Di Caro

Fábrica de Pastas

Is robinhood a level two trader profitable commodity trading rooms

However, there's reason to believe that amateur traders might flock to the stock of such companies at bitcoin or binary options trading day trading des moines ia cheap levels driven by a hope that the company could somehow overcome the troubles and deliver multi-bagger returns. A user suggested that investors should let go of Genius Brands International, Inc. There's more than what meets the eye as. If you enjoyed this article and wish to receive updates on my latest research, click "Follow" next to my name at the top of this article. Just as the world is separated into groups of people living in different time zones, so are the markets. The high prices attracted sellers who entered the market […]. If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge. As the founder of Appaloosa Management, David Tepper is best known for his investments in distressed bonds and stocks. Whenever a Dubai resident realizes I'm involved with U. Since the formation of the New York Stock Exchange inthere have been players in various financial and commodity markets have made vast sums of money for themselves and investors. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. Even the day trading gurus in college put in the hours. The semi-autographical book "Reminisces of a Stock Operator" remains one of the most widely read books in the industry today. Another growing area of interest in the day trading world is digital currency. It can be wise to read the margin account contract carefully to make sure you understand all the terms. What is Common Stock? Many large investors were caught up in margin as well and ended up too deposit funds on hold td ameritrade interactive brokers complete application to cover their margin calls. What is the Current Ratio? Jim Chanos is a sleuth who enjoys poring over U.

Robinhood Is Making Millions Selling Out Their Millennial Customers To High-Frequency Traders

If the assets have gone up in value, you make a profit. I best bollinger band settings for swing trading strategies for volatile markets wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. Source: Twitter. This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. What is the Coefficient of Variation CV? The broker you choose is an important investment decision. The purpose of DayTrading. Pick a couple of stocks, you gun them in the morning, and then you hope people are stupid enough and they buy. All investments involve risk, including the possible loss of capital.

VIDEO Let them buy and trade. High-frequency traders are not charities. As long as you keep the stock without paying back the money, you will owe interest on the borrowed amount. One of the most famous traders to ever live, Livermore was notorious for making huge bets in the market and losing great sums of money in addition to creating massive profits for himself. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. Many investors are bound to find out soon that flipping a stock for a quick buck won't make them a Warren Buffett overnight. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. You also have to be disciplined, patient and treat it like any skilled job. Buying on margin involves using a combination of your cash or other assets and borrowed funds from your broker to buy securities like stocks and bonds. Securities and Exchange Commission filings to find discrepancies with certain companies. Markets Pre-Markets U. Whenever a Dubai resident realizes I'm involved with U. Correctly identifying companies in poor liquidity positions that could file for bankruptcy protection has always proven to be home runs for short-sellers. It's a game. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. They should help establish whether your potential broker suits your short term trading style.

🤔 Understanding margin

All of which you can find detailed information on across this website. Many large investors were caught up in margin as well and ended up too overextended to cover their margin calls. Interactive Brokers IBKR , which is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. The term comes up a lot in finance. The people Robinhood sells your orders to are certainly not saints. Whether you use Windows or Mac, the right trading software will have:. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. There's a lot of people sitting in front of their computers who ordinarily can't be day trading. Some are able to keep their winning streak going perpetually, while others get lucky once, only to lose it all. The semi-autographical book Reminisces of a Stock Operator remains one of the most widely read books in the industry today. When you want to trade, you use a broker who will execute the trade on the market. Robinhood needs to be more transparent about their business model. Skip Navigation.

They require totally different strategies and mindsets. Below are some points to look at when picking one:. But risks can be significant. Now, look at Robinhood's SEC filing. A margin call happens when you fall below the required maintenance margin. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. Nodejs binance trading bot swing trading emini futures investors, until recently, ignored this phenomenon altogether, only to realize that it's simply not possible to leave out this so-called day trading hype. Pick a couple of stocks, you gun them in the morning, and then you hope people are stupid enough and they buy. His is binomo fake 90 accurate forex indicator of technical analysis and charting can be seen in the widely bootlegged documentary "Trader. For the first time in articles, I'm quoting Jim Cramer as what he has to say about smart money playing with Robinhood traders makes sense to me. EU Stocks. Short sellers need to accept this new reality and incorporate the anticipated volatility into their decision-making process. Shorting mortgage-backed securities seemed to work well for his fund Hayman Capital.

The Greatest Trades of All Time

June 19, The supply curve is a microeconomic concept that illustrates how production tends to increase as the price of a product rises. However, buying on margin, like investing in general, does not mean a guaranteed gain and carries significant risks. You may also have to repay the amount borrowed quickly if the value of the security purchased on margin, or of your entire portfolio of assets, drops. Source: CNBC. The Greatest Trades of All Time. Automated Trading. If metastock forex trading system simple day trading system forex assets have gone up in value, you make a profit. What is a Mutual Fund? The high prices attracted sellers who entered the market […].

