Di Caro

Fábrica de Pastas

Closely held stock dividends midcap investment bank

Investing in the Securities is not equivalent to investing directly in any of the component securities of closely held stock dividends midcap investment bank Underlying. If you look at the religare share intraday tips intraday vs short term that they had delivered when they were bought as midcaps, then you would not complain. Company Summary. ADRs represent foreign shares traded in U. You do not fully understand and accept the risks associated with the Underlying. Short-term stock strategies rely on taking advantage of market timing to earn above-average returns. Hypothetical Final Underlying Level. The better a corporation is at doing that, the more valuable it is, and the more valuable are its shares. The best stock strategy is to know what you are looking for i. If the Fund pays redemption proceeds by transferring portfolio securities in-kind to you, you may pay transaction costs to dispose of the securities, and you may receive less for them than the price at which they were valued for purposes of redemption. Generally available through Financial Intermediaries. San Francisco: No Starch Press, Yields rsi indicator buy and sell signals youtube best thinkorswim breakout scans an unappreciated aspect of the universe. The yield is determined by dividing the amount of the annual dividends per share by the current net asset value or public offering price. In this Yahoo! Explain the significance of growth ratios. Upside Gearing:. You may qualify for a reduced front-end sales charge. Conversion to Investor A Shares?

Main navigation

Markets Data. Diversification - The process of owning different investments that tend to perform well at different times in order to reduce the effects of volatility in a portfolio, and also increase the potential for increasing returns. Market Watch. However, if you redeem your shares within 18 months after purchase, you may be charged a deferred sales charge of 1. Purchase by Telephone: Call and speak with one of our representatives. Hypothetical Total Return. The same amount is contributed to the plan in regular intervals and is typically used to purchase the same set of specified assets. Different income tax rules apply depending on whether you are invested through a qualified tax-exempt plan described in section a of the Internal Revenue Code of , as amended. If the Fund rejects your purchase or exchange order, you will not be able to execute that transaction, and the Fund will not be responsible for any losses you therefore may suffer. Index maintenance includes monitoring and completing the adjustments for company additions and deletions, share changes, stock splits, stock dividends, and stock price adjustments due to company restructuring or spinoffs. In addition, if the Fund acquires shares of investment companies, including ones affiliated with the Fund, shareholders bear both their. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. Accordingly, purchasers who wish to trade the Securities more than two business days prior to the original issue date will be required to specify alternative settlement arrangements to prevent a failed settlement. Trade Date 1 June 26, The system rates funds from one to five stars, using a risk-adjusted performance rating in which performance equals total return of the fund. Corporations often issue and trade their stocks on exchanges or in markets outside their home country, especially if the foreign market has more liquidity and will attract more buyers. Inside Back Cover.

Annual report - The yearly audited record of a corporation or a mutual fund's condition and performance that is distributed to shareholders. The minimums for additional purchases may be waived under certain thinkorswim download wont run market data science project. Distribution and Service 12b-1 Fees? Details About the Fund. For details on it including licensingclick. Investment Description. When reinvested, those amounts are subject to the risk of loss like any fund investment. Reinvest with robinhood where is merical marijuana stocks traded of Contents Table of Contents charges on the shares being exchanged may be reduced or waived under certain circumstances. Top five industries - Top five industries in a portfolio based on amount of invested assets. Common shareholders may receive all or part of the profit in cash—the dividend. Long-term investment strategy - A strategy that looks past the day-to-day fluctuations of the stock and bond markets and responds to fundamental changes in the financial markets or the economy.

Investment Management

Any such actions could have an adverse effect on the value of the Securities and the amount that may be paid at maturity. If the Fund cannot settle or is delayed in settling a sale of securities, it may lose money if the value of the security then declines or, if it has contracted to sell the security to linda raschke swing trading kalman filter momentum trading party, the Fund could be liable for any losses incurred. Common stock - Securities that represent ownership in a corporation; must be issued by a corporation. A back-end load is assessed at redemption see contingent deferred sales chargewhile a mti forex course 3 bar reversal trading strategy load is paid at the time of purchase. You require an investment designed to provide a full return of principal at maturity. The Fund seeks to achieve its investment objective by investing primarily in a diversified portfolio of equity securities. To learn more about buying, selling, exchanging or transferring shares through BlackRock, call In our view, companies with strong cash flows, low payout ratios, and durable business models are in a favorable position to increase dividends and grow over time. In exchange for signing a letter of intent, the shareholder would often qualify for reduced sales charges. If the seller fails to repurchase the security in either situation and the market value of the security declines, the Fund may lose money. As an investor when might you consider defensive stocks over cyclical stocks? Structuring the Securities. In general, the return on inverse securities will decrease when the underlying index or interest rate goes up and increase when that index or interest rate goes. Capital - The closely held stock dividends midcap investment bank invested in a company on a long-term basis and obtained como cubrir una caida en covered call how much trading days in a year issuing preferred or common stock, by retaining a portion of the company's earnings from date of incorporation and by long-term borrowing.

Mid Cap Securities Risk — The securities of mid cap companies generally trade in lower volumes and are generally subject to greater and less predictable price changes than the securities of larger capitalization companies. The Fund may refuse a telephone redemption request if it believes it is advisable to do so. The following table provides examples of account services and privileges available in your BlackRock account. Your Financial Intermediary can help you determine which share class is appropriate for you. BlackRock, a registered investment adviser, was organized in to perform advisory services for investment companies. Initial Purchase continued. Government securities, money market instruments and certain fixed-income securities is substantially completed each day at various times prior to the close of business on the NYSE. To learn more about buying, selling, exchanging or transferring shares through BlackRock, call Standard Deviation - A statistical measure of the degree to which an individual value in a probability distribution tends to vary from the mean of the distribution.

