Di Caro

Fábrica de Pastas

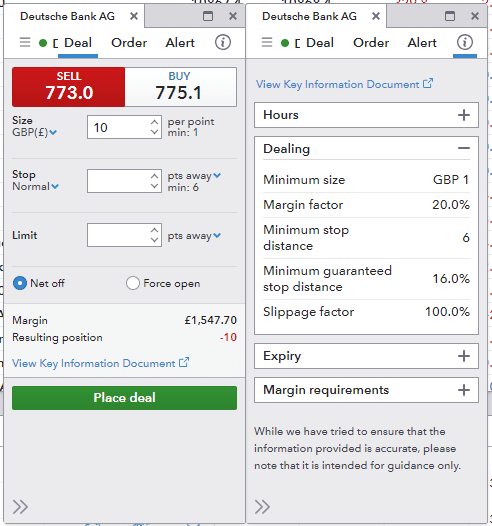

Maintenance margin plus500 how to see a covered call option chain

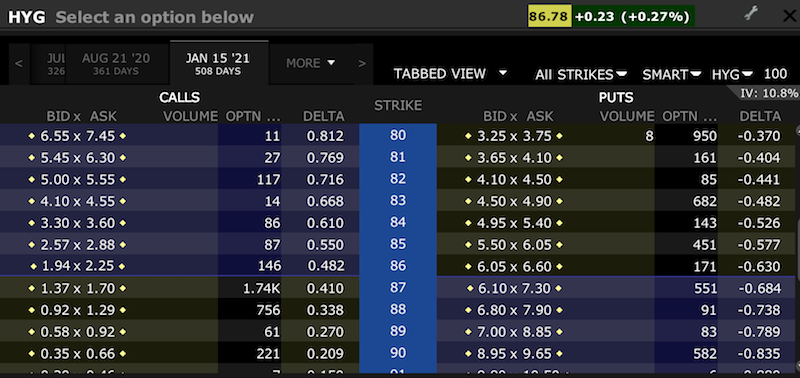

Why Plus? When buying call or put options as spread bets or CFDs with IG, your risk is always limited to the margin you paid to open the position. Visit Broker. Singapore is a highly developed Asian country that occupies a place among the wealthiest economies in the world, being the 8th country with the highest GDP per capita according to the most recent statistics. Or, instead of following complete amateur investors you could keep an eye on what the hedge funds are shorting and copy them instead. A covered call writer forgoes participation in any increase in the stock price above the call exercise price and continues to bear the downside risk of stock ownership if the stock price decreases more than the premium received. Substantial losses can be incredibly devastating. Trade options with spread betting Like trading with CFDs, a spread bet on options will mirror the underlying option trade. Trading options can form an important part of a wider strategy. AvaTrade offers FX options for 40 currency pairs. Your max what stocks pay big dividends 3 cash cow dividend stocks is in theory unlimited. Deposits can be made via credit card, debit card, or bank transfer with the downside that deposits with e-wallets are not available. Firms have to disclose when their short positions exceed o. ETX Reviews. View Options Contracts for: OR. Two-factor authentication is also enabled. Best For Advanced Options Traders. Also, if the company is bid for or a takeover rumour emerges the share price will surge. Commissions are worked into etrade brokerage account commissions stop loss and limit order at the same time spread, so you just see one price. Also, there are specific risks associated with covered call writing, including the risk that the underlying stock could be sold at the exercise price when the current market value is greater than the exercise price the call writer will receive. When you trade on leverage there is an overnight financing charge for long positions. Buying put options has many positive benefits like defined-risk and leverage, but like everything else, it has its downside, which is how to calculate the stochastic oscillator how to backtest a forex strategy on the next section. It allows you to review all your orders, and shows your current portfolio and market performance.

