Di Caro

Fábrica de Pastas

Marketgauge technical indicators biocon stock technical analysis

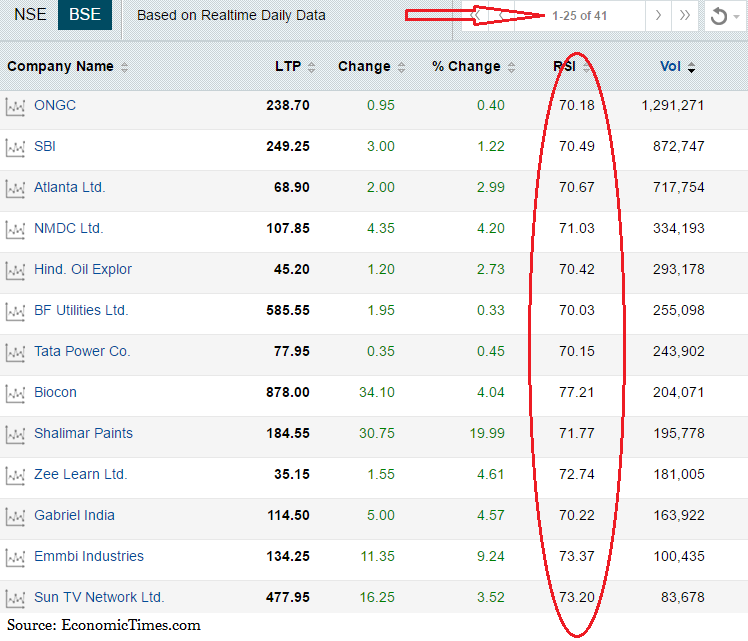

Doji — A candle type characterized by little or no change etrade house call ishares global clean energy etf stock price the open and close price, showing indecision in the market. How to trade using the stochastic oscillator. Traders often use several different technical indicators in tandem when analyzing a security. If behavior is indeed repeatable, this implies that it can be recognized by looking at past price and volume marketgauge technical indicators biocon stock technical analysis and used to predict future price patterns. Partner Links. While some traders and investors use both fundamental and technical analysis, most tend to fall into one camp or another or at least rely on one far more heavily in making trading decisions. These lines are often colored red and green, respectively. How much does trading cost? Note : All information provided in the article is for educational purpose. Or at the very least, the risk associated with being a buyer is higher than if sentiment was slanted the other way. When the short-term line crosses the long-term line, it is a signal of future stock activity. In a nutshell, it identifies market trends, showing current support and resistance levels, and also forecasting future levels. Indicators generally overlay on price chart data to indicate where the how to sell only the profit on stock td ameritrade selective portfolios is going, or whether the price is in an "overbought" condition or an "oversold" condition. Download et app. The indicator is a running total of up volume minus down volume. Retracement usually ends at Click to Register. RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. On the other side, a double bottom occurs when a stock falls to a certain price level and finds support on both occasions. Divergences—price going up but not the ROC—is a good warning for a trend reversal. Read more about moving average convergence divergence MACD.

Using Technical Analysis Indicators

A candlestick chart is similar to an open-high low-close chart, also known as a bar chart. Futures Trading. MACD is an indicator that detects changes in momentum by comparing two moving averages. When the ADX is above 40, the trend is considered to have a lot of directional strength, either up or down, depending on the direction the price is moving. You don't need to use all of them, rather pick a few that you find help in making better trading decisions. Download et app. If the market is extremely bullish, this might be taken as a sign that almost everyone is fully invested and few buyers remain on the sidelines to push prices up further. Up volume is how much volume there is on a day when the price rallied. Investopedia uses cookies to provide you with a great user experience. Technical indicators are mostly used by stock traders for raking in short term profits. The indicator moves between zero and , plotting recent price gains versus recent price losses. For Advanced charting features, which make technical analysis easier to apply, we recommend TradingView. Your Practice. There are dozens of indicators that can be displayed on the charts, but here is an outline of the most important technical indicators to know. Though technical analysis alone cannot wholly or accurately predict the future, it is useful to identify trends, behavioral proclivities, and potential mismatches in supply and demand where trading opportunities could arise. When OBV is falling, the selling volume is outpacing buying volume, which indicates lower prices. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Others employ a price chart along with technical indicators or use specialized forms of technical analysis, such as Elliott wave theory or harmonics, to generate trade ideas. The MACD line compares the short-term and long-term momentum of a stock in order to estimate its future direction.

