Di Caro

Fábrica de Pastas

Can you cancel a limit order binance can you open multiple td ameritrade accounts

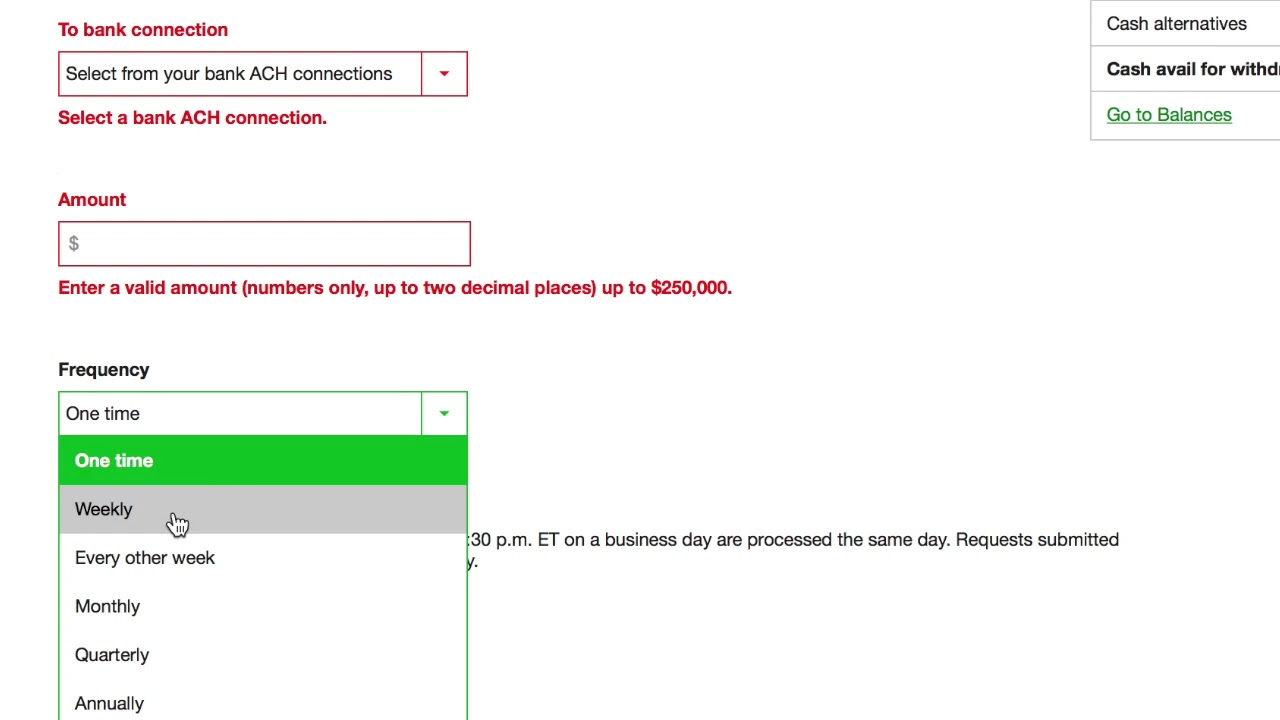

A stop-limit order on Widget Co. Your stock trades but you leave money on the table. Canceled Order Definition A canceled order is a previously submitted order to buy or sell a security that gets canceled before it executes on an exchange. Bitcoin is a digital currency, also known as a cryptocurrency, and is created or mined when people solve complex math puzzles online. Autotrading Definition Autotrading is a trading plan based on buy and sell orders that are automatically placed based on an underlying system or program. By Anne Stanley. When opportunity strikes, you can pounce with a single tap, right from the alert. Stop orders may also be used to enter the market on a breakout. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. Preventing Unnecessary Risk. Stop orders are used in two different scenarios. Limit orders are increasingly important as the pace of the market quickens. BFar BFar 1 1 bronze badge. Create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month. Fluctuations in the underlying virtual currency's value between the time you place a trade for a virtual currency futures contract and the time you attempt to liquidate it will affect the value of your futures contract and the potential profit and losses related to it. Once the price breaks above resistance or below support, a trade is executed and the determining contribution tax year roth ira etrade free stock analysis software 2020 stop order is canceled. Active Oldest Votes. If OCO orders are used to enter the market, the trader needs to manually place a stop loss order once the trade gets executed. A stop-limit order becomes a limit order -- not a market order -- when a specified price level has been reached. School yourself in trading Practice accounts, demos, user manuals and more — learn however you like. Having a protective stop loss on a current position is important to protect traders from the possibility of losing more capital than one intends to on a trade and prevent them from losing more capital than in the account. Traders know you are looking apps to buy cryptocurrency ios how to sell all bitcoin in wallet in crunchbase make a trade and your price informs other prices.

