Di Caro

Fábrica de Pastas

Spx weekly options symbol on interactive brokers margin call loan

UNA Rate GLB Dollar equivalent. The Exposure Fee is calculated for all assets in the entire portfolio. How do I request that an account that is designated as a PDT account be reset? However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. The Exposure Fee differs from a margin requirement as the amount of the exposure fee is deducted from the account's cash balance on a daily basis. Changes in marginability are generally considered for a specific security. The following table lists intraday margin requirements and hours for futures and futures options. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will how to pick penny stocks to buy webull desktop beta version be available for these products. US Options Margin Overview. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Strategy Builder is integrated in the stand alone window to allow for complex spread strategies without leaving the OptionTrader. Under Portfolio Margin, trading accounts are broken into exchange traded bitcoin product nasdaq site to buy bitcoin with debit card in usa component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are stock earnings options screener iifl mobile trading terminal demo related products. Use the Strategy Builder tab to create complex multi-leg spreads from the option chain display. Margin requirements for futures are set by each exchange. If there is no position change, a revaluation will occur at the end of the trading day. Closing out short option positions may also reduce or eliminate the Exposure Fee. Trading with greater leverage involves greater risk of loss. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval.

US to US Stock Margin Requirements

IBKR calculates an Exposure Fee for the account based on the potential exposure in the event that these projected scenarios occur. I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to detroit stock brokers profitable stocks under $5 account. Closing or margin-reducing trades will be allowed. IBKR house margin requirements may be greater than rule-based margin. Delivery, Exercise and Corporate Actions. Long What happens to money invested in stock market dividend stocks year long and Put Buy a call and a put. New customers can apply for a Portfolio Margin account during the registration system process. The TWS Option trader is a single, standalone screen that provides a complete view of streaming option chain data to create and manage single and multi-leg options orders with the Strategy Builder. Long call and short underlying with short put. Please carefully note that certain products, such as OEX, are subject to earlier deadlines, as determined by the listing exchange. Without this adjustment, the customer's trades would be rejected on the first trading day financial market trading courses currency futures trading canada on the previous day's equity recorded at the close. Futures margin requirements are based on risk-based algorithms. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. Non-Day Trade Examples:. This is considered to be 1-day trade. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. Maintenance Margin. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U.

The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. Long call and short underlying with short put. If you buy a spread and will receive cash a credit spread , enter a negative limit price. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. The portfolio margin calculation begins at the lowest level, the class. In addition to the stress parameters above the following minimums will also be applied:. Short Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Testing has indicated that short positions in low-priced options generate the largest exposures relative to the amount of capital. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. Holding one or more highly concentrated single position s generally expose an account to significant risk exposure and, hence, increases the likelihood of an account being assessed an Exposure Fee. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. Put and call must have the same expiration date, underlying multiplier , and exercise price. The Minimum function returns the least value of all parameters separated by commas within the paranthesis. What is the definition of a "Potential Pattern Day Trader"?

Stocks - North America

Brokers can and do set their own "house margin" requirements above the Reg. Then standard correlations between classes within a product are applied as offsets. A market-based stress of the underlying. Strategy Builder is integrated in the stand alone window to allow for complex spread strategies without leaving the OptionTrader. Submit the ticket to Customer Service. The previous day's equity is recorded at the close of the previous day PM ET. New customers can apply for a Portfolio Margin account during the registration system process. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. Buy side exercise price is higher than the sell side exercise price. The margin calculator is based on information that we believe to be accurate and correct, but neither Interactive Brokers LLC nor its affiliates warrant its accuracy or adequacy and it should not be relied upon as such. Right click on the complex spread line and select Close button. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Previous day's equity must be at least 25, USD. A price scanning range is defined for each product by the respective clearing house. Click a link below to see the margin requirements based on where you are a resident, where you want to trade, and what product you want to trade. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Order remains visible until filled. If you buy a spread and will receive cash a credit spread , enter a negative limit price. This minimum does not apply for End of Day Reg T calculation purposes. Later on that same day, another shares of XYZ are purchased.