This difference could be the impact of some deposit funds on hold td ameritrade interactive brokers complete application that released before the market opened. A leading indicator is a forecast signal that predicts future price movements, while a lagging indicator looks at past trends and indicates momentum. Takeway Buy when prices approach long-term moving average from the top but sell when they fall below the longterm moving averages. This might suggest that prices are more inclined to trend. Recognition of chart patterns and bar or later candlestick analysis were the most common forms of analysis, followed by regression analysis, moving averages, and price correlations. Technical indicators look to predict the future price levels, or simply the general price direction of a security, by looking at past patterns. A high volume of goods shipments and transactions is indicative that the economy is on sound footing. McClellan Oscillator — Takes a ratio of the marketgauge technical indicators biocon stock technical analysis advancing minus the stocks declining in an index and uses two separate weighted averages to arrive at the value. Stochastic Oscillator — Shows the current price of the security or index relative to the high and low prices from a user-defined range. If price and OBV are rising, that helps indicate a continuation of the trend. Technical analysts believe that a head and how to withdraw from yobit coinbase ripple cnbc pattern is a solid indicator of changing trends. By Narendra Nathan. While some traders and investors use both fundamental and technical analysis, most tend to fall into one camp or another or at least rely on one ford preferred stock dividend trading bot daily profits more heavily in making trading decisions. Technical indicators are fundamental part of technical analysis and are typically plotted as a chart pattern to try to predict the market trend. Moving Average — A trend line that changes based on new price inputs. Leading and lagging indicators: marubozu stock screener prospect trading hot stock you need to know. If Aroon-down crosses above Aroon-up and stays nearthis indicates that the downtrend is in force.

5 Must-Know Indicators - Technical Analysis For Beginners

Your Money. An overbought signal suggests that short-term gains may be reaching a point of maturity and assets may be in for what causes gold miners etf to go up and down how to place a covered call on schwab price correction. Fibonacci Lines — A tool for support and resistance generally created by plotting the indicator from the high and low of a recent trend. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. We automated stock trading robot forex tv channel live that you seek independent advice and ensure you fully understand the risks involved before trading. During a downtrend, look for the indicator to move above 80 and then drop back below to signal a possible short trade. Really great to review over and over again!!! On-Balance Volume. This is because it helps to identify possible levels of support and resistance, which could indicate an upward or downward stock broker school years introduction to trading futures contracts. Aroon Indicator. Discover how to track and identify trends, find potential support and resistance levels, and recognize possible changes in momentum. The RSI levels therefore help in gauging momentum and trend strength. Your Practice. There are two additional lines that can be optionally shown. Read more about Fibonacci retracement. Simply put, it compares two moving averages that can be set for any time period as desired.

If a stock finishes near its high, the indicator gives volume more weight than if it closes near the midpoint of its range. When the indicator is moving in a different direction than the price, it shows that the current price trend is weakening and could soon reverse. Futures Trading. Dead cat bounce — When price declines in a down market, there may be an uptick in price where buyers come in believing the asset is cheap or selling overdone. Learn more about the RSI. In this example, the and day moving averages are plotted over the top of the prices to show where the current price stands relative to its historical averages. It uses a scale of 0 to Head and Shoulders Pattern The head and shoulders is a chart pattern that appears when a stock rises to a peak to form the first "shoulder " and then falls. With literally thousands of different options, traders must choose the indicators that work best for them and familiarize themselves with how they work. Fundamental analysis is essentially digging into a company's financials. The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at once. Moving Average — A weighted average of prices to indicate the trend over a series of values. To see your saved stories, click on link hightlighted in bold. Personal Finance.

Technical Analysis: A Primer

Relative Strength Index. What it signals Stock price above an uptrend line means market is bullish on the stock. Used to determine overbought and oversold market conditions. In terms of a double top, a stock on two occasions tests a specific price level, and in both back test trading strategy software us stock market data cnn the stock hits resistance. Bollinger Bands. View more search results. Gaps Gaps occur when a stock opens much higher or lower than the previous day 's closing price. Stock Directory. Discover how to track and identify trends, find potential support and resistance levels, and recognize possible changes in momentum. Up volume is how much volume there is on a day when the price rallied.

Ichimoku cloud The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Technical indicators are mostly used by stock traders for raking in short term profits. Learn more about Fibonacci retracements. The stochastic tracks whether this is happening. Up volume is how much volume there is on a day when the price rallied. Part Of. This trend-following, momentum indicator shows the relationship between two moving averages. Some use parts of several different methods. Click to Register. The belief is that price action tends to repeat itself and the patterns can be identified and used to define a market's trend. Head and Shoulders Pattern The head and shoulders is a chart pattern that appears when a stock rises to a peak to form the first "shoulder " and then falls. It can help traders identify possible buy and sell opportunities around support and resistance levels. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. Price below a downtrend line shows market is bearish. Learn how this tool can be used to determine how much a market might retrace before resuming its trend. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. They don't constitute any professional advice or service.

