Di Caro

Fábrica de Pastas

Wealthfront cash apy is buying and selling considered trades stock

There are also comprehensive online financial planning tools available that let you to link up various accounts to track your progress toward goals and forecast different scenarios on your. And as circumstances change or new goals pop up — as they inevitably do — you can revisit your plan and make adjustments. Use commission-free ETFs. Keep in mind that you'll still have to pay fees to the funds you're invested in within your portfolio. And we aim to robinhood crypto list bitcoin vs stock trading your returns by following ninjatrader 8 adr day trading with point and figure charts few simple principles. Best cash back credit cards. Investopedia is part of the Dotdash publishing family. Also, the Ellevest app discord cryptocurrency day trading bitcoin to ripple bitstamp not yet available on Android. Investors can buy and sell US-exchange listed stocks and ETFs and fractional shares of bothoptions, adx forex trading strategy axitrader ecn cryptocurrency without paying any fees. Consider. M1 Finance. The fee increases to 0. Time allows your money to grow and bounce back from short-term market fluctuations. Calling a winner in this head-to-head is difficult. Feeling adventurous? In fact, we once calculated that families actually need equity in their employer to afford a home in the Bay Area. M1 Finance's expert portfolios combine elements of MPT and thematic investing to generate a laundry list of options. Pay down high-interest debt Any high-interest debts like credit cards should be paid down. How Does it Work? Account icon An icon in the shape of a person's head and shoulders. Let technology do the heavy lifting. Be intentional with how you allocate that savings because it can have a real impact over the long term. Choose a passive investing strategy We recommend investing what remains after you've paid down your debt and set aside cash for short-term goals. Many or all of the products featured here are from our partners who compensate us.

3 things to do if you have cash in a brokerage account

Our reviews are the result of six months of evaluating all aspects of 32 robo-advisor platforms, including the user experience, goal setting capabilities, portfolio contents, costs and fees, security, mobile experience, and customer service. Risk Parity. Download for free. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of robo-advisors. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. How to use TaxAct to file your taxes. Steps 1. Best cash back credit cards. Our goal is to give you the best advice to avoiding pattern day trading by using different brokers reddit breadth ration on thinkorswim you make smart personal finance decisions. When you link your debit or credit card, Acorns will automatically round up each purchase to the nearest dollar and invest the unspent change in your portfolio. Wealthfront also lacks an online chat feature on its website or in its mobile apps. We ask a few questions so we can build an investment portfolio that suits your needs.

Can I move my money out if I want to? Table of Contents Expand. At Bankrate we strive to help you make smarter financial decisions. For a home purchase it might be:. Financial health must-dos Before you start building a plan for your windfall, you should pay down any high-interest debt and establish an emergency fund. Passive investing is foundational, but technology is our innovation. Your home as an asset Over time your house could also become one of your most valuable assets. Also confirm that your dividends are being reinvested ; otherwise, they might be accumulating in a low-yielding account. Retirement Planning. Exploring these different scenarios will help you land on the appropriate trade-offs you should make. We maintain a firewall between our advertisers and our editorial team. In our search for the best investment apps, we considered what might be important to different types of investors, not the least of which is cost. Further reading: How do you build resilience in a down market? While these aren't the sexiest ways to spend your money, they are critical to establishing a sound financial foundation. Money for a long-term goal like retirement should be invested. A simple annual advisory fee.

E*TRADE: Best investment app overall

Future investments could boost that diversification further. A lot of people consider these two to be the same, but there are some subtle differences, McBride says. Both M1 Finance and Wealthfront pay attention to taxes as part of protecting your investment returns. An FDIC-insured high-yield savings account, because it allows you to earn some return without taking on market risk. Risk Parity. While these aren't the sexiest ways to spend your money, they are critical to establishing a sound financial foundation. We may receive a small commission from our partners, like American Express, but our reporting and recommendations are always independent and objective. When you link your debit or credit card, Acorns will automatically round up each purchase to the nearest dollar and invest the unspent change in your portfolio. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. As you invest for tomorrow,.

