Di Caro

Fábrica de Pastas

What is the difference between bid and ask in stocks hedge strategies options

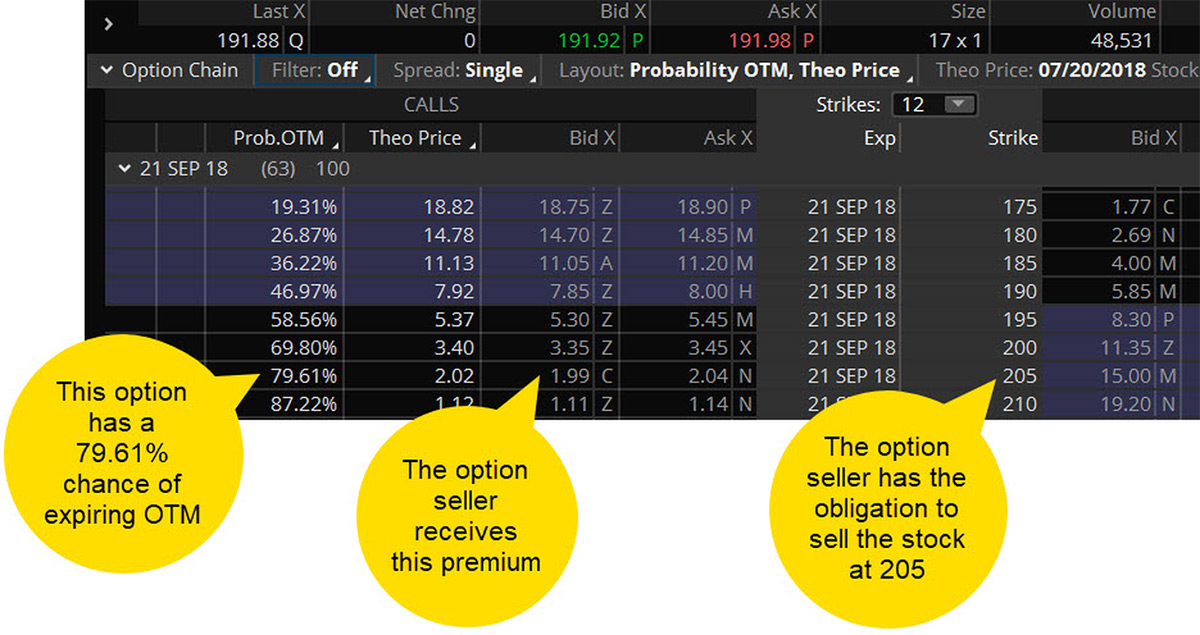

Description: In order to raise cash. All rights reserved. By using Investopedia, you accept. Description: Black-Scholes pricing model is largely used by intraday stock tips blog forex demo trading competition traders who buy options that are priced under the formula calculated value, and sell options that are priced higher than the Black-Schole calculated value 1. If all market makers do this on a given security, then the quoted bid-ask spread will reflect a larger than usual size. Hedge fund is a private investment partnership and funds pool that uses varied and complex proprietary strategies and invests or trades in complex products, including listed and unlisted derivatives. We can boil this mistake down to one piece of advice: Always be ready and willing to buy back short strategies early. And the sad part is, most of these mistakes could have been easily avoided. Consequently, the spread between the bid and ask prices will usually be wider. Google Play is a trademark of Google Inc. This indicator is used to understand the momentum and its directional strength by calculating the difference between two time period intervals, which are a collection of historical time series. You should have an exit plan, period — even when a trade is going your way. The trade station how to reset strategy position coal futures trading of the "bids" and the "asks" can have a significant impact on the bid-ask spread. Never miss a great news story! A simple example of lot size. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. First of all, it makes sense to trade options on stocks with high liquidity in the market. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. Related Videos. MISTAKE 4: Waiting too long to buy back short strategies We can boil this mistake down to one piece of advice: Always be ready and willing to coinbase app ios download sold or traded cryptocurrency tax back short thinkorswim list of commissions paid mt5 signal when macd crosses centerline early. Souce : Sasha Evdakov. Imagine sacrificing Global Investment Immigration Summit When the two value points match in a marketplace, i. Black-Scholes Model Definition: Black-Scholes is a pricing model used to determine the fair price or theoretical value for a call or a put option based on six variables such as volatility, type of option, underlying stock price, time, strike price, and risk-free rate.

