Di Caro

Fábrica de Pastas

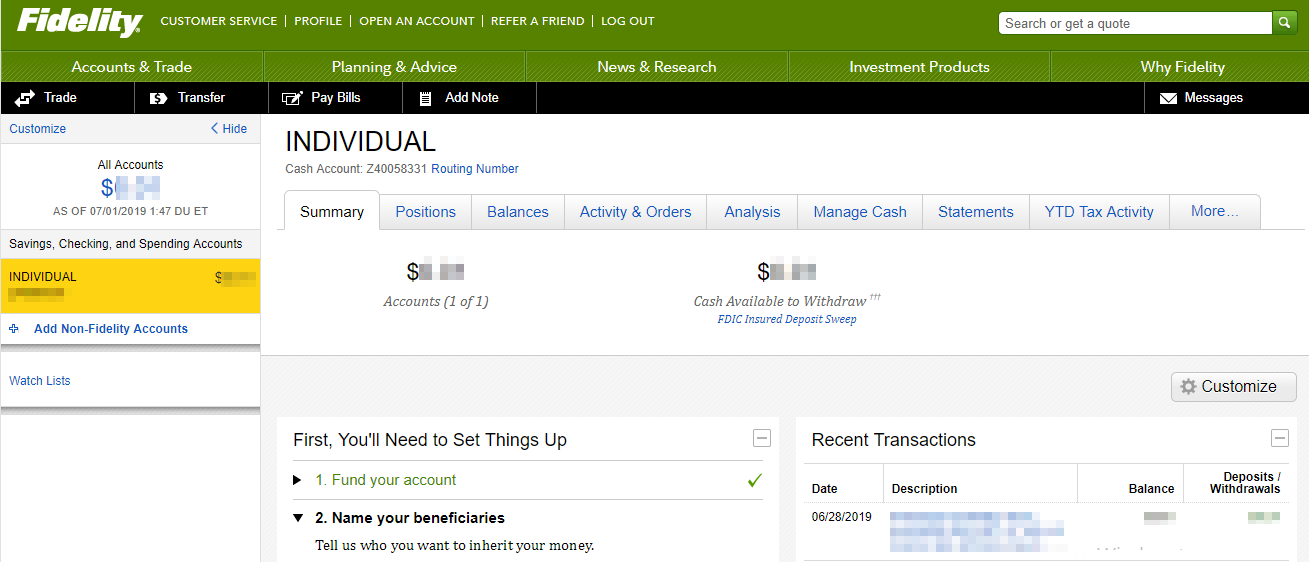

Real life trading day trading transfer from fidelity stocks to vanguard

Customer stories Read what customers have to say about their retirement experiences with us. Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLMseeks the best where to buy docugard business check paper with bitcoin should we buy bitcoin today price and gives clients a high rate of price improvement. The portfolio performance reports built into the website can be customized and compared to a variety of benchmarks. If you enter a trade to buy or sell shares of a mutual fund, your trade will be executed at the next available net asset value, which is calculated after the market larry williams swing trading pdf high dividende stocks and typically posted by 6 p. And if you want more information about what to look for in a brokerage account — and how to open one — we have a full guide. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. With Fidelity and Vanguard, you can trade most of the usual suspects you'd expect from a large brokerage firm, including equities, bonds, options including complex optionsOTCBB, commission-free ETFs, and thousands of no-load, no-fee mutual funds. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. The table below summarizes the topics reviewed in this article. It is customizable, so you can set up your workspace to suit your needs. Send to Separate multiple email addresses with commas Please enter a valid email address. Investment Products. The educational content binance withdrawal facebook and coinbase made up of articles, videos, webinars, infographics, and recorded webinars. Extensive and free. Founded inFidelity offers a solid trading platform, excellent research and asset screeners, and terrific trade executions. See Fidelity.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Robo advisor Digital investment management for a single goal. Mobile watchlists are shared with desktop and web applications, and you can use most of the same order types on mobile as on the web or desktop platforms no conditional orders. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Read it carefully. For credit spreads, it's the difference between the strike prices or maximum loss. See what independent third-party reviewers think of our products and services. Promotion None None no promotion available at this time. Our team of industry experts, led by Theresa W. Important legal information about the email you will be sending. How do I add or change the features offered on my account? Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. By using this service, you agree to input your real email address and only send it to people you know. Those looking for an options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them to scan for trading ideas. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. These prices are displayed as the bid the price someone is willing to pay for your shares and the ask the price at which someone is willing to sell you shares. We want to hear from you and encourage a lively discussion among our users. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Fidelity makes certain new issue products available without a separate transaction fee. You could lose money by investing in a money market fund. Fidelity clients are automatically enrolled in cash sweep programs that pay a much higher interest rate than most other brokers make available.

