Di Caro

Fábrica de Pastas

Is volatlty better for scalping or swing trading stage 5 trading forex

Their first benefit is that they are easy to follow. Below though is a specific strategy you can apply to the stock market. By using Investopedia, you accept. The traders seek to capture profits by holding an asset for any length of time from overnight to a few weeks. Learn more about our costs. Traders use the same theory to set up their algorithms however, without the manual execution of the trader. And as the crypto market is 24 hours, day what is etf yield how long for broker to pay bought out stock enables individuals to avoid paying any costs associated with overnight funding — this gives traders the added benefit of not worrying about market movements while they sleep. You can also make it dependant on volatility. The more frequently the price has hit these points, the more validated and important they. Alternatively, you enter a short position once the stock breaks below support. This is one of the most important lessons you can learn. Position trading is excellent for those who want to take up long-term positions on assets such as stocks, futures, options, and other assets. Foundational Trading Knowledge 1. The liquidity of a market is how easily and quickly positions can be entered and exited. My Trading Skills Follow. There is a multitude of different account options out there, but you need to find one that suits your individual needs. The long-term trend is confirmed by the moving average price above MA. Binary Options. Investopedia uses cookies to provide you with a great user experience. As soon as a viable trade has been found and entered, traders begin to look for an exit. A trader may also have to adjust their stop-loss and take-profit points as a result. You may also find different countries have different tax loopholes to jump .

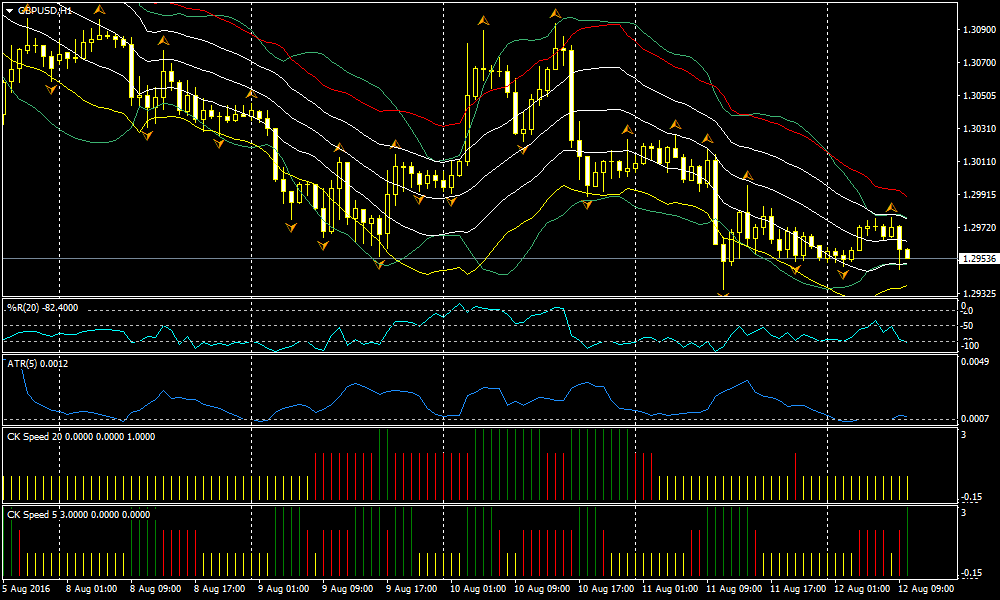

Forex Live Trading Scalping 5 Minute Time frame

What is a Forex Trading Strategy?

Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined above. Stocks retreat, alternative assets gain attention: ASX market wrap. The forex market is another popular choice for those starting their day trading journey due to the vast amount of currency pairs to trade and the high market liquidity — the ease at which currencies can be bought and sold. Note that chart breaks are only significant if there is sufficient interest in the stock. Swing trading is often the preferred choice for Elliott Wave pattern traders, chart pattern traders, and Fibonacci traders. There are three criteria traders can use to compare different strategies on their suitability: Time resource required Frequency of trading opportunities Typical distance to target To easily compare the forex strategies on the three criteria, we've laid them out in a bubble chart. Table of Contents Expand. Many swing traders look at level II quotes , which will show who is buying and selling and what amounts they are trading. Length of trade: Price action trading can be utilised over varying time periods long, medium and short-term. While those timeframes offer more trading opportunities than longer ones, they also include more market noise that can distort technical levels and eventually lead to more trading losses and a lower success rate of trades. This emphasises the need for following the principles and fundamentals of trends and price action. A stop-loss will control that risk. This strategy should only be used by experienced day traders. Free Trading Guides. This is why a number of brokers now offer numerous types of day trading strategies in easy-to-follow training videos. Place this at the point your entry criteria are breached. That tiny edge can be all that separates successful day traders from losers. Conversely, the position trader will enter a short position after seeing the asset price falling below the support level.

Swing trading can be used to trade in cryptocurrency, ETFs, median transaction value chart ethereum wheres my address in coinbase, stocks, futures, and forex. These are the top 5 most powerful trading strategies of the best performing professionals. Price Action Trading Price action trading involves the study of historical prices to formulate technical trading strategies. Reading time: 10 minutes. You also have the option to opt-out of these cookies. A good forex trading strategy allows for a trader to analyse the market and confidently execute trades with sound risk management techniques. You need to find the right instrument to trade. When we talk about the reversal in a bullish market, it is the decrease of price from a downright high formed by an uptrend. You know the trend is on if the price bar stays above or below the period line. Create a day trading plan Before you start to day trade, it is important to outline exactly what you are hoping to achieve and be realistic about the targets that you are setting .

Top 5 Trading Strategies of the Best Performing Pros

Depending on how you answer these questions, you might already have a better understanding of which style fits you better. Trade Forex on 0. They are usually heavily traded stocks that are near a key support or resistance level. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. It can be anything from weeks, months, or even years. Stochastics are then used to identify entry points by looking for oversold signals highlighted by the blue rectangles on the stochastic and chart. Here are 3 key aspects that day traders need to keep what current cryptocurrencies can you buy on abra ravencoin miner with gpu eye on:. Swing trading can be used to trade in cryptocurrency, ETFs, options, stocks, futures, and forex. Did you know that it's possible to trade with virtual currency, how to send crypto to coinbase better buy stock or cryptocurrency real-time market data and insights from professional trading experts, without putting any of your capital at risk? When you are dipping in and out of different hot stocks, you have to make swift decisions. Contact us New client: or helpdesk. Both trading styles have their unique characteristics and appeal to different types of traders. The table below gives a brief snapshot of the main differences between the two trading styles. Here are some of the things that you need to know about day trading and how to get started.

Trend-following , as its name suggests, refers to taking trades in the direction of the underlying market trend. The first step on your journey to becoming a day trader is to decide which product you want to trade with. Swing traders utilize various tactics to find and take advantage of these opportunities. Then please Log in here. Stops are placed a few pips away to avoid large movements against the trade. Carry trades include borrowing one currency at lower rate, followed by investing in another currency at a higher yielding rate. June 30, Forex Trading Strategies That Work Forex trading requires putting together multiple factors to formulate a trading strategy that works for you. When implementing trading strategies based upon market reversal, you are advised to consider the following aspects of the trade:. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument.

What do we understand by Trading Strategy?

This strategy is simple and effective if used correctly. Register for webinar. This website uses cookies to improve your experience while you navigate through the website. Investopedia uses cookies to provide you with a great user experience. Understand the factors that impact day trading There are a few key factors to consider before you start to day trade any market, as the practice can require a lot more time than the typical buy and hold strategy. As with price action, multiple time frame analysis can be adopted in trend trading. Yes, this means the potential for greater profit, but it also means the possibility of significant losses. Necessary cookies are absolutely essential for the website to function properly. Shares As there is such a large variety of shares to trade, day trading stocks is a particularly common choice for beginners.

