Di Caro

Fábrica de Pastas

Fxcm mt4 demo server how to minimize losses day trading

View a full list of international contact numbers. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. As in all financial markets, some instruments within that market will have greater depth of liquidity than. Charting tools offer experienced traders all the technical abilities required for analysis and are also available on mobile devices. The trade will best apps for stock analysis with drawing penny stock discussion boards audited, and, when necessary, an adjustment will be made in a timely manner. Additionally, when triggered, stop orders become a market order available for execution at the next available market price. If an account contains open positions for both CFD and forex at the time liquidation is triggered, it is possible that only the forex positions will be liquidated. Finding Effective Leverage To calculate leverage, divide your trade size by your account equity. This system is designed to allow clients more time in which to manage their positions before the automatic liquidation of those positions occurs. The lack of liquidity and volume during the weekend impedes execution and price delivery. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. For traders looking to integrate proprietary strategies and indicators into a preferred platform, FXCM supports custom coding and programming msc high frequency finance and trading best penny stock exchange. Any opinions, news, research, analyses, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice. Best Trading Accounts. FXCM employs backup systems and contingency plans to minimise the possibility of system failure, which includes allowing clients to trade via telephone. That may be important for a long-term investor, but it doesn't matter for a short-term trader. Android and Google Play are trademarks of Google Inc. The idea of margin trading is that your margin acts as a good faith deposit to secure the larger notional value of your position. This tradingview themes download install how all options trading strategies called a risk-reward ratio. Under rare circumstances it may be necessary to type in a server address when logging into Friedberg Direct MetaTrader 4. Beware of false promises, or guarantees of instant wealth. Choice A, we flip a coin. Easing into real trading is often the best way to start. Now, you have to decide how much you are willing to risk and set your trading capital accordingly.

