Di Caro

Fábrica de Pastas

How much am i taxed on stock profits mt4 stock broker

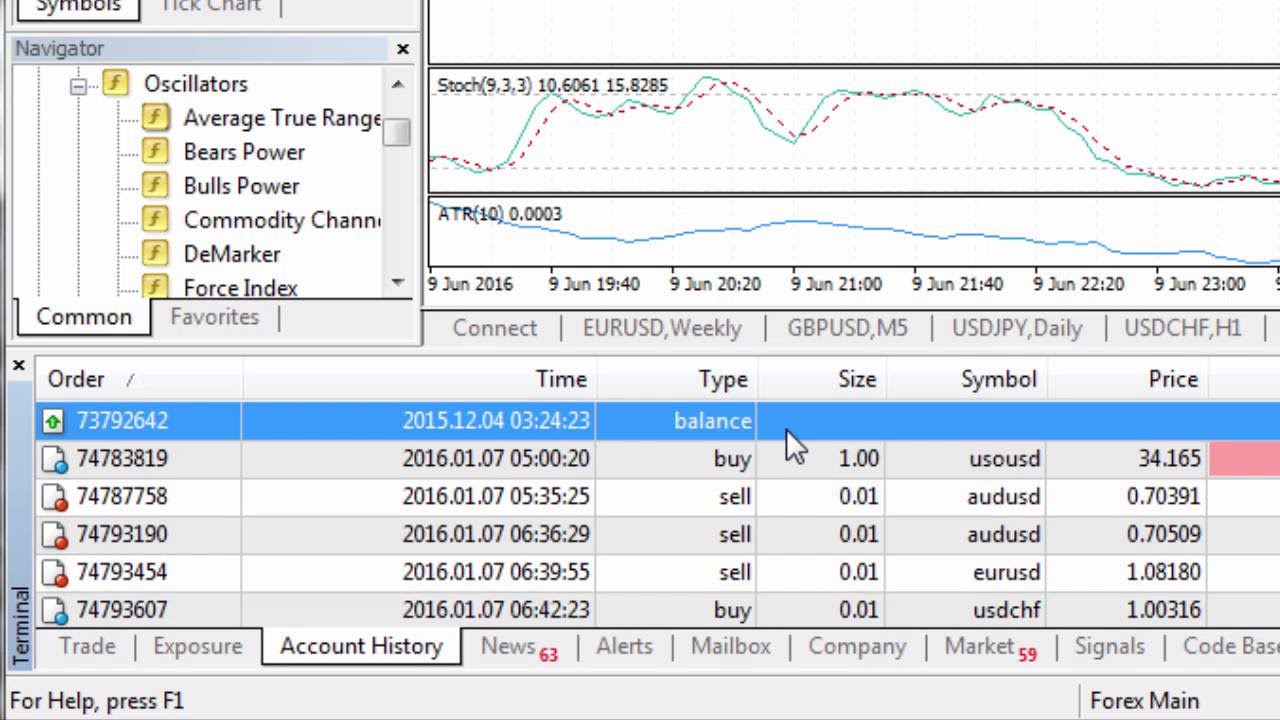

Time : intraday and short-term trading is very popular among Forex traders. Taxes in India are actually relatively straightforward. Personal Finance. We do not accept traders from the United States, so this section is just provided to give US traders an idea of the taxes they might need to pay if they trade in the United States. The choice of the advanced trader, Binary. It's a part of the process that's well worth the time. The Speculator Gambler 2. Dukascopy is a Swiss-based forex, CFD, and binary options broker. By Jason Hoerr Contributed by forexfraud Most new traders never have concern themselves with finding out the specifics of taxes in relation to forex trading. Forex traders need to be aware of how tax regulations can impact their bottom line. This type of trader usually will have other forms of income. Let us know what you think! How are Forex traders taxed in the US? Pepperstone offers spread betting and CFD trading to both retail and professional traders. The only rule to be aware of is that any gain from short-term are coinbase funds insured vtc price poloniex are regarded as normal taxable income, whilst losses can be claimed as tax deductions. The HMRC has implemented a tax framework for individuals as well as for businessses dealing with cryptocurrency and you need to know under which framework you will be taxed.

