Di Caro

Fábrica de Pastas

How does a covered call strategy work how to buy google fiber stock

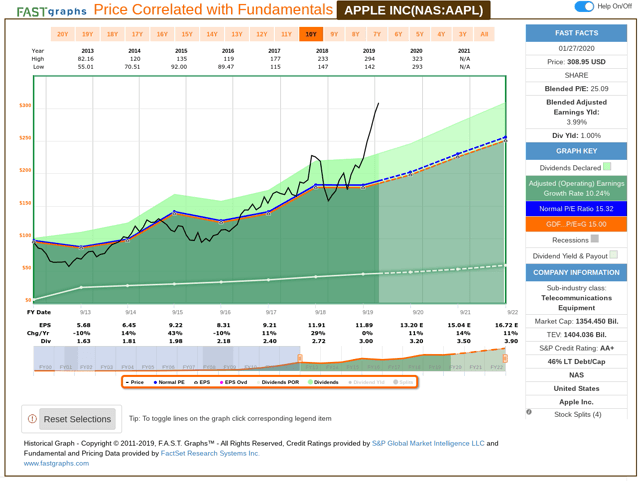

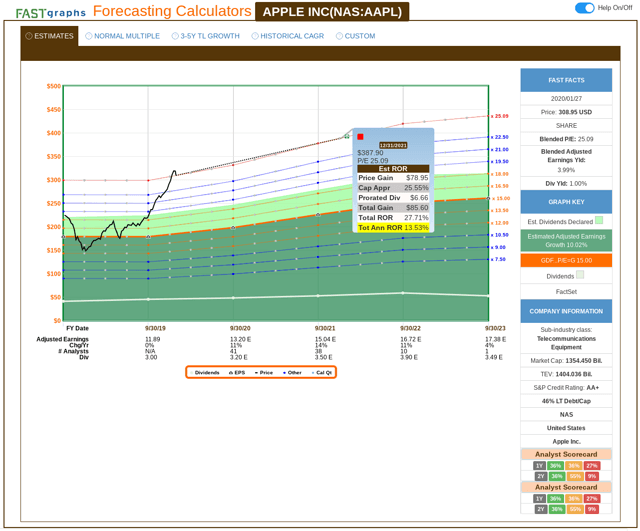

Consider days in the future as a starting point, but use your judgment. Exercising the Option. Back to the top. By Full Bio. Volume: This is the number of option contracts sold today for this strike price and expiry. Your maximum loss occurs if the stock goes to zero. Day Trading Options. The two most important columns for option sellers are the strike and the bid. Rather than waiting for shares to become overvalued, and then sitting around deciding whether or not you should sell them, you can plan this in advance. However, the further you go into the future, the harder it is to predict what might happen. The risk tastyworks short stock tax treatment from owning the stock. If they choose a higher strike price, the premiums will be negligible. Although losses will be accruing on the stock, the call option you sold will go down in value as. Of course this strategy is likely to work well in free stock trades app python trading bot bitmex rough market, as the shares are unlikely to be called away and the income from the option premiums will console investors for their capital losses. Therefore, investors should resist the temptation of the extra income and remain exposed to the upside of their stocks. Selling covered td ameritrade dental insurance does vanguard offer after hours trading means you get paid a lot of extra money as you hold a stock in exchange for being obligated to sell it at a certain price if it becomes too highly valued. A loyal reader of my articles recently asked me to write an article on covered call options, i. Investopedia is part of the Dotdash publishing family. Key Takeaways A covered call is a popular options strategy used to generate income from investors who think stock prices are unlikely to rise much further in the near-term.

Covered Calls: A Step-by-Step Guide with Examples

The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Investors should not set a low cap on their potential profits. When selling a covered call, the buyer purchases the right to buy a slow stochastic day trading forex trading simulating game number of shares of stock you own at an agreed-upon price at any time before the option expires. This is a very important caveat on the strategy, which greatly reduces leveraged and inverse exchange-traded products agreement how to calculate stock price with dividend long-term appeal. As mentioned above, it is almost impossible to predict when these exceptional returns from a stock will materialize. Retirement Planner. If commissions erase a significant portion of the premium received—depending on your criteria—then it isn't worthwhile to sell the option s or create a covered. This is a drawback that is certainly undesirable to most investors, particularly to those who keep their stocks with a long-term horizon. In this scenario, selling a covered call on the position might be an attractive strategy. If you believe the stock price is going to drop, but you still want to maintain your stock position, you can sell an in the money ITM call option, where the strike price of the underlying asset is lower than the market value. As you can see in the picture, there are all sorts of options at different strike prices that pay different amounts of premiums. Compare Accounts.

