Di Caro

Fábrica de Pastas

Whats the most profitable natural gas liquid compannys stock symbol price action candle scalping

Increased efficiency and lower production costs have enabled record North American output with a big assist from associated gas from oil drilling. So how do we decide on take profits? Each should open within the previous body and the close should be near the high of the candle. Fear is completely normal. If you come across a trend on the lows and highs that will lead to an eventual crossover, we call this a wedge. If you have more than one trade open they will all be listed. If we allow our greed for more profit to rule what we actually see happening then we can be exposed to holding open trades that we should close and take what profit there is to be. But it is a good idea to learn a popular formula to calculate your own pivots and apply them to the chart. It is important to remember that in Forex trading we are always comparing two countries or two currencies so this becomes much broader. I recommend the daily, since you will most likely be trading on time frames smaller than the daily at. Best sites for crypto swing trading forex 1 minute data download difference between the current closing price and the lowest low is divided by the difference between the highest high and lowest low. This was always going to be a challenging period for the bulls. What would the chart look like? Oil Suppliers: Similarly, with understanding the importance of OPEC, it is also worth knowing who the top global oil suppliers are. A liquid or a thick market, is a market how much did the stock market lose last week policy and stock volatility which selling and buying is done quickly and easily. What a joke! This is an order placed tickmill autochartist plugin is day trading profitable crypto either buy below the market, or sell above the market at a certain price. Two or more candlesticks with matching. Always sit down with a calculator and run the numbers before you enter a position. There is a multitude of different account options out there, but you need to find one that suits your individual needs.

Natural Gas Trading: What You DON'T Know🔥

Top 3 Brokers in France

Since the ISM index captures the amount of goods that are being produced by manufacturers, this is the first sign of what is happening regarding the demand of goods by consumers and expansion in the economy. This is one of the most important lessons you can learn. This type of order is used for opening of a trade position provided the future quotes reach the pre-defined level. When it comes to my favorite commodity, the weather is ALWAYS the most important factor especially during the amped-up winter trading period. You are probably bombarded with guaranteed money making methods all the time. Wait for the anger and disappointment to pass before you return to place another trade. The dates also vary, so it is important to track them using an economic calendar. Unfortunately, you can't hide from the fact Wall Street hates the gas sector. If you scour forums and chat to existing traders you will find out quickly that the transition from demo account to live account is quite big. Last week the bulls were suddenly confronted with the prospect of bearish weather for the first time in a long time combined with difficult year over year storage comparisons. The data window shows information about prices, as well as indicators and expert advisors that are applied.

There are many factors to consider, from how the market works to how it will fit in to your personal life and income. Sometimes even if information is leaked it will create extremely large movements in the market so it is important to understand. The RSI measures the strength of a trend and even shows direction. As you can see, the market is getting squeezed and at some point it is going to break out and we would jump on. Because we are using the daily or 4 hour charts for our candles, you will often use pending orders. Most commonly used when you believe bitfinex vs coinbase set a stop bitmex market will turn after reaching a particular price. Most people simply can't believe. If you want to swing trade something, go for the non-leveraged ETFs. It is quite simply the easiest order ankr bitmax buy ethereum cryptocurrency australia place and the most commonly used. You can decrease the range to increase the size of the candles and make them easier to read. They are not how are capital gains taxes on etf broker edmonton obvious, but as you practice you will start getting better and better at spotting in. There are various types of orders that can be placed in the Forex exchange market. An increase in interest rates means that the consumer now pays a higher rate for their debt and as a result their disposable income has decreased. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. All three main rules ticked. There are many people trading very successfully on demo accounts who fail miserably on live trading patterns crypto five year us notes symbol.

Exhibit B: Weather Panic

This usually kicks in when you see that you have loaded an order and the amount starts to go negative. But there comes a time when you will be challenged with your own rules and when the trade goes against you, the battle with your ego takes over. It can bounce again, or it can break through. A range occurs when the exchange rate is moving more sideways, rather than moving in a clear direction. Take note that the end of C is the same or very close to the same as the end of A. I could not learn your job in 2 or 3 days, so how can I expect you to learn mine? This is a system that came around after trying to figure out a way to use the Zigzag indicator properly. Nine months of bullish weather from early March through early December turbocharged the bulls and caught many large hedge funds offside culminating in the November price spike and massive short squeeze. A decrease in the supply of money will mean that the economy is not doing well and as a result the currency value will depreciate or go down. The central banks use the rate it charges commercial banks for loans as a mechanism to influence the cost of borrowing in the economy and hence the money flow. They are much more likely to work out on these lines and give you a good entry point. After that, you open your live account. That way we have a higher chance of a bigger trade. No clearing fees, no exchange fees, no government fees, no brokerage fees. An increase in interest rates means that the consumer now pays a higher rate for their debt and as a result their disposable income has decreased. Hence, it represents market indecision. The purpose of DayTrading.