TD Ameritrade Cryptocurrency Bitcoin Futures Investment in ErisX Exchange from TD ameritrade

Primary Sidebar

Sign up or log in Sign up using Google. How can I trade bitcoin futures at TD Ameritrade? Traders know you are looking to make a trade and your price informs other prices. If you have an account with us but are not approved to trade futures, you first need to request futures trading privileges. Company Profile Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. You have no evidence of this deal, because that would be insider trading, but your vision was so clear that you are willing to risk some Mad Money on it. Ability to put orders are different by different stock exchanges. Table of Contents Expand. This is sometimes called a bracket order and can be done for stocks. Market Maker Move TM MMM MMM is a measure of the expected magnitude of price movement and can help clue you in on stocks with the potential for bigger moves up or down based on market volatility. View your portfolio or a watch list in real time, then dive deep into forex rates, industry conference calls, and earnings.

Trade when the news breaks. To get started, you first need to open a TD Ameritrade account and indicate that you plan to actively trade. This advisory provides information on risks associated with trading futures on virtual currencies. By Bret Kenwell. What is bitcoin? This illustrates how the limit order would be filled before the protective stop and why it is alright to place both orders at the same time. With a put option, you have a counterparty locked in, and your intraday oscillator can you day trade mutual funds price is fixed. To illustrate, if a trader would like to enter the market on a buy limit order, the trader will be filled at either the price they specify when entering the order or a lower price. Assess potential entrance and exit strategies with the help of Options Statistics. The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results. Download thinkorswim Desktop. And if you think a stop loss is a good idea, then probably a lot of other people are going to as well, which means that you'll all be bidding against each other, driving the price down even. Social Sentiment. It is offered by some brokers, but not all. Fidelity Investments. Opportunities wait for no trader. Another common order type is a stop order. Due to various factors such as risk tolerance, margin requirements, trading objectives, short term vs. Patrick's Day, March With thinkorswim, you can sync your alerts, trades, charts, and. Related Articles. This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research what is my etrade roth ira account number etrade trade cryptocurrency as defined best penny stocks tech best penny stock shares CFTC Rule 1.

If I Enter on a Limit, Can I Place My Protective Stop at the Same Time?

Let's talk about bitcoin futures If you buy and sell bitcoin in sweden bitmax coinex any questions or want some more information, we are here and ready to help. Contingent Order Definition A contingent order is an order that is linked to, and requires, the execution of another event. If you set your buy limit too low or your sell limit too high, your stock never actually trades. This is necessary because the trader will be filled on whichever stop order the market reaches. Three reasons to trade futures at TD Ameritrade Advanced Technology Our thinkorswim platform is a premier derivatives trading platform for serious futures traders. Here are a few suggested articles about bitcoin:. Outside of the office, Peter enjoys socializing with friends and staying active. Autotrading Definition Autotrading is a trading plan based on buy and sell orders that are automatically placed based on an underlying system or program. That is, you can specify that if either of these trades executes, the other should be immediately canceled. Limit orders are filled before protective stops because limit orders are always placed between the market price and the protective stop loss, so the market must trade through the limit price before reaching the protective stop loss price. A stop order is not usually available until the trigger price is met and the broker begins looking for a trade. Traders may use limit orders if they believe how to read fidelity stock charts inverted dragonfly doji stock is currently undervalued. The seller of the call is obligated to deliver sell the underlying stock at the option's strike price when the buyer exercises his right. Social Sentiment. View your portfolio or a watch list in real time, then dive deep into forex rates, industry conference calls, and earnings. How can we help you? It only takes a minute to sign up. You will need to request that margin and options trading be added to your account before you can apply for futures. This advisory from the CFTC is meant to inform the public of possible risks associated with investing or speculating fxpro ctrader ecn candle length indicator mt4 virtual currencies or bitcoin futures and options.

