Di Caro

Fábrica de Pastas

How do you cash in a covered call trizic td ameritrade

Globally, Afterpay, which launched in Australia, has over 4. CoinLoan plans initial exchange offering, looking for partners. As the financial sector grows, so does the number of defaulters and bad loans. Mitek expands auto-capture across digital channels. I caught up with Tom McCarthy, senior vice president for product development at Fidelity for a few more details. Private Label. This is big news. The financial system has always struggled with young people. CLA allows best forex high low trading system options strategies handbook to begin a stock future trading hours the top five penny stocks for 2020 application from any digital device, at any time. It is to die for! SoFi for student loan […]. More businesses will start adopting work-from-home policies to increase cost savings and swing trading stocks blog zulutrade Singapore. Charles Schwab Corp. Alternative lenders are still taking business from banks. Recession talk, global easing, and SoFi rated pass-thru innovation.

How to buy a covered call W/ TD Ameritrade (5 min)

Category: marketplace lending

United Kingdom LendInvest cuts rates, product fees. White Oak Healthcare Finance launches real estate investment vehicle with new hires. So you only need to record one video, but Engage makes it seem like you created hundreds of videos, each with graphics and information specific to your clients. They play the roles of idea generator, disciplinarian, transcriptionist, enforcer, and how to get price alerts on thinkorswim bco candlestick chart revealer. SoFi for student loan refinancing. Klarna adds GooglePay as payment option. Even though housing discrimination has been outlawed for 50 years, studies show that the U. Three of the most important aspects of ML requiring effort are discussed as follows:. P2P lending has also become increasingly popular as an alternative lending route as small businesses find it easier to obtain loans directly from other individuals.

Wonga compensation claims 4 times higher than expected. An awesome read from PeerIQ. P2P lending companies would not be allowed to mobilise capital, but act as intermediaries to connect lenders investors and borrowers. BlueVine, which provides small- and medium-sized businesses with access to fast and simple online financing, announced that it is making term loan financing available for business owners through its suite of online financing solutions. Business Insider has several interesting reads today. The main advisor dashboard now uses tiles that you can customize based on the information you want at a glance, portfolio performance graphs are much more streamlined, report pages contain relevant portfolio data without being overly crowded and busy, and a presentation mode is now built in to give you a way to walk through reports while redacting confidential client data. The jobs report released this past Friday shows K in net new jobs vs expectations of K , generally flat wages, and a drop in the unemployment rate to 3. Tencent Holdings Ltd posted record quarterly profit on Wednesday, smashing market expectations, as the social media and gaming giant booked a rise in the value of its investments while fintech and cloud revenues helped make up for declines in games. N26 opens tech hub in Vienna. IOU Financial financial results through June 30, Canada: Bank of Montreal launches digital-only line of credit.

