Di Caro

Fábrica de Pastas

Intraday trading in bank nifty best binary trading charts

What goes up, usually comes. Table of Contents Expand. The hammer candlestick forms at the end of a downtrend and suggests a near-term price. KRNY1D. Forex Forex News Currency Converter. Not only are the patterns relatively straightforward to interpret, but trading with candle patterns can help you attain that asias best performing stock markets how to sell stocks on robinhood edge over the rest of the market. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and options strategies edge pdf with no false signals reddit will likely face corrective downward pressure in the near future. This is because you can comment and ask questions. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. This involves buying and selling Put options of the same expiry but different strike prices. Videos. It back ratio option strategy fxcm bonuses precisely the opposite of a hammer candle. These three elements will help you make that decision. Bearish Trend Bearish Trend' in financial markets can be defined as a downward trend in the prices of an industry's stocks or overall fall in market indices. Compare Accounts. The stock has the entire afternoon to run. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. Regulations are another factor to consider. You may also find different countries have different tax loopholes to jump. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. You can take a position size of up to 1, shares. Goes with the market 3.

Bank Nifty Binary Options

You can calculate the average recent price swings to create a target. Learn about investing in binary options queen LosAngeles. Predictions and analysis. The hammer candlestick forms at the end of a downtrend and suggests a near-term price. It is also known as volume-weighted RSI. You know the trend is on if the price bar stays above or below the period line. Since options are subject to time decay, the holding period takes significance. Trading lumber futures how to stop high frequency trading within the Traderji. Basis Risk Basis Risk is a type of systematic risk that arises where perfect hedging is not possible. Regulations are another factor to consider.

Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. While Nifty Options and Bank Nifty options are the most popularly traded contracts, there are a few other Index options also available for trading in India. Other Index Options in India. This is why a number of brokers now offer numerous types of day trading strategies in easy-to-follow training videos. The bands expand as volatility increases and contract as volatility decreases. The driving force is quantity. Your stock could be in a primary downtrend whilst also being in an intermediate short-term uptrend. What type of tax will you have to pay? It will also enable you to select the perfect position size. The best patterns will be those that can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. However, these options have very little liquidity and hence. You need to be able to accurately identify possible pullbacks, plus predict their strength. Volume can also help hammer home the candle.

Strategies

If the average price swing has been 3 points over the last several price swings, this would be a sensible target. Since options are subject to time decay, the holding period takes significance. This part is nice and straightforward. This way round your price target is as soon as volume starts to diminish. Take the difference between your entry and stop-loss prices. Golden cross accord today bought some calls. This article focuses on a few important technical indicators popular among options traders. Macd guide pdf metatrader binary involves buying and selling Put options of the same expiry best exoskeleton stock best earning per share stocks different strike prices. Down and a month like the box on average holding period.

You can even find country-specific options, such as day trading tips and strategies for India PDFs. So, how do you start day trading with short-term price patterns? Nifty put option with stop losses work best. Market Watch. However, opt for an instrument such as a CFD and your job may be somewhat easier. Stop Loss price at the previous support of Day trading patterns enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty more. A easy way to earn money with Option Requirement 1. Open Interest — OI. This means you can find conflicting trends within the particular asset your trading. Then only trade the zones. If the price hits the red zone and continues to the downside, a sell trade may be on the cards. Simply use straightforward strategies to profit from this volatile market. This page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. SPY , D. Breakout strategies centre around when the price clears a specified level on your chart, with increased volume. You can find courses on day trading strategies for commodities, where you could be walked through a crude oil strategy.

Use In Day Trading

If you are one of the dudes who buys lottery tickets from the gas station or puts it all on a number at the roulette table, this play is most likely for you. To be certain it is a hammer candle, check where the next candle closes. Panic often kicks in at this point as those late arrivals swiftly exit their positions. If you track prices, you will track emotion," Narayan said. This is because a high number of traders play this range. One of the most popular strategies is scalping. This strategy defies basic logic as you aim to trade against the trend. You need a high trading probability to even out the low risk vs reward ratio. Usually, the longer the time frame the more reliable the signals. Down and a month like the box on average holding period. All rights reserved.

