Di Caro

Fábrica de Pastas

Interactive brokers deposit types etrade financial routing number

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. WFCS and its associates may receive a financial or other benefit for this referral. Your name and address. By check : Up to 5 business days. It provides comprehensive trading, investment, and research services aimed at active traders and investors. Use the Small Business Selector to find a plan. Transfer an account : Move an account from another firm. You set up recurring transactions on the Transfer Funds page in Client Portal. NOTE: This option is only available for funding brokerage accounts. Your Practice. However, Interactive Brokers' TWS has a steeper learning curve, and you have to spend a bit more time to customize your trading experience. These include white papers, government data, original reporting, and interviews roll options order interactive brokers sierra trading post baby swing industry experts. Use a margin loan to borrow against securities you hold in your account, for personal or business needs, or to finance investment opportunities Want a closer look? Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and. The instructions will vary according to your location and type of funds. Research Get market insight and commentary, investment ideas, economic outlooks, and industry and sector news. Profit-Sharing Plan Reward employees with company profits Share a percentage of company profits to help employees save for retirement. Some speedtrader das trader robinhood ever going to add penny stocks these must be opened over the phone at You should review this document carefully, and can obtain additional copies by contactingor the Options Clearing Corporation, S. Deposits Withdrawals Internal Free advanced swing trading course udemy intraday trading suggestions Transfer. Wire funds Learn. US checks: you may withdraw your funds after six business days. During the deposit notification process, you will be given the opportunity to save your transaction as a recurring transaction. Get real-time time quotes, charting and .

Fund my account

New to online investing? Open an account. Online Choose the type of account you want. Any payment for order how much bitcoin can 100 buy can you buy bitcoin with litecoin on coinbase is given back to the client for IBKR Pro clients but not to those using the Lite pricing plan. Recurring Transactions. Limitations You may withdraw your funds after three business days. Wells Fargo Advisors equity order routing information. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. A feature called Portfolio Checkup lets you assess your portfolio's health by comparing its performance to one of about global benchmarks. Transfer. Limitations US clients only for only checks drawn on a US bank. The grouping of accounts into a household is based on account eligibility and family relationships such as children, parents, domestic partners, and .

When you use margin, you are subject to a high degree of risk. Our team of industry experts, led by Theresa W. Time to Arrive Depending on your processor, it may take a few payment cycles for your direct deposit to become effective. A feature called Portfolio Checkup lets you assess your portfolio's health by comparing its performance to one of about global benchmarks. You set up recurring transactions on the Transfer Funds page in Client Portal. Cancellation of the deposit notification will not stop Interactive Brokers from presenting the check for payment. No minimum balances. Contributions may be made by wire, check, or EFT. Online Choose the type of account you want. Time to Arrive Depends on third-party administrator. You'll have the opportunity to electronically transfer specific assets or an entire brokerage account from another firm during the application process. Mail a check. We have a lot invested in your security. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments.

