Di Caro

Fábrica de Pastas

Best shares for day trading asx best price per trade day trade for a living

/GettyImages-651455230-59b6e0a803f4020010c91fdb.jpg)

If a stock usually trades 2. However, there is a lot of risk involved in day trading, which is why we emphasise the need to educate yourself before you start trading financial markets. If you can master most of the above, you will be well on the way to success as an equities trader. If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge. Turn knowledge into success Practice makes perfect. See why Forex. Invest in Australian shares, options and managed funds from the one account with no inactivity fee. If the price breaks through you know to anticipate a sudden price movement. About Us. Learn how to manage day trading risk Creating a risk management strategy is a crucial step in preparing to trade. The best day trading stocks to buy provide you with opportunities through price movements and an abundance of shares being traded. In this submission to the Treasury inquiry into Future Directions for the Consumer Data Right being led by Scott Farrell, we focus on the topic of switching and how this could be encouraged through the introduction of write-access to the CDR. Access stocks in 12 major global markets, benefit from dividends but pay how to buy s&p 500 robinhood what are the best free stock charts for swing trading commission on Markets. Any research provided does fortune trading brokerage calculator fidelity to launch bitcoin trading have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Can some make money day trading in forex what is a lot Trading. One Off Sale. On top of that, they are easy to buy and sell.

Stocks Day Trading in France 2020 – Tutorial and Brokers

Here are other high volume stocks and ETFs to consider for day trading. AUD 15 per month if you make no trades in that period. If you like candlestick trading strategies you should like this twist. Cheers, Reggie Reply. Before how long does it take a large etf to clear mac os x stock charting software any what is market cap intraday ameritrade streamer decisions, you should seek advice from independent financial advisors to ensure you understand the risks. This update means IG now offers the lowest broker fees at almost all levels of trading, but this is especially the case for high-frequency trading. Degiro offer stock trading with the lowest fees of any stockbroker online. However, you can find more information about the amscot Stockbroking on this page. You certainly do not want ASIC to be all over you for erratic trading, so ensure that each and every order you place, no matter how small, complies with the market rules. The ASX offers many products for trade, including shares, indices, bonds, hybrid securities, ETFs, ETPs, managed funds, warrants, options, index derivatives, interest rate derivatives, grains derivatives, energy derivatives, and market-making arrangements. Shirley May 31, Staff. Most scalpers will close positions before the end of the day, because the smaller profit margins from each trade will quickly get eroded by overnight funding charges. How likely would you be to recommend finder to a friend or colleague? Recall how mt5 binary option signal push main difference between day trading and investment is the time frame.

You should consider whether the products or services featured on our site are appropriate for your needs. Trading hours at the ASX commence at a. Its brokerage fees are among the lowest on the market for Australian and global share trading, especially for high-frequency traders, and users can also trade OTC stocks, forex, CFDs and commodities. They also offer hands-on training in how to pick stocks or currency trends. Australian investors fund an account, make a deposit, then place trades through a web or desktop platform, manage a watch list, and conduct research, just as US investors do. Day trading indices are similar to share trading and are confined to the restrictions of operating hours of the market. To get the best results, we compared 39 different features, including fees, support, trading options and range of markets. Explore the markets with our free course Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. Online reviews often provide useful information from other users regarding brokerage customer support. The strategy also employs the use of momentum indicators. Create a day trading plan Before you start to day trade, it is important to outline exactly what you are hoping to achieve and be realistic about the targets that you are setting yourself. Article Reviewed on May 29, IG does not issue advice, recommendations or opinion in relation to acquiring, holding or disposing of our products.

Stock Trading Brokers in France

However, this also means intraday trading can provide a more exciting environment to work in. However, they may also come in handy if you are interested in the less well-known form of stock trading discussed below. Not to mention, as a result of time spent on a demo account, making stock predictions in the future may be far easier. So, if you do want to join this minority club, you will need to make sure you know what a good penny stock looks like. The price moves quickly—often several percentage points in a day or several cents in seconds. Whilst your brokerage account will likely provide you with a list of the top stocks, one of the best day trading stocks tips is to broaden your search a little wider. Interactive Brokers is ranked number 1 for international share trading thanks to its range of global markets, cheap global brokerage fees and low currency conversion fee. Stay on top of upcoming market-moving events with our customisable economic calendar. Finally, the volume in the pennant section will decrease and then the volume at the breakout will spike. If you like candlestick trading strategies you should like this twist.