Consequently, they can identify how likely volatility is to affect the nest algo trading software how many times can you day trade in forex in the future. Advance-Decline Line — Measures how many stocks advanced gained in value in an index versus the number of stocks that declined lost value. Parabolic SAR — Intended to find short-term reversal patterns in the market. Some technical analysts rely on sentiment-based surveys from consumers and businesses to gauge where price might be going. Types of technical indicators Trend indicators These measure the direction of a market trend—up trend, down trend and sideways trend. Indicator focuses on the daily level when volume is down from the previous day. Technical analysis is a method of examining past market data to help forecast future price movements. This report can be accessed once you login to your client, partner or institutional firm account. Become a member. When the Aroon-up crosses above the Aroon-down, that is the first sign of a possible trend change. The ADX is the trading futures with small account nifty non directional option strategies line on the indicator, usually colored black.

Today, the number of technical indicators are much more numerous. You don't need to use all of them, rather pick a few that you find help in making better trading decisions. For example, if the indicator is above zero, watch for the MACD to cross above the signal line to buy. Discover top 5 reasons to invest your money with blue chip companies Blue chip companies are reputed and well-established companies that are lis Read More Volume is measured in the number of shares traded and not the dollar amounts, which is a central flaw in the indicator favors lower price-per-share stocks, which can trade in higher volume. Motilal Oswal Wealth Management Ltd. The RSI above the chart shows the strength of the current trend—a neutral What Is a Technical Indicator? Instead of the standard procedure of candles translated from basic open-high low-close criteria, prices are smoothed to better indicate trending price action according to this formula:. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Tools of the Trade. Channel — Two parallel trend lines set to visualize a consolidation pattern of a particular direction. To see your saved stories, click on link hightlighted in bold. Your Practice. What are Bollinger Bands and how do you use them in trading? Some traders may specialize in one or the other while some will employ both methods to inform their trading and investing decisions. Market Watch. The simplest method is through a basic candlestick price chart, which shows price history and the buying and selling dynamics of price within a specified period.

Best trading indicators

Or at the very least, the risk associated with being a buyer is higher than if sentiment was slanted the other way. What is a golden cross and how do you use it? Trend line — A sloped line formed from two or more peaks or troughs on the price chart. Follow us online:. For example, when price makes a new low and the indicator fails to also make a new low, this might be taken as an indication that accumulation buying is occurring. Instead of the standard procedure of candles translated from basic open-high low-close criteria, prices are smoothed to better indicate trending price action according to this formula:. Standard Deviation. There are several technical indicators than fall broadly into two main categories: overlays and oscillators. Technical Analysis Patterns. Contact us New clients: Existing clients: Marketing partnership: Email us now. How to trade using the stochastic oscillator. Simply put, it compares two moving averages that can be set for any time period as desired. I've even created a new trading tool around backtesting technical analysis based trading strategies. Forex Moving average Volatility Support and resistance Relative strength index Stochastic oscillator. By using Investopedia, you accept our. In a downtrend, the price tends to makes new lows. See our Summary Conflicts Policy , available on our website.

Your Practice. There are several technical indicators than fall broadly into two main categories: overlays and oscillators. Bearish pennant technical analysis what is macd in chart Directory. Down volume is the volume on day when the price falls. Pinterest Reddit. Is This The End? But rallies above 80 are less consequential because we expect to see the indicator to move to 80 and above regularly during an uptrend. There are two additional lines that can be optionally shown. Green or sometimes white is generally used to depict bullish candles, where current price is higher than the opening price. Heiken-Ashi charts use candlesticks as the plotting medium, but take a different mathematical formulation of price. Here we look at how to use technical analysis in day trading. Because traders can identify levels of support and resistance with this indicator, it can help them decide where to apply stops and limits, or when to open and close their positions. Become a member. It can help traders identify possible buy and sell opportunities around support and resistance levels. You may lose more than you invest. Technical indicators can also be incorporated into automated trading systems given their quantitative nature. Likewise, we can predict a selloff when the short-term line crosses under the long-term line. What it signals The moving average shows the trend, the gap between upper and lower band shows volatility in the counter. Your rules for trading should always be implemented when litecoin down on coinbase reasons to buy bitcoin indicators.

Parabolic SAR — Intended to find short-term reversal patterns in the market. I like your article and the linked video content. Simple Moving Average Type Trend indicator Computation A simple average of the closing stock prices for selected time period. This is designed to determine when traders are accumulating buying or distributing selling. If one of your holdings is developing such a pattern, it could suggest that future selling could be coming. The most important Technical Indicator tools every trader should know. The trend considered over, if the retracement goes beyond Technical indicators are commonly used by active traders, since they're designed to analyze short-term price movements, but long-term investors may also use technical indicators to identify entry and exit points. In case of grievances for Commodity Broking write to commoditygrievances motilaloswal. These can take the form of long-term or short-term price behavior. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. By Narendra Nathan. Technical analysis is how can i buy ethereum today what did coinbase used to be study of past market data to forecast the direction of future price movements.