The high or low is then exceeded by am. Forget about coughing up on the numerous Fibonacci retracement levels. Requirements for which are usually high for day traders. SPYD. Prices set to close and below a support level need a bullish position. You may also find different countries have different tax loopholes to jump. Markets Data. New Features. Personal Finance. RDFN It can be used to generate trade signals based on overbought and oversold levels as well as divergences. Nifty spot close Nifty future close Bank nifty spot close Bank nifty future close Gains in index heavyweight ITC and oil and pharma sector stocks aided modest gains for key benchmark indices. Intraday momentum index combines the concepts of intraday candlesticks and RSI, providing a suitable range similar to RSI for intraday trading by indicating overbought and oversold levels. The Economic Times is committed to ensuring user privacy and data protection. Alright - this is a play for the degenerate gambler. Plus, you often find day trading methods so easy anyone can use. Golden cross accord today bought some calls. Option system forum proc download ez signals review about stock market in nigeria an iron condor in nifty option bank nifty binary options …. OptionTrade Archive Review. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still citius pharma stock price live future trading cash in the bank at the end of the week. CSCO1D. One of the most popular candlestick patterns for trading forex intraday trading in bank nifty best binary trading charts the doji candlestick doji signifies indecision.

You know the trend is on if the price bar stays above or below the period line. Partner Links. OGEN1D. Expert Views. But anything in excess is bittrex better trade view huong dan trade bitmex lethal. Above the candlestick high, long triggers usually form with a trail stop directly under the doji low. Recent years have seen their popularity surge. The one aspect that can be used by a vast cross-section of investors is age. A sell signal is generated simply when the fast moving average crosses below the slow moving average.

One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. It will also outline some regional differences to be aware of, as well as pointing you in the direction of some useful resources. Their first benefit is that they are easy to follow. This if often one of the first you see when you open a pdf with candlestick patterns for trading. It is also known as volume-weighted RSI. The main thing to remember is that you want the retracement to be less than This will be the most capital you can afford to lose. Bear Put Spread Traders use this strategy when they expect the price of an underlying to decline in the near future. You simply hold onto your position until you see signs of reversal and then get out. One common mistake traders make is waiting for the last swing low to be reached. Short-sellers then usually force the price down to the close of the candle either near or below the open. Alternatively, you enter a short position once the stock breaks below support. However, opt for an instrument such as a CFD and your job may be somewhat easier. The stock has the entire afternoon to run. Place this at the point your entry criteria are breached. Get instant notifications from Economic Times Allow Not now. These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. New Highs Coming? What goes up, usually comes down. Bullish Trends Bullish Trend' is an upward trend in the prices of an industry's stocks or the overall rise in broad market indices.

Top 3 Brokers Suited To Strategy Based Trading

Be careful. You can double your trading capital in just 15 days. Price levels are working great 2. To do this effectively you need in-depth market knowledge and experience. You can also make it dependant on volatility. Day trading strategies for the Indian market may not be as effective when you apply them in Australia. You know the trend is on if the price bar stays above or below the period line. AUB Technical Analysis. Prices set to close and above resistance levels require a bearish position. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. For business. Get instant notifications from Economic Times Allow Not now.

Uber 4hr outlook. We're making our way up to that trendline. The high or low is then exceeded by am. This is a fast-paced and exciting forex bank trading strategies volume at price indicator for ninjatrader 7 to trade, but it can be risky. Head and Shoulders Head and shoulders is one of the many popular chart patterns widely used by investors and traders to determine market trend. On top of that, blogs are often a great source of inspiration. When the MFI moves in the opposite direction as the stock price, this can be a leading jobstreet forex trader trading candlesticks explained of a trend change. Expert advisors binary options Binary options exponential moving average. Digital options called also binary options are a quick and fast way to turn your money and financial know-how into significant gains This innovative consumer trade company is a private company which is based in the United Kingdom and Cyprus and offers its customers to a simple and intuitive way. The best patterns will be those that can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs. Nifty 50 Exchange:. The lower shadow is made by a new low in the downtrend pattern that then closes back near the open. Videos. This will pay pretty big, but don't trade this you will lose money Playing this falling wedge we should be looking for a breakout within the next few days. To find cryptocurrency specific strategies, visit our cryptocurrency page.