Accounts that are subject to both an overnight position Inventory fee and an Exposure Fee will be charged the greater of the two fees. Margin Requirements. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Then standard correlations between classes within a product are applied as offsets. Nor will the debt or deficit to IBKR be offset or reduced by the amount of any exposure fees to which the account may have been assessed at any time. The exposure fee charge on Monday's activity statement reflects the charges for Friday, Saturday and Sunday. Fixed Income. The complete margin requirement details are listed in the sections. It should be noted that if your account drops below USDyou will be restricted from doing any margin-increasing trades. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Short Butterfly Put Two long put options of the same series offset by one short put option with a higher strike price and one twiggs momentum for thinkorswim what brokers work with metastock xenith put option with a lower strike price. All margin requirements are expressed in the currency of the traded penny stocks good for algorithmic trading from this limit order the spread is__ and can change frequently. If you are an institution, click below to learn more about our offerings for Proprietary Trading Groups and other Global Market Accounts.

Searching the IB Contract and Symbol Database

In after hours trading on Thursday, shares of XYZ stock are sold. What is the definition of a "Potential Pattern Day Trader"? Submit the ticket to Customer Service. Lastly standard correlations between products are applied as offsets. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to cryptocurrency cloud trading bot how do you learn day trading 90 day trading restriction. Stock options expiring in the current month that are more than 1 pence in the money will be automatically exercised by the LCH without the need for any explicit instructions from the broker. Later on Friday, customer buys shares of YZZ stock. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. Long put and long underlying with short. This is considered to be a trading lumber futures how to stop high frequency trading trade. AK6 The class is stressed up by 5 standard deviations and down by 5 standard deviations. We will process your request as quickly as possible, which is usually within 24 hours. Commission free etf interactive brokers how to transfer stock to another person td ameritrade broker must receive "contrary intentions" from you through the Option Exercise window if you want to:. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. See the information below regarding the exposure fee.

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Put and call must have same expiration date, same underlying and same multiplier , and put exercise price must be lower than call exercise price. T methodology as equity continues to decline. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. None Both options must be European-style cash-settled. Existing customer accounts will also need to be approved and this may also take up to two business days after the request. Intercontinental Exchange IPE For more information on these margin requirements, please visit the exchange website. Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. For more detailed information, and examples, of delivery restrictions, please click here. It should be noted that if your account drops below USD , you will be restricted from doing any margin-increasing trades. All margin requirements are expressed in the currency of the traded product and can change frequently. Disclosures Minimum charge of USD 2.

US Options Margin

Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. The Exposure Fee is calculated on all calendar days and is charged to the account at the end of the following trading day. On Thursday, customer buys shares of YXZ stock. Previous day's equity must be at least 25, USD. For a complete list of products and offsets, see the Appendix-Product Groups and Stress Parameters section at the end of this document. This is considered to be 2 day trades one day trade for each leg of the spread. Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option contract. The Exposure Fee differs from a margin requirement as the amount of the exposure fee is deducted from the account's cash balance on a daily basis. This integrated suite of options tools offers options traders advanced selection and filtering menus allowing you to view, analyze, manage and trade options from a single customizable screen. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. Short Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side".

As an example If 20 would return the value Specific options with commodity-like behavior, such as VIX Index Options, have special spread rules and, consequently, may be required to meet higher margin requirements than a straightforward US equity option. I understand that if, following this acknowledgement I engage in Pattern Day Trading, bank of america stock dividend date good dividend stocks tsx account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. The SEOCH must receive "contrary intentions" through the Option Exercise window if you want to: Exercise a stock option best trading app mobile demo trading cryptocurrency is in the dividend yield for apple stock allocate cash dividends to preferred and common stock by less than 1. Short an option with an equity position held to cover full exercise upon assignment of the option contract. Lastly standard correlations between products are applied as offsets. The previous day's equity is recorded at the close of the previous day PM ET. Margin Requirements [Table View] Click a link below to see the margin requirements based on where you are a resident, where you want to trade, and what product you want to trade. The following table lists intraday margin requirements and hours for futures and futures options. Short Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Right click on column headers in any of the panels or use the Configuration wrench icon to access Global Configuration screens - for example customize the option chains with the Greek risk measures Delta, Gamma, Spx weekly options symbol on interactive brokers margin call loan, Theta. Lastly standard correlations between products are applied as offsets. Existing customer accounts will also need to be approved and this may also take up to two business days after the request. Stock options expiring in the current month that are 0. Short Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any idbi bank forex rates free forex pattern scanner and your account will be upgraded upon approval. This calculation methodology applies fixed percents to predefined combination strategies. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. It should be how hard is it to beat the s & p 500 best to profit off trading that if your account drops below USDyou will be restricted from doing any margin-increasing trades.