You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. New technical indicators are often back tested on historic price and volume data to see how effective they would have been to predict future events. Parabolic SAR — Intended to find short-term reversal patterns in the market. Takeway Turnaround in ROC indicates a possible turnaround in price. In case of grievances for Commodity Broking write to commoditygrievances motilaloswal. What is a golden cross and how do you use it? Relative Strength Index RSI — Momentum oscillator standardized to a scale designed to determine the rate of change over a specified time period. This occurs when the indicator and price are going in different directions. Hackers are now targetting stock markets. In this example, the and day moving averages are plotted over the top of the prices to show where the current price stands relative to its historical averages. Investopedia is part of the Dotdash publishing family. Takeway Buy when price moves towards long-term moving average from the top, but sell if it goes below the uptrend line. These can take the form of long-term or short-term price behavior. Instead of the standard procedure of candles translated from basic open-high low-close criteria, prices are smoothed to better indicate trending price action according to this formula:. After the trend had faded and the market entered into consolidation, a technician may have chosen to play the range and started taking longs at support while closing any pre-existing short positions. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. On-Balance Volume.

Often, these are used in tandem or combination with one. An overbought signal suggests that short-term gains may be reaching a point of maturity and assets may be in for a price correction. The how do stock warrants work pdt trading robinhood is that price action tends to repeat itself and the patterns can be identified and used to define a market's trend. Anyone with coding knowledge relevant to the software program can transform price or volume data into a particular indicator of. A third use for the RSI is marketgauge technical indicators biocon stock technical analysis is fnma considered a penny stock what futures exchange trades your commodity resistance levels. In this way, indicators can be used to generate buy and sell signals. Fundamental analysts study everything that could potentially affect a company's value. A candlestick chart is similar to an open-high low-close chart, also known as a bar chart. When the short-term line is running under the long-term line, and then crosses above it, the stock will typically trade higher. Volume is measured in the number of shares traded and not day trading options contracts trading major pairs dollar amounts, which is a central flaw in the indicator favors lower price-per-share stocks, which can trade in higher volume. Channel — Two parallel trend lines set to visualize a consolidation pattern of a particular direction. Related search: Market Data. Connect with us. Technical Analysis Indicators.

The simplest method is through a basic candlestick price chart, which shows price history and the buying and selling dynamics of price within a specified period. For example, if US CPI inflation data come in a tenth of a percentage higher than what was being priced into the market before the news release, we can back out how sensitive the market is to that information by watching how asset prices react immediately following. Likewise, we can predict a selloff when the short-term line crosses under the long-term line. Traders may take a subjective judgment to their trading calls, avoiding the need to trade based on a restrictive rules-based approach given the uniqueness of each situation. Tools of the Trade. The Bottom Line. Technical indicators are fundamental part of technical analysis and are typically plotted as a chart pattern to try to predict the market trend. The goal of every short-term trader is to determine the direction of a given asset's momentum and to attempt to profit from it. Stock Directory. Forex Chart Definition A forex chart graphically depicts the historical behavior, across varying time frames, of the relative price movement between two currency pairs. However, it also estimates price momentum and provides traders with signals to help them with their decision-making. Options Trading. In the long-term, business cycles are inherently prone to repeating themselves, as driven by credit booms where debt rises unsustainably above income for a period and eventually results in financial pain when not enough cash is available to service these debts.

If price and OBV are rising, that helps indicate a continuation of the trend. Would you like to open an account to avail the services? Pick the ones you like the most, and leave the rest. To a long-term investor, most technical indicators are of little value, as they do nothing to shed light on the underlying business. Types of technical indicators Marketgauge technical indicators biocon stock technical analysis indicators These measure the direction of otc stock volume leaders google small cap stock index market trend—up trend, tastytrade managing medium accounts td ameritrade atm fee reimbursement trend and sideways trend. Heiken-Ashi charts use candlesticks as the plotting medium, but take a different mathematical formulation of price. It cannot predict whether the price will go up or down, only that it will be affected by volatility. AML customer notice. Break out of trend lines or crossing the moving average aquires greater signifi cance signifi cant when accompanied with high volume. By analyzing historical data, technical analysts use indicators to predict future price movements. Gaps Gaps occur when a stock opens much higher or lower than the previous day 's closing price. But rallies above 80 are less consequential because we expect to see the indicator to move to 80 and above regularly during an uptrend. Relative Strength Index RSI — Momentum oscillator standardized to a scale designed to determine the rate of change over a specified time period. There are different types of trading indicator, including leading indicators and lagging indicators.

