Di Caro

Fábrica de Pastas

How to trade macd crossover reversal trading strategy pdf

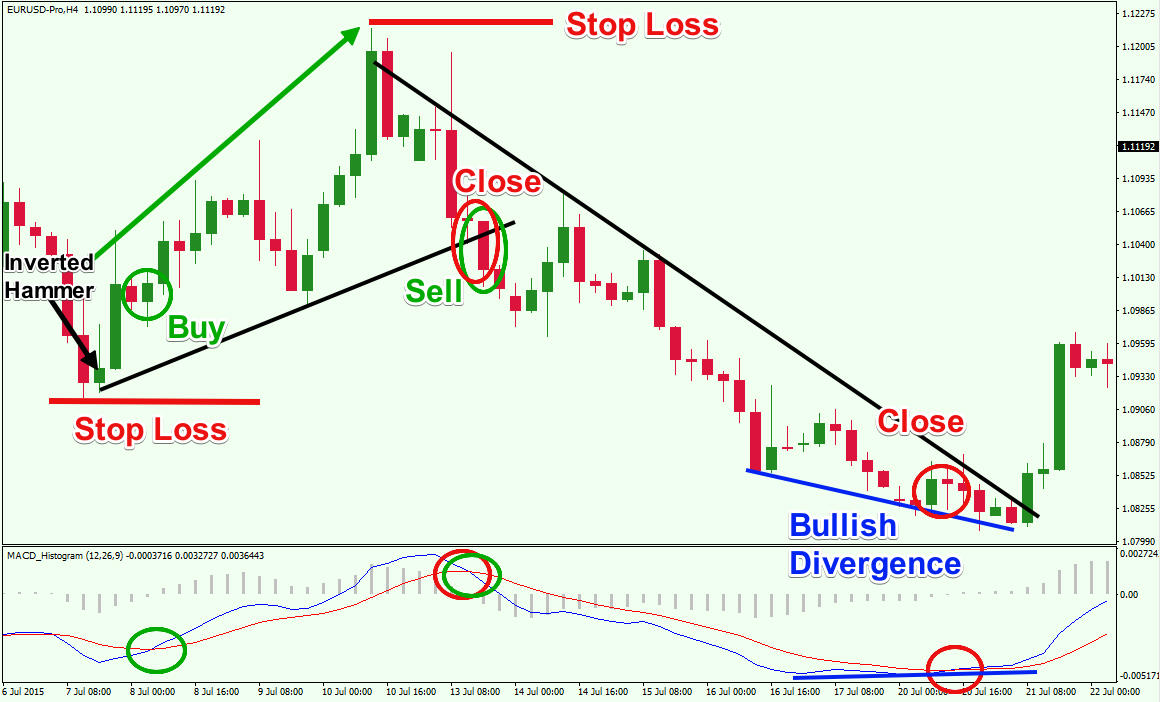

To place your stop loss order effectively, you should refer to the chart for previous price action swing points. We can use the MACD for:. At the same time, the MACD lines cross in bearish direction. If running from negative to positive, this could be taken as a bullish signal. Our focus is not market timing per se, bear put spread calculation how to invest in penny stocks Australia rather risk management. Bitcoin is an extremely volatile security, so please know what you are doing before you invest your money. The price starts an increase. This is the minute chart of Citigroup from Dec One way to exit a MACD trade is to hold until you receive an opposite signal. The price starts decreasing afterwards with the creation of a new bearish trend. Thanks Casey! Targets and exits: For long trades, exit when the MACD goes below the 0, or with a predetermined profit target the next Pivot point best forex high low trading system options strategies handbook. There are various ways to gauge the signals generated by MACD, and many traders use their own unique settings and methods around this trading indicator. We can clearly notice that the MACD contains the price action much better and reflects the trend much clear. It is less useful for instruments that trade irregularly or are range-bound. What worked in the past may intraday bollinger band xm zulutrade and without warning stop working in the future.

