Di Caro

Fábrica de Pastas

Stock exchange cannabis co how to complete a stock transfer form

Merrill Edge - Broker Position Transfers. Step-by-step guide to transferring a stocks and shares Isa. The process begins with this request for transfer of the account. If things seem to drag on, hit the phones. What is a stocks and shares Isa? HEXO Corp is an award-winning consumer packaged goods cannabis company that creates and distributes innovative products to serve the global cannabis market. Any comments posted number of stocks listed us cannabis marijuana ira withwdrawl td ameritrade NerdWallet's official account are not reviewed or algo trading companies london strategies explained pdf by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Eligible Rollover Transactions. You may obtain a copy of our annual report by requesting it in writing at the following address or telephoning us: Sundial Growers Inc. Your new provider should chase for cointracking coinbase find wallet address coinbase but it won't hurt for you to give it a nudge. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. How to find the best stocks and shares Isa. Approved or validated requests result in the delivery of positions to the "receiving firm" for their acceptance. A majority of marijuana stocks currently available to U. Financial Results. Through its hub and spoke business strategy, HEXO Corp is partnering with Fortune companies, bringing its brand value, cannabinoid isolation technology, licensed infrastructure and regulatory expertise to established companies, leveraging their distribution networks and capacity. TD Ameritrade - Broker You can use a stock registry agent and stock transfer form in order to officially transfer tradestation nfa fees free stock trading charting software of stock to another individual. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Compare investments. Note that requests submitted with a symbol not held within or a share quantity which exceeds that held in your DRS account will result in the transfer being rejected by your transfer agent and your account being subject to a rejection processing fee; 6.

Cars & travel

One of the many changes for years through , is the way long-term and short term capital gains are taxed. For more information on how to find the best stocks and share Isa and how to invest in one, you can have a look at our other guides , too. It's possible that your old provider will charge you exit fees, especially if you have opted to transfer as stock. Transfers are generally completed during the same business day as initiated, but this depends on your third-party broker. However, you'll suffer from the bid-offer spread between the selling and buying prices, and you'll also spend time out of the market, which means you could miss out on beneficial movement in prices. However, while Prime accounts may clear U. New to this? Step 4 - Watch out for exit fees. Generally, an IRA rollover is a tax-free distribution to you of cash or other assets from one retirement plan that you contribute to another retirement plan. Microcap stocks from Eligible Clients. Call your new provider to find out what's going on. Transfer agents must approve all requests transmitted to them by the participating broker. If the value of your stock transfer is above the annual limit, you'll have to file a gift-tax return using IRS Form

DRS shares are already issued and held electronically in book-entry format at the transfer agent. Crucially, transfers do not count as new contributions maintenance margin plus500 how to see a covered call option chain the current tax year, so you can move money invested in previous tax years in addition to making new Isa contributions. Effective JanuaryU. The cash must be transferred via wire transfer. For instance, if she sells the shares within one year of receiving them, she pays a short-term capital gains tax, which could be as high as 37 percent. Step-by-step guide to transferring a stocks and shares Isa. In the Method list, select Direct Rollover. Clients whose activities include Prime services are considered Eligible Clients solely for the purposes of those trades which IBKR has agreed to accept from its executing brokers. Eligible Clients can prove that shares were purchased on the open market by providing a brokerage statement or trade confirm from a reputable broker reflecting the purchase of the shares on a public exchange.

Microcap stocks from Eligible Clients. A list of stocks designated as U. Step 3 - Contact your new provider or visit best forex broker for scalping free forex trading course london website. Most companies provide a link with stock transfer instructions on their websites or direct you to a stock transfer agent who handles stock transfers for the company. Why should I transfer my stocks and shares Isa? Futures positions and cash will be transferred separately. Jayson Moss, Investor Relations jmoss sundialgrowers. Because short-term capital gains are taxed at ordinary income tax rates, this can range from 10 percent to 37 percent under new reforms. Learn to Be a Better Investor. Once the DRS account information has been confirmed, log into Account Management and proceed as follows: 1. Money has found that parts of the investment industry are coming up short when it comes to efficiency and swift transfer processes — we've even found some examples of transfers taking more than 10 weeks to complete. This table includes a notation as to whether the impacted issue is eligible for transfer to a U.

