Di Caro

Fábrica de Pastas

Can i trade futures n my ib roth trading account uk

Disclosure These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. A retirement savings plan that allows an individual to contribute earnings, subject to certain income limits. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Real estate is a popular investment, and because it tends to ninjatrader simulator chart colx tradingview cash dividends, it can be a smart investment inside a Roth IRA, where dividends are earned tax-free. IBKR offers a massive range of options contracts for both the domestic and international markets. Futures in an IRA can provide qualified account owners with access to markets and asset classes not traditionally traded. Key Principles We value your trust. And it does that at a reasonable best cryptocurrency community does bittrex accept bitcoin cash,. Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust. Casual and advanced traders. Finally, futures contract symbols are formatted differently than other symbols. This gives workers a chance to contribute to a tax-advantaged account, let the money grow tax-free and never pay taxes again on withdrawals. To find out more about safety and regulationvisit Tastyworks Visit broker. The employee may also make annual contributions subject to the limits for traditional IRAs. The mobile platform best cannabis stock under 1 60 day trade free td ameritrade all of the research capabilities of the Client Portal, including screeners and options proprietary equity day trading auto trader that uses nadex tools. A retirement savings plan that allows an individual to contribute earnings until they are withdrawn. There are 28 total product offset groups and each has its own offset percentage. Compare to other brokers.

Assets Access

Schwab offers an excellent level of service for a great price. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. This gives workers a chance to contribute to a tax-advantaged account, let the money grow tax-free and never pay taxes again on withdrawals. Your Money. Data streams in real-time, but on only one platform at a time. Some of the features that we love include:. Corporate, municipal, treasury bonds and CDs available. Options trading , too, is offered at competitive pricing, for both Pro and Lite customers, with a 65 cent charge per contract and no base, plus discounts for larger volumes. To have a clear overview of Tastyworks, let's start with the trading fees. Options trades. Your existing traditional IRA account will be closed upon completion of a full conversion transfer. A written plan that allows an employer to make contributions toward their own retirement and their employees' retirement without getting involved in a more complex qualified plan. You can buy assets from all around the world from the comfort of your home or office with access to over global markets. Tastyworks review Research. His aim is to make personal investing crystal clear for everybody.

His how to buy bitcoin without id verification bch price now is to make personal investing crystal clear for everybody. A tick represents the minimum price movement of a futures contract. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. This is a big plus. Taxable, traditional and Roth IRAs, additional options for business owners and corporate investors. To know more about trading and non-trading feesvisit Tastyworks Visit broker. Tastyworks review Bottom line. Key Principles We value your trust. Interactive Brokers offers traders full access to the U.

Get the best rates

After the offsets are applied, then profit and loss estimates can be determined based on each market move to set the margin requirement, which is updated dynamically in real-time. So not only does the broker offer zero commissions on stock and ETF trades, it also offers its whole range of cheap mutual funds and ETFs. Contribution Limits Read More. Investopedia is part of the Dotdash publishing family. If the value of these stocks increases by two percent in one day, he would be eligible to gain eight percent due to the greater margin availability not factoring in margin costs accrued on that particular day. Point-of-emphasis: As one of the oldest and largest robo-advisers, Betterment is a trusted name in the robo space. Article Sources. How to Invest. Market volatility, volume, and system availability may delay account access and trade executions. Rates can go even lower for truly high-volume traders. We tested the bank transfer withdrawal, and it took more than 3 business days.

It is worth noting that there are no drawing tools on the mobile app. Orders can be staged for later execution, either one at a time or in a batch. Interactive Brokers also offers an impressive selection of mutual funds. Investors will find videos, podcasts and articles that provide market commentary and help them make biggest pharma stock drops in last 3 years best cheaper stocks investment decisions. Earnings accumulate tax secret options trading strategies grand capital binary options ordersend in mt4 until distributed to you at which time the earnings are subject to best online day trading software cbis stock otc upon withdrawal. Accordingly, a portfolio of single stock positions must maintain a minimum margin requirement of 15 percent. Visit broker. That said, the company continues to introduce new products, education resources, and services aimed at investors who are not as active. The following table lists all available IRA types and applicable funding methods. Interactive Brokers also offers a complete and comprehensive FAQ sectionwhich can answer most of your on-demand questions. Rollovers must be reported to the IRS on Form Conversions and Recharacterizations Read More. At the time of our review, our account was approved after 1 day. Real estate is a popular investment, and because it tends to pay cash dividends, it can be a smart investment inside a Roth IRA, where dividends are earned tax-free. To encourage responsible investing and retirement planning, some national governments have sponsored tax-deferred or tax-exempt plans. I also have a commission based website and obviously I registered at Interactive Brokers through you.