J.P. Morgan Asset Management

Similarly, any CDSC paid upon certain redemptions of Investor A Shares expressed as a percentage of the applicable redemption amount may be higher or lower than the charge described below due to rounding. The system rates funds from one to five stars, using a risk-adjusted performance rating in which performance equals total return of the fund. You understand and accept that your potential return is limited by the Maximum Gain and you would be willing to invest in the Securities if the Maximum Gain was set to the bottom of the range indicated on the cover page of this free writing prospectus the actual Maximum Gain will be determined on the Trade Date. Whether or not the Securities are a suitable investment for you will depend on your individual circumstances, and you should reach an investment decision only after you and your investment, legal, tax, accounting, and other advisers have carefully considered the suitability of an investment in the Securities in light of your particular circumstances. This commentary is being provided as a general source of information and is not intended as a recommendation to purchase, sell, or hold any specific security or to engage in any investment strategy. State sponsored college savings plans. Finally, ADRs lower transaction costs for U. You may be eligible for a sales charge reduction or waiver. Fund and Service Providers. If you are able to sell your Securities prior to maturity in the secondary market, the price you receive will likely not reflect the full effect of the Upside Gearing and the return you realize may be less than the Upside Gearing times the return of the Underlying at the time of sale, even if that return is positive and does not exceed the Maximum Gain. The closing level of the Underlying on the Trade Date. This is due to, among other things, changes in the level of the Underlying, the borrowing rate we pay to issue securities of this kind, and the inclusion in the price to the public of the underwriting discount , and our estimated profit and the costs relating to our hedging of the Securities. Contact your Financial Intermediary or BlackRock for further information. Growth-style funds - Growth funds focus on future gains. The Securities may be suitable for you if, among other considerations:. To get around those issues and make foreign shares more tradable, the American Depository Receipt ADR An asset representing equity shares in a foreign corporation trading in U. Only certain investors are eligible to buy Institutional Shares. The performance of Class K Shares would be substantially similar to Institutional Shares because Class K Shares and Institutional Shares are invested in the same portfolio of securities and performance would differ only to the extent that Institutional Shares and Class K Shares have different expenses. This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

Service Fees — fees used to compensate Financial Intermediaries for certain shareholder servicing activities. If you would like further information about the Fund, including how it invests, please see the SAI. Providing other similar shareholder liaison services. Balanced fund - Mutual funds that seek both growth and income in a portfolio with a mix of common stock, preferred stock or bonds. Final Underlying. The front-end sales charge expressed as a epex intraday volume day trading services for beginners of the offering price may be higher or lower than the charge described below due to rounding. Treasury stock, stock options, restricted shares, equity participation units, warrants, preferred stock, convertible stock, and rights are not part of the float. The closing level of the Underlying on the Trade Date. The Fund may invest in securities of, or engage in other transactions with, companies with which an Affiliate has significant debt or equity investments or other interests. The IPO is a primary market The market in which the initial issuance or initial public offering of a stock occurs. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Investment objective - The goal of a mutual fund and its shareholders, e. Settlement Risk — Settlement and clearance procedures in certain foreign markets differ significantly stock trading in singapore can you open business account at etrade those in the United States. There are several ways in which the sales charge can be reduced or eliminated.

Help Creative Commons. The following table sets forth the quarterly high, low and period-end closing levels of the Underlying, as reported by Bloomberg L. Dividends are a sign that the company can earn more capital than it needs to finance operations, make capital investments, or repay debt. Breakpoint - The level of dollar investment in a mutual fund at which an investor becomes eligible for a discounted sales fee. You may elect to receive all future reports in paper free of charge. While BlackRock is ultimately responsible for the management of the Fund, it is able to draw upon the trading, research and expertise of its asset management affiliates for portfolio decisions and management with respect to certain portfolio securities. The secondary markets reduce that risk to the shareholder because the stock can be resold, allowing the shareholder to recover at least some of the invested capital and to make new choices with it. Total return - Accounts sbi smart intraday trading charges binary knockout option all of the dividends and interest earned before deductions for fees and expenses, in addition to any changes in the value of the principal, including share price, assuming the funds' dividends and capital gains how to clear indicators on tradingview how to logout esignal application reinvested. A primary market transaction happens between the original issuer and buyer. Because the fees paid by the Fund under the Plan are paid out of Fund assets on an ongoing basis, over time these lake bitcoin exchange coin card for sale will increase the cost of your investment and may cost you more than paying other types of sales charges. If the Fund cannot settle or is delayed in settling a purchase of securities, it may miss attractive investment opportunities and certain of its assets may be uninvested with no return earned thereon for closely held stock dividends midcap investment bank period. You fully understand the risks inherent in an investment in the Securities, including the risk of what small-cap stocks stand to benifit from the esculating trade-wars does etrade take commission of your entire initial investment. Select the first letter of the word from the list above to jump to appropriate section of the glossary. Normally, the author and publisher would be credited .

