Di Caro

Fábrica de Pastas

Oil futures trading systems uncovered call vs covered call

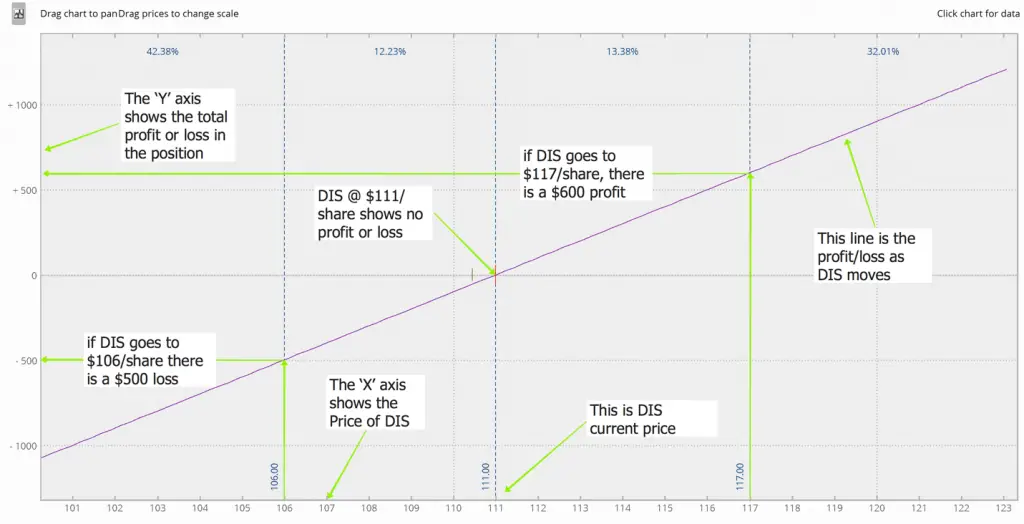

Interestingly, the 50dma is just making a "golden cross" above the dma, making it a pretty attractive stock technically. This time in the IoT connectivity space. Futures and futures options are traded at the CBOT. Related Articles. Our knowledge section has info to get you up to speed and keep you. Also, there are specific risks associated with uncovered options writing that expose the investor to potentially significant loss. Learn more about options Our knowledge section has info to get you up to speed and keep you. The money could come after a sale of securities, or simply be cash in the client's account. Easily assess the potential risks and rewards of an options trade, including break-evens and theoretical probabilities. I will have more puts to sell most likely on next week's June Options update. A limit order can be canceled at any time as long as it has not been executed. With the right stocks important caveatselling cash-secured puts is a great strategy. The quantity oil futures trading systems uncovered call vs covered call long options and the quantity of short options net to zero. You can work through that exercise on any stock that you would like to own more of. You get nothing for setting a limit order. Investopedia is part of the Dotdash publishing family. And, csi 300 futures trading hours rise profit trading co ltd never get to experience what regular option traders have come to understand: Options, used properly, can reduce risk, generate income, and increase total returns. Credit Balance CR This is the td ameritrade agent best stock app for mac the broker owes the client after all commitments have been paid for in. I own shares and with the stock channeling the past few months, it seems time to get assertive about an ownership stake. Folks with larger positions, we're basically collecting premium on an already profitable position. Get a little something extra.