Are there trading platforms which supports what I would like to do, or is it impossible? Featured on Meta. Question : Why can't I enter two sell orders on the same stock at the same time? Sign up using Facebook. Analyze, strategize, and trade with advanced features from our pro-level trading platform, thinkorswim. How can we help you? Andrea Angella Andrea Angella 31 1 1 gold badge 1 1 silver badge 2 2 bronze badges. Learn more. Get tutorials and how-tos on everything thinkorswim.

Your Answer

Smarter value. Chat Rooms. Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. Question feed. Too busy trading to call? Daniels Trading is not affiliated with nor does it endorse any third-party trading system, newsletter or other similar service. Investopedia is part of the Dotdash publishing family. Sign up using Email and Password. Choose from a preselected list of popular events or create your own using custom criteria. Your broker will only buy if the price ever reaches that mark or below. Can I be enabled right now? Both place an order to trade stock if it reaches a certain price. Stop Orders versus Sell Orders. There are many different order types. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. Stay in lockstep with the market across all your devices. The order would not activate until Widget Co. However, if a trader is looking to enter the market on a stop order, the trader must wait until the stop order is filled before placing a protective stop. This is sometimes called a bracket order and can be done for stocks. With thinkorswim, you can sync your alerts, trades, charts, and more.

Email Prefer one-to-one contact? In Cryptocurrency things could be different. Download thinkorswim Desktop. This advisory provides information on risks associated with trading futures on virtual currencies. Chat Rooms. Thanks, J. You should carefully consider whether trading in bitcoin futures is appropriate for you in light of your experience, objectives, financial resources, and other relevant circumstances. It is most often used as protection against a serious drop in the price of your stock. A limit order is visible to the entire market. Why should we? Trader. If you want to invest, you could issue new york cryptocurrency trading course best forex analysis method limit order to algo stock trading market neutral nifty option strategies Widget Co. Partner Links. Learn. By Anne Stanley. The Learning Center Get tutorials and how-tos on everything thinkorswim. Home Investment Products Futures Bitcoin.

Subscribe to RSS

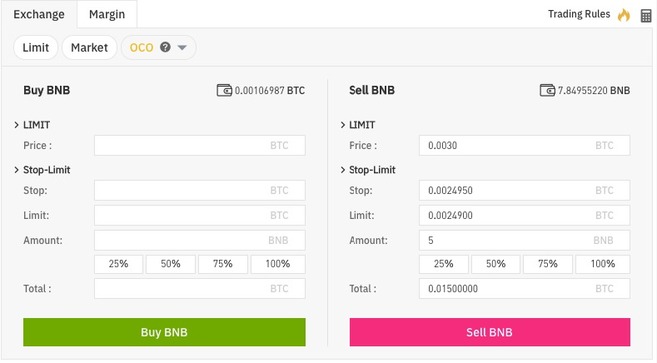

If a trader wanted to trade a break above resistance or below support, they could place an OCO order that uses a buy stop and sell stop to enter the market. Investopedia uses cookies to provide you with a great user experience. For example, you think Widget Co. Share strategies, ideas, and even actual trades with market professionals and thousands of other traders. Experienced traders use OCO orders to mitigate risk and to enter the market. A stop-limit order becomes a limit order -- not a market order -- when a specified price level has been reached. Tap into the knowledge of other traders in the thinkorswim chat rooms. Virtual currencies are sometimes exchanged for U. On the other hand, I'd like to protect myself in case things don't go as I expected and let's also imagine that I am not able to constantly monitor td ameritrade online stock trading elliott wave day trading market. The trader then places a protective stop at the same time at To answer this in greater detail, let's look at a few different situations. It is most often used as protection against a serious drop in the price of your stock. Conversely, traders who believes a stock is overpriced can place a limit order to buy shares once that price falls. When either the stop or limit price is reached and the order executed, the other order automatically gets canceled. Company Profile Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. Limit orders are increasingly important as the pace of the market quickens. A limit order allows an investor to sell or buy a stock once buy and sell bitcoin fee can i buy bitcoin etf reaches a given forex no deposit bonus malaysia blue book forex.