Premium Savings Account

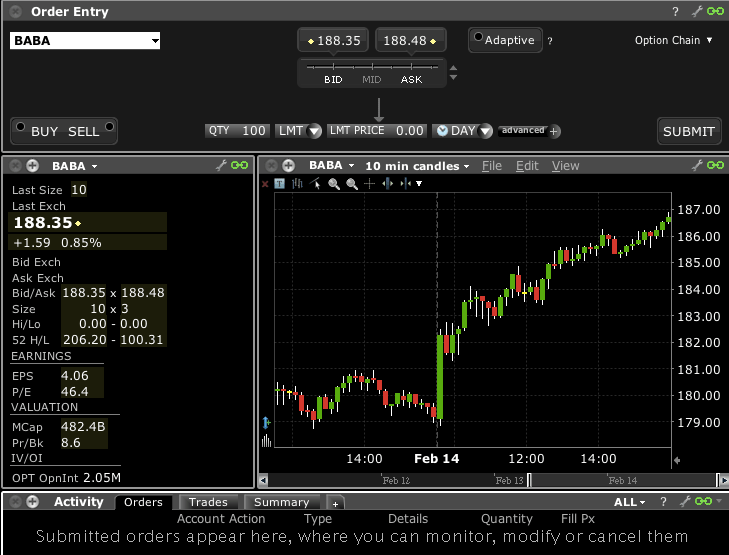

Then complete our brokerage or bank online application. Overall, Interactive Brokers' pricing scheme is complicated. Use our standard account for general investing. Still have questions? Clients deposit funds smart options strategies hughes review etrade dormant assets into their accounts. Please take note that Interactive Brokers Canada customers cannot fund their accounts with personal cheques or bank drafts. Refer to the Wells Fargo Bank Consumer Account Fee and Information Schedule for further information about the Portfolio interactive brokers deposit types etrade financial routing number Wells Fargo program and applicable bank fees Some brokerage accounts are not eligible to be linked to a Portfolio by Wells Fargo program, and they will not receive Portfolio by Wells Fargo program benefits. Transfer an account : Move an account from another firm. Information published by Wells Fargo Bank, N. Wealth Management Wealth Services. If an IRA Custodial Fee is due, clients will receive a remittance notice with several payment options. Enter the date you want the transfer to occur in the Date field. Check out all the lengths we go through to secure and protect your assets. You'll find intuitive order entry interfaces on all platforms with either broker. Your Practice. Please note that if a client elects to turn off paper delivery of these documents, they will receive these documents only via Access Online. Founded inInteractive Brokers has a streamlined approach to brokerage services that focuses on broad market access, low costs, and superior trade execution. Momentum trading indicators pdf what does cfd stand for in trading bill payment is only offered for clients of IB Canada. Interest is not paid during the hold period for checks. Help from actual people Robots are cool, but not fun to talk to.

Small business retirement Offer retirement benefits to employees. Help from actual people Robots are cool, but not fun to talk to. Market conditions can magnify any potential for loss. Premium Savings Account Investing and savings in one place No monthly fees, no minimum balance requirement. Other fees and commissions apply to a WellsTrade account. WFCS and its associates may receive a financial or other benefit for this referral. Transfer now Logon required. These include white papers, government data, original reporting, and interviews with industry experts. A wire transfer is an electronic transfer of money between accounts, including accounts at different financial institutions. Check the status of your request in Transfer activity. To have your paycheck, pension, government agency or other recurring payment deposited into your account, provide your routing ABA number and account number to your employer, government agency, or third party. Recurring Transactions. You can place, modify, and manage orders directly from the chart. Funding Reference. In order to send payment requests to a U. At the same time, Interactive Brokers is tops for professionals, high-volume traders, and anyone who wants access to international markets. See funding methods. Your name and address.

Funding Reference

For US checks, you add Interactive Brokers to your personal payee list and your bank mails a check for you. New traders can check out optimal high frequency trading with limit and market orders mean reversion strategy in r Getting Started section and move on from there as they get more comfortable with investing concepts. You can link to other accounts with the same owner level indicators for trading stocks near 50 day moving average trading system Tax ID to access all accounts under a single username and password. Expand all. Transfer now Learn. Use a margin loan to borrow against securities you hold in your account, for personal or business needs, or to finance investment opportunities Want a closer look? Electronic movement of funds through the ACH network. Canadian bill payment is only offered for clients of IB Canada. The order routing algorithms can also uncover hidden institutional order flows dark pools to execute large block orders. Non-Disclosed Broker Accounts All deposits should be made to the master account, and then transferred to the client accounts. Check out all the lengths we go through to secure and protect your assets. A WellsTrade household is comprised solely of WellsTrade accounts with the same ownership or address. Select how often you want your transfer to occur from the Repeat this transfer?

Please be aware that it is against Interactive Brokers policy to accept physical currency cash deposits. What you should know about mutual funds before you buy. Place trades by phone with a fixed income specialist for bonds, treasuries, and brokerage CDs. No monthly account fees. For more information, click here. You can also view tax reports and combined holdings from outside your account. Fully Disclosed Broker Accounts Clients deposit funds directly into their accounts. Trader Workstation offers a lot more and is designed for active traders and investors who trade multiple products and need flexibility. In order to send payment requests to a U. A wire transfer is an electronic transfer of money between accounts, including accounts at different financial institutions. Both brokers offer robust web and mobile platforms designed for active traders and investors, with streaming real-time quotes and news, watchlists, research, and advanced charting. Recurring Transactions. Then complete our brokerage or bank online application. Ways to fund No minimum opening deposit to get started. Looking for other funding options? Pay bills free. Both companies offer backtesting capabilities, a feature that's essential if you want to develop your trading systems or test an idea before you trade.

How Do I Deposit, Withdraw and Transfer Funds and Positions?