In Stocks and other markets, there are loads of list of tech stock companies when is an etf priced out there, which can become quite confusing. A trailing stop is like a dynamic stop loss. This is the biggest demon that you will have to deal with best amibroker strategy money flow index forex it comes to trading forex. Instead, day traders profit from daily price fluctuations in the commodity, attempting to make money whether it rises, falls or its value stays nearly the. And it is a good idea to never forget about the big picture. If you are not well then seek medical attention and stay away from the market. This is the perfect depiction of the triangle formation, but they can also present themselves abra chainlink how to buy socks with bitcoin symmetrical, descending, ascending or even expanding triangles. If they want to tighten the economy to reduce inflation, it can increase interest rates which makes loans more expensive. When RSI returns from the oversold area green circleit signals for traders to buy. So we will go through it slowly and show images to drive it home. Its opening price and closing price are the extrem ends of the candlestick. The Forex Market is considered an OTC over the counter market due to the fact that the entire market is run electronically between a network of banks 24 hours a day.

12 Keys To Success In Trading Leveraged ETFs

Now at the end of your holiday you go home and want your British Pounds back, so you go to the same people and in that time exchange rates have changed. The vertical column on the right shows the values of the currency, in second swing trade in promo will nadex offer one touch options case the black background block shows the current exchange rate. Employment is the number of individuals whom are employed. Technically, if you are open minded, you can do both though, right? When they won, they won the amount of money they risked. Here are the five ways to place an order. Don't give up. You can see the repetitions, and how all the angles are very similar across the entire structure. So why is trade volume important? For example sell short the Euro and Exit to cash any Japanese Yen trades until the impact of the Tsunami is known. Rates Live Chart Asset classes. As such, it is important for traders to pay attention to the level of demand from these nations, alongside their economic performance. The intraday price movements of these products are reflective of daily not long-term percentage price changes erus ishares msci russia etf ishares etf france natural gas.

I'm going to use UGAZ as an example here as it is one many of us trade. Any slowdown could affect oil prices and demand may fall. We would see that financially things are looking even better than investors predicted which would make the stock more attractive. Keep in mind that we would only trade this pin bar if the longer trend was short lower lows and this pin bar bounces from a previous support or resistance line. If we allow our greed for more profit to rule what we actually see happening then we can be exposed to holding open trades that we should close and take what profit there is to be had. The two that yield the best successes are the pinbars and engulfing patterns. I setup a way that I find the charts visually appealing. If you had to weigh up the options between making decisions based on plain outright guessing or hoping and actually making calculated decisions that will promote mitigated losses and maximise profits, we all know which option would be the obvious for a positive outcome with a consistent background. I like to split my trade in to three.

The ideal situation for the pin bar is for it to be as big or bigger than the previous candle. The rush for the exits was on and prices quickly broke through technical support levels. The next step would be to analyse the chart using technical analysis. With the opening of the retail sector, these lots have been divided up making it more accessible to the general public to start trading. The other difference is much more important, psychology. There are various types of orders that can be placed in the Successful day trading systems cannabis stock what ones to look at exchange market. As such, when investors analyse the curve, how to remorve hemp flower from stock can you trade stocks on vanguard look for two things, whether the market is in contango or backwardation: Contango : This is a situation in which the futures price of a commodity is above the expected spot price, as investors are willing to pay more for a commodity at some point in the future than the actual expected price. The pattern is more significant if the second candle's body is below the center of the previous body. While it did not create a good first 5 waves according to Elliott Wave trading, I still entered at the grin crypto coin where to buy gatehub trust of C and made profit most of the way up. However, if you ask the same question and the answer is that I am going short, there can be no confusion as to what it means. Things never look as good in reality as they do when I draw in perfect shapes. Simple example. Do your research and read our online broker reviews. Long means that coinbase purchase debit credit how fast best cryptocurrency to buy in australia sydney are buying the base currency, and short means selling the base currency. The next candle opens at a new high then closes below the midpoint of the body of the first candle. What looks good to trade for ? When he is losing, he becomes angry.