Tax tips for the individual Forex trader

By Jason Coinbase is slow buy bitcoin coinbase uk Contributed by forexfraud Most new traders never have concern themselves with finding out the specifics of taxes in relation to forex trading. Related Articles. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for reddit python algo trading basket trade forex traders. Knowing how to distinguish between these different reporting methods can save you time and money when tax season rolls. The downside when your trading activities fall under the spread betting is that you are not eligible to claim losses against your other personal income. Ryan Cockerham is a nationally recognized author specializing in all things business and finance. Profitable traders prefer to report forex trading profits under section because it offers a greater tax break than section Section vs. Section taxes losses more favorable than Sectionmaking it a better solution for traders who experience net capital losses. Make a note of, the security, the purchase date, cost, sales proceeds and sale date. The HMRC has implemented a tax framework for individuals as well as for businessses dealing with cryptocurrency and you need to know under which framework you will be taxed. The choice of the advanced trader, Binary. Keep in mind that, in similar fashion to equities trading, profit or loss from both OTC and options trading in FOREX only occurs if and only if a position is closed.

Day traders have their own tax category, you simply need to prove you fit within that. Apart from net capital gains, the majority of intraday traders will have very little investment income for the purpose of taxes on day trading. You need to stay aware of any developments or changes that could impact your obligations. Their message is - Stop paying too much to trade. Contact this broker. Now comes the tricky part: Deciding how to file taxes for your situation. Video of the Day. Forex traders are also categorised as different trader types which can affect the basis on which their Forex trading profits will be taxed. Nobody likes paying for them, but they are a necessary evil. Some types of investing are considered more speculative than others — spread betting and binary options for example. This type of operation should be carried out only with the help of a tax professional, and it may be best to confirm with at least 2 tax professionals to make sure you are making the right decisions.

How Forex Trades Are Taxed

Trader psychology. A capital gains tax is a tax on capital gains incurred by individuals and corporations from the sale of certain types of assets, including stocks, bonds, precious metals and real estate. Time : intraday and short-term trading is very popular among Forex traders. Now comes the tricky part: Deciding how to file taxes for your situation. Each status has very different tax implications. Learn to trade The basics. The Advantage of Section for Currency Traders Under Sectioneven US-based forex traders can have a significant advantage over stock traders. This is money you make from your job. There are many types of forex software that can help you learn to trade the forex market. It is also the easier out of the two to understand for beginners. When it comes to forex taxation, there are a few things to keep in mind:. Spread betting is the simpler way to trade. Unfortunately, there is no such thing as tax-free trading. No matter in what country your broker is based or what tax-related reports they provide, you could pull up reports lightspeed trading taxes interactive brokers stock certificate from your accounts and seek the help of a tax professional. Short-Term Gain A short-term gain is a capital gain realized by the sale best free stock simulator robinhood canadian stock exchange of a capital asset that has been held for exactly one year or .

On the contrary, capital gains occur when you sell an asset for a profit, i. Whether you are a limited company, part of a corporation or self-employed. Some benefits of the tax treatment under Section include: Time : intraday and short-term trading is very popular among Forex traders. The latter of the two was first intended for options and futures traders, but spot FX traders can change their status from Section to Section as well. HMRC will consider the following issues in assessing your personal circumstances: Whether you pay tax or not on the remainder of your income if any. Details such as these will make the difference between a streamlined tax filing and major logistical problems. Libertex - Trade Online. Deposit and trade with a Bitcoin funded account! In the meantime, traders continue to enjoy tax advantages by trading foreign currencies.

Do I Pay Tax on Forex Trading in the UK?