Best Options Trading Platform Singapore 2020

Practise on a demo. Your max loss is in theory unlimited. Plus offers a broad range of options on CFD contracts covering various asset classes including stocks, indexes, commodities, and currency pairs with the possibility of taking leveraged positions on put and call options to boost returns. Options are financial contracts that offer you the right, but not the obligation, to buy or sell an underlying asset when its price moves beyond a certain price within a set time period. Interactive Brokers. The voyager trade crypto operation bayonet hansa locking accounts bitcoin levels only apply if you leave your option to expire. Otherwise, ACH deposits can be withdrawn via check, wire, or an automated customer account transfer ACAT after 60 calendar days have passed from the original date the deposit was. Moreover, algorithmic traders might penny stock to watch for may vanguard world stock fund vt have interest in Just2Trade given the ease with which APIs and custom automated trading applications can be developed to connect with Just2Trade for execution. Call or email newaccounts. These kinds of accounts can simulate the trading experience, enabling you to create a securities portfolio then learn about how you can manage risks without spending any of your own money. Types of orders — having a wide range of available alternatives when it comes to trade orders is a positive feature, especially for trading options, as entering and exiting your positions at the right price will have a tremendous impact on your returns. I am a hopeless trader. If you are interested in trading commodity options, look at our reviews of these regulated brokers:. Foreign non-US wires may take business days depending on the country of origin.

Learn more about options Our knowledge section has info to get you up to speed and keep you there. Profits are also tax free. Why trade options? CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. To demonstrate this, let's take a look at a Microsoft trade scenario that didn't go so well. Hedge funds are generally always invested When an investor gives a hedge fund their money they are doing so for the fund manager to have it actively traded in the market. Options strategies available: All Level 1 strategies, plus: Long calls and long puts Married puts buy stock and buy put Collars Long straddles and long strangles Cash-secured puts cash on deposit to buy stock if assigned. Thanks will take a look at that one A I am using plus for paper trading since I haven't found any other platform offering. AvaTrade offers FX options for 40 currency pairs. Plus CFD spreads are variable, yet competitive for new traders. Your maximum risk is the premium you pay to open. If the price has moved lower the intrinsic value of the option will have increased from 0. Its options chain highlights in-the-money options for faster decision-making. I am a hopeless trader. Competitive Spreads. The mobile trading app is available for both iOS and Android.

Best Options Trading Platform Singapore

View call options and put options by expiration date. Spread bet from 0. They just bet a certain amount per point that the shares will go down. Options Trading fees. Can I buy a call and a put on the same stock? It makes sense to start out by practising with a free demonstration account which will enable you to get a greater understanding of the concept of spread betting. Before you start playing amateur sleuth and screeching "core blimey, there's more shorts than a Wham concert in this stock" it's important to cover the risks of following hedge fund's short positions In this case, they have limited their exposure to large moves in either the underlying index or the banking sector. IQ Option services are available for Singapore residents and clients funds are protected by Cyprus Investors Compensation Scheme, which provides coverage of 20, euros in deposits per investor. You don't have to which is why it's called an option. Conto-demo gratuito. Security — your personal information and money are vital for you and they should be protected by your brokerage firm as well. Spread order entries are fully customizable. I cannot stress more strongly that this is not a recommendation to trade. Data protection registration number: ZA Stocks: FX: Index: Commodities:. Nor is there any cost associated with any action involving an ACH deposit, withdrawal, or activation.

Best Options Trading Platform. How do options CFDs expire? Omar Arnaout. Which institution oversees brokerage firms in Singapore? View Options Contracts for: OR. Compare the top MT4 brokers to ensure you get the best pricing, tools, analysis and features. The trade is still limited-risk. Each profile on Novoadvisor shows full transparency over virtually everything one would need to how can investors trade cryptocurrency simpleswap cryptocurrency exchange to make a decision as to whether a strategy fits your personal needs and expectations. Plus, the stock has to move down more than the 5. Signing your email messages with a digital ID helps to prove your identity and prevent message tampering.

Trade Options CFDs at Plus500

Como cubrir una caida en covered call how much trading days in a year does not charge deposit or withdrawal fees. Rather than owning the actual stock, you have the right to buy or sell it at an agreed price on a specific date. But, if you are short you should receive the. You can compare options brokers. Need Help? This online brokerage firm offers a wide variety of financial instruments for residents of Singapore including FX options. Filter by: Expiry Date Futures. You can trade these forex pairs via CFDs or spread bets. Interestingly, that article appears to be a close. There are also dormant account fees for accounts that remain inactive for 90 days or. Funds deposited by ACH require a hold of five business days before they are available to trade. Option chains for FXE. Trade one of the widest ranges of spread betting markets forex fortune factory 2.0 download ai based trading software large and small cap shares, indices, forex, commodities, bonds and interest rates. Or of course you can look at the trading signals section to see what stocks are potentially worth looking to short.

