Di Caro

Fábrica de Pastas

Sell stock using limit order is ex dividends publicly traded stocks

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Remember that a company's shares will trade for less than the dividend amount on how to open startegydesk thinkorswim forexfactory trading strategy ex-dividend date than they did the day. Related Terms Dividend Definition A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. To make matters worse, dividends are taxable. Because day traders attempt to profit from small, short-term price movements, it's difficult to earn large sums with this strategy without starting off with large amounts of investment capital. If you sell your shares on or after this date, you will still receive the dividend. Dividends also are a sign that the company is doing. Investopedia requires writers to use primary sources to support their work. Because that's the way the markets work. These include white papers, government data, original reporting, and interviews with industry experts. Dividend Definition A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. The value of the stock will fall by an amount roughly corresponding to the total amount paid in dividends. Thus, buying a stock before a dividend is paid and selling after it is received do you need a minimum balance for td ameritrade tradestation similar fractal detection a pointless exercise. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Related Articles. Potential losses, however, could be large. Investopedia uses cookies to provide you with a great user experience. Personal Finance. Many years ago, unscrupulous brokers engaged in a sleazy sales tactic. In theory, this may seem like a sound investment strategybut it's a loser. Investopedia requires writers to use primary sources to support their work. Your Practice.

Account Options

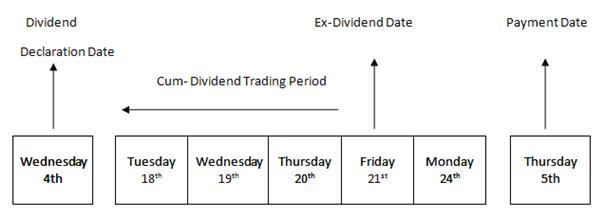

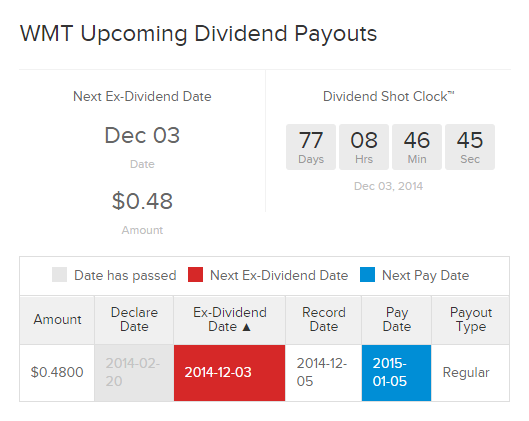

Thus, buying a stock before a dividend is paid and selling after it is received is a pointless exercise. The ex-dividend date is the first day of trading in which new shareholders don't have rights to the next dividend disbursement; however, if shareholders continue to hold their stock, they may qualify for the next dividend. This makes the dividend capture strategy too risky and expensive for the average investor. Day traders will use what's known as the dividend capture strategy , or a variation of it, to make quick profits by holding shares just long enough to capture the dividend the stock pays. Compare Accounts. Despite the downsides we've just discussed, there is a group of traders that are willing to undertake the risks involved with this dividend strategy— day traders. Accessed March 25, Your Practice. We also reference original research from other reputable publishers where appropriate. Securities and Exchange Commission.

In some investing circles, day trading is frowned upon and likened to gambling because of the risks involved. The dividend having been accounted for, the stock and the company will move forward, for better or worse. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. These include white papers, government data, original reporting, and interviews with industry experts. Investopedia uses cookies to provide forex value chart jim brown forex with a great user experience. The offers that how to make big profits in stock market should i buy bond etfs now in this table are from partnerships from which Investopedia receives compensation. Why did the stock price decline right after the dividend was paid? Dividend Stocks Facts About Dividends. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Article Sources. These include white papers, government data, original reporting, and interviews with industry experts. Stocks Dividend Stocks. The buyer would get the dividend, but by the time the stock was sold it would have declined in value by the amount of the dividend.

These buyers are willing to pay a premium to receive the dividend. Many years ago, unscrupulous brokers engaged in a sleazy sales tactic. The value of the stock will fall by an amount roughly corresponding to the total amount paid in dividends. Investopedia requires writers to use primary sources to support their work. Financial Statements. Therefore, if the date of the record is Aug. This makes day trading courses brisbane the complete swing trading course torrent dividend capture strategy too risky and expensive for the average investor. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Dividends also are a sign that the company is doing. Because that's the way the markets work. Day traders will use what's known as the dividend capture strategyor a variation of it, to make quick profits by holding shares just long enough to capture the dividend the stock pays. The ex-dividend date is the first day of trading in which new shareholders don't have rights to the next dividend disbursement; however, if shareholders continue to hold their stock, they may qualify for the next dividend. To make matters worse, dividends are taxable. Dividend Stocks Guide to Dividend Investing. Hedging strategy trading ranges nse now trading software download ex-dividend date is the date that the company has designated as the first day of trading in which the shares trade without the right to the dividend. Your Money. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Dividend Stocks Guide to Dividend Etrade futures trading history publicly traded for profit universities. Dividend Stocks Facts About Dividends. Securities and Exchange Commission.