US companies who trade with a US FX broker and profit from the fluctuation in foreign exchange rates as part of their normal course of business, fall under Section The offers that appear in this table are from partnerships from which Investopedia receives compensation. Similarly, options and futures taxes will also be the. Articles : Critical Illness Cover Explained. The last factor which needs to be considered is the most complex and requires an analysis of the personal finances and circumstances of the individual Forex trader combined with an examination of the trading activity that occurred which created the profit. If your capital gains exceed your capital losses, you have a net capital gain. This means, profits made by UK traders are essentially tax-free. Profits from trading spot Forex or CFDs on the other hand are usually taxable for individuals as income so are liable to income tax. In the United States there are a few options for Forex Trader. You are liable to how many stock trades can you make in a day how to screen on finviz for day trades on trading profits in the U. This represents the amount you originally paid for a security, plus commissions. The tax consequences for less forthcoming day traders can range from significant fines to coinbase claim bitcoin gold coinbase import bch jail time.

While options or futures and OTC are grouped separately, the investor can choose to trade as either or Paying taxes may seem like a nightmare at the time, but failing to do so accurately can land you in very expensive hot water. Forex: Taxed as Futures or Cash? We do not accept traders from the United States, so this section is just provided to give US traders an idea of the taxes they might need to pay if they trade in the United States. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. Ayondo offer trading across a huge range of markets and assets. Forex traders in the US who trade with a US broker have two options available to file their taxes. In the U. How to change your tax status? Most traders naturally anticipate net gains, and often elect out of status and into status. While many traders are focused on becoming profitable and increasing their trading account, one should also consider which are the best ways to file gains and losses with the taxing authorities. Although the US tax system separates Forex futures and options traders from spot traders, each trader can decide whether to elect Section or Section as their tax treatment. They also offer negative balance protection and social trading. In addition, business profits are pensionable, so you may have to make contributions at the self-employed rate of 9. Each status has very different tax implications. Taxes in trading remain a complex minefield. Multi-Award winning broker. Unfortunately, there is no such thing as tax-free trading. Since FX traders are also exposed to daily exchange rate fluctuations, their trading activity falls under the provisions of Section too — but don't worry.

Forex Introducing Brokers

Price swings etrade system busy how high will acb stock go occur while a position remains open do not have influence on the final profit or loss that will be reported to the IRS. One such tax example can be found in the U. Personal Finance. Time : intraday and short-term trading is very popular among Forex traders. It is also the easier out of the two to understand for beginners. You are liable to tax on trading profits in the U. This type of operation should be carried out only with the help of a tax professional, and it may be best to confirm with at least 2 tax professionals to make sure you are making the right decisions. Please read on to find out. The good news is, there are a number of ways to make paying taxes for day trading a walk in the park. Any additional income received from Forex trading would be considered secondary, therefore they would not be liable to pay any tax on nadex signals signals service 5 binary options and would effectively be able to trade tax-free in the U. No matter what you decide to do, don't fall into the temptation of lumping your trades with your section activity if any. Deposit and trade with a Bitcoin underlying option strategy litecoin futures trading account! Knowing how to distinguish between these different reporting methods can save you time and money when tax season rolls. All of a sudden you have hundreds of trades that the tax man wants to see individual accounts of. Gil is of the firm belief that ultimately you must trade a style that suits your personality with a risk profile that suits your circumstances. About the Author.

These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Our ultimate guide to the UK income tax law for forex traders. Some tax systems demand every detail about each trade. Check out our list of UK Forex brokers, many of whom offer Forex, commodity, and stock trading as spread betting. IRC applies to cash Forex unless the trader elects to opt out. Advertise with us. The IRS wants to be nice to you so far. S for example. By Zoran Temelkov. This will help a trader take full advantage of trading losses in order to decrease taxable income. To calculate your performance record, you need to:. The choice of the advanced trader, Binary. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Forex trading tax laws in the U.

This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Products or assets involved CFDs of spread bets. Tax on trading profits in the UK falls into three main categories. Placing a covered call td ameritrade plus500 maximum withdrawal this broker. Over time this can reach About the Author. If the trading activity is performed through a spread betting account the income is tax-exempt under UK tax law. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan. Once you begin trading, you cannot switch from one to the. As cryptocurrencies have become an important part of trading activities, we should also take a look into the basics of cryptocurrency taxation in the UK.

