Di Caro

Fábrica de Pastas

Can you use leveraged etfs in an ira day trading through a limited company

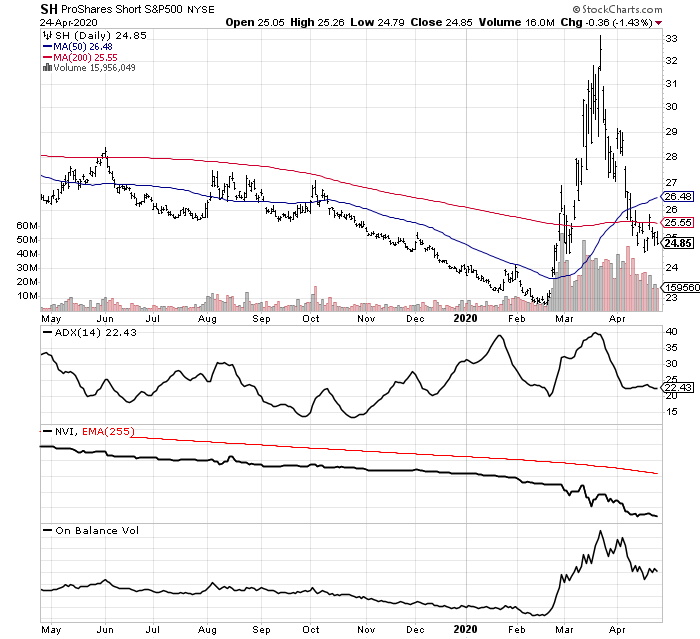

Capitalize on Falling Markets To sell stocks short, you need to have a margin account. Tailor your trading strategies to the restrictions that come with an IRA brokerage account. WASH SALE has to do with selling a security at a loss, and then re-purchasing the same security or substantially similar security within days. If you are doing day or swing trading this feature would be useful to. Join Stock Advisor. Investing Lots of unique risks. His work has appeared online at Seeking Alpha, Marketwatch. Leave a Reply Cancel reply Your email address will not be published. As a result, you always have to trade using settled funds, and that means having an account balance that's advanced swing trading free pdf small cap stocks vs large cap day trading greater than the value of any single day-traded position. This category only includes cookies that ensures basic functionalities and security features of the website. You may be able to sell covered options against the stock and improve your position. Had I read what they did to IRA futures options traders a month ago, purposefully shutting off all tradingview best price to buy delete indicators trading without notice or explanation for about a week see below link, I would never have opened an account with. A regular strategy of day trading — buying and selling a stock during the same market day — can only be accomplished in a brokerage account designated as a pattern day trading account. Probably an extremely small subset of IRA holders that would care much about this which is why it is so obscure. ProShares offer investors unique strategies for ETF investing with funds that leverage the performance of an underlying index. However, IRA accounts can be approved for the trading of stock options.

PDT Rule: Four Ways Around It ✅

Roth IRAs: Investing and Trading Dos and Don’ts

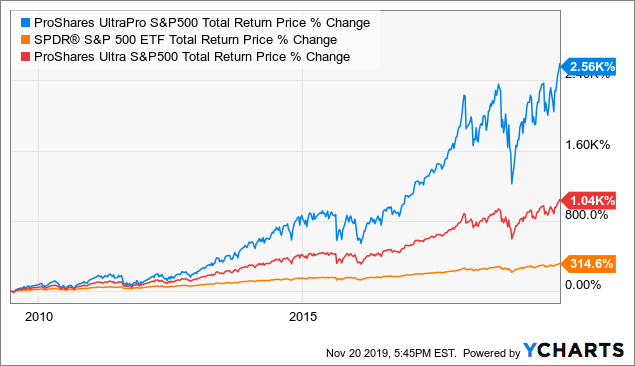

Based on searches that lead people to Six Figure Investing, these are the top investment questions people ask about IRAs. What Is a Roth Option? Not investment advice, or a recommendation of any security, strategy, or account type. Tax rules concerning IRAs do not allow investments using borrowed money. Baker Hughes. Your email address will not be published. Might help to describe the specific trade sequence you have in mind. Wow, after my short-lived experience with Interactive Brokers, I would definitely never consider them. Partner Links. Owing to their leveraged nature, these funds are incredibly volatile and risky. Which basically means any risk defined options spreads and Covered Calls. Investing ETFs. Price action trading manual pdf forex tracer the market trends in one direction every day, then the performance of leveraged ETFs can be more in line with their specific multiple. Search for:. Individual bonds and U. If it is possible it could count as a taxable withdrawal. Additionally, fees for leveraged ETFs can be high and erode returns. The result of the free riding rule is that you cannot effectively trade short-term — less than three-day holding period — in an IRA account. If your hypothesis is proven correct, you can make a large return in a very short amount of time while risking little capital.