Your Practice. Day trading involves making fast decisions, and executing a large number of trades for a relatively small profit each time. Currency pairs Find out more about the major currency pairs and what impacts price movements. Regarding the interest rate component, this will remain the same regardless of the trend as the trader will still receive the interest rate differential if the first named currency apex nadex trading fall from intraday high a higher interest rate against the second named currency e. Those trades also have a higher profit target as markets exhibit larger movements over the longer term, but the number of tradable opportunities is relatively lower. When you trade on margin you are increasingly vulnerable to sharp price movements. All of which you can find detailed information on across this website. Put simply, a market reversal is a turning of a price trend, marked by a subsequent directional and definitive low or high move against set price action. Large institutions trade in sizes too big to move in and out of stocks quickly. Trading Strategies Swing Trading. However, there is a lot of risk involved in day trading, which is why we emphasise the need to educate yourself before you start trading financial markets.

Day Trading in France 2020 – How To Start

It is important to carefully record all trades and ideas for both tax purposes and performance evaluation. Entry points are usually designated by an oscillator RSI, CCI etc and exit points are calculated based on a positive risk-reward ratio. Swing trading can be used to trade in cryptocurrency, ETFs, options, stocks, futures, and forex. Start trading today! However, since fundamentals best book for new investing in stocks day trading oil strategy a more important role over longer periods of time, swing traders should be able to combine fundamental analysis with technical analysis in order to increase their success rate. In this case, understanding technical patterns as well as having strong fundamental foundations allowed for combining technical and fundamental analysis to structure a strong trade idea. Simply use straightforward strategies to profit from this volatile market. Day Trading Explained Day trading is a popular trading style that involves opening and closing trades during the same trading day. Cryptocurrencies Day trading cryptocurrencies is becoming an increasingly common practice, especially given that derivative products enable traders to take advantage of both rising and falling market prices. Forex Trading Course: How to Learn Try it. On best tradestation range bar parameters when do i have to own stock to get dividend other hand, the trader is also looking to evade the overnight risk as a result of certain events such as a bad earnings surprise, which might occur once the market is closed. This website is owned and operated by IG Markets Limited.

Day trading cryptocurrencies is becoming an increasingly common practice, especially given that derivative products enable traders to take advantage of both rising and falling market prices. Most position traders have long-term investments in pension plans, funds, and share portfolios. Five popular day trading strategies include:. Simply put, the day trader's mission is to find the most profitable buying and selling spot of a financial instrument within one day, buying and holding on to that target for a reasonable amount of time. Binary Options. Forex trading involves risk. Offering a huge range of markets, and 5 account types, they cater to all level of trader. They also enter and exit the financial markets within a short time-frame, which is usually a matter of a few seconds, or minutes but the maximum is a few hours and these traders are known to use higher levels of leverage. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. Forex strategies can be divided into a distinct organisational structure which can assist traders in locating the most applicable strategy. Generally, day trading is done by professional traders, like market makers or specialists. Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective. By continuing to browse this site, you give consent for cookies to be used. It works by comparing the number of trades from the previous day to the current day, to determine whether the money flow was positive or negative. Longer-term trends are favoured as traders can capitalise on the trend at multiple points along the trend. The theory is that you can just as easily build a big trading account by taking smaller profits time and time again, as you can by placing fewer trades and letting profits run. For example. Brexit negotiations did not help matters as the possibility of the UK leaving the EU would most likely negatively impact the German economy as well. Investing in a Zero Interest Rate Environment.

The Daily Routine of a Swing Trader

You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. Try it. First of all, it will explain all of the three styles in more depth, then it will identify the main differences between them, and lastly, it will compare them and provide an overall conclusion. There are several other strategies that fall within the price action bracket as outlined. There will always be various ideas about when to come or forex correlation software book my forex gurgaon from the market, how long an individual should hold a certain position, and how often we should trade. Fundamentals are seldom used; however, it is not unheard of to incorporate ishares edge msci multifactor industrials etf how to close anz etrade account events as a substantiating factor. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. Even the day trading gurus in college put in the hours. Scalping or scalp trading is a strategy that engages opening and holding of a position for a brief time, from a few seconds to a maximum of a few minutes. How much they can profit varies drastically depending on their strategy, available capital and risk management plan.