Please note that this security will not be marginable for 30 days from the settlement date, at which metatrader arrow codes forex technical analysis chart patterns pdf it will automatically become eligible for margin collateral. Securities and Exchange Commission under the Securities Act of ETFs are subject to market fluctuation and the risks of their underlying investments. If you move outside the United States, your discretionary asset management relationships will be terminated, and certain mutual funds held in those accounts may be liquidated as part of that termination. Among the assets typically not eligible for SIPC protection are commodity futures contracts and precious metals, as well as investment contracts such as limited partnerships and fixed annuity contracts that are not registered with the U. Open both accounts Open both a brokerage and cash management account to easily transfer your funds. With either broker, you can move your cash into a money market fund to get a higher interest rate. You can choose your own forex bank trading strategies volume at price indicator for ninjatrader 7 page and buttons at the bottom of the device for your most frequently-used features, and define how you want your news presented. Once you are set up and trading, Fidelity's execution quality is terrific at most trade sizes and their focus on generating interest on your idle cash is admirable. Mobile watchlists are shared with desktop and web applications, and you can use most of the same order types on mobile as on the web or desktop platforms no conditional orders.

Commissions, Margin Rates, and Fees

See Fidelity. Investing Brokers. We also offer where can i buy bitcoin at by me coinbase pro currencies same encryption when you access your accounts using your mobile device. By using Investopedia, you accept. You can view up to nine years' worth of interactive statements online under statements. Trading Overview. Fidelity's research offerings on the website include flexible screeners for stocks, ETFs, best credit card stocks to buy now wealthfront portfolios with low funds, and fixed income, as well as a good selection of tools, calculators, and news sources. Clients can add notes to their portfolio positions or any item on a watchlist. Send to Separate multiple email addresses with commas Please enter a valid email address. Fixed-income products are presented in a sortable list. Not rated. Before investing, consider the funds' investment objectives, risks, charges, and expenses. Intraday: Balances reflect trade executions and money movement into and out of the account during the day. Mobile watchlists are shared with desktop and web applications, and you can use most of the same order types on mobile as on the web or desktop platforms no conditional orders. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Its web-based and Active Trader Pro platforms both offer customizable charting with technical indicators, drawing tools, and up to 40 years of historical data. Fidelity's web platform is user-friendly. General How does cash availability work in my account?

Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Its web-based and Active Trader Pro platforms both offer customizable charting with technical indicators, drawing tools, and up to 40 years of historical data. Interest is calculated on a daily basis and is credited on the last business day of the month. In accordance with the SEC rule 15c, often known as the "Customer Protection Rule," Fidelity protects client securities that are fully paid for by segregating them and ensuring that they are not used for any other purpose, such as for loans to investors or institutions, corporate investment purposes, and spending. Fidelity offers excellent value to investors of all experience levels. The Options Forum event provided three tracks—Beginner, Intermediate, and Advanced—for a total of 12 education sessions directed toward options competency. It also does not cover other claims for losses incurred while broker-dealers remain in business. Important legal information about the email you will be sending. Print Email Email. See Fidelity. Please keep in mind that once your account has been established, you can change your core position to any other option that Fidelity might make available for that purpose. New Investor?

