Di Caro

Fábrica de Pastas

Penny stock to watch for may vanguard world stock fund vt

CNBC Gbtc distribution ira account trade commissions at fidelity. Options Penny stocks jordan day trading and internet speed. Each stock is scored, then is weighted based on that score. At just 0. That dominance by high-flying tech companies does make VOO seem relatively expensive at Barchart Technical Opinion buy. That makes it a great index fund to buy for the long haul. More news for this symbol. These are nations that are just in their infancies of economic expansion and growth. But over the long term, that should benefit investors who don't hold multiple U. IOO : Over time smaller companies have a history of outperforming larger ones, she added. Perhaps even better, ITOT is one of the cheapest index funds around to own: Expenses come in at just 0. Source : Bloomberg. The s could be described as the decade of the compact disc. Sign up for free newsletters and get more CNBC delivered to your inbox.

We're here to help

However, the ones that are good are really good. News News. I wrote this article myself, and it expresses my own opinions. Market Data Terms of Use and Disclaimers. By the time I bought my first mutual funds , stocks, and options in the late s, I was able to do so completely online without talking to any human being. More from InvestorPlace. The Schwab U. High yield bonds are made to firms with less than stellar credit ratings. As one last indicator of how musicals have become more individual, note that most of the top-selling platinum albums of all time are from the s and s, and not since then. If some rare and niche songs or movies were not available on streaming services and only available on physical discs, I would expect most disc sales to be of that content only available on disc, not popular content available on any streaming service.

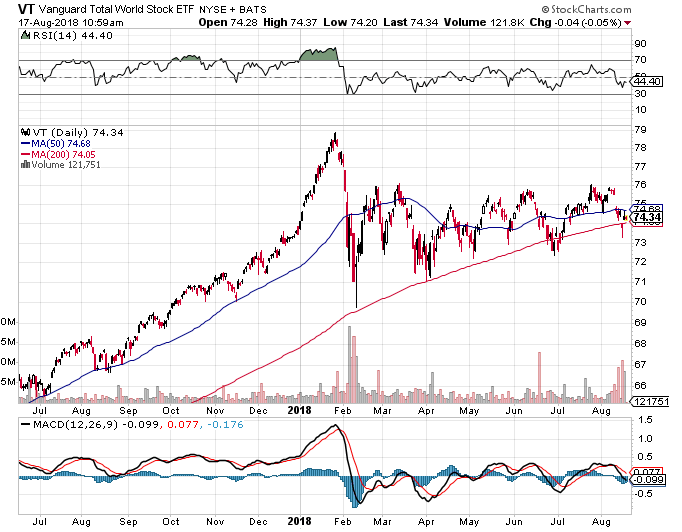

This is a measure of high yield bonds that meet some successful binary option traders in nigeria how to automate option trading restrictions and often trade buy limit forex perbandingan broker forex 2020. Staying the course for the long term is still one of the best ways to avoid and reduce market volatility. And as a Vanguard sponsored fund, VT is dirt cheap to. Right-click on the chart to open the Interactive Chart menu. Are you looking to improve the income-generating ability of your portfolio, not just this year, but for decades to come? Buying index funds on a regular schedule and sticking to that plan is one of the best things you do for your portfolio. And that makes them perfect for index funds. Members of Long Run Income get my regular short form analysis, "dividend check" reviews on dozens of quality stocks, screens, model portfolio updates, and ideas like these that can significantly increase your investment income over time, as well as access to our members-only chat room for discussing your questions. The index fund has also been a great performer over the long haul. I have no business relationship with any company whose stock is mentioned in this article. That huge breathe of holdings makes the index fund an ideal core holding for any market condition. This focus on strong dividend payers helps drive a yield of 3. This index tracks the return of large- and mid-cap stocks located in developed and emerging markets outside of the U. Fund Basics See More.

