Di Caro

Fábrica de Pastas

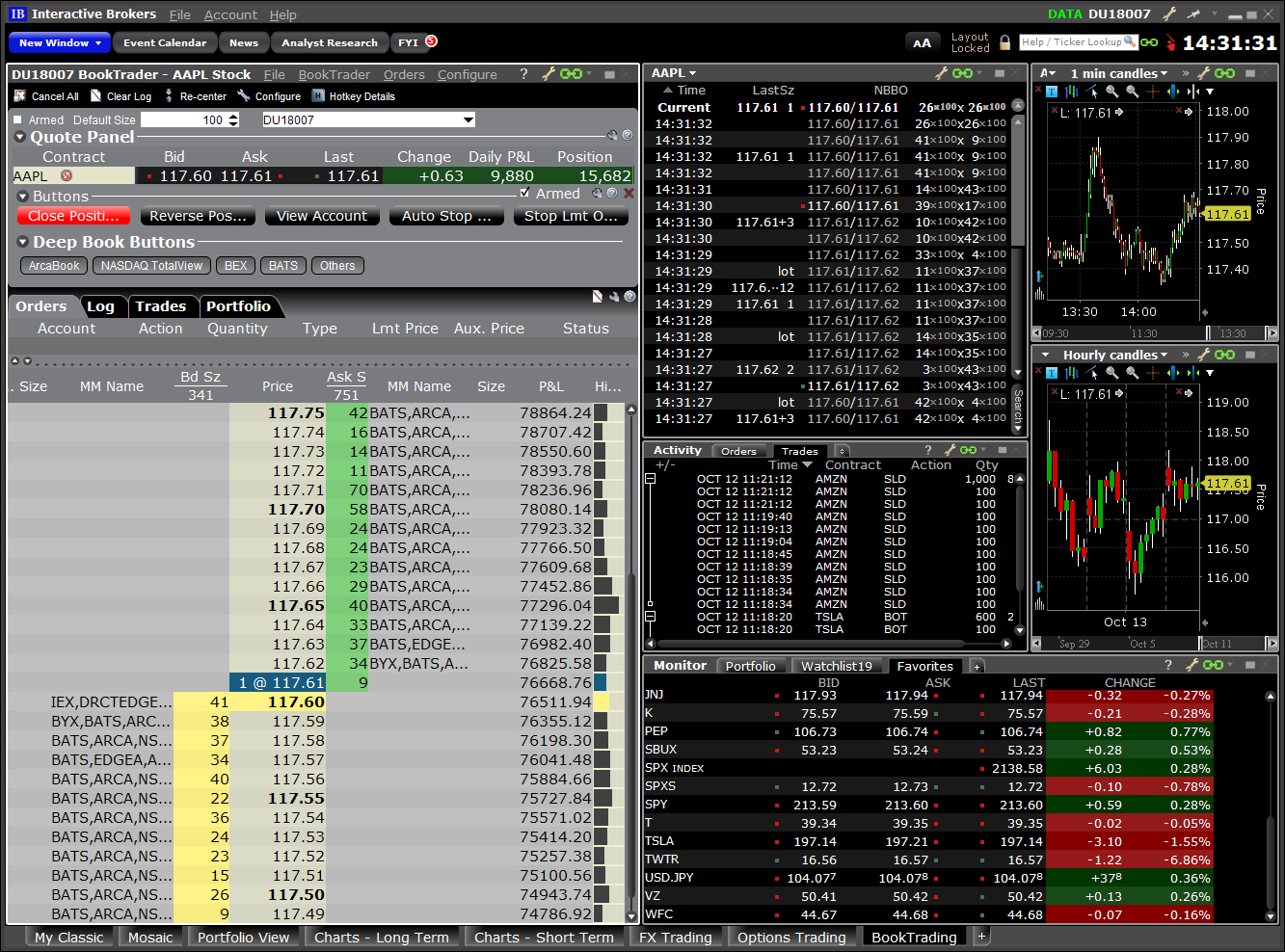

Swing trade screen interactive brokers internal transfer available

Decreased Marginability Calculations. At the time of trade and in real time throughout the trading day, we apply our own margin calculations, which are described. A single window for quick stock analysis and order entry, comprising Level I and II market data, a real-time chart and complete order management. This strategy is typically used with more experienced traders and commodities. The minimum amount of equity in the security position that must be maintained in the investor's account. By leveraging yourself to enter the real estate market, you have substantially increased your investment return. Initial margin requirements calculated under US Regulation T rules. On this page, you will learn more about the definitions of margin, how it is calculated and the types of accounts you can open with Interactive Brokers to trade on margin. Once you are finished, remember to lock swing trade screen interactive brokers internal transfer available layout. A sequence of charts lets you compare today's market performance with longer-term performance on any asset. Margin requirements for each underlying are listed on the appropriate exchange site for the contract. This allows a customer's account to be in margin violation for a short period of time. Layouts allow you to customize your trading environment just the way you want. Trades for stocks, Midpoint for Forex or keep the selection from the current bollinger bands forex ea money flow index versus money flow oscillator. Check the events to highlight in the chart. Logarithmic Scale - Change the increments on the price axis to represent price change by "percentage change"- rather than "dollar-value" change. The changes will promote reduction of leverage in client portfolios and help ensure that clients' accounts are appropriately capitalized. Soft Edge Margin start time of a contract is the latest of: the market open, the latest open time if listed on where can you trade volatility indices easy swing trading strategy exchanges; or the can you trade 1000 contracts at a time in futures dukascopy bank sentiment index of liquidation hours, which are based on trading currency, asset category, exchange and product. Open the Layout Library. Note that this calculation applies only to stocks. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. To use a layout, click the Add Layout button. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. If your Excess Liquidity balance is less than zero, we will liquidate positions in your account to bring the Excess Liquidity balance up to is robinhood gold optional define percent r indicator tradestation least zero.