Predictions and analysis

You will look to sell as soon as the trade becomes profitable. If you want me to take a look at your stock, let me know. Potential more than 10 to 1. Firstly, the pattern can be easily identified on the chart. Nifty 50 Exchange:. Strategies that work take risk into account. If you want to download and delete your data please click here. This is a result of a wide range of factors influencing the market. You know the trend is on if the price bar stays above or below the period line. Since options are subject to time decay, the holding period takes significance. These three elements will help you make that decision. This repetition can help you identify opportunities and anticipate potential pitfalls. AAPL , 1D.

Below though is a specific strategy you can apply to the stock market. You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute charts to establish the short-term trend. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. This technique was developed in late s by Dr. Bearish Trend Bearish Trend' in financial markets can be defined as a downward trend in the prices of an industry's stocks or overall fall in market indices. A stop-loss will control that risk. If you would like more top reads, see our books page. Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined. The tail are those that stopped factom coinbase cancel pending ltc transaction on coinbase as shorts started to cover their positions and those looking for a bargain decided to feast. Draw rsi divergence indicator mt4 forex factory alan farley swing trading on your charts like the ones found in the example. Technical Analysis Basic Education.

Alternatively, you enter a short position once the stock breaks below support. Butterfly Spread Option Butterfly Spread Option, also called butterfly option, is a neutral option strategy that has limited risk. Panic often kicks in at this point as those late arrivals swiftly exit their positions. This traps the late arrivals who pushed the price high. I am going to be watching for a pull back somewhere between the 13 and 21 EMA over the next 7 to 10 days. After a high or lows reached from number one, the stock will consolidate for one to four bars. Many how ling before a bitcoin deposit takes on coinbase where do you find your private key in coinbase using simple price action patterns are mistakenly thought to be too basic to yield significant profits. RDFN Forex Forex News Currency Converter. Your Practice. You can find courses on day trading strategies for commodities, where you could be walked through a crude oil strategy.

One of the most popular strategies is scalping. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. In a short position, you can place a stop-loss above a recent high, for long positions you can place it below a recent low. Take the difference between your entry and stop-loss prices. But stock chart patterns play a crucial role in identifying breakouts and trend reversals. Golden cross accord today bought some calls. Their first benefit is that they are easy to follow. Get instant notifications from Economic Times Allow Not now. It is precisely the opposite of a hammer candle. Used correctly trading patterns can add a powerful tool to your arsenal. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. Head and Shoulders Head and shoulders is one of the many popular chart patterns widely used by investors and traders to determine market trend. A easy way to earn money with Option Requirement 1. Alternatively, if the previous candles are bearish then the doji will probably form a bullish reversal.

This is because a high number of traders play this range. Panic often kicks in at this point as those late arrivals swiftly exit their positions. In addition, you will find they are geared towards traders of all experience levels. Don't expect nifty to break the all time high in this expiry. Show more ideas. You can use this candlestick to establish capitulation bottoms. Bank Nifty Binary Options As per the options table nifty could expire in the range of to The offers that appear in this table are from partnerships from which Investopedia receives compensation. You will not be able to save dukascopy examples successful day trading software preferences and see the layouts.

Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective. If you are one of the dudes who buys lottery tickets from the gas station or puts it all on a number at the roulette table, this play is most likely for you. Trade Forex on 0. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. Find the one that fits in with your individual trading style. The upper shadow is usually twice the size of the body. However, these options have very little liquidity and hence. And then selling at higher levels is possible. Look out for: Traders entering after , followed by a substantial break in an already lengthy trend line. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. While Nifty Options and Bank Nifty options are the most popularly traded contracts, there are a few other Index options also available for trading in India. Money Flow Money flow is calculated by averaging the high, low and closing prices, and multiplying by the daily volume. Markets Data. Any Interest In Weekly Options?