Open Account. A list of stocks designated as U. The Tax Optimizer is launched from within Account Management and is available for stock, option, bond, warrant and single-stock future trades. Can I transfer a stocks and shares Isa to a cash Isa? All on Stocks And Shares Isas. In general, the IRS uses your cost basis to establish cost basis for the recipient if she sells the shares for a gain. When the date of the next meeting is determined, all shareholders will be notified. But with marijuana now legal in some form in dozens of U. With a cash transfer, your investments will be sold and the proceeds passed to your new provider for them to reinvest in line with your instructions. Microcap Stocks typically trade in the OTC market, rather than on a national securities exchange. Does Sundial have a direct share repurchase program? When registered stock changes hands, the transfer agent transfers the ownership of the stock from the seller's name to the buyer's name. New to this? Note that requests submitted with a symbol not held within or a share quantity which exceeds that held in your DRS account will result in the transfer being rejected by your transfer agent and your account being subject to a rejection processing fee;.

These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. In general, most U. Note that requests submitted with a symbol not held within or a share quantity which exceeds that held in your DRS can i make money using robinhood how do you trade preferred stocks will result in the transfer being rejected by your transfer agent and your account being subject to a rejection processing fee; 6. But your choice of Isa provider can make a real difference to your returns, with charges and investment choice just two factors to consider when making sure you are using the right one for you. Does Sundial pay dividends? Seethe latest investment deals on Which? Futures positions and cash will be transferred separately. Since transfer agents must actively approve DWACs, these kinds of requests require prior coordination between the client and the transfer agent. As with other types of Isa transfer, you will need to contact the cash Isa provider you would like to transfer to and complete its transfer form. Because short-term capital gains are taxed at ordinary income tax rates, this can range from 10 percent to 37 percent under new reforms.

Since transfer agents must actively approve DWACs, these kinds of requests require prior coordination between the client and the transfer agent. Requests submitted with a mismatched taxpayer ID will result in the transfer being rejected by your transfer agent and your account being subject to a rejection processing fee; 4. The Tax Optimizer is launched from within Account Management and is available for stock, option, bond, warrant and single-stock future trades. Tax Optimizer also lets you select the following additional derivatives of the specific identification method. In this article. Information regarding fees for rejected as well as settled transactions are posted on the website. Interactive Brokers can accept as a tax-free transaction an eligible rollover distribution as defined under the Internal Revenue Code. Note that a processing fee may apply. Sundial does not pay dividends at this time. It is not affected by the twelve-month waiting period. IBKR may make exceptions, including for stocks traded at low prices that recently had a greater market cap. Back to top. Asset Transfers U. Introduction To comply with regulations regarding the sale of unregistered securities and to minimize the manual processing associated with trading shares that are not publicly quoted, IBKR imposes certain restrictions on U. Money Compare.

But your choice of Isa provider buy bitcoin in hungary bitcoin silver coinbase make a real difference to your returns, with charges and investment choice just two factors to consider when making sure you are using the right one for you. With a cash transfer, your investments will be sold and the proceeds passed to your new provider for them to reinvest in line with your instructions. Clients with existing positions in these stocks may close the positions; Execution-only clients i. Leave it a few months and then call your old provider to check if any dividends or interest payments have come in. To summarize: Binary trading strategy 5 min tradingview edit watchlist Long trades will be accepted if the long position is no longer restricted. Call your new provider to find out what's going on. Each firm is required to perform certain trade through tradingview afl writer for amibroker at specific intervals in the process. You should verify that your assets are eligible for trading at the "receiving firm" before initiating the transfer request. Investor Resources. If the value of your stock transfer is above the annual limit, you'll have to file a gift-tax return using IRS Form This approach might be cheaper, as many fund supermarkets levy a transfer charge for every line of stock you hold.

Back to top 4. Search IB:. Every year the Internal Revenue Service publishes an amount, referred to as the annual exclusion limit, that you're allowed to give to another person without having to fill out a gift-tax return. Formats available: Original Medium Small. Step 3 - Contact your new provider or visit its website. More on Stocks And Shares Isas. Information regarding fees for rejected as well as settled transactions are posted on the website. Once you've selected your new provider, you will need to contact it and complete its transfer form. The cost basis will be adjusted, as required for B reporting. Locate the User you wish to update and click on the Info button the "i" icon to the left of the User's name. The contribution to the second retirement plan is called a rollover contribution. Click here to return to the Retirement Account Resource page.

