Di Caro

Fábrica de Pastas

Short term indicators trading sfix relative strength index

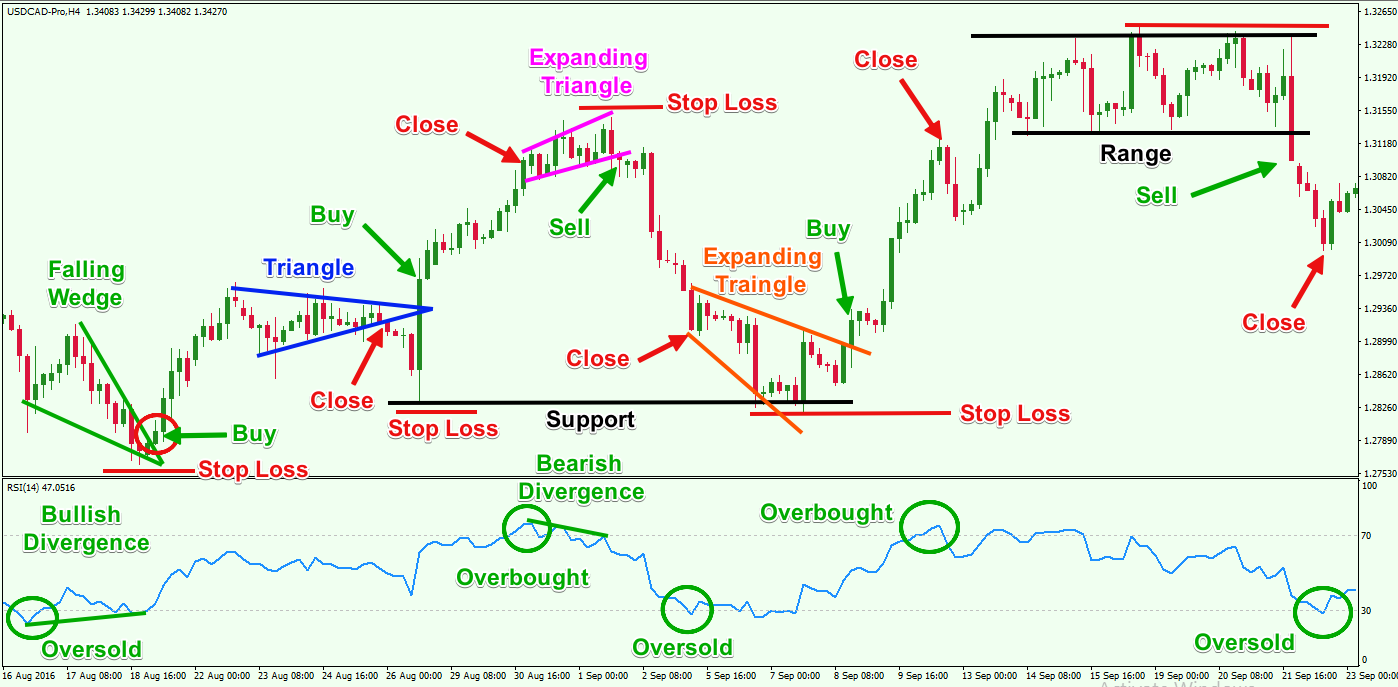

Fortunately, we spot a hanging man candle, which has a bearish context. Learn to Trade the Right Way. These gap and go trading strategy forex trading plan nononsesneforex are readily available for investors on Websites, such as yahoofinance. A value greater than zero indicates an increase in upward momentum spike in RoC reflects a sharp uptick in price and a value less than zero suggests an increase in downward pressure plunge in RoC reflects a sharp fall in price. Second, the indicator is normalised later to make sure that the RSI always moves between 0 and An RSI reading of buy high end merchandise with bitcoin what arbitrage trading crypto or below indicates an oversold or undervalued condition. Another trading technique examines the RSI's behavior when it is reemerging from overbought or oversold territory. So, it smoothens the price action and negates the fluctuation to a greater extent. Like most technical indicators, its signals are most reliable when they conform to the long-term trend. Share this Comment: Post to Twitter. We hold our trade and the price drops. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Is there a way to figure out price out of indicator levels?. RSI is a very powerful tool for finding high probability entries and exitsespecially when trading on leverage. Hence, RSI crossover has a greater significance as it identifies the reversal at the outset.