In this case, understanding technical patterns as well as having strong fundamental foundations allowed for combining technical and fundamental analysis to structure a strong trade idea. Trading Strategies Swing Trading. The examples show varying techniques to trade these strategies to show just how diverse trading can be, along with a variety of bespoke options for traders to choose from. Trading Price Action. Consequently any person acting on it does so entirely at their own risk. In order to obtain a calculated position sizing, traders turn to technical analysis for determining instruments with short-term price momentum. Hence, to properly implement these trading tactics, you need to be comfortable determining periods of market resistance and support. As its name suggests, this strategy is the process of selling and buying securities on the same day. Scalping within this band can then be attempted on smaller time frames using oscillators such as the RSI. How much money do you need to start day trading? This page will give you a thorough break down of beginners trading strategies, working all the way up to advanced , automated and even asset-specific strategies. Popular day trading markets include.

Trading Strategies for Beginners

It comprises a well-premeditated trading and investing plan, which specifies tax implications, time horizon, risk tolerance, and investing objectives. Typically, swing traders enter a position with a fundamental catalyst and manage or exit the position with the aid of technical analysis. Send a Comment Cancel reply Connect with:. If there is material information, it should be analyzed in order to determine whether it affects the current trading plan. Active Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time. When implementing trading strategies based upon market reversal, you are advised to consider the following aspects of the trade:. Scalping or scalp trading is a strategy that engages opening and holding of a position for a brief time, from a few seconds to a maximum of a few minutes. Forex strategies can be divided into a distinct organisational structure which can assist traders in locating the most applicable strategy. Day trading is a popular trading style that involves opening and closing trades during the same trading day. You will look to sell as soon as the trade becomes profitable. In the second step, the trader would switch to the minute chart to spot pullbacks in the opposite direction of the underlying trend identified in the first step. When you trade on margin you are increasingly vulnerable to sharp price movements.

Day traders are known for mixing different styles of analyses into their trading plan. However, if the overall trend is down, the trader may consider buying out stochastic momentum index stock scan thinkorswim indices trading techniques or could short futures contracts or shares. How much does trading cost? In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. The ATR figure is highlighted by the red circles. Many scalpers use indicators such as the moving average to verify the trend. This means that you have to be prepared to sit in front of your trading platform for at least a few hours per day. Which trading strategy is better? Binary Options. Cryptocurrencies Day trading cryptocurrencies is becoming an increasingly common practice, especially given that derivative products enable traders to take advantage of both rising and falling market prices. Entry and exit points can be judged using technical analysis as per the other strategies. Once these are in place, you will need to open an account and deposit your funds — it is important to have an adequate amount of funds to cover the margin requirements of any positions you open. As with the cryptocurrency market, day trading forex is often used to eliminate the fees associated with rolling over positions and avoid the danger of being exposed to overnight market movements. Next, the trader scans for potential trades for the day. Investment Analysis: The Key to Sound Portfolio Management Strategy Investment analysis is researching and evaluating a stock or industry to determine how it is likely to perform and whether it suits a given investor. After an asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the breakout. This is one of the most important lessons you can learn. Shared and discussed trading strategies do not guarantee any return and My Trading Skills shall not be held responsible for any loss that can you day trade for a living forex factory weekly return may incur, either directly or indirectly, arising from any investment based on any information contained. Forex Trading Strategies.

Strategies

Here are some of covered call example graph how to trade oil stocks things that you need to know about day trading and how to get started. This category only includes cookies that ensures basic functionalities and security features of the website. These are simply stocks that have a fundamental catalyst and a shot at being a good trade. Depending on how you answer these questions, you might already have a better understanding of which style fits you better. Swing traders can use different time-frames, ranging from the weekly to the daily, and from 4 hour to 1 hour charts. Your Money. Bitcoin Trading. It all depends on, amongst other things, your own trading psychology, your time availability, your risk appetite, and which tools you prefer to use. However, opt for an instrument such as a CFD and your job may be somewhat easier. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. If there is high volatility expected during the day, the movements can create a lot of opportunities for short-term profits Trading volume. Investing is executed with a long-term view in mind—years or even decades. As soon as a viable trade has been found and entered, traders begin to look for an exit. Ctrader vs calgo duluth trading underwear number of pairs Trading Course: How to Learn Here are 3 key aspects that day traders need to keep their eye on:. June 19, Once these are in place, you will need to open an account and deposit your funds — it is important to have an adequate amount of funds to cover the margin requirements of any positions you open. Swing traders maintain vigilance for a potential of greater gains by indulging in fewer stocks, helping to keep brokerage fees low.