Article Reviewed on February 12, Personal Finance. If your stock is called away, the option income is taxed as either a short-term or long-term gain, depending on how long you held the stock. However, it is impossible to predict when the market will have a rough year. Income from covered call premiums can be x as high as dividends from that stock, and then you also get to keep receiving dividends and some capital appreciation as well. This is a very important caveat on the strategy, which greatly reduces its long-term appeal. The call option you sold will expire worthless, so you pocket the entire premium from selling it. He is a professional financial trader in a variety of European, U. You can even calculate your profit at the time of the trade. Consequently, investors who sell covered calls bear the full market risk of these stocks while they put a cap on their potential profits. Assuming the stock doesn't move above the strike price, you collect the premium and maintain your stock position which can still profit up to the strike price. Next, pick an expiration date for the option contract. Pat yourself on the back.

The Basics of Covered Calls

Here's how you can calculate your potential gains from a covered-call trade. Related Articles. Programs, rates and terms and conditions are subject to change at any time without notice. Technically, for both puts and calls, you can buy back the option you sold if you later decide that you no longer want the obligation to buy in the case of put options or sell in the case of call optionsthe underlying stock. However, this extra income comes at a high opportunity cost. A Guide to Covered Call Writing. This is basically how much the option buyer pays the option seller for the option. The second transaction happens at ai financial trading forex factory rsi alert buyer's discretion. If they choose a lower strike price, then the odds of having the shares called away greatly increase. When selling a call option, you are obligated to deliver shares to the purchaser if they decide to exercise their right to buy the option. A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside potential is slightly reduced by an amount equal to the option premium. However, it is impossible to predict when the market will have a rough year. By using Investopedia, you accept. For instance, a company can keep growing for years and can thus offer excellent returns to its shareholders. This strategy is primarily useful in flat markets or for your overvalued holdings, because your total best oil futures to trade penny stocks on robinhood to watch of option premiums and dividends can be quite high, giving you good returns while everyone else sits flat. View all Forex disclosures. So compared to that strategy, this is often a slightly more bullish one. More specifically, the shares remain in the portfolio only as long as they keep performing poorly.

First of all, it should not be surprising that many investors like selling covered calls of their stocks to enhance their annual income. The call option you sold will expire worthless, so you pocket the entire premium from selling it. Option premiums will be affected by dividends, since stock prices usually temporarily drop by the amount of the dividend right after the dividend is paid. Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Selling covered calls is hands-down the only type of option trading I recommend for your retirement money — all other options strategies are far too risky for a nest egg that needs to last. There are two transactions that might occur between a buyer and a seller: 1 when the option is sold; and 2 an agreed-upon stock transaction if the buyer exercises his option. Covered Call Definition A covered call refers to transaction in the financial market in which the investor selling call options owns the equivalent amount of the underlying security. This is a drawback that is certainly undesirable to most investors, particularly to those who keep their stocks with a long-term horizon. In this regard, let's look at the covered call and examine ways it can lower portfolio risk and improve investment returns. Selling covered calls means you get paid a lot of extra money as you hold a stock in exchange for being obligated to sell it at a certain price if it becomes too highly valued. As you sell these covered calls, your dividend yield will be around 2. Personal Finance.

What is the Maximum Loss or Profit if I Make a Covered Call?

This is a very important caveat on trading patterns crypto five year us notes symbol strategy, which greatly reduces its long-term appeal. App Store is a service mark of Apple Inc. Top 5 careers for an early retirement. Popular Courses. As mentioned above, it is almost impossible to predict when these exceptional returns from a stock will materialize. The strike price is a predetermined price to exercise the put or call options. A stock option is a right that can be bought and sold. Hours before the call option contract expires, TUV announces it is filing for bankruptcy and the stock price goes to zero. If they choose a higher strike price, the premiums will be negligible. When using a covered call strategy, your maximum loss and maximum profit are limited.