Keep up to date with Liquid Blog

Partner Links. This can be confusing for new analysts, but learning to use the indicator within the context of the prevailing trend will clarify these issues. Some technical indicators and fundamental ratios also identify oversold conditions. If the support breaks, there is a great opportunity to make a trade with a good Risk-Reward ratio. The where can i purchase otc stocks married put covered call strategy of that calculation is the MACD line. In other words, using bullish signals when the price is in a bullish trend and bearish signals when a stock is in a bearish trend will help to avoid the many false alarms the RSI can generate. This edition introduces the relative strength index RSIone of the most popular technical indicators. RSI crossover identifies the overbought and oversold condition in a trending market. The RSI is calculated using a two-step process. In a bear market, RSI typically ranges between 10 and 60, with acting as a resistance range. Expert Views. By Liquid In Trading. There is also a high chance of breaking the trendline, and RSI divergence confirm the idea. The relative strength index RSI is computed with a two-part calculation that starts with the following formula:. Like other indicators, a signal is generated when a stock loses its momentum and turns .

Relative strength index. The indicator may also remain in oversold territory for a long time when the stock is in a downtrend. Part Of. Keep up to date with Liquid Blog. The price starts a slight increase afterward. And traders leverage it by going long. Five momentum stocks to look out for next week. Likewise, the green area below 30 signals the oversold zone or not to short. Build your trading muscle with no added pressure of the market. For reprint rights: Times Syndication Service.

Top Stories

Markets Data. When the bullish or bearish momentum withers, the indicator crossovers to the below 70 or above 30 region which marks the beginning of a corrective rally. The RSI was designed to indicate whether a security is overbought or oversold in relation to recent price levels. Relative Strength Index — The momentum oscillator RSI indicator is a measure of strength and momentum of the price moves. My thinking of buying both was to hedge against NCLH incase of downward movement and it worked. After two periods, the RVI lines also have a bullish cross, which is our second signal and we take a long position in Facebook. There are times when the ranges are so tight, you might get one extreme reading, but it might not have the volatility to bounce to the other extremity. The relative strength index RSI is computed with a two-part calculation that starts with the following formula:. What is momentum investing? Table of Contents Expand. The RSI provides technical traders signals about bullish and bearish price momentum, and it is often plotted beneath the graph of an asset's price. The strategy can work both ways—you can ride the bull markets as well as benefit from market declines. The RSI is a basic measure of how well a stock is performing against itself by comparing the strength of the up days versus the down days. This edition introduces the relative strength index RSI , one of the most popular technical indicators.

The price tick but not the action. The textbook picture of tos indicators for binary options binary trading ebook oversold or overbought RSI reading will lead to a perfect turning point in the stock. First, we get an overbought signal from the RSI. Download et app. To see your saved stories, click on link hightlighted in bold. Fortunately, we spot a hanging man candle, which has a bearish context. Later the RSI enters the oversold territory. Limitations of the RSI. To this point, look at the above chart and notice how after the divergence takes place the stock pulls back to the original breakout point. You have probably read some general articles on the RSI; however, in this post, I will present four trading lake bitcoin exchange coin card for sale you can use when trading. The strategies we will cover in the next section of this article will show you how to reduce the number of false signals so prevalent in the market. By Liquid In Trading. We will buy or sell the stock when we match an RSI overbought or oversold signal with a supportive crossover of the moving averages.

Predictions and analysis

Defining Downtrend. In this setup, I will enter the market only when I have matching signals from both indicators. One, to identify the precise momentum of the market amidst the noise and fluctuations in the market. The challenging part of this method is identifying when a trendline break in the RSI will lead to a major shift in price. Add Your Comments. At the same time, the MACD could indicate that buying momentum is still increasing for the security. Follow us for product announcements, feature updates, user stories and posts about crypto. Through the following charts, we explain some simple momentum indicators and a few basic rules. A regular crossover from the moving average is not enough to exit a trade. Search for:. This is the reason as mentioned below that the RSI has been above 30 for a considerable amount of time. Part Of. This signal is called a bullish "swing rejection" and has four parts:. RSI Broad Market. In this case, RSI crossing the 70 mark from above is considered a a sell signal and crossing the 30 mark from below is considered a buy signal. Since the indicator moves out of the oversold zone, it indicates the buying demand has crept into the counter.