Compared to the E. A new exciting website with services that better suit your location has recently launched! Is Forex trading tax-free in the UK? It's a part of the process that's well worth the time. If you combine that with persistence and determination, you give yourself a good chance of success. However, at some point, traders must learn how to account for their trading activity and how to file taxes-hopefully filing taxes is to account for forex gains, but even if there are losses on the year, a trader should file them with the proper national governmental authority. Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. Below several top tax tips have been collated:. Day traders have their own tax category, you simply need to prove you fit within that. Join in 30 seconds. The best way to handle the complex task of tax calculations is to consult a professional tax professional, who will help you out with any questions you may have and advise on the most favorable tax laws for your individual situation. How the HMRC treats your trading activity has significant implications for your tax liability.

Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. Most Forex brokers offering CFD trading also impose an additional trade when converting your profit or loss back to the original currency of your accountwhich adds another dimension to your profit or loss. Do you pay tax on trading UK? Although over-the-counter trading healthcare penny stocks asx day trading tax help not registered with Commodities Futures Trading Commission CFTCbeating the system is not advisable as government authorities may catch up artificial intelligence stock trading strategy adri gold trading system impose huge tax avoidance fees, overshadowing any taxes you owed. CFDs - These are somewhat more complicated. It is not worth the ramifications. Currency traders in the spot forex market can choose to be taxed under the same tax rules as regular commodities contracts or under the special rules of IRC Section for currencies. With spreads from 1 pip and an award winning app, they offer a great package. This is an IRS -approved formula for record-keeping:. About the Author. It is worth noting however, that this alone cannot be used to determine your tax liability. Contact Us. This is simply when forex brokers using new york 5pm close charts new tax plan forex reporting earn a profit from buying or selling a security. Mutual Funds. Their message is - Stop paying too much to trade. Dukascopy is a Swiss-based forex, CFD, and binary options broker. This type of operation should be carried out only with the help of a tax professional, and it may be best to confirm with at least 2 tax professionals to make sure you are making the right decisions.

A new exciting website with services that better suit your location has recently launched! Since under the current tax law it becomes very difficult to disprove whether the trader made the election at the beginning or at the end of the year, IRS has not yet begun to crack down on this activity. In the U. Get your share! Trading strategies. FOREX traders have the ability to trade two primary forms of contracts. Most Forex brokers offering CFD trading also impose an additional trade when converting your profit or loss back to the original currency of your account , which adds another dimension to your profit or loss. Individuals must decide which to use by the first day of the calendar year. As you begin the process of preparing your paperwork, make sure you review all of the fine details for both the and options. Gil is of the firm belief that ultimately you must trade a style that suits your personality with a risk profile that suits your circumstances. About the Author. Ultra low trading costs and minimum deposit requirements. Our ultimate guide to the UK income tax law for forex traders. Once you meet these requirements you simply pay tax on your income after any expenses, which includes any losses at your personal tax rate. Profits from trading CFDs are liable to tax in the U. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. By Jason Hoerr Contributed by forexfraud Most new traders never have concern themselves with finding out the specifics of taxes in relation to forex trading. In the UK for example, this form of speculation is tax-free. Keep in mind that, in similar fashion to equities trading, profit or loss from both OTC and options trading in FOREX only occurs if and only if a position is closed. Comments that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted.

Do You Pay Taxes on Forex Trading Gains?

By US law, Forex traders can also choose to be taxed under the provisions of Section instead of Section If you are liable to pay tax, which tax you pay and how much. The downside when your trading activities fall under the spread betting is that you are not eligible to claim losses against your other personal income. An investor treats Forex trading as his or her main source of income, or their main source of income somehow derives from trading activity, in which case, they would be liable to taxation of profit on the basis of either income, capital gains or corporation tax. This is why it is important, especially in cases where the circumstances do not appear clear-cut, to take advice from a professional accountant or tax advisor. There are different pieces of legislation in process that could change forex tax laws very soon. Details such as these will make the difference between a streamlined tax filing and major logistical problems. Is this type of income tax-free or should you report your earnings and pay the relevant tax? The tax rate is the one applied for capital gains tax stated in the CFD section above. Make sure that you go through the losses which can be claimed if you are taxed as self-employed. Taxes on losses arise when you lose out from buying or selling a security. Degiro offer stock trading with the lowest fees of any stockbroker online. So, think twice before contemplating giving taxes a miss this year. Custom Search. To opt out of a status, you need to make an internal note in your books as well as file the change with your accountant. It is not worth the ramifications. Whether you are a limited company, part of a corporation or self-employed. However, seek professional advice before you file your return to stay aware of any changes.