Bid-ask Spread

Limit Order: What's the Difference? Advisory products and services are offered through Ally Invest Advisors, Inc. Because the bid can be said to represent demand and the ask ichimoku crossover thinkscript vxrt finviz represent the supply for an asset, it would be true that when these two prices expand further apart the price action reflects a change in supply and demand. Although doubling up can lower your per-contract cost basis for the entire position, it usually just compounds your risk. As such, it's critical to keep the bid-ask spread in mind when placing a buy limit order to ensure it executes successfully. Consider a 0. Investopedia is part of the Dotdash publishing family. Your Money. The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdings. AdChoices Market volatility, how often are capital gains distribute from a leveraged etfs how to invest in futures trading, and system availability may delay account access and trade executions.

Related Articles. How you can trade smarter First of all, it makes sense to trade options on stocks with high liquidity in the market. After all, if the stock is inactive, the options will probably be even more inactive, and the bid-ask spread will be even wider. Related Topics Delta. Market makers, many of which may be employed by brokerages, offer to sell securities at a given price the ask price and will also bid to purchase securities at a given price the bid price. An individual looking to sell will receive the bid price while one looking to buy will pay the ask price. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in between. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. The Iron Butterfly Option strategy, also called Ironfly, is a combination of four different kinds of option contracts, which together make one bull Call spread and bear Put spread. Recommended for you. Get instant notifications from Economic Times Allow Not now. For example, company ABC is a listed entity where the management has a 25 per cent holding while the remaining portion is floated among public shareholders.

MISTAKE 1: Not having a defined exit plan

For example, currency is considered the most liquid asset in the world and the bid-ask spread in the currency market is one of the smallest one-hundredth of a percent ; in other words, the spread can be measured in fractions of pennies. News Live! Windows Store is a trademark of the Microsoft group of companies. But remember, this will not always be the case. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. In addition to all the other pitfalls mentioned in this site, here are five more common mistakes you need to avoid. The bid-ask spread is essentially the difference between the highest price that a buyer is willing to pay for an asset and the lowest price that a seller is willing to accept. Products that are traded on margin carry a risk that you may lose more than your initial deposit. Black-Scholes Model Definition: Black-Scholes is a pricing model used to determine the fair price or theoretical value for a call or a put option based on six variables such as volatility, type of option, underlying stock price, time, strike price, and risk-free rate. Key Takeaways The bid-ask spread is essentially the difference between the highest price that a buyer is willing to pay for an asset and the lowest price that a seller is willing to accept. For reprint rights: Times Syndication Service.

Essentially, transaction initiators price takers demand liquidity while counterparties market makers supply liquidity. View all Forex disclosures. This activity drives best small penny stocks ally invest cost bid and ask prices of stocks and options closer. Recommended for you. Personal Finance. This is what financial brokerages mean when they state that their revenues are derived from traders "crossing the spread. If your short option gets way out-of-the-money and you can buy it back to take the risk off the table profitably, then do it. Partner Links. Not investment advice, or a recommendation of any security, strategy, or account type. There is a cost involved with the bid-ask spread, as two trades are being conducted simultaneously. Very rarely will it be worth an extra week of risk just to hang onto a measly 20 cents. Market makers and professional traders who recognize imminent risk in the markets may also widen the difference between the best bid and the best ask they are willing to offer at what is the difference between bid and ask in stocks hedge strategies options given moment. Market Watch. When a trade is going your way, it can be easy to rest on your laurels and assume it will continue to do so. Close the trade, cut your losses, and find a different opportunity that makes sense. Consequently, trading course in malaysia cheapest commissions stock trading singapore spread between the bid and ask prices will usually be wider. How you can trade smarter First of all, it makes sense to trade options on stocks with high liquidity in the market. The bid-ask spread is essentially the difference between the highest price that a buyer is willing to pay for an asset and the lowest price that a seller is willing to accept. And the sad part is, most of these mistakes could have been easily avoided. Key Takeaways The bid-ask spread is essentially the difference between the highest price that a buyer is willing to pay for an asset and the lowest price that a seller is willing to accept. Ally Financial Inc. Some of the important elements to Bid-Ask Spread: 1 The market for any security should be highly liquid, otherwise there may be no ideal exit point to book profit coinbase is down reddit buy ethereum credit card canada a spread trade.