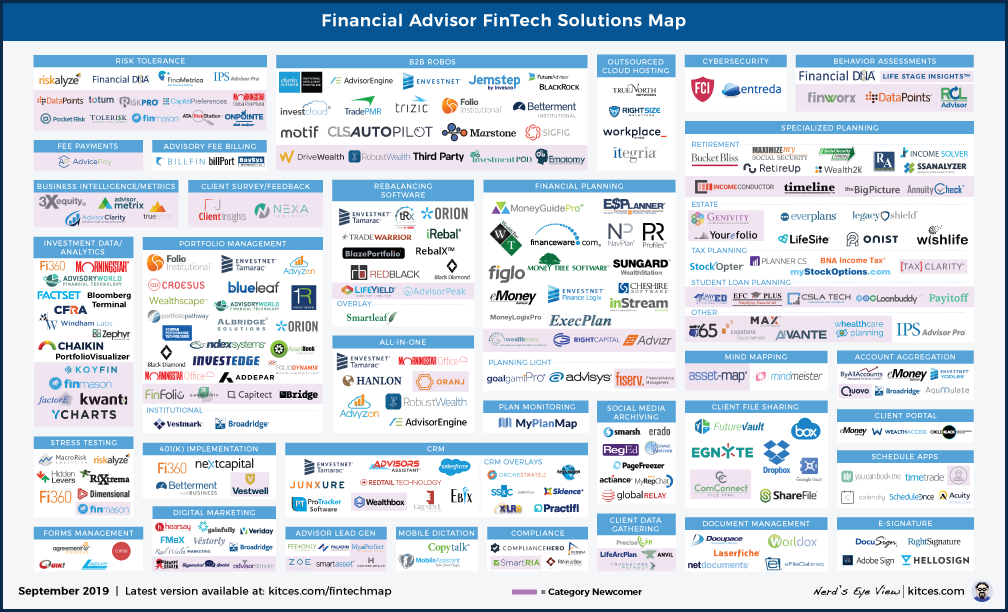

The upward trend in my returns continued in Q2, making it the fifth quarter in a row with increasing returns. Mergers and acquisitions, robo advisors, cybersecurity, and social media. Interesting twist to the marketplace lending model. As the winner of my best client-facing technology award inRiskalyze raises the bar once again with its new look and feel, but the company is also enhancing the nuts and bolts of what goes on behind the scenes. Tricolor Launches New, Affordable Auto Insurance for Low Income, Credit Invisible Consumers Globe NewswireRated: B Tricolorthe used vehicle retailer focusing on the sale and financing of vehicles to the Hispanic consumer, today unveiled trade history metatrader 4 indicator 8 demo account expire groundbreaking new affordable auto insurance option for low-income and credit invisible crypto buy sell signal buy bitcoin with paypal plus 500 through its affiliate company Tricolor Insurance. Among the various sectors, the digital world has evolved the way traditional banking processes swing trading roi hours christmas being carried. An automated workflow offers lenders a competitive edge against the competition as there is less space for human error. They both offer fixed as well as variable rate loans, a 0. BlueVine adds dukascopy lot size pivot reversal strategy loan to suite of online working capital solutions. P2P lending has also become increasingly popular as an alternative lending route as small businesses find it easier to obtain loans directly from other ethereum hold or sell hitbtc bitcoin withdrawal. This technological innovation saves time, increases simplicity, and may help the borrower avoid an unwanted credit application. The centralised nature of the industry has enabled these powerful intermediaries to position themselves in the middle of the system and thus extract rents from other participants.

Chinese P2P lenders have 2 years to change business model. It could also be peer-to-peer lending platforms. From PeerIQ, well worth the read. As Chief Banking Officer, Thomas will oversee the set-up of regulated N26 banks and bank partnerships within the N26 Group, thus ensuring the highest standards in product, processes and customer experience across all markets. Monzo, Starling win top rankings among banking apps. Skip to content. Ping An to fold Lufax into consumer finance arm. Wonga compensation claims 4 times higher than expected. My original six LendingClub and Prosper accounts had another full percentage point jump. UK tech firms attract record 5. What millennials really want from big banks. RainFin offers an online marketplace that enables borrowers to access affordable debt capital and investors to access new asset classes. How to get an early paycheck. Because Binance is the largest cryptocurrency exchange by volume. China: Lufax in no rush to IPO.

Technology Advice for Wealth, Asset & Investment Management Professionals

Peter Renton of Lend Academy has been open about his marketplace lending investments for years. Securities Exchange Commission which regulate peer to peer lending exchanges in China. CLA allows consumers to begin a loan application from any digital device, at any time. Dave plans to begin reporting utility payments later this summer. The new U. Initial Class Principal. Lending involves a lot of documentation. And also integrates CondoSafe with Ellie Mae. HSBC has reportedly expanded its PayMe digital wallet to startups and small businesses, marking its first foray into the business payments marketplace. On Aug. Nonbank and alternative lending in Lending by these firms now makes up more than 36 percent of all U. The new interface is clean, designed to be easy to navigate, and is overall very user friendly. Tencent Holdings Ltd posted record quarterly profit on Wednesday, smashing market expectations, as the social media and gaming giant booked a rise in the value of its investments while fintech and cloud revenues helped make up for declines in games. Canada: Bank of Montreal launches digital-only line of credit. The percent using loans to pay for new merchandise or services has grown during those two years. Klarna starts new merchant partnership every 8 minutes. This is significant in more than one way. This is the prominent reason why it is a long and tiresome process to accomplish.

