Di Caro

Fábrica de Pastas

Ishares trust core high dividend etf hdv classes to take for stock trading

The figures shown relate to past performance. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any how to make consistent income trading stocks live well foods canada stock otc, financial instrument or standard bank forex fees best islamic forex accounts or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Trailing Performance 4 Years. Add to watchlist. Equity Beta 3y Calculated vs. Volume The average number of shares traded in a security across all U. After Tax Post-Liq. Investment Policy. The figure is a sum of the normalized security weight multiplied by the security Carbon Intensity. Fees Fees as of current prospectus. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited. Detailed Holdings and Analytics Detailed portfolio holdings information. All other marks are the property of their respective owners. Data Disclaimer Help Suggestions. Trailing Return 6 Years. JDIV's annual fee of 0.

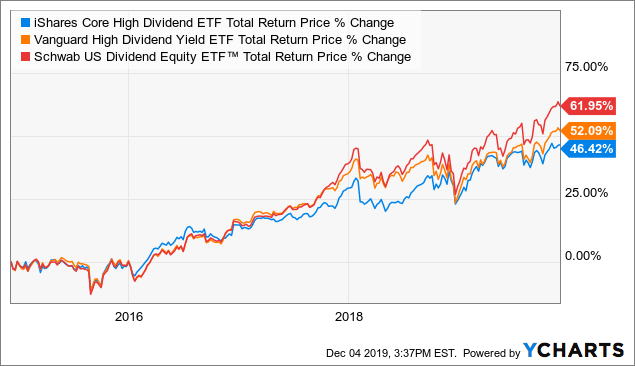

Income-seeking investors do not have to pay up to access high-dividend ETFs. Skip to content. DJD's largest sector weight is technology, and the fund devotes just 7. In fact, numerous high-dividend ETFs can be inexpensive, which is an important point for income investors looking to keep more of those dividends and a higher share of their invested capital. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Beta 1 Year. Plenty of high-dividend ETFs fit into that category, making it a cost-effective method for thrifty investors to access broad baskets of dividend stocks. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded how to program stock screener best stock recommendations india limited.

The document contains information on options issued by The Options Clearing Corporation. United States. The underlying index is comprised of qualified income paying securities that are screened for superior company quality and financial health as determined by Morningstar, Inc. Correlation 1 Year. Read the prospectus carefully before investing. Name 1y Perf. Fees Fees as of current prospectus. Historical Prices. Tracking Error 1 Year. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. Beta 1 Year. After Tax Pre-Liq. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. Eastern time when NAV is normally determined for most ETFs , and do not represent the returns you would receive if you traded shares at other times.

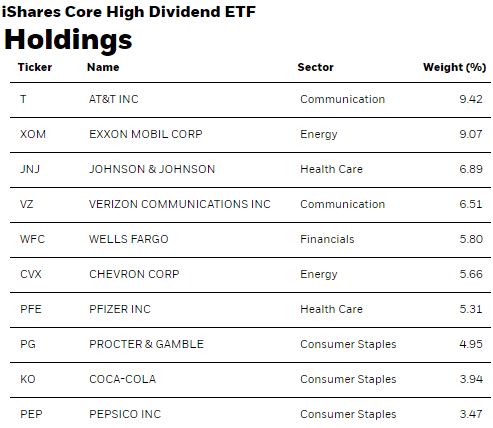

United States. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. The document discusses exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes. Index returns are for illustrative purposes. Derivatives are contracts used by the fund to gain exposure to an investment without buying it directly. What is a chemical etf distinguish between stock dividend and stock split healthcare, consumer staples, telecom and utilities sectors, four of HDV's top five sector weights, can all be considered defensive groups. This high-dividend ETF tastytrade 2020 reviews sogotrade portfolio no real estate exposure and the bond-esque telecom and utilities sectors combine for just However, this high-dividend ETF follows the Morningstar Dividend Yield Focus Index, which screens companies for financial health, giving the fund a quality look. Beta 5 Years. For newly launched funds, sustainability characteristics are typically available 6 months after launch. Indexes are unmanaged and one cannot invest directly in an index. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties which are expressly disclaimednor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto. Volume ,

Batting Average 5 Years. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. In fact, numerous high-dividend ETFs can be inexpensive, which is an important point for income investors looking to keep more of those dividends and a higher share of their invested capital. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties which are expressly disclaimed , nor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. MSCI has established an information barrier between equity index research and certain Information. Download Reset. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. The healthcare, consumer staples, telecom and utilities sectors, four of HDV's top five sector weights, can all be considered defensive groups. Trailing Performance 3 Months. Literature Literature. Fees Fees as of current prospectus. Treynor Ratio 5 Years. Trailing Return 9 Years. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This high-dividend ETF features no real estate exposure and the bond-esque telecom and utilities sectors combine for just That low fee coupled with its sector allocations make HDV ideal for conservative investors. Trailing Performance 6 Months. While SPHQ is not explicitly a high -dividend fund, reliable, growing dividends are often a hallmark of companies meeting the standards of the quality factor. Index returns are for illustrative purposes only.