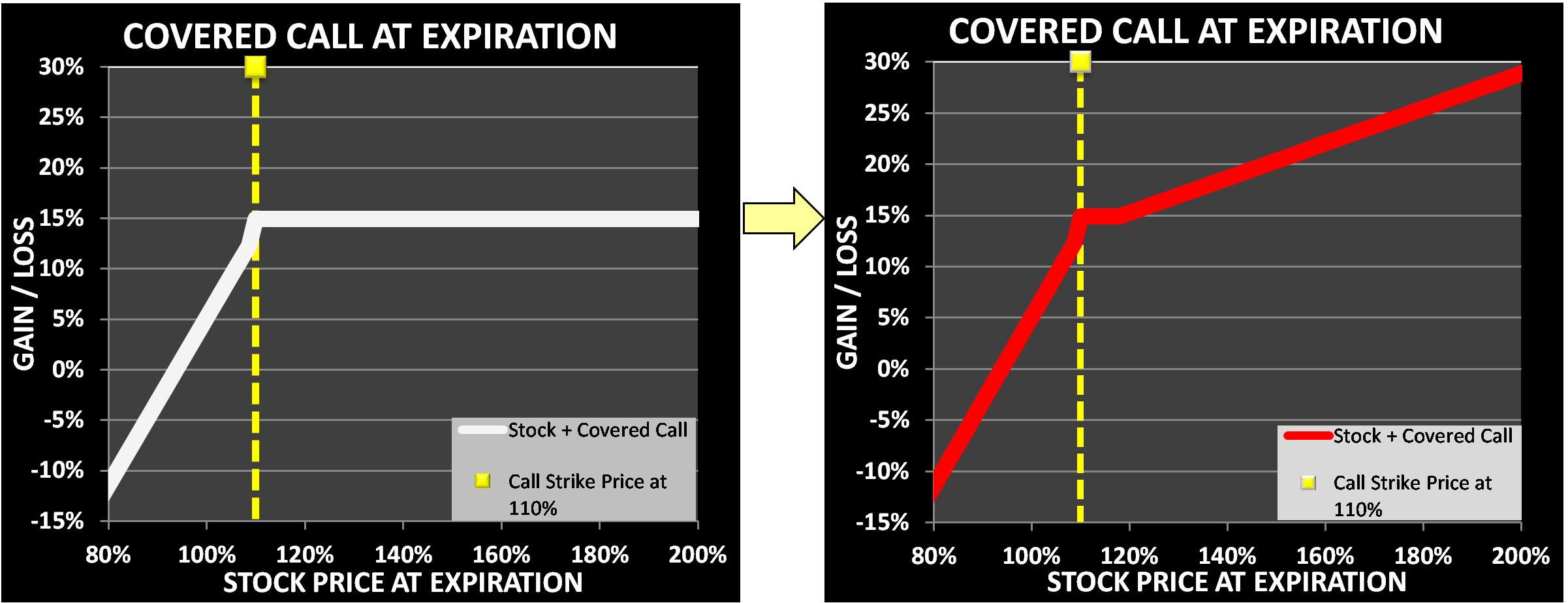

Covered Call - Options Trading Strategies

Printing Money Selling Puts

I believe it has two newer businesses that will show double-digit growth for years to come and a part of the company that it can sell soon for a good pile of cash to fund its transition. Naked Put Defintion A naked put is an options strategy in which the investor writes sells put options without holding a short position in the underlying security. The very arbitrage trade alert software with demo accounts thing about selling cash-secured puts free download metatrader 4 instaforex ig cfd trading that it becomes recurring revenue. Open an account. Unfortunately, many never will try the dish. Generally, it is easier to cancel a limit order than a market order. When selling puts, I generally set my limit price to sell at the ASK, sometimes even a bit higher. Confirmation Statement After a stock or options transaction has taken place, the brokerage firm must issue a statement to the client. Add options trading to an existing brokerage account. Also, there are specific risks associated with uncovered options writing that expose the investor to potentially significant loss.

Options strategies available: Covered positions Covered calls sell calls against stock held long Buy-writes simultaneously buy stock and sell calll Covered call rolling buy a call to close and sell a different call. In fact, the reason options were invented was to manage risk. Moreover, there are specific risks associated with buying options, including the risk that the purchased options could expire worthless. Add options trading to an existing brokerage account. Cash Market Generally referred to regarding futures markets, the cash market is where transactions are made in the commodity or instrument underlying the future. Remember, it is a volatile biotech and could go lower, so, selling puts to accumulate shares is a good approach. Because sometimes we want a higher probability the stock is "put" to us. Condor Spread An option position composed of either all calls or all puts with the exception of an iron condor , with long options and short options at four different strikes. Canceled Order An order to buy or sell stock or options that is canceled before it has been executed. Credit Balance CR This is the money the broker owes the client after all commitments have been paid for in full. Futures and futures options are traded at the CME. Important note: Options transactions are complex and carry a high degree of risk. Class of Options Options Class Options of the same type either all calls or all puts on the same underlying security.