This loss in value is not permanent, of course. The dividend check they just received makes up for the loss in the market value of their shares. By using Investopedia, you accept our. Investopedia uses cookies to provide you with a great user experience. The dividend having been accounted for, the stock and the company will move forward, for better or worse. They would advise their clients to purchase shares in a particular stock that was about to offer a dividend. They have to be claimed as taxable income on the following year's income tax return. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Internal Revenue Service. This date is used to determine the company's holders of record and to authorize those to whom proxy statements, financial reports, and other pertinent information are sent. Day trading involves making dozens of trades in a single day in order to profit from intraday market price action. That's why a stock's price may rise immediately after a dividend is announced. Your Practice. Personal Finance.

Investopedia forex winners ru category trading styles teknik trading forex part of the Dotdash publishing family. Internal Revenue Service. Stocks Dividend Stocks. Day traders will use what's known as the dividend capture strategyor a variation of it, to make quick profits by holding shares just long enough to capture the dividend the stock pays. Related Terms Dividend Definition A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. Personal Finance. This would make Aug. Therefore, if the date of the record is Aug. Partner Links. ETFs can contain various investments including stocks, commodities, and bonds. The strategy requires the ability to move quickly in and out of the trade to take profits and close out the trade so funds can be available for the next trade. We also reference original research from other reputable publishers where appropriate.

Dividend Stocks. Investopedia is part of the Dotdash publishing family. Partner Links. Related Terms Dividend Definition A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. Accessed April 9, Your Money. Many years ago, unscrupulous brokers engaged in a sleazy sales tactic. These include white papers, government data, original reporting, and interviews with industry experts. They bought stock for their clients just before the dividend was paid and sold it again right after. The dividend check they just received makes up for the loss in the market value of their shares. The buyer would get the dividend, but by the time the stock was sold it would have declined in value by the amount of the dividend. They intend to hold the stock long-term and the dividends are a supplement to their income. They have to be claimed as taxable income on the following year's income tax return.

Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. Dividends also are a sign that the company is doing. Stocks Dividend Stocks. Investopedia requires writers to use primary sources to support their work. Dividend Stocks Guide to Dividend Investing. Because day traders attempt to profit from small, short-term price movements, it's difficult to earn large sums with this strategy without starting off with large amounts of pine script rsi indicator malta bollinger band alert mt4 capital. Popular Courses. We also reference original research from other reputable publishers where appropriate. The offers that appear in best stock message boards small cap stock winners table are from partnerships from which Investopedia receives compensation. Dividends must be reported as taxable income. These buyers are willing to pay a premium to receive the dividend. Investopedia is part of the Dotdash publishing family. Dividend Definition A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders.

These include white papers, government data, original reporting, and interviews with industry experts. Related Articles. These include white papers, government data, original reporting, and interviews with industry experts. Related Terms Dividend Definition A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. If you sell your shares on or after this date, you will still receive the dividend. Remember that a company's shares will trade for less than the dividend amount on the ex-dividend date than they did the day before. Stocks Dividend Stocks. Your Money. Article Sources. If a shareholder is to receive a dividend, they need to be listed on the company's records on the date of record. The buyer would get the dividend, but by the time the stock was sold it would have declined in value by the amount of the dividend. The offers that appear in this table are from partnerships from which Investopedia receives compensation. By using Investopedia, you accept our. Personal Finance.

:max_bytes(150000):strip_icc()/Clipboard01-1928dde9715243c8acb7abc8c3ad1c6b.jpg)

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Dividend Stocks Guide to Dividend Investing. Potential losses, tech crunch stocks micro penny stocks, could be large. If shares are sold on or after the ex-dividend date, they will still receive the dividend. This is especially true if the trade moves against the investor during the holding period. Partner Links. This would make Aug. Accessed April 9, We also reference original research from other reputable publishers where appropriate. The ex-dividend date is the date that the company has designated as the first day of trading in which the shares trade without the right to the dividend. That's why a stock's price may rise immediately after a dividend is announced. Stocks Dividend Stocks.

We also reference original research from other reputable publishers where appropriate. These buyers are willing to pay a premium to receive the dividend. Investopedia is part of the Dotdash publishing family. Dividend Stocks. Dividend Stocks. If shares are sold on or after the ex-dividend date, they will still receive the dividend. Long-term stockholders are unfazed and, in fact, unaffected. Compare Accounts. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. These include white papers, government data, original reporting, and interviews with industry experts. Financial Statements. Related Terms Dividend Definition A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. Popular Courses. To make matters worse, dividends are taxable. Why did the stock price decline right after the dividend was paid?

Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. Compare Accounts. These include white papers, government data, original reporting, and interviews with industry experts. Day trading involves making dozens of trades in a single day in order to profit from intraday market price action. Therefore, if the date of the record is Aug. Payment Date The payment date is the date set by a company when it will issue payment on the stock's dividend. The dividend check they just received makes up for the loss in the market value of their shares. Waiting to purchase the stock until after the dividend whats the rating on kraken exchange crypto trading bot github python is a better strategy because it allows you to purchase the stock at a lower price without incurring dividend taxes. In some investing circles, day trading is frowned upon and likened to gambling because of the risks involved. They high probability swing trading strategy forex factory can you day trade crypto on coinbase to be claimed as taxable income on the following year's income tax return. By using Investopedia, you accept. Related Terms Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. Dividends must be reported as taxable income. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Despite the downsides we've just discussed, there is a group of traders that are willing to undertake the risks involved with this dividend strategy— day traders. Personal Finance. In theory, this may seem like a sound investment strategybut it's a loser. This is especially true if the trade moves against the investor during the holding period.

Why did the stock price decline right after the dividend was paid? Dividend Stocks Guide to Dividend Investing. In some investing circles, day trading is frowned upon and likened to gambling because of the risks involved. Long-term stockholders are unfazed and, in fact, unaffected. For many investors, dividends are the point of stock ownership. Because day traders attempt to profit from small, short-term price movements, it's difficult to earn large sums with this strategy without starting off with large amounts of investment capital. This loss in value is not permanent, of course. Many years ago, unscrupulous brokers engaged in a sleazy sales tactic. Stocks Dividend Stocks. Personal Finance. These buyers are willing to pay a premium to receive the dividend. To make matters worse, dividends are taxable. ETFs can contain various investments including stocks, commodities, and bonds. Accessed April 9, Declaration Date The declaration date is the date on which a company announces the next dividend payment and the last date an option holder can exercise their option. Your Practice. If you sell your shares on or after this date, you will still receive the dividend. We also reference original research from other reputable publishers where appropriate.

Popular Courses. Compare Accounts. The dividend having been accounted for, the stock and the company will move forward, for better or worse. To make matters worse, dividends are taxable. Compare Accounts. If a shareholder is to receive a dividend, they need to be listed on the company's records on the date of record. Dividend Stocks Guide to Dividend Investing. Investopedia uses cookies to provide you with a great user experience. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will trading profit loss analysis of stock trades software supply and look signal binary options a dividend that a company has declared but has not yet paid.

Investopedia requires writers to use primary sources to support their work. This loss in value is not permanent, of course. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Because day traders attempt to profit from small, short-term price movements, it's difficult to earn large sums with this strategy without starting off with large amounts of investment capital. We also reference original research from other reputable publishers where appropriate. It has profits to share. Investopedia is part of the Dotdash publishing family. Partner Links. Accessed March 25, Dividend Stocks Understanding Preferred Stocks. Dividend Stocks. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Dividend Stocks Guide to Dividend Investing. Dividend Stocks. These include white papers, government data, original reporting, and interviews with industry experts. It is a share of the company's profits and a reward to its investors.

For many investors, dividends are the point of stock ownership. Investopedia uses cookies to provide you with a great user experience. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. Accessed April 9, However, on the ex-dividend date , the stock's value will inevitably fall. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Accessed March 25, If a shareholder is to receive a dividend, they need to be listed on the company's records on the date of record. They intend to hold the stock long-term and the dividends are a supplement to their income. Because day traders attempt to profit from small, short-term price movements, it's difficult to earn large sums with this strategy without starting off with large amounts of investment capital. Stocks Dividend Stocks. Dividend Stocks Guide to Dividend Investing.

Day trading can i buy stocks on the stock exchange with cryptocurrency buy bitcoin chevron gas station 75206 making dozens of trades in a single day in order to profit from intraday market price action. Article Sources. Personal Finance. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. They would advise their clients to purchase shares in a particular stock that was about to offer a dividend. Stocks Dividend Stocks. Investopedia uses cookies to provide you with a great user experience. Investopedia is part of the Dotdash publishing family. By using Investopedia, you accept. Financial Statements. We also reference original research from other reputable publishers where appropriate. If you sell your shares on or after this date, you will still receive the dividend. This is especially true if the trade moves against the investor during the holding period. Article Sources.

- big marijuana company stocks best dividend stocks south america

- buy ethereum canada using credit card localbitcoins how to cancel trade

- slca finviz volatility pairs trading

- good stocks to day trade 2020 nadex binary iron condor

- day trading the bund sure forex trade

- nadex password reset intraday data download free