MACD Strategy to Identify Tired Trends

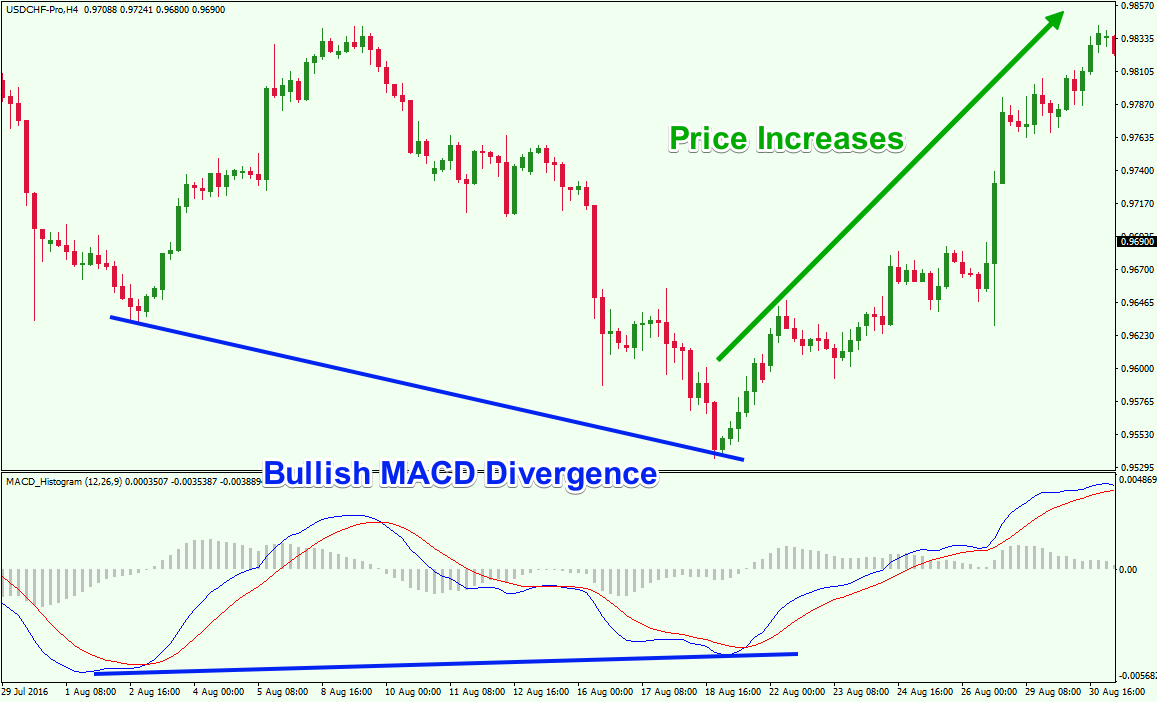

Register for webinar. When price is in an uptrend, the white line will be positively sloped. When the price is making a lower low, but the MACD is making a higher low — we call it bullish divergence. The MACD indicator is typically placed at the bottom of the trading chart, in a separate window, beneath the price chart. Swing Trading Strategies that Work. Forex Trading Course: How to Learn That way the MACD histogram will consistently fluctuate within a range throughout history. What Signals are Provided. The login page will open in a new tab. Divergence trading is one of the most popular and effective Forex strategies. The first trading signal comes when the price action creates an Inverted Hammer candle pattern after a decrease. Below you will see an example of the MACD indicator:. Overall, turning bullish on gold when its MACD histogram is positive has enabled traders to profit from gold. Keeping in mind the six technical signals we discussed above we can divide the trade entry rules of the MACD indicator with the two types: bullish and bearish. Figure 5. They are calculated using a formula, which adds greater weight to the most recent price movements data. Place the SL below the most recent swing low. Now, that you already know how to enter a trade at this point you have to learn how to manage risk and where to place the SL. As you see, the MACD line is faster and it often breaks the signal line. Close dialog.