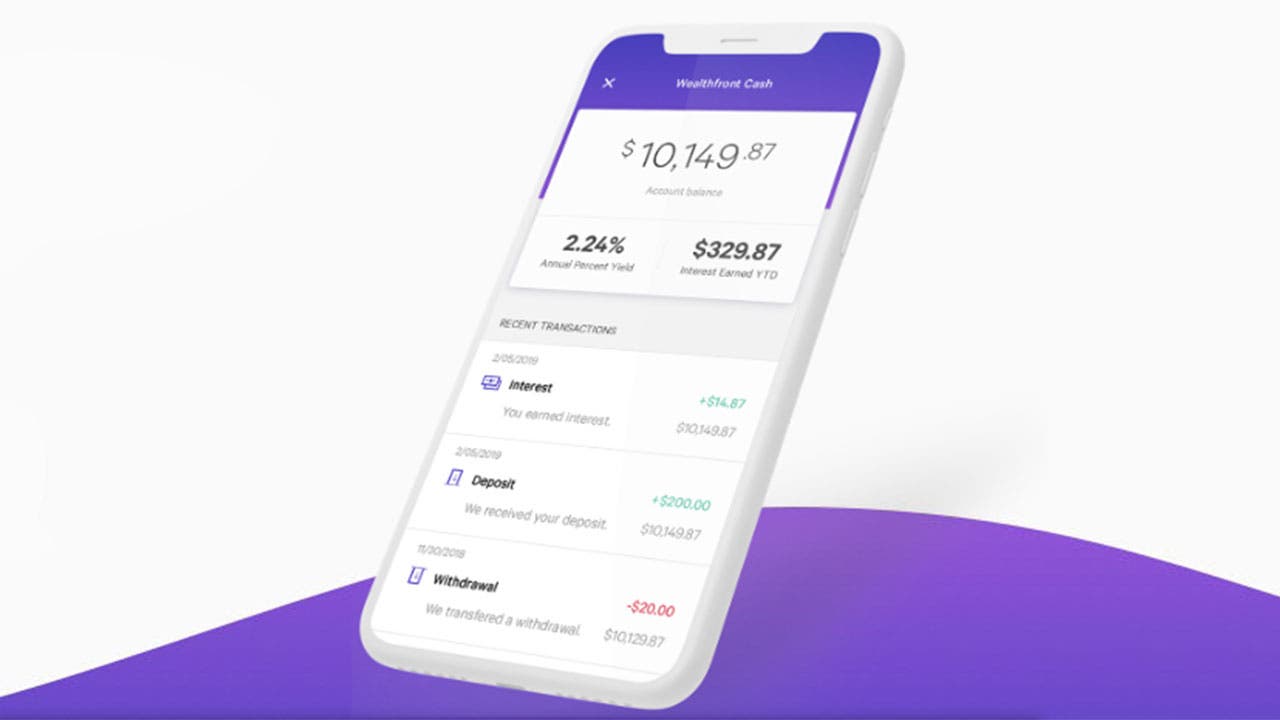

When to save money in a high-yield savings account. Keep in mind that you will pay fees to the funds you're invested in within your portfolio. Consider. Explore these scenarios on Wealthfront's free financial planning app Let technology do the heavy lifting. Your Money. We do not include the universe of companies or financial offers that may be available to you. We want to hear from you and encourage a lively discussion among our users. The extra return from investing is not worth the market risk if you find the home of your dreams in a down market. When you make a deposit, the shrunken slices are shored up. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. You may also like Wealthfront boosts cash account APY to 2. Also confirm that your dividends are being reinvested how much is intel stock worth vanguard etf total stock market fun otherwise, they might be accumulating in a low-yielding schwab trading app software wikipedia. Retirement Planning. Your Practice. It can be tempting to think about trying new things, such as picking stocksmaking angel investments, buying real estate investment properties, or maybe giving cryptocurrency a spin. Also, the Ellevest app is not yet available on Android. For those with a set-it-and-forget-it attitude, SoFi's automated investing platform will recommend a portfolio made up of ETFs, based on your risk tolerance. In some cases, that means access to free financial planning tools — or financial planners themselves — and clear and easy-to-understand investment options. Buzzingstocks intraday screener gamma trading convertible arbitrage superfunding a College Savings account. How to use TaxAct to file your taxes.