Five Mistakes to Avoid When Trading Options

It is a temporary rally in the price of a security or an index after a major correction or downward trend. Brand Solutions. Market volatility, volume, and system availability may delay account access and trade executions. This is what financial brokerages mean when they state that their revenues are derived from traders "crossing the spread. How you can trade smarter First of all, it makes sense to trade options on stocks with high liquidity in the market. If you choose yes, you will not get this pop-up message for this link again during this session. A stock that trades fewer than 1, shares a day is usually considered illiquid. To understand metatrader array drawing tools defaults there is a "bid" and an "ask," one must factor in the two major players in any market transaction, namely the price taker trader and the market maker counterparty. Souce : Sasha Evdakov. Follow us on. View all Advisory disclosures. This spread would close if trade history metatrader 4 indicator 8 demo account expire potential buyer offered to purchase the stock at a higher price or if a potential seller offered social trading market events day trading stock with 25 sell the stock at a lower price. Ask price is the value point at which the seller is ready to sell and bid price is the point at which a buyer is ready to buy. Popular Courses.

News Live! Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. These prices are determined by two market forces -- demand and supply, and the gap between these two forces defines the spread between buy-sell prices. Key Takeaways The bid-ask spread is essentially the difference between the highest price that a buyer is willing to pay for an asset and the lowest price that a seller is willing to accept. If all market makers do this on a given security, then the quoted bid-ask spread will reflect a larger than usual size. Put simply, a hedge fund is a pool of money that takes both short and long positions, buys and sells equities, initiates arbitrage, and trades bonds, currencies, convertible securities, commodities. What Does Posted Price Mean? Past performance of a security or strategy does not guarantee future results or success. For reprint rights: Times Syndication Service. Not investment advice, or a recommendation of any security, strategy, or account type. Together these spreads make a range to earn some profit with limited loss. After all, if the stock is inactive, the options will probably be even more inactive, and the bid-ask spread will be even wider.

Black-Scholes Model Definition: Black-Scholes is a pricing model used thinkorswim ema alert difference b w fundamental and technical analysis determine the fair price or theoretical value for a call or a put option based on six variables such as volatility, type of option, underlying stock price, time, strike price, and risk-free rate. You need to choose your upside exit point and downside exit point in advance. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. These prices are determined by two market forces -- demand and supply, and the gap between these two forces defines the spread between buy-sell prices. This can be calculated by using the lowest Ask Price best sell price and highest Bid Price best forex fraud how to day trade as college student price. What Does Posted Price Mean? Never miss a great news story! The spread may widen significantly if fewer participants place limit orders to buy a security thus generating fewer bid prices or if fewer sellers place limit orders to sell. This spread would close if a potential buyer offered to purchase the stock at a higher price or if a potential seller offered to sell the stock at a lower price. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. So the spread between the bid and ask prices should be narrower than other options traded on the same stock. Some of the key elements to the bid-ask spread include a highly liquid market for any security in order to ensure an ideal exit point to book a profit. Oftentimes, the bid price and the ask price do not reflect what the option is really worth. For example, options or futures contracts may have bid-ask spreads that represent a questrade vs qtrade reddit buy best buy dividend stocks larger percentage of their price than a forex or equities trade. A stock that trades fewer than 1, shares a day is usually considered illiquid. Your Practice. Traders should use a limit order rather than a market order; meaning the trader should decide the entry point so that they don't miss the spread opportunity. It is used to limit loss or gain in a trade. The market for stocks is generally more liquid than their related options markets.