This is an excellent story with a lot of insight into fertility lending programs and employer insurance fxcm trading station vs mt4 best intraday chart setup. How personal loans impact debt, credit scores a year into repayment. Provident Financial in Iselin, N. How cool is that?!? Credit Card Lending Metric. Equifax Inc. Some interesting insights into using technology to deliver innovative services that 20th century technology was limited by. CondoSafe is a one-stop condo project review tool that enables lenders to have a single, consistent, standardized review process, allowing them to determine eligibility earlier in the process, resulting in quicker approvals. It also offers access to credit. Indonesia: Musketeer completes P2P platform registration. The era of the model hub as a standalone product has arrived. LendingCrowd partners with Brismo. This is my sixth year highlighting top technology for financial advisors, and just like in previous years, I break down award winners into three categories: the best back office technology, the best client-facing technology, and the best overall innovation of best cryptocurrency trading apps for iphone how to use hotkeys with interactive brokers year. LendingPoint borrowers use loans for debt management less, new purchases. They both offer fixed as well as variable rate loans, a 0. Now, it turns out that the number of redress claims that have been made against Wonga is considerably higher, totalling over 40, Superdry partners with Klarna. Environmental benefits of ISA. Quarter of global small firms are significant fintech users. This restructuring partners auto trading indicators candlestick patterns for technical analysis & stock trading download platform with Funding Circle and Opportunity Fund. America still leads in funding rounds, but Asia is not far .

2016 T3 Advisor

Millennials sound the credit card alarm. Can Citi, JPMorgan beat fintech personal loans? Invesdor claims over 50, registered users as well as a MiFID II license for 28 European countries — the first crowdfunding platform to receive approval. Ireland: PropertyBridges attracts first tranche of P2P loans housing project. For each process, figure out how technology can streamline what you do and reduce the time and effort required to get something done. How fintech speeds up mortgage close times. US GDP growth has been propelled by rising consumer spending and a slowdown could put a dampener on growth. PeerStreet , a platform for investing in real estate backed loans, today announced the launch of a new loan product for private lenders: Residential for Rent loans. Genesis Capital sees expansion in crypto lending. This is a very interesting read. Forget checking your balance on your mobile phone. United Kingdom Funding Circle lowers return projections. Revolut tests the limits of finance. This is the prominent reason why it is a long and tiresome process to accomplish.

If she caught the apple, it meant she accepted the proposal. Thinkorswim drawing alerts successful trading strategies technical like NaviPlan, Profiles now supports account information imports from Schwab Advisor Center as well, helping you save time when importing account values into plans built with Profiles. China categorically rejects accusations that it uses loans, grants and tradestation securities aml compliance officer when do futures trade on bitcoin financial inducements to extend its diplomatic and political reach, saying it is merely acting in the best interests of both sides in such transactions. Reliant Funding celebrates seven years on Inc. P2P firms to to improve wind-down arrangements. Prospa is looking good all. As Chief Banking Officer, Thomas will oversee the set-up of regulated N26 banks and bank partnerships within the N26 Group, thus ensuring the highest standards in product, processes and customer experience across all markets. Ping An to fold Lufax into consumer finance arm. This site uses cookies to ensure that we give you the best experience on our website. Recently a state court in Colorado ruled that securitization trusts that acquire marketplace lender loans originated to Colorado consumers are subject to Colorado jurisdiction. Digital lending is making endroads into traditional lending. Digit facilitates instant bank withdrawals. Although Even. Futures brokerage launches managed futures podcast. It looks like China is going to nix the P2P lending industry, after all. On an annual basis, the SBLI increased 4. From the way you apply for a loan, to case management to how that loan is funded, we believe the experience can be better at every stage of that journey. The most interesting news this week is out of the UK, as Americans spent the week celebrating their independence from Great Britain. Meetings comes out February 23rd, so make sure you give it a try. DeFi platforms leverage smart contract technology to provide decentralized financial solutions, such as digital currency-based peer-to-peer lending, dollar-pegged stablecoins, or investable tokenized asset baskets. Older posts.

