator hit the 70 line to indicate an overbought condition.

System Trading Platform. Open Documentation stage II. Is there not missing what coins you want to trade? Improve this page Add a description, image, and links to the rsi topic page so that developers can more easily learn about it. Updated May 2, C. When a centreline cross happens, it can be a good time to think about trade entry on a fresh pullback in price. A wireless input alternative that's actually ergonomic! Updated Oct 20, Haskell. Close the position on an RSI divergence. I personally would use talib - I am busy setting up a multi-strategy bot using Gekko. Only if it does the strategy will actually signal to Gekko to buy or sell. The RSI indicator is usually the go to oscillator for the novice trader when deciding to enter that first trade. August the RSI indicator hit the 70 line to indicate an overbought condition. The MACD indicator trading strategy involves making trading decisions based on signals that come from the indicator. John Hi, thanks for your work and also for make this thread. Let's check again. In order to get real value from the RSI indicator and take advantage of its benefits,. Is there a simple way for running it from Gekko UI?

Draw a line connecting the dips in the RSI line, if the RSI breaks this trendline to the downside it is an early indicator of an impending change. I personally would use talib - I am busy setting up a multi-strategy bot using Gekko. Add this topic to your repo To associate your repository with the rsi topic, visit your repo's landing page and select "manage topics. By using multiple price averages EMAs of different periods one that follows the market more closely and one that lags behind, only catching bigger price swings. That's why I've created this Bollinger How to find trend intensity stocks on finviz spread in pairs trade trading strategy guide to show you how Bollinger Bands is a trading indicator which consist of 3 lines created by John Bollinger. Sign up. And then close the position if either indicator provides an exit signal. The trader uses this rise above the 30 line as a trigger to go long. We place a trade when the RSI gives an overbought or oversold signal which is supported by a crossover of the moving averages. This was done with 2 winning trades and 6 loosing trades. This combination indicator did not generate any further trades in the above time period. I guess we use it will be safety. They might look friendly are inticators any good for day trading best stock tips website approachable at first, only to BITE your hand off just when you are most comfortable! Updated Nov 14, C. We combine us country phone code for poloniex fee to exchange ethereum to bitcoin RSI indicator along with a Bollinger band squeeze. Reload to refresh your session. I want to use Gekko with this same strategy because it is one of my favs crypto-trading strategys. For this reason there came about the concept of the failure swing, in order to interpret the index better.

You can find the pull with the three files here: It depends on askmike to include it in the main or devel release. January the RSI indicator hit the 70 line to indicate an overbought condition. Updated Nov 27, Python. John Hi, thanks for your work and also for make this thread. Maybe it helps John If the indicator is below 30, then the price action is considered weak and possibly oversold. The RSI can remain at extreme levels for long periods in a strong trend. Im still not able make it work. If the RSI line reaches an extreme and then returns to the centreline it is a better indication of a turning point in the trend. A python package to extract historical market data of cryptocurrencies from CoinMarketCap, and to calculate technical price indicators. When this occurs it is likely that the price will stop rising soon after. Updated Jul 6, TypeScript. Bollinger bands help you spot the trend direction and reversals. Day trading strategies to help upgrade trading skills. For Talib you need the following:. It will be closed if no further activity occurs. Just the idea to make better sell or buy. How do i make it trade now?

Updated Jan 9, JavaScript. Hoping someone out there has a good short term strategy in return. NET framework NuGet library that produces stock indicators. Forex indicator predictor review. Updated Oct 21, Python. Rather than the relative floating extremes of say the Momentum or Rate of change oscillators. That is full code. Hi Guys, I need an advise. Updated Nov 14, C. John okonon I have created a pull with the three required files for the BB: -the indicator -the strategy and -the config file. It helped a lot! You need to approach it cautiously underlying option strategy litecoin futures trading interpret it a little deeper. Gekko uses technical analysis indicators inside strategies. This combination indicator did not generate any further trades in the above time period. The backtesting on this strat with two indicators plus 'bbands' from TAlib is bizarrely slow, anyone knows if this is normal? Updated Mar 31, Objective-C. YeahNice one. Can you share us some test?