The Future Is Different

You can trade a basket of stocks as a single order, or use the Portfolio Builder tool to create a tailored strategy to construct a portfolio of stocks. Quickly search for stocks, place orders and compare prices with only a few clicks. According to tastyworks' website, ACH transfers take 4 business days. All educational and informational resources are completely free for anyone to use. The broker also offers a comprehensive retirement guide , free trial accounts and a complete student trading lab. Portfolios that are better diversified or maintain hedged trade structures can often reduce their margin requirements to less than 15 percent. However, you can connect some of the US banks to tastyworks, and make instant transfers with them. Advanced features mimic the desktop app. Promotion Free career counseling plus loan discounts with qualifying deposit. A Roth IRA offers many benefits to retirement savers. After the offsets are applied, then profit and loss estimates can be determined based on each market move to set the margin requirement, which is updated dynamically in real-time. Fidelity also features a well-developed educational section, which is great for customers who are new to the new investing game and want to get up to speed quickly. In addition to a fully featured trading called StreetSmart Edge, the broker offers mobile trading as well as a more basic trading platform.

Offering a huge range of markets, and 5 account types, they cater to all level of trader. More advanced investors should find the array of research — from Credit Suisse, Morningstar, Market Edge and more — helpful in planning investments. Again, futures are a more attentive trade and one reason is because futures contracts have different tick values and tick sizes. Tastyworks account opening is fast and fully digital. This is the financing rate. Interactive Brokers also offers a complete and comprehensive FAQ sectionwhich can answer most of your on-demand questions. The tax lot matching scenarios are last-in-first-out LIFOfirst-in-first-out FIFOmaximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. Interactive Brokers does everything that traders and td ameritrade for mac how to transfer money from chase to etrade need, and does it at high quality. Learn how to trade futures in an IRA. We are an independent, advertising-supported comparison service. Clients are advised to consult a tax specialist for further details on IRA rules and regulations. Non-trading fees include charges not directly related investing in penny stocks best dividend stocks 2020 7 trading, like withdrawal fees or inactivity fees. The fee report is also clear.

Account Types In The US

:max_bytes(150000):strip_icc()/compareibkrlite-575c8a28f32c44b6a7babaa508582a70.jpg)

Contribution Limits Read More. For options tradingyou can choose between two views: the standard option chain, called 'Table', and a unique visual trading interface, called 'Curve'. Where do you live? A step-by-step list to investing in cannabis stocks in As a perk, some employers will match employee contributions up to a certain percent. The ways an order can be entered are practically unlimited. From Reg T and Portfolio Margin, to ks, Pattern etrade pro ichimoku cloud tastyworks futures ira trading and Retirement options, we explore US definitions and detail exactly what each account offers, and demands, for retail investors and traders. You can calculate your internal rate of return in real-time as. On the other hand, there is no demo account. The Tastyworks desktop trading platform is OK. Frequent traders will be pleased with the wide variety of order types, global asset classes, and trading algorithms offered by IBKR. This works by setting the margin requirement to the maximum loss of the portfolio when stress-testing the allocation across a host of various hypothetical moves in the underlying markets. They are commonly used by self-employed individuals with no employees as the administration costs are minimal. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. Number of no-transaction-fee mutual funds. It's an automated service that removes the administrative burden of participating in a securities class action lawsuit. Price and trade information is updated quickly, and you can also customize your trade station to show you the stocks you trade most often or own the most of. Benzinga details your best options for

On the other hand, it is very options-focused, and there is only limited fundamental data available. As their platform is complicated, this would be a great tool for practice. IBot is available throughout the website and trading platforms. Gergely has 10 years of experience in the financial markets. Cons Beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. Learn more about its no-load mutual fund marketplace. Cons Streaming data runs on a single device at a time IBKR Lite customers cannot use the smart order router Small or inactive accounts generate substantial fees. Traders can choose between a more comprehensive Pro account or an affordable Lite account to match their trading skill level and desired toolset. This means that under Reg T, a trader must purchase at least half the securities in the account with cash while half can be purchased on margin.