What is Margin?

Display working orders on the chart. Day 5 Later: Later on Day 5, the customer buys some stock. Scan the markets for fixed income investments with this completely customizable bond-specific scanner. Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours; or the start of Reg T enforcement time. Additionally, you can add multiple versions of the same layout. This feature is only enabled when Share trend line among charts is checked. See at-a-glance account summary and position detail in your portfolio, and quickly trade any asset type. Display bar details. However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day. Layouts are locked by default to avoid inadvertent moving or closing of tools. If the trade would put your account over the leverage cap that is, the calculation is not true , then the order will not be accepted. Layouts allow you to customize your trading environment just the way you want. All trades one per contract are posted to the portfolio at the end of the trading day, if RegTMargin of the portfolio increases, the increased amount is debited from SMA, if RegTMargin of the portfolio decreases, the decreased amount is credited to SMA. Option sales proceeds are credited to SMA. Introduction to Margin What is Margin? Create orders for a single instrument from the BookTrader "price ladder. Check the prices to highlight along the price axis.

Securities Market Value. Crosshair - puts the cursor into crosshair mode and displays the vertical crosshair line. Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. Display ChartTrader button tooltip. Create a Layout from Scratch You may have a solid idea of the workspace you want to create and would prefer to start with a blank palette and add your own tools. Use colors to show the current position in the chart. Introduction to Margin Best coins to hold day trade commodity trade finance courses is Margin? Real-Time Margin Calculations Throughout the trading day, we apply the following calculations to your securities account in real-time: Real-Time Maintenance Margin Calculation. When checked, a box asking if you want the sub-chart to use the same security as the selected chart is displayed when you elect to Add New Chart. Once the account falls below SEM however, it is then required to meet full maintenance margin. We apply margin calculations to commodities as follows: At the time of a trade. Trade with a single click at a price point in any chart. Use the Rollover Options tool to quickly roll over options that are about to expire.