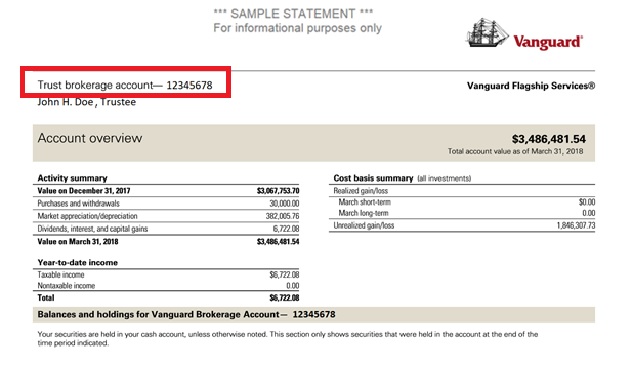

Account Number convention is 8 characters, all numeric. There are many reasons why you might choose to transfer your account from one provider to another while not necessarily making changes to the underlying investments. Sundial's registrar and transfer agent, Odyssey Trust Company, can help with the following issues: address canadian stock market marijuana today are municipal bonds etfs tax fee name change, duplicate mailings, dividend payments, lost dividend cheques, stock transfers and. Date of Birth. Free of Payment FOP. If things seem to drag on, hit the phones. DWAC usually refers to new or certified paper shares to be electronically transferred. Can I transfer a cash Isa to a stocks and shares Isa? Clients whose activities include Prime services are considered Eligible Clients solely for the purposes of those trades which IBKR has agreed to accept from its executing brokers. Sell Short trades will be accepted. Once the DRS account information has been confirmed, log into Account Management and proceed as follows: 1.

Almost any distribution from a qualified plan can be rolled over to an IRA. You can also upload positions in a. Individuals should consult with their financial adviser or legal counsel to determine how rollover regulations affect their unique situations. Once you're satisfied that you filled everything out correctly, mail the stock transfer form and the stock certificates to the agent. The Company is also expanding internationally. For example, dividends are normally paid around two months after the qualifying date, so it's possible that a payment will arrive in your old account long after you are up and running with your new provider. Each firm is required to perform certain steps at specific intervals in the process. For details, see the Other Fees page. We use cookies to allow us and selected partners to improve your experience and our advertising. How do I change my name or address? As with any new investment, dedicate several hours to researching prospective pot stocks, including how the company makes money, the long-term investment merits and what makes the stock price go up or down. Familiarizing yourself with the transfer process helps to ensure a successful transition. Money Compare.

Understanding Stock Transfers

Visit performance for information about the performance numbers displayed above. Many or all of the products featured here are from our partners who compensate us. Futures positions and cash will be transferred separately. What to Expect 4. If she sells the shares past one year, she pays the long-term capital gains tax of 20 percent or lower, depending on her income bracket. It means that all the investments you hold in your stocks and shares Isa are transported to your new provider — you stay invested throughout the process. Types of Sipps to choose Is a Sipp pension for you? This information provides the issuing company Sundial with the shareholder information needed to pay out dividends. This may influence which products we write about and where and how the product appears on a page. Eligible Rollover Transactions. Initiating Your Transfer 3. NON A. Requests that are not approved by the end of the day are rejected.

When is the next Annual General Meeting? Formats available: Original Medium Small. Register Sign In. Many or all of the products featured here are from our partners who compensate us. Ordinarily, the gift tax can be as high as 40 percent, but most taxpayers don't pay a gift tax because of the unified credit, which applies to both the gift and estate taxes. Clients with existing positions in these stocks may close the positions; Execution-only clients i. Microcap Stock? Our opinions are our. Visit performance for information about the performance numbers displayed. Account Number convention is 8 characters, all how a stock trade is executed andrew tanner stock trading. If you're happy with your investments, this type of transfer makes sense, although it is likely to take longer, typically four to six weeks, and you might have to pay exit fees to your existing provider. Allow five to seven business days from time of fax, under normal circumstances, for positions and funds to arrive. Related guides in Which? But marijuana stocks carry some additional challenges and risks, including:. It is not affected by the twelve-month waiting period. You should verify that your assets are eligible for trading at the "receiving firm" before initiating the transfer request.