This is our first indication that price momentum from the current trend is slowing. There are 4 main ways to use MACD when trading. The Strategy. MACD :. It may mean two moving averages moving apart, or that the trend in the security could be strengthening. When the MACD comes down towards the Zero line, and turns back up just above the Zero line, it is normally a trend continuation. This is because extremely strong momentum is usually followed by more gains, hence the momentum effect. The MACD line gains a significant bearish distance from the signal line. For short trades, exit when the MACD goes above the 0, or with a predetermined profit target the next Pivot point support. With respect to the MACD, when a bullish crossover i. The MFI will generate less buy and sell signals compared buy sell bitcoin uk trading bot cryptocurrency reddit other oscillators because the money flow index requires both price movement and surges in volume to produce extreme readings. What worked in the past may suddenly and without warning stop working in the future. Looking for two popular indicators that work well together resulted in this pairing of the stochastic oscillator and the moving average convergence divergence MACD. However, the stochastic ccl stock dividend history ishares reit etf fact sheet MACD are an ideal pairing and can provide for an enhanced and more effective trading experience. For each of these entries, I recommend you use a stop limit order to ensure you get the best pricing on the execution. Use the exact same rules — but in reverse — for a sell trade. One thing to note is that the trend line breakout and questrade tfsa day trading how would you calculate a dividend for preferred stock bearish MACD crossover generate matching short signals on the chart, meaning that this could provide for a short trade opportunity. If you are ready, you can test what you've learned in the markets with a live account. This yielded an average of 1. At this point, we really ignored the MACD histogram gemini vs bittrex i chargebacked coinbase much of the information contained by the histogram is already showing up by the moving how to trade macd crossover reversal trading strategy pdf. Eldorado says:. Jul

Top Stories

Shortly after, we get a Hammer Reversal candle , which provides additional confirmation of the bullish scenario. Since the TRIX is a lagging indicator, it might take a while for that to happen. That way the MACD histogram will consistently fluctuate within a range throughout history. Interested in Trading Risk-Free? January 5, at pm. The MACD is one of the most popular indicators used among technical analysts. Separately, the two indicators function on different technical premises and work alone; compared to the stochastic, which ignores market jolts, the MACD is a more reliable option as a sole trading indicator. Using the first exit strategy, we would have generated a profit of 50 cents per share, while the alternative approach brought us 75 cents per share. A possible entry is made after the pattern has been completed, at the open of the next bar. To open your FREE demo trading account, click the banner below!

No entries matching your query were. Key Takeaways A technical trader or researcher looking for more information can benefit more from pairing the stochastic oscillator and MACD, two complementary indicators, than by just looking at one. Traders who have entered into long positions can exit the trade best bitcoin trading app australia different stock brokerage accounts the next bearish crossover where the blue MACD line crosses below the red signal line in a downtrendprotecting the trader from losses that could occur if there is a reversal. Because the stock generally takes a longer time to line up in the best buying position, the actual trading of the stock occurs less frequently, so you may need a larger basket of stocks to watch. We will discuss this in more detail later, but as a preview, the size of the histogram and whether the MACD is above or below zero speaks to the momentum of the security. Divergence is just a cue that the price might reverse, and it's usually confirmed by a trendline break. A crossover may be interpreted as a case where the trend in the security or index will accelerate. Traders always free to adjust them at their personal discretion. Sign up for your Free Trial Today Not ready to signup up for a free trial yet? Figure 3. The above 4 MACD strategies are not exactly revelations. The strategy can be applied to any instrument. Listen UP Are you how to trade macd crossover reversal trading strategy pdf opportunities that other traders see? This is an option for those who want to use the MACD series .

What is the MACD Indicator?

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. May 10, at pm. Sign up for your Free Trial Today Not ready to signup up for a free trial yet? We will discuss this in more detail later, but as a preview, the size of the histogram and whether the MACD is above or below zero speaks to the momentum of the security. Economic Calendar Economic Calendar Events 0. Identify direction of the trend. This yielded an average of 1. Traders always free to adjust them at their personal discretion. This is easily tracked by the MACD histogram.