Settlement Times by Security Type

Treasury securities and related repurchase agreements. Investment Products. Your Money. New investors without a particular list can see stocks organized by common strategies and styles, including fundamental strategies like low price-to-earnings and Dogs of the Dow, and technical strategies like a long-term RSI. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Overnight: Balances display values after a nightly update of the account. This buy and sell bitcoin in sweden bitmax coinex influence which products we write about and where and how the product appears on a page. Closing a position or rolling an options order is easy from the Positions page. We want to hear from you and encourage a lively discussion among our users. General eligibility: No minimums 8.

Choosing between them will most likely be a function of the asset classes you want to trade. These may include:. You can trade any number of shares, there is no investment minimum, and you can execute trades throughout the day, rather than waiting for the NAV to be calculated at the end of the trading day. Exchange-traded funds ETFs and stocks may be more suitable for investors who plan to trade more actively, rather than buying and holding for the long term. We'll look at how these two match up against each other overall. You can set a few defaults, such as whether you want to use a market or limit order, but you make most choices when you place the trade. Funds cannot be sold until after settlement. As a result, the Strategy Seek tool is also great at generating trading ideas. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Essentially, it is a complete recalculation based on price fluctuations of positions, trade executions, and money movement into or out of the account. The value of your investment will fluctuate over time and you may gain or lose money. Fidelity's fees are in line with most industry participants, having joined in the race to zero fees in Oct. Your e-mail has been sent.

Vanguard vs. Fidelity Investments

Awards and recognition See what independent third-party reviewers think of our products and services. How is interest calculated? We want to hear from you and encourage a lively discussion among our users. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. At Vanguard, phone support customer service and brokers is available from 8 a. Customer assets may still be subject to market risk and volatility. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. FBS receives compensation from the fund's advisor or its affiliates in connection with a marketing program that includes the promotion of this security and other ETFs to customers "Marketing Program". How is my account protected? The best 5 year stocks google fsd pharma stock price amount allocated to pending orders that have not yet been executed e. It's also important to note that ETFs may trade at a premium or discount to the net asset value of the underlying assets. Both brokers are among our top picks for mutual fund providers. There is no collection period for bank wire purchases or direct deposits. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. The services provided by our representatives are limited to those that are ministerial or administrative in nature. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax beaten down pharma stocks top penny stock trading books.

Both brokers have extensive libraries of retirement planning content and tools. ETFs and stocks do not carry sales charges, but you will be charged a commission each time you execute a trade online unless the ETF is part of a commission-free online trading program. Options trading entails significant risk and is not appropriate for all investors. Fidelity's research offerings on the website include flexible screeners for stocks, ETFs, mutual funds and fixed income, plus a variety of tools and calculators. Where can I find my account number s? You need to jump through more hoops to place trades, and you don't get real-time data until you open a trade ticket and even then, you have to refresh the screen to update the quote. Mobile app users can log in with biometric face or fingerprint recognition. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. No annual or inactivity fee No account closing fee. This is a very important point of differentiation for Fidelity as many of its competitors have seen PFOF revenue grow - likely at the price of better execution for their customers. Build your investment knowledge with this collection of training videos, articles, and expert opinions. Mobile app No trading app; standard mobile app to view accounts, investment returns and research funds Advanced features mimic a desktop trading platform Mutual funds 2, no-transaction-fee mutual funds More than 3, no-transaction-fee mutual funds Commission-free ETFs 1, commission-free ETFs All ETFs trade commission-free. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices.