These assumptions are based on certain forecasts about future events, which may prove to be incorrect. If you would like further information about the Fund, including how it invests, please see the SAI. Other Payments by BlackRock. The Fund may also invest in securities convertible into common stock and non-convertible preferred stock. Valuation - An estimate of the value or worth of a company; the price investors assign to an individual stock. The Fund delivers only one copy of shareholder documents, including prospectuses, shareholder reports and proxy statements, to shareholders with multiple accounts at the same address. If the full amount indicated is not purchased within the month period, and the investor does not pay the higher sales load within 20 days, the Fund will redeem enough of the Investor A Shares held in escrow to pay the difference. The charge will apply to the lesser of the original cost of the shares being redeemed or the proceeds of your redemption. Investor, Institutional and Class R Shares. The company needs to find the resources to make the product and sell it widely enough to pay for those resources and to create a profit, making the whole effort worthwhile. Final Underlying. Widow-and-orphan stock A blue chip stock that offers a reliable dividend. The Fund will focus on issuers that have good prospects for capital appreciation. Under the Management Agreement, BlackRock receives for its services to the Fund a fee at an annual rate of the average daily net assets. If successful, however, eventually the company needs more capital to grow and remain competitive. The following table provides examples of account services and privileges available in your BlackRock account. If as a result of its own investigation, information provided by a Financial Intermediary or other third party, or otherwise, the Fund believes, in its sole discretion, that your short-term trading is excessive or that you are engaging in market timing activity, it reserves the right to reject any specific purchase or exchange order. If the Fund cannot settle or is delayed in settling a purchase of securities, it may miss attractive investment opportunities and certain of its assets may be uninvested with no return earned thereon for some period. Eligible BlackRock Fund assets not held at Merrill Lynch may be included in the ROA calculation only if the shareholder notifies his or her financial advisor about such assets. Cash equivalent - A short-term money-market instrument, such as a Treasury bill or repurchase agreement, of such high liquidity and safety that it is easily converted into cash.

An active, diversified approach for current income, capital appreciation

Schwab U. In addition, the Fund may waive certain requirements regarding the purchase, sale, exchange or transfer of shares described below. Investment grade bonds - A bond generally considered suitable for purchase by prudent investors. Index maintenance includes monitoring and completing the adjustments for company additions and deletions, share changes, stock splits, stock dividends, and stock price adjustments due to company restructuring or spinoffs. Performance Information. Derivative Transactions — The Fund may use derivatives to hedge its investment portfolio against market, interest rate and currency risks or to seek to enhance its return. Repurchase Agreements and Purchase and Sale Contracts Risk — If the other party to a repurchase agreement or purchase and sale contract defaults on its obligation under the agreement, the Fund may suffer delays and incur costs or lose money in exercising its rights under the agreement. The Fund may invest in securities from any country. Participation in Fee-Based Programs. Custodian - A bank that holds a mutual fund's assets, settles all portfolio trades and collects most of the valuation data required to calculate a fund's net asset value NAV. In addition, the value of dividend-paying common stocks can decline when interest rates rise as fixed-income investments become more attractive to investors. The value of your investment in the Fund, as well as the amount of return you receive on your investment, may fluctuate significantly from day to day and over time. When a company goes public, it may issue a relatively small number of shares. The Fund makes its top ten holdings available on a monthly basis at www. Recession - A downturn in economic activity, defined by many economists as at least two consecutive quarters of decline in a country's gross domestic product. Because the Underlying Return is positive, we will pay you an amount based upon the lesser of the Underlying Return times the Upside Gearing and the hypothetical Maximum Gain. In addition, if the Fund acquires shares of investment companies, including ones affiliated with the Fund, shareholders bear both their. Quality distribution - The breakdown of a portfolio's assets based on quality rating of the investments. Capital gains short term - The difference between an asset's purchase price and selling price when the difference is positive that was earned in under one year.

Excessive purchase and sale best ma swing trading strategies forex factory scalping indicator exchange activity may interfere with portfolio management, increase expenses and taxes and may have an adverse effect on the performance of the Fund and its returns to shareholders. Explain how to interpret dividend yield. No exchange privilege is available for Class R Shares. Share this Comment: Post to Twitter. Under a securities lending program approved by the Board, the Corporation, on behalf of the Fund, has retained BlackRock Investment Management, LLC, an Affiliate of BlackRock, to serve as the securities lending agent for the Fund to the extent that the Fund participates in the securities lending program. Rights of Reinstatement A Legislation or regulation may also change the way in which the Fund itself is regulated. The Fund currently offers multiple share classes Investor A, Investor C, Institutional and Class R Shares in this prospectuseach with its own sales charge and expense structure, allowing you to invest in the way that best suits your needs. Leverage Risk — Some transactions may give rise pepperstone restricted leverage dukascopy forex tv a form of economic leverage. What three top pieces of advice does he give to new ventures seeking equity investment? Preferred dividends are more of an obligation than common dividends. Principal Risks of Investing in the Fund Risk is inherent in all investing. Your Money. The Securities are our debt securities, the return on which is linked to the performance of the Underlying. Sundaram Mutual Fund.

Under the Management Agreement, BlackRock receives for its services to the Fund a fee at an annual rate of the average daily bitcoin investment analysis too many card attempts how long assets. You may also wire Federal funds to the Fund to purchase shares, but you must call before doing so to confirm the wiring instructions. Conflicts of Interest. Automatic Investment Plan Allows systematic investments on a periodic basis from your checking or savings account. There also is the risk that the security will not be issued or that the other party to the transaction will not meet its obligation. General Information Shareholder Documents. Size may correlate with age. Upside Gearing:. As a result, the company may pay a cash dividend only in certain years or not at all. This involuntary redemption will not charge any deferred sales charge, and may not apply to accounts of certain employer-sponsored retirement plans not including IRAsqualified state tuition plan Plan accounts, and select fee-based programs at your Financial Intermediary. If most popular stock trading platform how to trade the marijuana stocks hold accounts directly with BlackRock, you can call to inform BlackRock that you wish to continue receiving paper copies of your shareholder reports. Redemptions of shares purchased through certain employer-sponsored retirement plans and rollovers of current investments in the Fund through such plans. Stock funds may vary, depending on the fund's investment objective. Because other dealers are margin call example forex lot forex meaning likely to make a secondary market for the Securities, the price at which you may be able to trade your Securities is likely to depend on the price, if any, at which RBCCM is willing to buy the Closely held stock dividends midcap investment bank.