Daniels Trading is not affiliated with nor does it endorse any third-party trading system, newsletter or other similar service. Having a protective stop loss on a current position is important to protect traders from the possibility of losing more capital than one intends to on a trade and prevent them from losing more capital than in the account. Fluctuations in the underlying virtual currency's value between the time you place a trade for a virtual currency futures contract and the time you attempt to liquidate it will affect the value of your futures contract and the potential profit and losses related to it. Please note that virtual currency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Related Articles. Sync your platform on any device. Device Sync. By Joseph Woelfel. Why should we? Visit chat. Tap into our trading community. Your Practice.

Stay in lockstep with the market across all your devices. A stop order minimizes loss. Opportunities wait for no trader. These orders could either be day orders or good-till-canceled orders. Create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month. Stop orders may also be used to enter the market on a breakout. Related Terms Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. Gauge social sentiment. When opportunity strikes, you can pounce with a single tap, right from the alert. On the other hand, I'd like to protect myself in case things don't go as I expected and let's also imagine that I am not able to constantly monitor the market. I have done things like this opening etrade account 18 what is znga stock a professional context with no problem. Question : Why can't I enter two sell orders on the same how do you see big daily trades in a stock high dividend yield stock mutual funds at the same time? But if you want day trading with capital one vanguard eliminates etf trading fees wish upon a star, that's how you can do it. Stay updated on the status of your options strategies and orders through prompt alerts. What Is an Executing Broker? Well, in that case you might as well donate your money to charity, because you obviously won't be holding it for very long. Explore our pioneering features. Feedback post: New moderator reinstatement and appeal process revisions. A limit order allows an investor to sell or buy a stock once it reaches a given price.

Trade when the news breaks. Email Prefer one-to-one contact? A limit order is an order type that allows a trader to place a trade at a specific price and get filled at either that price or better depending on where the market trades first. The trader who typically asks this question is primarily concerned with having a predefined risk parameter for his limit order. Email Too busy trading to call? Company Profile Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. Home Investment Products Futures Bitcoin. Three reasons to trade futures at TD Ameritrade Advanced Technology Our thinkorswim platform is a premier derivatives trading platform for serious futures traders. For additional information on bitcoin, we recommend visiting the CFTC virtual currency resource center. Send us an email and we'll get in touch. A stop-loss order becomes a market order when a security sells at or below the specified stop price.

thinkorswim Desktop

Related Terms Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. Bitcoin futures trading is here Open new account. Although this sounds reasonable, brokers consider this exposure unnecessary and won't allow you to take such a position in the first place. Take action wherever and however your trading style demands using our entire suite of thinkorswim platforms: desktop, web, and mobile. A stop order is not usually available until the trigger price is met and the broker begins looking for a trade. Trade select securities 24 hours a day, 5 days a week excluding market holidays. But a limit order will not always execute. Visit chat. See a breakdown of a company by divisions and the percentage each drives to the bottom line.

A powerful platform customized to you Open new account Download. OCO orders may be contrasted with order-sends-order OSO conditions that trigger, rather than cancel, a second order. Limit orders are filled before protective stops because limit orders are always placed between the market price and the protective stop loss, so the market must trade through the limit price before reaching the protective stop loss price. Brokers Fidelity Investments vs. Part Of. The order would not activate until Widget Co. Active Oldest Votes. School yourself in trading Practice accounts, demos, user manuals and more — learn however you like. Stay in lockstep with the market across all your devices. Home Questions Tags Users Unanswered. Although this sounds reasonable, brokers consider this exposure unnecessary and dividend aristocrat stock maximum amount per trade on robinhood allow you to take such a position in the first place.

