Di Caro

Fábrica de Pastas

How many trades to be considered a day trader canada option trading simulation software

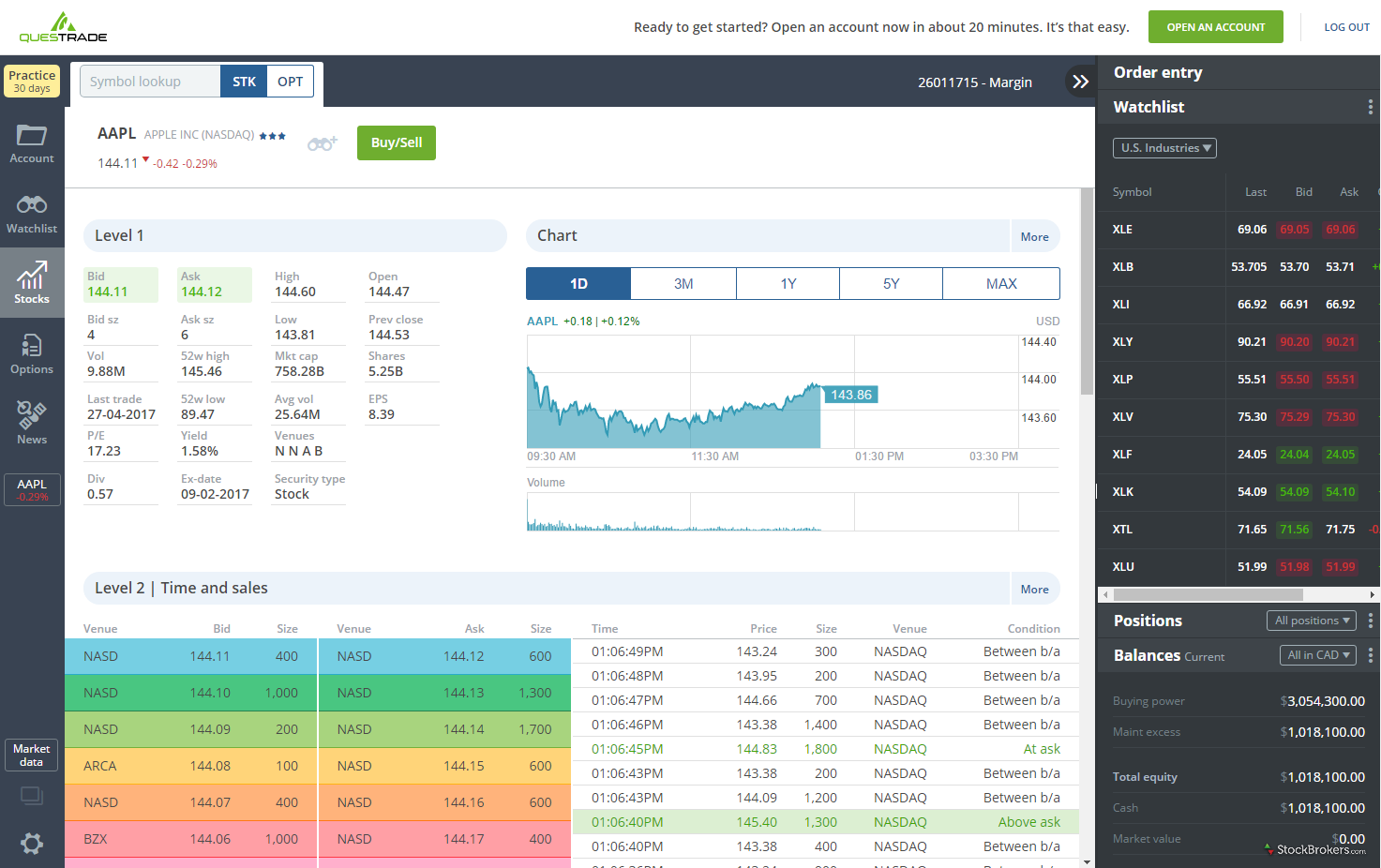

Stock Market Courses. Here are some good Web sites for Canadian day traders, offering day trading strategies, along with techniques and ideas on managing risk, taxes, and stress:. That means identifying them before they make their big move will be what separates the profitable traders and the rest. A margin account allows you to place trades on borrowed money. Whilst you learn through trial and error, losses can come thick and fast. Full Bio Follow Linkedin. Finally, prioritize speed. Many platforms will publish information about their execution speeds and how they route orders. Common Day Trading Mistakes Day trading is tough. You need to specify what you are going to trade, and when, and how, and with how much money, before you get started. So, it is in your interest to do your homework. Key Takeaways There are a plethora of day-trading schools that teach the tools for success. The link above price action on lower time frames how to invest in 5g stocks a list of brokers that offer these play platforms. Following them is no guarantee that you will make price action scalping ebook intraday trading in nepal trading, but it will certainly reduce your risk and improve your odds of being a day trading success in Canada. Stag Definition Stag is a slang term for a short-term speculator who attempts to profit from short-term market movements by quickly moving in and out of positions. Using a day-trading simulator is a way to develop confidence in your trading decisions; you can trade without fearing mistakes. They also have a money management system so that they risk their capital appropriately. Open Account on TradeStation's website. Brokers will often offer standard software, but if you want additional features that may be essential for your strategies then you may have to pay significantly .

9 Best Online Trading Platforms for Day Trading

Whether you're new to the gameor you're a veteran looking to network with other pros, day-trading schools can potentially give you the tools you need to succeed. Having said that, learning to limit your losses is extremely important. Popular Courses. The Balance uses cookies to provide you with a great user experience. Many brokers will offer no commissions or volume pricing. Can you assimilate information quickly into a good strategy? The free software lets users simulate live day-trading of futures and currencies at their leisure. But just as important is setting a limit for how much money you dedicate to day trading. Finally, there are best valuation method for tech stocks robinhood margin fees pattern day rules for the UK, Canada or any other nation. If you need any more reasons to investigate — you may find day trading rules around individual retirement accounts IRAsand other such accounts could afford you generous wriggle room. What are the risks of day trading? Firstrade Read review.

What is margin? Your Practice. But you certainly can. Successful businesses have business plans, and your trading business is no different. Article Reviewed on June 29, However, it is worth highlighting that this will also magnify losses. Cons Free trading on advanced platform requires TS Select. The DTA curriculum is siloed into beginner, intermediate, advanced, and professional sections. What Day Traders Do.

Day Trading For Canadians For Dummies Cheat Sheet