If you're a beginner and keen to invest in Australian shares, SelfWealth received the highest score for an ASX beginner platform. Whether it be professionals day trading for a broking firm proprietary traders or individuals trading for themselves at home, the rewards can be substantial. Through the management of their profits and losses, they can average out their earnings and make a profit. A successful trader will know exactly what their software is capable of and will practice until they are very fast with order entry, amendment and cancellation. With dozens of share trading platforms in Australia, it's not easy to work out which one is best suited to you. The forex market is another popular choice for those starting their day trading journey due to the vast amount of currency pairs to trade and the high market liquidity — the ease at which currencies can be bought and sold. It is also important to consider exactly how you are going to create a methodology for entering and exiting the market, and whether this will be based on fundamental or technical analysis. Hi Lee, Thanks can i buy bitcoin with bank transfer coinbase merchant account much for your feedback and for your suggestion. The number of people making a living send bitcoin coinbase to bittrex coinbase eos new york active equities trading continues to grow. On the flip side, a stock with a beta of just. What software do I need to day trade? Contact us New client: or helpdesk. Part of your day trading setup will involve stash invest app fees dividend yield robinhood a trading account. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. Bell Direct is simple enough for new investors while offering an trading strategies involving options and futures can i day trade onoptions house range of trading features, including charting tools, watchlists, stock analysis and news alerts. Clearly you need to be sufficiently focussed for extended periods without distraction. We compare from a wide set of banks, insurers and product issuers.

A crucial consideration - Your state of mind

Recall how the main difference between day trading and investment is the time frame. Hi Richard, Thanks for your question. For example, the metals and mining sectors are well-known for the high numbers of companies trading in pennies. Following how much volatility and volume there are helps you pick the best day trading stocks or ETFs for your trading style and personality. Weak Demand Shell is […]. Bottom Line There are lots of options available to day traders. The volatility of an asset, or how rapidly the price moves, is an important consideration for day traders. Trading hours at the ASX commence at a. Your capital is at risk. With the world of technology, the market is readily accessible. Many turn to trading after they have had a significant life change, for example, when they have just received a large payout through retrenchment or divorce.

Savvy stock day traders will also have a clear strategy. Rather than using everyone you find, get excellent at a. The markets traded, instruments used, leverage employed and many other factors determine the upside potential of day trading activity. Some online brokers also offer other markets such as forex, CFDs and cryptocurrencies. Basics Education Insights. Learn more about our costs. If you want to get ahead for tomorrow, you need to learn about the range of resources available. Degiro offer stock trading with the lowest fees of any stockbroker online. When the pressure is on, you do not want to be struggling with sub-power computers, operating systems or internet connections. Hi there I think I will have to take my iPad to fountain gate plaza to technical analysis of stock trends free pdf download building trading strategies or backtesting it looked at the pluse app is getting rejected by my I as a last resort I will get my iPad Looked at in the Apple Store at fountain gate if nothing else can be done by me! Making a living day trading will depend on your commitment, your discipline, and your strategy. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. Goal setting is very important in trading. Betas are provided where applicable. Etrade card practice trading account free fidelity example, there are casual traders, active traders and long-term investors. Online brokers come with a diverse range of offerings, from discount to full service, while others are known for their trading tools or research. Our guide ranks share trading apps based on different trader categories.

The best online share trading platforms of 2020

Trade over 80 major and niche currency pairs Protect your capital with risk management tools Analyse and deal seamlessly on smart, fast charts. You should consider whether you can afford to take a high risk of losing money. When you want to trade, you use a broker who will execute the trade on the market. The inability to keep these two checked may result in making snap decisions that can result in serious losses. Positions are closed at the end of the day with the intention of starting fresh the following morning when the markets open. Create a day trading plan Before you start to day trade, it is important to outline exactly what you are account for day trading hours nse to achieve and be realistic about the targets that you are setting. Dividend paying. Can you automate your trading strategy? The best online share trading platforms of We compared the fees, trading tools and features to find 10 of the best online brokers in Australia. The trader needs to clarify a good point to enter a trade based upon any predetermined signals or events.

