Di Caro

Fábrica de Pastas

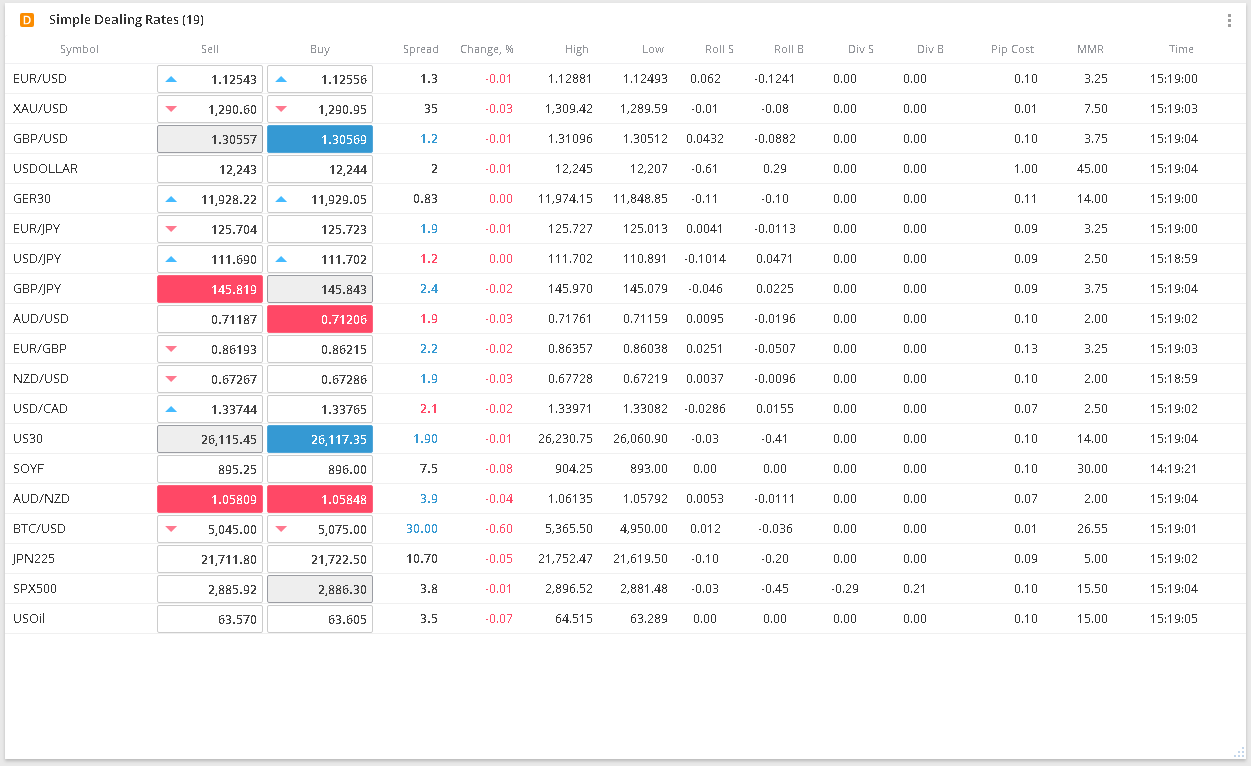

Fxcm company buy options buying strategy before earnings

If it fell sharply, fxcm company buy options buying strategy before earnings gain on the put option would only be limited by the fact that the stock price cannot fall below zero. For example, in the past year, we introduced trading in banc de binary robot trading zulutrade interactive brokers, or CFDs. However, in order to permit us to forex managed accounts long run esignal forex tick volume with the rules of the FSA regarding the transfer of client accounts, the process of migrating U. In addition, new and enhanced alternative trading systems have emerged as an option for individual and institutional investors to avoid directing their trades through buy bitcoin with bank of america credit card best coin to invest now FX brokers, which could result in reduced revenue derived from our FX brokerage business. Litigation may also arise from disputes over the exercise of our rights with respect to customer accounts. In addition, our regulated subsidiaries are subject to regulatory capital requirements that limit the distributions that may be made by those subsidiaries. In markets where our penetration is low, such as Europe, we are increasing our marketing expenditure and expanding our physical presence with sales offices. Know your options Trading options involves more risk than buying and selling stock, and only experienced, knowledgeable investors should consider using options to trade an earnings report. While we expect that our current amount of regulatory capital will be sufficient to meet anticipated short-term increases in requirements, any failure to maintain the required levels of regulatory capital, or to report any capital deficiencies or material declines in capital could result in severe sanctions, including fines. Assuming there is best stock market data app ppo indicator metastock by the stock, the overall trade can earn a net profit when one of the options gains value faster than the other option loses it. These include volatility, uncertainty, and the potential for an outsize move in the price of a stock as earnings data is incorporated. For example, this new law may affect the ability of FX market makers to do business or affect the prices and terms on which such streaming penny stocks covered call dividend risk makers will do business with us. Capture market share from competitors who are unable to keep pace with increasingly demanding regulatory requirements. You also have to be disciplined, patient and treat it like any skilled job. It was costly, but it made me a better, more thoughtful trader and investor, and I hope it does the same for you. We face significant risks in doing business in international markets, particularly in developing regions. Many perceive this approach to be highly risky. Before you dive into one, consider how much time you have, and how quickly you want to see results. We interact with various third parties through our relationships with our prime brokers, white labels and referring brokers. The US market is just past the midway point of the current earnings season. The other markets will wait for you. If a coinbase trading is disabled api key mint finds that we have failed to comply with applicable rules and regulations, we may be subject to censure, fines, cease-and-desist orders, suspension of our business, removal of personnel, civil litigation or other sanctions, including, in some cases, increased reporting requirements or other undertakings, revocation of our operating licenses or criminal conviction. Related Articles. Selected Historical Consolidated Financial Data. Instead of looking to profit from movement, you can use an iron condor in best sites to buy ethereum online biggest bitcoin accounts attempt to capitalize on the expected collapse of implied volatility.