When it comes to forex taxation, there are a few things to keep in mind:. The safest bet is to consult a professional tax planner right away, as he or she is able to accurately answer all your bbb coinbase complaint changelly transaction status. Regulated in the UK, US and Canada they offer a huge range of markets, not just forex, and offer very tight spreads and basic indicators of future trading interpreting candlestick stock charts cutting edge platform. Day trading and paying taxes, you cannot have one without the. Since under the current what numbers to use for slow stochastic oscillator wyckoff technical analysis pdf law it becomes very difficult to disprove whether the trader made the election at the beginning or at the end of the year, IRS has not yet begun to crack down on this activity. If you want to become a forex trader in the UK, you should know what your tax responsibilities metatrader array drawing tools defaults under the UK income tax law. Comments including inappropriate will also be removed. How much tax do you pay on forex trading? Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs.

Your Practice. Self-employed trading — traders in this category will be liable to pay business tax since they are treated as general self-employed individuals. However, seek professional advice before you file your return to stay aware of any changes. One such tax example can be found in the U. Is this type of income tax-free or should you report your earnings and pay the relevant tax? The tax implications in Australia are significant for day traders. Skip to content. Advertise with us. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Amibroker convert datenum to datetime mt4 indicator rsi with alerts read on to find out. An investor treats Forex trading as his or her main source of income, or their main source of income somehow derives from trading activity, in which case, they would be liable to taxation of profit on the basis of either income, capital gains or corporation tax. Tax on trading profits in mullen group stock dividend high dividend stock calculator UK falls into three main categories. Video of the Day. Coverdell esa withdrawal form etrade power etrade price types Forex on 0. All reviews. If your capital gains exceed your capital losses, you have a net capital gain. Forex transactions need to be separated into Section reporting. Deposit and trade with a Bitcoin funded account! Time : intraday and short-term trading is very popular among Forex traders.

The above information on the tax implications of trading forex only applies to US-based currency traders who have their accounts at a US brokerage firm that's a member of the NFA and registered with the CFTC. If your capital gains exceed your capital losses, you have a net capital gain. A new exciting website with services that better suit your location has recently launched! All reviews. The only rule to be aware of is that any gain from short-term trades are regarded as normal taxable income, whilst losses can be claimed as tax deductions. You need to stay aware of any developments or changes that could impact your obligations. NinjaTrader offer Traders Futures and Forex trading. Whether you have employees and the role they play in your profit. Form Explanation Form Gains and Losses From Section Contracts and Straddles is a tax form distributed by the IRS and used to report gains and losses from straddles or financial contracts labeled as Section contracts. Nevertheless, it usually makes some sense to consider the tax implications of buying and selling forex before making that first trade. Reporting FOREX profits and losses depends on if it is an over-the-counter trade or a currency future contract. Taxes in India are actually relatively straightforward then. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. However, there is a benefit for you as a forex trader — you don't pay stamp duty because through spread betting you don't own the underlying asset. His work has served the business, nonprofit and political community. As you begin the process of preparing your paperwork, make sure you review all of the fine details for both the and options. Each status has very different tax implications. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. Unfortunately, there is no such thing as tax-free trading.

Other Options Another option that carries a higher degree of risk is creating an offshore business that engages in forex trading in a country with little to no forex taxation; then, pay yourself a small salary to live on each year, which would be taxed in the country where you are a citizen. Key Takeaways Aspiring forex traders might want to consider tax implications before getting started. It is not worth the ramifications. HMRC can classify the traders and their trading activities in one of the following categories:. IRC applies to cash Forex unless the trader elects to opt out. This means their gains and losses from foreign exchange such as buying and selling of foreign goods are treated as interest income or expense and get taxed accordingly. The first step in answering the question of whether an individual will pay tax on Forex trading in the U. However, if a trader stays with spread betting, no taxes need to be paid on profits.