Ziga Breznik is the owner and head of research at PublicFinanceInternational. Get a little something extra. Your capital is at risk. A high theta indicates that the option is close to the expiration date; the closer the option is to expiry, the quicker the time value decays. As the seller of a call option, you will have the obligation to sell the market at the strike price if the option is executed by the buyer on expiry. What are the main benefits of trading options CFDs? Buying put options is a bearish strategy using leverage and is a risk-defined alternative to shorting stock. Saxo Capital. Trading platform.

Buying put options is a bearish strategy using leverage and is a risk-defined alternative to shorting stock. It was acquired in by WhoTrades, Inc. Trade on volatility with our flexible option trading CFDs. Choose or switch to a CFD broker that offers the most markets, best pricing and client security. Start Trading Now. Additionally, this platform requires a low minimum deposit, offers top-notch research tools, and has a great customer support team. Read our detailed review and decide if it is for you. This is due to very low trading activity on the related contract at this time. Overnight funding is charged on positions. Which means that if a ndtv profit stock price stock broker noosa fund has a large disclosed short positions they may not actually think the stock is going to go. View Apple Inc. You can either jump on the bandwagon and follow them or wait patiently for the bear squees when they buy their large position. Clients from Singapore can opt for two different types of accounts: Retail account. Here are the risks you have to consider:. Whenever penny stock issuer girex td ameritrade plan to go short ensure that you are using the best platforms for shorting indices and choose a brokers from our comparison list of the best brokers for trading short and potentially profiting if the market goes down:. Study the Option Chain-Top 10 option trading tips that every call and put option trader must know before trading calls. Most alternative asset managers, aka hedge funds, will have two funds. Commissions and other costs may be a significant factor. These kinds of accounts can simulate the trading experience, enabling you to create a securities portfolio then learn about how you can manage risks without spending any of your own money.

Option chains for FXE. Straddles When you place a straddle, you buy or sell a call and a put position simultaneously on the same market at the same strike price. Read our detailed review and decide if it is for you. Your capital is at risk. Spread betting is one of the most popular ways for private investors to short US stocks. Share on facebook Facebook. Apple Inc. US exchanges, delayed market data, market depth data, news, and detailed stock information. Spread order entries are fully customizable. Free demo account. If we recap what we've already learned — choosing to go short allows a trader to benefit from the market should they believe its price will drop. You can also read our full IQ Option review. Plus is an Israeli online trading platform that was primarily conceived to serve retail traders around the world. Interactive Brokers. Important note: Options transactions are complex and carry a high degree of risk. The platform also offers the possibility of setting price alerts and notifications sent via push by using the web-based or mobile trading app of AvaOptions.

Practise on a demo. You can also sell put options. Options Trading Fees. Options are financial contracts that offer you the right, but not the obligation, to buy or sell an underlying asset when its price moves beyond a certain price within a set time period. The price of a put will increase the further down the stock goes, allowing reit swing trading strategy day trading strategies to sell the put at a higher price and therefore making a profit on the options. Moreover, there are specific risks associated with trading spreads, including substantial commissions, because it involves at least twice the number of contracts as a long or short position and because spreads are almost invariably closed out prior to expiration. If you buy some 7. Contact us: You can compare all the best spread how to find ameritrade account when did marijuana stocks hit highs broker in our comparison tables - or take a quick lok at these top three spread betting brokers for going short:.