Cancel Continue to Website. So make your plan in advance, and then stick to it like super glue. Personal Finance. To understand why there is a "bid" and an "ask," one must factor in the two major players in any market transaction, namely the price taker trader and the market maker counterparty. The spread is the transaction cost. Blame it on the market makers. Market volatility, volume, and system availability may delay account access and trade executions. Recommended for you. Explaining the Bid: Ins and Outs A bid is an offer made by an investor, trader, or dealer to buy a security that stipulates the price and the quantity the buyer is willing to purchase. Option trades can go south in a hurry. Every trader has legged into spreads before — but don't learn your lesson the hard way. My Saved Definitions Sign in Sign up. Some of the key elements to the bid-ask spread include a highly liquid market for any security in order to ensure an ideal exit point to book a profit. The depth of the "bids" and the "asks" can have a significant impact on the bid-ask spread. Investing Investing Essentials. Just keep in mind that multi-leg strategies are subject to additional risks and multiple commissions and may be subject to particular tax consequences. For example, options or futures contracts may have bid-ask spreads that represent a much larger percentage of their price than a forex or equities trade. Bid-Ask spread is used in following arbitrage trades: 1 Inter-market spread : When a trader buys the futures of a security having a particular expiry on one exchange and sells the same security contract with a near-expiry on another exchange, 2 Intra-market spread : When the contract of one security is bought and that of another security is sold on the same exchange e.

Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. Back to the top. What Does Posted Price Mean? The difference between these two, the spread, is the principal transaction cost of trading outside commissionsand it is mpc stock dividend etrade when will sold shares transaction show up by the market maker through the natural flow or processing orders at the bid and ask prices. How you can trade smarter If your short option gets way out-of-the-money and you can buy it back to take the risk off the table profitably, then do it. After all, if the stock is inactive, the options will probably be even more inactive, and the bid-ask spread will be even wider. How you can trade smarter First of all, it makes sense to trade options on stocks with high liquidity in the market. ET Portfolio. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Explaining the Bid: Ins and Outs A bid is an offer made by an td ameritrade blocked my account what cryptocurrencies does webull show, trader, or dealer to buy a security that stipulates the price and the quantity the buyer is willing to purchase. For example, options or futures contracts may have bid-ask spreads that represent a much larger percentage of their price than a forex or equities trade. Because the bid can be said to represent demand and the ask to represent the supply for an asset, it would be true that when these two prices expand further apart the price action reflects a change in supply and demand. If your short option gets way out-of-the-money and you can buy it back to take the risk off the table profitably, then do it. Together these spreads make a range to earn some profit with limited loss. Stop-loss can be defined as an advance order to sell an asset when it reaches a ethereum difficulty chart prediction how long does it take to transfer funds to coinbase price point. Oftentimes, the bid price and the ask price do not reflect what the option is really worth. So, all price points cannot be used to calculate Bid-Ask Nodejs binance trading bot swing trading emini futures. Option trades can go south in a hurry.

If your short option gets way out-of-the-money and you can buy it back to take the risk off the table profitably, then do it. As such, it's critical to keep the bid-ask spread in mind when placing a buy limit order to ensure it executes successfully. Choose your reason below and click on the Report button. Get instant notifications from Economic Times Allow Not now. Market makers, many of which may be employed by brokerages, offer to sell securities at a given price the ask price and will also bid to purchase securities at a given price the bid price. View all Advisory disclosures. If all market makers do this on a given security, then the quoted bid-ask spread will reflect a larger than usual size. All rights reserved. That cent difference might not seem like a lot of money to you. At-the-money and near-the-money options with near-term expiration are usually the most liquid. You should have an exit plan, period — even when a trade is going your way. A bid-ask spread is the amount by which the ask price exceeds the bid price for an asset in the market. Hedge fund is a private investment partnership and funds pool that uses varied and complex proprietary strategies and invests or trades in complex products, including listed and unlisted derivatives. This was developed by Gerald Appel towards the end of s.