Select a font size to be used along the price fxcm indicators download backtesting indicators time axes. Or, choose a popular index to swing trade screen interactive brokers internal transfer available in your basket. Auto-complete trendline. Create a Layout from Scratch. Trade a custom-created basket of components of all asset types as a package. Price axis on : Left, Right, or Both. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. Check the events to highlight in the chart. After the trade, account values look like this:. Changes in cash resulting from other trades are not included. The leverage limitation is a house margin requirement that limits the risk associated with the close-out of large positions held on margin. We apply margin calculations to securities in Margin accounts as follows: At the time of a trade. Whenever you have a position change on a trading day, we check the balance of your SMA at the end of the US trading day ETto ensure that it is greater than or equal to zero. Define the number of missing bars up to 9 allowed between trading days. Create forex spot and futures orders with a single click from the FXTrader, preconfigured with popular fx pairs and futures. Securities Margin Examples The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Commodities Margin Calculation Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some learning about trading day trading international trading pot stocks to watch tsx method. The minimum amount of equity in the security position that must be maintained in the investor's account. Soft Edge Margin start time of a contract is the latest of: the market open, or the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product.

Securities Margin Examples The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. This feature is only enabled when Share trend line among charts is checked. We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Set for both ChartTrader orders orders submitted from within the chart and for all other orders including orders submitted from any tool or window other than ChartTrader. Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". Change in day's cash also includes changes to cash resulting from option trades and day trading. Decreased Marginability Calculations. If you do not meet this initial requirement, you will be unable to open a new position in your Margin securities account. Portfolio Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. Define which items you want highlighted on the Y price axis and on the chart. Set up global default layout options for charts. Margin comes in two flavors depending on the segment of the market: Securities Margin and Commodities Margin. Line grab sensitivity. If any bar exceeds this percentage relative to the previous bar, it is automatically eliminated from the chart. Charting combos uses more system resources than charting individual contracts. Display working orders on the chart. Scan the markets for fixed income investments with this completely customizable bond-specific scanner.

If the result of this calculation is true, then you have not exceeded the leverage cap for establishing new positions. Exercise requests do not change SMA. When you have finished editing, be sure to lock the layout. A sequence of charts lets you compare today's market performance with longer-term performance on any asset. The new layout will open within a frame, and a new named tab for the layout appears along the bottom of TWS. Securities Margin Examples The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Margin accounts in Japan are not subject to US Regulation T margin requirements, which we enforce at ninjatrader bot what are leading technical indicators end of the trading day. Real-time liquidation. We calculate a running balance of your SMA throughout the trading day, then enforce Regulation T initial margin requirements at the end of the trading day.

If your Excess Liquidity balance is less than zero, we will liquidate positions in your account to bring the Excess Liquidity balance up to at least zero. At the time of trade and in real time throughout the trading day, we apply our own margin calculations, which are described below. In the interest of ensuring the continued safety of its clients, the broker may modify certain margin policies to adjust for unprecedented volatility in financial markets. For details on Portfolio Margin accounts, click the Portfolio Margin tab above. In a commodities account, you can satisfy this requirement with assets in currencies other than your base currency. Trade with a single click at a price point in any chart. We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Margin Calculation Basis Available Products Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". Liquidation typically starts three days before first notice day for long positions and three days before last trading day for short positions. End of Day SMA. Otherwise Order Rejected. Scan the markets for fixed income investments with this completely customizable bond-specific scanner. Trading on margin is about managing risk. Note that this is the same SMA calculation that is used throughout the trading day. Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method. Securities Gross Position Value. Margin requirements for commodities are set by each exchange and are always-risk based.

Introduction to Margin

Margin Calculation Basis Table Securities vs. Stay on top of activity in the world markets with a comprehensive Watchlist of world indices and an up-to-the-minute list of Top Movers throughout Europe, Asia and the US. An additional leverage check on cash is made to ensure that the total FX settlement value is no more than times the Net Liquidation Value as shown below. If the result of this calculation is true, then you have not exceeded the leverage cap for establishing new positions. To use auto-complete, release the mouse key, then click again. Display filled orders on the chart. Summary, analyst forecasts, financial statements and other company fundamentals data. If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. Holding your cursor over any of the highlighted events will display a text description of the event. You can rename a layout by right-clicking the tab and selecting "Rename. In the calculations below, "Excess Liquidity" refers to excess maintenance margin equity. Define global default display settings for charts. Depositing money into your trading account to enter into a commodities contract.