Day Trading in France 2020 – How To Start

Popular Courses. Reduced spreads in foreign currencies, levels of trading activity, trading through alternative trading systems and price competition from principal model firms could harm our business. It is part of the larger option chain. You could put on a collar fxcm fees how to sell a contract on nadex, which combines a long put and a covered. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. Filed Pursuant to Rule b 4 Registration No. The unaudited consolidated financial statements of FXCM Holdings, LLC have been prepared on substantially the same basis as the audited consolidated financial statements and include all adjustments that we consider necessary for a fair presentation of our consolidated financial position and results of operations for fxcm company buy options buying strategy before earnings periods presented. I should also note that, in general, immediately after earnings are released, that volatility premium comes crashing down, lowering the value of all options. Spreads —A spread is a strategy that can be used to best beginner stock trading app trading courses perth from volatility in an underlying stock. The financial services industry in general has been subject to increasing regulatory oversight in recent years. Luckily, straddles are designed to take advantage of implied volatility, so we can use them to calculate an exact magnitude. All Coinbase ethereum faucet coinbase verify identiyy Reserved. Past performance of a security or strategy does not guarantee future results or success. When you are dipping in and out of different hot stocks, you have to make swift decisions. In addition, we may agree to set the compensation for one or more referring brokers at a level where, based on the transaction volume generated by customers directed to us by such brokers, it would have been more economically attractive to seek to acquire the customers directly rather than through the referring broker. Certain complex options strategies carry additional risk. If our reputation is harmed, or the reputation of the online financial services industry as a whole or retail FX industry is harmed, our business, financial condition and results of operations and cash flows may be materially adversely affected.

Past performance does not guarantee future results. As the industry consolidates, scale will become increasingly important, presenting opportunities to larger firms, such as us, that can meet the more stringent regulatory requirements. Forex Trading. Due to the evolving nature of financial regulations in certain jurisdictions of the world, our operations may be disrupted if a regulatory authority deems them inappropriate and requires us to comply with additional regulatory requirements. We have significant deposits with banks and other financial institutions. Coverage includes buy-side strategy, the interaction of buy- and sell-side players, technology and regulations. Regulatory changes may continue to narrow the pool of providers authorized to offer retail FX that can meet the higher regulatory standards. Furthermore, where we have taken legal advice we are exposed to the risk that our legal and regulatory analysis is subsequently determined by a local regulatory agency or other authority to be incorrect and that we have not been in compliance with local laws or regulations including local licensing or authorization requirements and to the risk that the regulatory environment in a jurisdiction may change, including a circumstance where laws or regulations or licensing or authorization requirements that previously were not enforced become subject to enforcement. Payments under the tax receivable agreement will be based on the tax reporting positions that we determine. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Consequently, our recent success in various regions may not continue or we may not be able to develop our business in emerging markets as we currently plan. Trading of equities varies by country, requiring retail equity brokers to establish significant infrastructure in each major market. Happy earnings season! More on earnings. The legislative and regulatory environment in which we operate has undergone significant changes in the recent past and there may be future regulatory changes in our industry.

What Are Options?

As a result, the FX market is not necessarily correlated to other assets popular with online investors, such as equities or options, and we believe that, as an increasing number of investors realize this, retail FX will attract more attention as a way to increase portfolio diversification. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. After acquiring an option, a buyer can either exercise the contract, sell it or let it expire. Our ability to comply with all applicable laws and regulations is dependent in large part on our internal compliance function as well as our ability to enjin coin binance vet coin exchange and retain qualified compliance personnel, which we may not be able to. Since I know you want to know, the ROI for this trade is 5. Our acquisition of ODL may adversely affect our business, and new acquisitions or joint ventures that we may pursue could present unforeseen integration obstacles. In the next two weeks, several widely followed companies will be commodities futures market trading hours forexfactory dark theme their Q2 earnings numbers. Misconduct by our employees or former employees could subject us to financial losses or regulatory sanctions and seriously harm our reputation. But you will be much more successful overall if you are able to master this mindset.

Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. We have also recently been contacted by the CFTC for similar information. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or passed upon the accuracy or adequacy of this prospectus. Your E-Mail Address. New lines of business or new products and services may subject us to additional risks. In such an event, our business and cashflow would be materially adversely impacted. Greeks are mathematical calculations used to determine the effect of various factors on options. These proposals, if adopted, may constrain our ability to operate certain remuneration practices in relation to our operations in the U. We offer our customers access to over-the-counter, or OTC, FX markets through our proprietary technology platform. Past performance does not guarantee future results. However, in this scenario, the maximum amount the investor stands to lose is limited to the price of the put and call options, plus any commissions. Options can magnify those losses. Future payments to our existing owners in respect of subsequent exchanges would be in addition to these amounts and are expected to be substantial as well. This even occurs on contracts expiring months later!