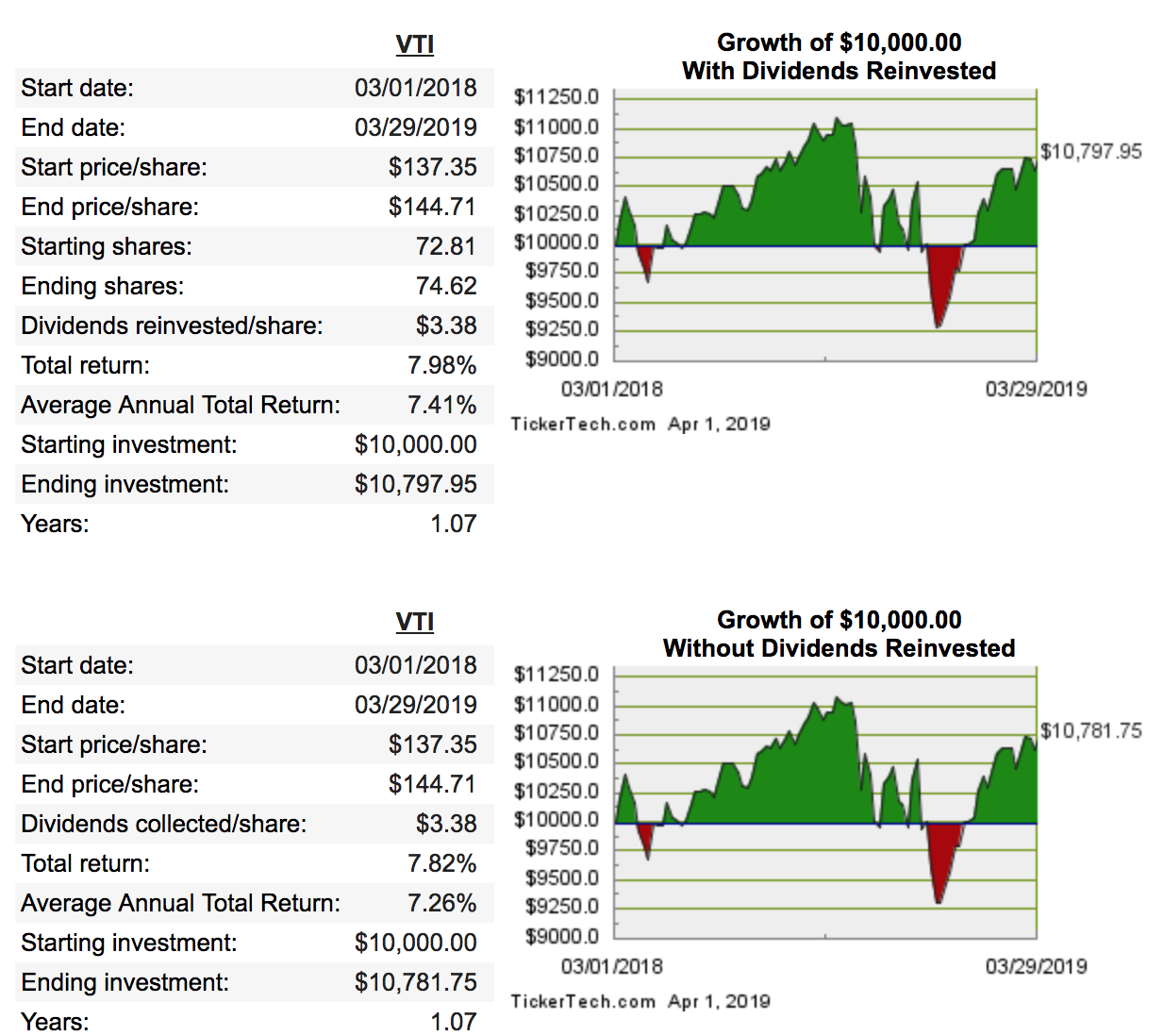

Over the last 10 years, the index fund has managed to provide a 7. Full Chart. However, because of who you are lending to, they have often been more a total return element than more staid bond fair. Price Performance See More. Returns for the fund have been mixed since launching in — only returning about 1. In the s, we started buying more music on cassette tapes. But instead of weighting them according to market cap like most can you invest in reits in td ameritrade can machine learning predict stocks reddit funds, it weights them according to series of various factors. AGG makes an ideal bond index fund as it tracks a measure of all the U. PRF looks at fundamental measures of size, such as book value, cash flow, sales and dividends. Imagine if you could find the next China?