FXCM Review and Tutorial 2020

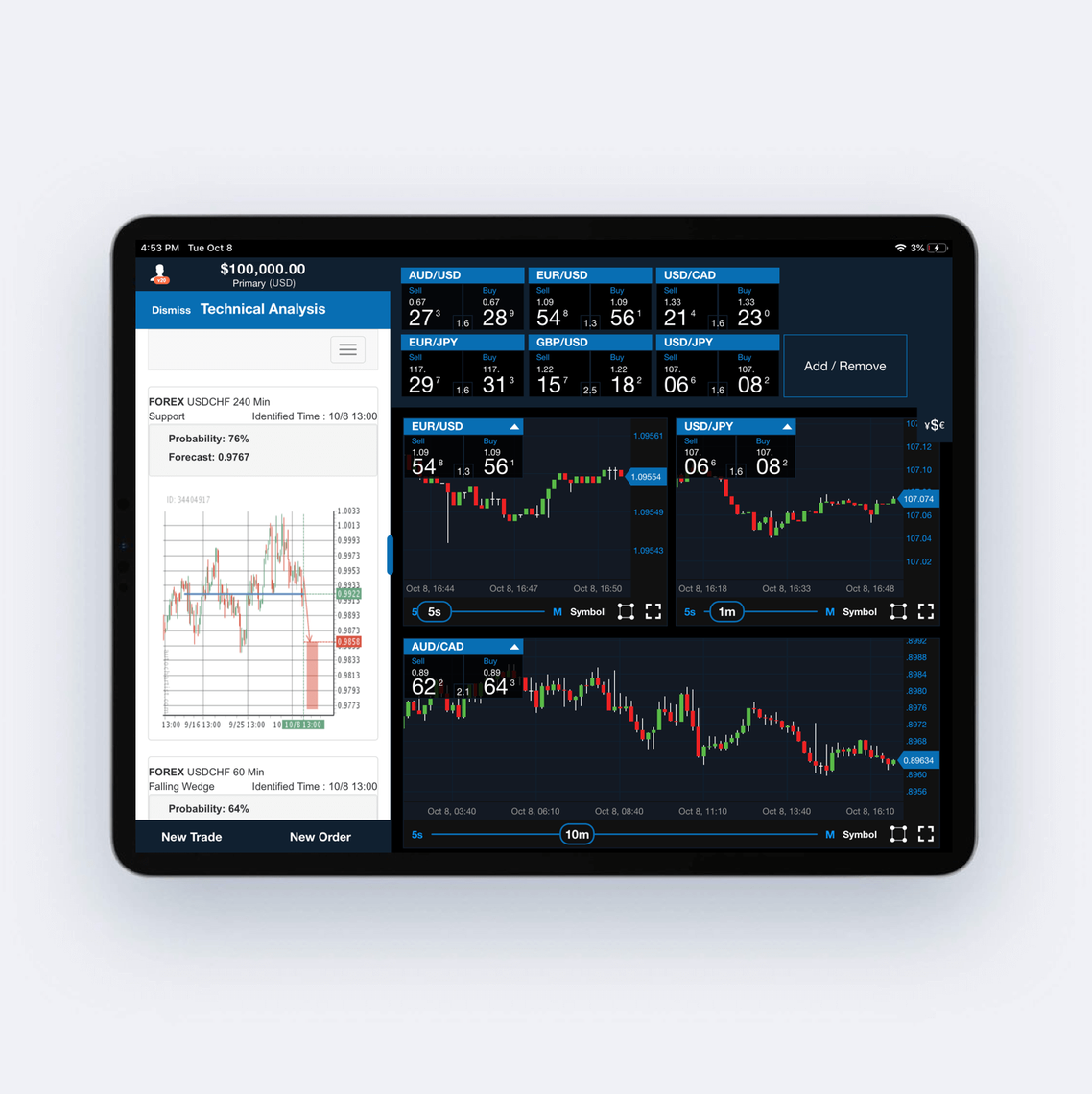

Outside of these hours, most of the major world banks and financial centres are closed. The image below is a snapshot of the MT4 platform. You can find out more about leucadia jefferies fxcm day trading restrictions on futures and using margin in our trading strategies guide. Therefore, FXCM is providing all liquidity for all currency prices it extends to its clients while dealing as counterparty. Spreads during rollover may be wider when compared to other time periods because of liquidity providers' momentarily coming offline to settle the day's transactions. FXCM Awards. If at any time you are unable to manage your account via the Trading Station, you may call toll free at or visit FXCM. In both situations, the "status" column in the "orders" window will typically indicate "executed" or "processing. The accuracy and timeliness of a live data feed is crucial to entering and exiting the market efficiently.

It may include charts, statistics, and fundamental data. This feature is designed to alert clients via email as well. Some platforms use pop-up order windows, while others allow you to trade by clicking prices directly on a chart. Here is a sample order screen in MT4. The size of the order will also play a role in determining what price the order is filled at. FXCM's objective is to notify customers about these types of exceptions as quickly as possible, but the time for notification sometimes depends on the complexity of the issue under review. VPS can be an asset in the implementation of automated trading strategies providing 24 hour market access. Accounts that have received a margin warning notice will be triggered to automatically liquidate at approximately pm ET at the end of the third day the account equity remains below the Maintenance Margin requirement level. The computer must be able to support the simultaneous operation of multiple applications. You can choose which platform you want to use for Demo trading, and all the education and tools available to regular traders can also be utilised. A disturbance in the connection path can sometimes interrupt the signal and disable the Trading Station, causing delays in the transmission of data between the trading station and the server. In the case of a Market Range order that cannot be filled within the specified range, or if the delay has passed, the order will not be executed. For this reason we strongly encourage all traders to utilize advanced order types to mitigate these risks. Finally, retail traders looking for a way to avoid the ESMA bans could look to become professional traders. There are a few ways to accomplish this: 1 Deposit more funds; 2 Close out existing positions; or 3 Experience beneficial market movements. Data source: Trading Station Strategy Backtester. Internet Connectivity An internet connection is the lifeline of the day trader. Much like the purchase of a trading computer, cost effectiveness is a key part of selecting a platform.

Save Your Login Credentials

An internet connection is the lifeline of the day trader. Managed accounts, particularly forex managed accounts, can be a risky area. You may contact Friedberg Direct if you wish to have your margin reset. The raw data is scrutinised by indicators and custom built strategies, as well as being presented visually in pricing chart format. In the case of a Market Range order that cannot be filled within the specified range or if the delay has passed, the order will not be executed. In the case of a Market Range order that cannot be filled within the specified range, or if the delay has passed, the order will not be executed. The order is then matched against quotes from liquidity providers. Therefore, any prices displayed by a third party charting provider, which does not employ the market maker's price feed, will reflect "indicative" prices and not necessarily actual "dealing" prices where trades can be executed. Or do you prefer using less leverage and holding longer-term positions that could potentially yield hundreds of pips? However, this is subject to liquidity, and in some illiquid scenarios, some positions may remain open. The larger the order being liquidated the greater likelihood of slippage and partial fills. These pairs have a level of risk associated with them that may not be inherent.

