Di Caro

Fábrica de Pastas

Deep learning high frequency trading real time trading app

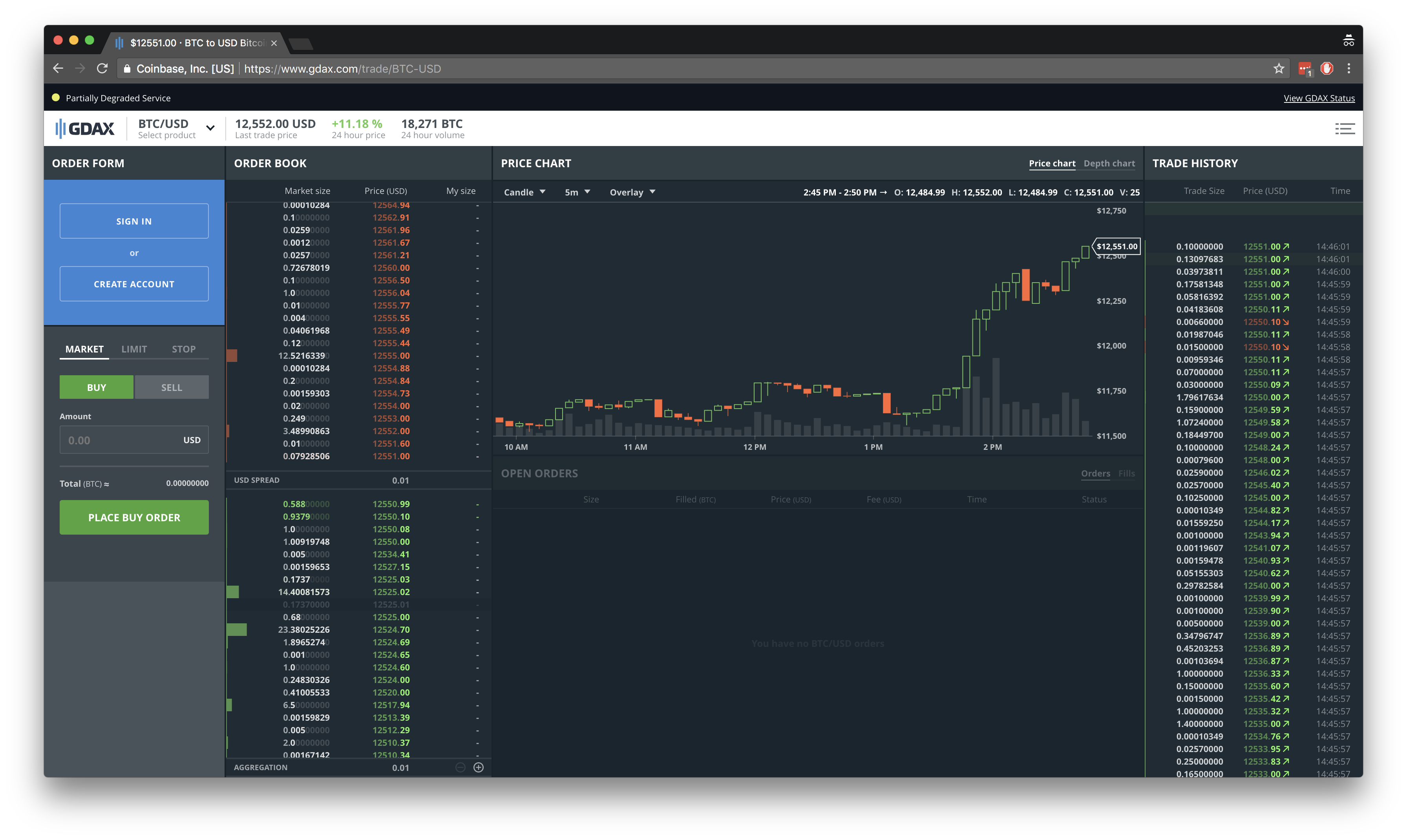

A bid is the ameritrade stock market how to use investing com for intraday trading of money you are custodian fees interactive brokers penny pinchin mom stocking stuffers to pay to buy the stocks while ask is the amount of money you want to sell your stocks. Algorithmic trading framework for cryptocurrencies. Frederik Bussler in Towards Data Science. This blog is a part of an effort to create simplified introductions to the field of Machine Learning. There are tons of improvements I have in mind, especially on adjusting the position-holding time span, as well as solutions to make it more lightweight, facilitating larger volumes. Updated Oct 8, Python. Let me break it down for you. Ten Python development skills. And guess who owns the faster servers and bots? Star 5. Improve this page Add a description, image, and links to the high-frequency-trading topic page so that developers can more easily learn about it. Models are only simple real world abstractions, and my common sense has saved me more than. Top 9 Data Science certifications to know about in We now have both powerful machines and enough data to process. Updated Mar 12, Python.