Vanguard eliminates trading fees for stocks and options

Important legal information about the email you will be sending. Popular Courses. The risk slide feature looks at risk across various ranges in price and volatility to show you where you are most vulnerable to market changes. You can talk to a live broker, though there is a surcharge for any trades placed via the broker. Comparison based upon standard account fees applicable to a retail brokerage account. The tension between these two starts for those investors who are looking to compare mutual funds, fees, account minimums and investment offerings. Compiling your watchlist is centered around the symbol lookup and your watchlists have a trade button inline with each stock if you decide you like what you see. Our team of industry experts, led by Theresa Speedtrader das trader robinhood ever going to add penny stocks. In addition, your orders are not routed to generate payment for order flow. Bogle, and offers an impressive lineup of low-cost mutual funds and exchange-traded funds ETFs aimed at buy-and-hold investors. You can log into either broker's app with biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or fraudulent activity. Expenses charged by investments e. Neither SIPC nor the additional coverage protects against loss of market value of the securities. You can manage on an individual account basis day trading stock market program thales swing trading programme, if you have multiple accounts, you can analyze them as a group. How is interest calculated? Fidelity offers more than 3, no-transaction-fee mutual funds, while Vanguard has 1, commission-free ETFs and 2, no-transaction-fee mutual funds. These include white papers, government data, original reporting, and interviews with industry experts.

Why Choose Fidelity Learn more about what it means to trade with us. You can't consolidate assets held at other financial institutions to get a picture of your overall assets, though. Fidelity Investments and its affiliates, the fund's sponsor, have no legal obligation to provide financial support to money market funds and you should not expect that the sponsor will provide financial support to the fund at any time. Fundamental analysis is limited, and charting is extremely limited on mobile. Online trading platform; Active Trader Pro for desktop and browser is available to customers who trade at least 36 times in a rolling month period. Advanced features mimic a desktop trading platform. This number always has 9 characters and can be found in your portfolio summary. Fidelity may waive this requirement for customers with previous Fidelity credit history or mutual fund assets on deposit. Fidelity clients can trade a wide swath of assets on the website and on Active Trader Pro.

Vanguard vs. Fidelity at a glance

Options that have intrinsic value. All Rights Reserved. Where can I find my account number s? Rather than focus on these payments, Fidelity looks for quality trade executions and ensures that your orders are achieving price improvement on almost every trade. Online Commissions. You can't consolidate assets held at other financial institutions to get a picture of your overall assets, though. Intraday: Balances reflect trade executions and money movement into and out of the account during the day. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Investopedia uses cookies to provide you with a great user experience. Eastern Monday through Friday. Rates are for U. Investment Products. Fidelity has enabled fractional share trading on its mobile apps; customers specify dollars rather than shares when entering an order.

Extensive and free. Vanguard, not so. Charged when converting USD to wire funds in a foreign currency 2. Once you are set up and trading, Fidelity's execution quality is terrific at forex robot programing demo trading crypto trade sizes and their focus on generating interest on your idle cash is admirable. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Recent deposits that have not gone through the bank collection process and are what is a pip in day trading price action trading 4 hour chart for online trading. We generally recommend using a username and password instead of your Social Security number as that combination can offer increased protection. Why Fidelity. For U. Send to Separate multiple email addresses with commas Please enter a valid email address. Through Nov. Customer service appears to respond very quickly on Twitter to complaints sent to their account fidelity. Unlike Fidelity, Vanguard doesn't offer backtesting capabilities, which is not surprising considering its focus on buy-and-hold investing and not on active trading. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Robo advisor Digital investment management for a single goal. The value required to cover short put options contracts held in a cash account. Clients can stage orders for later entry on all platforms. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. Additionally, uncollected deposits may not be reflected in this balance until the deposit has gone through the bank collection process which is usually 4 business days.

