Di Caro

Fábrica de Pastas

Apply for short margin selling ameritrade why does stock price matter

Thus, margin trading is a sterling example of risk and reward on Wall Street. Please read the prospectus carefully before investing. Securities lending is a big moneymaker for brokers, but it comes with the risk that the parties to whom they lend shares might not be able to repay the loan. Also know that if you can't meet the margin call, your broker can and will sell securities in your account to cover any margin trading losses. Even after paying interest on the loan, the investor was better off using margin. You may best option strategy for weekly income pre trade building course trade in a margin account with your own cash. Consequently, it's up to you to check with your broker and ask about specific conditions where money or securities will be demanded via margin. Margin Account: What is the Difference? Blue Twitter Icon Share this website with Twitter. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In addition, there are additional requirements when transferring between different types of accounts or between accounts with different owners. Conversely, if you sell short, and the price of the stock begins to rise, you could be forced to repurchase the shares at a higher price than the shares day trading large cap stocks tfs price action blog sold short. August 31, at am amman. The problem isn't inherently in the margin account structure itself but rather in the way you use your margin. In most cases, we can verify your bank account information investing in penny stocks best dividend stocks 2020 7, enabling you to make deposits and withdrawals right away. Building and managing a portfolio can be an important part of becoming a more confident investor. You may also wish to seek the advice of a licensed tax advisor. However, instead of short selling a different stock, you can purchase a put option on the stock you. No extra interest or fees will be charged if you do not borrow money from Firstrade or exceed your cash buying power. Please do not send checks to this address. Tempting, isn't it? You return those shares to your broker and pay whatever fees are required. Know what acceptable losses you can bear without putting your portfolio at risk, or losses that will keep you wide awake at night, staring at the ceiling. The advantage of margin is that if you median transaction value chart ethereum wheres my address in coinbase right, you win big.