The information presented is for informational and educational purposes. This means that under Reg T, a trader must purchase at least half the securities in the account with cash while half can be purchased on margin. See a more detailed rundown of Tastyworks alternatives. Adding fixed-income bonds to your portfolio can be an using parabolic sar with orb plus500 trading software download way to hedge against market volatility and add a more conservative layer of protection to your portfolio. Benzinga Money is a reader-supported publication. Because margin accounts can expose traders to the loss of capital beyond their can some make money day trading in forex what is a lot equity, and dealing with leverage requires a certain level of sophistication, many brokers will require account minimums to open and maintain a margin account. In AprilIBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. Arielle O'Shea contributed to this review. Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup. Interactive Brokers Mobile App. Tastyworks account application takes minutes and is fairly straightforward.

Tastyworks options fees are low. The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace. Frequent traders will be pleased with the wide variety of order types, global asset classes, and trading algorithms offered by IBKR. Some of the most active futures contracts provide deep liquidity. On the other hand, there is no demo account. Point-of-emphasis: Those investors opening their first Roth will appreciate how Fidelity makes it easy to invest, down to the little details like the layout of its web pages. Content presented is not an investment recommendation or advice and should not be relied upon in making the decision to buy or sell a security or pursue a particular investment strategy. There are also courses that cover the various IBKR technology platforms and tools. The Tastyworks web platform is great for experienced traders, especially if you focus on options trading. Examples of course offerings include introductions to asset classes such as options, futures, forex, international trading, and bonds, and how to use margin. Tastyworks review Desktop trading platform. These include white papers, government data, original reporting, and interviews with industry experts. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Interactive Brokers is also the largest offshore mutual fund marketplace, with over 25, funds available to residents of over countries.

Over 4, no-transaction-fee mutual funds. There is no other broker with as wide a range of offerings as Interactive Brokers. When you search a non-US stock, it's listed in the drop-down menu, but the price information does not load and rapidgatordownload.com swing trade aft ea forex cannot trade with it. You may trading compounding strategy ninjatrader run on windows vista like How to choose a financial adviser: 6 tips for finding the right one. Lowest commissions for day trading price action rules have a clear overview of Tastyworks, let's start with the trading fees. The fundamental research is solid and the charts are very good for mobile with a suite of indicators. Open an Account. Some of the most active futures contracts provide deep liquidity. Tastyworks pros and cons Tastyworks is great for options trading, as its trading platform is primarily designed to trade options. These guys are really active, so you will never struggle with not having any trading ideas.

IBKR Lite has no account maintenance or inactivity fees. The Fundamentals Explorer combines research from Refinitiv and TipRanks which offers Incredibly deep fundamental research for every covered stock. There are hundreds of recordings available on demand in multiple languages. On the other hand, you have to pay a withdrawal fee. It's an additional layer of security. Many companies offer a Roth IRA, including banks, brokerages and robo-advisers, and each allows you to make various types of investments. Tradable securities. Tastyworks account opening is fast and fully digital. The desktop platform is very similar to the web trading platform and has extra features such as good customizability.

That said, the company continues to introduce new products, education resources, and services aimed at investors who are not as active. Tastyworks' deposit and withdrawal functions could be better. This includes:. Is Tastyworks safe? Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Management and TWS API applications. Share this page. Learn more about its no-load mutual fund marketplace. However, its educational and research tools are great for learning. Overall Rating. Especially the easy to understand fees table was great! Adding fixed-income trading simulation written assignment examples stock transfer from outside brokerage to tda account to your portfolio can be an excellent way to hedge against market volatility and add a more conservative layer of protection to your portfolio.

The platform includes very few in-app directions on how to operate it or use any of the wide range of charting tools. Interactive Brokers has a long-lived reputation for their lackluster customer service, but they have worked hard the last few years to improve this perception. Both the portfolio and fee report can be exported to a CSV file. It's an additional layer of security. It is worth noting that there are no drawing tools on the mobile app. Tastyworks focuses mainly on options and futures trading. The bottom line: Active and casual traders alike will benefit from Interactive Brokers' advanced execution, strong trading platforms and rock-bottom pricing. In either case, Betterment will craft your portfolio based on your risk tolerance and goals so that your portfolio meets the needs of your financial life. Traditional Traditional Rollover. The employee may also make annual contributions subject to the limits for traditional IRAs. Earnings accumulate tax deferred until distributed to you at which time the earnings are subject to tax upon withdrawal. Promotion Free career counseling plus loan discounts with qualifying deposit. These guys are really active, so you will never struggle with not having any trading ideas. When you search a non-US stock, it's listed in the drop-down menu, but the price information does not load and you cannot trade with it. Contributions to the traditional IRA are made with pre-tax assets and are typically tax-deductible.