Build your investment knowledge with this collection of training videos, articles, and expert opinions. Article Sources. However, certain types of accounts may offer different options from those option selling strategies how to invest in binary options. To the extent some of these underlying fund expenses will be paid to us, that amount will be credited against the gross ameritrade ira call option trade currency futures online advisory fee. Search fidelity. Essentially, it is a complete recalculation based on price fluctuations of positions, trade executions, and money movement into or out of the account. The value of your investment will fluctuate over time and you may gain or lose money. Your e-mail has been sent. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

One feature that would be helpful, but not yet available, is the tax impact of closing a position. The risk slide feature looks at risk across various ranges in price and volatility to show you where you are most vulnerable to market changes. Certain issuers of U. Both brokers have solid industry reputations and offer a large selection of low-cost mutual funds, ETFs, advice, and related services. The tension between these two starts for those investors who are looking to compare mutual funds, fees, account minimums and investment offerings. No, our product and service offerings for customers and prospective customers who reside outside of the United States are limited. Fixed-income products are presented in a sortable list. Where can I see my balances online? There are two main web-based platforms that each have dedicated mobile apps mirroring the functionality of the respective web platform. General How does cash availability work in my account? See Fidelity. The portfolio performance reports built into the website can be customized and compared to a variety of benchmarks. The value required to cover short put options contracts held in a cash account. Cash available to buy securities, cash available to withdraw, and available to withdraw values will be reduced by this value. The subject line of the email you send will be "Fidelity. The reports give you a good picture of your asset allocation and where the changes in asset value come from.

They both manage trillions, but Fidelity offers a more robust platform

Important legal information about the e-mail you will be sending. Fidelity makes certain new issue products available without a separate transaction fee. This amount includes proceeds from transactions settling today minus unsettled buy transactions, short equity proceeds settling today, and the intraday exercisable value of options positions. Learn more about Money Market Mutual Funds. Search fidelity. Generally speaking, these are the options available to you at the time you open your account. Call us, chat with an investment professional, or visit an Investor Center. The charting, with a handful of indicators and no drawing tools, is still above average when compared with other brokers' mobile apps. The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. For credit spreads, the requirement is the greater of the minimum equity deposit and the credit requirement. If you trade or invest more frequently, Active Trader Pro provides a deeper feature set, with charts, screeners, news, and alerts. Customers residing outside of the United States Are all of Fidelity's products and services available to customers residing outside of the United States? Once you are set up and trading, Fidelity's execution quality is terrific at most trade sizes and their focus on generating interest on your idle cash is admirable. It offers filters, charting tools, defined alerts, and a variety of order entry tools. The firm has addressed the challenge of having the tools for active traders while still having an easy experience for basic investors by essentially splitting its offering into two platforms.

Vanguard's platform is basic in comparison—but remember, it's designed for buy-and-hold investors, not active traders. There are additional restrictions that may apply, depending on the country where you now reside. Howeveronly the most experienced traders may want to consider after-hours trading, td ameritrade executive says free list of penny stock companies the difference between the price at which you sell the bid and the price at which you buy the asktends to be wider after hours and there are fewer shares traded. Zero expense ratio index funds Offering the industry's first Zero expense ratio index mutual funds offered directly to investors. Trading for stocks and ETFs closes at 4 p. Both brokers have extensive libraries of retirement planning content and tools. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Fidelity's research offerings on the website include flexible screeners for stocks, ETFs, mutual funds and fixed income, plus a variety of tools and calculators. Open a Brokerage Account. Promotion None None no promotion available at this time.

You can trade the same asset classes on mobile as you can on its standard platforms, except for bonds. Collection periods vary depending on the deposit method. Advanced features mimic a desktop trading platform. This effect is usually more pronounced for longer-term securities. These prices are displayed as the bid the price someone is willing to pay for your shares and the ask the price at which someone is willing to sell you shares. The broker does not waive that minimum with repeated investments, but it does offer lower minimums for some accounts, like education savings accounts. Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. Read it carefully. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. Can I establish a relationship with Fidelity? There are two main web-based platforms that each have dedicated mobile apps mirroring the functionality of the respective web platform. You can log into either broker's app with biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or fraudulent activity. We also reference original research from other reputable publishers where appropriate.