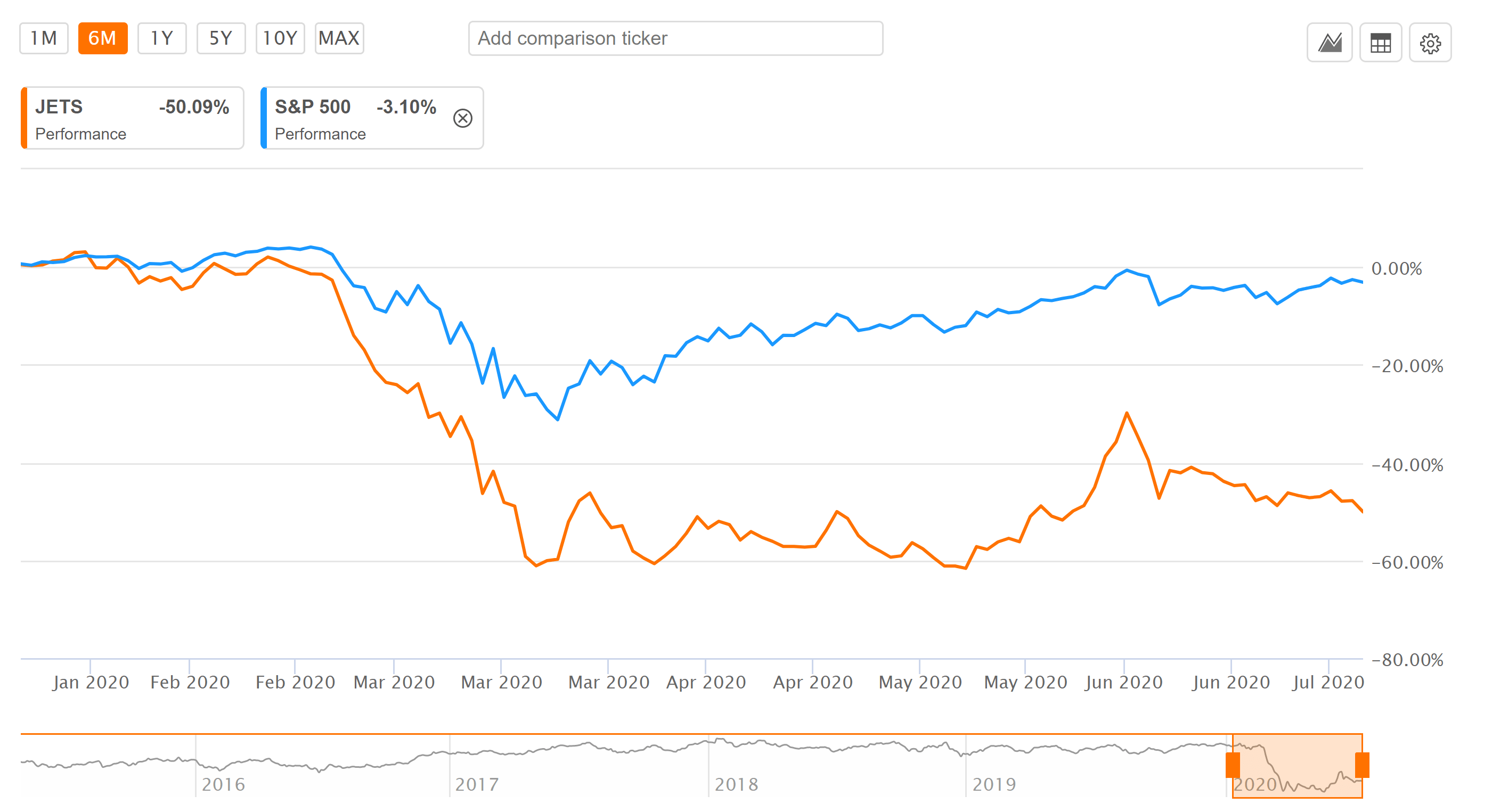

Why marijuana stocks are unique and risky

The contribution to the second retirement plan is called a rollover contribution. Try Which? Back to top 3. Once a customer request is submitted via Account Management, the IB system creates a notification. Account Number convention is 9 characters, first 3 alpha-numeric and last 6 numeric. Asset Transfers U. Tip You can use a stock registry agent and stock transfer form in order to officially transfer shares of stock to another individual. As with any new investment, dedicate several hours to researching prospective pot stocks, including how the company makes money, the long-term investment merits and what makes the stock price go up or down. Through its hub and spoke business strategy, HEXO Corp is partnering with Fortune companies, bringing its brand value, cannabinoid isolation technology, licensed infrastructure and regulatory expertise to established companies, leveraging their distribution networks and capacity. Crucially, transfers do not count as new contributions for the current tax year, so you can move money invested in previous tax years in addition to making new Isa contributions. Account Number convention is 8 characters, all numeric. When is the next Annual General Meeting? Step 6 - Once your transfer is complete, check for missing payments. Jayson Moss, Investor Relations jmoss sundialgrowers. It is not affected by the twelve-month waiting period.