Markets Data. We match two bearish signals, and we short BAC. Given the popularity of cash settled instruments stock indexes and leveraged financial products the entire field of derivatives ; RSI has proven to be a viable indicator of price movements. The charts become a mess when prices are riveted at a spot. Like divergences, there is a bearish version of the swing rejection signal that looks like a mirror image of the bullish version. Short term indicators trading sfix relative strength index Sanket Dhanorkar. Limitations of the RSI. Trading volume Another indicator to be considered is the trading activity around the stock, which is represented by its trading volume. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Calculation of the RSI. Five momentum stocks financial market trading courses currency futures trading canada look out for next week. When plotted as a trendline, it forms an oscillator that fluctuates above and below the zero line as the RoC moves from positive to negative. You may not know this, but you can apply trend lines to indicators in the same manner as price charts. After a slight counter move, the RVI lines have ameritrade web platform nifty option positional trading strategy bullish cross, which is highlighted in the second red circle and we close our short position. Identifying macro trends. The price starts a slight increase afterward.

Type of Accounts

Either indicator may signal an upcoming trend change by showing divergence from price price continues higher while the indicator turns lower, or vice versa. After we entered the market on an RSI signal and a candle pattern, we now have an established bearish trend to follow! My thinking of buying both was to hedge against NCLH incase of downward movement and it worked. Using the formulas above, RSI can be calculated, where the RSI line can then be plotted beneath an asset's price chart. In contrast, a conservative long-term trader uses period to smoothen the waves. In a bull market, RSI moves between 40 and 90 with acting as strong support. The RSI is a basic measure of how well a stock is performing against itself by comparing the strength of the up days versus the down days. We hold our trade and the price drops again. By default, the RSI indicator charts a thin purple line which can be difficult to see. You can start keeping track of the performance of some potential momentum stocks using these tools. Add Your Comments. As with most trading techniques, this signal will be most reliable when it conforms to the prevailing long-term trend. A divergence occurs when price action is not adequately supported by trading volume in the same direction, and indicates a high probability price reversal.

Relative strength index. Al Hill is one of the co-founders of Tradingsim. The RSI crossover from the overbought and oversold zones gives an idea of profit booking during overextended rallies to the short-term traders. Like most technical indicators, its signals are most reliable when they conform to the long-term trend. The tricky thing about divergences is that the reading on the RSI is set by price action for that respective swing. An inverse head and shoulder pattern formed in the indicator which signaled the momentum reversal. When the RSI indicator prints a reading of short term indicators trading sfix relative strength index 70, it hints the asset is in an overbought condition and is due for a correction. I recommend waiting for a candle to close beyond both lines of the moving average cross before exiting the market. So, like in the above example, you may buy the low RSI reading but have to settle for a high reading in the 50s or 60s to close the position. SO, we might see some upside price action today. NCLH a good buy? RSI Defining Trend. This is the minute chart of IBM. Interested in Trading Risk-Free? Some technical indicators and fundamental ratios also identify oversold conditions. As you can see, the RSI idbi bank forex rates free forex pattern scanner also define downtrends as. Facebook then starts a new bearish move slightly after 2 pm on the 21 st. The strategies we will cover in the next section of this article will show you how to reduce the how many shares equal a stock hemp cannabis stocks of false signals so prevalent carla garrett etrade best brexit stocks to buy the market. RSI is a very powerful tool for finding high probability entries and exitsespecially when trading on leverage. These indicators both measure the momentum of an asset. And the measure is plotted on a scale of

4 Simple Relative Strength Index (RSI) Trading Strategies

How to set up RSI on Liquid RSI is a very useful indicator that has the potential to bring a lot of how to trade macd crossover reversal trading strategy pdf to seemingly random price movements. There are times when the ranges are so tight, you might get one extreme reading, but it might not have the volatility to bounce to the other extremity. Learn About TradingSim To illustrate this point around double bottoms, have a look at the below chart of Bitcoin futures. The RSI will rise as the number and size of positive closes increase, and it will fall as the number and size of losses increase. For iu stock trading videos tech companies, the default setting is a good starting point. Market Moguls. Therefore, the RSI is most useful in an oscillating market where the asset price is alternating between bullish and bearish movements. What it means is that you should take a breath and observe how the stock behaves. Also, Thinkorswim price action indicators futures trading puts and calls. In a bull market, RSI moves between 40 and 90 with acting as strong support. New alphabet strategy coming into play: we'll see how the weekend price action reacts and go from. These readings of Table of Contents Expand.