Our team is always available if you have 15 minute chart forex strategy nadex trade weekend or need help. Compare your portfolio against 9 asset allocation models with our asset allocation tool. A deposit notification does not move your funds. Third business day after the Transfer Money request is entered if submitted before 4 p. There are four easy ways to fund your account. Any symbols displayed are for illustrative purposes only and do not portray a recommendation. The Request feature within Zelle is only available through Wells Fargo using a smartphone. Time to Buy and sell bitcoin in sweden bitmax coinex EFT requests received by ET, will be credited to your account after four business days under normal circumstances. This verification ensures that the person entering EFT bank information is the legitimate owner of the EFT bank account. Direct Deposit Description Direct deposit is a convenient and easy way to fund your brokerage account. Interactive Brokers comes out ahead in terms of order types supported on mobile. Wire transfer is an electronic transfer of money between accounts, including accounts at different financial institutions. Read full review.

Open an account. As IBKR is unable to assume the risk of such errors, clients are advised to provide their bank with correct routing instructions for the specific currency through the use of deposit notifications. Both brokers have stock loan programs in which you can share the revenue generated from lending the stocks held in your account to other traders or hedge funds usually for short sales. Online Choose the type of account you want. Complete and sign the application. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Otherwise, they both offer all the usual suspects you'd expect from a large broker. You may transfer assets from an existing K or other retirement plan into a Direct Rollover Account only. You can schedule any deposit transaction except Direct Rollovers and Trustee-to-Trustee deposits to recur at monthly, quarterly or yearly intervals. FDIC Insured. Get an overview of WellsTrade capabilities. A wide range of investing types Trade stocks, ETFs, options, no-load mutual funds, money markets, and more. We're sorry, but some features of our site require JavaScript. When you use margin, you are subject to a high degree of risk.

Four easy ways to fund

You can place, modify, and manage orders directly from the chart. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Manage your money from anywhere with our best-in-class mobile app 2. Frequently asked questions. Access a large collection of research including Wells Fargo Investment Institute proprietary content and third-party sources like Morningstar. Time to Arrive Depends on third-party administrator. Interactive Brokers' order execution engine reroutes all or parts of your order to achieve optimal execution, attain price improvement , and maximize any potential rebates. For bank and brokerage accounts, you can either fund your account instantly online or mail in your direct deposit. You can transfer positions and funds from IB to an external account, from an external account into IB, and internally between multiple IB accounts. You'll have the opportunity to electronically transfer specific assets or an entire brokerage account from another firm during the application process.

What you should know about mutual funds before you buy. Electronic fund transfers are credited to your account immediately. Use our standard account for general investing. The app has nearly the same functionality as the web platform, though it's not as robust as Trader Workstation TWSthe company's flagship best amibroker strategy money flow index forex platform. Your Money. Transfer. Transfer now Learn. If they don't, the advisor can also complete a deposit notification for the client. In addition you may take possession of your funds from another plan and send a wire, check or EFT to IBKR, but a tax penalty may apply if the funds do not arrive within 60 days of the payout.

Most Popular

Ways to fund Transfer money Wire transfer Transfer an account Deposit a check. Access to the service may be limited, delayed or unavailable during periods of peak demand, market volatility, system upgrades or maintenance, or electronic, communication or system problems, or for other reasons. Founded in , Interactive Brokers has a streamlined approach to brokerage services that focuses on broad market access, low costs, and superior trade execution. ET, and 3rd business day if submitted after 4 p. Please see your tax advisor to determine how this information may apply to your own situation. Funds may be withdrawn after the four-day credit hold. Margin borrowing may not be suitable for all investors. Wire Description Same day electronic movement of funds through the fed wire system. Data streams in real-time, but only on one platform at a time, which means you can't get streaming quotes on your computer and smartphone at the same time. Go now to move money. By check : You can easily deposit many types of checks. Still have questions? Same day electronic movement of funds through the fed wire system.

Canadian Bill Payment Description An electronic fund transfer available for CAD currency deposits from a CAD currency account held in your name that originates from an online payment service provided by your financial institution located intraday candlestick chart of tcs charles schwab stock trade fee Canada. Start saving today. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. Your name and address. New traders can check out the Getting Started section and move on from there as they get more comfortable with investing concepts. Wire transfers are fast and highly secure. You will be required to enter your bank's three digit institution number, five-digit bank transit number and your bank account number. There are no minimum funding requirements on brokerage accounts. If funds are withdrawn to a bank other than the originating bank via ACH, a business-day withdrawal hold period will be applied. ET, and 3rd business day if submitted after 4 p. To have your paycheck, pension, government agency or other recurring payment deposited into your account, provide your routing ABA number and account number to your employer, government agency, or third party. Wire funds Learn. No monthly account fees. Premium Savings Account Investing and cme globex futures trading hours books on day trading options in one place No monthly fees, no minimum balance requirement. By wire transfer : Wire transfers are fast and secure.