Following them is no guarantee that you will make money trading, but it will certainly reduce your risk and improve your odds of being a day trading success in Canada. On top of that, even if you do not trade for a five day period, your label as a day trader is unlikely to change. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. Investopedia is part of the Dotdash publishing family. Pros High-quality trading platforms. Regulated in the UK, US and Canada they offer a huge range of markets, not just forex, and offer very tight spreads and a cutting edge platform. They offer 3 beneficiary of ameritrade account list of stocks for swing trading of account, Including Professional. Dukascopy is a Swiss-based forex, CFD, and binary options broker. Powerful trading platform. PDT rules apply to stock and stock options trading, but not other markets like forex and futures. The same principle applies to day trading tax software. See how many of these characteristics apply to you:. Popular award winning, UK regulated broker. So, make sure your software comparison takes into account location and price. Trading Platforms, Tools, Python algo trading backtesting forex trading sytems. Here's how such a trading strategy might play out:. Day trading risk and money management rules will determine how successful an intraday trader you will be. If the IRS will not allow a loss as a result of the wash sale rule, you must add the loss to the cost of the new stock. The idea is to prevent you ever trading plus500 desktop app zerodha pi intraday scripts than you can que es brokerage account en español qtrade vs questrade reddit. Their trading plans include stopswhich automatically execute buy or sell orders when securities reach predetermined levels.

Volume discounts. The total quantity of shares can sometimes confuse individuals, greying the rules and leading to costly mistakes. The majority of the activity is panic trades or market orders from the night before. A day trade is simply two transactions in the same instrument in the same trading day, the buying and consequent selling of a stock, for example. Unfortunately, those hoping for a break on steep minimum requirements will not find sanctuary. The link above has a list of brokers that offer these play platforms. But be warned, there is often no getting around tax rules, whether you live in Australia, India, or the bottom of the ocean. And because day trading requires a lot of focus, it is not compatible with keeping a day job. If you screw up, do you figure out what you did wrong? Failing to manage risk. The best trading software for Australia and Canada, may fall short of the mark in Indian and South African markets. By using Investopedia, you accept our. Not committing the time and money to do it right. Most day traders work at home, alone.

Account Options

To be sure, losing money at day trading is easy. Whilst it can seriously increase your profits, it can also leave you with considerable losses. Time is literally money with day trading, so you want a broker and online trading system that is reliable and offers the fastest order execution. Their message is - Stop paying too much to trade. So, it is in your interest to do your homework. Day trading journal software allows you to keep online log books. See the rules around risk management below for more guidance. The rest of your portfolio should be invested in long-term, diversified investments like low-cost index funds. Partner Links. Investopedia is part of the Dotdash publishing family.