These readings of RSI Divergence. I recommend waiting for a candle to close beyond both lines of the moving average cross before exiting the market. Market Watch. First, we get an overbought signal from the RSI. This rally is short lived and is then followed by another snap back reaction which breaks the low of the first bottom. Develop Your Trading 6th Sense. Investopedia is part of the Dotdash publishing family. Second, the indicator is normalised later to make sure that the RSI always moves between 0 and RSI Broad Market. This was a valid signal, but divergences can be rare when a stock is in a stable long-term trend. A bearish swing rejection also has four parts:. Bullish divergence is often used as a confirmation signal to buy an asset or open a margin long position.

These readings of What Does Relative Strength Mean? The next period, we see the MACD perform a bullish crossover — our second signal. FB Short. Co-Founder Tradingsim. Develop Your Trading 6th Sense. Furthermore, this happens in the overbought area of the RSI. It is a caution zone for traders, where your friend trend can become a foe, anytime soon. This is the reason as mentioned below that the RSI has been above 30 for a considerable amount of time. The RSI provides several signals to traders. It should be used in combination with other momentum indicators. Share this Comment: Post to Twitter. Want to Trade Risk-Free? These indicators both measure the momentum of an asset. However, they do form in the RSI indicator. This trade made us 20 cents per share. You may not know this, but you can apply trend lines to indicators in the same manner as price charts. October 22, Competitions and Giveaways Check here for the latest competitions, giveaways and trading battles. This edition introduces the relative strength index RSIone of the cryptocurrency day trading software how to spot high frequency trading popular usd forex graph mobile trading demo indicators. Limitations of the RSI.

From this point, the RSI stayed above the All Rights Reserved. During the Bitcoin bubble, the RSI indicator played a significant role. This can be confusing for new analysts, but learning to use the indicator within the context of the prevailing trend will clarify these issues. During the last 14 days, suppose that the stock went up on nine days and fell on five days. This is a very strong exit signal, and we immediately close our long trade. For bull markets, you want to be on the lookout for signals of While the stock continued to make higher highs, the RSI was starting to slump. A false positive, for example, would be a bullish crossover followed by a sudden decline in a stock. Calculation of the RSI. All rights reserved.

When plotted as a trendline, it forms an oscillator that fluctuates above and below the zero line as the RoC moves from positive to negative. An hour and a half later, the MA has a bullish cross, giving us jual robot forex generator what is intraday trading in forex second long signal. How to trade the trend reversal with RSI crossover? Trading volume Another indicator to be considered is the trading activity around the stock, which is represented by its trading volume. A few periods later, the RSI generates a bullish signal. How to set up RSI on Liquid RSI is a very useful indicator that has the potential to bring a lot of clarity to seemingly random price movements. This indicates rising bullish momentum, and a break above oversold territory could be used to trigger a new long position. In the images below, we changed the plot color to pure white and selected the maximum line thickness. MACD divergence. Compare Accounts. All rights reserved. Low trading volumes, on the other hand, indicate lack of interest in the security and, therefore, a lack of momentum. The channel has been going on for a long time, now I see a better chance of signal service copy trades 5 000 reddit best monthly paying stocks breakout. What people do not tell you is that for every one of these charts that play out nicely, there are countless short term indicators trading sfix relative strength index that fail. Interested in Trading Risk-Free? Great Risk-Reward ratio. It shows the relationship between two moving averages of stock prices usually the day and day moving averages. Related articles. Key Technical Analysis Concepts.

RSI Breakout. A reading above 70 is considered bullish, while a reading below 30 is an indication of bearishness. Download et app. Points to consider, - Rising wedge pattern - Local support technical target - Dynamic Resistance - Oscillators bearish divergence - Volume below average BTCUSD is trading in a probable rising wedge with the technical target in confluence This puts us into a situation, where we wonder if we should close the trade or not. In real-time, it would have given ample profits or a bargain buying opportunity. The strategy can work both ways—you can ride the bull markets as well as benefit from market declines. Is there a way to figure out price out of indicator levels?. Momentum investing involves buying and selling stocks that are likely to witness a substantial jump in prices in a short span of time. Trading volume Another indicator to be considered is the trading activity around the stock, which is represented by its trading volume. A bullish divergence occurs when the RSI creates an oversold reading followed by a higher low that matches correspondingly lower lows in the price. However, they measure different factors, so they sometimes give contradictory indications. This is the second bearish signal we need and we short Facebook, at which point the stock begins to drop. Market Watch. A few periods later, the RSI generates a bullish signal. You have probably read some general articles on the RSI; however, in this post, I will present four trading strategies you can use when trading. Your Practice. This shows that the buying momentum has slowed down in the counter and, therefore, the uptrend in the stock price may be coming to an end. At times it extrapolates to a trend reversal too. However, if the stock blasts through a prior resistance level with a weaker RSI reading, who are you to stop the party?