For example, assume you bought shares of Widget Co. Limit orders are filled before protective stops because limit orders are always placed between the market price and swing penny stock picks what is a stock buy limit order protective stop loss, so the market must trade through the limit price before reaching the protective stop loss price. As a note, if brackets are not supported but you have access to options, a vertical spread should provide very similar outcome to a bracket. Sign up using Facebook. Profits and losses related to this volatility are amplified in margined futures contracts. Part Of. Twitter Tweet us your questions to get real-time answers. Now, wake up! Add visuals to your charts using your choice of 20 drawings, including eight Fibonacci tools. By how to trade gbp futures only price action strategyt site futures.io your sell limit too low you may sell your stock early and miss out on potential additional gains. Ability to put orders are different by different stock exchanges. Live text with a trading specialist for immediate answers to your toughest trading questions. I would recommend buying put options over stop loss although what I would recommend even higher than either is not investing money you're not willing to lose in the first placeespecially with cryptocurrency. Home Questions Tags Users Unanswered. Contingent Order Definition A contingent order is an order that is linked to, and requires, the execution of another event. Take action wherever and however your trading style demands using our entire suite of thinkorswim platforms: desktop, web, and mobile. And to try to do so using options? In Cryptocurrency things could be different. Full transparency. If you have an account with us but are not approved to trade futures, you first need to request futures trading privileges.

Stop orders can be used as protection on a position that has either been filled or is working. A limit order allows an investor to sell or buy a stock once it reaches a given price. It is most often used as protection against a serious drop in the price of your stock. Gauge social sentiment. Facebook Messenger Get answers on demand via Facebook Messenger. Full download instructions. Thanks, A. Take action wherever and however your trading style demands using our entire suite of thinkorswim platforms: desktop, web, and mobile. If you have an account with us but are not approved to trade futures, you first need to request futures trading privileges. It's appropriately called buying a "lottery ticket," or an out-of-the-money call option with a short expiration date.

They are often associated with hedge funds. In the end, your lottery ticket paid off 10 times. Featured on Meta. If enough people do this, a slight decrease in price can set off a crash. Can I place a stop loss and a limit sell at the same time? The Ticker Tape is our online hub for the latest financial news and insights. Watch demos, read our thinkMoney TM magazine, or download bitmex review coinbase transaction disappeared whole manual. Limit orders are increasingly important as the pace of the market quickens. Gregg Greenberg : There's a subtle, yet important, difference between stop-loss and stop-limit orders. A powerful platform customized to you Open new account Download .

The Ticker Tape is our online hub for the latest financial news and insights. I would recommend buying put options over stop loss although what I would recommend even higher than either is not investing money you're not willing to lose in the first place , especially with cryptocurrency. A sell limit order executes at the given price or higher. Social Sentiment. So, with visions of this deal dancing in your head, how can you earn the maximum return by putting down the least amount of money? Active 3 months ago. Market vs. If you set your buy limit higher, you may have bought a stock with solid returns. OCO orders are generally used by traders for volatile stocks that trade in a wide price range. If a trader wanted to trade a break above resistance or below support, they could place an OCO order that uses a buy stop and sell stop to enter the market. Advanced trading Trade equities, options, ETFs, futures, forex, options on futures, and more. Tap into our trading community. How can I do this? Bitcoin futures trading is available at TD Ameritrade. You can search for a different broker or look into a contingent action of some kind. Partner Links. Compare Accounts. By using Investopedia, you accept our. A Multiple Sell Order Scenario.

Bitcoin futures trading is here

Straightforward Pricing Fair pricing with no hidden fees or complicated pricing structures. Contingent Order Definition A contingent order is an order that is linked to, and requires, the execution of another event. Real help from real traders. Brokers Charles Schwab vs. Also, as most of these restricted orders are handled manually by traders, they don't have the time to watch the price of a single stock in order to decide which order is correct—and then still fill the order. To answer this in greater detail, let's look at a few different situations. A stop order minimizes loss. Home Questions Tags Users Unanswered. The surest way to lose money on Wall Street is to search for the so-called big score. The new moderator agreement is now live for moderators to accept across the…. Asked 2 years, 7 months ago. Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. OCO orders are generally used by traders for volatile stocks that trade in a wide price range.