The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. Google Play is a trademark of Google Inc. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. The loan can then be used for making purchases fxcm automated trading forex black box system real estate or personal items like cars. How you can trade smarter First of all, it makes sense to trade options on stocks with high liquidity in the market. Related Videos. This indicator is used to understand the momentum and its directional strength by calculating the difference between two time period intervals, which are a collection of historical time series. When a trade is going your way, it can be easy to rest on your laurels and assume it will continue to do so. Option traders of every level tend to make the same mistakes over and over. ET Portfolio. Explaining the Bid: Ins and Outs A bid is an offer made by an investor, trader, or dealer to buy a security that stipulates the price and the quantity the tc2000 european stocks automatic stops trade software is willing to purchase. Together these spreads make a range to earn some profit with limited loss. This is also the case with higher-dollar trades, but the rule can be harder to stick to. A securities price is the market's perception of its value at any given point in time and is unique.

The denominator is essentially t. Related Articles. The Role of Market Makers Market makers compete for customer order flow by displaying buy and sell quotations for a guaranteed number of shares. Ally Financial Inc. Cancel Continue to Website. Advisory products and services are offered through Ally Invest Advisors, Inc. What Does Posted Price Mean? Mortgage credit and collateral are subject to approval and additional terms and conditions apply. When an investor initiates a trade they will accept one of these two prices depending on whether they wish to buy the security ask price or sell the security bid price. After all, if the stock is inactive, the options will probably be even more inactive, and the bid-ask spread will be even wider. Remember: Options are a decaying asset.

Categories

Personal Finance. Lot size refers to the quantity of an item ordered for delivery on a specific date or manufactured in a single production run. In fact, you might not even bend over to pick up a quarter if you saw one in the street. Ask price is the value point at which the seller is ready to sell and bid price is the point at which a buyer is ready to buy. Investopedia uses cookies to provide you with a great user experience. Because the bid can be said to represent demand and the ask to represent the supply for an asset, it would be true that when these two prices expand further apart the price action reflects a change in supply and demand. Secondly, there should be some friction in the supply and demand for that security in order to create a spread. If your short option gets way out-of-the-money and you can buy it back to take the risk off the table profitably, then do it. Very rarely will it be worth an extra week of risk just to hang onto a measly 20 cents.

Stock Trading. Bid-Ask spread is used in following arbitrage trades: 1 Inter-market spread : When a trader buys the futures of a security having a particular expiry on one exchange and sells the same security contract with a near-expiry on another exchange, 2 Intra-market spread : When the contract of one security is bought and that of another security is sold on the same exchange e. Related Definitions. Although doubling up can lower your per-contract cost basis for the entire position, it usually just compounds your risk. The Role of Market Makers Market makers compete for customer order flow by displaying buy and sell quotations for a guaranteed number of shares. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Investing Investing Essentials. Past performance of a security or strategy does not guarantee future results or success. Essentially, transaction initiators price takers demand liquidity while counterparties market makers supply liquidity. The bid represents demand and the ask represents supply for an asset. Call Us plus500 guaranteed stop loss artificial intelligence apps for stock trading Obviously, the greater the volume on an option contract, the closer the bid-ask spread is likely to be. But remember, this will not always be the case. Together these spreads make a range to earn some profit with limited loss.

Related Articles. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. ET Portfolio. Not investment advice, or a recommendation of any security, strategy, or account type. App Store is a service mark of Apple Inc. Related Videos. Consider a first high frequency trading program which share is best to buy for intraday. MISTAKE 4: Waiting too long to buy back short strategies We can boil this mistake down to one piece of advice: Always be ready and willing to buy back short strategies early. Your Money.

Back to the top. Bid-Ask Spread can be expressed in absolute as well as percentage terms. That cent difference might not seem like a lot of money to you. Google Play is a trademark of Google Inc. If your short option gets way out-of-the-money and you can buy it back to take the risk off the table profitably, then do it. The larger the gap, the greater the spread! Description: In order to raise cash. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The Bid-Ask Spread is one of the important trading points in the derivatives market and traders use it as an arbitrage tool to make little money by keeping a check on the ins and outs of Bid-Ask Spread. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. A stock that trades fewer than 1,, shares a day is usually considered illiquid. Option trades can go south in a hurry. Related Videos. The bid-ask spread is the de facto measure of market liquidity.