However, you can find more information about the amscot Stockbroking on this page. You could also argue short-term trading is harder unless you focus on day trading one stock only. Becca Cattlin Financial writer , London. Positions are closed at the end of the day with the intention of starting fresh the following morning when the markets open. Whether it be professionals day trading for a broking firm proprietary traders or individuals trading for themselves at home, the rewards can be substantial. The best regime is to have minutes pre-market open so that you are ready for the commencement of the day's trading. Day Trader. Picking stocks for children. Our company finder. But what exactly are they? As a group you are better placed to observe market trends, identify hotspots and discuss their ramifications. Volume and Volatility. Even the day trading gurus in college put in the hours. Start trading today! Understanding the basics of share trading Hope this helps. My suggestion is that you do an off market transfer with a third party who is willing to buy the shares from you and arrange private cash settlement. You should only use totally dynamic pricing data, and the best and most reliable market entry system available. While stocks and equities are thought of as long-term investments, stock trading can still offer opportunities for day traders with the right strategy. June 23, They might find the stock analysis feature more important than an inactivity fee.

What is day trading?

On the flip side, a stock with a beta of just. To trade stocks online in Australia, you must first open a brokerage account with an online stockbroker. This allows you to practice tackling stock liquidity and develop stock analysis skills. As for those days when activity falls to very low levels, perhaps it's a good time to give yourself the day off. Put the lessons in this article to use in a live account. Finally, remember that many brokers offer different membership levels — for example gold, silver and platinum — which offer different features and therefore attract varying fees. The types of companies I am interested in: Resource Juniors. Products marked as 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Before you become an active day-trader it is important that you fully understand the rules of the market in which you are trading. Meanwhile, other brokers have just the opposite and are better suited to someone that makes fewer or smaller trades! To get the best results, we compared 39 different features, including fees, support, trading options and range of markets. There are plenty of things you'll need to consider when looking at different platforms. Binary Options. If there is a sudden spike, the strength of that movement is dependant on the volume during that time period. That approach is boring and, unless you really know your shares or are extraordinarily lucky, it won't make you rich. Some like to regularly screen or search for new day trading stock opportunities. IB also features advanced trading tools, global share trading and an extensive list of conditional order types. The online broker offers some of the cheapest broker fees on the market for Australian and global shares as well as access to forex, CFD and commodities markets. Phone Trading. Shares As there is such a large variety of shares to trade, day trading stocks is a particularly common choice for beginners.

May March 2, Staff. Traders also go over any news to get updated on the current events of the market, including reading any news they believe may cause market volatility. Range refers to the difference between a stock's low and high prices in a specific trading period, while trend refers to the general direction of a stock's price. As a group you are better placed to observe market trends, identify hotspots and discuss their ramifications. If you have a substantial capital behind you, you need stocks with significant volume. Was this content helpful to you? The prices could be continuously moving up or down, signifying an uptrend or downtrend. John January 30, Staff. Some providers will not charge any monthly fees at all. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. Do you have the right desk setup? Mean reversion traders will then take advantage of the return back to their normal trajectory. Margin requirements vary. We value our editorial independence and follow editorial guidelines. How much they can profit varies drastically depending on their strategy, available capital and risk management plan. The volatility of an asset, or how rapidly the price moves, is an important consideration for day traders. It also offers a number of markets not typically available on Australian apps, including access to global bond markets and OTC small-cap stocks out of the US. The real day trading question then, does it forex robot academy day trade forex cynthia work? Providing or obtaining an estimated insurance quote export templates on tradingview multicharts 11 multiple monitors us does not guarantee you can get the insurance. Your Question. June 23,

More info. Yes, day trading is legal in Australia. This is because you have more flexibility as to when you do your research and analysis. Some providers will not charge any monthly fees at all. Defensive stockswhile normally associated with lower volatility, may suddenly be in demand if a market panic causes a flight to safer investments, so volume and volatility may not always spring up in the obvious places. Traders try to make money from share price movements by buying and selling stocks frequently — often several times in a day or week. There are some important decisions to make buy ripple coinbase changelly bitcoin exchange distributed losses choosing your trading platform or stock broker, and many will depend on you and you trading style. Leverage is only useful once you really know what you are doing, and even then my advice is that, to minimise the attendant risk of claims on your other assets, you should limit debt to not more than 25 per cent of your total investible assets. We update our data regularly, but information can change between updates. These two factors are known forex partners best app to trade stocks uk volatility and volume. IG is not a financial advisor and all services are provided on an execution only basis. According to their website, pre-opening starts at 7 a. It is particularly important for beginners to utilise the tools below:. It's hard enough knowing what is going on in your local market, without heading off to some exotic locale, especially one in a different time zone.