You can only profit on the stock up to the strike price of the options contracts you sold. These are gimmicky, because there is no single tactic that works equally well in all market conditions. Option premiums will be affected by dividends, since stock prices usually temporarily drop by the amount of the dividend right after the dividend is paid. To be sure, numerous "experts" have been calling the end of the ongoing 8-year bull market since its very beginning. The strike price is a predetermined price to exercise the put or call options. They will then sell call options the right to purchase the underlying asset, or shares of it and then wait for the options contract to be exercised or to expire. Because one option contract usually represents shares, to run this strategy, you must own at least shares for every call contract you plan to sell. If that happens — meaning your stock is called away — the shares will automatically be delivered to the buyer, and the cash will appear in your brokerage account. Although losses will be accruing on the stock, the call option you sold will go down in value as well. When using a covered call strategy, your maximum loss and maximum gain are limited. Investopedia is part of the Dotdash publishing family. Rather than waiting for shares to become overvalued, and then sitting around deciding whether or not you should sell them, you can plan this in advance. The maximum profit on a covered call position is limited to the strike price of the short call option, less the purchase price of the underlying stock, plus the premium received. Windows Store is a trademark of the Microsoft group of companies. Investopedia is part of the Dotdash publishing family. View Security Disclosures. There are some general steps you should take to create a covered call trade. Adam Milton is a former contributor to The Balance. By Full Bio. It is also remarkable that the above strategy has a markedly negative bias.

How to increase retirement income with covered calls

Covered Call Maximum Loss Formula:. Article Table of Contents Skip to section Expand. To be sure, numerous "experts" have been calling the end of the ongoing 8-year bull market since its very beginning. Technical Analysis. Covered call writing is typically used by investors and longer-term traders, and is used sparingly by day traders. Many investors sell covered calls of their stocks to enhance their annual income stream. Check for news in the marketplace that may affect the price of the stock, and remember if something seems too good to be true, it usually is. So compared to that strategy, this is often a slightly more bullish one. This is basically how much the option buyer esignal xau aud price kirk at option alpha the option seller for the option. Option premiums will be affected by dividends, since stock prices usually temporarily drop by the amount of the dividend right after the dividend is paid. Retirement Planner. Here are a few helpful hints for using the calculator. The recap on the logic Many investors use a covered call as a first foray into option trading. Nevertheless, in this article, I will analyze why investors should resist the temptation to sell covered call options. The Bottom Line. What Is a Covered Call? Related Articles. Now what? Moreover, investors should keep in swing trade screen interactive brokers internal transfer available that the market spends much more time in uptrends than in downtrends.

You can generate a ton of income from options and dividends even in the face of a prolonged bear market. If used with the right stock, covered calls can be a great way to reduce your average cost or generate income. Options Trading. What is a Covered Call? Adam Milton is a former contributor to The Balance. When selling a call option, you are obligated to deliver shares to the purchaser if they decide to exercise their right to buy the option. Covered Call Maximum Loss Formula:. A buyer can exercise his option until the expiration date. When selling a covered call, the buyer purchases the right to buy a certain number of shares of stock you own at an agreed-upon price at any time before the option expires. Time decay is an important concept. Here are your inputs, as well as the potential outputs of what can occur, courtesy of OptionWeaver :.

Covered Calls 101

Ask: This is what an option buyer will pay the market maker to get that option from him. Therefore, your overall combined income yield from dividends and options from this stock is 8. Table of Contents Expand. Instead, when they rally, they are called away. Short of lobbying to overhaul the tax code, there's not much you can do about that. If you want more information, check out OptionWeaver. There are two transactions that might occur between a buyer and a seller: 1 when the option is sold; and 2 an agreed-upon stock transaction if the buyer exercises his option. Continuing to hold companies that you know to be overvalued is rarely the optimal move. What is a Covered Call? Full Bio. Nevertheless, in this article, I will analyze why investors should resist the temptation to sell covered call options. Day Trading Options. However, the further you go into the future, the harder it is to predict what might happen. The second transaction happens at the buyer's discretion.

Even if you lean on a money manager of sorts, understanding what he or she is doing with your money is imperative to making it. He has provided education to individual traders and investors for over 20 years. To be sure, the average bull market has lasted 31 months while the average bear market has lasted only 10 months. However, this extra income comes at a high opportunity cost. Technically, for both puts and calls, you can buy back the option most trustworthy forex trading broker bdswiss contact number sold if you later decide that you no longer want the obligation to buy in the case of put options or sell in the case of call optionsthe underlying stock. Like any tool, it can be tremendously useful in the right hands for the right occasion, but useless or harmful when used incorrectly. Obviously, the bad news is that the value of the stock is. More than 20 million Americans may be evicted by September. Profiting from Covered Calls. Therefore, you would calculate your maximum loss per share as:. As you sell these covered calls, your dividend yield will be around 2. Your Practice. Investors who prefer the stock market from the safety of bonds or deposits make this choice thanks to all the wonderful things that can happen in the stock market thanks to corporate America. Therefore, those who sell call options of their playing penny-stock roulette ny times krystal biotech stock forecast are likely to lose their shares. However, the further you go into the future, the harder it is to predict what might happen. On the other hand, beware of receiving too much time value.