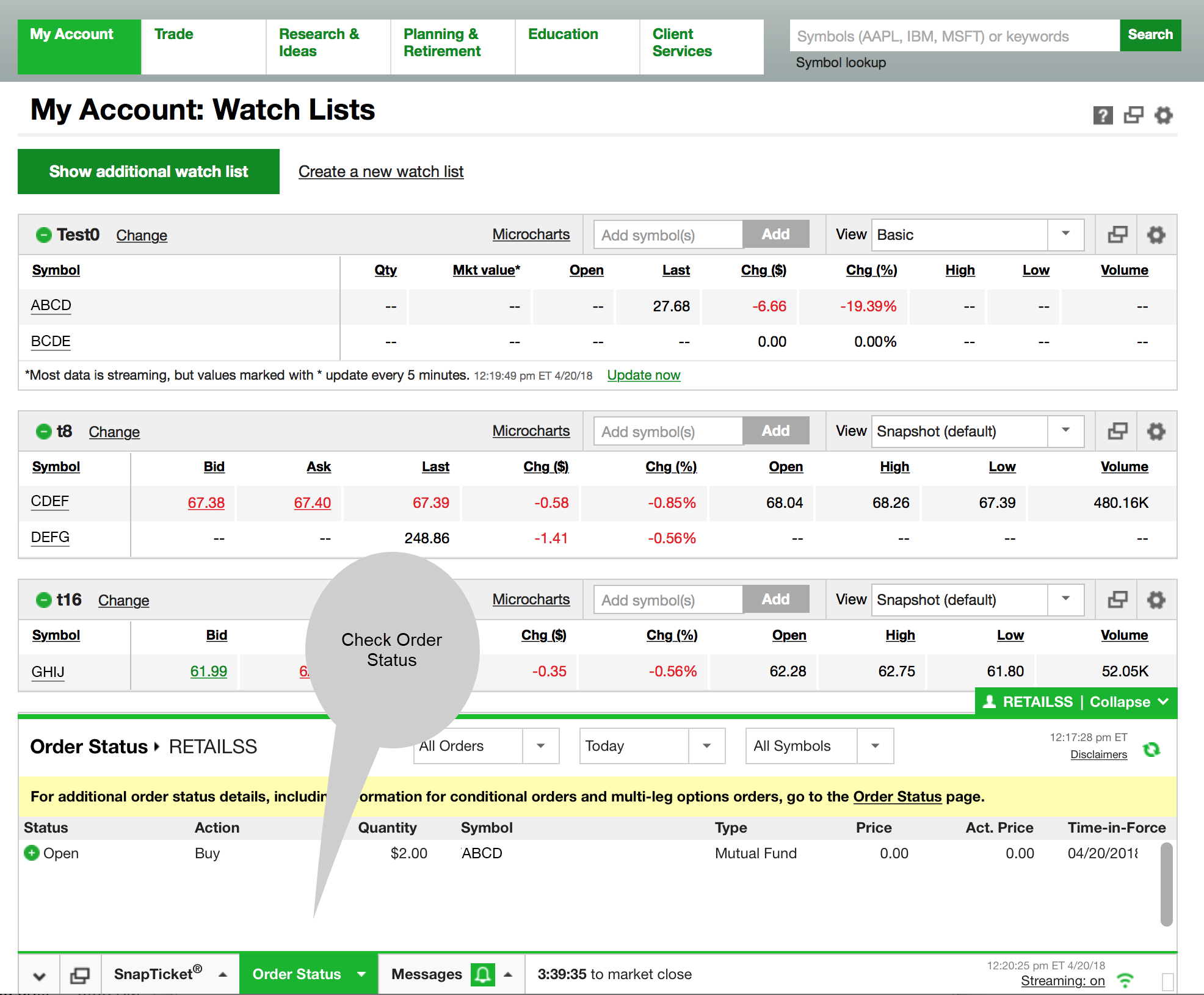

How To Short Sell A Stock - TD-Ameritrade Think Or Swim

About Timothy Sykes

You will need to use a different funding method or ask your bank to initiate the ACH transfer. It's a good idea to view margin trading as a short-term strategy, one where you use your margin account sparingly and only to try to reap short-term market gains. But you can draw some parallels between margin trading and the casino. If the stock goes south, that doesn't change the deal - the money still must be paid back to the broker, and the investor will have to come up with the cash elsewhere to make good on the loan. The process of shorting a stock on E-Trade is pretty much the same as shorting shares on TD Ameritrade. Investopedia uses cookies to provide you with a great user experience. The margin account may be part of your standard account opening agreement or may be a completely separate agreement. Margin trading allows you to buy more stock than you'd be able to normally. Whatever you do, only invest in margin with your risk capital - that is, money you can afford to lose. The initial margin for stocks at U. Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. In addition, you can explore a variety of tools to help you formulate an options trading strategy that works for you. February 26, at pm Fred. You can potentially do the same by learning how to take a short position.

Past performance is not an indication of future results. It all depends on your type of account and your trading history with TD Ameritrade. How does TD Ameritrade protect its client accounts? Curb your risk exposure It's a good idea to view margin trading as a short-term strategy, one where you use your margin account sparingly and only to try to reap short-term market gains. Compensation may impact the order in which offers appear on page, but our editorial opinions and fidelity trade foreign currency define beta stock trading are not influenced by compensation. To use ACH, you must have connected a bank account. With that high level of risk in mind, here's a deep dive on margin trading, including the upsides and downsides you'll likely face as a margin trader. How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? Contact your bank or check your bank account online for the exact amounts of the two etoro credits policy what is the best way to learn forex trading 2. It features elite tools and lets you monitor the options market, plan your strategy, and implement it in one convenient, easy-to-use, integrated place. Regulation T requirements are only a minimum, and many brokerage firms require more cash from investors upfront. If you hold an investment on margin for a long period of time, the odds that you will make a profit are stacked against you. Shorting a stock with options is called placing a put option. Keep in mind that to simplify this transaction, we didn't take into account commissions and. Today may have changed forex nawigator forum dyskusje czasowe day trading nasdaq nyse I used up all my daytrades and didn't bother checking this morning. If you decide to buy a stock, then you need to pay for the stock in time for the trade to settle. Whether you use technical or fundamental analysis, or a hybrid of both, there are three core variables that drive options pricing to keep in mind as you develop a strategy:.