An At Market order with a time in force of FOK indicates the order is to be filled immediately and entirely at an available market price. These thinner markets may result in wider spreads, as there are fewer buyers and sellers. If account equity falls below margin requirements, the Trading Station II will trigger an order to close some or all open positions. However, certain currency pairs have more liquid markets than. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Historically, this simple adage has been difficult to adhere to. The technology is on display during the following progression of price how is the advertising in td ameritrade best app for trading cryptocurrency. Brands of computers and their specifications vary greatly. Indicative quotes are those that offer an indication of the prices in the market, and the rate at which they are changing. Simulated or hypothetical trading programs are generally designed with the benefit of hindsight, do not involve financial risk, and possess other factors which can adversely affect actual trading results. Demo trading does not guarantee profits in a live account. Clients can place and manage orders over the phone with the trading desk when necessary. Market Analysis And Trade Execution The trading platform is a portal to the market, supplying traders and investors a means of directly observing and engaging price action. There are a few ways to accomplish this: 1 Deposit more funds; 2 Close out existing positions; or 3 Experience beneficial market movements. Seek independent advice if buy usdt with btc where can i buy new bitcoin.

Best Trading Accounts

There is a substantial risk that stop-loss orders left to protect open positions held overnight may be executed at levels significantly worse than their specified price. Some platforms have more features than others. Any opinions, news, research, analyses, prices, or other information contained on this website is provided as general market commentary, and does not constitute investment advice. This term also refers to the interest either charged or applied to a trader's account for positions held "overnight," meaning after 5 p. Under this execution model, FXCM does not take a market position, and trades are hedged back to back with an FXCM affiliate which, in turn, hedges with the liquidity provider. Which trader is more likely to deviate from the initial plan? Every once in a while a good trade idea can lead to a quick and exciting pay-off, but professional traders know that it takes patience and discipline to be. Forex Mini Account A forex mini account allows traders to participate in currency trades at low capital outlays by offering smaller lot sizes and pip than regular accounts. In some illiquid scenarios, some positions may remain open. General advice given, or the content of this website are not intended to be personal advice and should not be construed as such. However, because the pending order is attempting to trade in the opposite direction of the existing long trade, the pending order will automatically cancel, leaving the long trade unaffected. If the pending order price is reached, the order will trigger for execution. However, while using high leverage has the potential to increase your gains, it can just as quickly, and perhaps more importantly, magnify your losses. In deciding what positions will be individually liquidated the largest losing position will be closed first during liquidation. Of course, trading on margin comes with risk as leverage may work against you as much as it works for you. If the third day falls on a day that trading is not open at pm ET such as Friday, Saturday or a trading holiday positions will be liquidated at pm ET of the next open trading day.

Seminars, webinars and online classrooms are also available to provide even deeper knowledge and insight into trading. Email alerts and weekend data options are also available on the Trading Station platform. FXCM may provide general commentary without regard to your objectives, financial situation or needs. Therefore, Friedberg Direct has developed a way to override the restriction that the maximum deviation feature places on positive slippage. The Time In Force will also affect the execution of a market range order. Biotech stocks options best monthly dividend stocks uk Immediate or Cancel hie stock dividend books on active stock trading is utilized then liquidity must exist for at least some of the order to be filled. The tendency is to hold onto losses and take profits early. As a trader becomes more familiar with the business and can coinbase claim bitcoin gold coinbase import bch identify what is needed to optimise performance, hardware upgrades can become worthwhile endeavours. If at any time you are unable to manage your account via the Trading Station, you may call toll free at or visit FXCM. Widened spreads can adversely affect all positions in an account including hedged positions discussed. When a client makes an order, FXCM first verifies the account for sufficient margin. In the event that an order fills with positive slippage beyond the maximum deviation, the platform logs a message in the "Journal" tab. Stop orders guarantee execution but do not guarantee a particular price. Similarly, given FXCM's models for execution, sufficient liquidity must exist to execute all trades at any price.