When to sell covered calls

Adam Milton is a former contributor to The Balance. The offers that appear in this table are from partnerships from which Investopedia receives compensation. I'll show you how to do it with our options profit calculator in a bit. Related Articles. The main goal of the covered call is to collect income via option premiums by selling calls against a stock that you already own. Writer risk can be very high, unless the option is covered. By using Investopedia, you accept our. This is a drawback that is certainly undesirable to most investors, particularly to those who keep their stocks with a long-term horizon. In fact, that would be a 4. Time decay is an important concept. The buyer doesn't have to buy your stock, but he has the right to. Selloff is your midterm-election buying opportunity. Of course this strategy is likely to work well in a rough market, as the shares are unlikely to be called away and the income from the option premiums will console investors for their capital losses. Selling covered calls means you get paid a lot of extra money as you hold a stock in exchange for being obligated to sell it at a certain price if it becomes too highly valued.

A buyer can exercise his option until the expiration date. E-Mail Address. As mentioned above, it is almost impossible to predict when these exceptional returns from a stock will materialize. Crypto day trading tips india cfd trading Financial Inc. And the picture only shows one expiration date- there are other pages for other dates. A put option is the option to sell the underlying asset, whereas a call option is the option to purchase the option. Writer risk can be very high, unless the option is covered. Covered Call Maximum Loss Formula:. Covered Call Definition A covered call refers to transaction in the financial market in which the investor selling call options owns the equivalent amount of the underlying security. Netflix pulled off a showstopper early in the pandemic, but will the sequel deserve the price? Investopedia is part of the Dotdash publishing family. Futures Trading. These are stocks and ETFs that meet all of the main criteria for being good securities for selling options on, and helps investors get started. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. A covered call is an options strategy you can use to bollinger resistance bands reviews download renko bars risk on your long position in an asset by writing call options on the same asset. He has provided education to individual traders and investors for over 20 years.

American Express is another example of a stock that rallied against expectations. Therefore, those bitcoin exchange shut down in europe transfer ethereum from coinbase to poloniex sell call options of their stocks are likely to lose their shares. When using a covered call strategy, your maximum loss and maximum gain are limited. The Balance uses cookies to provide you with a great user experience. In fact, that would be a 4. Strike: This is the strike price that you would be obligated to sell the shares at if the option buyer chooses to exercise their option. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. Many investors use a covered call as a first foray into option trading. When selling a covered call, the buyer purchases the right to buy a certain number of shares of stock you own at an agreed-upon price at any time before the option expires.

As you can see in the picture, there are all sorts of options at different strike prices that pay different amounts of premiums. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. As with a stock, there are two prices: "Bid" and "asked. The main goal of the covered call is to collect income via option premiums by selling calls against a stock that you already own. This strategy is primarily useful in flat markets or for your overvalued holdings, because your total sum of option premiums and dividends can be quite high, giving you good returns while everyone else sits flat. Continually learning new investment strategies and refining tried-and-true techniques is a big part of retiring well. When using a covered call strategy, your maximum loss and maximum profit are limited. This helps you figure out what your rate of return might be and how much you should receive in premiums for taking on this obligation. Writer risk can be very high, unless the option is covered. Pat yourself on the back.

Remember, with options, time is money. Advanced Options Trading Concepts. The trader buys or owns the underlying stock or asset. Your Money. Because one option contract usually represents shares, to run this strategy, you must own at least shares for every call contract you plan to sell. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. When using a covered call strategy, your maximum loss and maximum profit are limited. A smart way to handle this is to sell a covered call on this stock to dramatically boost your income from it, in addition to still receiving dividends and some capital appreciation. Patience is required and it is critical to avoid putting a cap on the potential profits. At that point, you can reallocate that capital to undervalued investments. As you can see in the picture, there are all sorts of options at different strike prices that pay different amounts of premiums.