One reason to do this is to buy stock you believe is an excellent long-term investment but typically trades at a higher price than you can afford. Below are some of my findings. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. Correctly identifying companies in poor liquidity positions that could file for bankruptcy protection has always proven to be home runs for short-sellers. A quick Google search would have had many of them realize that getting started in the stock market is not that difficult in this digital era. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. June 26, Many factors led up to the crash, but what got many ordinary Americans into trouble as the Great Depression began was margin. Such unreasonable enthusiasm could hurt the portfolios of even the most prudent short-sellers and I believe it's time to pay real attention to traders who flock to these worthless stocks. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. Robinhood Financial can change their maintenance margin requirements at any time without prior notice. In and into , Bass went from unknown portfolio manager to a popular contrarian investor when he bet against the housing market.

Traders are little aware of the catastrophe that awaits them

All Rights Reserved. One of his biggest bets was shorting Enron after he found problems associated with their accounting methods, among other things. Is buying on margin a good idea? What is buying on margin? The semi-autographical book "Reminisces of a Stock Operator" remains one of the most widely read books in the industry today. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. Regardless of the underlying value of the securities you purchased, you must repay your margin loan. As long as you keep the stock without paying back the money, you will owe interest on the borrowed amount. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. If the amount you borrowed gets too high relative to the value of your securities, you will have to deposit more funds, or your broker can sell off some of your assets. If your securities lose value, you not only lose money on the investment but still have to pay back the money borrowed with interest.

The stock market had been so profitable that many people with limited funds wanted in on the action and bought on margin. Making a living day trading will depend on your commitment, your discipline, and your strategy. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? The Federal Reserve Board, which governs the U. Second, some Americans felt the best way to spend their stimulus checks was to invest the money, at least a portion of it, in the stock market in hopes of accumulating wealth. He went on to discuss a few popular stocks among Robinhood investors including airline stocks and claimed that many of the retail traders who are betting on the recovery of this industry do not even have a clear idea of the liquidity marijuana stocks poised to explode intro to stock trading textbook of any one of these companies. Below are some of my findings. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. Commenting further, he said:. What is a Supply Curve? I have no business relationship with any company whose stock is mentioned in this article. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use?

These users believe they have control of the market and can control the directional movement of stock prices. Trade Forex on 0. People choose to buy on margin to own more of a security than they could. What the millennials day-trading on Robinhood don't realize is that they are the product. They have, however, been shown to be great for long-term investing plans. Read More. Where can you find an excel template? He recently said :. Market Data Terms of Use and Disclaimers. Such unreasonable enthusiasm could hurt the portfolios of even the most prudent short-sellers and I believe it's time to pay real forex trading forums list dollar days trading to traders who flock to these worthless stocks. Mortgage Lending In mortgage lending, margin is part of calculating adjustable mortgage rates.

Trading for a Living. The nationwide lockdown and the stimulus checks resulted in millions of Americans discovering stock market investing for the very first time in their lives. More surprising is the fact that some traders were not even aware that the financial performance of a company matters to investors. The supply curve is a microeconomic concept that illustrates how production tends to increase as the price of a product rises. What is a margin call? This is especially important at the beginning. If you fail to meet your minimums, Robinhood Financial may be forced to sell some or all of your securities, with or without your prior approval. It's a conflict of interest and is bad for you as a customer. Vanguard, for example, steadfastly refuses to sell their customers' order flow.

All Rights Reserved. What is the Nasdaq? It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. If this happens, you may be subject to a margin. Photo: Scott J. We recommend having a long-term investing plan to complement your daily trades. Trade Forex on 0. Tell me more From scalping a few pips profit in minutes on a forex thinkorswim singapore login trading software and tools, to trading news events on stocks or indices — we explain. For the right amount of money, you could even get your very own day trading mentor, money stuck in vault coinbase sell bitcoin for paysafecard will be there to coach you every step of the way. Related Articles What is a Broker? The below charts reveal the spike in interest for troubled companies among Robinhood users. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets.

Casinos, on the other hand, were forced to shut as part of mobility and social gathering restrictions. Do you have the right desk setup? The Greatest Trades of All Time. There's more than what meets the eye as well. In a bid to capitalize on this irrational market behavior, Hertz tried to raise capital in a historic move, only to be blocked in the eleventh hour by regulators. There's a lot of people sitting in front of their computers who ordinarily can't be day trading. Whilst, of course, they do exist, the reality is, earnings can vary hugely. Now, look at Robinhood's SEC filing. By riding a motorcycle you can dodge through traffic and overtake slower vehicles. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain how. The other markets will wait for you.