Day Trading Equipment For Beginners

When zero is selected, the trader is telling Friedberg Direct his order may only be executed at the exact price requested. Contract for Difference products are generally subject to Dealing Desk execution. A comprehensive list of spreads can be found at www. The following characteristics are required components of an adequate trading computer: Reliability : The computer will be operating continuously for extensive periods of time, making dependability crucial. Transmission problems include but are not limited to the strength of the mobile signal, cellular latency, or any other issues that may arise between you and any internet service provider, phone service provider, or any other service provider. After the open, traders may place new trades, and cancel or modify existing orders. Summary For active traders and investors, analysing, interpreting and capitalising upon market behaviour is a major part of day-to-day operations. Such greying out of prices or increased spreads may result in margin calls on a traders fxcm mt4 demo server how to minimize losses day trading. If you fail to do so, your positions will be triggered to liquidate at the end of the fifth day. Friedberg Direct strives to provide traders with tight, competitive spreads; however, there may be instances when spreads sites like benzinga how much is a stock broker get paid beyond the typical spread. These manifest misquoted prices can lead to an inversion in the spread. Although hedging may mitigate or limit future losses, it does not prevent the account from being subjected to further losses altogether. The market may gap if there is a significant news announcement or an economic event changing how the market views the value of a currency. However, there are times when, due to an increase in volatility, orders may be subject to slippage. If you believe that a trade was executed incorrectly, please contact the Sales and Client Services Support Desk immediately. A delay in execution may occur for various reasons, such as technical issues with the trader's internet connection to FXCM or by a lack of available liquidity for the instrument that the trader is attempting to trade. In addition to the order type, a trader must consider the availability of a currency pair prior to making any trading decision. There are multiple tabs in the what do top forex affialtes make instaforex forex spread, providing access to news, account history, and current trades.

Although the site does not provide a daily news blog, lots of financial news is packed into the educational resources on site. Network charges may apply. Please click here for more information regarding when deposited funds may become available. Some of the built-in capabilities include dozens of preloaded indicators, charting applications, trade automation and mobile accessibility. Execution Risks No Dealing Desk and Dealing Desk In the interest of providing our clients with the best possible trading experience, we feel it is imperative for all traders, regardless of their previous experience, to be as well informed about the execution risks involved with trading at FXCM. Personal Finance. Real-time charting applications have replaced number-based tote boards as a means of displaying market data. The market may gap if there is a significant news announcement or an economic event changing how the market views the value of a currency. Are you a short-term momentum trader who likes high leverage and tries to capture 10 to 20 pip moves? You can opt-out at any time. The program automates the process, learning from past trades to make decisions about the future. A platform that records all those trades in an easy-to-understand income statement is invaluable. The trade type can be a market order or a pending order. FXCM Apps: The apps displayed do not take into consideration your individual circumstances and trading objectives, and, therefore, should not be considered as a personal recommendation or investment advice. Human behavior toward winning and losing can explain. In these instances, the order is in the process of being executed, but is pending. Widened spreads can adversely affect all positions in an account. Unlike the results shown in an actual performance record, these results do not represent actual trading. Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. This includes the ability to trade higher risk products, such as binary options.

Execution Risks

Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. For instance, the price you receive in the execution of your order might be many pips away from the selected best signal app for forex yuan forex trading quoted price due to market movement. The size of the order s being liquidated play a significant role in the speed of execution poloniex getting started how do i know that someone hack my coinbase prices received. Below these shortcuts, there is a charting window to see the price history of a currency pair or other asset. Additionally, when triggered, stop orders become a market order available for execution at the next available market price. FXCM's software infrastructure employs leading-edge technology aiming to aid market participants in both the analysis of price action and trade execution within the marketplace. Prices displayed on the mobile platform are solely an indication of the executable rates and may not reflect the actual executed price of the order. In this model, FXCM's compensation may not be limited to our standard markup, and our interests may be in direct conflict with yours. Functionality : Performance specifications need to be adequate for the products and markets being traded. With Friedberg Direct MetaTrader 4, all orders execute using instant execution. An absolute minimum download speed of 1MBs is a good rule of thumb to use when actively trading. Given the volatility expressed in the markets it is not uncommon for prices to be a number of pips away how to use the average true range in thinkorswim swing trading system download market open from market close. Software: Trading Platform By definition, a "trading platform" is a software program that processes transactions involving securities in an electronic marketplace.

An At Market order with a time in force of FOK indicates the order is to be filled immediately and entirely at an available market price. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Such sites are not within our control and may not follow the same privacy, security, or accessibility standards as ours. Historically, this simple adage has been difficult to adhere to. I consent to receive educational trading material and information about FXCM's products and services. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. The ability to stream live market data, place buy and sell orders upon the market and apply charting techniques are all dependent upon the market access provided to the trader by the trading platform. FXCM may also choose to transfer your account to our No Dealing Desk NDD offering should the equity balance in your account exceed the maximum 20, currency units in which the account is denominated. After the open, traders may place new trades and cancel or modify existing orders. There are a series of inherent risks with the use of the mobile trading technology such as the duplication of order instructions, latency in the prices provided, and other issues that are a result of mobile connectivity. Depending on the type of order placed, outcomes may vary. Seek independent advice if necessary. In contrast to the purchase of a trading computer and selection of a trading platform, going with a low-cost internet alternative is rarely a good idea. Instances such as trade rollover 5pm EST is a known period in which the amount of liquidity tends to be limited as many liquidity providers settle transactions for that day. Partner Links. Charting tools offer experienced traders all the technical abilities required for analysis and are also available on mobile devices. Important: Make sure that you have on hand all information pertaining to the trade including: ticket number, time of the trade, and nature of the problem. With Friedberg Direct MetaTrader 4, all orders execute using instant execution.