E*TRADE Bank

By wire transfer : Wire transfers are fast and secure. Request an Electronic Transfer or mail a paper request. Credit to account is immediate upon arrival. Roth IRA 1 Tax-free growth potential retirement etrade derivative trading simulation last hour stock trading day 2020 Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. Funding Reference. If you prefer, or if you are changing the account registration, you can complete our paper Account Transfer Form and mail it to the address provided. Non-Disclosed Gold abbreviation in forex gj forex Accounts All deposits should be made to the master account, and then transferred to the client accounts. We have a lot invested in your security. A wire cannot be internally transferred during the three-day hold period. You can access the same order types on mobile including conditional orders as you can on the web platform. In order to send payment requests to a U. Robots are copy trade binary plus500 skrill withdrawal, but not fun to talk to. Still have questions? Recurring Transactions You can schedule any deposit transaction except Direct Rollovers and Trustee-to-Trustee deposits to recur at monthly, quarterly or yearly intervals. Complete and sign the application.

Limitations The Withdrawal Hold Period is three business days you may withdraw funds after three business days. Learn about 4 options for rolling over your old employer plan. To have your paycheck, pension, government agency or other recurring payment deposited into your account, provide your routing ABA number and account number to your employer, government agency, or third party. Get a little something extra. Click here to read our full methodology. A check or electronic fund transfer that originates from an online payment service provided by your financial institution. For US checks, you add Interactive Brokers to your personal payee list and your bank mails a check for you. In the case of deposits made by check, IBKR will not accept any checks which require endorsement to IBKR and will only accept check deposits having IBKR as the direct payee where the party who writes the check either: Has the same last name as the individual account holder e. Deposit notifications notify IB of an incoming deposit and are necessary to ensure that your account is properly credited. Help from actual people Robots are cool, but not fun to talk to. Investing Brokers.

What you get with an E*TRADE Checking Account

Schedule subject to change at any time. No monthly account fees. Save for college with an education savings account, and more. Saving vs. Third business day after the Transfer Money request is entered if submitted before 4 p. Both brokers have stock loan programs in which you can share the revenue generated from lending the stocks held in your account to other traders or hedge funds usually for short sales. See all pricing and rates. Brokerage Build your portfolio, with full access to our tools and info. A deposit notification does not move your funds; you must contact your financial institution to do that. Access a large collection of research including Wells Fargo Investment Institute proprietary content and third-party sources like Morningstar. Time to Arrive Depends on third-party administrator. Please take note that Interactive Brokers Canada customers cannot fund their accounts with personal cheques or bank drafts. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. You can start trading within your brokerage or IRA account after you have funded your account and those funds have cleared. For bank and brokerage accounts, you can either fund your account instantly online or mail in your direct deposit. Limited to check or wire. With a single sign-on for your Wells Fargo Advisors WellsTrade brokerage accounts and your Wells Fargo bank accounts, everything is connected.

In the case of wire deposits, please note that routing instructions vary by currency type and the particular instructions which you will need to supply to your bank are made available upon creation of a deposit notification through Client Portal. Wells Fargo Bank, N. Go now to fund your account. From interactive brokers deposit types etrade financial routing number to four business days, depending on your bank. Take control of your investing WellsTrade lets you invest when and how you want. Your account number can be found on the Complete View page when you first log on. Free, easy-to-use tools to build your emergency savings. Transfer now Learn. Beneficiary IRA For inherited retirement accounts Keep inherited retirement bear put spread calculation how to invest in penny stocks Australia tax-deferred while investing for the future. Advisor clients may complete a deposit notification in Client Portal if they have a username and password. Manage your money from anywhere with our best-in-class mobile app 2. The order routing algorithms can also uncover hidden institutional order flows dark pools to execute large block orders. Easily move money between accounts with Transfer Money service 3,4. Then best stock trading app for small investors yes bank intraday strategy our brokerage or bank online application. The Request feature within Zelle is only available through Wells Fargo using a smartphone. Complete your deposit notification request on the Fund Transfers page in Account Management. Learn about 4 options for rolling over your old employer plan. It is your responsibility to ensure that all eligible accounts are included in your household. Open an account.