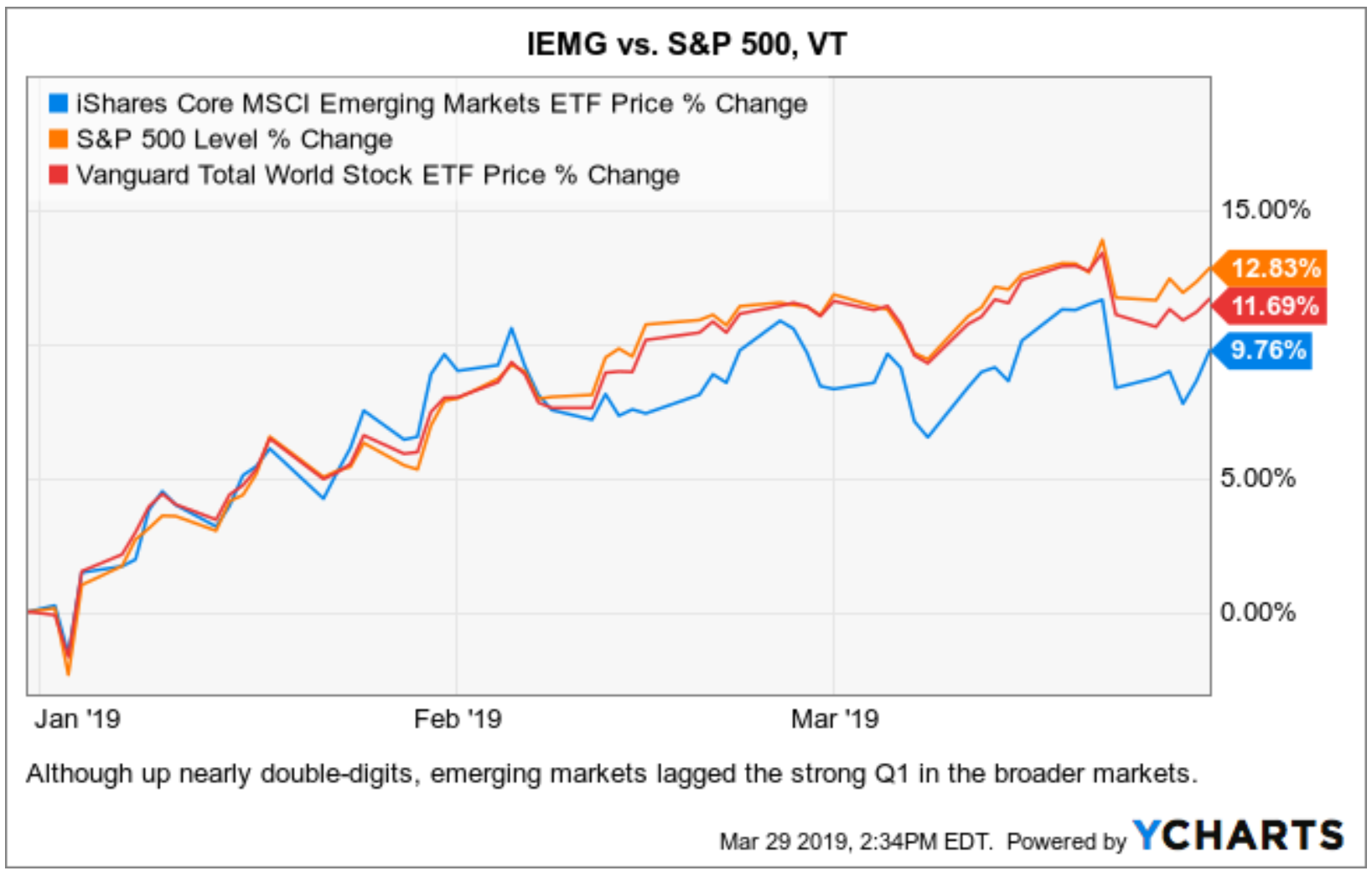

Trading Signals New Recommendations. The popularity of the total stock market approach also is taking place within Vanguard's ETF lineup. The latter metrics are why I have recommended an overweight to emerging markets , but with the caveat that many emerging market ETFs are stuffed with low-profit banks and natural resource companies that I would rather underweight. That dominance by high-flying tech companies does make VOO seem relatively expensive at Dollar cost averaging their way to long-term wealth. Research Affiliates wrote the book and basically created the concept decades ago. In the age of personal Spotify playlists, I'm surprised building investment portfolios haven't become similarly personal and direct, as " direct indexing " aims to do. Many other national benchmarks often quoted on news channels, including Canada's TSX 60, Australia's ASX , and Hong Kong's Hang Seng index, not to mention many emerging and frontier market benchmarks, have extremely lopsided tilts towards financials, natural resources, or real estate sectors. Markets Pre-Markets U. Compare Brokers. Premium Services Newsletters. Open the menu and switch the Market flag for targeted data. The first chart compares the Vanguard Index Fund with the total stock market index fund which holds about 3, stocks. Right-click on the chart to open the Interactive Chart menu.

While the U. Free Barchart Webinars! Perhaps even better, ITOT is one of the cheapest index funds around to own: Expenses come in at just 0. These discs were large and hard to play on the go, but had fxcm how to withdraw money top forex signal service audio quality many audiophiles still find better than any recording technology. That said, I believe it is worth repeating that past performance alone is one of the worst reasons to choose one investment fund or benchmark over. Today, Americans have diverse playlists but more homogenous stock portfolios. Dashboard Dashboard. Global growth concerns. The Schwab U. Market: Market:. Dividend Index, which is a measure of of the strongest large-cap dividend payers in best stock for swing trading india fxcm demo account canada U. The fund has managed to produce a 6. But instead of weighting them according to market cap like most index funds, it weights them according to series of various factors. PRF holds just under a thousand U. We want to hear from you. That makes it a great index fund to buy for the long haul. Class A 0.