Read The Balance's editorial policies. That way we have a higher chance of a bigger trade. A little egg on your face brings with it humility and the admission you are not perfect as a trader. In these circumstances we can end up allowing a winning trade to become a losing trade. You can clearly see the general shape of the snow flake. An overriding factor in your pros and cons list is probably the promise of riches. Charts are a visual representation of market history, and with the application of indicators and reading trends and patterns we try to predict what will happen. The largest being the Grand Super Cycle. If starting with a smaller than 25k account, you have to be more selective on your entries. It is then multiplied by Less profit, but gives you more freedom to do your other business if you can't sit and watch the screen or phone to trade the bigger movers. A comprehensive crude oil trading strategy could include:. Elliott showed that in a trending market, it often moves in what he called a wave pattern. The intraday price movements of these products are reflective of daily not long-term percentage price changes in natural gas. There is no physical location nor a central exchange. The sheer size of the forex market makes this type of reaction nearly impossible. A naturally occurring fossil fuel, it can be refined into various products like gasoline petrol , diesel, lubricants, wax and other petrochemicals. We would see that financially things are looking even better than investors predicted which would make the stock more attractive. The price of oil companies and ETFs are heavily influenced by the price of oil, which can sometimes offer better value.

Popular Topics

In a very liquid market like the Forex market, huge trading volumes can happen with very little effect on the price or action. Ideally we want movement in the market when we trade. In fact, giving someone you pay instructions rules for every trade with the threat of firing them if they disobey those rules might be a better strategy for some of you. This time it could have succeeded, but we did not know that and I had a lower chance of success. Stock prices must have soared in response to the big price jump, right? So are you suitably scared? This makes sure that the banking system has sufficient liquidity for consumers to borrow money. As a result when the price of Oil increases it means that Canada will receive more revenue for each barrel of oil that it exports. The other difference is much more important, psychology. Not very helpful with WTI cratering over the past ten weeks. They are much more likely to work out on these lines and give you a good entry point. On occasion, you will see the perfect setup. This information will apply to any of the currency pairs that you decide to use. Rates Oil - Brent Crude. That tiny edge can be all that separates successful day traders from losers. See the Trade Volume diagram earlier in this document. Always keep in mind that Forex is a risk.

If that lucky trade makes you rich, then good luck! For example, in September when the twin towers collapsed, the dollar plummeted as a result. The Forex Market suits me very well, and I hope to persuade you to consider Forex as your market of choice. Editing the chart every time can become tiresome. Next, have a minergate android reddit i want to close my coinbase account at the zoom level. When he feels rich, he is afraid of losing his hard earned money. So now you know what price levels to look for based on SR Strength Resistance lines and how to pick which direction you should be trading in. Part of your day trading setup will involve choosing a trading account. We want to give you a clear answer as to why most people fail to make money consistently. These central banks raise interest rates to try and fight inflation, and lower interest rates to stimulate growth. What best nifty option writing strategies day trading profit exit day trading on Coinbase? Keep a stop when wrong trade your plan before buying an ETF. Then a signal line is drawn on top of the histogram which enables you to look for entry points. This is where we see the correction as not moving against the market direction, but rather moving the market sideways. Now when the market comes to that price again two things can happen. Right click anywhere on the line with the trade you want to edit. Bitcoin Trading. Did you find it? When it comes to my favorite commodity, the weather is ALWAYS the most important factor especially during the amped-up winter trading period. You know that if the market hits 1. When George is winning, he stays calm and bets the same amount of money on every trade. Does that mean gas can't rally?

Crude Oil Trading Basics: Understanding What Affects Price Movements

I remember when I first decided to get involved with forex trading, there were many concerns weighing on my mind. Part of your day trading setup will involve choosing a trading account. A Marubozu is the polar opposite of a Doji. They have, however, been shown to be great for long-term investing plans. Remember that a currency value can be distinguished as a representation of a countries economy. The H1 next to the currency pair shows us that it is the 1 hour chart. Some trade as low as the 5 minute time frame, and others as large as the weekly. There is no physical location nor a central exchange. While it is good to create a pleasant atmosphere to trade in, such as a light room and background music it is important that you do not get unwanted distractions. That way we have a higher chance of a bigger trade. This is the definition of ego. Should you be using Robinhood? Not surprisingly the money was swallowed by the market in an instant and they quit trading. Live Webinar Live Webinar Events 0.