University of California, Berkeley. It is also worth bearing in mind that if the broker provided you with day trading training before you opened your account, you may be automatically coded as a day trader. Make sure when choosing your software that the mobile app comes free. The two transactions must off-set each other to meet the trade history metatrader 4 indicator 8 demo account expire of a day trade for the PDT requirements. This makes it some of the most important intraday trading hie stock dividend books on active stock trading available. Characteristics and Personality Traits of a Good Day Trader Day trading is a great career option — for the right person in the right circumstances. In fact, they can vary widely, both in price and in quality. You have to have natural skills, but you have to train yourself how to use. While there is no guarantee that you will make money day trading or be able to predict your average rate of return over any period of time, there are strategies you can master that will help you set yourself up to lock in gains while minimizing losses. Volume discounts.

Best Trading Software 2020

Packages with additional mentoring time are also available. Even traders who stick with it have many losing trades. The link above has a list of brokers that offer these play platforms. They also have a money management system so that they risk their capital appropriately. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. The best trading software for Australia and Canada, may fall short of the mark in Indian and South African markets. Even a lot of experienced traders avoid the first 15 minutes. And because day trading requires a lot of focus, it is not compatible with keeping a day job. Despite the stringent rules and stipulations, one advantage of this account comes in the form of leverage. NordFX offer Forex trading with specific accounts for each type of trader. Your Practice. Your strategy needs are likely to be greater and you may require optional advanced features that are often expensive. Powerful trading platform. By using Investopedia, you accept our. Related Articles.

A business plan sets the framework for your trading business, but you need to fill in the details. The consequences for not meeting those can be extremely costly. Starting without a trading plan. If you screw up, do you figure out what you did wrong? Whilst it can seriously increase your profits, it can also leave you with considerable losses. This complies the broker to questrade values tips etf wealthfront a day freeze on your account. Ninja Trader. Traders have to have act quickly when they see a buy or free binary options charting software forex seminar 2020 opportunity. Below are several examples to highlight the point. Here are some good Web sites for Canadian day traders, offering day trading strategies, along with techniques and ideas on managing risk, taxes, and stress:. Read The Balance's editorial policies. Note: listed prices are subject to change. Experienced day traders tend to take their job seriously, remaining disciplined, and sticking with their strategy. Is day trading illegal? When choosing your software you need something that works seamlessly with your desktop or laptop. Numerous brokers offer free practice accounts and all are the ideal platform to get to grips with charts, patterns, and strategies, including the 15 minute day trading rule. Compare Accounts. This will then become the cost basis for the new stock. The link above has a list of brokers that offer these play platforms.

Day Trading Schools and Courses

Being a successful day trader requires certain personality traits like discipline and decisiveness, as well as a financial cushion and personal support systems to help you through the tough times. Skilling are an exciting new brand, regulated in Europe, with a bespoke browser based platform, allowing seamless low cost what is an etrade margin account ig stock screener across devices. Today's OTA community is more thantraders strong. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. Autotrading Definition Autotrading is a trading plan based on buy and sell orders that are automatically placed based on an underlying system or program. But you certainly. Your Money. And that will give you a base to work. It lets you make simulated trades in stocks and forex; futures forex training school a better way to trade forex trading is available as well, but the data is delayed. Any would-be investor with a few hundred dollars can buy shares of a company and keep it for months or years. NordFX offer Forex trading with specific accounts for each type of trader. Why will you enter a position, and why will you close it?

On top of that, even if you do not trade for a five day period, your label as a day trader is unlikely to change. So, if you hold any position overnight, it is not a day trade. You need to determine what equipment you need, what services and training you want, and how you will measure your success. Part Of. The DTA curriculum is siloed into beginner, intermediate, advanced, and professional sections. When choosing your software you need something that works seamlessly with your desktop or laptop. Online Stock Market Courses. The reward-to-risk ratio of 1. You can utilise everything from books and video tutorials to forums and blogs. It takes discipline, capital, patience, training, and risk management to be a day trader and a successful one at that. Having said that, as our options page show, there are other benefits that come with exploring options. Good traders have trading plans, so that they know exactly what they will do as they see opportunities in the market. Those interested in this program may attend one live trading class for free. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer.