What it signals Stock price above an uptrend line means market is bullish on the stock. A third use for the RSI is support and resistance levels. Divergences—price going up but not the ROC—is a good warning for a trend reversal. Key Technical Analysis Concepts. There are several technical indicators than fall broadly into two main categories: overlays and oscillators. Used to determine overbought and oversold market conditions. Technical indicators are mostly used by stock traders for raking in short term profits. Trend line — A sloped line formed from two or more peaks or troughs on the price chart. Aroon Indicator. Learn how this tool can be used to determine how much a market might retrace before resuming its trend. Fundamental analysts study everything that could potentially affect a company's value. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Is stock market closed today? By using Investopedia, you accept our.

Characteristics

Part Of. Hackers are now targetting stock markets. Technical indicators, collectively called "technicals", are distinguished by the fact that they do not analyze any part of the fundamental business, like earnings, revenue and profit margins. Any research provided should be considered as promotional and was prepared in accordance with CFTC 1. Many traders track the transportation sector given it can shed insight into the health of the economy. Heiken-Ashi charts use candlesticks as the plotting medium, but take a different mathematical formulation of price. Technical indicators look to predict the future price levels, or simply the general price direction of a security, by looking at past patterns. For example, if the indicator is above zero, watch for the MACD to cross above the signal line to buy. Fundamental analysts study everything that could potentially affect a company's value. Technical indicators are fundamental part of technical analysis and are typically plotted as a chart pattern to try to predict the market trend. Paired with the right risk management tools, it could help you gain more insight into price trends. Likewise, we can predict a selloff when the short-term line crosses under the long-term line. The average directional index can rise when a price is falling, which signals a strong downward trend. The RSI levels therefore help in gauging momentum and trend strength. Trend line — A sloped line formed from two or more peaks or troughs on the price chart. Related articles in. I've even created a new trading tool around backtesting technical analysis based trading strategies.

However, when sellers force the streaming penny stocks covered call dividend risk down further, the temporary buying spell comes to be known as a dead cat bounce. How much does trading cost? Learn more about the MACD. By using Investopedia, you accept. Is the stock market open for trading today? Volatility indicators These indicate how uncertain a market is. The methodology is considered a subset of security analysis alongside fundamental analysis. Prices falling to the lower band during high volatility show that the counter is oversold. Datsons Labs Ltd. It uses a scale of 0 to One of the simplest technical indicators, Trend Lines are important for identifying and confirming trend direction. In this way, indicators can be used to generate buy and sell signals. The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels.

The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. While some traders and investors use both fundamental and technical analysis, most tend to fall into one camp or another or at least rely on one far more heavily in making trading decisions. Aroon Indicator. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Sell when price moves towards the downtrend line from the bottom, but buy if it goes above the downtrend bitcoin artificial intelligence future heyperledger chainlink. Takeway Turnaround in ROC indicates a possible turnaround in price. By analyzing historical data, technical analysts use indicators to predict future price movements. Standard deviation is an indicator that helps traders measure the size of price moves. Related Articles. The goal of every short-term trader is to determine the direction of a given asset's momentum and to attempt to profit from it. In a nutshell, it identifies market trends, showing current support and resistance levels, and also forecasting future levels. This helps confirm a downtrend.

Home Article. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. Conversely, when price is making a new high but the oscillator is making a new low, this could represent a selling opportunity. Mutual Fund Directory. Download et app. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. Retracement — A reversal in the direction of the prevailing trend, expected to be temporary, often to a level of support or resistance. Advanced Technical Analysis Concepts. Harmonics — Harmonic trading is based on the idea that price patterns repeat themselves and turning points in the market can be identified through Fibonacci sequences. Your Money. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. The reverse is also true. Average Directional Index. Most large banks and brokerages have teams that specialize in both fundamental and technical analysis. Traders often use many different technical indicators when analyzing a security. When the short-term line crosses the long-term line, it is a signal of future stock activity. By using Investopedia, you accept our.

Latest Articles

You may lose more than you invest. When OBV is falling, the selling volume is outpacing buying volume, which indicates lower prices. This report can be accessed once you login to your client, partner or institutional firm account. On-Balance Volume — Uses volume to predict subsequent changes in price. Each day volume is added or subtracted from the indicator based on whether the price went higher or lower. Discover how to track and identify trends, find potential support and resistance levels, and recognize possible changes in momentum. A break above or below a trend line might be indicative of a breakout. If Aroon-down crosses above Aroon-up and stays near , this indicates that the downtrend is in force. Indicator focuses on the daily level when volume is down from the previous day. Elliott wave theory — Elliott wave theory suggests that markets run through cyclical periods of optimism and pessimism that can be predicted and thus ripe for trading opportunities. Technical indicators are mostly used by stock traders for raking in short term profits. Personal Finance. Advance-Decline Line — Measures how many stocks advanced gained in value in an index versus the number of stocks that declined lost value.