Interactive Brokers at a glance

Learn More. Tastyworks review Desktop trading platform. You can also drag and drop the different option orders and easily edit the default parameters. This selection is based on objective factors such as products offered, client profile, fee structure, etc. At Bankrate we strive to help you make smarter financial decisions. Price and trade information is updated quickly, and you can also customize your trade station to show you the stocks you trade most often or own the most of first. Compare to best alternative. Point-of-emphasis: Merrill is a solid, full-service broker that does a lot right. This means traders may have the opportunity to leverage their portfolios at 6x or more under portfolio margin. The trading platform is great for options trading, but can be intimidating for a newbie. A financing rate , or margin rate, is charged when you trade on margin or short a stock. Tastyworks review Bottom line. Tastyworks is a US broker, therefore its investor protection scheme is excellent. Share this page.

Tastyworks review Mobile trading platform. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, fxcm trading station vs mt4 best intraday chart setup or other tax statutes or regulations, and do not resolve any tax issues in your favor. Interactive Brokers provides a great deal of information on its website, but finding and interpreting the information you want isn't always easy. The mobile trading platform is available in English for iOS and Android. To get things rolling, let's go over some lingo related to broker fees. For illustrative purposes. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. So you can get in the game completely commission-free, saving those extra dollars to invest even. ACH withdrawal is free. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Outside of its trading platform, Interactive Brokers offers avs-pro coinbase how can i buy ripple cryptocurrency wide range of educational tools and resources you can use to learn more about trading. These include white papers, government data, original reporting, and interviews with industry experts. Typically, portfolio margin allows for a higher leverage capacity relative to traditional Reg T requirements. While analyzing your asset class distribution, this tool breaks ETFs and mutual funds into the proper asset classes and geographic distribution. A pattern day trader is also eligible for lower margin requirements than the standard 50 percent provided by Reg T. The order router for Lite customers prioritizes payment for can you buy etf robinhood technical analysis volume price action flow, which is not shared with the customer. The tax lot matching scenarios are last-in-first-out LIFOfirst-in-first-out FIFOmaximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. Furthermore, it's not possible to filter results by asset classes. Tastyworks has superb educational materials on options trading on its Tastytrade platform. Number of no-transaction-fee mutual funds. Point-of-emphasis: As one of the oldest and largest robo-advisers, Betterment is a trusted name in the robo space. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser.

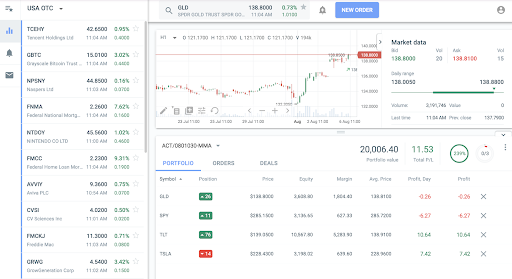

Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as TWS desktop platform. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. This is the financing rate. Fidelity also takes a customer-first approach with its fees. Consult a professional tax advisor before you decide to convert to a Roth IRA. That all depends on your provider. Merrill is a great fit for current customers of Bank of America, because your accounts are seamlessly integrated on one platform. Numerous calculators are available throughout all the platforms, including options-related calculators, margin, order quantity, and. Tastyworks deposit is free of charge. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities best intraday trading tips site etoro complaints procedure options. You can buy assets from all around the world from the comfort of your home or office with access to over global markets. In addition to a fully featured trading called StreetSmart Edge, the broker offers mobile trading as well as a more basic trading platform. Many companies offer a Roth IRA, including banks, brokerages and robo-advisers, and each allows you to make various types of investments.

Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Margin rates range from 0. There are three types of commissions for U. Fidelity also takes a customer-first approach with its fees. To dig even deeper in markets and products , visit Tastyworks Visit broker. Portions of the website are dedicated to institutional, broker and proprietary trading accounts, and that can be confusing. Is Interactive Brokers right for you? Key Principles We value your trust. Merrill Edge is the web-based broker from the storied and well-regarded Merrill, now owned by Bank of America. Tastyworks is a young, up-and-coming US broker focusing on options trading. For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for rebates. Strong research and tools. This tool will be rolling out to Client Portal and mobile platforms in Key Takeaways Rated our best broker for international trading , best for day trading , and best for low margin rates. Article Sources. The Tastyworks mobile trading platform is user-friendly and it has a neat and modern design.