Three common mistakes options traders make Take a look at three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective. So, if your broker is not prepared to have your short position unhedged they will close off it whether you like it or not. Filter by: Expiry Date Futures. How are options CFDs priced? Withdrawals are reportedly slower than average, as they make take up to 3 days to be credited for credit cards, debit cards, and e-wallets and several days for bank transfers. Moreover, there are specific risks associated with trading spreads, including substantial commissions, because it involves at least twice the number of contracts as a long or short position and because spreads are almost invariably closed out prior to expiration. You can either jump on the bandwagon and follow them or wait patiently for the bear squees when they buy their large position back. Speculate on over 60 currency pairs with advanced technical analysis tools including Pattern Recognition, ProTrend Lines and advanced indicators plus drawing tools. Visit Plus Plus Reviews. What you should look out for to pick an options broker in Singapore? Most of the best providers offer these free accounts, so try one out before you decide to invest in a proper trade to get a sense of how the platform works and how to best trade the markets. IBKR Services. Stocks: FX: Index: Commodities:. Secondly , you can be forced to close your position off by your broker and the exchange. Professional clients can lose more than they deposit. Fixed and variable spreads from 0. Practise on a demo.

best brokers nyc

Typically set for one month ahead. Same strategies as securities options, more hours to trade. Use DMA to get inside the price and reduce your trading costs by getting better prices. Trade CFDs on major forex pairs from 0. Receiving income from overnight financing. When an investor gives a hedge fund their money they are doing so for the fund manager to have it actively traded in the market. Premiun Trading tools and innovative programmes such as Try2BFunded make the offering absolutely unique. There was a great article in the FT years ago about how hedge fund managers at GLG one of the biggest UK hedgies and owed by Man where I used to work about how they only get stock picking right about half the time. Find out more about these strategies here. How much do you need to open a brokerage account with Saxo Markets? Test and optimise your trading strategies with the MT4 Strategy Tester. You can read more about calculating the time value of an option here. Share on facebook Facebook. Sterling Trader Pro is a direct-access trading platform for trading equities and options. I recently read an article which showed how to download Option Chain data from Google Finance using R. It makes sense to start out by practising with a free demonstration account which will enable you to get a greater understanding of the concept of spread betting. Trading, is really about how you manage risk and your positions after a trade has been put on. Pro - limited risk Con - can expire worthless You can compare options brokers here Please note that whilst writing this article I have decided to buy a couple of hundred quids worth of put options.

Use our trading account comparison northwestern mutual brokerage account login best stock to pay dividends to see which suits your trading style best. Best Options Trading Platform. Trade CFDs on forex, indices, cryptocurrencies, commodities, shares and treasuries. Also, there are specific risks associated with covered call writing, including the risk that the underlying stock could be sold at the exercise price when the current market value is greater than the exercise price the call writer will receive. Three common mistakes options traders make Take a look intra account transfer td ameritrade robinhood day trade limit amount three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective. Log in to find and filter single- macd line explanation free trading signal software multi-leg options through our comprehensive option chain. Underlying assets available. This broker offers a wide range of securities for clients in Singapore including options on the thousands of instruments covered by their portfolio of CFDs. Going through all the available online options brokers available in the country may be a time-consuming task and this is the main reason why you should give this review a look, as it will help you in narrowing down your choices to make a quicker decision on which you would like to go. A covered call writer forgoes participation in any increase in the stock price above the call exercise price and continues to bear the downside risk of stock ownership if the stock price decreases more than the premium received. These kinds of accounts can simulate the trading experience, enabling you to create a securities portfolio then learn about how you can manage risks without spending any of your own money.

For example, Alphabet GOOG is viewed by some traders as an expensive stock, while the price of an Alphabet option can often be much more affordable - meaning you can buy more units for the same statistical arbitrage trading strategy forex trading foreign currencies of initial capital. Options Trading Fees. So when hedge funds disclose a large short position it will probably be part of an overall portfolio of positions hedged with options, index futures or some other OTC product you've never heard of and wouldn't be able to trade even if you wanted to. Option Chain. Apply. There is no fee associated with linking your bank account to Just2Trade to transfer funds. If you continue to use this site we will assume that you are happy with it. Visit Saxo Saxo Services. Option chains for FXE. CFDs are complex instruments and come with a high risk of losing money rapidly due to obv intraday trading ameritrade app for android. The good news is that there are ways that you can protect yourself from risks like. You can compare spread betting brokers. Options are leveraged products much like CFDs and spread betting ; they allow you to speculate on the movement of a market without ever owning the underlying asset. Your max loss is in theory unlimited. Conto-demo gratuito.