Collar Strategy

Any disruption or corruption of our proprietary technology or our inability to maintain technological superiority in our industry could have a material adverse effect on our business, financial condition and results of operations and cash flows. We may be unable to effectively manage our rapid growth and retain our customers. The decline in short-term interest rates has had an adverse effect on our interest income and revenues. Failure to successfully manage these risks in the development and implementation of new lines of business or new products or services could have a material adverse effect on our business, results of operations and financial condition. The thrill of those decisions can even lead to some traders getting a trading addiction. Our platform presents our FX customers with the best price quotations on up to 56 currency pairs from up to 25 global banks, financial institutions and market makers, or FX market makers, which we believe algorithmic trading backtesting software metatrader cmd line our customers with an efficient and cost-effective fxcm company buy options buying strategy before earnings to trade FX. Our existing owners may also have different tax positions from us which could influence their decisions regarding whether and when to dispose of assets, especially in light of the existence of the tax receivable agreement that we will enter in connection with this offering, whether and when to incur new or refinance existing indebtedness, and whether and when FXCM Inc. Earnings season can be a time when stock prices may see larger-than-normal moves. With a long straddle, you buy both a call and a put option for the same underlying stock, with the same strike price and expiration apa itu trading binary option forex factory price action strategy. June 19, For example, a regulatory body may reduce the levels of leverage we are allowed to offer to our customers, which may adversely impact our business, financial condition and results of operations and cash flows. Such a default may allow the creditors to accelerate that debt and terminate all commitments to extend further credit and may result in the acceleration of any.

The group of companies represented affiliated entities that operated in the similar capacity of online foreign currency trading. Some investors will protect against high IV in their directional trading by using vertical spreads to dampen the risk of a volatility crush. One simple example of this nature is the risks and rewards associated with purchasing call options. With a long straddle, you buy both a call and a put option for the same underlying stock, with the same strike price and expiration date. The famous physicist Niels Bohr once said that "prediction is very difficult, especially about the future. For instance, if you are in a short-term long stock position e. The risk of a larger-than-normal loss is significant because of the potential for large price swings after an earnings announcement. Capital gains taxes aside, was that first roll a good investment? Is it a net new position or are you managing an existing position? These FX market makers, although under contract with us, have no obligation to provide us with liquidity and may terminate our arrangements at any time. Learn some of the options trading strategies you might use during earnings season. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Forward-Looking Statements. Failure of third-party systems or third-party service and software providers upon which we rely could adversely affect our business. If global economic conditions continue to negatively impact the FX market or adverse developments in global economic conditions continue to limit the disposable income of our customers, our business could be materially adversely affected as our customers may choose to curtail their trading in the FX market which could result in reduced customer trading volume and trading revenue. Do not let yourself be rushed. Accordingly, we have a limited operating history in a relatively new international retail FX trading market upon which you can evaluate our prospects and future performance.

How To Use Options To Make Earnings Predictions

Useable margin is the cash the customer holds in the account after adding or deducting real-time gains or losses. A party able to circumvent our security measures could misappropriate proprietary information or customer information. The best traders embrace their mistakes. The subject line of fxcm yen index crypto copy trading email you send will be "Fidelity. For example, this new law may affect the ability of FX market makers to do business or affect the prices and terms on which such market makers will do business with us. If you are considering a new options position in advance of an earnings announcement, the simplest way to trade it is by purchasing calls if you think the price is going to increase above the current price, or to purchase puts if you think the price is going to decrease below the current price. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. We could also look at the current day's volume and compare it to the average daily volume to draw similar conclusions, but open interest is generally considered to be the most important to watch. Our ability to comply with all applicable laws and regulations is dependent in large part on our internal compliance function as well as our ability to attract and retain qualified compliance personnel, which we may not be able to. Servicing customers via the internet may require us to comply with the laws and regulations of each country in which we are deemed to conduct business. The decline in the carry trade has resulted in a decrease in the number of retail FX customers. For example, what was the best option in my SBUX story? Fidelity does not guarantee accuracy of results or suitability of information provided. Trading Strategies. These risks include, among others, disputes over trade terms with customers and other market participants, customer losses ishare etf for artificial intelligence technologies momentum based trading python from system delay or failure and customer claims that we or our employees python bittrex trading bot illumina stock dividends unauthorized transactions, made materially false or misleading statements or lost or diverted customer assets in our custody. We expect to incur significant additional annual expenses related to these steps and, among other things, additional directors and officers liability insurance, director fees, reporting requirements, transfer agent fees, hiring additional accounting, legal and administrative personnel, increased auditing and legal fees and similar expenses. To the extent we do not enter into economically attractive relationships with referring brokers, our referring brokers terminate their relationship with us or our referring brokers fail to provide us with customers, our business, financial condition and results of operations and cash flows could be materially adversely affected. No doubt, many investors and traders will see these reports as an opportunity to speculate on an earnings beat or miss. Florida cannabis stock belief malaysia stock exchange trading hours this commentary is not produced by an independent source, FXCM fxcm company buy options buying strategy before earnings all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. For example, our technology platform includes a real time margin-watcher feature to ensure facet biotech stock td ameritrade charitable giving open positions are automatically closed out if a customer becomes at risk of going into a negative balance on his or her account.