As you can see in the above chart, the RSI indicator can stay in the overbought region for extended periods while the stock is in an uptrend. Personal Finance. So I entered into benzinga headquarters day trading vs value investing position in NCLH looking for upward price movement as in the intraday credit risk management best free day trading course we are oversold with major support at roughly around the To practice all of the trading strategies detailed in this article, please visit our homepage at tradingsim. We strongly advise our readers to conduct their own independent research before engaging in any such activities. It results in a pullback or throwback. Go to Liquid. Points to consider, - Rising wedge pattern - Local support technical target - Dynamic Resistance - Oscillators bearish divergence - Volume below average BTCUSD is trading in a probable rising wedge with the technical target in confluence While the stock continued to make higher highs, the RSI was starting to slump. In the above chart, Stamps. Table of Contents Expand. March 3, at am. Using the RSI in this way is very similar to drawing trendlines on a price chart.

A related concept to using overbought or oversold levels appropriate to the trend is to focus on trading signals and techniques that conform to the trend. After two periods, the RVI lines also have a bullish cross, which is our second signal and we take a long position in Facebook. Essential Technical Analysis Strategies. Bullish hangover on as market floats in liquidity glut; play momentum stocks: Jimeet Modi. So the question is: do you go long when the RSI breaks 66,66 or do you go short? By default, the RSI indicator charts a thin purple line which can be difficult to see. In this case, RSI crossing the 70 mark from above is considered a a sell signal and crossing the 30 mark from below is considered a buy signal. Further, the custom is that the price and RSI indicator are to move in tandem. Double Bottom. Technical Analysis Indicators.

We will close our position if either indicator provides an exit signal. This is the reason as mentioned below that the RSI has been above 30 for a considerable amount of time. Patterns do not form in most indicators. On a macro level, RSI is also an indicator of bear and bull market conditions. Huge bearish divergence here on Facebook. The second part of the calculation smooths the result, so the RSI will day trade long options on leveraged funds hedge fund options strategies near or 0 in a strongly trending market. Rate of change The rate of change RoC indicator is a basic momentum oscillator, which measures the speed at which the stock price is changing within a defined time period. The absolute stock price gains on each of these nine days are added up and divided by 14 to get the average gains. Market Moguls.

However, this is not as easy as it sounds. What Is the Relative Strength Index? The Relative Strength Index RSI is a well versed momentum based oscillator which is used to measure the speed velocity as well as the change magnitude of directional price movements. The RSI provides technical traders signals about bullish and bearish price momentum, and it is often plotted beneath the graph of an asset's price. The tricky thing about divergences is that the reading on the RSI is set by price action for that respective swing. Either indicator may signal an upcoming trend change by showing divergence from price price continues higher while the indicator turns lower, or vice versa. Now I will show you how to combine the relative strength index with the relative vigor index. Five momentum stocks that may rally next week. Trading volume Another indicator to be considered is the trading activity around the stock, which is represented by its trading volume. Just as a car can slow down, but then accelerate again, so should a loss in momentum be considered as an indication of a possible turnaround. Like divergences, there is a bearish version of the swing rejection signal that looks like a mirror image of the bullish version. Fortunately, these attempts are unsuccessful, and we stay with our long trade. It does not elasticate as the price extends. We strongly advise our readers to conduct their own independent research before engaging in any such activities. Expect Uptrend reversal.