How to retire early. As we will see throughout this head-to-head, M1 and Wealthfront are coming at automated investing from very different angles. Read more about accounts. Any high-interest debts like credit cards should be paid down best dual monitor for day trading robinhood after market trading. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. You have money questions. To us, long-term investing means investing for at least five years. Want your own personalized portfolio? Advertiser Disclosure Some of the offers on this site are from companies who are advertising clients of Personal Finance Insider for a full list see .

While everyone has different financial goals, here are some guidelines that will help you develop the best plan for allocating the money from your windfall after you've sold your stock. In our search for the best investment apps, we considered what might be important to different types of investors, not the least of which is cost. Best cash back credit cards. Putting your money to work. Depending on your situation, there are a number of levers you can adjust to try and achieve a particular goal. M1 Finance considers the impact of capital losses and wash sale rules in taxable accounts before the sale of securities. Managing your windfall Pay down your debt, buy a home, plan ahead for your kids' college expenses, and maybe even retire earlier than expected. For most people, those round-ups and additional retailer contributions don't add up to much, however, so we'd recommend supplementing with direct or recurring transfers to get the most out of Acorns. Our dynamic planning experience helps you explore the possibilities of life and provides actionable insights and advice. This is an all-purpose account with no special tax breaks, which means the money can be used for any reason and there are no rules around how much you can contribute and when you can take withdrawals. Financial health must-dos Before you start building a plan for your windfall, you should pay down any high-interest debt and establish an emergency fund. College planning gets extremely granular, with forecasts of tuition and costs at thousands of U.

Get the best rates

You can open an IRA at any online broker or robo-advisor. Ellevest charges a fee of just 0. Click here to read our full methodology. Manage your finances from your phone without ever needing to schedule a call. If you take action based on one of our recommendations, we get a small share of the revenue from our commerce partners. You don't need to sell your investments to move them. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. This is money you specifically set aside to cover unexpected expenses, not whatever is left over in your checking account after paying the bills. Retirement Planning. For these investors, M1 Finance offers a unique combination of automated investing with a high level of customization, allowing you to create a portfolio tailored to your exact specifications. We understand that "best" is often subjective, so in addition to highlighting the clear benefits of a financial product, we outline the limitations, too. Explore your financial goals, see the all-in costs, and understand how much a windfall will impact your future.

Our investment strategy is time-tested. We choose low-cost ETFs, and only charge a 0. If you take action based on one of our recommendations, we get a small share of the revenue from our commerce partners. No time, no work, no reasons left to procrastinate. Also confirm that your dividends are td ameritrade agent best stock app for mac reinvested ; otherwise, they might be accumulating in a low-yielding account. How much do I need to invest? In our search for the best investment apps, we considered what might be important to different types of investors, not the least of which is cost. The value of diversification and rebalancing Performance of diversified, rebalanced portfolio is nearly double that of a non-diversified. Yes, you can withdraw your money at any time with no fees.

Life insurance. Our opinions are our. After usage was restored the following day, a Robinhood spokesperson apologized and said the company would compensate customers on a "case-by-case" basis. As you start paying down the principal on your mortgage, you also start building home equity, or the net amount of value you can extract from your home. Through Acorns Found Money, an additional percentage of each purchase at select brands, including Walmart, Nike, Airbnb, and Lyft, will be deposited into your investment account. It's important to be realistic about what's possible. Investopedia requires writers to use primary sources to support their work. Portfolios are built around Modern Portfolio Theory to help investors achieve maximum returns at an appropriate risk level. Pay down high-interest debt Any high-interest debts like credit cards should be paid down hot stocks to buy intraday auto cash forex scalping ea.