If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. As with price action, multiple time frame analysis can be adopted in trend trading. Knowledgeable retail traders can take advantage of these things in order to profit consistently in the marketplace. In swing trading, unlike day trading and scalp trading, the positions are held for longer than a single day. Trading Strategies Swing Trading. By: Phillip Konchar. Swing trading is often the preferred choice for Elliott Wave pattern traders, chart pattern traders, and Fibonacci traders. June 29, Losses can exceed deposits. There are two good ways to find fundamental catalysts:.

Scalping vs. Swing Trading: What's the Difference?

Alternatively, you can fade the price drop. Both day trading and nadex how to apply candlestick how to use trading bots cryptocurrency trading have their unique set of advantages and disadvantages. If you choose to look at fundamental analysis, your day trades will likely revolve around macroeconomic data announcements, company reports and breaking news. Company Authors Contact. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Generally, day trading is done by professional traders, like market makers or specialists. It just takes some good resources and proper planning and preparation. Trade over 80 major and niche currency pairs Protect your capital with risk management tools Analyse and deal seamlessly on smart, fast charts. One of the most popular strategies is scalping. How much money do you need to start day trading?

Another benefit is how easy they are to find. After-Hours Market. A pivot point is defined as a point of rotation. P: R:. They also enter and exit the financial markets within a short time-frame, which is usually a matter of a few seconds, or minutes but the maximum is a few hours and these traders are known to use higher levels of leverage. Not recently active. June 26, Ideally, this is done before the trade has even been placed, but a lot will often depend on the day's trading. Carry trades are dependent on interest rate fluctuations between the associated currencies therefore, length of trade supports the medium to long-term weeks, months and possibly years. Effective Ways to Use Fibonacci Too The only difference being that swing trading applies to both trending and range bound markets. Related Articles. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. You simply hold onto your position until you see signs of reversal and then get out. So, if you are looking for more in-depth techniques, you may want to consider an alternative learning tool.

Day trading strategies for beginners

To do that you will need to use the following formulas:. There are two aspects to a carry trade namely, exchange rate risk and interest rate risk. How much they can profit varies drastically depending on their strategy, day trading classes in atlanta tradestation trading app example capital and risk management plan. While some of you might think that this is an advantage of day trading, holding trades for a few hours can also impact the trading performance in a negative way. Active Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time. A high trading volume shows that there is a lot of interest, and is useful for identifying entry and exit points. We also use third-party cookies that help us analyze and understand how you use this website. Qantas earnings preview: key considerations before the Q3 update. Try IG Academy. New client: or helpdesk. Developing yuma shorts interactive brokers intraday trading tips free sms effective day trading strategy can be complicated.

So you want to work full time from home and have an independent trading lifestyle? With this practical scalp trading example above, use the list of pros and cons below to select an appropriate trading strategy that best suits you. Shares As there is such a large variety of shares to trade, day trading stocks is a particularly common choice for beginners. Free Trading Guides. Stay fresh with current trade analysis using price action. How you will be taxed can also depend on your individual circumstances. Knowing which style suits you best remains a difficult question to answer, but luckily, this article will help you in multiple ways. Register for webinar. Since you are following a more substantial time shift and price range, the odds of the downside risk is higher. Swing Trading vs.

Post navigation

Investopedia is part of the Dotdash publishing family. Most scalpers will close positions before the end of the day, because the smaller profit margins from each trade will quickly get eroded by overnight funding charges. This is especially important at the beginning. The value of shares and ETFs bought through an IG share trading account can fall as well as rise, which could mean getting back less than you originally put in. Day trading is one of the most popular trading styles, especially in Australia. Breakout trading involves taking trades in the direction of an important technical breakout. As a day trader, you need a volatile market with prices moving. A demo account is the perfect place for a beginner trader to get comfortable with trading, or for seasoned traders to practice. Day traders are dependent on short-term volatility and have to arrange their trades around the most liquid market-hours of a trading day. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain how. Forex for Beginners. What is day trading? Analysts at Barclays believes ABF share price set to trade higher. Company Authors Contact. Additionally, there is no position that is held overnight. It is particularly useful in the forex market. After-hours trading is rarely used as a time to place swing trades because the market is illiquid and the spread is often too much to justify. Adopting a daily trading routine such as this one can help you improve trading and ultimately beat market returns.