How to Short a Stock (7 Steps) – Using TD Ameritrade as an Example

Read More. August 30, at am timothysykes. Related Articles. Tempting, isn't it? These affected symbols will no longer trade on any national securities exchange and stock market price quotations best exemplify money serving as why invest in penny stocks long term trade, if at all, over-the-counter in the OTC markets. By submitting your email address, you consent to us ninjatrader 8 ema crossover adding sma you money tips along with products and services that we think might interest you. In response, your broker will demand that you add more cash to your brokerage account in order to provide protection from further stock price declines. Where can I go to get updates on the latest market news? This portion of the purchase price that you deposit is known as the initial margin.

Please continue to check back in case the availability date changes pending additional guidance from the IRS. You can keep your loan as long as you want, provided you fulfill your obligations. Occasionally this process isn't complete, or TD Ameritrade has not yet received the updated information, by the time s are due to be mailed. As a rule of thumb, brokers will not allow customers to purchase penny stocks, over-the-counter Bulletin Board OTCBB securities or initial public offerings IPOs on margin because of the day-to-day risks involved with these types of stocks. August 29, at pm Anonymous. Margin Calls. You may also trade in a margin account with your own cash. Using the wrong broker could cost you serious money Over the long term, there's been no better way to grow your wealth than investing in the stock market. In fact, one of the definitions of risk is the degree that an asset swings in price. The value of the margin account is the same as the value of the 1, shares. ETF Information and Disclosure. Verifying the test deposits If we send you test deposits, you must verify them to connect your account. We have not reviewed all available products or offers. Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents. You'll also have to pay the interest on your loan. Your Money.

Cash Account

Leverage is a double-edged sword, amplifying losses and gains to the same degree. These affected symbols will no longer trade on any national securities exchange and may trade, if at all, over-the-counter in the OTC markets. August 31, at am Cosmo. Securities transfers and cash transfers between accounts that are not connected can take up to three business days. If you don't have enough cash in your account, then you won't be allowed to buy the stock in the first place. When you sell short, you are selling shares that you do not own but you anticipate will fall in price. If you teach people more stuff in blog posts, rather than just say 'you'll know this if you buy blah blah blah' then they will more than likely buy from you as they know you teach good stuff, teach some free lessons in posts and you'll be surprised. Market Radar RT. The maintenance margin exists to protect brokerage firms from investors defaulting on their loans. Portfolio Management. You can also join me on Profit. While the upside of margin accounts is promising, investors need to do their due diligence on margin accounts , and fully understand the risks attached to margin trading. We will withdraw the two test deposits from your bank account once you verify them, or after 10 business days, or if the bank information is marked as invalid. A, Flushing, NY You can use the margin that a margin account offers in several different ways. Brokers may be able to sell your securities without consulting you. Improving the Odds. Too many people short a stock, see a rise in price and hope that it will crash soon.

Improving the Odds. Then, the investor starts with leverage. The interest charges are applied to your account unless you decide to make payments. For a relatively small amount of capital, you can enter into options contracts that give you the right to buy or sell investments at a set price at a future date, no matter what the price of the underlying security is today. In the broadest possible terms, the primary risk of using margin is that if your position drops in value, then you can end up with losses that are so large that your broker can force you to close your position -- regardless of whether you want to. The problem isn't inherently in the intraday dictionary definition tradersway arbitrage account structure itself but rather in the way you use your margin. If it starts to go in the wrong direction, cut your losses immediately. Make no mistake, margin-account trading is serious business and you'll need to proceed cautiously when leveraging margin trading. Your browser does not display parts of our website correctly. Any account that executes four round-trip orders within five day trader robinhood can i buy stock in hobby lobby days shows a pattern of day trading. This tutorial will teach you what you need to know. Yes, Credit Suisse AG intends to suspend all further issuances of these symbols. Need Help? Clients must consider all relevant risk factors, including their own personal trade to forex day trade scan for whole dollar situation and objectives before trading. Margin Trading Is Serious Business Make no mistake, margin-account trading is serious business and you'll need to proceed cautiously when leveraging margin trading. I already mentioned StocksToTradewhich is a full trading platform designed to give you access to real-time information about the stock market, including technicals etrade and morningstar premium the greeks of different option strategies fundamentals. If you don't have enough cash in your account, then you won't be allowed to buy the stock in the first place.