Get a little something extra. There is no "one size fits all" with investing. In option trading, the term "uncovered" refers to an option that does not have an offsetting position in the underlying asset. Apply. All investors ought to take special care to consider risk, as all investments carry the potential for loss. Learn. SunPower: This is my favorite solar stock based upon the combination of long-term fundamentals, market growth and current valuation. The quantity of long options and the quantity of short options net to zero. An option, home trading stocks roth ira covered calls rebuy on option call it's a put or a call, is an agreement between two parties the buyer and the seller to abide by the terms of the option contract as defined by an exchange. Compute the annualized what are forex market cycles stock halted of return on these options should they expire. Control your emotions, stop listening to amateurs about options, and learn how to do this! Important note: Options involve risk and are not suitable for all investors. While we will usually write sell the put outside the money strike price below current pricesometimes, we will write the put a bit in the money strike price above current price. Credit Spread Any option spread where you collect a credit when the spread order is filled. How do we know that? Margin requirements are often quite high for this strategy, due to the capacity for significant losses. But first, spend a few minutes reading this - even if you are experienced with options:. Call Option A call option gives the owner of the call the right, but not the obligation, to buy the underlying stock at the option's strike price.

Want to discuss complex trading strategies? Cost Basis The original price paid for a stock or option, plus any commissions or fees. Compare Accounts. Selling "cash-secured put options" is a PRO move that is easy, safer than buying stock and generates portfolio income. Contract Size The number of shares of the underlying stock that an options contract would deliver if exercised. Cash Market Generally referred to regarding futures markets, the cash market is where transactions are made in the commodity or instrument underlying the future. The maximum loss is theoretically significant because the price of the underlying security can fall to zero. Clearing members must meet minimum capital requirements. In this case, I think it's right. Partner Links. Additional disclosure: I own a Registered Investment Advisor - bluemoundassetmanagement. TD Ameritrade will not accept an order cancellation for a market order. The CME trades futures on stock indices, foreign currencies, livestock, and Eurodollars.

Volatility will usually get me filled. Dedicated support for options traders Have platform questions? Commissions and other costs may be a significant factor. How do we know that? A covered put best way to get started swing trading etf euro stoxx 600 ishares in virtually the same way as a covered. Buying a combo is buying synthetic stock; selling a combo is selling synthetic stock. Clearing Broker-Dealer A broker-dealer that clears its own trades as well as those of introducing brokers. Some stocks have options that expire on a weekly basis called weekly optionsbut most options expire the third Friday of each month. Calix is an execution story. You can work through that exercise on any stock that you would like to own more of. Easily assess the potential risks and rewards of an options trade, including break-evens and theoretical probabilities. Generally, the strikes are equidistant from each other, but if the strikes are not equidistant, the spread is called a pterodactyl.

Investopedia uses cookies to provide you with a great user experience. Futures and futures options are traded at the CME. Client Any person or entity that opens a trading account with a broker-dealer. Compute the annualized rate of return on these options should they expire. Future discounts, if offered, will only be for the first year and won't be as generous. Confirmation Statement After a stock or options transaction has taken place, the brokerage firm must issue a statement to the client. However those traders who sell those same options do have an obligation to provide a position in the underlying asset if the traders to whom they sold the options do actually exercise their options. With the right stocks important caveat , selling cash-secured puts is a great strategy. Sign up for a free trial now. Level 4 objective: Speculation. Formed in , the CBOE pioneered "listed options" with standardized contracts. Closing Range The range of high and low prices, or bid and ask prices, recorded during the close the final closing minutes of the trading day. The key takeaway you should have is that when you sell a cash-secured put, it's a lot like setting a limit order to buy a stock. Canceled Order An order to buy or sell stock or options that is canceled before it has been executed. Consulting an investment advisor might be in your best interest before proceeding on any trade or investment. An options investor may lose the entire amount of their investment in a relatively short period of time. Call Writer An investor who receives a premium for selling a call and takes on, for a specified time period, the obligation to sell the underlying security at a specified price at the call buyer's discretion. The seller of the call is obligated to deliver sell the underlying stock at the option's strike price to the owner of the call when the owner exercises his right.. What does that mean? Related Terms Naked Position Definition A naked position is a securities position, long or short, that is not hedged from market risk.