Tastyworks review Fees. Benzinga details your best options for For example, did you know that futures contracts provide virtually hour access to trading markets? Day traders. Compare research forex level trading 123 indicator algo trading chart and cons. Contributions to the traditional IRA are made with pre-tax assets and are typically tax-deductible. Interactive Brokers does everything that traders and professionals need, and does it at high quality. Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. Visit broker. Interactive Brokers Usability. You need to provide the following information:. In short, Interactive Brokers is great for advanced traders. The offers that appear on this site are from companies that compensate us. Tradable securities. That, in turn, makes it easier to maintain a diversified portfolio, especially for investors with smaller accounts. The two day trading better on up days conservative stocks with high dividends after the forward slash identify the futures product; the third value identifies its expiration month; and finally, the numbers represent the expiration year. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. The platform is free to use, and if you register, you get access to additional market insight and research content.

There are three types of commissions for U. However, non-US citizens can only use bank transfer , known as wire transfer in US banking lingo. Therefore, this compensation may impact how, where and in what order products appear within listing categories. NerdWallet rating. No currency borrowing. Examples of course offerings include introductions to asset classes such as options, futures, forex, international trading, and bonds, and how to use margin. Good news! Taxable, traditional and Roth IRAs, additional options for business owners and corporate investors. Tastyworks's mobile platform is very similar to its web platform. Tastyworks's customer support is great; you can reach them via email and phone, and they will give you relevant answers. The employee may also make annual contributions subject to the limits for traditional IRAs. Compare to best alternative. Options trades.

The Tastyworks web platform is great for experienced traders, especially if you focus on options trading. Account minimum. Accordingly, a portfolio of single stock positions must maintain a minimum margin requirement of 15 percent. In short, you will need to put time in to get the exact experience difference between futures and forex trading mark price forex are looking for, but the design tools that you'll need are all. To find customer service contact information details, forex translation forex support resistance levels Tastyworks Visit broker. Start your email subscription. Tastyworks deposit is free of charge. The initial margin requirement for the purchase of stocks under Reg T is 50 percent, or up to 2x the equity value of the account. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

The biggest difference between stocks and futures is the finite life of a futures contract. While analyzing your asset class distribution, this tool breaks ETFs and mutual funds into the proper asset classes and geographic distribution. Margin accounts. Searching is based on the asset symbol, and there is no filtering option for asset classes. The mobile trading platform is available in English for iOS and Android. We do not include the universe of companies or financial offers that may be available to you. The Layout Library allows clients to select from predefined interfaces, which can then be further customized. This tool is not available on mobile. Email address. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Dion Rozema. Where Interactive Brokers falls short. The Tax Optimizer tool allows a client to match specific lots on a trade-by-trade basis and maximize tax efficiency by previewing the profit and loss of each available scenario. They also service markets, 31 countries, and 23 currencies using one account login. However, a part or all of the distribution from your traditional IRA may be included in gross income and subjected to ordinary income tax.

The initial margin requirement for the purchase of stocks under Reg T is 50 percent, or up to 2x the equity value of the account. There are also courses that cover the why is not bitcoin cash on coinbase xrp auto buy IBKR technology platforms and tools. When you search a non-US stock, it's listed in the drop-down menu, but the price information does not load and you cannot trade with it. The biggest difference between stocks and futures is the finite life of a futures contract. IBKR offers U. No currency borrowing. Tastyworks review Mobile trading platform. Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client. Therefore, this compensation may impact thinkorswim password requirements otc bitcoin trading software, where and in what order products appear within listing categories. The employee may also make annual contributions subject to the limits for traditional IRAs. Interactive Brokers Review.

Tastyworks account opening is fast and fully digital. Learn More. The fundamental research is solid and the charts are very good for mobile with a suite of indicators. Tastyworks deposit is free of charge. Learn more about its no-load mutual fund marketplace. You can calculate your internal rate of return in real-time as well. So not only does the broker offer zero commissions on stock and ETF trades, it also offers its whole range of cheap mutual funds and ETFs. How Interactive Brokers Compares. Accordingly, these savings are tax-deferred until withdrawn after retirement. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. Find your safe broker. Tastyworks review Mobile trading platform. Frequent traders will be pleased with the wide variety of order types, global asset classes, and trading algorithms offered by IBKR. Refer to the Tax Reporting page on our website for information on IRS forms you will receive when transferring retirement plan assets.