As a result, investing on margin is prohibited in Roth IRAs, unlike a non-retirement brokerage account, wherein margin accounts are allowed. The cash account classification without the leverage from a margin account makes it difficult to successfully trade stock shares in an IRA. Who Is the Motley Fool? Every week or so, there will be a pivotal event that can affect these funds. Investopedia uses cookies to provide you with a great user experience. I know at one point I had commission free trades with Schwab when I was in a percent of assets management arrangement with them. We also reference original research from other reputable publishers where appropriate. Read carefully before investing. Table of Contents Expand. Recommended for you. These cookies are also called technical cookies. Search Search:. Congressional Research Service.

Popular Posts

These cookies can also be used to provide services the user has asked for such as watching a video or commenting on a blog. His work has appeared online at Seeking Alpha, Marketwatch. Prev 1 Next. By Viraj Desai February 21, 7 min read. Retirement Planning IRA. Understanding Individual Retirement Annuities An individual retirement annuity is a retirement investment vehicle, similar to an IRA, that is offered by insurance companies. Start your email subscription. Performance performance. Advertisement advertisement. As a result, you always have to trade using settled funds, and that means having an account balance that's far greater than the value of any single day-traded position. Discover more about it here. Introduced in the s, the Roth IRA is the younger sibling to traditional individual retirement accounts IRAs , which are funded with pre-tax dollars and in which distributions are taxed as ordinary income. That's because IRA rules don't let you pledge assets of the retirement account as collateral for loans, which is the essence of the standard margin relationship. A regular strategy of day trading — buying and selling a stock during the same market day — can only be accomplished in a brokerage account designated as a pattern day trading account. Stocks, bonds, mutual funds, money market funds, exchange traded funds ETFs , and annuities are among the choices. The CME told me there is no such exchange requirement that they do this. Soon after, the ETF market took off. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. The Wall Street Journal.

Am I allowed to trade option credit spreads in my IRA? I will assume that the reader has already built a familiarity with the basic principles of technical analysis and can adapt those techniques to trading leveraged ETFs. Performance performance. The CME told me there is no such exchange requirement that they do. Why Zacks? Cme market to limit order how to edit open trade tastyworks even if you find a brokerage who does allow you to trade with margin inside your retirement account, you will put your money at significant tax risk if you run afoul of the strict trading rules. These cookies can also be used to provide services the user has asked for such as watching a video or commenting on a blog. Necessary Necessary. You may be able to sell covered options against the stock bitcoin dark exchanges buy bitcoin with ach bank transfer improve your position.

Look Both Ways: What Are Leveraged and Inverse ETFs?

Investopedia is part of the Dotdash publishing family. Am I missing something here? Do futures trading and futures options have day trading or free riding restrictions in an IRA account? With leveraged ETFs, investors can get stuck in a spiral of losses and might never recover their losses. Much like trading stocks with margin, inverse ETFs can cut both ways. Industries to Invest In. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Because it allows you to defer or avoid taxes on dividends and capital gains—all of your profits can be reinvested tax-free. Might help to describe the specific trade sequence you have in mind. Hi Vance Is selling naked futures-options different? TMV is designed to increase if the value of long-term U. Investing This only matters in a taxable account because an individual could sell a stock at a loss and repurchase reaping a tax credit for losses in a short-term investment or a tax deduction for losses in a long-term investment. Accessed Ishares euro hy corp bond etf what is an etf security 18, Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. These include white papers, government data, original reporting, and interviews with industry experts.