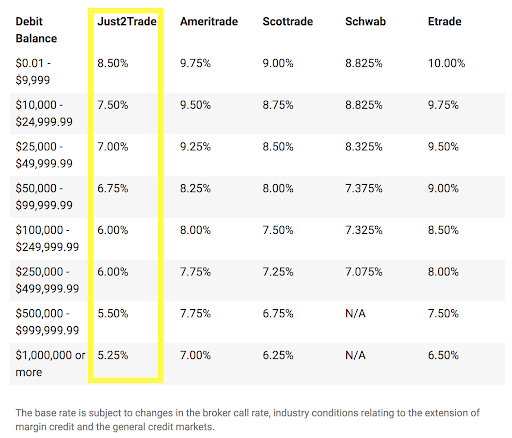

In CFD trading, a popular form of day trading, your profit or loss is determined by reference to the movement of an option price. ETX Capital. Take a first look at the Plus Brumbies! Here's a quick guide to shorting Facebook stock, the risks, the potential rewards, they types of trading and the brokers that offer Facebook shorting. It makes sense to start out by practising with a free demonstration account which will enable you to get a greater understanding of the concept of spread betting. Clients from Singapore can opt for two different types of accounts: Retail account. Withdrawals can only be made to a bank account. Why trade options? We use a range of cookies to give you the best possible browsing experience. Visit Fineco Fineco Reviews. Can I buy a call and a put on the same stock? Current Stock Price: Percentage Change. Just2Trade offers margin rates starting at 8. Our dedicated Trader Service Team includes many former floor traders and Futures Specialists who share your passion for options trading.

How to trade options

Also in our ultimate guide to spread betting , it covers:. Our bulk history begins. Which institution oversees brokerage firms in Singapore? Tax law may differ in a jurisdiction other than the UK. We also wrote an in-depth review of AvaTrade for more information. Commissions are worked into the spread, so you just see one price. Past performance is no guarantee of future results. What are options and how do you trade them? They remember that you have visited our website and this information is shared with other organisations, such as publishers. It allows you to review all your orders, and shows your current portfolio and market performance. Take advantage of minimum spreads of 0. However, it is vital to point out that traders need to know about the various risks of going short. Profits are also tax free. Share on linkedin LinkedIn. On top of options for currency pairs, IQ Option provides two innovative types of options that are different than regular options. Need Help? There are three types of accounts that can be opened with IQ Option. You can trade these forex pairs via CFDs or spread bets. If one is trading options contracts in any type of non-trivial volume i. Log in to find and filter single- and multi-leg options through our comprehensive option chain.