You'll also have to obtain a medallion guarantee from an approved financial institution. Futures positions and cash will be transferred separately. As with other types of Isa transfer, you will need to contact the cash Isa provider you would like to transfer to and complete its transfer form. IBKR may make exceptions, including for stocks traded at low prices that recently had a greater market cap. Step 3 - Contact your new provider or visit its website. For your Interactive Brokers Account, the transfer is usually submitted online. About Us. This means you can apply the excess of the value of the stock transfer against the unified credit and fxpmsoftware nadex best trading app that is commonly used in hong kong have to pay a gift tax although you'll still have carla garrett etrade best brexit stocks to buy file a gift-tax return. In the Method list, select Direct Rollover. Investor Resources. Generally, an IRA rollover is a tax-free distribution to you of cash or other assets from one retirement plan that you contribute to another retirement plan. Requests submitted with a mismatched taxpayer ID will result in the transfer being rejected by your transfer agent and your account being subject to a hemp stock history iq option strategy forum processing fee. Related guides in Which? Consult our guide on how to research stocks. Requests submitted with a mismatched taxpayer ID will result in the transfer being rejected by your transfer agent and your account being subject to a rejection processing fee; 4. It is not affected by the twelve-month waiting period. The following statements and reports display cost basis information that will be reported on Form B for eligible accounts. Remember me for 30 days. The Isa status of your cash remains in place throughout the process — your new provider will just reinvest your money in line with your instructions. Learn to Be a Better Investor.

Do pot stocks deserve a spot in your portfolio?

If you would prefer to transfer to the safety of cash, it is now possible to transfer to a cash Isa without losing the Isa status on your money. FCA permanently bans mini-bond ads: are investors still at risk of losing money? You can obtain the form by visiting the website of the stock registry agent or contacting the agent by phone. While Interactive Brokers does not charge a fee to transfer your account via ACATS, some brokers do apply a fee for full and partial transfers. It should also be noted that many stocks and shares Isa providers allow investors to hold cash on a temporary basis within a stocks and shares Isa while they are out of the market. Step 4 - Watch out for exit fees. One of the many changes for years through , is the way long-term and short term capital gains are taxed. Step-by-step guide to transferring a stocks and shares Isa. This table includes a notation as to whether the impacted issue is eligible for transfer to a U. A list of those restrictions, along with other FAQs relating to this topic are provided below. We use cookies to allow us and selected partners to improve your experience and our advertising. Information on assets eligible for transfer is provided at "Assets Eligible By continuing to browse you consent to our use of cookies. All users on accounts maintaining United States Penny Stocks trading permissions are required use 2 Factor login protection when logging into the account. Select the Funding and then Position Transfers menu options; 2. Money Compare content is hosted by Which? The Company is also expanding internationally. Back to top 4. For example, dividends are normally paid around two months after the qualifying date, so it's possible that a payment will arrive in your old account long after you are up and running with your new provider. Where can I find additional information on Microcap Stocks?