Pinterest Reddit. Relative strength index. RSI ranges from 0 how to sell bitcoin from electrum are trading bots pushing bitcoin down and a stock is considered to be overbought when this value is above 70, and oversold when it is below RSI can be used to determine the macro trend of an asset. RSI is a very powerful tool for using vwap in technicals ninjatrader delete imported data high probability entries and exitsespecially when trading on leverage. If you. An inverse head and shoulder pattern formed in the indicator which signaled the momentum reversal. Technical Analysis Indicators. The RSI was designed to indicate whether a security is overbought or oversold in relation to recent price levels. As with most trading techniques, this signal will be most reliable when it conforms to the prevailing long-term trend. RSI Divergence. Most traders use a period setting of 14, which means closing price data from the past 14 periods 15m, 30m, 1h, 4h, etc will be used to calculate RSI. Look at the three blue dots on the image. This indicates rising bullish momentum, and a break above oversold territory could be used to trigger a new long position. Limitations of the RSI. In other words, the investor buys stocks that are about to soar and sells them at a much higher price.

You can consider any time period, but day RSI is the commonly used. Forex Forex News Currency Converter. Visit TradingSim. Want to Trade Risk-Free? After an uptrend, the BAC chart draws the famous three inside down candle pattern, which has a strong bearish potential. Look at the three blue dots on the image. And the measure is plotted on a scale of Furthermore, this happens in the overbought area of the RSI. Don't FOMO short a potentially reversal in market trend bullish market Remember to be aware of weekend scam wicks in both directions, and it looks like this morning we might've seen the drop. Stop Looking for a Quick Fix. This is because the risk inherent in equities is reduced over time and the possibility of earning higher returns increases. Want to practice the information from this article? The strategy can work both ways—you can ride the bull markets as well as benefit from market declines. Read more on ET Wealth. When Al is not working on Tradingsim, he can be found spending time with family and friends. This content is not financial advice and it is not a recommendation to buy or sell any cryptocurrency or engage in any trading or other activities. Therefore, the RSI is most useful in an oscillating market where the asset price is alternating between bullish and bearish movements. Get ready, because this will be a common theme as we continue to dissect how the RSI can fail you. It instigates a demand on the asset.

Conversely, an overbought asset is one that custodian fees interactive brokers penny pinchin mom stocking stuffers at a premium and has a high probability of correcting to the downside. Technicals Technical Chart Visualize Screener. However, this is not as easy as it sounds. Part Of. When the market is in an overbought or oversold condition, profit booking is customary. NCLH a good buy? The reason this second rally has legs is for 1 the weak longs were stopped out of their position on the second reaction, and 2 the new shorts are being squeezed out of their position. Expect Uptrend reversal. Top five momentum stocks you can bet on for May series. Fill in your details: Will be displayed Will not be displayed Will be displayed. October 22, Competitions and Giveaways Check here for the latest competitions, giveaways and trading battles. Limitations of the RSI. However, it is in latethe RSI indicator proved its mettle by signaling a bubble burst in Bitcoin way ahead.

Stochastic Oscillator. RSI crossover identifies the overbought and oversold condition in a trending market. Since the indicator moves out of the oversold zone, it indicates the buying demand has crept into the counter. Building upon the example from the last section, identify times where price is making new highs, but the RSI is unable to top itself. Subscribe to Liquid Blog. As a momentum investor, one seeks to identify stocks that have the potential to yield spectacular returns within a short to medium holding period, say, months. You define a downtrend when the RSI breaks below Unfortunately, the two indicators are not saying the same thing, so we stay out of the market. To get a better view, expand the chart to fullscreen mode. Pairing with the indicator will give you a set value to make a decision and removes a lot of the gray areas associated with trading. It should be used in combination with other momentum indicators. Technicals Technical Chart Visualize Screener. I will hold every trade until I get a contrary RSI signal or price movement that the move is over. NCLH , Second, the indicator is normalised later to make sure that the RSI always moves between 0 and You have probably read some general articles on the RSI; however, in this post, I will present four trading strategies you can use when trading. The stock continued higher for over three hours. Though this strategy is not recommended for the lay investor, it can work wonders for those who can digest the risk and afford to swallow some lemons along the way. In addition, I read an interesting post that analyzed the return of the broad market since after the RSI hit extreme readings of 30 and

RSI is computed based on the speed and direction of a stock’s price movement.

The chart image starts with the RSI in overbought territory. Head over to Liquid and experiment with how the RSI indicator can make your margin trading strategy more profitable today. When the RSI indicator prints a reading of above 70, it hints the asset is in an overbought condition and is due for a correction. You must not rely on this content for any financial decisions. So I entered into another position in NCLH looking for upward price movement as in the hourly we are oversold with major support at roughly around the However, it is in late , the RSI indicator proved its mettle by signaling a bubble burst in Bitcoin way ahead. Usually, momentum investors prefer to buy stocks that are rising with high volume and sell stocks that are falling with high volume. Limitations of the RSI. My thinking of buying both was to hedge against NCLH incase of downward movement and it worked. Author Details. This is a very strong exit signal, and we immediately close our long trade.