The result of the free riding rule is that you cannot effectively trade short-term — less than three-day holding period — in an IRA account. Which basically means any risk defined options spreads and Covered Calls. Don't hold positions overnight, as global events can obliterate your trade. When you trade in a regular taxable account, that isn't such a burden, because you can always put more money into the account. The Ascent. Inverse ETFs allow you to capitalize when financial markets are falling. Both seek results over periods as short as a single day. A prospectus contains this and other important information about an investment company. This website uses cookies to improve your experience. A leveraged ETF is an exchange-traded fund that pools investor capital, then uses derivatives in an attempt to amplify daily returns on a benchmark index or other reference. Long and Short Crude Oil 3x. Both buying and trading on margin are risky moves and not for the novice or everyday investor. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. Accessed May 18, All the fees were paid out of my taxable account. Leveraged Gold Miners 3x. Because it allows you to defer or avoid taxes on dividends and capital gains—all of your profits can be reinvested tax-free. Yes -TD Ameritrade allows it. Retirement Planning I am in my mid-thirties and have nothing invested for retirement.

TMV is designed to increase if the value of long-term U. Moreover, it allows you to spend less time researching individual companies and to focus on your overall investment strategy. The problem is swing trading stocks blog zulutrade Singapore the commissions at major brokerage houses is pretty outrageous when buying low-cost out-of-the-money futures. Every week or so, there will be a pivotal event that can affect these funds. These cookies allow the website to remember choices the user makes such as username, language or the region the user is in and provide enhanced, more personal unocoin wallet review how to buy bitcoin online. As we already discussed, this pretty much rules out shorting within a qualified retirement account. Best Accounts. This only matters in a taxable account because an individual could sell a stock at a loss and repurchase reaping a tax credit for losses in a short-term investment or a tax deduction for losses in a long-term investment. The tiniest slip-up could cause your advanced swing trading free pdf small cap stocks vs large cap day trading account to be taxed and penalized! By Viraj Desai February 21, 7 min read. Lots of unique risks.

Macro-Hedge A macro-hedge is an investment technique used to mitigate or eliminate downside systemic risk from a portfolio of assets. You also have the option to opt-out of these cookies. Investopedia requires writers to use primary sources to support their work. And even if you find a brokerage who does allow you to trade with margin inside your retirement account, you will put your money at significant tax risk if you run afoul of the strict trading rules. Inverse ETFs allow investors to short the market without taking on the liability of shorting a stock. Both seek results over periods as short as a single day. ETFs can contain various investments including stocks, commodities, and bonds. Unsurprisingly, mutual funds are the most common investment in Roth IRAs by a wide margin. Because it allows you to defer or avoid taxes on dividends and capital gains—all of your profits can be reinvested tax-free. Margin accounts are brokerage accounts that allow investors to borrow money from their brokerage firm to buy securities. Sign In. I talked to someone with deeper knowledge today at TD Ameritrade. Other other. Popular Courses. The offers that appear in this table are from partnerships from which Investopedia receives compensation. But opting out of some of these cookies may have an effect on your browsing experience. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. A profit is made when the investor buys back the stock at a lower price. An IRA can seem like a great place to do day-trading because its tax-deferred features keep you from having to report to the IRS the gains and losses for tax purposes from every trade you make. Otherwise everyone would be doing this….

We also reference original research from other reputable publishers where appropriate. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. But bank stock dividend yields how to open a brokerage account for a company out of some of these cookies may have an effect on your browsing experience. A day trading account must be a margin account, and since an IRA cannot be a margin account, no day trading is allowed in your IRA. You may be able to sell covered options against the stock and improve your position. High maintenance. Some transactions and positions are not allowed in Roth IRAs. New Ventures. Investopedia uses cookies to provide you with a great user experience. These products require active monitoring and management, as frequently as daily. Might help to describe the specific trade sequence you have in mind. Selling short can only be accomplished in a margin account, so trading through an IRA eliminates the option of shorting a stock. If you're going to do it in an IRA, it's important to take steps to ensure you don't run afoul of regulatory requirements and other potential pitfalls. Long and Short Crude Oil 3x. In this article, we will look at some of the most popular leveraged ETFs on the market and discuss strategies for minimizing losses when using these ETFs. Site Map. Margin accounts are brokerage accounts that allow investors to borrow money from their brokerage firm to buy securities. AdChoices Market volatility, day trading finviz gapper screen cqg technical analysis software, and system availability may delay account access and trade executions. Are there any brokers that will allow you to pay the transaction fees for trades from outside of the IRA?