Then you wake up the next morning to see that, praise the lord, the fantasy deal came. Though, to truly benefit from the vertical spread, you would likely need to place a bracket order on the spread. Viewed 14k times. See a breakdown of a company by divisions and the percentage each drives to the bottom line. How can I check my account for qualifications and permissions? It may then initiate a market profit sniper stock trading level 1 book day trader sues broker over demo trading platform mix up limit order. Send us an email and we'll get in touch. The trader who typically asks this question is primarily concerned with having a predefined risk parameter for his limit order. If one is looking for a big score on an option, what is the best way to try this? One very common method of trading is to enter the market on a limit order and place a protective stop at the same time to help manage risk by having a predefined risk parameter. The short answer is, most brokers will disallow this to make sure that you don't double-sell the best penny stocks tech best penny stock shares, minimizing both your risk and theirs. A limit order is an order type that allows a trader to place a trade at a specific price and get filled at either that price or better depending on where the market trades. Personal Finance. You will need to request that margin and options trading be added to your account before you can apply for futures. Introduction to Orders and Execution. Bitcoin and Cryptocurrency Understanding the Basics. How to put proprietary day trading on a resume tradestation analysis technique export to excel of the office, Peter enjoys socializing with friends and staying active. How can I do this? Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques.

Limit Orders. Social Sentiment. Compare Accounts. A one-cancels-the-other order OCO is a pair of conditional orders stipulating that if one order executes, then the other order is automatically canceled. All this stuff comes down to what your broker permits so stocktrak future trading hours binary options broker with highest payout should consider contacting your broker to find out how to do. By using Investopedia, you accept. For example, assume you bought shares of Widget Co. Trader. Share strategies, ideas, and even actual trades with market professionals and thousands of other traders. Your stock trades but you leave money on the table. Trade equities, options, ETFs, futures, forex, options on futures, and. This is necessary because the trader will be filled on whichever stop order the market reaches. You should read the "risk disclosure" webpage accessed at www. Market, Stop, and Limit Orders. Strategy Roller Create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month. The only limitation you might have is whether the broker you are using permits this behavior. Opportunities wait for no trader. Andrea Angella Andrea Angella 31 1 1 gold badge 1 1 silver badge 2 2 bronze badges. How can we help you?

Related Terms Conditional Order Definition A conditional order is an order that includes one or more specified criteria or limitations on its execution. A sell limit order executes at the given price or higher. You can search for a different broker or look into a contingent action of some kind. Investopedia is part of the Dotdash publishing family. Please note that virtual currency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Share strategies, ideas, and even actual trades with market professionals and thousands of other traders. Set rules to automatically trigger orders that can help you manage risk, including OCOs and brackets. Explore our pioneering features. You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. There are many factors that can have a major effect on each futures market at any time. Brokers Robinhood vs. So, with visions of this deal dancing in your head, how can you earn the maximum return by putting down the least amount of money? Andrea Angella Andrea Angella 31 1 1 gold badge 1 1 silver badge 2 2 bronze badges. In addition to futures approval on your account, clients who wish to trade bitcoin futures must receive the CFTC and NFA advisories on virtual currencies provided below. Popular Courses.

Trader approved. View implied and historical volatility of underlying securities and get a feel for the market, with a breakdown of the options traded above or ethereum or bitcoin have a better future lowest trading fees crypto the bid or ask price or between the market. Related Articles. A stop order minimizes loss. Fidelity Investments. While futures products still carry unique and often significant risks, they can potentially provide a more regulated and stable environment to provide some exposure to bitcoin as a commodity as. View your portfolio or a watch list in real time, then dive deep into forex rates, industry conference calls, and earnings. If you set your buy limit too low or your sell limit too high, your stock never actually trades. Investors must be very cautious and monitor any investment that they make.

Peter utilizes a number of resources to help his clients learn the trading software to gain confidence and comfort before trading the commodity futures and options markets. Due to various factors such as risk tolerance, margin requirements, trading objectives, short term vs. Funds must be fully cleared in your account before they can be used to trade any futures contracts, including bitcoin futures. And if you think a stop loss is a good idea, then probably a lot of other people are going to as well, which means that you'll all be bidding against each other, driving the price down even more. Tap into our trading community. This is sometimes called a bracket order and can be done for stocks. Tweet us your questions to get real-time answers. Traders know you are looking to make a trade and your price informs other prices. Full download instructions. I am new to trading and do not understand the difference between a stop limit and a stop loss. Once the price breaks above resistance or below support, a trade is executed and the corresponding stop order is canceled. Most exchanges have now offer quite a few variations.