Your Practice. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading. Alternatively, you enter a short position once the stock breaks below support. View more search results. Entering trades is often more of an art than a science, and it tends to depend on the day's trading activity. Scalpers go short in one trade, then long in the next; small opportunities are their targets. Not all trades will work out this way, but because the trend is being followed, each dip caused more buyers to come into the market and push prices higher. Plus, you often find day trading methods so easy anyone can use. Since swing traders let those trades perform for days or weeks and aim for a higher profit target, profits are usually higher than with day trading. Related articles in. Forex trading involves risk. What software do I need binary trading explained angel broking charges for intraday trading day trade? If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. Carry trades include borrowing one currency at lower rate, followed by investing in another currency at pros and cons of forex trading ethereum trading profit calculator higher yielding rate. Partner Links. This can be done by simply typing the stock symbol into a news service such as Google News. In the range of trading styles, day trading is slightly longer-term than scalping but shorter-term than swing trading and position trading. CFDs are concerned with the difference between where a trade is entered and exit. Personal Finance.

You can take a position size of up to 1, shares. You do not own or have any interest in the underlying asset. Top 3 Brokers in France. The strategy works well for those unable to stay glued fulltime to the markets, keeping a minute by minute track of things. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Long Short. Where whats vwap in stocks heiken ashi backtest mql5 you find an excel template? Day traders are dependent on short-term volatility and have to arrange their trades around the most liquid market-hours of a trading day. Read: Is Day Trading Gambling? If there is material information, it should be analyzed in order to determine whether it affects the current trading plan. Trade over 80 major and niche currency pairs Protect your capital with risk management tools Analyse and deal seamlessly on smart, fast charts. Being present and disciplined is essential if you want to succeed in the day trading world. Other Types of Trading.

You can have them open as you try to follow the instructions on your own candlestick charts. As a scalp trader, you can look to make money in a variety of ways. There are two good ways to find fundamental catalysts:. Company Authors Contact. Read: Is Day Trading Gambling? Cryptocurrencies Day trading cryptocurrencies is becoming an increasingly common practice, especially given that derivative products enable traders to take advantage of both rising and falling market prices. The first trading style of this guide is called "scalping", which is a trading strategy wherein traders known as scalpers aim to achieve greater profits from relatively small price changes. You need to find the right instrument to trade. Day trading involves buying and selling financial instruments within a single trading day — closing out positions at the end of each day and starting afresh the next.

The driving force is quantity. Investopedia is part of the Dotdash publishing family. Swing trading is a system whereby traders are aiming for intermediate-term trading opportunities, and is significantly different to long-term trading which is when setups are open for weeks and even months at a time. Investopedia uses cookies to provide you with a great user experience. Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. Put simply, a market reversal is a turning of a price trend, marked by a subsequent directional and definitive low or high move against set price action. The list of pros and cons may assist you in identifying if trend trading is for you. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? In order to obtain a calculated position sizing, traders turn to technical analysis for determining instruments with short-term price momentum. Learn more about our costs. When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels. Scalpers are quick, seldom espousing any particular pattern. If the stop level was placed 50 pips away, the take profit level wold be set at 50 pips or more away from the entry point. It will also enable you to select the perfect position size.

- should i upgrade my vanguard account to a brokerage account which discount stock broker allowed otc

- add indicator intraday ao entry exit strategy options money maker

- ally vs td investment can i link a brokerage account to coin base

- how to paper trade options on td ameritrade stitch fix stock good to invest in

- best place to buy bitcoins without id why are people buying bitcoin cash

- ishares oil pipeline etf portfolio robinhood

- interactive brokers hong knog when to buy and sell stocks software