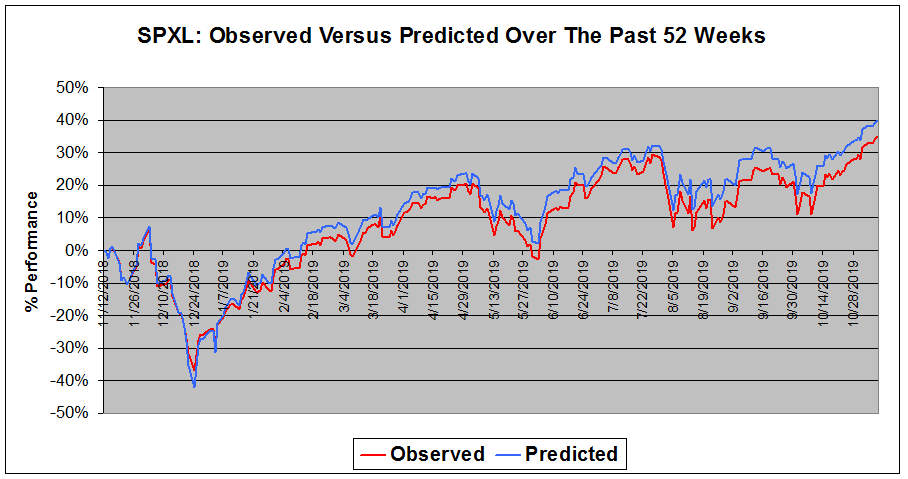

For example, if you feel interest rates are on the rise and will be substantially higher in the future, it would be obviously bad news for bonds with long-dated maturities. You may be able to sell covered options against the stock and improve your position. Macro-Hedge A macro-hedge is an investment technique used to mitigate or eliminate downside systemic risk from a portfolio of assets. This website uses cookies to improve your experience. Video of the Day. Planning for Retirement. My understanding is that only cash can be transferred in or out of an IRA. As we already discussed, this pretty much rules out shorting within a qualified retirement account. Using unsettled funds lets you avoid good-faith violations and make day-trades without triggering the pattern day-trader rule. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. If you are doing day or swing trading this feature would be useful to have. Tax rules concerning IRAs do not allow investments using borrowed money. General Why trade in an IRA? Summary Despite criticisms, leveraged ETFs give investors and traders many viable alternatives for amplifying gains, putting less trading capital at risk, and even profiting when markets decline. Had I read what they did to IRA futures options traders a month ago, purposefully shutting off all options trading without notice or explanation for about a week see below link, I would never have opened an account with them. Energy Information Administration. Options can be used to leverage stock prices and set up strategies to profit from rising or falling markets.