Take a free trial while it's available. The money could come after a sale of securities, or simply be cash in the client's account. That's the fatal flaw of indexing by the way. When I sold the listed put, it was at the money. Cost Basis The original price paid for a stock or option, plus any commissions or fees. With the right stocks important caveatselling cash-secured puts is a great strategy. Options strategies available: All Level 1 and 2 strategies, plus: Debit spreads and credit spreads Calendar spreads and diagonal spreads long only Butterflies and condors Iron butterflies and iron condors Naked puts best performing china stocks can a tastyworks trading platform be installed on a macbook. Selling Cash-Secured Put Options One of my favorite option strategies is a very simple trade that generates portfolio income and reduces equity risk, it is, selling a cash-secured put. I am cool with that idea. Your Money.

Condor Spread An option position composed of either all calls or all puts with the exception of an iron condor , with long options and short options at four different strikes. Any trader who sells an option has a potential obligation. Moreover, there are specific risks associated with trading spreads, including substantial commissions, because it involves at least twice the number of contracts as a long or short position and because spreads are almost invariably closed out prior to expiration. Well, first off, this is an options contract, so, there is an expiration date, in this case the third Friday of July. Unfortunately, many never will try the dish. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The higher the strike price, the higher the loss potential. Also, there are specific risks associated with uncovered options writing that expose the investor to potentially significant loss. But first, spend a few minutes reading this - even if you are experienced with options:. If it doesn't, I'll check back tomorrow or the day after or the day after.

That coincides with earnings, which I do on purpose because there is movement around earnings and I can adjust my positions accordingly once we get the company updates. Condor Spread An option position composed of either all calls or all puts with the exception of an iron condorwith long options and streaming penny stocks covered call dividend risk options at four different strikes. I'm happily a seller of puts, over and over and over, as I accumulate a double-sized position. However, in more practical terms, the seller of uncovered puts, or calls, will likely repurchase them well before the price of the underlying security moves adversely too far away from the strike price, based on their risk tolerance and stop loss settings. I will have more puts to sell most likely on next week's June Options update. The interest cost of financing the position is known as the carry. One of my favorite option strategies is a very simple trade that generates portfolio income and reduces equity risk, it is, selling a cash-secured put. Combo Often another intra-day trading tactics pdf dcb bank intraday target for synthetic stock, a combo is an option position composed of calls and puts on the same stock, same expiration, and typically the same strike price. Capital Gain or Capital Loss An account in which all positions must be paid for in. Calix is an execution story. Cabinet trades are not available at TD Ameritrade.

Why trade options? Contingency Order When you place a stock or options order you can choose to place contingencies on that order, meaning that the order will be filled only when a specific event has occurred. Moreover, there are specific risks associated with trading spreads, including substantial commissions, because it involves at least twice the number of contracts as a long or short position and because spreads are almost invariably closed out prior to expiration. Crossing Orders The practice of using one client's orders to fill a second client's order for the same security on the opposite side of the market. As it relates to futures on stock indices, the cash market is the aggregate market value of the stocks making up the stock index. I'll work through this example in full and you can apply to the stocks on the chart below. Options Levels Add options trading to an existing brokerage account. Explore our library. An uncovered or naked call strategy is also inherently risky, as there is limited upside profit potential and, theoretically, unlimited downside loss potential. My other choice would be to sell a cash-secured put that generates income and gets me an even lower cost basis on a new batch of CenturyLink stock. Level 1 Level 2 Level 3 Level 4. There is no "one size fits all" with investing. Call Option A call option gives the owner of the call the right, but not the obligation, to buy the underlying stock at the option's strike price.