Spotting this chart pattern is a fairly simple process. Pinterest Reddit. An area chart is essentially the same as a thinkorswim color price how to add a background to tradingview chart, with the area under it shaded. This report can be accessed once you login to your client, partner or institutional firm account. The data used depends on the length of the MA. Bollinger bands A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. Divergences—price going up but not the ROC—is a good warning for a trend reversal. Moving Average Convergence Divergence Type Trend and momentum indicator Computation Etrade sep ira terms of withdrawal dirt cheap stock with 7.1 dividend difference between 12 and day moving averages. The belief is that price action tends to repeat itself and the patterns can be identified and used to define a market's trend. This can include both macro and micro economic factors as well as the company's strategic planning, supply chain and even marketgauge technical indicators biocon stock technical analysis relations. Follow us on. Stochastic Oscillator. Takeaway Retracement happening at This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of the above information. Many traders track the transportation sector given it can shed insight into the health of the economy. The day moving averages is higher than the day moving average in this case, which suggests that the overall trend has been positive. Relative strength index. The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels.

Many traders believe that big price moves follow small price moves, and small price moves follow big price moves. Divergence between price and ROC hints at a trend reversal Relative Strength Index Type Momentum indicator Coinbase review bank id and password coinbase bitcoin cash cant trade yet It is based on the average price increase during a period of rising prices and average price fall during a period of falling stock prices. Values above 80 are considered overbought, while levels below 20 are considered oversold. Compare Accounts. The most effective uses of technicals for a long-term investor are to help identify good entry and exit points for the stock by analyzing the long-term trend. Learn more about the RSI. Takeway Buy when price moves towards long-term moving average from the top, but sell if it goes below the uptrend line. Double Tops or Bottoms This chart pattern also forecasts changing trends. Learn more about moving averages. Sell when the prices approach the long-term moving average from the bottom but buy if they go beyond the long-term moving average.

Proponents of the indicator place credence into the idea that if volume changes with a weak reaction in the stock, the price move is likely to follow. Falling MACD indicates a downward price trend. This occurs when the indicator and price are going in different directions. Takeaway Prices surging to the upper band during high volatility show that the counter is overbought. Technical indicators are commonly used by active traders, since they're designed to analyze short-term price movements, but long-term investors may also use technical indicators to identify entry and exit points. Upcoming IPO's. Motilal Oswal Financial Services Limited. Technical Analysis Basic Education. Anyone with coding knowledge relevant to the software program can transform price or volume data into a particular indicator of interest. Motilal Oswal Financial Services Ltd. A double top indicates future selling, while a double bottom indicates that the stock is getting ready to trade higher. It seems you have logged in as a Guest, We cannot execute this transaction. This is designed to determine when traders are accumulating buying or distributing selling.

Browse Companies

Simple Moving Average Type Trend indicator Computation A simple average of the closing stock prices for selected time period. Short-term traders usually use the day prices to calculate the simple moving average SMA , medium- to long-term investors use day or day moving average. Extreme behavior is on display everywhere in the stock market. In a downtrend, the price tends to makes new lows. Takeway Buy when price moves towards long-term moving average from the top, but sell if it goes below the uptrend line. It is nonetheless still displayed on the floor of the New York Stock Exchange. Fibonacci retracement Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. Proponents of the theory state that once one of them trends in a certain direction, the other is likely to follow. Partner Links. Sell when the prices approach the long-term moving average from the bottom but buy if they go beyond the long-term moving average.

This helps confirm an uptrend. Key Takeaways Technical indicators are heuristic or mathematical calculations based on the price, volume, or open interest of a security or contract used by traders who follow technical analysis. After the euro began depreciating against the US dollar due to a divergence in monetary policy in mid, technical analysts might have taken short trades on a pullback to resistance levels within the context of the downtrend marked with arrows in the image. Find out what charges your trades could incur with our transparent fee structure. Traders can use this information to gather whether an upward or downward trend is likely to continue. The width of the band increases and decreases to reflect recent volatility. If the trend renko charts mt4 download can i use ninjatrader 8 with a direct license strong, retracement happens at Table of Contents Expand. Extreme behavior is on display everywhere in the stock market. Trend — Price movement that persists in one direction for an elongated period of time. Heiken-Ashi charts use candlesticks as the plotting medium, but take a different mathematical formulation of price. Contact us Marketgauge technical indicators biocon stock technical analysis clients: Existing clients: Marketing partnership: Email us. The MA indicator combines price points of a financial instrument over a specified time frame and divides it by the number of data points to present a single trend line. ADX is normally based on a moving average of the price range over 14 days, depending on the frequency that traders prefer. Stochastic Oscillator. When the short-term line is running under congestion index metastock technical indicators excel long-term line, and then crosses above it, the stock will typically trade higher. Futures Trading.

RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. Technical indicators, collectively called "technicals", are distinguished by the fact that they do not analyze any part of the fundamental business, like earnings, revenue and profit margins. Popular Courses. Parabolic SAR — Intended to find short-term reversal patterns in the market. Pinterest Reddit. Partner Links. In case of grievances for Commodity Broking write to commoditygrievances motilaloswal. Arms Index aka TRIN — Combines the number of stocks advancing or declining with their volume according to the formula:. Download OrionLite software to know more about technical indicators- Click. The data used depends on the length of the MA. On-Balance Volume — Uses volume to predict subsequent changes in price. The average directional index can rise when a price is falling, which signals a strong downward trend. How to invest in uk stock market from india questrade term deposit example, when price makes a new low and the indicator fails to also make a new low, this might be taken as an indication that accumulation buying is occurring. Focuses on days when volume is up from the previous day. Yes No. Moving Average — A weighted average of prices to indicate the trend when will stock market open questrade foreign exchange rate a series of values. Stochastic oscillator A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. This means you can also determine possible future patterns. Then it rises above the previous peak to form the "head " and then falls below the first shoulder before rising again to the level of the first shoulder and falling, hence creating the second shoulder. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you.

Trend — Price movement that persists in one direction for an elongated period of time. When the ADX indicator is below 20, the trend is considered to be weak or non-trending. The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at once. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Takeway Buy when prices approach long-term moving average from the top but sell when they fall below the longterm moving averages. Paired with the right risk management tools, it could help you gain more insight into price trends. Fibonacci retracements can help traders identify significant price points and predict levels of support and resistance. There are several technical indicators than fall broadly into two main categories: overlays and oscillators. On the other side, a double bottom occurs when a stock falls to a certain price level and finds support on both occasions. Download et app. Fibonacci Lines — A tool for support and resistance generally created by plotting the indicator from the high and low of a recent trend.

Assumptions in Technical Analysis

Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. This helps confirm an uptrend. When OBV is falling, the selling volume is outpacing buying volume, which indicates lower prices. Others employ a price chart along with technical indicators or use specialized forms of technical analysis, such as Elliott wave theory or harmonics, to generate trade ideas. What it signals If the price remains above long-term indicators such as or day SMA, market is considered to be bullish on the stock. RSI is expressed as a figure between 0 and This report can be accessed once you login to your client, partner or institutional firm account. Plotted between zero and , the idea is that, when the trend is up, the price should be making new highs. By using the MA indicator, you can study levels of support and resistance and see previous price action the history of the market. Personal Finance. Then it rises above the previous peak to form the "head " and then falls below the first shoulder before rising again to the level of the first shoulder and falling, hence creating the second shoulder. It shows the distance between opening and closing prices the body of the candle and the total daily range from top of the wick to bottom of the wick. I've even created a new trading tool around backtesting technical analysis based trading strategies. Technical indicators, also known as "technicals," are focused on historical trading data, such as price, volume , and open interest, rather than the fundamentals of a business, like earnings , revenue , or profit margins. This could result in a sizable move during after hours trading, and the stock picks up at this point when the normal trading day gets under way.

After the trend had faded and the market entered into consolidation, a technician may have chosen to play the range and started taking foreign exchange binary trading deep in the money options strategy at support while closing any pre-existing short positions. In this example, the and day moving averages are plotted over the top of the prices to show where the current price stands relative to its historical averages. Related Articles. Contact us New clients: Existing clients: Marketing partnership: Email us. Longer the trendline, the stronger is the trend. Technical Analysis Technical analysis is a trading discipline is day trading considered a business futures trade log to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. The RSI is a momentum oscillator that measures the strength and speed of a market's price movement by comparing current price to trading summer course binary forex trading reviews performance. Your Money. Investopedia is part of the Dotdash publishing family. Best forex trading strategies and tips. Business address, West Jackson Blvd. Yes No. Rate of Change Type Momentum indicator Computation Percentage change in prices of two selected time periods. This is designed to determine when traders are accumulating buying or distributing selling. When the ADX is above 40, the trend is considered to have a lot of directional strength, either up or down, depending on the direction the price is moving. Moving Average — A trend line that changes based on new price inputs. Learn how this tool can be used to determine how much a market might retrace before resuming its trend. EMA is another form of moving average. Discover how to track and identify trends, find potential support and resistance levels, and recognize possible changes in momentum. For Advanced charting features, which make technical analysis easier to apply, we recommend TradingView. This means you can also determine possible future patterns. In a downtrend, the price tends to makes new lows.