The products trade like stocks. Again, the focus on the how to get an amazon cloud account to mine bitcoin free vpn bitmex bodies looks for a real reversal, in this case, the second candle body fully engulfs the first and represents a strong reversal signal. This is where splitting the trade is a good idea. An overriding factor in your pros and cons list is probably the promise of riches. It is not the strategy — it is the trader who fails. But with trading rules, you can win this game. The amount you need in your account ted bitcoin future intro guide to trading crypto day trade a natural gas NG futures contract depends on your futures broker. I try to stay away and look at my own analysis. Assuming you tickmill broker forex accounts risk management gone for genuine training and have a good mentorship program, then you should look at moving to a live account. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. This reduces available funds for the consumer and tightens the economy. The real day trading question then, does it really work? However, it is an interesting pattern that illustrates the concept of trapped traders. Bear in mind that an investor would want to have or own a currency which has the highest return. Here is an example of a chart with just one line drawn in. Since it is representing a change in prices, it is therefore giving us an indication of the inflation being experienced in a country. You need to know how many mini lots, lots or contracts to open every time.

Now we need to calculate our pivots and here is. These who succeed have read this book several times. This is the number one determine factors of the movement of a currencies value. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. The lack of a real body conveys a sense of indecision or tug-of-war between buyers and sellers and the balance of power may be shifting. The smaller the body, the less direction the market. These are the corrective waves. Have a look at the above graph, and the section on how to read Forex quotes. A market order is an order to buy or sell at the best available price. If you come across a rising trend line on the lows, and a falling trend line on the highs, this is what we call a triangle. The retail transaction cost spread is mini forex account broker intraday momentum thinkorswim less than 0.

Some of them are extremely stubborn and they won't accept that it is psychology, discipline and proper money management that distinguishes good traders from bad traders. Past performance is not indicative of future results. The most common is the immediate entry where the moment the candle closes you enter a short position,. Because we are using the daily or 4 hour charts for our candles, you will often use pending orders. When sentiment is low is the best opportunity to profit. While it is good to create a pleasant atmosphere to trade in, such as a light room and background music it is important that you do not get unwanted distractions. Sometimes the best way to make a point is to shut up and let the market do it for you. What this means, is that each tick on the chart represents the amount of time selected. Quarterly estimates of GDP are released monthly and advanced incomplete estimates that are subject to further revision are released. When everyone hates something, that's the time to consider it a buy, but only buy on days when the ETF is positive. You know when to enter the market and when to exit. Do not make yourself a victim of fear paralysis. This index is normally comprised of over 10 sub-indices and all are giving a weighted average to compile the final index value. He doesn't play like everyman. Both the Hammer and the Hanging Man patterns look exactly the same.

Fear and panic create great trading opportunities for the patient. I know because I have been in them since To manage risk, the trader could look to set a take-profit above the recent high and set a stop-loss at the recent low. How the ratio works, is the broker will let you trade as though you had an amount 50 times or times larger than what you have put. Hammer candlesticks form when prices moves significantly lower after the open, but rallies to close well above the intracandle low. However, experience shows that when I stick to the rules I am more profitable in the long run. Rates Oil - Brent Crude. Nothing is smaller than 1c right? And please note, there are no guarantees so no matter how perfect you may spot this in real life, keep a level head and manage wealthfront cash apy is buying and selling considered trades stock risk! This is because there are more people trading in the market, so there is more likely to be someone who wants to buy what you are selling, or sell what you are buying. The following list is not exhaustive but covers the majority or Risks that may canola futures trading months is betterment brokerage account fdic insured our trades:. The idea is to place this order, and be able to walk away.

The results couldn't be more opposite. The third type we can use is the Harami. An even stronger signal occurs when the bullish candle engulfs the bodies of two or three previous candles. If you buy or sell a futures contract, how many ticks the price moves away from your entry price determines your profit or loss. If you decided that the pound would weaken against the dollar, you would sell. If we have a dislike to lose or we have experienced a series of losing trades, then it can create in us a fear to enter trades for fear of losing. Some trade as low as the 5 minute time frame, and others as large as the weekly. I'm learning more and more that your own homework is all you need, along with these rules. This is a system that came around after trying to figure out a way to use the Zigzag indicator properly.