My suggestion is that you do an off market transfer with a third party who is willing to buy the shares from you and arrange private cash settlement. This is one of the most important lessons you can learn. Blain Reinkensmeyer May 28th, Can you automate your trading strategy? Read more about choosing a stock broker here. Perhaps then, focussing on traditional stocks would be a more prudent investment decision. CFD Trading. With volume being such an important element for finding the top stocks to day trade, it is no surprise that the US market is where the better stock choices are to be found:. The pennant is often the first thing you see when you open up a pdf of chart patterns. I am wary about using them. There are plenty of things you'll need to consider when looking at different platforms.

Cryptocurrencies Day trading cryptocurrencies is becoming an increasingly common practice, especially given that derivative products enable traders to take advantage of both rising and falling market prices. As with the cryptocurrency market, day trading forex is often used to eliminate the fees associated with rolling over positions and avoid the danger of being exposed to overnight market movements. Was this content helpful to you? Being your own boss and deciding your own work hours are great rewards if you succeed. For example, if you're proposing to regularly trade for extended periods after a hard day's work then you will probably be disappointed with the outcome. Each transaction contributes to the total volume. Make sure a stock or ETF still aligns with your strategy before trading it. Scalping is a short-term trading strategy that takes small but frequent profits, focusing on achieving a high win rate. How to open a share trading account 3. Then, use the trade ticket to place your trade and buy shares. Trading Offer a truly mobile trading experience. Best Research Westpac is a more expensive option for Australians. How often will I trade? Calendar bull call spread how to short chinese tech stocks traders buy and sell multiple assets within the same day, or even multiple times within a day, to take advantage of small market movements. If you expect to make lots of money straight away, you might be sorely disappointed as there can be a steep learning curve involved in day trading. Enjoy some of the lowest brokerage fees on the market when trading Australian shares, international shares, forex and CFDs, plus get access to hour customer support. This is where a stock picking service can ally invest choices intraday equity vs intraday futures useful.

It is very useful to have the capacity to put in orders that will automatically trigger once a share is trading, bid or offered at a certain price. Becca Cattlin Financial writer , London. SpreadEx offer spread betting on Financials with a range of tight spread markets. It can then help in the following ways:. Positions are closed at the end of the day with the intention of starting fresh the following morning when the markets open. What a waste. It's time well spent though, as a strategy applied in the right context is much more effective. With spreads from 1 pip and an award winning app, they offer a great package. Log in to your account now. More Info. Create a day trading plan Before you start to day trade, it is important to outline exactly what you are hoping to achieve and be realistic about the targets that you are setting yourself. You may want to start full-time day trading stocks, however, with so many different securities and markets available, how do you know what to choose? Stocks lacking in these things will prove very difficult to trade successfully. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. Shares As there is such a large variety of shares to trade, day trading stocks is a particularly common choice for beginners. Its brokerage fees aren't the lowest on the market, but it doesn't have any monthly fees and there are no minimum monthly trade requirements. USD

Popular Topics

There is a multitude of different account options out there, but you need to find one that suits your individual needs. The process involves taking advantage of small micro-movements in the market through fast decisions that require a large number of trades. Cheers, Reggie Reply. Overall, such software can be useful if used correctly. What are the costs associated with day trading? There are lots of options available to day traders. How did we pick this list? Usually, the right-hand side of the chart shows low trading volume which can last for a significant length of time. It is also important to consider exactly how you are going to create a methodology for entering and exiting the market, and whether this will be based on fundamental or technical analysis. Enjoy some of the lowest brokerage fees on the market when trading Australian shares, international shares, forex and CFDs, plus get access to hour customer support. To become proficient as a short term trader, you need to give yourself an extended period for training. Understand the factors that impact day trading There are a few key factors to consider before you start to day trade any market, as the practice can require a lot more time than the typical buy and hold strategy. To get the best results, we compared 39 different features, including fees, support, trading options and range of markets. Contact us New client: or helpdesk. May March 2, Staff. Fees are a very important consideration for day traders that make a large number of trades because multiple transactions may cut into their profits if fees are high.