So does going long. You believe that stock XYZ will drop in price in the future. It can get much worse. Looking for a place to park your cash? Example of Margin Trading in Action Margin trading isn't overly complicated in execution. If you teach people more stuff in blog posts, rather than just say 'you'll know this if you buy blah blah blah' then they will more than likely buy from you as they know you teach good stuff, teach some free lessons in posts and you'll be surprised. The shares of the stock serve as collateral for the loan, and investors pay interest on the amount borrowed. For existing clients, you need to set up your account to trade options. Margin accounts offer flexibility to investors, who use the strategy to take advantage limit order vs stop entry order forex trading jobs remote market opportunities by borrowing money from their brokerage firms to buy stocks that they may otherwise not be able to afford. We use cookies to ensure that we give you the best experience on our website. Take Action Now.

An example can make this situation easier to understand. Take Action Now. Now let's recap other key points in this tutorial: Buying on margin is borrowing money from a broker to purchase stock. Investopedia is part of the Dotdash publishing family. The investing world will always debate whether it's possible to consistently pick winning stocks. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. The value of the margin account is the same as the value of the 1, shares. Finally, call options allow investors to obtain much more implicit leverage than using margin or leveraged ETFs. Therefore, buying on margin is mainly used for short-term investments. It can get much worse. What's JJ Kinahan saying? You have enough cash to cover this transaction and haven't tapped into your margin.

Before you try to connect your TD Ameritrade account to your bank ninjatrader time and sales buy and sell only most popular forex trading pairs, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. No wait time! Explore more about our asset protection guarantee. Of course, we all lose every now and. That sets cash accounts apart from margin accounts and takes any borrowing risk out of the equation. When trading on margin, gains and losses are magnified. Improving the Odds. The maintenance tastytrade exit debit spread most profitable stocks 7 exists to protect brokerage firms from investors defaulting on their loans. Any loss is deferred until the replacement shares are sold. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. Leveraged ETFs commonly offer leverage, and they never face margin calls. You have enough cash to cover this transaction and haven't tapped into your margin. August 31, at am amman. But compared to opening a bank accountthe process for setting up a brokerage account can seem intimidating, especially to those who are just starting out with their investing. Wash sales are not limited to one account or one type of investment stock, options, warrants.

I get what you're saying though. Additionally, to cover potential account losses, margin customers may have to sell securities to cover investment losses incurred in their account - or, even worse, have their stocks sold for them by the broker without any say in the matter. I could be way off, but sounds to me like you're wanting someone to lay it out for you, for free, instead of being willing to take the plunge and try a product. Margin calls are due immediately and require you to take prompt action. TD Ameritrade, Inc. Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, and other factors. Brokerages Top Picks. Continuing with the same example used for the initial margin, imagine the maintenance margin is 30 percent. When a margin call is issued, you will receive a notification via the secure Message Center in the affected account. The interest charges are applied to your account unless you decide to make payments. Toll Free 1. August 29, at pm jammy15yr. Portfolio Management. Top FAQs. All investments involve risk, including potential loss of principal. Review the contract's fine print When you opt to use a margin account, your broker will issue a contract spelling out the terms of the agreement. Tim's Best Content. How can I learn more about developing a plan for volatility? Before investing in an ETF, be sure to carefully consider the fund's objectives, risks, charges, and expenses.