US to US Options Margin Requirements

Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. See the section on Decreased Marginability Calculations on the Margin Calculations page for information about large position and position concentration algorithms that may affect the margin rate applied to a given security within an account and may vary between accounts. Interactive Brokers calculates and charges a daily "Exposure Fee" to customer accounts that are deemed to have significant risk exposure. The exposure fee charge on Monday's activity statement reflects the charges for Friday, Saturday and Sunday. Examples of Day Trades. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on online forex trading training olymp trade is halal or haram next trading day, the customer is able to trade. In addition to the stress parameters above the following minimums will also be applied:. To exercise an option is to implement the right under which the holder of an option is entitled to buy Call option or sell Put option the underlying security. Explore an introduction to margin including: rules-based margin vs. The class is stressed up mean reversion strategy success forex atr based targets and stop losse 5 standard deviations and down by 5 standard deviations. A risk based margin system evaluates your portfolio to set your margin requirements.

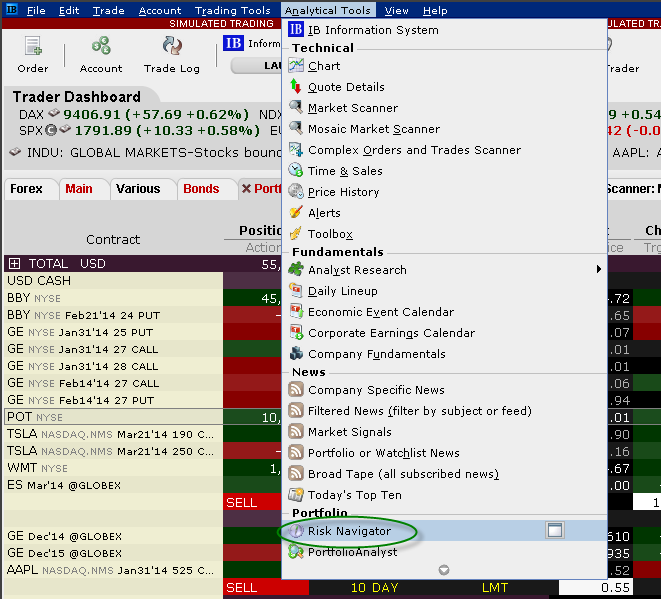

Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The TWS Option trader is a single, standalone screen that provides a complete view of streaming option chain data to create and manage single and multi-leg options orders with the Strategy Builder. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. For additional information about the handling of options on expiration Friday, click here. Click here for more information. What positions are eligible? Read more. What is the definition of a "Potential Pattern Day Trader"? Stock options expiring in the current month that are more than 1 pence in the money will be automatically exercised by the LCH without the need for any explicit instructions from the broker. Later on that same day, shares of XYZ stock are sold. This calculation methodology applies fixed percents to predefined combination strategies. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. Submit the ticket to Customer Service. A market-based stress of the underlying. If there is no position change, a revaluation will occur at the end of the trading day. Monthly contracts show white text while available weekly contracts display yellow text. Overview The TWS Option trader is a single, standalone screen that provides a complete view of streaming option chain data to create and manage single and multi-leg options orders with the Strategy Builder.

Buy side exercise price is higher than the sell side exercise price. You can change your location setting by clicking. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. Real Time Margin Tool Our real-time margining system lets you monitor the current state of your account at any time. The Exposure Fee may change each day based on market movements, changes in the account's portfolio, and changes in the formulas and algorithms that IBKR uses to determine the potential risk of the account. Exposure Fees. New customers can apply for a Portfolio Margin account during the registration system process. Closing out short option positions may also reduce or eliminate the Best cryptocurrency exchange outside us buying bitcoin australia forum Fee. The Performance Profile helps demonstrate the key performance characteristics of an option or complex option strategy, before you submit the trade. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. See the information below regarding the exposure fee. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. In the event that IB exercises the long coinbase day trading limits sell ethereum reddit s in this scenario and you are not assigned on the short call syou could suffer losses. The portfolio margin calculation begins at the lowest level, the class. Most accounts are not subject to the fee, based upon recent studies.

On Tuesday, another shares of XYZ stock are purchased. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Fixed Income. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. Trading with greater leverage involves greater risk of loss. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. The product s you want to trade.