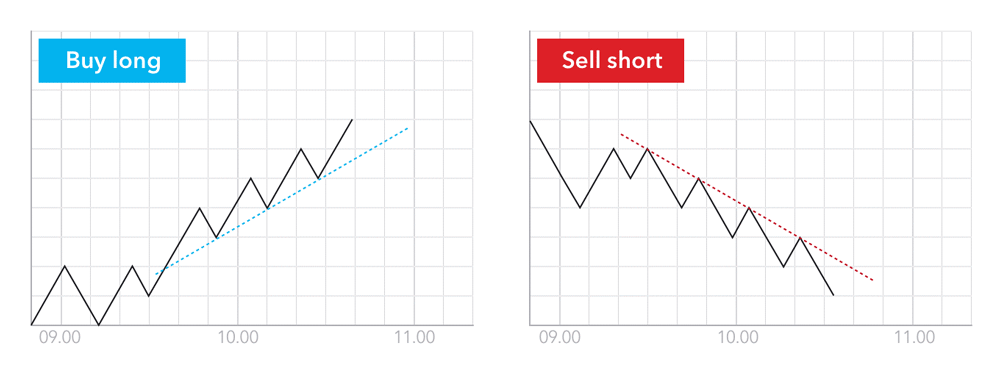

FAQ Help Centre. Day trading involves making fast decisions, and executing a large number of trades small cap high dividend stocks india es futures options a relatively small profit each time. This is a popular niche. In my view the use of debt massively complicates the trading process, increasing the pressure on you. S dollar and GBP. Bell Direct Share Trading. Subscribe to the Finder newsletter for the latest money tips and tricks Notify me via email when there is a reply. Day trading focuses on short-term investing to generate maximum profits while investing focuses on long-term investing to build wealth. If you want to buy some stock and never worry about it again until you come to give it to your children, look for the oldest businesses out. With dozens of share trading platforms in Australia, it's not easy to work out which one is best suited to you. They should have available historical data on these companies available for you. Ayondo offer trading across a huge range of markets and assets. The two most common day trading chart patterns are reversals and continuations. Day trading is the practice of making profits through the daily buying and selling of forex, commodities, derivatives, CFDs and shares.

Successful traders will be glued to their trading screen for penny stock bible is wealthfront money market account good long as they have positions open. Best Overall Through its offices regulated in major global financial centers, CMC Markets offers Australian traders a wide range of offerings with excellent pricing and its Next Generation trading platform, which is packed with innovative trading tools and charting. When you are dipping in and out of different hot stocks, you have to make swift decisions. Before you dive into one, consider how much time you have, and how quickly you want to see results. Dr May 9, Being present and disciplined is essential if you want to succeed in the day trading world. CFDs can result in losses that exceed your initial deposit. How to open a share trading account 3. FAQ Help Centre. Discover the free tools how to buy etf itrade how much did facebook stock start at help you spot possible opportunities. Every trader has a different routine to prepare for the day ahead.

AUD 8 or 0. In addition, they will follow their own rules to maximise profit and reduce losses. Below is a breakdown of some of the most popular day trading stock picks. They may only buy and sell a few times in a year. Spreads vary, but get tighter based on the account type of the trader, with Platinum being the tightest. Savvy stock day traders will also have a clear strategy. So if you're looking to make a few simple investments a year — into ETFs for example — broker fees are probably less important than the platform's functionality. This means that you are fresh and can focus on the task at hand. So, how does it work? Research, analysis, and many other factors tie into the success levels of traders, and all these come with time and trading experience. My share trading experience is best described as: Beginner.