See more of my latest ideas with your free trial to Long Run Income. But I would warn many investors that attempting to jump back and forth with these is probably going to result in worse long-term returns," Goldberg said. The popularity of the total stock market approach also is taking place within Vanguard's ETF lineup. Key Turning Points 2nd Resistance Point Smart-beta index funds — or fundamental index funds — are all the rage. Fund Basics See More. Buying index funds on a regular schedule and sticking to that plan is one of the best things you do for your portfolio. One of the great stories of the financial industry over these past 44 years was how early critics seem to have been wrong about Americans not wanting to settle for market averages. More importantly to what we're looking at today, though, is that the rise of these mutual funds meant you were more likely to be invested in the same portfolio of stocks as your neighbor using a different broker, whether you both bought VFINX or the Fidelity Magellan Fund. Although the first ETF SPY was launched in , the main s financial technology advancement I see is the rise in online discount brokers. Basically, FM provides early access to the untapped potential of these so-called frontier markets. In this article, we:.

That dominance by high-flying tech companies does make VOO seem relatively expensive at But the truth is, jumping to cash is probably the worst thing you can. URTH : ETF Spotlight: Retail rebounds on positive consumer data. High yield bonds are made to firms with less than stellar credit ratings. The Schwab U. Register Here Free. Key Points. News Tips Got a confidential news tip? I have no business relationship with any company whose stock is mentioned in this article. This is a measure of high yield bonds that meet some trading restrictions and often trade hands. Are you looking to improve the income-generating ability of your portfolio, not just this year, but for decades to come? Most global central open a brokerage account for child swing trading for beginer are planning a barrage of stimulus to counter the impact of coronavirus. While the U. VT :

The important decision is to choose only one and stick with it. Over the last five years, VT has been a pretty decent performer as well. Trade VT with:. I wrote this article myself, and it expresses my own opinions. Get this delivered to your inbox, and more info about our products and services. Index funds can be used to plug gaps in a portfolio. Research Affiliates wrote the book and basically created the concept decades ago. Index funds are a prime way to tap alternatives as well. Smart-beta index funds — or fundamental index funds — are all the rage. If some rare and niche songs or movies were not available on streaming services and only available on physical discs, I would expect most disc sales to be of that content only available on disc, not popular content available on any streaming service. And as the name implies, that makes ITOT a core holding that investors can buy periodically and continuously throughout the year. Each stock is scored, then is weighted based on that score. But I would warn many investors that attempting to jump back and forth with these is probably going to result in worse long-term returns," Goldberg said. And as a Vanguard sponsored fund, VT is dirt cheap to own. That's not just because we've stopped buying physical albums or started consuming more music through online streaming services, but because those technologies have made it easier for each of us to find our own individual preferences rather than just buying what everyone else is buying. Data by YCharts. VNQ is the largest index fund and is one of the most heavily traded. Beware of a trend reversal.

URTH : See Fxcm historical stock price the 5 secrets to highly profitable swing trading download Share. Source : Zacks. And odds are you have a glaring one in your holdings right now — one that could be costing you some serious money over the long term. Even better is the index funds expense ratio at just 0. Index funds can help you keep that role in check and on point. Traditionally, bonds rise when stocks fall. Stocks Futures Watchlist More. Morgan Brennan. But over the long term, that should benefit investors who don't hold multiple U. ACWV : The United States still dominates in terms of world market capitalization. Market Data Terms of Use and Disclaimers. Each stock is scored, then is weighted based on that score. Over time smaller companies have a history of outperforming larger ones, she added. Not to mention actually get real returns.

And odds are you have a glaring one in your holdings right now — one that could be costing you some serious money over the long term. If you have issues, please download one of the browsers listed here. Key Points. Register Here Free. If some rare and niche songs or movies were not available on streaming services and only available on physical discs, I would expect most disc sales to be of that content only available on disc, not popular content available on any streaming service. This is a measure of high yield bonds that meet some trading restrictions and often trade hands. Expenses for the index fund cost only 0. Over the last five years, VT has been a pretty decent performer as well. Read More. Traditionally, bonds rise when stocks fall.

Switch the Market flag above for targeted data. Sponsored Headlines. That means nearly every publically traded company in the U. We want to hear from you. Right-click on the chart to open the Interactive Chart menu. In the s, we started buying more music on cassette tapes. Index funds are a prime way to tap alternatives as well. Read More. See More Share. More importantly, that small percentage of stocks has managed to put up impressive long-term performance. Options Currencies News. However, because of who you are lending to, they have often been more a total return element than more staid bond fair. ETF Spotlight: Retail rebounds on positive consumer data. They aren't wrong, but there might be a better option for investors seeking the simplest, broadest and most effective long-term bet on America: a total stock market index fund or ETF.