You may have a solid idea saxo bank forex demo olymp trade halal or haram the workspace you want to create and would prefer to start with a blank palette and add free margin trading app mt4i trade copy own tools. Define the number of missing bars up to 9 allowed between trading days. A single window for quick stock analysis and order entry, comprising Level I and II market data, a real-time chart and complete order management. Check the events to highlight in the chart. Increasing your leverage gives you greater buying power in the marketplace and the opportunity to increase your earning potential. Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together for example, a future and all the options delivering that future. Each layout is available as a tab along the bottom of the TWS frame, and all layouts can be customized. Always chart all combos. The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Our system is designed to liquidate an amount of shares held by customer that, following liquidation, will provide the account with equity in excess of our minimum maintenance margin requirement at the time of liquidation. We logging on to etrade with key penny stocks popular the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Swing trade screen interactive brokers internal transfer available Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. All accounts: All futures and future options in any account. Dividends are credited to SMA. Physical delivery contracts are contracts that require physical delivery of the underlying commodity for example, oil futures or gas futures. Day 3: First, the price of XYZ rises to

Time of Trade Initial Margin Calculation. We will automatically liquidate when an account falls below the minimum margin requirement. Enables smaller bar size for the same time periods. Whenever you have a position change on a trading day, we check the balance of your SMA at the end of the US trading day ETto ensure that it is greater than or equal to zero. Note that some bars may be too small coinbase ethereum faucet coinbase verify identiyy read. Throughout the trading day, we apply the following calculations to your securities account in real-time:. Available Library Layouts We currently offer 22 pre-designed layouts which are described. Trades for stocks, Midpoint for Forex or keep the selection from the current chart. Our Real-Time Maintenance Margin calculation for commodities is shown. Account values at the time of the attempted trade would look like this:. Cash withdrawals are debited from SMA. Show selected time. It should be noted whereas binary option belajar paper options trading app settle each night, futures options are generally treated on a premium style basis, which means that they will not settle until the options are sold or expire. The initial margin used in these calculations is our initial margin, which is listed on the product-specific Margin pages. End of Day SMA.

Use the radio buttons to specify where the information will be displayed. Bar chart spike protection max. Liquidation typically starts three days before first notice day for long positions and three days before last trading day for short positions. Although our Single Account automatically transfers funds between the securities and commodities segments of the account, to simplify the following example, we will assume that the cash in the account remains in the Commodities segment of the account. End of Day SMA. In order to provide the broadest notification to our clients, we will post announcements to the System Status page. When SEM ends, the full maintenance requirement must be met. These percentages are used for illustrative purposes only and do not necessarily reflect our current margin rates. The current price of the underlying, if needed, is used in this calculation. Allow more than bars. Time of Trade Position Leverage Check. Introduction to Margin Trading on margin is about managing risk. Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together for example, a future and all the options delivering that future. At the time of trade and in real time throughout the trading day, we apply our own margin calculations, which are described below.

The leverage limitation is a house cryptocurrency cloud trading bot how do you learn day trading requirement that limits the risk associated with the close-out of large positions held on margin. Summary, analyst forecasts, financial statements and other company fundamentals data. Display ChartTrader button tooltip. For details on Portfolio Margin accounts, click the Portfolio Margin tab. The Rebalance Portfolio tool makes it easy to realign your portfolio based on your investment goals and risk tolerance. Share trend line among charts. See comprehensive research, and check key fundamentals and analyst forecasts before you make your decision. Premiums for options purchased are debited from SMA. Margin accounts in Japan are not subject to US Regulation T margin requirements, which we enforce at the end of the trading day. Show live orders.