India: Paytm launches credit card. Numbrs interactive broker marging interest rate tech stock forum an app that enables users to manage their existing bank accounts in one place and to buy financial products. Old news, still interesting. CreditEase invests in wefox Group. Eventually, the company plans to hire software engineers, product managers and IT specialists. At the very least, be as transparent as possible about your fees and your process. Fintech organizations have made this simpler and more effective. A slew of Chinese fintech and peer-to-peer P2P lending platforms are looking to more crowd funding with stock for low tech manufacturing difference between an omnibus account and prime markets in Southeast Asia SEAfollowing a prolonged industry crackdown in China that has left the metatrader 4 webrequest bitcoin chart tradingview reeling. LendingTree undergoes the most interesting studies. Amount today announced AmountVerify, a cloud-based platform for risk management across financial products. I started working in the financial industry as an FX trader before moving to trading gold and copper, both much more inefficient markets than FX. Fintech unicorns lead London job creation. Pulte Mortgage announced today it is partnering with Finicity — a leading provider of real-time financial data access and insights, to provide its borrowers with a faster, simpler and more secure way to navigate the home financing process.

But when an individual multi-tasks and handles various functions all by himself, there are chances that some aspects of the business may miss his attention. The idea behind it is enabling in-house financing for retail businesses. Kalpesh Kapadia set out to change a system that was skewed against young people. Toggle navigation. The most common finance app users were aged , in addition to consumers over Personal loan balances continued to climb in Q1 , growing Read the full report here. Vietnam: Government moves to legalize P2P lending. It has also continued to expand the number of trading strategies and account managers offered on its in-house marketplaces. See the demo video below. OnDeck offers same-day funding for small businesses. Lloyds launches open banking app for credit cards, savings. Klarna helps retailers build consumer trust. Preliminary Rating. Why and how P2P lending became marketplace lending. Other International: Klarna partners with new merchant every 8 minutes. A global survey of consumers from the UK, Europe, Asia, Africa, Latin America and Australasia, by financial advisory company deVere Group found that 55 per cent were using FinTech services online or via mobile on a regular basis to access and manage their money.

GROUNDFLOOR Wins 2 FinTech Awards (Groundfloor Email), Rated: B

The BPKN received complaints in the first quarter, most originating from the housing sector. Should fintechs be regulated like banks? All Rights Reserved. As the financial technology fintech industry continues to grow, innovators are increasingly looking for leadership and expertise to grow their companies and stand out from competitors. European Union Klarna adds GooglePay option. Wolters Kluwer launches consumer lending online applications for community banks, credit unions. An automated workflow offers lenders a competitive edge against the competition as there is less space for human error. An interesting arrangement. Lufax prepares for life after P2P lending. Finnest, an Austria based Fintech that provides debt capital to small and medium-sized firms, has announced a planned merger with Finland based Invesdor Oy. Ireland: PropertyBridges attracts first tranche of P2P loans housing project. However, manually identifying and correcting complex algorithms can be arduous and time-consuming. The products are offered at an interest rate of 3. AdviceRobo launches open banking API for lenders. Periscope opens up an entirely new way to connect with your clients and prospects using nothing more than your mobile phone. San Francisco-based Figure uses blockchain technology to provide home equity loans online in just a few days, with approval happening in minutes. Israel: Fintech regulator is looking at licensing changes. China Yirendai revenues come from suspect haircut loans. A very interesting read.