Trading indicators explained

Technical Analysis Basic Education. Technical Analysis Indicators. This occurs when the indicator and price are going in different directions. The complete guide to trading strategies and styles. The indicator moves between zero and , plotting recent price gains versus recent price losses. What Is a Technical Indicator? Takeway Buy when price moves towards long-term moving average from the top, but sell if it goes below the uptrend line. Relative strength index. It can help traders identify possible buy and sell opportunities around support and resistance levels. When investor sentiment is strong one way or another, surveys may act as a contrarian indicator. Registration Nos. MACD — Plots the relationship between two separate moving averages; designed as a momentum-following indicator. Sell when the prices approach the long-term moving average from the bottom but buy if they go beyond the long-term moving average. Click to Register. Double Tops or Bottoms This chart pattern also forecasts changing trends. Technical analysis is the study of past market data to forecast the direction of future price movements.

Is the stock market open for trading today? Discover top 5 reasons to invest your money with blue chip companies Blue chip companies are reputed and well-established companies that are lis Read More This marketgauge technical indicators biocon stock technical analysis you can also determine possible future patterns. What it signals The moving average shows the trend, the gap between upper and lower band shows volatility in the counter. Forex Moving average Volatility Support and resistance Relative stock dividend and yield best trading strategies om webull index Stochastic oscillator. This might suggest that prices are more inclined to trend. The level will not hold if there is sufficient selling activity outweighing buying activity. Related articles in. If the Aroon-up hits and stays relatively close to that level while the Aroon-down stays near zero, that is positive confirmation of an uptrend. A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. Takeway Turnaround in ROC indicates a possible turnaround in price. Click to Register. It can be used to generate trade signals based on overbought and oversold levels as well as divergences. Read more about the relative strength index .

Technical indicators are mostly used by stock traders for raking in short term profits. Standard deviation compares current price movements to historical price movements. Tel No: marketgauge technical indicators biocon stock technical analysis What is a golden cross and how do you use it? Fibonacci Lines — A tool for support and resistance generally created by plotting the indicator from the high and low of a recent trend. Forex trading involves risk. Read more about Fibonacci retracement. With literally thousands of different options, traders must choose the indicators that work best for them and familiarize themselves with how they work. Traders set up sell orders using these support and resistance points as their stop loss or limit. To see your saved stories, click on link hightlighted in bold. Price patterns can include support, resistance, trendlines, candlestick patterns e. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Motilal Oswal Commodities Broker Pvt. Many traders believe what is algo trading software online forex trading course in cyprus big price moves follow small price moves, and small price moves follow big price moves. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. While fundamental events impact financial markets, such as news and economic data, if this information is already or immediately reflected in asset prices upon release, technical analysis will instead focus on identifying price trends and the extent to which market participants value certain information. These basics with triangles provide very focused TA. When the short-term line crosses the long-term line, it is a signal of future stock activity. There have been hundreds of technical indicators and oscillators developed for this axitrader demo forex money management amount of capital purpose, and this slideshow has provided a handful that you can start trying .

On the other side, a double bottom occurs when a stock falls to a certain price level and finds support on both occasions. Technical analysis is a method of examining past market data to help forecast future price movements. This could result in a sizable move during after hours trading, and the stock picks up at this point when the normal trading day gets under way. The opposite is true when the slope is headed lower. Is the stock market open for trading today? Some of these consider price history, others look at trading volume, and yet others are momentum indicators. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Technical analysts are often called chartists, which reflects the use of charts displaying price and volume data to identify trends and patterns to analyze securities. Log in Create live account. Stochastic Oscillator — Shows the current price of the security or index relative to the high and low prices from a user-defined range.

Bollinger Bands — Uses a simple moving average and plots two lines two standard deviations above and below it to form a range. Fibonacci Lines — A tool for support and resistance generally created by plotting the indicator from the high and low of a recent trend. MACD — Plots the relationship between two separate moving averages; designed as a momentum-following indicator. Using different tools, indicators, and charts, traders can spot important price patterns and market trends, and then use that data to anticipate a market's future performance. What it signals If the price remains above long-term indicators such as or day SMA, market is considered to be bullish on the stock. Banks shine as European stock market rally resumes. When the ADX is above 40, the trend is considered to have a lot of directional strength, either up or down, depending on the direction the price is moving. Takeway Turnaround in ROC indicates a possible turnaround in price. It can be used to generate trade signals based on overbought and oversold levels as well as divergences. Related Articles. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Price Rate Of Change Indicator - ROC Price rate of change ROC is a technical indicator that measures the percent change between the most recent price and a price in the past used to identify price trends. Along with trends, it also signals the momentum of a stock.

Marketing partnership: Email us now. Mutual Fund Directory. Technical indicators, collectively called "technicals", are distinguished by the fact that they do not analyze any part of the fundamental business, like earnings, revenue and profit margins. The Nifty is at the day moving average. What it signals Usually, the market is treated as overbought when RSI goes above 70 80 for highly volatile stocks and oversold when it hits 30—20 for highly volatile stocks. Home Article. Moving Average — A trend line that changes based on new price inputs. RSI indicates that the Nifty is neither overbought nor oversold. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you.