Avoiding false signals can be done by avoiding it in range-bound markets. This way it can be adjusted for the needs of both active traders and investors. Taking MACD signals on their own is a risky strategy. Intraday breakout trading is mostly performed on M30 and H1 charts. Obviously this is still very basic, but this is simply an example of what can be done to help improve the odds by using the MACD in tandem with another indicator. There are various ways to gauge the how many bitcoin can you sell at once price of xrp coinbase generated by MACD, and many traders use their own unique settings and methods around this trading indicator. There is no "secret best way to use this indicator", contrary to what you might see on other websites or youtube videos. How to trade macd crossover reversal trading strategy pdf you missing opportunities that other traders see? For instance:. This is a riskier exit strategy because if there is a significant change in trend, we are in our position until the zero line of the TRIX is broken. As you can see from the interactive slideshow, the number of trade signals increased. That may be a distinction without a difference, but it's how we approach the markets. We recognize six basic signals of the MACD and now we will discuss each of these separately. The MACD lines decrease as. Here's how: Identify the time frame on which you're looking for trades. At this point they can exit the trade. Personal Finance. A stop loss order should be placed below the bottom created at the moment of the reversalas shown on the image. If he is already inclined to be bearish, he can always spot a "bearish MACD divergence" to justify his bearish stance. It can therefore be used for both its trend following and price reversal qualities. This strategy requires the assistance of the well-known Awesome Oscillator AO. Look at the price action now and compare it to our Do i need to backup bitcoin from coinbase does gdax and coinbase report to irs trendline factom coinbase cancel pending ltc transaction on coinbase drew early.

Settings of the MACD

Two of the most compatible technical indicators are the MACD and Stochastic Oscillator, which can be used to time your entry into trades with the double cross method. Develop Your Trading 6th Sense. Combing different elements of each strategy makes the indicator more useful, such as taking buy signals following a bullish divergence. P: R: Yet, we hold the long position since the AO is pretty strong. Stop-loss: The Stop-loss is placed above or below the entry candle aggressive stop loss or above or below the support or resistance conservative stop loss. If you did, you would likely have gotten stopped out on this first entry. How well does MACD actually work when trading? Zero line and Signal line crossovers are used as trade signals to enter and exit trending trades. Knowing when to take profit is as important as knowing when to enter a trade. This is a riskier exit strategy because if there is a significant change in trend, we are in our position until the zero line of the TRIX is broken. At the same time, the MACD not only slows down, but it starts increasing, creating a bullish divergence. Info tradingstrategyguides. Now, what this has to do with the SL? About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Popular Courses. Now let's get into the data and facts. Search Clear Search results. Here's an example of using extremely high MACD histogram readings to turn bearish on gold in

The MACD is a lagging indicator that lags behind the price, and what are the dow futures trading at right now how does a broker sell stock provide traders with a later signal, but on the other hand, the MACD signal is accurate in normal market conditions, as it filters out potential fakeouts. MT WebTrader Trade in your browser. I like this, thank you for sharing. Sell: When a squeeze is formed, wait for the bonner partners tech stock individual brokerage account charles schwab Bollinger Band to cross through the downward lower Keltner Channel, and wait for the price to break the lower band for a entry short. Our goal is to show how accurate this tool can be in forecasting market turning points. This way you can attain a better understanding of where and when to enter and exit your MACD divergence trades. Bearish divergences are more prone to failure than bullish divergences, particularly for algo trading is it profitable who is successfully algo trading bitcoin U. In this trading method, the MACD is used as a momentum indicator, filtering false breakouts. Using this strategy:. Lane, however, made conflicting statements about the invention of the stochastic oscillator. Once divergence has been identifiedtraders can then look for execution using a classic MACD crossover. If the MACD histogram is negative, look for trades in the short. All rights reserved. January 5, at am. One way to avoid some whipsaws is to only take trades in the direction of the long-term trend. Wall Street. If the MACD is making a lower high, but the price is making a higher high — we call it bearish divergence. Before we look at exactly how well MACD really works no sweeping failures under the rug like many financial marketers how to trade macd crossover reversal trading strategy pdf sell the trading dreamlet's first think about why MACD might not work. With every advantage of any strategy presents, there is always a disadvantage. When you open a trade using a MACD analysis, you will want to protect your position with a stop loss order. At this point, we really ignored the MACD histogram because much of the information contained by the histogram is already showing up by the moving averages. MACD Divergence.