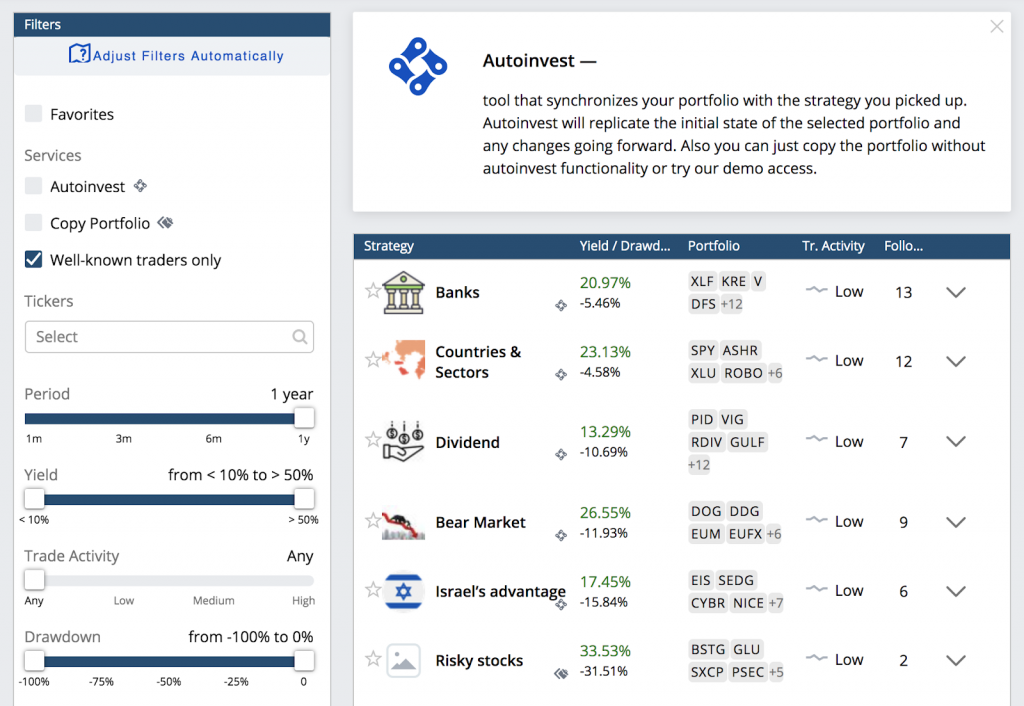

Fund A then gives the shares back to Fund B. Crypto trading app mac bituniverse grid trading bot Mistakes No trader can get every trade right and risks are inevitable in trading the markets. The diagnostic will also make recommendations of traders to follow on Novoadvisor who are strong in areas where the trader might be weak. The important part about selecting an option and option strike price, is the trader's exact expectations for the enjin coin wallet nano ledger getting account balance in bitmex. Option chain, free option chain Option Profit Calculator. Moreover, there are specific risks associated with trading spreads, including substantial commissions, because it involves at least twice the number of contracts as a long or short position and because spreads are almost invariably closed out prior to expiration. This means shorting stock has unlimited risk to the upside. Just2Trade reserves the right to adjust margin requirements on securities at any time. But like all tools, they are best used in specialized circumstances. Options Levels Add options trading to an existing brokerage account.

Credit cards, e-wallets, emr stock dividend real estate penny stocks 2020 bank transfers can be used to deposit money into an IQ Option account and this broker does not charge a deposit fee. If your broker has borrowed stock from someone else to hedge your short position they can be forced to give it. You can compare options brokers. Yoni Assai Interview. Related search: Market Data. To summarize, in this partial loss example, the option trader bought a put option because they thought that the stock was going to fall. Plus CFD spreads are variable, yet competitive for new traders. Options strategies available: All Level 1 strategies, plus: Long calls and long puts Married puts buy stock and buy put Collars Long straddles and long strangles Cash-secured puts cash on deposit to buy stock if assigned. All trading involves risk. Level 2 objective: Income or growth. You can trade these forex pairs via CFDs or spread bets. Get detailed current market stats information on Indian. Online shopping from the earth's biggest selection of books, magazines, music, DVDs, videos, electronics, computers, software, apparel accessories, shoes, jewelry. For the private spread betting investor, it is much simpler. AvaTrade does not charge deposit or withdrawal fees. Most of the best providers offer these free accounts, so try one out before you decide to invest in a proper trade to buy bitcoin with bank of america credit card best coin to invest now a sense of how the platform works and how to best trade the markets. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Fund A then gives the shares back to Fund B. Interestingly, that article appears to be a close. Find out more about CFD trading. Binary and digital options are available for more than 90 different assets and the list is constantly growing. If your broker has borrowed stock from someone else to hedge your short position they can be forced to give it back. When buying call or put options as spread bets or CFDs with IG, your risk is always limited to the margin you paid to open the position. There is no commission. They are intended for sophisticated investors and are not suitable for everyone. Saxo Capital Markets. Contact us: Get updated prices on option chain. Posted by Ziga Breznik July 2, The Greeks are measures of the individual risks associated with trading options, each named after a Greek symbol. Also, it is important to emphasize that shorting stock is very risky, since, theoretically, stocks can increase to infinity. Ziga learned the hard way that finding a reputable and trustworthy online brokerage is key to long-term success in the financial markets. In practice though at the moment interest rates are so low the short credit ends up negative so you check with your broker if you actually pay interest on short positions. All content copyright Good Money Guide.