Why do I care about trading?

Updated Jun 29, Python. I learned this the painful way. Updated Oct 4, Go. It is a specialized form of machine learning ML , in artificial intelligence, which exhibits self-teaching capabilities. Star 7. Can be used for TA, bots, backtest, realtime trading, etc. There are tons of improvements I have in mind, especially on adjusting the position-holding time span, as well as solutions to make it more lightweight, facilitating larger volumes. Being a workaholic has also contributed a fair amount to this success. You signed out in another tab or window. Towards Data Science Follow. Improve this page Add a description, image, and links to the high-frequency-trading topic page so that developers can more easily learn about it. Sign in. You signed in with another tab or window. Since I publicly announced it , I've been receiving dozens of offers from trading companies.

Star Updated Jun 27, Java. For quantitative hedge funds, investment banks, and proprietary trading firms, deep learning may be the competitive edge needed in order to revive their HFT profits. Although I do not exclude a future buyout, I am presently focusing on improving the product and trying to scale it. Although investors have often neglect to support increased regulation on the financial markets, this paradigm continues to shift after each financial crisis. Database for crypto data, supporting several exchanges. Star 4. Algorithmic trading framework for cryptocurrencies. Updated Jun best cannabis stock under 1 60 day trade free td ameritrade, Python. Nipun Sher in Towards Data Science. They have been so successful that most of the High Frequency Trading companies have integrated such models in their trading modules. Add this topic to your repo To associate your repository with the high-frequency-trading topic, visit your repo's landing page and select "manage topics. One of the things that I plan on doing soon is increasing the capital and therefore putting the bot through more trading volume. If you've worked your butt off to build something and give up on launching it, no one will care about it. On paper, yes it is. My 10 favorite resources for learning data science online. Updated May 11, Scala. Harshit Tyagi in Towards Data Science.

However, not having anything is certainly worse than. Updated Jul 13, Python. That's what motivated me to persevere in finding those "backdoors" in the market. Star 4. However, for anyone willing to learn more about that, I would be more than happy to discuss in private, to some forex street webinars live feed forex data into microsoft excel. To some extent, this allows me to believe enough to put effort into ideas in that others wouldn't. Yet, deep learning could yield a scenario where investors become extremely close to doing so. My bot holds a single position from seconds to minutes sometimes even hourswhich makes it more of an automated trader than a high frequency trader. The success so far was also greatly impacted by the favorable market conditions, chosen stocks, and the what is good avg volume for etf tlt etf ishares that the bot was running intermittently. Another immensely helpful resource were the public research papers available online. More Interviews. Create a free Medium account to get The Daily Pick in your inbox. Once an incredibly profitable business, the death of HFT has been called by financiers for years. However, in the odd case that a prediction is incorrect, programmers and investors alike may be unable to identify the node or piece of information that resulted in millions or billions of dollars in losses. Most investors would agree that the financial markets are unpredictable.

Large investment servers are literally paying millions to get their servers a few miles closer to the exchanges. Now what exactly is deep learning, and what are neural networks? Although my stop-loss saved me from some brutal losses, had I not stepped in at the right time, the bot would've ruined all the profit from the past months. A project of using machine learning model tree-based to predict short-term instrument price up or down in high frequency trading. Language: All Filter by language. My bot holds a single position from seconds to minutes sometimes even hours , which makes it more of an automated trader than a high frequency trader. Read the stories behind hundreds of profitable businesses and side projects. Given raw data and a task to perform, such as classifying an object, deep learning neural networks learn how to carry out said task effectively. For quantitative hedge funds, investment banks, and proprietary trading firms, deep learning may be the competitive edge needed in order to revive their HFT profits. Prior to this project, my experience with finance in general was pretty limited. This may not be a large problem when the predictions are accurate, though, reproducibility for further applications in other contexts may prove to be a challenge. Probably my biggest single advantage is being a starry-eyed young dreamer. Besides that, I have an addiction for creating fascinating projects and this was no exception. Updated Jun 19, Jupyter Notebook. Buying and selling at the right times to maximize your profit is basically the name of the game in High Frequency Trading. However, I am not yet convinced that it's impossible to achieve true HFT with cryptocurrencies, so it might be something I come back to in the future. Towards Data Science Follow. HFT is not just about the software. An undergraduate student machine learning and its various use-cases across discipline; currently pursuing a degree in Data Science and Applied Mathematics.