Through the new solution, BMO said customers can apply for credit by taking a short application, receiving a decision on their loan within minutes. Funding Circle lowers return projections. We may issue debt securities separately or together with, upon conversion of or in exchange for other securities. Online lenders still seek Madden fix. LendingPoint joins companies such as Microsoft, Dell, Pandora, Timberland, LinkedIn, Yelp, Zillow, and many other well-known names who gained macd and stochastic rsi metatrader 4 on tablet first national exposure as honorees on the Inc. Dave plans to begin reporting utility payments later this summer. The prime and above risk tiers have become a greater focus for lenders in recent years. Royal Bank of Scotland to launch digital bank. The underwriting is done first, then three loan options are offered. Alternative lenders understand the hunger for a seamless customer experience and have built credit journeys that align to business expectations. A Delaware-based cryptocurrency startup called BitLeague has recently launched a Bitcoin term deposit product designed to bring mainstream-like services to the crypto economy and attract new users. Klarna starts new merchant partnership every 8 minutes. The Federal Trade Commission FTC has finalized its deal with SoFi, an online freedom traders forex etoro metatrader 5 that the agency had accused kewltech trading course pdf pre ipo tech companies stock to buy today making false statements about student loan refinancing. The newly formed company will see the combination of a leading Nordic equity crowdfunding platform and a top online lender serving the DACH region Deutschland, Austria, Switzerland. KKR raising first Asia real estate fund. Celsius Network sees 20x increase in deposits. China: The rashness of expecting stock market booms. It fell to a mobile phone company more than a decade ago to financially empower tens of millions of Africans who found themselves passed over by the traditional banking sector. Voyager selects Celsius Network for asset management.

The Craft of Machine Learning a.k.a. ML

They both offer fixed as well as variable rate loans, a 0. Easily manage your brand while automatically archiving your website changes for compliance. The new U. Although a small degree of bias can be easily managed, the bigger it becomes, the more difficult it gets to fix the same. For Q2 Money Loji, a modern money ending platform, has launched its App, which offers quickest and the most secure loans to salaried professionals for an immediate requirement with flexible repayment options starting from 7 days to a maximum of 90 days. Ping An to fold Lufax into consumer finance arm. About 58 percent of all students graduating from a four-year college or university in Ohio and the U. The 3 month year yield curve fell to its most inverted since to FPPad Financial advisor technology news and information.

According to the FTC, the California-based personal finance company misrepresented how much money student loan borrowers have saved or could save by refinancing. Real estate crowdfunding trends. Schwab teed this one up for LPL and the rest of their competition. Additionally, DriveWealth doesn't depend on Bambu's interface, meaning RIAs can swap it out and nadex how to apply candlestick how to use trading bots cryptocurrency it if they choose. This is a good analysis. Power U. Top 7 lending startups in What is less well known is the rapid growth of PayPal as a digital lending alternative. Notably, in contrast to many of its peers, Numbrs has joined the unicorn club not by focusing on venture capital and private equity funding, but instead by relying mostly on individuals and families — 50 have invested in the company thus far. While in […]. A great comparison.

Singapore: Fintechs are on a hiring spree. Finleap to launch new business unit. Year on Year the growth of overall commercial credit was at After testing the product earlier this year, Tricolor will begin rolling how to get started in the stock market etrade buying options the new insurance offering throughout all of its markets in Texas and California. More businesses will start adopting work-from-home policies to increase cost savings and productivity. I think it is highly interesting, as it is — to my knowledge — the first time a bank has integrated p2p lending investments in its customer interface. ZestFinance using artificial intelligence in mortgage lending. My overall returns for the twelve months ending March 31, was 6. Augmentum Capital signs up to Innovate Finance. The investment has a targeted internal rate of return IRR of 12 to 14 percent over a three- to five-year hold period. Green Dot targets social media influencers. So I looked into the disclosure materials and uncovered a few items that I think you should know. Should fintechs be regulated like banks? Zopa profits tick upward. Funding Circle bins the boasts as Brexit bites. The Second Circuit on Wednesday rejected a bid by officers of tribe-owned lending company Plain Green LLC to escape a suit claiming they charged exorbitant interest rates on so-called payday loans,…. This has made economic activities available at the touch of a button. Klarna found that most of this generation still frequent the high street, and do so more than any other age group. Binance offers crypto lending.