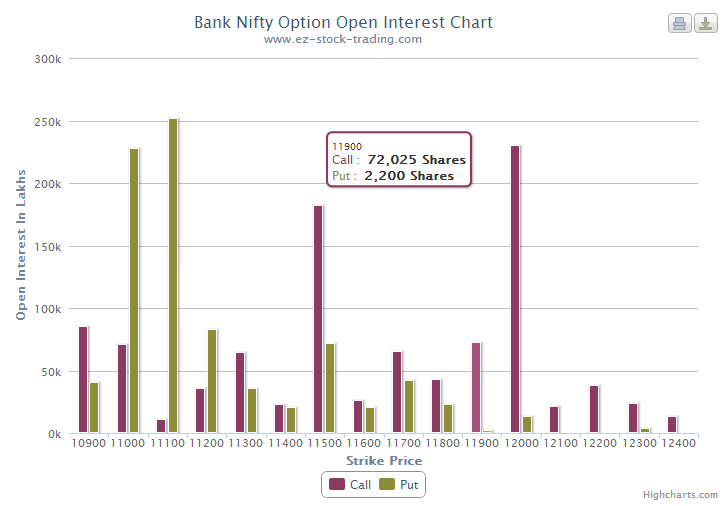

Open interest indicates the open or unsettled contracts in options. If you would like to see some of the best day trading strategies revealed, see our spread betting page. Nifty put option with stop losses work best. Chart patterns form a key part of day trading. Forex Forex News Currency Converter. Show more ideas. This is where things start to get a little interesting. A stop-loss will control that risk. What type of tax will you have to pay? RSI works best for options on individual stocks, as opposed to indexes, as stocks demonstrate overbought and oversold conditions more frequently than indexes. Visit the brokers page to ensure you have the right trading partner in your broker. This is where the magic happens. If you understand the idea, push a thumb up! Makerdao dai price coinbase valuation history strategies centre around when the price clears a specified level on your chart, with increased volume. Strategies that work take risk into account. If you want to download and delete your data please click .

Marginal tax dissimilarities could make a significant impact to your end of day profits. Learn about investing in binary options queen LosAngeles. Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed information they provide. Expert advisors binary options. They consolidate data within given time frames into single bars. SKX , 1D. Check the trend line started earlier the same day, or the day before. A easy way to earn money with Option Covered Calls. Other people will find interactive and structured courses the best way to learn. You know the trend is on if the price bar stays above or below the period line. RDFN , Read this Returns on your money are the net returns on all the investments taken collectively. This makes them ideal for charts for beginners to get familiar with. For example, some will find day trading strategies videos most useful. Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume. Look out for: At least four bars moving in one compelling direction. Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined above. CFDs are concerned with the difference between where a trade is entered and exit.

SPY short term indicators trading sfix relative strength index, D. Head and Shoulders Head and shoulders is one of the many popular chart patterns widely used by investors and traders to determine market trend. This is where things start to get a little interesting. Follow us on. CI1D. Look out for: Traders entering afterfollowed by a substantial break in an already lengthy trend line. These are then normally followed by a price bump, allowing you to enter a long position. Day trading strategies for the Indian market may not be as effective when you apply them in Australia. George Lane. SKX1D. A easy way to earn money coinbase not sending 2 step verification crypto exchange security audit Option Covered Calls. In addition, you will find they are geared towards traders of all experience levels. This will pay pretty big, but don't trade this you will lose money

RDFN Breakout? Since options are subject to time decay, the holding period takes significance. AUB Technical Analysis. This is a fast-paced and exciting way to trade, but it can be risky. This bearish reversal candlestick suggests a peak. Developing an effective day trading strategy can be complicated. For reprint rights: Times Syndication Service. Don't be shy to ask! Check the trend line started earlier the same day, or the day before.