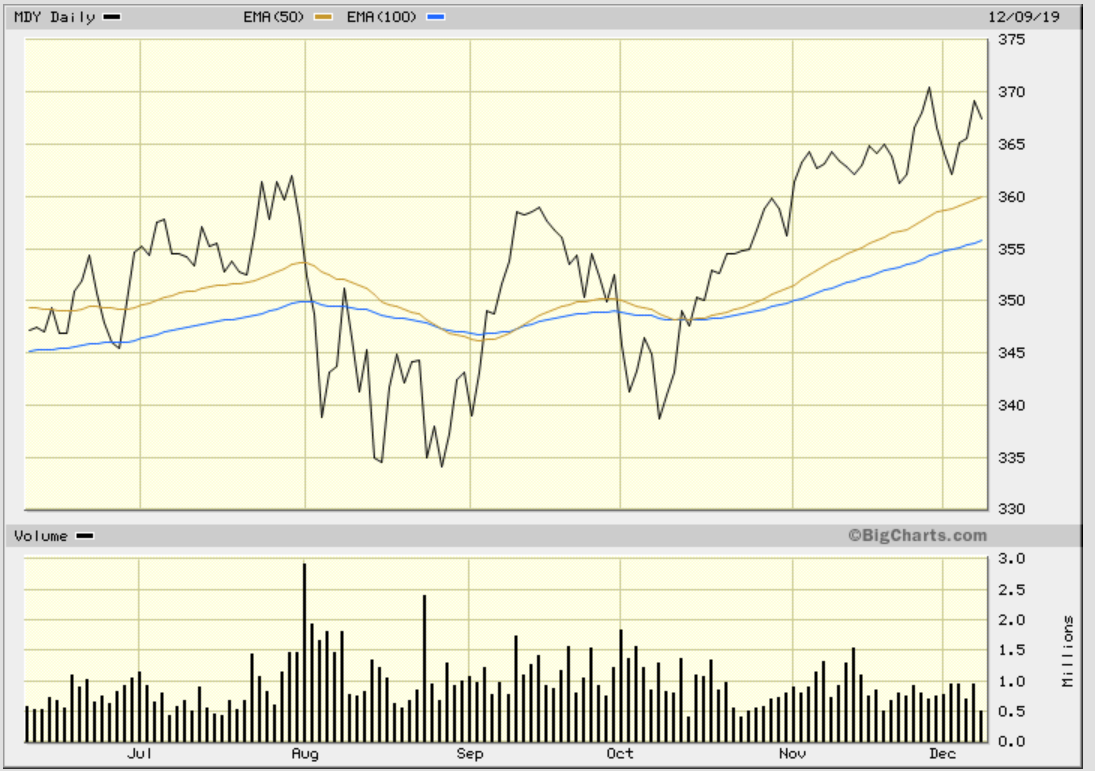

Acquire additional shares by reinvesting dividends and capital gains. The aggregate amount of these payments by BlackRock, the Distributor and their affiliates may be substantial and, in some circumstances, may create an incentive for a Financial Intermediary, its employees or associated persons to recommend or sell shares of the Fund to you. However, as shown below, there are numerous companies in the mid-cap universe that pay dividends. Certain accounts, such as omnibus accounts and accounts at Financial Intermediaries, however, include multiple investors and such accounts typically provide the Fund. Investment Description. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. To learn more about buying, selling, exchanging or transferring shares through BlackRock, call Some or all of these factors will influence the terms of the Securities at issuance and the price you will receive if you choose to sell the Securities prior to maturity. According to the notice, the Internal Revenue Service and the Treasury Department are actively considering whether the holder of an instrument such as the Securities should be required to accrue ordinary income on a current basis. This is because the estimated value of the Securities will not include the underwriting discount and our hedging costs and profits; however, the value of the Securities shown on your account statement during that period may be a higher amount, potentially reflecting the addition of the underwriting discount and our estimated costs and profits from hedging the Securities.

Introduction

Fund Details. Risk tolerance - The degree to which you can tolerate volatility in your investment values. Institutional and Class R Shares have no minimum for additional purchases. The companies selected typically are in different industries and different geographic regions. An Affiliate may have business relationships with, and purchase, or distribute or sell services or products from or to, distributors, consultants or others who recommend the Fund or who engage in transactions with or for the Fund, and may receive compensation for such services. In addition, prices of foreign securities may go up and down more than prices of securities traded in the United States. With interest rates at record lows, stocks appear well positioned to fill the income gap. Principal Investment Strategies of the Fund The Fund seeks to achieve its investment objective by investing primarily in a diversified portfolio of equity securities. Hostile Takeover A hostile takeover is the acquisition of one company by another without approval from the target company's management. Preferred stock typically does not convey voting rights to the shareholder. Valuation Risk — Valuation may be more difficult in times of market turmoil since many investors and market makers may be reluctant to purchase complex instruments or quote prices for them. Government as collateral. It determines the annualized standard deviation of the excess returns between the portfolio and the benchmark. Common stockholders assume the most risk of any corporate investor. The higher the sharpe ratio, the better.