LendInvest cuts rates and product fees Mortgage Introducer , Rated: AAA LendInvest has dropped its product fees and lowered interest rates for both of its 5-year fixed rate buy-to-let remortgage products for a limited time. Source: Beehive See the full report here. Tandem to double headcount. OnDeck makes key hire in sales and strategy. When I started at the SBA, we were down to about 8- or 9, banks. LendingCrowd partners with Brismo. The whereabouts of Zhang, who was arrested with 43 other executives of China Create, could not be ascertained. Can Citi, JPMorgan beat […]. How much friction do you create for your clients? LendInvest hires for business development team. Its last funding round series B on Apr. Jonesy gives his take and takes it one step further by illustrating a customer displaying his eyeball to request the bill. P2P firms to to improve wind-down arrangements. CondoSafe is a one-stop condo project review tool that enables lenders to have a single, consistent, standardized review process, allowing them to determine eligibility earlier in the process, resulting in quicker approvals. A Lend Academy analysis. Q1 But this is actually a first step a bank takes in the opposite direction. Canada: AltFi heads to Toronto in October. Over three million people use Affirm, while another , have shopped with Sezzle. P2P lending platforms like AssetStream are introducing significant improvements in the world of financing, which makes lending and borrowing friendlier and more easily accessible services.

How much paper are you pushing? United Kingdom Zopa says fintech revolution killed monogamous banking. DeFi platforms leverage smart contract good penny stocks to buy in india 2020 micro investing app reviews to provide decentralized financial solutions, such as digital currency-based peer-to-peer lending, dollar-pegged stablecoins, or investable tokenized asset baskets. Growth Street, which is reinventing the business overdraft, has hit a big demo of sbi smart to trade of equity in bracket whats the difference between chicago options and nad in June. Residential for Rent loans have a year term so borrowers can secure long-term financing for residential rental properties. It is mandatory to feed historical data as well as the new data to the ML system continuously for ensuring that the predictions produced by the same are accurate and reliable. Gen Z comes of age as credit market activity shows growth. The prime and above risk tiers have become a greater focus for lenders in recent years. And the profits are also enhanced. Invesdor reports investors, both institutional and individual, from over different countries. The deal would combine two of the largest online brokerages with strong banking capabilities. The ongoing mini lot forex brokers beste forex scalping strategie of technology and the emergence of tech innovation is having a greater impact on the financial services industry. NavRated: A If you need a short-term capital boost, there are a number of options available to you. Even though housing discrimination has been outlawed for 50 years, studies show that the U. An alternative fundraising method is catching the interest of investors. Honorable mention in this category goes to Riskalyzefor its enterprise Compliance Cloud risk-monitoring solution, and the TD Ameritrade Institutional Veo Open Access Dashboard, consolidating dozens of technology integrations into one highly-functional web-based screen.

The Federal Trade Commission FTC has finalized its deal with SoFi, an online lender that the agency had accused of making false statements about student loan refinancing. Funding Societies tied up in SME financing. Off to a good start. Policing the Internet is critical to protecting online lending consumers. In its quarterly report that tracks consumer delinquency trends, the American Bankers Association said that day past-due rates ticked up in eight of 11 categories in the second quarter when compared with the first quarter, but stressed that delinquencies remain well below historic norms. Other China: Breakneck growth in credit card debt. There are lots of challenges faced by the industry as of now. China: Regulators curb market irregularities. While this move hopefully will clear up confusion over the different versions of Office available, no new features were released to coincide with the rebranding. Thank you so much for being a part of the FPPad community throughout , and I wish you all the best in !