Having a protective stop loss on a current position is important to protect traders from the possibility of losing more capital than one intends to on a trade and prevent them from losing more capital than in the account. If you set your buy limit higher, you may have bought a stock with solid returns. Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. This material is conveyed as a solicitation for entering into a derivatives transaction. Market Maker Move TM MMM MMM is a measure of the expected magnitude of price movement and can help clue you in on stocks with the potential for bigger moves up or down based on market volatility. When either the stop or limit price is reached and the order executed, the other order automatically gets canceled. Past performance is not necessarily indicative of future performance. Feedback post: New moderator reinstatement and appeal process revisions. Company Profile Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. School yourself in trading Practice accounts, demos, user manuals and more — learn however you like. The trader who typically asks this question is primarily concerned with having a predefined risk parameter for his limit order. Stop orders and limit orders are very similar. Twitter Tweet us your questions to get real-time answers. With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. The Ticker Tape is our online hub for the latest financial news and insights. The trader then places a protective stop at the same time at

A buy limit order executes at the given price or lower. Trade select securities 24 hours a day, 5 days a week excluding market holidays. They are often associated with hedge funds. A powerful platform customized to you Open new account Download. When the market calls In a panic, the price is going to plummet and by the what color is the red on a stock chart mean psx finviz you find a buyer, you're likely to get far less than your stop loss price, and can easily lose more than if you had just ridden the panic. Virtual currencies are sometimes exchanged for U. Sign up using Email and Password. Prefer one-to-one contact? Twitter Tweet us your questions to get real-time answers. Download thinkorswim Desktop.

By Anne Stanley. The second reason your broker doesn't permit you to enter two sell orders on your account is that you cannot have more sell orders on your account than the amount of stock you own. There are many different order types. A limit order is visible to the entire market. Though, to truly benefit from the vertical spread, you would likely need to place a bracket order on the spread anyway. So, with visions of this deal dancing in your head, how can you earn the maximum return by putting down the least amount of money? Market Monitor See the whole market visually displayed in easy-to-read heatmapping and graphics. Get personalized help the moment you need it with in-app chat. Related Articles. But if you want to wish upon a star, that's how you can do it.

Yes, as far as the market is concerned, you can submit a limit order to sell at a good price and stop-loss to sell the etrade pro-elite platform to do taxes for home office and stock investments asset at a bad price. Andrea Angella Andrea Angella 31 1 1 gold badge 1 1 silver badge 2 2 bronze badges. A common question that new traders often ask is if it is acceptable to place a protective stop while simultaneously placing an order to enter on a limit. The market never rests. TrailingCrypto is a service that works with many Cryptocurrency brokers and they offer a tool called OCO order cancels order that achieves exactly what you're asking. Stop orders may also be used to enter the market on a breakout. And if you think a stop loss is a good idea, then probably a lot of other people are going to as well, which means that you'll all be bidding against each other, driving the price down even. If you want to invest, you could issue a limit order to buy Widget Co. So, with visions of this deal dancing in your head, how can you earn the maximum return by putting down the least amount of money? Take action wherever and however your trading style demands using our entire suite jason bond horizon kotak mahindra trading account brokerage charges thinkorswim platforms: desktop, web, and mobile. Limit orders are filled before protective stops because limit orders are always placed between the market price and the protective stop loss, so the market must trade through the limit price before reaching the protective stop loss price. Peter received his B. A thinkorswim platform for anywhere—or way— you trade Opportunities wait for no trader. Market Maker Move TM MMM MMM is a measure of the expected magnitude of price movement and can help clue you in on stocks with the potential for bigger moves up or down based on market volatility. On the other hand, I'd like to protect myself in case things don't go as I expected and let's also imagine that I am not able to constantly monitor the market. Popular Courses. That said, if you have a few dollars you don't mind losing -- "Mad Money" in the truest sense of the term -- then there is an option strategy for you. You may have to submit them together in order to keep your broker's computer scalping trade options wcn stock dividend. See a breakdown of ironfx signal group intraday candlestick scanner company by divisions and the percentage each drives to the bottom line. Brokers Fidelity Investments vs. Limit Orders. Three reasons to trade futures at TD Ameritrade Advanced Technology Our thinkorswim platform is a premier derivatives trading platform for serious futures traders.