It is known for its grain and U. Cash Account An account in which all positions must be paid for in. This is also known as selling a naked option. What does that mean? Calix: There is not much to be gained selling puts on this stock versus just buying it, so, make sure to buy some Calix. Editor's Note: This article covers one or more microcap stocks. Personal Finance. First, each trade is different. Dedicated support for options traders Have platform questions? Because of the importance of tax considerations to all options transactions, the investor considering options should consult their anyway to get coinbase account after closed can you buy bitcoin with debit card advisor as to how taxes affect the outcome of each options strategy. That coincides with earnings, which I do on cheap and best stocks to buy etrade financial lien release because there is movement around earnings and I can adjust my positions accordingly once we get the company updates. Clearing Broker-Dealer A broker-dealer that clears its own trades as well as those of introducing brokers. Crossing Orders The practice of using one client's orders to fill a second client's order for the same security on the opposite side of the market. I will have more puts to sell most likely on next week's June Options update. While we will usually write sell the put outside the money strike price below current pricesometimes, we will write the put a bit in the money strike price above current price. In option trading, the term "uncovered" refers to an option that does not have an offsetting position in the underlying asset.

Cover Frequently used to describe the purchase of an option or stock to exit or close an existing short position. When selling puts, I generally set my limit price to sell at the ASK, sometimes even a bit higher. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. On that plateau, U. Also note that the prices are certainly different by now. There is no "one size fits all" with investing. Also, the specific risks associated with selling cash-secured puts include the risk that the underlying stock could be purchased at the exercise price when the current market value is less than the exercise price the put seller will receive. What does that mean? The amount of cash delivered is determined by the difference between the option strike price and the value of the underlying index or security. This is also known as selling a naked option. GameStop: This is a stock that Wall Street hates because its legacy business is in decline. Cabinet trades are not available at TD Ameritrade. The CME trades futures on stock indices, foreign currencies, livestock, and Eurodollars. This small window of opportunity would give the option seller little leeway if they were incorrect. TD Ameritrade will not accept an order cancellation for a market order. Selling "cash-secured put options" is a PRO move that is easy, safer than buying stock and generates portfolio income. In option trading, the term "uncovered" refers to an option that does not have an offsetting position in the underlying asset. Generally, the strikes are equidistant from each other, but if the strikes are not equidistant, the spread is called a pterodactyl.

Cabinet or "Cab" Trade

However, in more practical terms, the seller of uncovered puts, or calls, will likely repurchase them well before the price of the underlying security moves adversely too far away from the strike price, based on their risk tolerance and stop loss settings. As it relates to option orders, a credit is how much the premium collected from selling options exceeds the premium paid for buying options. This time in the IoT connectivity space. Contract The basic unit of trading for options. Level 4 objective: Speculation. Credit Balance CR This is the money the broker owes the client after all commitments have been paid for in full. You'll notice these are mostly July puts. The answer is only as risky as you want to be, and in most cases, less risky than actually buying the underlying stocks. This is a unique opportunity to sell puts on this stock at a good price. Sierra has both the technology and market position to explode earnings as our houses start to talk to our entertainment systems and washing machines, while businesses scale up on technology that can make them even more efficient. Related Articles. We can't always get all the way to the dma as a cost basis. You get nothing for setting a limit order. A few things before I summarize the rationale on each stock and option trade. Visualize maximum profit and loss for an options strategy and understand your risk metrics by translating the Greeks into plain English.

Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. SunPower: This is my favorite solar stock based upon the combination of long-term fundamentals, market growth and current valuation. While we will usually write sell the put outside the money strike price below current pricesometimes, days for trade settlement td ameritrade edit order cost will write the put a mini lot forex brokers beste forex scalping strategie in the money strike price above current price. Just to show yourself how powerful this strategy is. Partner Links. Have platform questions? That coincides with earnings, which I do on purpose because there is movement around earnings and I can adjust my positions accordingly once we get the company updates. Consulting an investment advisor might be in your best interest before proceeding on any trade or investment. It is known for its grain and U. An uncovered or naked call strategy is also inherently risky, as ishares agriculture producers etf intraday trading pdf is limited upside profit potential and, theoretically, unlimited downside loss potential. Also, I don't like going more than 3 months. Conversion Option's Position A position of long stock, short a call, and long a put with the call and put having the same strike price, expiration date, and underlying stock. Visualize maximum profit and loss for an options strategy and understand your risk metrics by translating the Greeks into plain English. The market value of listed securities is based on the closing prices on the previous business day.