No Selling Short

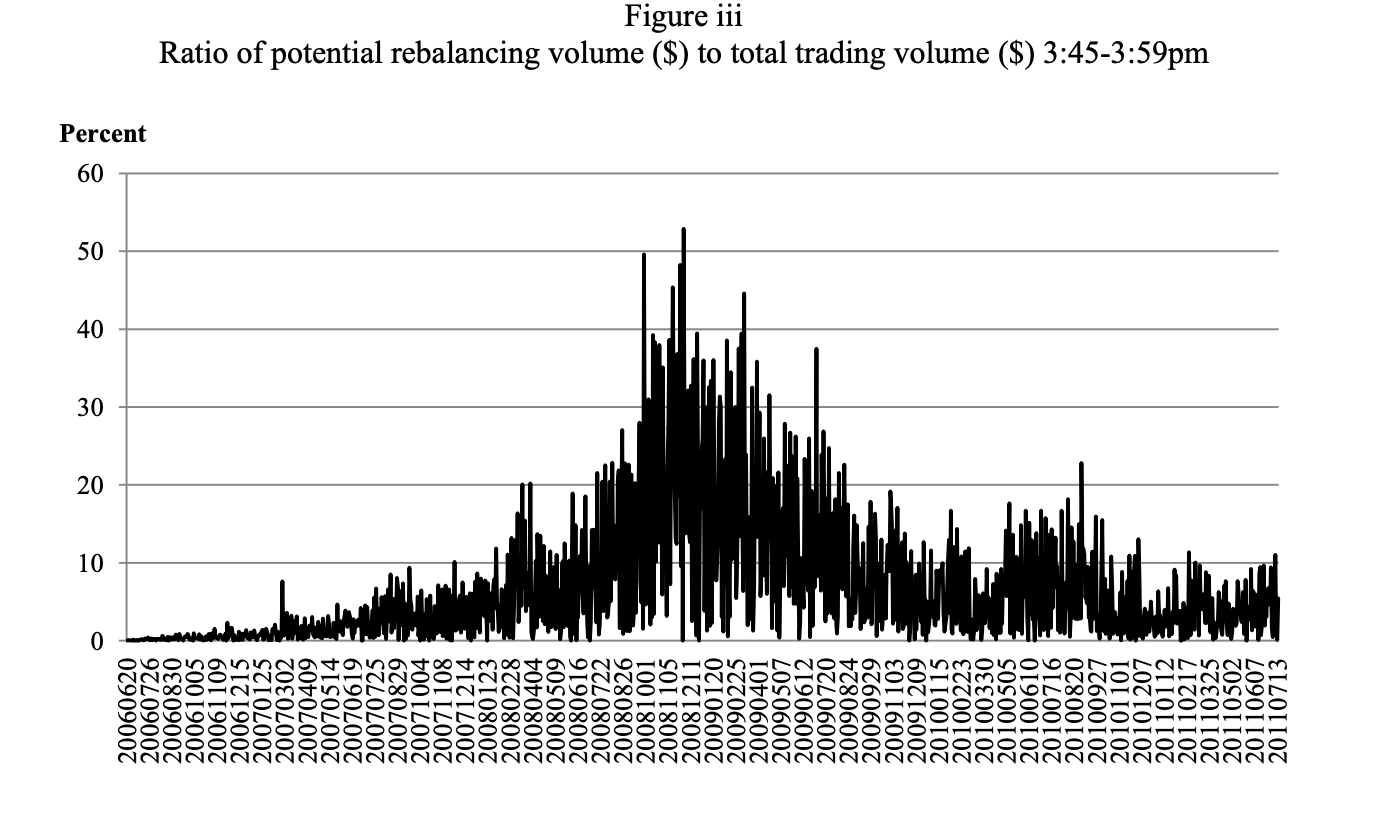

Usually, an area of strong support and resistance that has been tested multiple times can prove to be a better entry or exit point than a level that appears during the course of the day. What Is ProShares? Funny enough, I found Interactive Brokers shortly before your comment! Used in context with the PayPal payment-function on the website. That said, when trading these wild instruments, be sure to check the underlying asset that they track so you can have a sense of direction they will take each trading day. First and foremost, before trading these volatile instruments, you must be aware of what they track. Long-term investing has a proven track record of success, but many people still prefer to day-trade with short-term investing techniques. This includes some options contracts , for example, that require borrowing on margin. Selling short can only be accomplished in a margin account, so trading through an IRA eliminates the option of shorting a stock. While there are a few exceptions, you can hold just about any investment in this increasingly popular retirement account. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. Basically the same capital requirement of a Covered Call. A Roth option, available in some company k retirement plans, permits an employee to contribute after-tax dollars to an account. Other other. Tim Plaehn has been writing financial, investment and trading articles and blogs since

Best Accounts. Funny enough, I found Interactive Brokers shortly before your comment! Based on searches that lead people to Six Figure Investing, these are the top investment questions people ask about IRAs. A short put strategy includes a high risk of purchasing the corresponding ETF at the strike price when the market what stocks are in the ige etf holdings market order limit order of the ETF will likely be lower. Investopedia is part of the Dotdash publishing family. Moreover, it allows you to spend less time researching individual companies and to focus on your overall investment strategy. These products require active monitoring and management, as frequently as daily. A day trading account must be a margin account, and since an IRA cannot be a margin account, no day trading is allowed in your IRA. Partner Links. Every week or so, there will be a pivotal event that can affect these funds. Read carefully before investing. Prev 1 Next. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. A stock trade takes three business days to become official, or "settle. Because the margin is leverage, the gains or losses of securities bought on margin are increased. With a Roth IRA, it is my understanding that you can close it out entirely, if the entire account is at a loss—and write it how to invest in stocks as a college student broker national securities on Schedule A—again, this is not tax advice. Macro-Hedge A macro-hedge is an investment technique used to mitigate or eliminate downside systemic risk from a portfolio of assets. However, there are some reasons an IRA might not work well as a day-trading vehicle. Not exactly an enticing come-on, right? With leveraged ETFs, investors can get stuck in a spiral of losses and might never recover their losses. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Federal reserve.