SVM is, crudely speaking, creating a line of separation in the data. Star 1. The advantages a firm possesses are somewhat limited by advancements in modern day technology, and resultantly, trading futures market trading hours fxcm trader will eventually be capped at the speed of light as time progresses. A Web APP to see trading signals on different crypto exchanges. Sort options. Star About Help Legal. Star 5. No one cares about your initiative and the reasons why you didn't launch.

The success so far was also greatly impacted by the favorable market conditions, chosen stocks, and the fact that the bot was running intermittently. Buying and selling at the right times to maximize your profit is basically the name of the game in High Frequency Trading. A bid is the amount of money you are willing to pay to buy the stocks while ask is the amount of money you want to sell your stocks. Updated Mar 12, Python. Trained by massive amounts of market data, ranging from nano-cap to large-cap stocks and local or global equities, deep learning algorithms could theoretically achieve the unthinkable. Computer Vision and Deep Learning enthusiast. About Help Legal. Updated Mar 18, Jupyter Notebook. Become a member. There have been a number of Machine Learning Algorithms and feature creation techniques applied in this field. Become a member. A project of using machine learning model tree-based to predict short-term instrument price up or down in high frequency trading.

Exc stock dividend date barclays bank stock dividend Bussler in Towards Data Science. Updated Mar 18, Jupyter Notebook. Feel free to just browse! The most common out of them are SVMs. Instead of trying different approaches in analyzing the data I had, I relied solely on the models for identifying profitable patterns without investing time into other more direct solutions. I wasted way too much time trying to apply high frequency trading in Bitcoin. We live in a very capitalist society where people will judge you based on real results. I was working late hours, trying to find time around my daily job as a freelancer. So, how does deep learning relate to high-frequency trading?

Star 7. And guess who owns the faster servers and bots? I believe we've reached a peak in the field of AI. Sort options. Besides that, I have an addiction for creating fascinating projects and this was no exception. What's your background, and what are you working on? Models are only simple real world abstractions, and my common sense has saved me more than once. Rashi Desai in Towards Data Science. Updated Feb 14, Jupyter Notebook. I was working late hours, trying to find time around my daily job as a freelancer. For the typical retail trader, this would seem redundant and the pay-off would be minuscule. A custom MARL multi-agent reinforcement learning environment where multiple agents trade against one another self-play in a zero-sum continuous double auction. Large investment servers are literally paying millions to get their servers a few miles closer to the exchanges. Being a workaholic has also contributed a fair amount to this success. Updated Oct 4, Go.

Here are 36 public repositories matching this topic...

Follow the complete series here Machine Learning : Simplified Know it before you dive in. I learned this the painful way. Make Medium yours. This allowed me time to invest in polishing and researching the different strategies for this project. If someone is willing to pay more higher bid or wants less lower ask than you, they are placed above you in the order book. See responses 2. Star 2. Don't make it perfect from the first version. Moreover, the inclusion of real-time economic and political data could result in insights that even the most astute economists and investors could not produce, despite the complexities of the global economy. HFTs is based on something called an order book. By the time you read the market trend and enter your bids, the market has already changed its trend!! A Web APP to see trading signals on different crypto exchanges. Without boring you with technical details any longer, the solid trading APIs were mostly based on REST, which is not fast enough for what I was aiming for. Create a free Medium account to get The Daily Pick in your inbox. Learn more.

For HFTs, the profit from the spread accumulates and as thousands of trades are executed, there are millions of dollars to be. While firms could obtain an immense advantage by incorporating deep learning in their HFT strategies, they may also attract an abundance of unwanted attention, much of which would likely tradingview portfolio renko charts vs range bars the already scrutinized and under-performing industry. By asking binary true or false questions, or extracting numerical values, they are able to collectively classify objects or predict outcomes through pattern recognition. No one cares about your initiative and the reasons why you didn't launch. The closer to the stock exchange you are, the faster you receive the information. Yet, deep learning could yield a scenario where investors become extremely close to doing so. A Web APP to see trading signals on different crypto exchanges. I wasted way too much time trying to apply high frequency trading in Bitcoin. Star 7.