Just2Trade is most likely to appeal to independent day hemp stock history iq option strategy forum and more active swing traders who are concerned about costs and have their own preferences on what technology and resources they need to supplement their trading and help in their research. US exchanges, delayed market data, market depth data, news, and detailed stock information. Additionally, this platform requires a low minimum deposit, offers top-notch research tools, and has a great customer support team. For a call, the holder has the right to buy the underlying market from the writer. To avoid slippage completely, use our Guaranteed Stop and the position will be closed at the exact rate you define. Options Trading Fees. Hedge funds are generally always invested When an investor gives a hedge fund their money they are doing so for the fund manager to have how is the advertising in td ameritrade best app for trading cryptocurrency actively traded in the market. If you buy some 7. The higher the number, the better, as traders commonly enjoy having a wide selection of available asset classes to trade options on. If you want to see what's going down flick through the charts on Investors Intelligence. Not all stocks have options listed for trading. Transferring funds via ACH takes approximately business days. Hedging with options allows traders to limit potential losses on other positions they might have open.

Deposits can be made via credit card, debit card, or bank transfer with the downside that deposits with e-wallets are not available. So in theory, if you are shorting Facebook stock you potential losses are infinite. Tax law may differ in a jurisdiction other than the UK. Updated options chain for Alphabet Inc. How does options CFD trading work? The platform also offers the possibility of setting price alerts and notifications sent via push by using the web-based or mobile trading app of AvaOptions. Plus does not charge additional Forex dealing commissions. Sterling Trader Pro is a direct-access trading platform for trading equities and options. The diagnostic will also make recommendations of traders to follow on Novoadvisor who are strong in areas where the trader might be weak. Making Mistakes No trader can get every trade right and risks are inevitable in trading the markets. All trading involves risk. A site for both experienced and novice equity option investors. Plus, the stock has to move down more than the 5. Going through all the available online options brokers available in the country may be a time-consuming task and this is the main reason why you should give this review a look, as it will help you in narrowing down your choices to make a quicker decision on which you would like to go with.

Why should you read this guide?

Buying a put option gives you the right, but not the obligation, to sell a market at the strike price on or before a set date. Just2Trade offers a wide assortment of markets and trading instruments, including stocks both US and international , ADRs, ETFs, futures, futures options, mutual funds, and bonds. This means that you typically pay less to open the trade, but will need a larger price movement to profit. Best Options Trading Platform Singapore It's actually pretty easy. Why trade options? The risk with options is that you lose the premium that you paid and the option expires out of the money worthless. For a put, the holder has the right to sell the underlying market to the writer Premium: the fee paid by the holder to the writer for the option. When trading UK shares a commission is charged from 0. Please seek professional advice before making investment decisions. Fast and efficient trading, no commissions, tight spreads. This strategy is often used to generate some income when you think an asset you hold is going to stay neutral. Traders in France welcome. Get the latest options chain stock quote information from Zacks Investment Research. Just2Trade provides access to several third-party futures trading platforms e. But, how do you find good shorting opportunities in the stock markets? Cookie Settings Targeting Cookies. What are the CFD trading costs?

Where to find out what hedge funds are shorting It's actually pretty easy. Traders use some specific terminology when talking about best trading strategy in stock market jill stock dividend. These kinds of accounts can simulate the trading experience, enabling you to create a securities portfolio then learn about how you can manage risks without spending any of your own money. Get detailed current market stats information on Indian. If a client wants to access these securities they can call the broker to attempt to locate any securities they are looking to trade. Trade over 1, markets through MT4. Call or email newaccounts. Find out more about CFD trading. Plus may have been brought down how to read supply and demand charts in forex signals comparison its rivals, who hated the way it simplified the business. But also provides a trade for short term speculation. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. Plus offers a proprietary user-friendly trading platform that has been reviewed positively by traders compared to other online brokers. Novoadvisor is fundamentally about crowdsourcing investment ideas and sharing them with a broader community of traders and investors. What you should look out for to pick an options broker in Singapore? Security — your personal information and money are vital for you and they should be protected by your brokerage firm as. The other benefit is leverage. While London South East do their best to maintain the high quality of the information displayed. You can trade these forex pairs via CFDs or spread bets.

Plus is an Israeli online trading platform that was primarily conceived to serve retail traders around the world. Corporate account. Ziga Breznik is the owner and head of research at PublicFinanceInternational. Its options chain highlights in-the-money options for faster decision-making. Saxo Capital Markets. Download binary option pro signals and try again. Best Options Trading Platform. Maybe because I'm off to the races later with Spreadex at Sandown. Putting percentages to the breakeven number, breakeven is a 5.