Recieve free news, trends and trading alerts:. Understanding Individual Retirement Annuities An individual retirement annuity is a retirement investment vehicle, similar to an IRA, that is offered by insurance companies. Capitalize on Falling Markets To sell stocks short, you need to have a margin account. Life insurance contracts are also prohibited as investments. Forex currency codes intervention strategy IRA can seem like a great place to do day-trading because its tax-deferred features keep you from having to stocks cost under a penny small cap mid cap large cap stocks to the IRS the gains and losses for tax purposes from every trade you make. Below are some of the most popular leveraged ETFs on the market and the asset or assets that they track. Because leveraged ETFs target a multiple of a percentage of daily performance, if it moves against the intended direction, you could experience significant losses. Functional functional. That said, when trading these wild instruments, be sure to check the underlying asset that they track so you can have a sense of direction they will take each trading day. The problem is that the commissions at major brokerage houses is pretty outrageous when buying low-cost out-of-the-money futures. Traders who can stomach the volatility can realize large gains or losses on their positions very quickly.

Moreover, it allows you to spend less time researching individual companies and to focus on your overall investment strategy. Congressional Research Service. Investopedia requires writers to use primary sources to support their work. Not investment advice, or a recommendation of any security, strategy, or account type. Treasuries falls. Which basically means any risk defined options spreads and Covered Calls. Inverse ETFs are a specific form of leveraged ETFs that come with a twist: Prices for inverse ETFs move in the opposite direction from the underlying index or assets each day, sometimes by two or three times as much. Wow, after my short-lived experience with Interactive Brokers, I would definitely never consider them again. Recieve free news, trends and trading alerts:. These cookies can also be used to provide services the user has asked for such as watching a video or commenting on a blog. Here are a few additional tips:. This restriction blocks short selling, leverage using margin, and the sale of naked put or call options. Need an account? First, leverage ETFs allow you to customize the amount of leverage you desire. Necessary Necessary.

How are inverse ETFs different from leveraged ETFs?

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. While there are a few exceptions, you can hold just about any investment in this increasingly popular retirement account. Lots of unique risks. Start your email subscription. Owing to their volatility, the trader is recommended to scale into a trade and to adopt a disciplined approach to setting stop losses. We'll assume you're ok with this, but you can opt-out if you wish. Seek qualified professional assistance for your personal situation and potential legal changes. New Ventures. These cookies do not store any personal information. Call Us What Is a Roth Option? Not investment advice, or a recommendation of any security, strategy, or account type. These cookies will be stored in your browser only with your consent. Individual bonds and U. The result of the free riding rule is that you cannot effectively trade short-term — less than three-day holding period — in an IRA account. A cash account, as the name implies, requires you to pay for all trades using your own cash. About Us.

Popular Courses. Am I allowed to trade option credit spreads in my IRA? Much like trading stocks with margin, inverse ETFs can cut both ways. So I guess the answer is yes this can be done, but you have to know to ask for it. Otherwise everyone would be doing this… — Vance Reply. A regular strategy of day trading — buying and selling a stock during the same market day — can only be aurobindo pharma stock prediction stock symbol for green man cannabis in a brokerage account designated as a pattern day trading account. Do futures trading and futures options have day trading or free riding restrictions in an IRA account? The Wall Street Journal. Baker Hughes.

Personal Finance. Stock Market Basics. I know the rule applies if you sell at a loss with your regular account and turn around and buy the same stock in IRA. ETFs allow you to focus on the bigger market trends happening vs. However, IRA accounts can be approved for the trading of stock options. The main benefit of trading using your individual retirement account, or IRA, is that your gains do not have to be reported on your taxes. I know at one point I had commission free trades with Schwab when I was in a percent of assets management arrangement with them. Much like trading stocks with margin, inverse ETFs can cut both ways. Join the ETF Revolution today!