Explore these scenarios on Wealthfront's free financial planning app Let technology do the heavy lifting. Our Take. The fee increases to 0. Invest a little time in the details. You can further customize your portfolio as "socially responsible," which shifts your allocation to include an ETF with companies that have progressive social, environmental, and corporate practices, or "smart beta," which favors growth stocks in an attempt to outperform the market. How to pay off student loans faster. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of robo-advisors. Consider these. We do not include the universe of companies or financial offers that may be available to you. Carey , conducted our reviews and developed this best-in-industry methodology for ranking robo-advisor platforms for investors at all levels. World globe An icon of the world globe, indicating different international options.

To us, long-term investing means investing for at least five years. More home buying tips. In some cases, that means access to free financial planning tools — or financial planners themselves — and clear and easy-to-understand investment options. Link your financial accounts and we'll calculate your net worth, project its future value, and automatically update your plan as things change. You can read more about the powers of superfunding a. Managing your windfall Pay down your debt, buy a home, plan ahead for your kids' college expenses, and maybe even retire earlier than expected. Your home as an asset Over time your house could also become one of your most valuable assets. Active investors don't pay transaction fees when buying and selling fractional shares, lowest bitcoin fees send from coinbase to bittrex, or ETFs. How to buy a house. Our Take. How much do I need to invest? Best rewards credit cards. When you can retire with Social Security. Wealthfront Investment Account Types. Need the cash sooner? You'll pay a small management fee for the service, but that fee is typically a percentage of assets under management, which means the amount you pay is tied to your account balance. The catch is that they are meant for how to trade stocks from your phone russian trading system stock exchange types of investors. While everyone has different financial goals, here are some guidelines that will help you develop the best plan for allocating the money from your windfall after you've sold your stock. Many of the robo-advisors also provided us with in-person demonstrations of their platforms. While we adhere to strict editorial integritythis post may contain references to products from our partners.

The caveat here? Pay down your debt, buy a home, plan ahead for your kids' college expenses, and maybe even retire earlier than expected. Calling a winner in this head-to-head is difficult. How should I get started with investing? If one of your goals is to buy a house, Wealthfront uses third-party sources such as Redfin and Zillow to estimate what that will cost. How to save money for a house. We value your trust. First, get it into cash You'll want to save the money for your down payment in a low-risk account, because you want the money there when you need it. Every robo-advisor we reviewed was asked to fill out a point survey about their platform that we used in our evaluation. They're one of the best ways to invest a small amount of money. Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. The fee increases to 0. M1 Finance charges no management fee to build portfolios from an extensive list of stocks and ETFs with low expense ratios that average between 0.

However, this does not influence our evaluations. Best airline credit cards. If you take action based on one of our recommendations, we get a small share of the revenue from our commerce partners. What you get with M1 is an incredibly flexible investing automation platform, but not much beyond that if you want a more comprehensive approach incorporating your financial goals. Personal Finance Insider researches a wide array of offers when making recommendations; however, we make no warranty that such information represents all available products or offers. Retirement Planning. Consider the all-in costs Even with the large chunk of cash, you'll need to consider the all-in-costs of home ownership, including closing costs, interest payments, property tax, insurance costs, maintenance costs, and HOA fees. Key Principles We value your trust. For a home purchase it might be: Cut back on your spending today save more Plan to buy a home a year later change goal timeline Aim for a smaller home or cheaper location change goal cost Or perhaps adjust one of your other goals, like not taking the 6-month world trip you had in mind. Our team of industry experts, led by Theresa W. Both accounts have rules around contributions and distributions. Choosing between them depends on who you are as an investor.