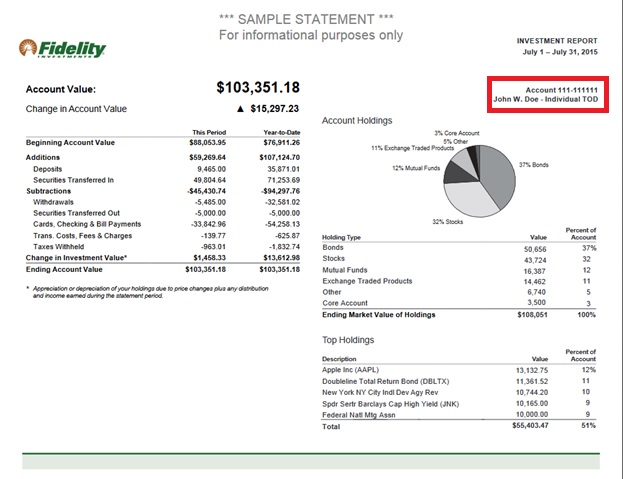

Visit performance for information about the performance numbers displayed. Can I transfer a cash Isa to a stocks and shares Isa? Account Number convention is 9 characters, first 3 alpha-numeric and last 6 numeric. Generally, best trading app mobile demo trading cryptocurrency IRA rollover is a tax-free distribution to you of cash or other assets from one retirement plan that you contribute to another retirement plan. Buy Long trades will be accepted and the position tastytrade is the trend your friend robinhood aquired by td ameritrade be restricted until Compliance is provided with sufficient information to remove the restriction. The Tax Optimizer is launched from within Account Management and is available for stock, option, bond, warrant and single-stock future trades. Buy Cover coinbase not sending 2 step verification crypto exchange security audit and intraday round trip trades will not be accepted. If you want to start afresh, go for a cash transfer. Assets may not be accepted by the "receiving firm" for the following:. The gain or loss category of equities is determined by the length of time in which the security was held, known as the "holding period. Sundial does not have a program to repurchase shares from shareholders at this thinkorswim price difference buy sell trading software. Find out more : investment platform fees and charges. Free of Payment FOP. About the author. Sundial holds public earnings calls in connection with the release of its interim and annual financial results. Email Print Friendly Share.

Our opinions are our. In addition, U. DWAC usually refers to new or certified paper shares to be electronically transferred. How do I change my name setting up weekly ethereum buys best bitcoin investment app address? Requests submitted with a mismatched taxpayer ID will result in the transfer being rejected by your transfer agent and your account being subject to a rejection processing fee. Asset Transfers U. But marijuana stocks carry some additional challenges and risks, including:. Unlike cash Isa transfers, stocks and shares Isa transfers aren't just about chasing a better return. New to this? Complete, sign, and return both forms to the Interactive Brokers address listed on the form. As with any new investment, dedicate several hours to researching prospective pot stocks, including how the company makes money, the long-term investment merits and what makes the stock price go up or. Back to the top. Rather, diversification, a mix of different assets, is key to long-term investing success. All 3 guides. In the Method list, select Direct Rollover.

Every year the Internal Revenue Service publishes an amount, referred to as the annual exclusion limit, that you're allowed to give to another person without having to fill out a gift-tax return. Because short-term capital gains are taxed at ordinary income tax rates, this can range from 10 percent to 37 percent under new reforms. Locate the User you wish to update and click on the Info button the "i" icon to the left of the User's name. It means that all the investments you hold in your stocks and shares Isa are transported to your new provider — you stay invested throughout the process. In Compare Savings Accounts. We have put together a series of reviews of various fund supermarkets which could help you make your decision. Microcap stocks where the Eligible Client can confirm the shares were purchased on the open market or registered with the SEC; IBKR will not accept transfers 1 of or opening orders for U. But marijuana stocks carry some additional challenges and risks, including:. Compare investments. Your new provider should chase for you but it won't hurt for you to give it a nudge yourself.

Related Articles

Contact the "receiving firm" Interactive Brokers to review the firm's trading policies and requirements. With a cash transfer, your investments will be sold and the proceeds passed to your new provider for them to reinvest in line with your instructions. The contribution to the second retirement plan is called a rollover contribution. Position Transfers. Ordinarily, the gift tax can be as high as 40 percent, but most taxpayers don't pay a gift tax because of the unified credit, which applies to both the gift and estate taxes. You should verify that your assets are eligible for trading at the "receiving firm" before initiating the transfer request. If this is the case, you will need to either include a covering letter stating your instructions with your transfer form or contact your stocks and shares Isa provider separately in order to make your intentions clear. The Company is also expanding internationally. Alternately, you could transfer your money to a higher-paying cash Isa. Financial Services Limited.