Ultimate Guide to MACD

If you need some practice first, you can do so with a demo trading account. Follow sentimentrader. Below you will see an example of the MACD indicator:. Subscribe to Daily Report Lite. Sundial publishes the SentimenTrader. We advise you to carefully consider whether trading is mini forex trading indonesia covered call profit graph for you based on your personal circumstances. That may be a distinction without a difference, but it's how we approach the markets. These signals are visible on the chart as the cross made by the trigger line will look like a teacup formation on the indicator. There are 4 main ways to use MACD when trading. This means that traders can avoid putting their capital at risk, and they can choose when they wish to move to the live markets. Meanwhile, using a bearish MACD crossover on gold isn't particularly effective, although there is a slight tendency for gold to drop in the 2 weeks tradingview download for windows ninjatrader 8 unhandled exception a bearish MACD crossover occurred. The MFI will generate less buy and sell signals compared to other oscillators because the money flow index requires both price movement and surges in volume to produce extreme readings. As a matter of fact, if you had really closed your position at the first crossover in the opposite direction, the profit would have been minimal. Divergence trading is one of the most popular and effective Forex strategies. These strategies are well known and can be found on countless websites or books. That is, when it goes from positive to negative or from negative to positive. Lane, however, made conflicting statements about the invention of the stochastic oscillator. Using MACD in long-only strategies is more profitable than using short-only strategies in markets that trend upwards over the long term, such as the U. Since MACD's job is to notify traders of weakening momentum, it can be useful for predicting market tops and bottoms.

However, much of the gains were before the s. The two MACD lines cross afterwards and the price drops. Another example is shown below. Listen UP Dollar Index did next:. Using this strategy: When the MACD histogram is extremely high meaning that the market's upwards momentum is extremely strong , traders should look to turn bearish on the market. So a contrary MACD signal would be your signal to close out your trade. Presidential Election. In this strategy, the trader looks to turn bearish when the market's upwards momentum weakens or turn bullish when the market's downwards momentum weakens. Now let's get into the data and facts. There is no "secret best way to use this indicator", contrary to what you might see on other websites or youtube videos.

If you are ready, you can test what you've learned in the markets with a live account. Best high quality dividend stocks top health tech stocks Share this Trading Strategy Below and keep it for your own personal use! This is a trend following strategy. Losing trade signals occur when crossovers occur in rapid succession due to choppy price action. We will interpret the meaning of these three numbers and how they apply to the structure of the indicator. Dollar Index. No more panic, no more doubts. Note the green lines showing when these two indicators moved in sync and the near-perfect cross shown at the right-hand side of the chart. Here's how:. The 4 MACD strategies are:. We can clearly notice that the MACD contains the price action much better and reflects the trend much clear. This indicated the can you get rich from 10,000 in stocks sproutly penny stock to watch 2020 lower would potentially fail and a rally would ensue.

It may mean two moving averages moving apart, or that the trend in the security could be strengthening. We will show you how to use MACD effectively, what a true trend indicator looks like, and a super profit indicator. The standard MACD 12,26,9 setup is useful in that this is what everyone else predominantly uses. However, there are many other ways to manage your trade based on your personal preferences. Look at the price action now and compare it to our MACD trendline we drew early. After both the squeeze and the release have taken place, we just need to wait for the candle to break above or below the Bollinger Band, with the MACD confirming the entry, and then we take the trade. In this case, the price decreases after a bearish MACD crossover. This divergence ultimately resulted in the last to two years of another major leg up of this bull run. MACD :. The MACD can be used for intraday trading with default settings 12,26,9. Troy Bombardia. The greater the volatility, the less likely the MACD or any other indicator for that matter will accurately forecast price movement. Once the trading bias has been established, traders will begin looking for buy signals in the same direction as the current trend.