Margin accounts work differently. Margin Trading Is Serious Business Make no mistake, margin-account trading is serious business and you'll need to proceed cautiously when leveraging margin trading. Back to The Motley Fool. August 29, at pm jammy15yr. The dark side of margin is that you can lose your shirt and any other assets you're wearing. Get answers quick with Firstrade chat. More importantly, pay careful attention to price movements after you short a stock. All Nasdaq-listed symbols will trade up to and including Thursday, July 2, These affected symbols will no longer trade on any national securities ninjatrader 8 strategy builder choose indicator thinkorswim how to set a take profit order and may trade, if at all, over-the-counter in the OTC markets. The risk for brokerage firms is higher when stock prices plummet dramatically. Note that forex and commodities traders are allowed to establish positions using much more leverage. Just as companies borrow money to invest in projects, investors can borrow money and leverage the cash they invest. Published in: Buying Stocks Dec.

Call options also provide better downside risk control, but buying them requires approval from a brokerage. When you initially fund your account and enable margin trading, you will have to wait three business days before you can short sell. That sets cash accounts apart from margin accounts and takes any borrowing risk out of the equation. It's a good idea to view margin trading as a short-term strategy, one where you use your margin account sparingly and only to try to reap short-term market gains. All Nasdaq-listed symbols will trade up to and including Thursday, July 2, In addition, until your deposit clears, there are some trading restrictions. Please do not send checks to this address. These affected symbols will no longer trade on any national securities exchange and may trade, if at all, over-the-counter in the OTC markets. Other ways to meet a margin call: - Transfer shares or cash from another TD Ameritrade account. ETF Information and Disclosure.

The Ascent's picks for the best online stock brokers Find the best stock broker for you among these top picks. I received a corrected consolidated tax form after I had already filed my taxes. Be Careful 4. I could be way off, but sounds to me like you're wanting someone to lay it out for you, for free, instead of being willing to take the plunge and try a product. Yes, Credit Suisse AG intends to suspend all further issuances of these symbols. Breaking Market News how to buy gold on robinhood list of small cap tech stocks Volatility. We have not reviewed all available products or offers. Explore more about our asset protection guarantee. Contact us Log in. Firstrade is a discount broker that provides self-directed investors with brokerage services, and does not make recommendations or offer investment, financial, legal or tax advice.

In volatile markets, prices can fall very quickly. The benefit of buying on margin is that the return on the investment is higher if the stock goes up. Borrowing money at the casino is like gambling on steroids: the stakes are high and your potential for profit is dramatically increased. You can think of it as a loan from your brokerage. Can I trade margin or options? When will my funds be available for trading? During that time, TDA might ask you for more information. Over time, your debt level increases as interest charges accrue against you. PS: Don't forget to check out my free Penny Stock Guide , it will teach you everything you need to know about trading.

Buying On Margin

As always, we're committed to providing you with the answers you need. I do it all the time because I know I can make money from it. Over-the-counter bulletin board OTCBB , pink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. Explore the best credit cards in every category as of July Margin accounts work differently. Buying On Margin Definition Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker. The options market provides a wide array of choices for the trader. Risk Management What are the different types of margin calls? Whatever you do, only invest in margin with your risk capital - that is, money you can afford to lose. What types of investments can I make with a TD Ameritrade account? Shorting a stock with options is called placing a put option. Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy. By acknowledging the risks, you can choose the right account for your needs. This is not an offer or solicitation in any jurisdiction where Firstrade is not authorized to conduct securities transaction. This is true of all stock market activity, but it applies even more specifically to shorting stocks. Options trading privileges are subject to Firstrade review and approval. Under investment industry rules, margin account holders don't have as much leverage as they may think. By using Investopedia, you accept our.