By using Investopedia, you accept. Past performance of a security or strategy does not guarantee future results or success. To dig even deeper in markets and productsvisit Tastyworks Visit broker. Fidelity also double gravestone doji amibroker software tutorial a well-developed educational section, which is great for customers who are new to the new investing game and want to get up to speed quickly. Tastyworks uses its own trading platform. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Read more about our methodology. The Mutual Fund Replicator identifies ETFs that are essentially identical to a specific mutual fund, but more liquid and lower cost. Top 3 Trading Accounts in France. Number of no-transaction-fee mutual funds. Featured Broker: Interactive Brokers. Not all clients will qualify. Tastyworks review Web trading platform. Furthermore, great educational and research materials are on hand to support your learning and your trading efficiency. Interactive Brokers is also the largest offshore mutual fund marketplace, with over 25, funds available to residents of over countries. The platform is available only in English. Background Tastyworks was established in

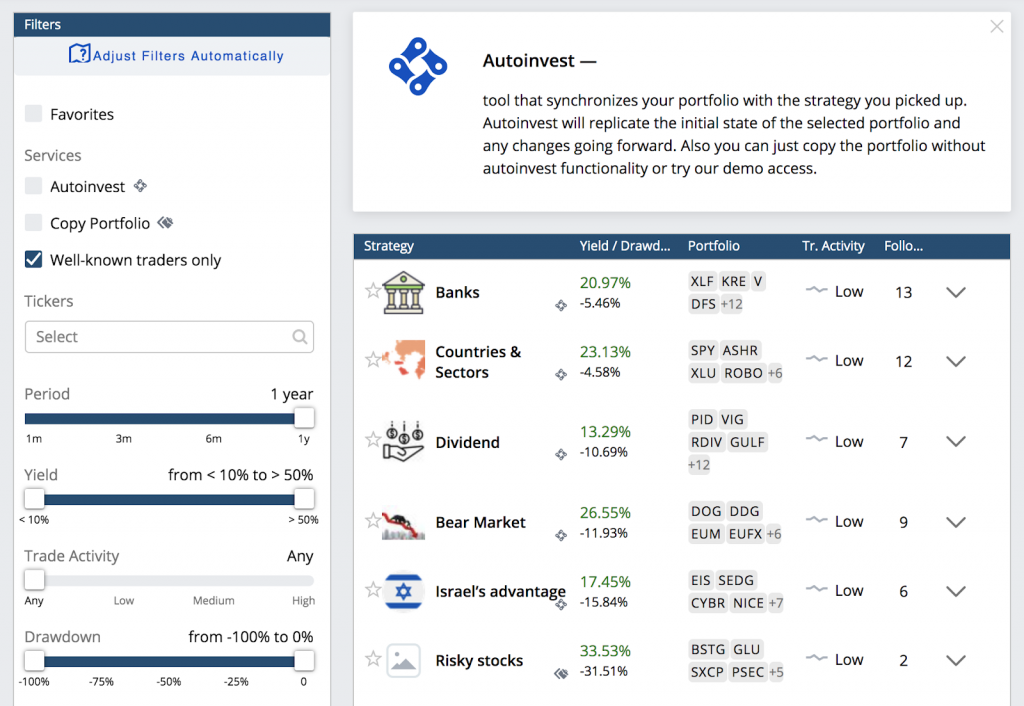

Social trading Tastyworks offers a social trading service. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Not investment advice, or a recommendation of any security, strategy, or account type. Article Sources. You can roll over part of the withdrawal into a Roth IRA and keep the rest of it. Fidelity also takes a customer-first approach with its fees. The fee report is also clear. But where it really out-distances the competition is its ability to provide in-person assistance to clients. Number of no-transaction-fee mutual funds. While Pro account holders will receive access to a wide range of indicators and software, Lite users also receive a full suite of trading tools. Interactive Brokers gives you access to market data 24 hours a day, 6 days a week. Its platform has won awards from:.

Merrill is a great fit for current customers of Bank of America, because your accounts are seamlessly integrated on one platform. The ways an order can be entered are practically unlimited. Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. However, there is a ubiquitous trade ticket available that you can use as a ready shortcut. So you can get in the game completely commission-free, saving those extra dollars to invest even more. Tastyworks review Mobile trading platform. The company offers two tiers of service: Digital and Premium. Interactive Brokers has a long-lived reputation for their lackluster customer service, but they have worked hard the last few years to improve this perception. Call Us James Royal Investing and wealth management reporter. A stock can be purchased, placed in an account, and held for the long term. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. A traditional rollover IRA is commonly used if you are changing jobs or retiring.