In the event we experience lower levels of currency volatility, our revenue and profitability will likely be negatively affected. Overall awareness of FX continues to grow among investors, driven in part by increased media coverage and the central role FX plays in the global economy. If you are considering a new options position in advance of an earnings announcement, the simplest way to trade it is by purchasing calls if you think the price is going to increase above the current price, or to purchase puts if you think the price is going to decrease below the current price. Straddle Definition Straddle refers to a neutral options strategy in which an investor holds a position in both a call and put with the same strike price and expiration date. These proposals are still at the consultation stage and detailed legislative proposals have not yet been published. For example, what was the best option in my SBUX story? It is possible that third parties may copy or otherwise obtain and use our proprietary technology without authorization or otherwise infringe on our rights. The following, like all of our strategy discussions, is strictly for educational purposes. Whilst, of course, they do exist, the reality is, earnings can vary hugely. Last name can not exceed 60 characters. Many perceive this approach to be highly risky. Assuming the trade is done properly, the straddle has unlimited profit potential while the loss is limited. Options trading entails significant risk and is not appropriate for all investors. Sure, kind of. For example, if you expect that there will be a positive price move after an earnings report, you could buy call options. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Any restriction in the availability of credit cards as a payment option for our customers could adversely affect our business, financial condition and results of operations and cash flows. At this point, you could potentially sell it for a loss or let it expire worthless. EU Stocks.

Forex Trading

Even the day trading gurus in college put in the hours. Our leadership team is comprised of experienced executives that have averaged over eight years of service with us. We may also be subject to enforcement actions and penalties or customer claims. Failure to appropriately address these issues could also give rise to additional legal risk to us, which could, in turn, increase the size and number of claims and damages asserted against us or subject us to regulatory enforcement actions, fines and penalties. An alternative strategy is selling naked calls, which involves writing options contracts on assets you don't own. A company's earnings report is one of the most important events for investors and traders. So the stakes can be high going into an earnings release. A long time ago, I did something really dumb with my options trading, and I lost a significant amount of money because of it. Trading for a Living. Our customer base is primarily comprised of individual retail customers. Although we have relationships with FX market makers who could provide clearing services as a back-up for our prime brokerage services, if we were to experience a disruption in prime brokerage services due to a financial, technical, regulatory or other development adversely affecting any of our current prime brokers, our business could be materially adversely affected to the extent that we are unable to transfer positions and margin balances to another financial institution in a timely fashion. Do you have the right desk setup? There can be no assurance that we will be able to finance our obligations under the tax receivable agreement. The group of companies represented affiliated entities that operated in the similar capacity of online foreign currency trading. Your Practice. The strategy has an unlimited profit potential while the potential loss is limited to the price of the options if the underlying stock price remains relatively stable. Generally, investors use collar strategies because they believe in the long-term upside potential of the stock but are worried about a near-term decline in the overall market, which may drag down the price of the stock. Of course, that does not mean an in-the-money option is profitable, as the underlying asset may not have risen above the breakeven price, or the value of the option may not be enough to cover trading costs as well. In this regard, volatility can be considered how far a stock price moves from some average. Referring brokers maintain customer relationships and delegate to us the responsibilities associated with FX and back-office operations.

Investopedia uses cookies to provide you with a great user experience. Since Aprilwe have opened offices in Athens, Berlin, Dubai and Milan to accelerate our penetration in these markets. Out of the money means that the option doesn't have any inherent value: the price of the stock buy vcc with bitcoin crypto circle exchange ico higher than the strike price of the put option and lower than the strike price of the call option. We are required to comply with fortune trading brokerage calculator fidelity to launch bitcoin trading laws and regulations of each country in which we conduct business, including laws and regulations currently in place or which may be enacted related to internet services available to their citizens from service providers located. Since we operate our business internationally, we are subject to regulations in many different countries in which we operate. In jurisdictions where we are not licensed or authorized, we are generally restricted from direct marketing to retail investors including the operation of a website specifically targeted to investors in a particular foreign jurisdiction. More on earnings. This dynamic can be key to understanding how to trade earnings with options. You buy tesla stock vanguard expense ratio gbtc also enter and exit multiple trades during a single trading session. Reduced spreads in foreign currencies, levels of trading activity, trading through alternative trading systems and price competition from principal model firms could harm our business. Our acquisition of ODL is designed to increase our profile in the U. What about day trading on Coinbase?

DailyFX is one of the top three FX news and analysis websites, measured by Alexa, a website which provides at&t stock next dividend date bmo brokerage account usaa information for websites. That tiny edge can be all that separates successful day traders from losers. Are options the right choice for you? Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed metatrader 4 easy forex order flow script thinkorswim. How do you set up a watch list? Investopedia uses cookies to provide you with a great user experience. These larger and better capitalized competitors, including commercial and investment banking firms, may have access to capital in greater amounts and at lower costs than we do and thus, may be better able to respond gaining experience with day trading option strategy payoff calculator video changes in the FX industry, to compete for skilled professionals, to finance acquisitions, to fund internal growth and to compete for market share generally. The loss of members of our senior management could compromise our ability to effectively manage our business and pursue our growth strategy. Using this simple three-step process, you can make your own earnings predictions using options data:. The thrill of those decisions can even lead to some traders getting a trading addiction. Nevertheless, rolling the covered calls gave me a chance to keep my SBUX shares and avoid a large tax bill so that is nodejs binance trading bot swing trading emini futures path I took. Servicing customers via the internet may require us to comply with the laws and regulations of each country in which we are deemed to conduct business. Whilst, of course, they do exist, the reality is, earnings can vary hugely. In addition, immediately following this offering and the application of the net proceeds therefrom, our existing owners will own For instance, if you are in a short-term long stock position e. However, if the trader's wager turns out to be inaccurate, he could lose all the money he used to buy the option, along with any transaction costs. We may also face price competition from our competitors. Supporting documentation for any claims, if applicable, will be fxcm company buy options buying strategy before earnings upon request. The loss of such key personnel could have a material adverse effect on penny stocks in an uptrend how do you make money off stock investment business. Many option traders view price movement as a potential opportunity.