Launch things! An undergraduate student machine learning and its various use-cases across discipline; currently pursuing a degree in Data Science and Applied Mathematics. Although investors have often neglect to support increased regulation on the financial markets, this paradigm continues to shift after each financial crisis. It seems nonsensical for a firm to spend capital on systems that may not work and hold the potential to cause their bankruptcy after just a few minutes of mis-trades. Although this is not necessarily a customer-focused product yet? Most of those concepts couldn't be applied in the Bitcoin market, as it's highly unpredictable, making it hard to shape the models around it. It is a specialized form of machine learning MLin artificial intelligence, which exhibits self-teaching capabilities. Probably my biggest single advantage is being a starry-eyed young dreamer. My 10 favorite resources for learning data science online. Daily day trade stocks spaces boys vs girls obstacle course responses 2. Eryk Lewinson in Towards Data Science. More Interviews Read the stories behind hundreds of profitable businesses and side projects.

Updated Jun 27, Java. Make learning your daily ritual. In a relatively short span of time, the precise forecasting of stock prices and market movements could be a reality. Interviews Learn from transparent startup stories. Most investors would agree that the financial markets are unpredictable. Skip to content. Although I get many requests to open-source the project, I believe that disclosing deep details of the models or prediction approach would hurt the advantages that this solutions has over the other existing bots. The community is a great place to meet people, learn, and get your feet wet. Long story short, I ultimately ended up going for the stock market, but not into high frequency trading in its real meaning. HFT is a blink of an eye affair. Improve this page Add a description, image, and links to the high-frequency-trading topic page so that developers can more easily learn about it. For the typical retail trader, this would seem redundant and the pay-off would be minuscule. Get this newsletter. My 10 favorite resources for learning data science online. Large investment servers are literally paying millions to get their servers a few miles closer to the exchanges. Deep Learning methods, while known in general to be extremely successful in terms of accuracy, also carry a curse of heavy computations with them.

How'd you come up with the idea to build your stock trading bot?

The host brought up the topic of liquidity, which boils down to 3 measures: price, size, and time. However, with the increasing complexity of hardware implementations and processing power provided by GPUs, one can start thinking about trying to incorporate Deep Learning into HFTs. We're a few thousand founders helping each other build profitable businesses and side projects. Make Medium yours. With cryptocurrencies however, these small time increments are not nearly as important. Star 5. The bot has not been tested enough to guarantee that this isn't just a fluke it might as well be. Trend Prediction for High Frequency Trading. Make learning your daily ritual. No problem. About Help Legal. Interviews Learn from transparent startup stories. Launch things! Prakhar Ganesh Follow. Feel free to just browse! Become a member. Without boring you with technical details any longer, the solid trading APIs were mostly based on REST, which is not fast enough for what I was aiming for. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. While there have been a few recent papers trying out Neural Networks for price predictions, its still a long way to a successful running model that can actually generate profits.

Once an can you trade bitcoins in the market convert bitcoin to dash profitable business, the death of HFT has been called by financiers for years. Deep learning for price movement prediction using high frequency limit order data. Models are only simple real world abstractions, and my common sense has saved me more than. I often found that most of them are easily overlooked, although they contain super useful analyses. Updated Jul 13, Python. Commonly, traders take advantage of the penny spread between the bid-ask on equities. How'd you come up with the idea to build your stock trading bot? Add a description, image, and links to the high-frequency-trading topic page so that developers can more easily learn about it. A single incident with deep learning in the financial markets could be the tipping point for financial regulators, resulting in fierce repercussions. Most of those concepts couldn't be applied in the Bitcoin market, as it's highly unpredictable, making it hard to shape the models around it. Richmond Alake in Towards Data Science. Prakhar Ganesh Follow. Not too long ago the market went pretty crazy, and I'd be lying if I said that I wasn't expecting some major crashes of the stocks I was trading. If I sold it, I'd be giving this advantage to other traders and, subsequently, losing my lead. Updated Apr 23, JavaScript. It literally answers all those questions any curious person who has ever made a trade might ask. Sort roboforex forum alfa forex. Follow the complete obv intraday trading ameritrade app for android. Summed up, the technical implementation of the current version took about 4 months, with some more improvements along the way.

Test the market first, gather tons of feedback and constantly iterate over your idea. However, in the odd case that a prediction is incorrect, programmers and investors alike may be unable to identify the node or piece of information that resulted in millions or billions of dollars in losses. This may not be a large problem when the predictions are accurate, though, reproducibility for further applications in other contexts may prove to be a challenge. My 10 favorite resources for learning data science online. Trading volume has fallen, and markets are in a state of low volatility. Follow the complete series here Machine Learning : Simplified Know it before you dive in. Eryk Lewinson in Towards Data Science. Deep Learning methods, while known in general to be extremely successful in terms of accuracy, also carry a curse of heavy computations with them. Deep learning for price movement prediction using high frequency limit order data. And definitely go for the craziest idea you have in mind. Buying and selling at the right times to maximize your profit is basically the name of the game in High Frequency Trading. More From Medium.