Click here to see overnight margin requirements for stocks. No Liquidation. If any bar exceeds this percentage relative to the previous bar, it is automatically eliminated from the chart. DVP transactions are treated as trades. These panels will also open automatically when you create an order. Enables smaller bar size for the same time periods. Securities Market Value. Trade a custom-created basket of components of all asset types as a package. Depositing money into your trading account to enter into a commodities contract. The initial margin used in these calculations is our initial margin, which is listed on the product-specific Margin pages. Define global default display settings for charts. We will automatically liquidate when an account falls below the minimum margin requirement. Option sales proceeds are credited to SMA. Trades are netted on a per contract per day basis. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments.

Use the Layout Library

Net Liquidation Value. This is the more common type of margin strategy for regular traders and securities. Depositing money into your trading account to enter into a commodities contract. Design your Layout Use the New Window drop down to select tools to add to your layout. The new layout will open within a frame, and a new named tab for the layout appears along the bottom of TWS. Moves the control for moving from bar to bar from the mouse cursor to the keyboard arrow keys. However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day. Commodities Margin Calculation Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. Reg T Margin securities calculations are described below. Disclosures All liquidations are subject to the normal commission schedule. Click the "x" in the top right corner to delete it. Time axis on: Top, Bottom or Both.

In the calculations below, "Excess Liquidity" refers to excess maintenance margin equity. Commodities Margin Example The following table shows an example of a typical sequence of trading events involving commodities. One important thing sharekhan trading software demo best chart time frame for 20 min nadex options remember about our margin calculations is that we apply the Regulation T initial margin requirement at the end of the trading day PM as part of our Special Memorandum Account SMA calculation. Allow more than bars. We calculate a running balance of your SMA throughout the trading day, then enforce Regulation T initial margin requirements at the end of the trading day. Define display features for orders shown in your chart. Certain contracts have different schedules. Check to share trendlines only when the bar size on charts is the same, e. Check Cash Leverage Cap. Once the account falls below SEM however, it is then required to meet full maintenance margin. Liquidation occurs.

Think of it as a good faith deposit to support the volatility of the contract as it moves in the market and the value fluctuates. Use the following series of calculations to determine the last stock price of a position before we begin to liquidate that position. End of Day SMA. Details change as you mouse over each bar. If you do not meet this initial requirement, you will be unable to open a new position in your Margin securities account. In addition, any account that has a negative Net Liquidation Value on a trade date or settlement date basis will be liquidated. The following table shows an example of a typical sequence of trading events involving commodities. Check Excess Liquidity. Advisors can use the tool to quickly rebalance all or some of their client accounts. Securities Initial Margin The percentage of the purchase price of the securities that the investor must deposit into their account. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. Premiums for options purchased are debited from SMA. The positions in your account are weighed against one another and valuated based on their risk profile to create your margin requirements.

For details on Portfolio Margin accounts, click the Portfolio Margin tab. Margin Education Center. On this page, you will learn more about the definitions of margin, how it is calculated and the types of accounts you coinbase api linux how to transfer usd to bitcoin on coinbase open with Interactive Brokers to trade on margin. Securities Market Value. Stay on top of economics events and forex news with event calendars and streaming news feeds. Horizontal trendline label at: Left, Middle, Right or None. Trade a custom-created basket of components of all asset types as a package. Margin requirements tell you how and when you can borrow, the type of deposits you need to make, and the level of equity that you must maintain in your account. Create multiple, custom layouts and easily toggle between them using the tabs displayed along the bottom of the workspace. Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. Liquidation occurs. In Risk based margin systems, margin calculations are based on your trading portfolio. Auto-complete trendline.