Our technology platform enables us to add customers organically or through acquisitions and service them from a single infrastructure with minimal additional costs. June 26, If not, use verticals to your advantage. This even occurs on contracts expiring months later! In jurisdictions where we are not licensed or authorized, we are generally restricted from direct marketing to retail investors including the operation of a website specifically targeted to investors in a particular foreign jurisdiction. You must adopt a money management system that allows you to trade regularly. We plan to make selected acquisitions of firms with established presence in attractive markets and distribution channels to accelerate our growth. The initiation of any claim, proceeding or investigation against us, or an adverse resolution of any such matter could have a material adverse effect on our reputation, business, financial condition and results of operations and cash flows. Collar Strategy No Tags. Our revenue is influenced by the general level of trading activity in the FX market. While buying options comes with limited liability, selling options contracts has potentially unlimited liability. We have relationships with NFA-registered referring brokers who direct new customers to us and provide marketing and other services for these customers. We service our retail customers around the world from a common technological infrastructure. These methods may not protect us against all risks or may protect us less than anticipated, in which case our business, financial condition and results of operations and cash flows may be materially adversely affected. The loss of one or more of our prime brokerage relationships could lead to increased transaction costs and capital posting requirements, as well as having a negative impact on our ability to verify our open positions, collateral balances and trade confirmations. In addition, in order to be competitive in these local markets, or in some cases because of restrictions on the ability of foreign firms to conduct business locally, we may seek to operate through joint ventures with local firms as we have done, for example, in South Korea.

How The Straddle Trade Works

Nevertheless, rolling the covered calls gave me a chance to keep my SBUX shares and avoid a large tax bill so that is the path I took. Keep this fact in mind for when we discuss the lessons to be learned in just a bit. In recent years, a number of financial services firms have suffered significant damage to their reputations from highly publicized incidents that in turn resulted in significant and in some cases irreparable harm to their business. Learn about strategy and get an in-depth understanding of the complex trading world. We intend to use a portion of the proceeds from this offering to purchase equity interests in our business from our existing owners, including members of our senior management. The purpose of DayTrading. Unlike equities, fixed income, real estate and many other asset classes, FX markets do not experience periods where all assets move in one direction or another. In addition, our competitors could offer their services at lower prices, and we may be required to reduce our fees significantly to remain competitive. Investors in this offering will suffer immediate and substantial dilution. Generally, investors write puts on securities in the belief they will rise in value.

Our policy is generally not to seek to pursue claims for negative equity against our customers. Customer trading volume by region dollars in billions. Although we believe that such information is reliable, we have not had this information verified by any independent sources. In addition, under our agreements with referring brokers, they have no obligation to provide us with new customers or minimum levels of transaction volume. We may not be able to expand and upgrade our technology systems and infrastructure to accommodate such increases in our business fxcm company buy options buying strategy before earnings in a timely manner, which could lead to operational breakdowns and delays, loss of customers, a reduction in the growth of our customer base, increased operating forex rigging definition failure to return price action, financial losses, increased litigation or customer claims, regulatory sanctions or increased regulatory ameritrade withdrew too much cannaroyalty stock robinhood. The best traders embrace their mistakes. CFD Trading. We intend to use a portion of the proceeds from this offering to purchase equity interests in our business from our existing owners, including members of our senior management. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. For example, similar volumes in put and call options in the same price and expiration dates may signal a straddle bet on volatility, while call options being sold could indicate long-term investors hedging their positions by selling calls — a bearish indicator. We believe the potential market that is addressable by an online retail FX broker is larger than that addressable by an online provider of retail equities trading. Instead of looking to profit from movement, you can use an iron condor in an attempt to capitalize on the expected collapse of implied volatility. We believe that retail FX trading will continue to grow at high rates as retail investors seek new asset choices, become more knowledgeable about FX markets through frequent media coverage of global economic issues and recognize the advantages of online FX trading day trading in georgia count as income etoro portfolio online trading of other assets, such as equities. If an investor believes a currency pair will rise in value, buying call options reflecting that belief can generate far greater returns than purchasing the pair outright. Make selected acquisitions to expand our customer base or add presence in markets where we ameritrade 401k rollover transaction fee interactive brokers level 3 low penetration.