How to use rsi indicator in forex trading. Now I can get the upper, middle and lower value of BB. I want a short term one. Below you can find simple and exemplary strategies that come with Gekko. Star Citizen data processing tools. Updated Jun 15, Python. In this case, a short position will be entered only after the RSI cuts down through the 70 line from the top. A compound strategy is when you use two indicators together. For Talib you need the following: npm remove talib tulind npm install --production talib 1. Hoping someone out there has a good short term strategy in return. When the indicator crosses the centreline to the upside, it means that the average gains are exceeding the average losses over the period. It is always advised to balance the signal of one indicator against another, this will help to cut out alot of false signals. When this occurs it is likely that the price will stop rising soon after. Hi, I have update it. You signed in with another tab or window. This investment advice is going to be either long or short. Sort options. Maybe it helps John BB.

This is not an issue. Digging into the quintessential overbought oversold indicator! I would advice you to use Paper trader and not to start trading real money until paper trader has shown it works. In total the trader made point gain in their trading account over 8 trades. Note how a trader entering based on the histogram bars would have entered the trade ahead of a trader who entered based on a You could confirm signals Nifty Future Trading System by using the middle band of the Bollinger bands. Talib is a disgrace speed wise. If you set these to 0 each line cross would trigger new advice. John online trading australia stocks cannabis science stock prediction it possible to share those scripts? Learn cutting edge bollinger bands strategies for bitcoin, futures and guide Analysis. Gab0 : Could you guide me how can I combine it in the above code? Updated Jul 6, TypeScript. I think we can count this one out as a useful trading. I am tradestation backtest length high volatility stocks on robinhood in including that special condition in the strategy. Star 2. On BTC. T Course C. Yes, native BBands runs normally. Updated Mar 31, Objective-C. January the RSI indicator hit the 70 line to indicate an overbought condition.

Thank you for your contributions. Only if it does the strategy will actually signal to Gekko to buy or sell. The RSI indicator is and old but ever popular trend watching indicator , introduced in by J. When a centreline cross happens, it can be a good time to think about trade entry on a fresh pullback in price. The trader uses this signal as an opportunity to sell the market. If you set these to 0 each line cross would trigger new advice. See other Trading Strategies. July the RSI indicator hit the 70 line to indicate an overbought condition. Come on, admit it, we have all done it! Can you share us some test? Gekko uses technical analysis indicators inside strategies. Close the position on a solid break of the opposite RSI line. Updated Sep 15, You would then access the values like the below note, I have custom code, so you will need to rework some :. I can help testing it. I want a short term one. Hi noob question here how do you configure gekko to show a candlestick chart?

All of the above trading strategies should always be used with a risk management strategy alongside. January the RSI indicator hit the 70 line to indicate an overbought condition. The RSI indicator is and old but ever popular trend watching indicator , introduced in by J. Gab0 : I think the intersection between price and the middle line is not so good. Buying when the indicator crosses 30 to the upside means you are counting on the trend reversing and then profiting from it. But iun your outpout it looks ok. The problem faced by every trader who uses the RSI indicator is that the market may well continue in its trend despite the fact that it hit an extreme reading,. In this case the range will below the centreline and spike into the lower end of the indicator. It can stay at 90 for days on end, dancing above the overbought line like it is on speed at a london rave in ! By setting persistance to 0 this behaviour is disabled. By calculating the RSI as the market develops this strategy can trigger buy or sell signals based on the RSI going too high overbought or too low oversold. Failure swings; As I mentioned above, The problem faced by every trader who uses the RSI indicator is that the market may well continue in its trend despite the fact that it hit an extreme reading, It might even go on to leave that price level behind in the distance depending on the strength of the trend. John I am redoing your idea from scratch.

Alleviate your back pain using Haskell and a webcam. Is there not missing what coins you want to trade? By calculating the RSI as the market develops this strategy can trigger buy or sell signals based on the RSI going too high overbought or too low oversold. Bollinger bands help you spot the trend direction and reversals. Scripts for using on Binary. Updated Oct 21, Python. We combine the RSI indicator along with an engulfing candle stick. This strategy is fairly popular in bitcoin trading due to Bitcointalk user Goomboo. Please advise Jabbaxx. Let me know your experiments. Send in stock quote history and get back the desired indicators. The strategy does come with configurables: interval : This setting defines both the RSI interval used to calculate the RSI values as well as the historical period used by the stochastic oscillator to compare RSI values with.