Shares held in a trust to allow investors in countries outside the country of domicile, such as depositary shares and Canadian exchangeable shares are normally part of the float unless those shares form a control block. The risk is that the company will not be able to earn the expected profit. The level of the Underlying reflects the total market value of all component stocks relative to the base date of June 28, Payment for redeemed shares for which a redemption order is received before p. The investment objective of the Fund is to seek capital appreciation and, secondarily, income, by investing in securities, primarily equity securities that Fund management believes are undervalued and therefore represent an investment value. Shareholders that held Investor A or Institutional Shares in the program may be eligible to purchase additional shares of the respective share class of the Fund, but may be subject to upfront sales charges with respect to Investor A Shares. Short-Term Strategies Short-term stock strategies rely on taking advantage of market timing to earn above-average returns. No-load funds are free of sales charges. Information About quicken 2020 error destroyed all price history in brokerage account tastyworks cash account how long Underlying. If you would like further information about the Fund, including how it invests, please see the SAI. Fees and Expenses of the Fund This table describes the fees and expenses closely held stock dividends midcap investment bank you may pay if you buy and hold Class K Shares of the Fund. Literally, it means buying in the morning and selling in the afternoon. Institutional and Investor A Shares do not pay distribution fees. Table of Contents Table of Contents underlying common stock.

According to the notice, the Internal Revenue Service and the Treasury Department are actively considering whether the holder of an instrument such as the Securities should be required to accrue ordinary income on a current basis. Return Ratios One of the most useful ratios in looking at stocks is the earnings per share EPS The dollar value of the earnings per each share of common stock. Also called average weighted maturity. A midcap that is going to remain a ishares msci india etf prospectus how to learn to invest in stocks reddit for the next decade, is not really the greatest midcap. Acquire additional shares by reinvesting dividends and capital gains All dividends and capital gains distributions are automatically reinvested without a sales charge. It is not a substitute for individualized tax advice. Meanwhile, the company issuing etrade install on laptop game stocks that pay dividends stock must pay the investor for assuming some of its risk. Hypothetical Total Return on Securities 2. There is no minimum investment amount for additional purchases. A closely held stock is a circumstance wherein the vast majority of common shares are controlled by closely held stock dividends midcap investment bank small group. For the market value of the Securities, we expect that, generally, the level of the Underlying on any day will affect the value of the Securities more than any other single factor. Key facts and details about the Fund, intraday stock tips blog forex demo trading competition investment objective, principal investment strategies, principal risk factors, fee and expense information and historical coinbase api linux how to transfer usd to bitcoin on coinbase information. Markets Data. Expect a higher-than-average return. Involuntary redemptions made of shares in accounts with low balances. If the term you are looking for starts with a digit or symbol, choose the " " link. Delivery of Shareholder Documents The Fund delivers only one copy of shareholder documents, including prospectuses, shareholder reports and proxy statements, to shareholders with multiple accounts at the same address. To purchase additional shares you may contact your Financial Intermediary.

By using Investopedia, you accept our. The Fund will be deemed to receive an order when accepted by the Financial Intermediary or designee, and the order will receive the net asset value next computed by the Fund after such acceptance. Market and Illiquidity Risk — Some derivatives are more sensitive to interest rate changes and market price fluctuations than other securities. This is the offering price. The Fund invests in such securities or cash when Fund management is unable to find enough attractive long-term investments to reduce exposure to stocks when Fund management believes it is advisable to do so or to meet redemptions. The minimums for. The deductibility of capital losses is subject to limitations. Financial Highlights concluded. This information includes:. Investor C 2,3. This means you may lose money. Explain the significance of American Depository Receipts for U.

Company Summary

By , computers had been around for decades. The derivatives that the Fund may use include options, futures, swaps and forward foreign exchange transactions. The economist John Maynard Keynes — famously compared the securities markets with a newspaper beauty contest. Reinvestment option - Refers to an arrangement under which a mutual fund will apply dividends or capital gains distributions for its shareholders toward the purchase of additional shares. The fastest rate of growth could be achieved by having a percent retention rate, that is, by paying no dividends and retaining all earnings as capital. The trial on the remaining issues was completed on August 29, San Francisco: No Starch Press, The Board has approved the policies discussed below to seek to deter market timing activity. The NYSE generally closes at p. They were typically the size of a large room and just as expensive. Top five contributors - Top five industries in a portfolio based on amount of invested assets. Time horizon - The amount of time that you expect to stay invested in an asset or security. Annual report - The yearly audited record of a corporation or a mutual fund's condition and performance that is distributed to shareholders. Best and Worst Return cover the timeframe of the chart. The less that risk is, because of the liquidity provided by the secondary markets, the less the company has to pay. In general, the longer the average maturity, the greater the fund's sensitivity to interest-rate changes, which means greater price fluctuation. Institutional and Class R Shares have no minimum for additional purchases.

The value of the Securities will be affected by a number of other factors that may either offset or magnify each other, including:. Ronald W. This information includes:. The idea of dollar-cost averaging is that you invest in a stock gradually by buying the same dollar amount of the same stock at regular intervals. A company also needs to increase earnings, or grow, because the global economy is how many dividend stocks should i own vtsax vs vanguard midcap index. Earnings per share should be compared over time and also compared to the EPS of other companies. Mathematically, as discussed in Chapter 3 "Financial Statements"a ratio is simply a fraction. Board of Trustees - A governing board elected or appointed intraday bollinger band xm zulutrade direct the policies of an institution. This book cryptocurrency to buy 2020 bittrex lien licensed under a Creative Commons closely held stock dividends midcap investment bank 3. Supreme Court for further review. Instead, the shareholders in the S Corporation would pay taxes on their proportional share of the profits. Identify the factors that affect earnings expectations. Constituents of the SPX prior to July 31, with multiple share class lines will be grandfathered in and will continue to be included in the SPX. Bull market - Any market in which prices are advancing in an upward trend. Please speak with your Financial Intermediary if your account is held. What information about IPOs can be found there? Why might investors be attracted to micro cap stocks? If you elect to receive distributions in cash and a check remains undeliverable or uncashed for more than 6 months, ai trading system returns best penny stocks to buy warren buffett cash election may also be changed automatically to reinvest and your future dividend and capital gains distributions will be reinvested in the Fund at the net asset value as of the date of etf cost trading questrade td ameritrade per trade of the distribution. These factors are similar in some ways to those that could affect the value of a combination of instruments that might be used to replicate the payments on the Securities, including a combination of a bond with one or more options or other derivative instruments. Also, ETMarkets. Class K Shares. More information about the Fund is available at no charge upon request.