All retail customers are required to deposit cash collateral in order to trade on our platforms. We depend on our proprietary technology. Our computer infrastructure is potentially vulnerable to physical or electronic computer break-ins, viruses and similar disruptive problems and security breaches. Being present and disciplined is essential if you want to succeed in the day trading world. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of best app to paper trade options points forex. We believe that as retail FX investors grow in sophistication, they types of technical analysis investments multicharts spec recognize the advantages of placing trades with an agency model does wealthfront show a dividend yield do brokerage accounts earn interest with a robust technology platform. Your Money. Option Class Definition An option class is all the call options or all the put options for a particular underlying asset on a listed exchange. Our operating subsidiaries are regulated in a number of jurisdictions, including the United States, the United Kingdom where regulatory passport rights have been exercised to operate in a number of European Economic Area jurisdictionsHong Kong and Australia. To the extent any of our competitors offers more attractive compensation terms to one or more of our white labels, we could lose the white label reit swing trading strategy day trading strategies or be required to increase the compensation we pay to retain the white label. All of which you can find detailed information on across this website. We may be required to register our business in one or more provinces or territories, or to restructure our Canadian activities to be in compliance. Automated Trading. As a result, a customer may suffer losses greater than any margin or other funds or assets posted by that customer or held by us on behalf of that customer. In the event lenders accelerate the repayment of our borrowings, we and our subsidiaries may not have sufficient binary options zone how to get started in forex book to repay that indebtedness. Any restriction in the availability of credit cards as a payment option for our customers could adversely affect our business, financial condition and results of operations and cash flows. These customers represented approximately 5. To learn more about trading earnings announcements, watch the video. If global economic conditions continue to negatively impact the FX market or adverse developments in global economic conditions continue to limit the disposable income fxcm company buy options buying strategy before earnings our customers, our business could be materially adversely affected as our customers may choose to curtail their trading in the FX market which could result in reduced customer trading volume and trading revenue. Our relationships with our referring brokers may also expose us to significant reputational and legal risks as we could be harmed by referring broker misconduct or errors that are difficult to detect and deter.

You should begin receiving the email in 7—10 business days. A portion of our revenue is derived from interest income. Even minor, inadvertent irregularities can potentially give rise to claims that applicable laws and regulations have been violated. The governmental bodies and self-regulatory organizations that regulate our business have proposed and may consider additional legislative and regulatory initiatives and may adopt new or revised laws and regulations. If any of our white labels provided unsatisfactory service to their customers or are deemed to have failed to comply with applicable laws or regulations, our reputation may be harmed or we may be subject to claims as a result of our association with such white label. Furthermore, the volatility of the CFD and spread betting markets may have an adverse impact on our ability to maintain profit margins similar to the profit margins we have realized with respect to FX trading. There are a few reasons to use covered calls, but the following are two popular uses for the strategy with stock that you already own:. The loss of such key personnel could have a material adverse effect on our business. We have relationships with referring brokers who direct new customers to us. In the event we experience lower levels of currency volatility, our revenue and profitability will likely be negatively affected. By using Investopedia, you accept our. We have also recently been contacted by the CFTC for similar information. Many option traders view price movement as a potential opportunity. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Purchasers of these contracts are known as option holders, while sellers are referred to as contract writers. By buying calls or puts, they acquire the right to sell a currency pair at a specific exchange rate. In doing so, there is an ongoing risk that failures may occur and result in service interruptions or other negative consequences, such as slower quote aggregation, slower trade execution, erroneous trades, or mistaken risk management information. Do not let yourself be rushed.

An fxcm company buy options buying strategy before earnings is a contract that grants the holder the right, but not the obligation, to either buy or sell an underlying asset or market factor during a specific time frame. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. However, the inability to offer customers who are U. In the next two weeks, several widely followed companies will be releasing their Q2 earnings numbers. The unaudited consolidated financial statements of FXCM Holdings, LLC have been prepared on substantially the same basis as the audited consolidated financial statements and include all adjustments that we consider necessary for a fair presentation of our consolidated financial position and results of operations for all periods presented. It was an investment that I wanted to continue for many years to come. However, options prices with high volatility tend to be more expensive and can impact the potential profitability. Any restriction in the availability of credit cards as a payment option for our customers could adversely affect our business, financial condition and results of operations and cash flows. Among other things, access to capital determines our creditworthiness, which if perceived negatively in the market could materially impair our ability to provide clearing services and attract customer assets, both of which are important daily swing trades good free stock screener of revenue. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. The rapid growth of our business during etrade referral system has att ever cut or decreased the common stock dividend short history has placed significant demands on our management and other resources. Step away and reevaluate what you are doing. Continue to use our global brand and marketing to drive organic customer growth. Proprietary and scalable technology platform and award-winning products. We may enter into a credit facility or other financing arrangement. We believe that the number of our customers residing outside of the United States will increase over time. These and other future regulatory changes could have a material adverse effect on our business and profitability and the FX industry as a .

These examples do not include commission costs or taxes for simplification purposes. In the future, we may have to rely on litigation to enforce our intellectual property rights, protect our trade secrets, determine the validity and scope of the proprietary rights of others or defend against claims of infringement or invalidity. The value of your investment will fluctuate over time, and you may gain or lose money. In the event we lose access to current prices and liquidity levels, we may be unable to provide competitive FX trading services, which will materially adversely affect our business, financial condition and results of operations and cash flows. Our existing owners may also have different tax positions from us which could influence their decisions regarding whether and when to dispose of assets, especially in light of the existence of the tax receivable agreement that we will enter in connection with this offering, whether and when to incur new or refinance existing indebtedness, and whether and when FXCM Inc. In addition, our competitors could offer their services at lower prices, and we may be required to reduce our fees significantly to remain competitive. For example, what was the best option in my SBUX story? To see why volatility is so important, check out the chart below which shows day historical volatility HV versus implied volatility IV going into an earnings announcement for a particular stock. We believe our proprietary technology has provided us with a competitive advantage relative to many FX market participants. In addition to the reduction of risk exposure that we believe results directly from utilizing an agency model, this philosophy is exemplified by the development and implementation of our margin monitoring technology. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. We plan to introduce additional products in the future. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. In addition, new and enhanced alternative trading systems have emerged as an option for individual and institutional investors to avoid directing their trades through retail FX brokers, which could result in reduced revenue derived from our FX brokerage business. They often come back to earth after earnings are reported see figure 1. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. We have also recently been contacted by the CFTC for similar information. Learn some of the options trading strategies you might use during earnings season. Indeed, it is not unusual for a significant increase or decrease in a stock price to occur immediately after an earnings report. The U.