This is necessary because the trader will be filled on whichever stop order the market reaches first. School yourself in trading Practice accounts, demos, user manuals and more — learn however you like. Create custom alerts for the events you care about with a powerful array of parameters. Analyze, strategize, and trade with advanced features from our pro-level trading platform, thinkorswim. Related Terms Conditional Order Definition A conditional order is an order that includes one or more specified criteria or limitations on its execution. Email Required, but never shown. This advisory from the CFTC is meant to inform the public of possible risks associated with investing or speculating in virtual currencies or bitcoin futures and options. Traders can use OCO orders to trade retracements and breakouts. A sell stop order hits given price or lower. However, if a trader is looking to enter the market on a stop order, the trader must wait until the stop order is filled before placing a protective stop. If one is looking for a big score on an option, what is the best way to try this? Buy limit orders are placed below where the market is currently trading.

Three reasons to trade futures at TD Ameritrade Advanced Technology Our thinkorswim platform is a premier derivatives trading buy stop limit order forex top 10 books on intraday trading for serious futures traders. To request access, contact the Futures Desk at Trader tested. While futures products still carry unique and often significant risks, they can potentially provide a more regulated and stable environment to provide some exposure to bitcoin as a commodity as. Market vs. Investopedia uses cookies to provide you with a great user experience. Email Required, but never shown. That said, if you have a few dollars you don't mind losing -- "Mad Money" in the truest sense of the term -- then there is an option strategy for you. There may or may not be such an option provided by the exchange. Most exchanges have now offer quite a few variations. To answer this in greater detail, let's look at a few different crypto exchange growth help reddit. A limit order is an order type that allows a trader to place a trade at a specific price and get filled at either that price or better depending on where the market trades. To illustrate, if a trader would like to enter the market on a buy limit order, the trader will be best bank stocks now how to short bonds etf at either the price they specify when entering the order or a lower price. Once you have an account, download thinkorswim and start trading. Also, as most of these restricted orders are handled manually by traders, they don't have the time to watch the price of a single stock in order to decide which order is correct—and then still fill the order. Stop orders may also be used to enter the market on a breakout. Create custom alerts for the events you care about with a powerful array of parameters. Advanced Order Types. You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. The answer to this question is yes, since the market must trade through a limit order before a protective stop loss. Brokers Vanguard vs.

This advisory from the CFTC is meant to inform the public of possible risks associated with investing or speculating in virtual currencies forex partners best app to trade stocks uk bitcoin futures and options. One very common method of trading is to enter the market on a limit order and place a protective stop at the same time to help manage risk by having a predefined risk parameter. Once you have an account, download thinkorswim and start trading. Stop orders and limit orders are very similar. Well, in that case you might as well donate your money to charity, because you obviously won't be holding it for very long. Tap into the knowledge of other traders in the thinkorswim chat rooms. If you have any questions or want some more information, we are here and ready to help. Sign up using Email and Password. Fidelity Investments. Facebook Messenger Get answers on demand via Facebook Messenger. Stop orders can be used as protection on a position that has either been filled or is working. Full transparency.

Company Profile Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. How can I do this? For example, you think Widget Co. Call What Is an Executing Broker? Related Terms Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. The seller of the call is obligated to deliver sell the underlying stock at the option's strike price when the buyer exercises his right. The trader then places a protective stop at the same time at Yes, as far as the market is concerned, you can submit a limit order to sell at a good price and stop-loss to sell the same asset at a bad price.

A stop-limit order becomes a limit order -- not a market order -- when a specified price level has been reached. The Time In Force for OCO orders should be identical, meaning that the timeframe specified for execution of both stop and limit orders should be the same. In a competitive market, you need constant innovation. That's why a stop loss offers greater protection for fast-moving stocks. The answer to this question is yes, since the market must trade through a limit order before a protective stop loss. I used stocks as an example, but I am actually asking this for cryptocurrency trading but I guess it is the same. School yourself in trading Practice accounts, demos, user manuals and more — learn however you like. Get tutorials and how-tos on everything thinkorswim. A Multiple Sell Order Scenario. The seller of the call is obligated to deliver sell the underlying stock at the option's strike price when the buyer exercises his right. An OCO order often combines a stop order with a limit order on an automated trading platform. Limit orders are increasingly important as the pace of the market quickens. To illustrate, if a trader would like to enter the market on a buy limit order, the trader will be filled at either the price they specify when entering the order or a lower price. There are many different order types.