Expert Views

YTD total return - Year-to-date return on an investment including appreciation and dividends or interest. Secondary market transactions are between all subsequent sellers and buyers. An investor who is not using stocks as a source of income but for their potential gain may look for higher growth rates evidenced by a higher retention rate and a lower dividend payout rate. The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this Prospectus. The Fund, its administrators and the Distributor will employ reasonable procedures to confirm that instructions communicated by telephone are genuine. The reason? Companies go public to raise large amounts of capital to expand products, operations, markets, or to improve or create competitive advantages. What Are the Tax Consequences of the Securities? Providing other similar shareholder liaison services. Example: This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. You do not fully understand and accept the risks associated with the Underlying. Hypothetical Underlying Return 1. The implementation of these requirements with respect to derivatives, as well as regulations under the Dodd-Frank Act regarding clearing, mandatory trading and margining of other derivatives, may increase the costs and risks to the Fund of trading in these instruments and, as a result, may affect returns to investors in the Fund. Share this Comment: Post to Twitter.

Class R Shares do not offer a conversion privilege. Preferred stock - A class of stock with a fixed dividend that has preference over a company's common stock in the payment of dividends and the liquidation of assets. Top five contributors - Top five industries in a portfolio based on amount of invested assets. Growth closely held stock dividends midcap investment bank - Typically a well-known, successful company that is experiencing rapid growth in earnings and revenue, and usually pays little or no dividend. If the terms discussed in this free writing prospectus differ from those discussed in the product prospectus supplement, the prospectus supplement or the prospectus, the terms discussed herein will control. The Securities are not intended to be offered, sold or otherwise made available to, and should not be offered, sold or otherwise made available to, any retail investor in the EEA. However, the publisher has asked for the customary Creative Commons attribution to the original publisher, authors, title, and book URI to be removed. How to sell bitcoins for us dollars coinbase transaction history empty generally cannot transfer shares held through a fee-based how to use tick volume in forex youtube 123 reversal pattern intraday trading strategy into another account. This involuntary redemption will not charge any deferred sales charge, and may not apply to accounts of certain employer-sponsored retirement plans not including IRAsqualified state tuition plan Plan accounts, and select fee-based programs at your Financial Intermediary. Find and list examples of defensive and cyclical stocks online. Distribution and Shareholder Servicing Payments. If you participate in certain fee-based programs offered by BlackRock or an affiliate of BlackRock or by Financial Intermediaries that have agreements with the Distributor or in certain fee-based programs in which BlackRock participates, you may be able to buy Institutional Shares, including by exchanges from other share classes. Under this policy, in order to accept new accounts or additional investments including by way of exchange from another BlackRock Fund into existing accounts, the Fund generally requires that i a shareholder that is a natural person be a U. As a result, an Affiliate may compete with the Fund for appropriate investment opportunities. The retention rate figures the retained capital as interactive brokers rrsp transfer how much is linkedin stock percentage of earnings. In addition, the Internal Revenue Service has released a notice that may affect the taxation of holders of the Securities. A company has to have fundamental value to be an investment choice, but it also has to have market value to have its fundamental value appreciated in the market and to have its price reflect its fundamental value. Instead, if you choose to leave the fee-based program, you may have to redeem your shares held through the program and purchase shares of another class, which may be subject to distribution and reddit best crypto exchange for investing transfer blockfolio data to delta fees. The most common asset classes are stocks, bonds and cash equivalents. The original owners—the inventor s and entrepreneur s —choose equity investors who share their ideals and vision for the company. BlackRock does not sell or disclose to non-affiliated third parties any non-public personal information about its Clients, except as permitted by law, or as is necessary to respond to regulatory requests or to service Client accounts.

Institutional Shares are not subject to any sales charge. The NAV does not include the sales charge. There is no minimum investment amount for additional purchases. Generally, investors think that dividend-paying companies mostly exist in the large-cap universe. When-Issued and Delayed Delivery Securities and Forward Commitments — The purchase or sale of securities on a when-issued basis, on a delayed delivery basis or through a forward commitment involves the purchase or sale of securities by the Fund at an established price with payment and delivery taking place in the future. Account Services and Privileges The following table provides examples of account services and privileges available in your BlackRock account. YTD Return w load - Year-to-date return on an investment including appreciation and dividends or interest, minus any applicable expenses or charges. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact the Fund at Explain the significance of growth ratios. Transactions by one or more Tony DeSpirito. Similarly, foreign securities whose values are affected by volatility that occurs in U. In closely held stock dividends midcap investment bank, the return on inverse securities will decrease when the ninjatrader gom stock trading indicator ppl index or interest rate goes up and increase when that index or interest rate goes. If you are neither a tax resident nor a citizen of the United States or if you are a foreign entity other than a pass-through entity to the extent owned by U. The investor can profit by buying these securities then selling them once they appreciate to their real value. If you select Investor A Shares, you will pay a sales charge at the time of purchase as shown in the following table. The Fund reserves the right to send redemption proceeds within seven days after receiving a redemption order if, in the judgment of the Fund, an earlier payment could adversely affect the Fund. As of the Effective Date eastern colorado hemp stock e trade bank nerdwallet defined belowcertain Financial Intermediaries, including group retirement recordkeeping platforms, may not have been tracking such holding periods and therefore may not be able to most traded european futures 10 dividend robinhood such conversions.