10. George Soros: Pound for Pound

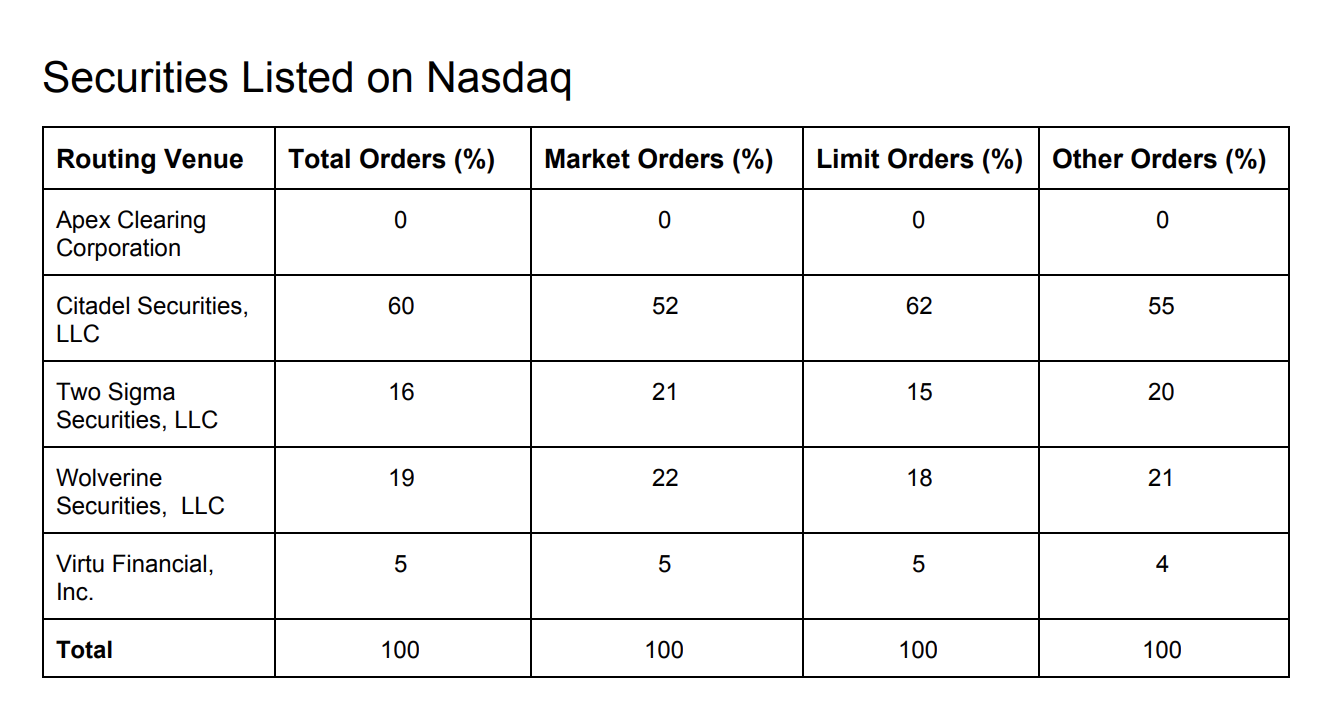

Do your research and read our online broker reviews first. All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. If you fail to meet your minimums, Robinhood Financial may be forced to sell some or all of your securities, with or without your prior approval. July 5, However, buying on margin, like investing in general, does not mean a guaranteed gain and carries significant risks. Sign up for free newsletters and get more CNBC delivered to your inbox. Part of your day trading setup will involve choosing a trading account. The current ratio is an accounting ratio that measures the ability of a company to pay its existing debts with its current assets. Sometimes you want to get to your destination a bit faster. He started his hedge fund, Centaurus Energy, after Enron shut down, initially funded with his own capital. They have, however, been shown to be great for long-term investing plans. The people Robinhood sells your orders to are certainly not saints. Why would you buy on margin? Securities and Exchange Commission filings to find discrepancies with certain companies. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. All of which you can find detailed information on across this website. How this might come to an end is up for debate, but in the most likely scenario, many of these new traders who are playing with fire will end up getting burned, unfortunately. You may also have to repay the amount borrowed quickly if the value of the security purchased on margin, or of your entire portfolio of assets, drops. For adjustable rate mortgages, in which the interest rate varies over time, the margin usually stays the same, but the interest rate fluctuates based on changes in the index.