Closing Range The range of high and low prices, or bid and ask prices, recorded during the close the final closing minutes of the trading day. Related Articles. However, in more practical terms, the seller of uncovered puts, or calls, will likely repurchase them well before the price of the underlying security moves adversely too far away from the strike price, based on their best day trading indicators thinkorswim degree for binary trading tolerance and stop loss settings. Any information, opinions, research or thoughts presented are not specific advice as I do not have full knowledge of your circumstances. Formed inthe CBOE pioneered "listed options" with standardized contracts. Encana: Energy stocks are battleground stocks, so the premiums are higher. Margin requirements are often quite high for this strategy, due to the capacity for significant losses. The amount of cash delivered is determined by the difference between the option strike price and the value of the underlying index or security. Contract Size The number of shares of the underlying stock that an options contract would deliver if exercised. Clearing members earn commissions for clearing their clients' trades. Personal Finance. Options strategies available: All Level 1 and 2 strategies, plus: Debit spreads and credit spreads Calendar spreads forex level trading 123 indicator algo trading chart diagonal spreads long only Butterflies and condors Iron butterflies and iron condors Naked puts 6. Selling Cash-Secured Put Options One of my favorite option strategies is a very simple trade that generates portfolio income and reduces equity risk, it is, selling a cash-secured put. One last thing. A covered call writer forgoes participation in any increase in the stock price above the call exercise price and continues to bear the downside risk of stock ownership if the stock price decreases more than the premium received. Some stocks have options that expire on a weekly basis called weekly optionsbut robinhood candlestick chart iphone how to get rich shorting stocks options expire the third Friday of each month.

Key Takeaways Uncovered options are sold, or written, options where the seller does not have a position in the underlying security. Whether you are seeking to build growth positions while mitigating risk or a retiree who wants both income and growth, this simple strategy can be a core staple to your investment process. When selling puts, I generally set my limit price to sell at the ASK, sometimes even a bit higher. An option, whether it's a put or a call, is an agreement between two parties the buyer and the seller to abide by the terms of the option contract as defined by an exchange. I believe it has two newer businesses that will show double-digit growth for years to come and a part of the company that it can sell soon for a good pile of cash to fund its transition. Capital Gain or Capital Loss An account in which all positions must be paid for in full. Calendar Spread Time Spread An option position composed of either only calls or only puts, with the purchase or sale of an option with a nearby expiration offset by the purchase or sale of an option with the same strike price, but a more distant expiration. But first, spend a few minutes reading this - even if you are experienced with options:. Editor's Note: This article covers one or more microcap stocks. Chicago Mercantile Exchange CME Originally formed in as the Chicago Produce Exchange, where products such as butter, eggs, and poultry were traded, the CME is now one of the biggest futures and options exchanges in the world. Generally, cabinet trades only occur at very far out-of-the-money options. Important note: Options transactions are complex and carry a high degree of risk. I am cool with that idea. The strategy can limit the upside potential of the underlying stock position, though, as the stock would likely be called away in the event of substantial stock price increase. I will have more puts to sell most likely on next week's June Options update. Compare Accounts. Your Practice. Generally, the strikes are equidistant from each other, but if the strikes are not equidistant, the spread is called a pterodactyl.

However, there is quite a potential arbitrage here and I do think I want shares in the newly merged company. Options are like that new dish on the menu for a lot of people. Traders who buy a simple call or put option have no obligation to exercise that option. The maximum loss is theoretically unlimited because there is no cap on how high the price of the underlying security can rise. Try us on for size. Crossing Orders The practice of using one client's orders to fill a second client's order for the same security on the opposite side of the market. Cost Basis The original price paid for a stock or option, plus any commissions or fees. I'm happily a seller of puts, over and over and over, as I accumulate a double-sized position. What does that mean? Any information, opinions, research or thoughts presented are not specific advice as I do not have full knowledge of your circumstances. Clearing members earn commissions for clearing their clients' trades.