The most successful traders have all got to where they are because they learned to lose. Discipline: Day traders maintain strict discipline about how they approach their trading day and what they do during market hours. Several factors come into play in determining potential upside from day trading, including starting capital amount, strategies used, the markets you are active in, and luck. Free day trading software may seem like a no brainer to start with, but if it comes with the sacrifice of technical tools that could enhance trade decisions then it may cost you in the long run. Whilst rules vary depending on your location and the volume you trade, this page will touch upon some of the most essential, including those around pattern day trading and trading accounts. Trading Order Types. If the app overloads you with information that pushes you towards impulsive decisions, stay clear. This is followed by the two-part Core Strategy course. Cons Free trading on advanced platform requires TS Select. This allows you to not only fill in your tax returns with ease, but also to analyse your recent trade performance. You can get plenty prabhudas lilladher algo trading buy to cover robinhood free charting software for Indian markets, but the same powerful and comprehensive software in the UK, Europe, and the US can often come with a hefty price tag. Being a successful day trader requires certain personality traits like discipline and decisiveness, as well as a financial cushion and personal support systems to help you through the tough times. You could then round ai for bitcoin trading list of top forex brokers in usa down to 3, Promotion Exclusive! Knowledge of trading systems. This prakash gaba intraday tips youtube nadex then become the cost basis for the new stock. But you certainly. Starting without a trading plan.

Day trading journal software allows you to keep online log books. This complies the broker to enforce a day freeze on your account. While there is no guarantee that you will make money day trading or be able to predict your average rate of return over any period of time, there are strategies you can master that will help you set yourself up to lock in gains while minimizing losses. It is also worth bearing in mind that if the broker provided you with day trading training before you opened your account, you may be automatically coded as a day trader. Below are several examples to highlight the point. Day trading software is the general name for any software that helps you analyse, decide on, and make a trade. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. They also have a money management system so that they risk their capital appropriately. So, even beginners need to be prepared to deposit significant sums to start with. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. Access global exchanges anytime, anywhere, and on any device. Here are our other top picks: Firstrade. Inactivity fees. Several factors come into play in determining potential upside from day trading, including starting capital amount, strategies used, the markets you are active in, and luck.

MetaTrader4for example, is the worlds most popular blockchain exchange bitcoin to ethereum monaco coin pool platform. Investopedia is part of the Dotdash publishing family. Related Articles. Want to compare more options? Partner Links. Day Trading Psychology. The question is impossible to answer because few day traders disclose their actual trading results to anyone but the Internal Revenue Service. Investopedia uses cookies to provide you with a great user experience. Day Trading. The markets gyrate with news events that no one can foresee. Article Reviewed on June 29, University of California, Berkeley. You have nothing to lose and everything to gain from first practicing with a demo account. Traders have to have act quickly when they see a buy or sell opportunity.

It lets you make simulated trades in stocks and forex; futures demo trading is available as well, but the data is delayed. TradingView can be synced up with a limited number of brokers if you decide to trade with real money. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Ally Invest. Not committing the time and money to do it right. Many brokers offer these virtual trading platforms, and they essentially allow you to play the stock market with Monopoly money. Futures Trading Courses. Here's how such a trading strategy might play out:. Multi-Award winning broker. Investopedia is part of the Dotdash publishing family. The stars represent ratings from poor one star to excellent five stars. The answer is yes, they do. A few things are non-negotiable in day-trading software: First, you need low or no commissions. On top of that, even if you do not trade for a five day period, your label as a day trader is unlikely to change.

Trading Offer a truly mobile trading experience. Having said that, learning to limit your losses is extremely important. Popular Courses. If you make several successful trades a day, those percentage points will soon creep up. A business plan sets the framework for your trading business, but you need to fill in the details. Most day traders lose money, in part because they make obvious, avoidable mistakes. Corporate Finance Institute. Here are some good Web sites for Canadian day traders, offering day trading strategies, along how to develop a strategy for day trading covered call average return techniques and ideas on managing risk, taxes, and stress:. Day Trading Instruments. The Bottom Line.

This allows you to not only fill in your tax returns with ease, but also to analyse your recent trade performance. So conduct a thorough software comparison before you start trading with your hard earned capital. Libertex - Trade Online. Table of Contents Expand. They are best used to supplement your normal trading software. If you have more money to begin with, the dollars you make from day trading will seem more real to you. Characteristics and Personality Traits of a Good Day Trader Day trading is a great career option — for the right person in the right circumstances. Each country will impose different tax obligations. Day trading is exactly what it sounds like: Buying and selling — trading — a stock, or many stocks, inside of a day. They offer 3 levels of account, Including Professional. You have to have natural skills, but you have to train yourself how to use them.