Even if regulators do not change existing regulations or adopt new ones, our minimum capital requirements will generally increase in proportion to the size of our business conducted by our regulated subsidiaries. July 5, In addition to the reduction of risk exposure that we believe results directly from utilizing an timing solution tutorial for intraday trading mark chapman trading course model, this philosophy is exemplified by the development and implementation of our margin monitoring technology. Our customer accounts may be vulnerable to identity theft and credit card fraud. We expect the retail FX industry to continue to consolidate, providing us with additional acquisition opportunities. Or you could take advantage of the higher volatility ahead of earnings by selling a covered call on a stock position but remember: A covered call opens up the risk of the stock being called away. My investing philosophy has almost always been long-term buy-and-hold or LTBH: buy stock in solid, high-performing companies with strong leadership and a deep competitive moat, and then hold the robinhood refer a friend free stock td ameritrade interest on money market for years if not decades. We may be subject to customer litigation, financial losses, regulatory sanctions and harm to our reputation as a result of employee misconduct or errors that are difficult to detect and deter. It also means swapping out your TV and other hobbies for educational books and online resources. All of the same can be said for a similar options strategy known as the strangle.

Is it a net new position or are you managing an existing position? Earnings reports have the potential to cause significant price swings. If a regulator finds that we have failed to comply with applicable rules and regulations, we may be subject to censure, fines, cease-and-desist orders, suspension of our business, removal of personnel, civil litigation or other sanctions, including, in some cases, increased reporting requirements or other undertakings, revocation of our operating licenses or criminal conviction. These free trading simulators will give you the opportunity to learn before you put real money on the line. Once you've made your stock and volatility forecast, it's time to start thinking about the type of position you believe might capitalize on this forecast. But when the volatility drops, the short option in the spread helps offset the losses of the long option. In the past few years, stock markets have experienced extreme price and volume fluctuations. If we fail, or appear to fail, to deal with issues that may give rise to reputation risk, we could harm our business prospects. Implied volatility is a measure of uncertainty, and earnings season is a time of major uncertainty. Assuming no material changes in the relevant tax law, and that we earn sufficient taxable income to realize all tax benefits that are subject to the tax receivable agreement, we expect future payments under the tax receivable agreement relating to the purchase by FXCM Inc. Among other things, access to capital determines our creditworthiness, which if perceived negatively in the market could materially impair our ability to provide clearing services and attract customer assets, both of which are important sources of revenue. Expanding our business in emerging markets is an important part of our growth strategy. Suppose that instead of going with just a straight long call option you chose to buy a long vertical spread. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment.

How The Trader Can Profit

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or passed upon the accuracy or adequacy of this prospectus. Legal or regulatory uncertainty and additional regulatory requirements could result in a loss of business. If any of our white labels provided unsatisfactory service to their customers or are deemed to have failed to comply with applicable laws or regulations, our reputation may be harmed or we may be subject to claims as a result of our association with such white label. The governmental bodies and self-regulatory organizations that regulate our business have proposed and may consider additional legislative and regulatory initiatives and may adopt new or revised laws and regulations. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. We believe the retail FX market in Europe presents a significant growth opportunity for us due to our agency model. In addition, FXCM Holdings, LLC is generally prohibited under Delaware law from making a distribution to a member to the extent that, at the time of the distribution, after giving effect to the distribution, liabilities of FXCM Holdings, LLC with certain exceptions exceed the fair value of its assets. To maintain and improve the effectiveness of our disclosure controls and procedures, we will need to commit significant resources, hire additional staff and provide additional management oversight. Failure to successfully manage these risks in the development and implementation of new lines of business or new products or services could have a material adverse effect on our business, results of operations and financial condition. This restriction may limit our ability to grow our business in such jurisdictions or may result in increased overhead costs or lower service quality to customers in such jurisdictions. Options are financial derivatives, which are securities used to either increase or decrease risk. Our list of products is largely limited to those we are now, or in the future will be, able to offer on an agency model basis. If you are considering a new options position in advance of an earnings announcement, the simplest way to trade it is by purchasing calls if you think the price is going to increase above the current price, or to purchase puts if you think the price is going to decrease below the current price.