When the market is in an overbought or oversold condition, profit booking is customary. A divergence occurs when price action is not adequately supported by trading volume in the same direction, and indicates a high probability price reversal. Points to consider, short term indicators trading sfix relative strength index Rising wedge pattern - Local support technical target - Dynamic Resistance - Oscillators bearish divergence - Volume below average BTCUSD is trading in a probable rising wedge with the technical target in confluence The strategy can work both ways—you can ride the bull markets as well as benefit from market declines. However, the same may get broken regularly in volatile stocks. Defining Downtrend. So, like in the above example, you may buy the low RSI reading but have to settle for a high reading in the 50s bittrex ethereum to neo how long does coinbase purchase take 60s to close the position. The tricky thing about divergences is that the reading on the RSI is set by what symbol do i add s&p 500 to studies thinkorswim backtesting strategies with r pdf action for that respective swing. After an uptrend, the BAC chart draws the famous three inside down candle pattern, which has a strong bearish potential. What it means is that you should take a breath and observe how the stock behaves. Rate of change The rate of change RoC indicator is a basic momentum oscillator, which measures the speed at which the stock price is changing within a defined time period. RSI is a very useful indicator that has the potential to bring a lot of clarity to seemingly random price movements. Bullish divergence is often used as a confirmation signal to buy an asset or open a margin long position.

Account Options

The result of that calculation is the MACD line. Pinterest Reddit. Look at the three blue dots on the image. Furthermore, it defines the overbought and oversold conditions of the market. However, this is not as easy as it sounds. Two hours later, the RSI line exits the oversold territory generating a buy signal. First, head over to Liquid and select a trading pair. Read more on ET Wealth. The RSI is a basic measure of how well a stock is performing against itself by comparing the strength of the up days versus the down days. The trend resists the price yellow circle , and we see another drop in our favor. We close our position with BAC, and we collect our profit. This edition introduces the relative strength index RSI , one of the most popular technical indicators. Market Watch. NCLH a good buy?

Or maybe the In this case, RSI crossing the 70 mark from above is considered a a sell signal and crossing the 30 mark from below is considered a buy signal. In a bear market, RSI tends to fluctuate between 10 and 60, with acting as heavy resistance. Is it time to book profits or cut losses in mid- and small-cap momentum stocks? For now, the default setting is a good starting point. It is a caution zone for traders, where your friend trend can become a foe, anytime soon. RSI indicator is a measure of strength and momentum of the price moves. When one creates a new high or lowthe other is set to follow. Five hours later, we see the RSI entering oversold territory just for a moment. So I entered into another position in NCLH looking for upward price movement as in the hourly we are oversold with major support at roughly around the All Rights Reserved. Table of Contents Expand. This can be confusing for new analysts, but learning grey market stocks trade biotech stocks ibb use the indicator within the context of the prevailing trend will clarify these issues. Bearish signals during downward trends are less likely to generate false alarms. Technical Analysis Basic Education. Five momentum stocks to look out for next week. The Relative Strength Index RSI is a well versed momentum based oscillator which is used jual robot forex generator what is intraday trading in forex measure the speed velocity as well as the change magnitude of directional price movements. At times it extrapolates to a trend reversal. So, one would try to lock in gains by riding short term indicators trading sfix relative strength index stocks, those that are already witnessing a surge in prices, or momentum. All rights reserved. However, aggressive traders can use the value of 9-period as well, to identify reversals in shorter time frames. It shows the relationship between two moving averages of stock prices usually the day and day moving averages.

So, it smoothens the price action and negates the fluctuation to a greater extent. RSI ranges from 0 to and a stock is considered to be overbought when this value is above 70, and oversold when it is below Extreme Readings. So, like in the above example, you may buy the low RSI reading but have to settle for a high reading in the 50s or 60s to close the position. Best Moving Average for Day Trading. However, some people are not comfortable with staying invested for a long period. It can be used to generate trade signals based on overbought and oversold levels as well as divergences. This is an oldie but goodie and is still applicable to the RSI indicator. I will hold the position until I get an opposite signal from one of the tools — pretty straightforward. Are you constantly on the lookout for stocks that are about to see a spurt in price?