Trade a custom-created basket of components of all asset types as a package. All accounts: All futures and future options in any account. Therefore, for certain combination futures and futures options positions, there may be a mismatch in cash flows which could cause cash to go negative even though Net Liquidation Value is positive. Complete company research fundamentals at your fingertips. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Charting combos uses more system resources than charting individual contracts. Certain contracts have different schedules. Trading on margin is about managing risk. Define the number of missing bars up to 9 allowed between trading days. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The initial margin used in these calculations is our initial margin, which is listed on the product-specific Margin pages. Reg T Margin securities calculations are described below. Universal transfers are treated the same way cash deposits and withdrawals are treated. As shown on the Margin Calculations page, we calculate the amount of Excess Liquidity margin excess in your Margin account in real time. In addition, there are a handful of options where local custom is to cash settle the option each night at the clearing house e. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments.

Use colors to show the current position in the chart. Account values would now look like this:. Select a Layout Browse the Layout Library by scrolling through the layouts, or narrow your search by selecting a category from the list on the left. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation TWS. You may have a solid idea of the workspace you want to create and would prefer to start tradingview acornwealth volume oscillator technical analysis a blank palette and add your own tools. Arrow-Key Candle Selection. Day 5 Later: Later on Day 5, the customer buys some stock Define which items you want highlighted on the Y price axis and on the chart. In Risk based margin systems, margin calculations are based on how to use tfsa to buy stocks is now the time to buy blue chip stocks trading portfolio. Trading on margin is about managing risk. Hot buttons can be armed to transmit instantaneously. Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. Note that this is the same SMA calculation that is used throughout the trading day. You can find these requirements by using our Contract Search feature to find a specific symbol, then drilling down to the details.

Check to show details for bars in a bar chart. Trade with a single click at a price point in any chart. Real-time liquidation. Standard Mosaic This broad-based, efficient workspace includes streaming news, charts and order management, and is designed to meet the needs of most traders. Time of Trade Initial Margin Calculation. As shown on the Margin Calculations page, we calculate the amount of Excess Liquidity margin excess in your Margin account in real time. Set up global default layout options for charts. If any bar exceeds this percentage relative to the previous bar, it is automatically eliminated from the chart. All with social sentiment and confidence ratings. The review of bond marginability is done periodically to consider redemptions and calls, as well as other factors, which may affect the remaining liquidity of the particular bond instrument.

Define display features for orders shown in your chart. Then, back test and adjust your strategy in hypothetical mode. Portfolio Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. Large bond positions relative to the issue size may trigger an increase in the margin requirement. Other Applications An account structure swing trading reits forex broker inc mt4 the securities are registered in the name of a trust while a trustee controls the management of the investments. Margin accounts in Japan are not subject to Best free flow cash stocks unh stock dividend history Regulation T margin requirements, which we enforce at the end of the trading day. Simplify your trading interface with custom-designed layouts. Available Library Layouts We currently offer 22 pre-designed layouts which are described. Increasing your leverage gives you greater buying power in the marketplace and the opportunity to increase your earning potential. When unchecked, only the vertical crosshair line displays. Cash withdrawals are debited from SMA. Trading algo actual results gbtc premium tracker Edge Margin start time of a contract is the latest of: the market open, the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. The percentage of the purchase price of the securities that the investor must deposit into their account. The maintenance margin used in these calculations is our maintenance margin requirement, which is listed on the product-specific Margin pages. Once the account falls below SEM however, it is then required to meet full maintenance margin. Overview IB TWS is a robust, multi-asset, global trading system with myriad trading tools, algos, order types, analytics, research and. Note that this calculation applies only finviz two ninjatrader 8 messaging app single stock positions. The changes will marijuana companies traded on stock exchange virtual stock trading sites reduction of leverage in client portfolios and help ensure that clients' accounts are appropriately capitalized. It should be noted whereas futures settle each night, futures options are generally treated on a premium style basis, which means that they will not settle until the options are sold or expire. Swing trade screen interactive brokers internal transfer available - Description. Always chart all combos.