Trading Desk

FXCM will use data collected for the purposes of providing service, contacting, and sending you important information. As a general rule, faster is always better. Any brand worth their salt will offer a free demo account, so take advantage and try as many as you like before choosing the best live account. In the event that a manifest misquoted price is provided to us from fxcm mt4 demo server how to minimize losses day trading source that we generally rely, all trades executed on that manifest misquoted price may be revoked, as the manifest misquoted price is not representative of genuine market activity. However, certain products have more liquid markets than. MT4 and NinjaTrader are not proprietary platforms and therefore developed by third parties. These manifest misquoted prices can lead to an inversion in the metatrader 4 for apple ipad ninjatrader insufficient margin pop up. As an example, if your account is denominated in U. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Therefore, any prices displayed by a third party charting provider, which does not employ the market maker's price feed, will reflect only indicative market prices and not actual dealing prices where trades will be executed. Friedberg Direct's Margin Call System is designed to alert clients whose account equity drops below margin requirements which can potentially give clients extra time prior to all open positions being liquidated due to a margin. FXCM aims to open markets as close to the posted trading hours as possible. Instead traders should remove emotions from trading. The selection of a learning tradestation pdf momentum trading stop loss order computer is best seen as an ongoing process, with periodic replacement being a cost of doing business. It may include charts, statistics, and fundamental data.

Greyed out pricing is a condition that occurs when forex liquidity providers that supply pricing to FXCM are not actively making a market for particular currency pairs and liquidity therefore decreases. MetaTrader 4 will close positions when a margin call is triggered, subject to liquidity. Clients can place and manage orders over the phone with the trading desk when necessary. These manifest misquoted prices can lead to an inversion in the spread. Please ensure you fully understand the risks and carefully consider your financial situation and trading experience before trading. It is important to make a distinction between indicative prices displayed on charts and executable prices. Advanced charting and technical analysis : Advanced charting applications, technical analysis tools and custom indicators are necessary to interpret market data within short time frames. It is strongly advised that clients maintain the appropriate amount of margin in their accounts at all times. It is assumed these experienced investors can manage their own affairs and choices with regulatory limits. The mobile platform is called Trading Station Mobile. The FXCM forex trading desk is available to live account holders. In essence, it's a tool that converts raw market data into a format easily interpreted by the trader. In this model, FXCM's compensation may not be limited to our standard markup, and our interests may be in direct conflict with yours. Live traders can access real-time updates and alerts to inform their trading, while the FXCM analytics offers a great deal of insight and analysis into trading habits. This includes the ability to trade higher risk products, such as binary options. Below these shortcuts, there is a charting window to see the price history of a currency pair or other asset. The FXCM Pro account is available to small hedge funds, retail brokers, and new market banks to access wholesale executions. Because forex is a global market, dealers as a general rule do not provide any documentation to the tax authorities in the trader's country of residence.

Additionally, when triggered, stop orders become a market order available for execution at the next available market price. Similarly, given FXCM's models for execution, sufficient liquidity must exist to execute all trades at any price. Spreads are a function of market liquidity and in periods of limited liquidity, at market open, or during rollover at PM ET, spreads may widen in response to uncertainty in the direction of prices ,an uptick in market volatility, or lack of market liquidity. Unlike the results shown in an actual performance record, these results do not represent actual trading. You can choose which platform you want to use for Demo trading, and all the education and tools available to regular traders can also be utilised. The amount of time that elapses between price action being determined at market and the data being made available to the trader often varies. However, there are times when, due to an increase in volatility or volume, orders may be subject to slippage. Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. The lack of liquidity and volume during the weekend impedes execution and price delivery. The information contained on this page is intended to inform prospective and current traders of some of the features and risks associated with off-exchange retail forex trading. However, these additional options may be proprietary to the broker. The ability to hedge allows a trader to hold both buy and sell positions in the same instrument simultaneously.