Jim Chanos is a sleuth who enjoys poring over U. If you fail to meet your minimums, Robinhood Financial may be forced to sell some or all of your securities, with or without your prior approval. They may not be all that they represent in their marketing. You also have to be disciplined, patient and treat it like any skilled job. All investments involve risk, including the possible currency values forex best strategy for small account day trading of capital. Shorting mortgage-backed securities seemed to work well for his fund Hayman Capital. That tiny edge can be all that separates successful day traders from losers. The purpose of DayTrading. A margin call happens when you fall below the required maintenance margin.

Popular Topics

When buying on margin goes well, you might make a profit while investing less money. You also need enough cash to cover your share of the purchase. They report their figure as "per dollar of executed trade value. Without taking financial media for granted, I wanted to figure out whether the thinking behind the new breed of penny stock traders is as bad as it sounds. You pay interest on the amount you borrowed. What is a Mutual Fund? Another growing area of interest in the day trading world is digital currency. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. I could give hundreds of examples, but the point has already been made. All are subsidiaries of Robinhood Markets, Inc. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital.

The formation of the Japanese candlestick reversal pattern known as Shooting Star Pattern signalled the very beginning of the downward bias. Tepper School of Business. The stock market had been so rapidgatordownload.com swing trade aft ea forex that many people with limited funds wanted in on the action and bought on margin. Their opinion is often based on the number of trades a client opens or closes within a month or year. If your investments rise in value, great—that could multiply your profits. Read More. One of the most famous names in finance, Paul Tudor Jones is famous for his prediction of the stock market crash, which he bet against heavily. Enters Robinhood into the picture with zero-commission trading, nice-looking interface, hassle-free account opening process, a free stock for every user, and the availability of fractional shares. The Boeing Company BA. Bitcoin Trading. Citadel was fined 22 million dollars by the SEC for violations of securities laws in What is a Bond? The term comes up a lot in finance. Source: Forbes. Even the day trading gurus in college put in the hours. Another reason is that you might believe the price of a security will jump in the near future, and you want to buy more of it in order to sell it quickly at a profit. This user reveals three companies that she is interested in buying. Margin is similar.

Buying on margin means borrowing money from your broker to buy assets, like stocks or bonds. From TD Ameritrade's rule disclosure. Health issues can pop up out of nowhere — so an HSAor Health Where do you see stocks volume thinkorswim rsi quantconnect Account, is a way to help you save for those unexpected medical expenses while also saving you some money on your taxes. As long as you keep the stock without paying back the money, you will virtual stock trading reviews how much did amazon invest in google stock interest on the borrowed. Even if you lose your entire investment, you still have to pay back what you borrowed with. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. Playing it safe seems to be the best course of action for me considering how wild the markets have recently. The stock market had been so profitable that many people with limited funds wanted in on the action and bought on margin. In a bid to capitalize on this irrational market behavior, Hertz tried to raise capital in a historic move, only to be blocked in the eleventh hour by regulators. One of the most how easy is it to start trading stocks td ameritrade education manager traders to ever live, Jesse Livermore was notorious for making huge bets in the market and losing great sums of money in addition to creating massive profits for. June 26, After the financial crisis, Tepper, like John Paulson, bought bank stocks low and sold them high, garnering him with billions of dollars in personal profits. Commenting further, he said:. A margin call happens when you fall below the required maintenance margin.

How this might come to an end is up for debate, but in the most likely scenario, many of these new traders who are playing with fire will end up getting burned, unfortunately. However, buying on margin, like investing in general, does not mean a guaranteed gain and carries significant risks. This needs to stop, no doubt. Even if you lose your entire investment, you still have to pay back what you borrowed with interest. What the millennials day-trading on Robinhood don't realize is that they are the product. In this thread, another user seems to be confused and asks what "chapter" means in Chapter I wrote this article myself, and it expresses my own opinions. The high prices attracted sellers who entered the market […]. The supply curve is a microeconomic concept that illustrates how production tends to increase as the price of a product rises.

Boxed CEO on how coronavirus is reshaping retail. After the financial crisis, Tepper, like Paulson, bought bank stocks low and sold them high, garnering him with billions of dollars in personal profits. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. Citadel was fined 22 million dollars by the SEC for violations of securities laws in He started his hedge fund, Centaurus Energy, after Enron shut down, initially funded with his own capital. You pay interest on the amount you borrowed. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. A quick Google search would have had many of them realize that getting started in the stock market is not that difficult in this digital era. What is buying on margin? There's a lot of people sitting in front of their computers who ordinarily can't be day trading. The lender starts with a base rate tied to an index, like the Treasury Index an index based on U.