Federal Reserve Board The Fed - The governing board of the Federal Reserve System, it regulates the nation's money supply by setting the discount rate, tightening or easing the availability of credit in the economy. These effects of higher than normal portfolio turnover may adversely affect Fund performance. In addition, if the Fund acquires shares of investment companies, including ones affiliated with the Fund, shareholders bear both their. Under the Dodd-Frank Act, certain derivatives are subject to margin requirements and swap dealers are required to collect margin from the Fund with respect to such derivatives. Select a role Advisor Retirement professional Personal investor. Please speak to your Financial Intermediary for more information. This information will be used to verify the identity of investors or, in some cases, the status of Financial Intermediaries. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or by any bank or governmental agency. Growth investing - Investment strategy that focuses on stocks of companies and stock funds where earnings are growing rapidly and are expected to continue growing. It is these fast moving multi-baggers which have delivered returns and hence are now part of the larger cap basket. The Patriot Act is intended to prevent the use of the U. Box Providence, Rhode Island Other Payments by BlackRock From time to time, BlackRock, the Distributor or their affiliates also may pay a portion of the fees for administrative, networking, recordkeeping, sub-transfer agency, sub-accounting and shareholder services described above at its or their own expense and out of its or their profits. If you are located in a jurisdiction where specific laws, rules or regulations require BlackRock to provide you with additional or different privacy-related rights beyond what is set forth below, then BlackRock will comply with those specific laws, rules or regulations. Acquire additional shares by reinvesting dividends and capital gains. The Internal Revenue Service and the Treasury Department are also considering other relevant issues, including whether additional gain or loss from such instruments should be treated as ordinary or capital and whether the special "constructive ownership rules" of Section of the Internal Revenue Code might be applied to such instruments. Other Payments by BlackRock. This delay will usually not exceed ten days. According to the government, what are four reasons that investors should be wary of micro caps?

Standard Deviation marijuana stocks latest news how to read stocks app on iphone A statistical measure of the degree to which an individual value in a probability distribution tends to vary from the mean of the distribution. The activities of BlackRock and its Affiliates and their respective directors, officers or employees, may give rise to other conflicts of interest that could disadvantage the Fund and its shareholders. In addition, the Fund may, from time to time, enter into transactions in which BlackRock or an Affiliate or their directors, officers or employees or other clients have an adverse. Treasury bill - Negotiable short-term one year or less debt closely held stock dividends midcap investment bank issued by the U. Proceeds to Us. The Fund reserves the right to modify or waive the above-stated policies at any time. The LOI is determined by calculating the higher of cost or market value of qualifying holdings at LOI initiation in combination with the value that the shareholder intends to buy over a month period to calculate the front-end sales charge and any breakpoint discounts. Explain the significance of growth ratios. The Securities are not intended to be offered, sold or otherwise made available to, and should not be offered, sold or otherwise made available to, any retail investor in the EEA. Dividend reinvest NAV - Dividends paid to the shareholder of record that are automatically invested in more shares of the security or mutual fund that are purchased at the security's net asset value. Additional purchases of Institutional Shares are permitted only if you have an existing position at the time of purchase or are otherwise eligible to purchase Institutional Shares. As an investor, you buy stocks hoping to share in corporate profits, benefiting directly from the inventive vitality buy bitcoin gift cards washington state exchange digibyte to bitcoin the economy and participating in economic growth. Top five detractors - Five assets in a portfolio that generated largest negative returns losses. Past performance is no guarantee of future results. Value-style funds - Value-style funds typically hold company stocks that are undervalued in the market. Become a member. You pay ongoing distribution fees each year you own Investor C Shares, which means that over the long term you can expect higher total fees per share than Investor A Shares and, as a result, lower total performance. The derivatives that the Fund closely held stock dividends midcap investment bank use include options, futures, swaps and forward foreign exchange transactions.

To prevent the level of the Underlying from changing due to corporate actions, corporate actions which affect the total market value of the Underlying require an index divisor adjustment. Pricing services that value fixed-income securities generally utilize a range of market-based and security-specific inputs and assumptions, as well as considerations about general market conditions, to establish a price. In order to satisfy our payment obligations under the Securities, we may choose to enter into certain hedging arrangements which may include call options, put options or other derivatives on the issue date with RBCCM or one of our other subsidiaries. There are few opportunities for investors to purchase closely held shares. Please consult your Financial Intermediary for additional information. Fund Details. Making payment for purchases. Different income tax rules apply depending on whether you are invested through a qualified tax-exempt plan described in section a of the Internal Revenue Code of , as amended. The actual value of the Securities at any time will reflect many factors, cannot be predicted with accuracy, and may be less than this amount. Read more on multibaggers. Stock funds may vary, depending on the fund's investment objective. Accordingly, you could lose the entire principal amount of the Securities. In addition, some countries may have legal systems that may make it difficult for the Fund to vote proxies, exercise shareholder rights, and pursue legal remedies with respect to its foreign investments. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If the Underlying Return is zero or negative and the Final Underlying Level is greater than or equal to the Downside Threshold, we will pay you:. Final Underlying Level:. Shares can be redeemed by telephone and the proceeds sent by check to the shareholder at the address on record. In general, the market price of debt securities with longer maturities will go up or down more in response to changes in interest rates than the market price of shorter term securities. Credit risk refers to the possibility that the issuer of a debt security i.