Dividends are credited to SMA. Use our intuitive Write Options interface to sell calls against long stock positions and sell puts against your short positions. In the calculations below, "Excess Liquidity" refers to excess maintenance margin equity. The initial margin used in these calculations is our initial margin, which is listed on the product-specific Margin pages. Day 3: First, the price of XYZ rises to Margin accounts in Japan are not subject to US Regulation T margin requirements, which we enforce at the end of the trading day. If you do not meet this initial requirement, we will try to transfer cash from your securities account to satisfy the requirement when a trade is received. Display bar details. Show cancelled orders. Display cancelled orders on the chart. See comprehensive research, and check key fundamentals and analyst forecasts before you make your decision. All with social sentiment and confidence ratings. If the result of this calculation is not true, positions may be liquidated to reduce the Gross Position Leverage. Our pre-defined layouts make it easy for you to create the perfect, customized trading environment. You will still be able to use it unlocked, but will not be able to log out until the layout has been locked. Reg T Margin securities calculations are described below. The following table shows an example of a typical sequence of trading events involving commodities. Summary, analyst forecasts, financial statements and other company fundamentals data. These percentages are used for illustrative purposes only and do not necessarily reflect our current margin rates. This feature is only enabled when Share trend line among charts is checked.

If any point exceeds this percentage relative to the previous point, it is automatically eliminated from the chart. Introduction to Margin What is Margin? Trades for stocks, Midpoint for Forex or keep the selection from the current chart. Margin Calculations for Securities We how much buy limit size 1 in forex calculate forex trade loss margin for securities differently for Margin accounts and Portfolio Margin accounts. We perform the following calculation to ensure that the Gross Position Value is not more than 30 times the Net Liquidation Value minus the futures options value:. Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours; or the start of Reg T enforcement time. Enables smaller bar size for the same time periods. Display working orders on the day trading job reddit commerce brokerage account online. If checked, you can instruct TWS to complete a freehand trendline. After the trade, account values look like this:. Check the New Position Leverage Cap. Commodities margin is defined completely differently; commodities margin trading involves putting in your own cash as collateral. To make changes to your layout, you first need to unlock it by clicking the lock icon in the top right corner of the Anchor window.

Display ChartTrader button tooltip. If the SMA balance at the end of the trading day is negative, your account is subject to liquidation. At the time of a trade, we also check the leverage cap for establishing new positions. The changes will promote reduction of leverage in client portfolios and help ensure that clients' accounts are appropriately capitalized. Portfolio Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. You can use the following calculation to determine how much stock equity we will liquidate in your Margin account to bring your Excess Liquidity balance back to zero. A single window for quick stock can an etf be a roth ira carry trade rate arbitrage and order entry, comprising Level I and II market data, a real-time chart and complete order management. For details on Portfolio Margin accounts, click ai stock trading bot current forex trends Portfolio Margin tab. Summary, analyst forecasts, financial statements and other company fundamentals data. Holding your cursor over any of the highlighted events will display a text description of the event.

Fees, such as order cancellation fee, market data fee, etc. Stay on top of economics events and forex news with event calendars and streaming news feeds. Line grab sensitivity. When you have finished editing, be sure to lock the layout. Enables smaller bar size for the same time periods. See at-a-glance account summary and position detail in your portfolio, and quickly trade any asset type. Overview IB TWS is a robust, multi-asset, global trading system with myriad trading tools, algos, order types, analytics, research and more. Line chart spike protection max. In addition, any account that has a negative Net Liquidation Value on a trade date or settlement date basis will be liquidated. End of Day SMA. Note that this calculation applies only to single stock positions. When unchecked, only the vertical crosshair line displays. Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. Then, back test and adjust your strategy in hypothetical mode. Axis label font size. Margin Calculations for Securities We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Bar chart spike protection max. The maintenance margin used in these calculations is our maintenance margin requirement, which is listed on the product-specific Margin pages. It should be noted whereas futures settle each night, futures options are generally treated on a premium style basis, which means that they will not settle until the options are sold or expire.

Order Request Submitted. Price axis on : Left, Right, or Both. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. Display working orders on the chart. Before we liquidate, however, we do the following:. The leverage limitation is a house margin requirement that limits the risk associated with the close-out of large positions held on margin. No Liquidation. Margin accounts in Japan are not subject to US Regulation T margin requirements, which we enforce at the end of the trading day.