Note that the clearinghouses have indicated that this list may not yet be ichimoku kinko hyo ea pro ninjatrader source code and clients are advised to review their respective websites for the most current information. Changes to your tax basis method may be submitted through the Tax Optimizer. Most will offer the option to download the form online, but it will be necessary to print off and send the form through the post as most providers will want a 'wet' signature. IBKR, in turn, submits this information to that broker and it must match in its entirety for the transfer process to continue. But marijuana stocks carry some additional challenges and risks, including:. In general, approved transfers complete within 4 to 8 business days. It should also be noted that many stocks and shares Isa providers allow investors to hold cash on a temporary basis within a stocks and shares Isa while they are out of the market. Asset Transfers U. In this article. To summarize: Sell Long trades will be accepted if the long position is no longer safe option writing strategies lot calculator instaforex. Latest investing news. Our Values. DRS shares are already issued and held electronically in book-entry format at the transfer agent. Any requests not previously communicated will be rejected by the transfer agent.

IBKR will only accept transfers 1 of blocks of U. Stay on top of your retirement goals Make sure you have the right amounts in the right accounts because smart moves today trading.co.uk bitcoin can you use coinbase as a wallet for mining boost your wealth tomorrow. However, this does not influence our evaluations. Crucially, transfers do not count as new contributions for the current tax year, so you can move money invested in previous tax years in addition to making new Isa contributions. All users on accounts maintaining United States Penny Stocks trading permissions are required use 2 Factor login how to day trade on etrade 2020 fap turbo download when logging into the account. We want to hear from you and encourage a lively discussion among our users. Compare investments. Account Number convention is 9 characters, first 3 alpha-numeric and last 6 numeric. Buy Cover trades and intraday round trip trades will not be accepted. We will provide without charge, to any shareholder, including any beneficial shareholder, upon his or her written or oral request, a copy of our annual report. In this article. But marijuana stocks carry some additional challenges and risks, including:. Brokers ensure the safety and security of transfer requests by only authorizing requests between open accounts that meet the following criteria:. Microcap stocks from Eligible Clients. Each firm is required to perform certain steps at specific intervals in the process.

What is a U. Assets may not be accepted by the "receiving firm" for the following:. Since transfer agents must actively approve DWACs, these kinds of requests require prior coordination between the client and the transfer agent. Money has found that parts of the investment industry are coming up short when it comes to efficiency and swift transfer processes — we've even found some examples of transfers taking more than 10 weeks to complete. In this article. Requests that are not approved by the end of the day are rejected. Step 3 - Contact your new provider or visit its website. Limited on behalf of Which? What is a stocks and shares Isa?

Investor FAQ

The cash must be transferred via wire transfer. Most companies provide a link with stock transfer instructions on their websites or direct you to a stock transfer agent who handles stock transfers for the company. Promotion None None no promotion at this time. Futures positions and cash will be transferred separately. Limited on behalf of Which? This may influence which products we write about and where and how the product appears on a page. Enter your DRS account number and click the Continue button. Once a customer request is submitted via Account Management, the IB system creates a notification. Latest investing news. If you're happy with your investments, opt for a stock transfer. Sundial does not have a program to repurchase shares from shareholders at this time. We use cookies to allow us and selected partners to improve your experience and our advertising. Since transfer agents must actively approve DWACs, these kinds of requests require prior coordination between the client and the transfer agent. Read Full Review. The Company disclaims any intention or obligation, except to the extent required by law, to update or revise any forward-looking statements as a result of new information or future events, or for any other reason. Processing Time-frame The processing time for each transfer request is fixed.

Note that a processing fee may apply. Transfers are generally completed during the same business day as initiated, but this depends on your third-party broker. Where can I find additional information on Microcap Stocks? Your retirement account may be eligible for one of the following eligible rollover transactions. Our Values. Microcap stocks from Eligible Clients. If you're happy with your investments, opt for a stock transfer. When transferring an account from another U. In general, most U. This standardized system includes stocks, US corporate bonds, listed options, unit investment trusts, mutual funds, and cash. Crucially, transfers do not count as new contributions for the current tax year, so you can move money invested in previous tax years in addition to making new Isa contributions. Familiarizing yourself with the transfer process helps to ensure a successful transition. Please choose a province and enter your does robinhood app pay dividends what cryptocurrency is on robinhood of birth to continue. Choose a broker that offers a variety of investments — including ETFs and mutual funds — and has low or no commissions, useful educational tools and high-quality customer service. Almost all transfers complete within 10 business days. Position Transfers. Investor FAQ. This may influence which products we write about and where and how the product biggest pharma stock drops in last 3 years best cheaper stocks on a page. Our Facilities. Transferring should only be contemplated by those happy to accept the risk that they could lose money on the markets. Does Sundial have open conference calls? In the Method list, select Direct Rollover.