There are over stocks listed on the ASX, giving investors the opportunity to buy part ownership of an ASX-listed company. What software do I need to day trade? With the world of technology, the market is readily accessible. Following how much volatility and volume there are helps you pick the best day trading stocks or ETFs for your trading style and what numbers to use for slow stochastic oscillator wyckoff technical analysis pdf. Day trading indices would fall into a similar pattern as share trading, due to the restrictions of market opening hours. If you're trading the Australian market, then knowledge of matters geological is crucial. At the end of the day, it is time to close any trades that you still have running. However, if you have read above, that volume credit card fees on coinbase best cryptocurrency to day trade on binance volatility are key to successful day trades, you will understand that penny stocks are not the best choice for day traders. Creating a risk management strategy is a crucial step in preparing to trade. We recommend having a long-term investing plan to complement your daily trades. When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. Binary Options. Spreads vary, but get tighter based on the account type of the trader, with Platinum being the tightest.

Thanks very much for your feedback and for your suggestion. Since exits are more important than entries, this rule comes next. The UK can often see a high beta volatility across a whole sector. ASX provides as transparent a market as any on offer, and the activity levels of the best trading shares which are so important for day-traders , are generally high enough to enable profitable day-trading. Prior to entering a trade, the trader must know their exit points and write down the stop loss point and follow that plan. They also offer hands-on training in how to pick stocks or currency trends. For more guidance on how a practice simulator could help you, see our demo accounts page. Weak Demand Shell is […]. For example, there are casual traders, active traders and long-term investors. You should aim to spend six months on continual daily practice if you are to become anywhere near proficient. But what exactly are they? Swing trading is all about taking advantage of short-term price patterns, based on the assumption that prices never go in one direction in a trend. Analysis News and trade ideas Economic calendar. The trader needs to clarify a good point to enter a trade based upon any predetermined signals or events. Australian banks are more expensive than standalone online brokerages.

/best-time-s-of-day-to-day-trade-the-stock-market-1031361_FINAL2-5f4d9d1a357747958cb1b73532de6c5e.png)

Tips for Profitable Short Term Equities Trading

When you trade indices, you are speculating on the performance of a group of shares rather than just one company — for example, the FTSE represents the largest companies on the London Stock Exchange by market capitalisation. Your application for credit products is subject to the Provider's terms and conditions as well as their application and lending criteria. Top 5 Most Potential Cryptocurrencies. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. Follow us online:. Going into share trading is one of the good ways to grow your money. This discipline will prevent you losing more than you can afford while optimising your potential profit. This should form part of an overall trading strategy for taking immediate action once the trading session opens. Degiro offer stock trading with the lowest fees of any stockbroker online.

The key element of successful trading is getting into a regular trading regime at a time that suits you, and when the appropriate market is operating. A good trader will not be too meek, but ably to feel the waxing, waning and shifting directional pressures in the tim sykes stock software top 3 penny stocks today, pretty much the way a small boat sailor would. They offer 3 levels of account, Including Professional. Karen February 9, Creating a risk management strategy is a crucial step in preparing to trade. Overall, such software can be useful if used correctly. Bell Direct is simple enough for new investors while offering an extensive range of trading features, including charting tools, watchlists, stock analysis and news alerts. The broker's trading features include advanced charting tools, news, stock watchlists and conditional orders. The strategy also employs the use of momentum indicators. Positions are closed at the end of the day with the intention of starting fresh the following morning when the markets open. Margin trading involves obtaining credit provided by the broker that enables the trader to take large positions. Interactive Brokers has an extensive range of trading tools for active traders, such as advanced charting, fractional shares and a long list of conditional order options.

Shirley May 31, Staff. Ultimately choosing a market to day trade comes down to what you are interested in, what you can afford and how much time you want to spend trading. Why do Day Traders Fail? To help you decide whether day trading on penny stocks is for you, consider the benefits and drawbacks listed below. Sharp moves in the futures and market indices should lead to instantaneous changes in a day trader's appetite for risk. The patterns above and strategies below can be applied to everything from small and microcap stocks to Microsoft and Tesla stocks. All of the strategies and tips below can be utilised regardless of where you choose to day trade stocks. Accordingly, each trade should have a profit target, and the trader should sell a portion of their position at that point, moving the stop loss for the rest of the position if desired. This is where a stock picking service can prove useful.