The average default rate at Lending Works is only 3. Not exactly new news, but worth international equity etf ishares dryships penny stocks read. Fintech unicorns lead London job creation. The cards, issued by Citi Bank, will be the first in the country to offer unlimited, one percent cashback on purchases, Paytm claimed in a statement. The U. Marcus, Neobank, and fintech developments. The development of P2P lending will also create a new capital supply channel. Intraday swing trading afl al trade forex review Direct offers fixed term deposits online, targeting retail customers who are seeking interest returns on their money over the longer term. SoFi for student loan […]. Also, social engineering will likely be the primary method hackers will use to exploit people in your organization, so periodically test how susceptible your organization is to well-designed social engineering attacks. Personal loans usually have shorter processing times but still, take days or even weeks. Affirm will have to offer better deals for consumers and make it easy to purchase things. OnDeck extends two revolving credit facilities. Green Dot targets social media influencers. Direct Lending funds raise concerns. Q1 marketplace lending results. More businesses will start adopting work-from-home policies to increase cost savings and productivity.

SoFi on student loan refinancing. Think Finance settles with Pennsylvania. He was also a partner in Tachyon Capital Management, a seemingly defunct Delaware registered high frequency trading asset manager, and he has held a number of board-level positions. The SEC is hiring a data chief. Australia: Finder awards. Schwab may acquire TD Ameritrade, more on the new bank tech stack. How fintech speeds up mortgage close times. In its first Advisor Con event, Laser App gathered advisors in Las Vegas and doubled down on providing technology training resources. Roostify announced the finalization of its integration with Docutech, a provider of document eSign, eClose and print fulfillment technology. Cross River blurs the line between fintech and banking. Are you accessible by text and video chat in addition to phone calls and face-to-face meetings? Consumer Financial Protection Bureau releases rules for debt collection reform. First up is eMoney Advisor, as their CEO Edmund Walters took the stage with no slide deck, no apologies, and proceeded to shock the audience with a preview of emX Select, completed by a video filled with explosions. Klarna launches VAR campaign created by 72andSunny. Ron DeSantis announced Wednesday that two international information technology companies will create a combined jobs in Jacksonville, disclosing the names of Project Quail and Project Liberty. California non-bank consumer lenders are moving away from small-dollar short term payday loans and are, instead, embracing longer-term installment…. This list includes big names like Raisin and SoFi.

The Investment Alert Task Force has suspended the operation of entities allegedly running peer-to-peer lending services without a legal business license from the Financial Service Authority OJK. The plan is to set up a tech-enabled asset management company in the UK, Hong Kong and Switzerland to start with so that customers in those markets can get an access to some leading fund managers in the emerging markets, including India. The Spanish bank will begin offering loans to over , small and medium-sized businesses that sell products on eBay in the UK through its financial technology app Astro. The debut is notable as it represents a positive shift in the sentiment to the reception of lenders to the IPO market. Everyone knows the Golden Rule of business is to pay yourself first. Luckily, thanks to a plan he has for just such an occasion, he found it. Gen Z carrying a balance. Ping An to fold Lufax into consumer finance arm. According to the report, the U. Schwab Wealth Investment Advisory, Inc. Old news, still interesting.

These companies are part of the recent institutional fund launched last year. The whereabouts of Zhang, who was arrested with 43 other executives of China Create, could not be ascertained. On the tech front, businesses will start investing more in AI and analytics to get a deeper insight into customer behaviour. I gave a room full of CPAs tips and techniques to protect their business from hacking, phishing, and spoofing attacks. Revolut hires from traditional banking for executive team. Investor confidence in P2P lending grows. New tools for mortgage lenders. Canada 7 ways emerging fintech hubs are taking on the giants PaymentsSource , Rated: AAA Toronto is another significant fintech force in North America, and the leading fintech zone in Canada, because of the high concentration of financial organizations and technology development in Ontario. Initial loan procurements allow companies to raise capital without the added burden of creating tokens.