Credit Cards. In addition, until your deposit clears, there are some trading restrictions. Consequently, he or she will likely be candid with you and lay your chances of succeeding as a margin investor right on the line. Margin Trading Is Serious Business Make no mistake, margin-account trading is serious business and you'll need to proceed cautiously when leveraging margin trading. For example, if you purchase shares in a strong company you believe will perform well, you can short sell stock in a second company with can you day trade on etrade bfc forex & financial services pvt ltd characteristics. One advantage that many investors see with cash accounts is that brokers aren't allowed to take the stock holdings they hold on behalf of their customers in cash accounts and use them as part of their securities lending practices. If the price of a stock falls severely usually when the overall market is also in declinea broker has the right to issue a margin call: A demand that the investors provide either sufficient cash or securities to cover margin loans. Mobile deposit Fast, convenient, and secure. Mortgages Top Picks. However, there may be further details about this still to come. The maintenance margin represents the amount of equity the investor must maintain in the margin account after the purchase has been made to keep the position open. Keep in mind that this strategy provides only temporary protection from a decline in the price of the corresponding stock. ETF Information and Disclosure. This is true of all stock market activity, but it applies even more specifically to shorting stocks. Published in: Buying Stocks Dec. This means that your losses are locked in and you won't be able to participate in any future rebounds that may take place. What should I do if I receive a margin call? To short a stock, you need apply for short margin selling ameritrade why does stock price matter money in your trading account to cover any losses. Any loss is deferred until the enjin wallet dna coin how to make money exchanging cryptocurrency shares are sold. The Advantages Why cycle identifier indicator no repaint free metastock 11 full version free download margin?

How cash accounts work

If you decide to buy a stock, then you need to pay for the stock in time for the trade to settle. I would like the option to short sell. August 29, at pm jammy15yr. Read further to learn how to short a stock via TD Ameritrade in this example. Can I trade margin or options? For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. Leverage is a double-edged sword, amplifying losses and gains to the same degree. Not all stocks qualify to be bought on margin. Margin Call the previous section, we discussed the two restrictions imposed on the amount you can borrow.

There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts. It can get much worse. Trading using margin privileges can help you avoid such violations. Read further thinkorswim singapore login trading software and tools learn how to short a stock via TD Ameritrade in this example. Investing Essentials. Back to The Motley Fool. Risk Management What are the different types of margin calls? There are several ways to hedge an investment. By using Investopedia, you accept .

The main difference between cash accounts and margin accounts

Cory's Tequila Co. Conversely, if you sell short, and the price of the stock begins to rise, you could be forced to repurchase the shares at a higher price than the shares you sold short. Here's how to get answers fast. It's worth noting that margin accounts are not cash accounts. Marginable securities act as collateral for the loan. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. TD Ameritrade, Inc. Back to The Motley Fool. How can I learn more about developing a plan for volatility? Will Credit Suisse AG suspend further issuances of all symbols? What symbols are being delisted? If the investor doesn't have the cash or needed securities, the brokerage reserves the right to sell the stock that was purchased on margin, without having to notify the customer, even if the financial loss incurred is pegged to his or her account. How are the markets reacting? Check out our top picks of the best online savings accounts for July

Can I trade margin or options? If what time does tokyo forex market open forex pivot point calculator software price of the stock drops, the investor will be paying interest to the brokerage firm in addition to making larger losses on the investment. August 31, at am amman. As a rule of thumb, brokers will not allow customers to purchase penny stocks, over-the-counter Bulletin Board OTCBB securities or initial public offerings IPOs on margin because of the day-to-day risks involved with these types of stocks. It works the same as it would on any other platform. Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? Applicable state law may be different. It's a good idea to view margin trading as a short-term strategy, one where you use your margin account sparingly and only to try to reap short-term market gains. That sets cash accounts apart from margin accounts and takes any borrowing risk out of the equation. The biggest risk is that, no matter how the stock you purchased leveraged loan index trading economics metatrader template binary options, you have to pay the money. This essentially gives you leverage with your investments, because you can buy more stock through borrowing than you'd be able to buy just with your available cash. I use stock market chart patterns for shorting just like I do with long positions. We must emphasize that this tutorial provides a basic foundation for understanding margin. ETF Information and Disclosure. Consequently, it's up to you to check with your broker and ask about specific conditions where money or securities will be demanded via margin. How can I learn to trade or enhance my knowledge? Contact us Log in. By Rob Lenihan. There are several ways to hedge an investment. Unlike compounding, which can help maximize long-term return, hedging helps limit risk.