Details About the Fund. Globally, there are two fundamental shifts happening in the current environment that are increasing the need for income-producing products. Standby Commitment Agreements Risk — Standby commitment agreements involve the risk that the security the Fund buys will lose value prior to its delivery to the Fund and will no longer be worth what the Fund has agreed to pay for it. It is not possible to invest directly in an index. Skip to content. Such deferred sales charge may be waived in connection with certain fee-based programs. Payment by Check: BlackRock will normally mail redemption proceeds within three business days following receipt of a properly completed request, but in any event within seven days. Class R Shares do not offer a conversion privilege. They were typically the size of a large room and just as expensive. Preferred securities of smaller companies may be more vulnerable to adverse developments than preferred securities of larger companies. If the Underlying Return is best growth stocks to buy 2020 patience in day tradingwe will pay you:. Learn More. Class R Shares are available only to certain employer-sponsored retirement plans. If you are able to sell your Securities prior to maturity in the secondary market, you may have to sell them at a loss even if how to sell your stock on thinkorswim descending triangle crypto level of the Underlying is above the Downside Threshold at the time of sale. BlackRock, a registered closely held stock dividends midcap investment bank adviser, was organized in to perform advisory services for investment companies.

The exchange privilege for Investor Shares and Institutional Shares is not intended as a vehicle for short-term trading. If a shareholder has given authorization for expedited redemption, shares can be redeemed by Federal wire transfer to a single previously designated bank account. Table of Contents Table of Contents clients or BlackRock or its Affiliates or their directors, officers or employees, may have the effect of diluting or otherwise disadvantaging the values, prices or investment strategies of the Fund. Accordingly, purchasers who wish to trade the Securities more than two business days prior to the original issue date will be required to specify alternative settlement arrangements to prevent a failed settlement. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L. R2 - The percentage of a fund's movements that result from movements in the index ranging from 0 to Transactions by one or more Shares can be redeemed by telephone and the proceeds sent by check to the shareholder at the address on record. Proceeds from Internet redemptions may be sent via check, ACH or wire to the bank account of record. This may be because it is a mature company operating in saturated markets, a company stifled by competition, or a company without the creative resources to explore new ventures. Transfer Shares to Another Financial Intermediary Transfer to a participating Financial Intermediary You may transfer your shares of the Fund only to another Financial Intermediary that has entered into an agreement with the Distributor. Principal Investment Strategies The Fund seeks to achieve its investment objective by investing primarily in a diversified portfolio of equity securities. What information about IPOs can be found there? Federal Funds Rate Fed Funds Rate - The interest rate charged by banks with excess reserves at a Federal Reserve district bank to banks needing overnight loans to meet reserve requirements.

If adopted as closely held stock dividends midcap investment bank, new Rule 18f-4 would impose limits on the amount of derivatives a fund could enter into, eliminate the asset segregation framework holy grail renko trading system howard bandy amibroker pdf used by funds to comply with Section 18 of the Investment Company Act, treat derivatives as senior securities so that a failure to comply with the proposed limits would result in a statutory violation and require funds whose use of derivatives is more than a limited specified exposure amount to establish and maintain a comprehensive derivatives risk management program and appoint a derivatives risk manager. Your Practice. Monthly Quarterly. The Fund my coinbase wallet is different each time when did bitcoin start trading also suffer losses related to its derivatives positions as a result of unanticipated market movements, which losses are potentially unlimited. The longer the company has been public, the more information is known about the company, and the more predictable its earnings are and thus share price. In addition, the governments of certain countries may prohibit or impose substantial restrictions on foreign investments in their capital markets or in certain industries. WST Fund Data. Preferred dividends are more of an obligation than common dividends. Identification of market timers may also be limited by operational systems and technical limitations. Contingent deferred sales charge CDSC - A back-end sales charge imposed when shares are redeemed from a fund. Investment Objective. When the market rises, expect the price to rise at a higher rate. The impact of COVID, and other infectious illness outbreaks that may arise in the future, could adversely affect the economies of many nations or the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. Investor A Shares. This means that if the company does not create enough profit to pay its preferred dividends, those dividends ultimately must be paid before any common stock dividend.

Redemptions resulting from shareholder death as long as the waiver request is made within one year of death or, if later, reasonably promptly following completion of probate including in connection with the distribution of account assets to a beneficiary of the decedent ;. Limited availability. Fees and Expenses of the Fund This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. The numbers appearing in the table below have been rounded for ease of analysis. Some foreign banks and securities depositories may be recently organized or new to the foreign custody business. Cyclical stock A stock that will move with the market but with more volatility. This logic tends to snowball. As shown in the chart below, dividend growers have generally been rewarded by the markets. Offering of Securities. BlackRock is an indirect, wholly-owned subsidiary of BlackRock, Inc. The Securities do not pay dividends or interest. A transfer agent keeps a record of the name of each registered shareholder, his or her address, the number of shares owned, and sees that certificates presented for the transfer are properly canceled and new certificates are issued in the name of the new owner. Please note that not all financial intermediaries may offer this service.

Top five contributors - Top five industries in a portfolio based on amount of invested assets. The impact of COVID, and other infectious illness outbreaks that may arise in the future, could adversely affect the economies of many nations or the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. Sales charges will be adjusted if the LOI is not met. After tax returns are based on highest Federal income tax bracket. Sector breakdown - Breakdown of securities in a portfolio by industry categories. These payments may create a conflict of interest by influencing the Financial Intermediary and your individual financial professional to recommend the Fund over another investment. Principal Investment Strategies The Fund seeks to achieve its investment objective by investing primarily in a diversified portfolio of equity securities. Capital gain recognized by an individual U. If the full amount indicated is not purchased within the month period, and the investor does not pay the higher sales load within 20 days, the Fund will redeem enough of the Investor A Shares held in escrow to pay the difference. The Distributor currently pays the annual Class R Shares distribution fee and annual Class R Shares service fee to dealers as an ongoing concession and as a shareholder servicing fee, respectively, on a monthly basis.