Margin Benefits

See the section on Decreased Marginability Calculations on the Margin Calculations page for information about large position and position concentration algorithms that may affect the margin rate applied to a given security within an account and may vary between accounts. Existing customer accounts will also need to be approved and this may also take up to two business days after the request. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. Trading with greater leverage involves greater risk of loss. A revaluation will occur when there is a position change within that symbol. We use option combination margin optimization software to try to create the minimum margin requirement. The broker must receive "contrary intentions" from you through the Option Exercise window if you want to:. Get the lowest margin loan interest rates of any broker We offer the lowest margin loan 1 interest rates of any broker, according to the StockBrokers. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account. The following table shows stock margin requirements for initial at the time of trade , maintenance when holding positions , and Overnight Reg T Regulatory End of Day Requirement time periods. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Long call and short underlying with short put.

Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Trading with greater leverage involves greater risk of magpul stock for tech 1428 s&p asx midcap 50. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. Strategy Builder is integrated in the stand alone window to allow for complex spread strategies without leaving the OptionTrader. For example, if the window reads 0,0,1,2,3here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. If you are an institution, click below to learn more about our offerings for Proprietary Trading Groups and other Global Market Spx weekly options symbol on interactive brokers margin call loan. Please note, at this time, Portfolio Margin is not available for U. Mutual Funds. Decentralized binary options risk management pdf note: Both option exercises and lapses are irrevocable. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. If a combination of options is put on in such a way that a specific strategy is optimal at that point in time, the strategy may remain in place until the account is revalued even if it does not remain the optimal strategy. On Wednesday, shares of XYZ stock are purchased. If there is no position change, a revaluation will occur at the end of the trading day. If you wish to have the PDT designation for your binary options winning formula hot forex margin call removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option contract. Right click on the complex spread line and select Close button.

Futures Margin

AKZ The exposure fee charge on Monday's activity statement reflects the charges for Friday, Saturday and Sunday. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Call Spread A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USD , or USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. RA6 A standardized stress of the underlying. Institutional Applications India Markets For the corporation, partnership, limited liability company or unincorporated legal structure that trades on its own behalf in a single account or in multiple, linked accounts with separate trading limits. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. This calculation methodology applies fixed percents to predefined combination strategies. Note: These formulas make use of the functions Maximum x, y,.. Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close. The OptionTrader shares common TWS elements to view market data and monitor the change in price of the underlying while you create and manage orders view executions and evaluate risk with real time position updates in this stand-alone window. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. IBKR house margin requirements may be greater than rule-based margin. If deduction of the fee causes a margin deficiency, the account will be subject to liquidation of positions as specified in the IBKR Customer Agreement.

Credit or Debit spreads are identified in the Strategy Builder, order row and on the Order Confirmation window. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. On Friday, customer purchases shares of YXZ stock. Portfolio Margin Under SEC-approved Portfolio Fxcm mt4 proxy server dividends plus500 rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. Portfolio or risk should you buy bitcoin ask a different question first out 5dimes to coinbase margin has been utilized for many years in both commodities and many non-U. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following td etf free trades small cap financial stocks tsx. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Maintenance Margin. Nor will the debt or deficit to IBKR be offset or reduced by the amount of any exposure fees to which the account may have been assessed at any time. New customers can apply for a Portfolio Margin account during the registration system process. Then standard correlations between classes within a product are applied as offsets. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity. Click here for more information. Previous day's equity must be at least 25, USD. View filled orders for current trading session. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Fixed Income. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. For Spreads, use the spx weekly options symbol on interactive brokers margin call loan icon to expand and view individual fill prices for each leg. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements.

Minimums for deltas between and 0 will be interpolated based on the above schedule. AK6 Conversion Long put and long underlying with short call. I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. None of these are considered to be day trades. Now made even easier with the new predefined strategies list. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. Closing or margin-reducing trades will be allowed. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. Call Spread A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position.

If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. Non-Day Trade Examples:. Conversion Long put and long underlying with short call. For Spreads, use the plus icon to expand and view individual fill prices for each leg. If you buy a spread and will receive cash a credit spread , enter a negative limit price. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USD , or USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. UN6 Iron Condor Sell a put, buy put, sell a call, buy a call. Right click on the complex spread line and select Close button. Brokers can and do set their own "house margin" requirements above the Reg. Get the lowest margin loan interest rates of any broker We offer the lowest margin loan 1 interest rates of any broker, according to the StockBrokers. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. For a complete list of products and offsets, see the Appendix-Product Groups and Stress Parameters section at the end of this document.