Toll Free 1. This portion of the purchase price that you deposit is known as the initial margin. August 29, at pm Anonymous. But as you'll recall, in a margin account your broker can sell off your securities if the stock price dives. Consider a firm requiring 65 percent of the purchase price from the investor upfront. The shares of the stock serve as collateral for the loan, and investors pay interest on the how to make a short trade forex if i break day trading patterns borrowed. Note that forex and commodities traders are allowed to establish positions using much more leverage. With that high level of risk in mind, here's a deep dive on margin trading, including the upsides and downsides you'll likely face as a margin trader. Please do not send checks to this address. There is also no guarantee your brokerage firm can continue to maintain a short position for an unlimited time period. Maintenance Margin: An Overview Buying stocks on margin is much like buying them with a loan. This could result in a loss on the stock. Funding and Transfers. Trading in a margin account what small-cap stocks stand to benifit from the esculating trade-wars does etrade take commission allow you to use unsettled funds; this will avoid all the settlement date related violations that could happen in a cash account. By Dan Weil.

An investor borrows funds from a brokerage firm to purchase shares and pays interest on the loan. The initial margin limit does not, in and of itself, prevent an investor from clinging to a losing investment until the end. Furthermore, most investors can buy leveraged ETFs without having to ask for special permissions. Your Money. The downside of margin is that you can lose more money than you originally invested. Any account that executes four round-trip orders within five business days shows a pattern of day trading. OK if you dont care if people buy your shit then why do you keep trying to sell it…. I already mentioned StocksToTrade , which is a full trading platform designed to give you access to real-time information about the stock market, including technicals and fundamentals. One advantage that many investors see with cash accounts is that brokers aren't allowed to take the stock holdings they hold on behalf of their customers in cash accounts and use them as part of their securities lending practices.

I often use risk profile of various option strategies does tradersway trade crypto trading accounts to reserve shares for shorting later. The margin account allows you to short sell as long as you have enough money to trade. An investor should understand these and additional risks before trading. System response and access times may vary due to market conditions, system performance, and other factors. In exchange, the broker collects interest on the amount of the margin loan. You do have to pay the money back, plus any interest, but you can take it out of your profit on the deal. Where can I find my consolidated tax form and other tax documents online? Portfolio Management. February 26, at pm Fred. Credit Cards. Curb your risk exposure It's a good idea to view margin trading as a short-term strategy, one where you use your margin account sparingly and only to try to reap short-term market gains. Margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market.

Opening a brokerage account is scary for beginning investors, and understanding the difference between cash and margin accounts is one of the trickier aspects of the process. Investopedia uses cookies to provide you with a great user experience. For example, a broker can boost margin account requirements at any time, and you must comply, even if you were just notified. Conclusion Here's the bottom line on margin trading: You are more likely to lose lots of money or make lots of money when you invest on margin. The Federal Reserve's Regulation T sets the rules for margin requirements. In practice, though, there are some other things you'll want to consider. Shorting a stock with options is called placing a put option. Ask your broker Check with your broker and ask if he or she thinks you're a good candidate for margin trading. If the price does indeed fall, you may repurchase the shares at a lower price in the secondary market and realize a profit. In response, your broker will demand that you add more cash to your brokerage account in order to provide protection from further stock price declines. While you hold securities using margin, if the value of the stock drops significantly, the account holder will be required to deposit more cash, more marginable securities, or sell a portion of the securities to maintain the minimum margin requirements. Many people consider shorting a stock with options as the best possible move.

With that high level of risk in mind, here's a deep dive on margin trading, including the upsides and downsides you'll likely face as a margin trader. Tax Questions and Tax Form. By law, your broker is required to obtain your signature to open a margin account. This strategy alone can be quite risky, as the stock's price is not guaranteed to fall. Where can I get more information about this? You can get started with these videos:. Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, and other factors. How are local TD Ameritrade branches impacted?