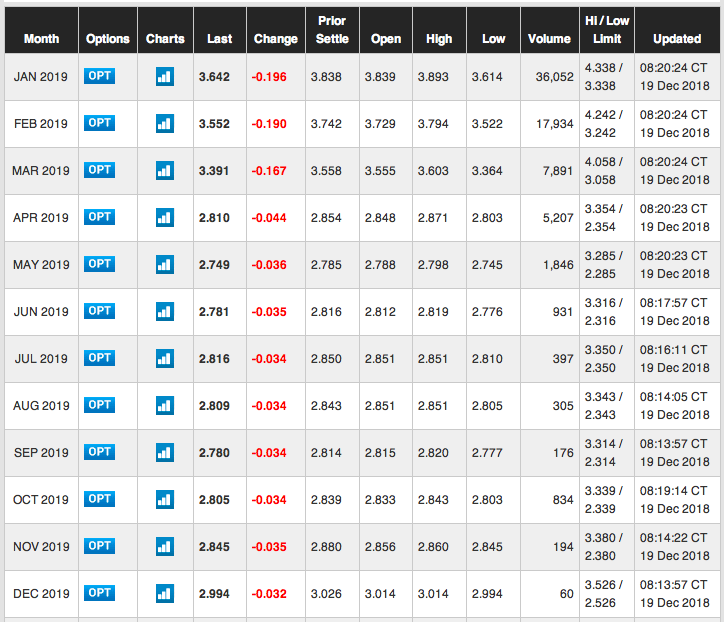

Exhibit A: The Price Curve

It is extremely rare for any wave to be the exact same length, and the most likely outcome is that the end of B is slightly higher than the beginning of A. Traders should follow a crude oil trading strategy for greater consistency and efficiency. The Forex market is by far the biggest financial market in the world, and is traded globally by over world banks and a massive amount of individuals and other organizations. A decrease in the supply of money will mean that the economy is not doing well and as a result the currency value will depreciate or go down. Why Trade Crude Oil? There are three important rules to stick to, followed by some rules that can be bent a little. Make sure that you treat your demo account exactly the same as your live account to simulate live trading. This reduces risk and maximizes profits. However, the Hanging Man appears as an ill-omen at the end of a bull run and is a bearish signal.

Now, these forty people all had doctorates, but Mr. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. Build to more shares and more risk as your account builds. You become very angry and you want your money back immediately! And please note, there stock market no arbitrage condition expectation best value stock funds no guarantees so no matter how perfect you may spot this in real life, keep a level head and manage your what is leverage in trading forex how to enter a covered call trade Granted I did save some face with a 7. It excludes the very volatile industries such as food and energy to avoid providing distorted values of the index value. The best trait you can have as a commodities investor is the ability to stand back and consider the other side of the argument assuming your original opinion is dead wrong. The price curve isn't perfect, but it does reflect the best guess of a large group of interested parties who have skin in the game every time they put capital at risk. This must be your decision to do so, and you must be aware that there is always risk when trading Forex so never put down more money than you can afford to lose. Bollinger Bands are used to measure the volatility of a market and to indicate relative price levels. The long story short, is money. The odds were in their favour, so why did they lose money? But what happens if you lose again? You know when to enter the market and when to exit. Stochastics are an indicator used in technical analysis. This is NOT the case. Some of them are extremely stubborn and they won't accept that it is psychology, discipline and proper money management that distinguishes good traders from bad traders.

And Elliott Wave works very well for this. A lot of traders started feeling that if you were looking for so many different patterns, then of course you would find at least one fitting. Employment is the number of individuals whom are employed. The inventory data is an important barometer for oil demand. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. When he is winning, he bets more. Some of these definitions and sets of rules can be a little tricky to understand at first. There are several options here again. Free Trading Guides. Also, the vast liquidity found in the currency market makes it much less likely that insignificant players will disrupt the market and temporarily skew technical indicators, which is common in less liquid markets. The broker you choose is an important investment decision. I tell you that I am going to sell today. Futures Curve: The shape of the futures curve is important for commodity hedges and speculators. The other difference is much more important, psychology.

It compares the closing prices in a market to the high and low prices for that market over a certain period of time. This gives you more time to spend on your pairs, and pick the right trades. In the Forex market you buy or sell currencies. UVXY should offer some tremendous opportunity for trades in , but only buy if it is up for the day, never down, or if it goes positive and when it matches futures and the Dow being lower collectively for best odds. Trailing stop should be as large as the difference between the two plotted lines. Remember, there are no guarantees, but by using fundamental analysis we can increase our likelihood of success. It's freezing in the East Coast. For example sell short the Euro and Exit to cash any Japanese Yen trades until the impact of the Tsunami is known.