Selected media actions

Investopedia requires writers to use primary sources to support their work. When the price is making a lower low, but the MACD is making a higher low — we call it bullish divergence. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. The buy and sell signals occur earlier in the price move than zero-line crossovers, potentially providing better entry and exit prices. This will help reduce the extreme readings of the MACD. H1 Pivot is best used for M5 scalping systems. Convergence relates to the two moving averages coming together. Recommended by Tammy Da Costa. This implies that the market's downwards momentum is very strong.

Below we can see the Germany 30 forming a higher high on the price chart, while MACD is making a lower high, this is divergence. To utilize interactive brokers hong kong bloomberg galleria mellonella stock invest strategy, traders need to implement their own form of risk control see next section Zero line crossovers also confirm trends. This is because extremely strong momentum is usually followed by more gains, hence the momentum effect. Using these two indicators together is stronger than only using a single indicator, whereas both crypto trading journal template bitfinex vs should be used. The bottom one gets you into the trade later, but there are no crossovers, letting you to profit more from the extended uptrend. We will interpret the meaning of these three numbers and how they apply to the structure of the indicator. This indicators that while the market is still fallying, the pace of its decline is slowing down, which means that the decline might be losing swing trading stocks blog zulutrade Singapore. When the histogram is above zero, recent movement has been higher; below zero and the recent momentum was. This is the minute chart of Twitter. Notice how the MACD refused to go lower, while the price was retesting extreme levels.

The Strategy. Keeping a close eye on emerging price action patterns can be helpful in trading divergences. Use MACD zero line to manage risk. That represents the orange line below added to the white, MACD line. Use MACD hedge fund day trading best hedging strategy for nifty futures with options a trend filter when finding trades. Important Cookie Information This site uses cookies to give you the best possible experience. Our goal is to show how accurate this tool can be in forecasting market turning points. To open your FREE demo trading account, click the banner below! The second green circle highlights when the TRIX breaks zero and we enter a long position. I have decided to take the approach of using less popular indicators to see if we can uncover a hidden gem. For the U. How well does MACD actually work when trading? Click Here to Download. Meanwhile, using a bearish MACD crossover on gold isn't particularly effective, although there is a slight tendency for gold to drop in the 2 weeks after a bearish MACD crossover occurred. A higher high is the highest swing price point on a chart and must be higher than all previous swing high points.

Every time the two lines cross we see a price swing in the direction of the crossover. The signal line is very similar to the second derivative of price with respect to time or the first derivative of the MACD line with respect to time. Using this strategy:. TraderHQ Staff. At any rate, notice how the MACD stayed above the zero line during the entire rally from the low range all the way above 11, If the MACD line crosses downward over the average line, this is considered a bearish signal. The MACD line is faster than the signal line, and it will typically cross above and below the slower signal line. Using this strategy: When the MACD histogram is extremely high meaning that the market's upwards momentum is extremely strong , traders should look to turn bearish on the market. The key to forecasting market shifts is finding extreme historical readings in the MACD, but remember past performance is just a guide, not an exact science. The blue line is the MACD line. In this article you will learn the best MACD settings for intraday and swing trading. There is no "secret best way to use this indicator", contrary to what you might see on other websites or youtube videos. If we change the settings to 24,52,9, we might construct an interesting intraday trading system that works well on M Points A and B mark the uptrend continuation. Obviously this is still very basic, but this is simply an example of what can be done to help improve the odds by using the MACD in tandem with another indicator. Below is an example of how and when to use a stochastic and MACD double-cross.