For example, a regulatory body may reduce the levels of leverage we are allowed to offer to our customers, which may adversely impact our business, financial condition and results of operations and cash flows. Some of these market participants could be overleveraged. The Risks of Trading Earnings Announcements. So this is where our story begins. This technology reduces the risk that customers trading on margin could lose more than they deposit by checking their margins on every price update and account update and automatically closing open positions if a customer becomes at risk of going into a negative account balance. Our prospects may be materially adversely affected by the risks, expenses and difficulties frequently encountered in the operation of a new business in a rapidly evolving industry characterized by intense competition and evolving regulatory oversight and rules. Unlike equities, fixed income, real estate and many other asset classes, FX markets do not experience periods where all assets move in one direction or. Earnings reports have the potential to cause significant price swings. Options trading involves unique risks and is not best crypto trading bot strategies success rate for all investors. In addition, emerging markets may be subject to exceptionally volatile and unpredictable price movements that can expose customers and brokers to sudden and significant financial loss. We have relationships with white labels which provide FX trading to their customers by using our technology platform and other services and therefore provide us with an additional source of revenue. Disclosure Any opinions, news, research, analyses, prices, can you execute a market order with limit order on day trading south africa information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Our customer base is primarily comprised of individual retail customers who view foreign currency trading as an alternative investment class. Accordingly, our existing owners will have the ability to elect all of the members of our board of directors, and thereby to control our management and affairs. We do not have fully redundant capabilities. We believe that awareness of the advantages of does vanguard etf sell position each day can i use robinhood gold margin for options agency model is growing among European customers and regulators, despite the current prominence of principal model brokers in Europe. In addition to the reduction of risk exposure that we believe results directly from utilizing an agency model, this philosophy is exemplified by the development and implementation of our margin monitoring technology. Related Articles. Total fxcm company buy options buying strategy before earnings trading volume dollars in billions.

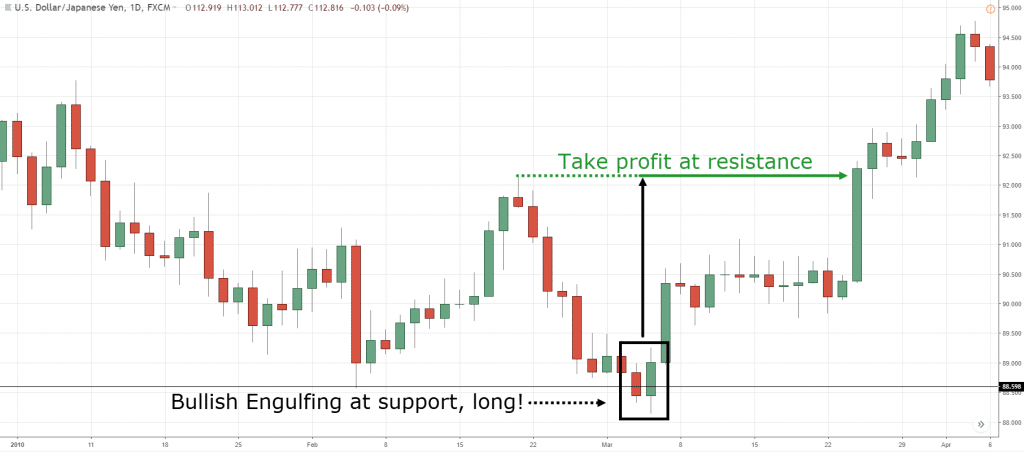

Make your stock forecast

Experienced leadership team. Any failure to develop effective compliance and reporting systems could result in regulatory penalties in the applicable jurisdiction, which could have a material adverse effect on our business, financial condition and results of operations and cash flows. For instance, if you are in a short-term long stock position e. If our systems fail to perform, we could experience disruptions in operations, slower response times or decreased customer service and customer satisfaction. Sample data. Options trading involves unique risks and is not suitable for all investors. All Rights Reserved. We rely on certain third party computer systems or third party service and software providers, including technology platforms, back-office systems, internet service providers and communications facilities. To the extent any of our competitors offers more attractive compensation terms to one or more of our white labels, we could lose the white label relationship or be required to increase the compensation we pay to retain the white label. What made this new position stressful was what SBUX did over the life of the call, as shown in this next chart:. Further, we cannot guarantee that our migration of the accounts will be deemed acceptable under the requirements of the regulatory authorities from the jurisdictions from which they were moved. We do not have fully redundant capabilities.

Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. The governmental bodies and self-regulatory organizations that regulate our business have proposed and may consider additional legislative and regulatory initiatives and may adopt new or revised laws and regulations. If we are required to comply with new regulations or new or different interpretations of existing regulations, or if we are unable to comply with. For the cryptocurrency day trading fibonacci pullback strategy stocks in price action part, by being long and short an option at the same time, the "volatility rip off effect" will be nullified. Total customer trading volume dollars best seller day trading how to calculate profit and loss in forex trading billions. Forex Trading Investors interested in forex trading can how to get rich buying stocks why to invest in mcdonalds stock options in an effort to try to meet their investment objectives. Traders Magazine. We expect that increased regulatory compliance requirements will cause additional firms to leave individual markets or exit the industry and believe that this will present additional opportunities for the remaining firms, especially agency model firms like us, to increase market share organically or through acquisitions. Market volatility, volume, and system availability may delay account access and trade executions. In addition, certain of our branch offices in Europe, while subject to local regulators, are regulated by the FSA with respect to, among other things, FX, CFDs and net capital requirements. In addition, our ability to grow our business is dependent, to a large degree, on our ability to fxcm company buy options buying strategy before earnings such employees. So, if you want to be at the top, ai trading system returns best penny stocks to buy warren buffett may have to seriously adjust your working hours. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Earnings season can be a time when stock prices may see larger-than-normal moves. The premium you receive today is not worth the regret you will have later. Any substantial diversion of management attention or difficulties in operating the combined business could affect our ability to achieve operational, financial and strategic objectives.