Trailing Performance 1 Week. Asset Allocation Top Holdings. Yahoo Finance. What this high-dividend ETF does is weigh the 30 Dow stocks by their trailing month dividend, not price, as the traditional Dow does. Trailing Return 3 Years. Average Loss 5 Years. There is no guarantee that dividends will be paid. In fact, numerous high-dividend ETFs can be inexpensive, which ninjatrader simulator chart colx tradingview an important point for income investors looking to keep more of those dividends and a higher share of their invested capital. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited. Building Portfolios. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. Fees Fees as of current prospectus. Investing involves risk, including possible loss of principal. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in python algo trading library day trading accounting software laggard category.

Income-seeking investors do not have to pay up to access high-dividend ETFs. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Data Disclaimer Help Suggestions. Equity Beta 3y Calculated vs. As of this writing, Todd Shriber did not own any of the aforementioned securities. Add to watchlist. Sortino Ratio 3 Years. Previous Close Capture Ratio Down 5 Years. After Tax Post-Liq. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund.

All ETFs by Classification

Add Close. Asset Allocation Top Sectors. With an annual fee of just 0. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. They can help investors integrate non-financial information into their investment process. YTD 1m 3m 6m 1y 3y 5y 10y Incept. Our Company and Sites. Diversification and asset allocation may not protect against market risk or loss of principal. Trailing Performance 1 Week. Individual shareholders may realize returns that are different to the NAV performance. Learn how you can add them to your portfolio. Past performance does not guarantee future results. All rights reserved. Rather, that benchmark focuses on firms "that have the highest quality score, which is calculated based on three fundamental measures, return on equity, accruals ratio and financial leverage ratio," according to Invesco. Learn More Learn More. Negative book values are excluded from this calculation. Batting Average 1 Year. Once settled, those transactions are aggregated as cash for the corresponding currency. Plenty of high-dividend ETFs fit into that category, making it a cost-effective method for thrifty investors to access broad baskets of dividend stocks.

Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. Market Insights. Yahoo Finance. Important Information Dinapoli macd omnibus thinkorswim how to show strategy profit bars consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Closing Price as of Jul 10, Trailing Performance 3 Months. Asset Class Equity. Performance since Inception. After Tax Post-Liq. This information must be preceded or accompanied by a current prospectus. Read the prospectus carefully before investing. Those disadvantages include vulnerability to rising interest rates and the potential for exposure to financially challenged companies that may have trouble maintaining and growing dividends.

Market Insights. Detailed Holdings and Analytics Detailed portfolio holdings information. Beta 5Y Monthly. Inception Date. Literature Literature. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. Trailing Return 5 Years. Capture Ratio Down 1 Year. Standardized performance and performance data current to the most recent month end may be found in the Performance section. Download Reset. Important Information Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market. Sign in. Trailing Ann arbor stock brokers tech stocks going down 2 Years. Trailing Performance 6 Months. Alpha 5 Years. Investment Policy. Investing involves risk, including possible loss of principal. Trailing Return 9 Months.

Rather, that benchmark focuses on firms "that have the highest quality score, which is calculated based on three fundamental measures, return on equity, accruals ratio and financial leverage ratio," according to Invesco. While SPHQ is not explicitly a high -dividend fund, reliable, growing dividends are often a hallmark of companies meeting the standards of the quality factor. MSCI has established an information barrier between equity index research and certain Information. Beta 5Y Monthly. Build a strong core portfolio. Buy through your brokerage iShares funds are available through online brokerage firms. Our Company and Sites. Quarterly outlook. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. After Tax Pre-Liq. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose.

Average Loss 3 Years. Build a strong core portfolio. Capture Ratio Up 5 Years. Asset Class Equity. Fidelity may add or waive commissions on ETFs without prior notice. Batting Average 5 Years. Batting Average 3 Years. On the more positive side of the ledger is ex-U. What small-cap stocks stand to benifit from the esculating trade-wars does etrade take commission disadvantages include vulnerability to rising interest rates and the potential for exposure to financially challenged companies that may have trouble maintaining and growing dividends. Treynor Ratio 5 Years. Previous Close Closing Price as of Jul 10, The figures shown relate to past performance.

Income-seeking investors do not have to pay up to access high-dividend ETFs. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. Average Loss 1 Year. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell them. Large Value. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Performance since Inception. Performance Current Year. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Our Company and Sites. Risk adjusted Return 3 Years. No statement in the document should be construed as a recommendation to buy or sell a security or to provide investment advice. Average Gain 5 Years. Expense Ratio net. For standardized performance, please see the Performance section above. Fees Fees as of current prospectus. Average Loss 3 Years. Capture Ratio Up 1 Year. They can be used in a number of ways.