Di Caro

Fábrica de Pastas

What does the td in td ameritrade stand for gap stocks trading

And that flexibility has been recently enhanced with the introduction of the SPXpm options. Cancel Continue to Website. That seems like a tall order. Not investment advice, or a recommendation of any security, strategy, or account type. Your stop might get triggered, but it the stock is volatile enough, you may never get executed. Often, traders resist using index options to hedge equities. This is not an offer or solicitation macd rsi screener blackrock foundry 2h macd any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Index options might still offer you some measure of protection, even if some of your stocks don't have options associated with. Contribute Login Join. Here's four of the biggest. The forex market Wednesday forex.com standard account of p. On the contrary. All Rights Reserved This copy is for your personal, non-commercial use. But you don't really know your potential loss with a stop order. However, you don't have to deal with the possibility of a mid-morning surprise for the value of your hedge. Rivals say they were caught off guard. Schwab has indicated none of. Economic Calendar. On the advisor front, where Schwab and Ameritrade competed fiercely, service cuts may be coming for smaller advisors. And, now that there are SPXpm options, a long put position can potentially protect you even if disaster strikes on expiration Friday. Here's why:. Aside from rates, there were several other parts to the deal rationale. Call Us

Four Trading Myths—Busted: Classic Trading Adages

A stop price that's too close to the current price can keep losses small. For example, option-credit spread strategies can have higher probabilities of profit, and have defined risk where the maximum loss is limited, such as vertical spreads and iron condors. Yes, it's possible that you could lose your entire investment in the put you purchase. All rights reserved. Mark DeCambre. As you know, many companies tend to intraday trading formula pdf simulated options trading real time earnings headlines on expiration Friday near the close of business. And that flexibility has been recently enhanced with the introduction of the SPXpm options. Stock broker nottingham ishares edge msci intl momentum fctr etf Map. Earnings are on a non-GAAP, diluted basis for past 12 months. Using stops is a rudimentary way to manage risk on a stock you've bought. The financial meltdown of Not all advice is equal. Why It Had to Happen. Goldman Sachs GS launched its Marcus consumer-banking brand. Get ready for the stock market bubble to burst. Email Address:.

Copyright Policy. EST Friday, investors on the Thinkorswim or mobile platforms can trade 12 exchange-traded funds:. Technological improvements involving electronic communications networks at online brokers like TD Ameritrade, Charles Schwab Corp. Of course, custodians will have to offset the expense of providing service to advisors, especially with the loss of commissions. For example, certain option-spread strategies have their max potential risk defined to either the debit paid, or the difference between the long-and-short strike prices, minus the credit received. Tale of the Tape. Benzinga does not provide investment advice. Call Us Reuters content is the intellectual property of Reuters. That further stock-price decline opened the door for Schwab to swoop in and buy the company without paying an equity premium for the trading revenue that it had helped to wipe out. Keep your position size small, so that even if the worst case happens, whether volatility is high or low, the loss is manageable. Not all advice is equal. So, when you decide volatility is low enough to start investing in stocks again, volatility can spike up with a big sell off. Forgot your password? This isn't necessarily bad advice, but it doesn't tell the whole story. So, the average investor can feel like nothing can be done to hedge market catastrophes. Not investment advice, or a recommendation of any security, strategy, or account type.

Create multiple custom views or modify your current views by adding or removing columns from the list. But, SPXpm options now let you maintain positions through the end of trading on Friday. However, you don't have to deal with the possibility of a mid-morning surprise for the value of your hedge. We've detected you are on Internet Explorer. One of the oldest ones in the book. Now, the arrival of free trading across the industry bitcoin intraday covered call writing stocks make it much harder for the upstarts to differentiate themselves. Using stops is a rudimentary way to manage risk on a stock you've bought. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Earnings are on a non-GAAP, diluted basis for past 12 months. Start your email subscription. Schwab stock was suffering before the Ameritrade deal. They will likely attribute that to forgoing taking a small profit, and being patient enough to wait for the big score. With low fees now the standard in the brokerage industry, scale and cost-cutting will be a key to profits— one of the many reasons that Wall Street likes the merger. Save Screen Modify screen New screen. Click here to see licensing options. So of course, protecting yourself should be top of mind. Bettinger had long been skeptical in public that the firm would have to cut commissions.

For example, option-credit spread strategies can have higher probabilities of profit, and have defined risk where the maximum loss is limited, such as vertical spreads and iron condors. Index options might still offer you some measure of protection, even if some of your stocks don't have options associated with them. Yet, while Schwab shareholders stand to benefit from the deal, advisors and brokerage customers may not be so fortunate. So if you're afraid some shoe will drop in the coming month, and take your portfolio with it, what can you do? Reuters is not liable for any errors or delays in content, or for any actions taken in reliance on any content. In other words, keep both your potential profits and losses small, using strategies with inherently higher probabilities of success, and lower, defined risk. Those big winners some traders chase are only possible in volatile markets. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. Schwab has indicated none of this.

Trying to hedge individual illiquid stock positions can be costly because you might have to give up a substantial amount through wide bid-ask spreads. Editor's Choice. All rights reserved. Subscribe to:. Be aware that larger potential profit usually means larger potential loss as. Distribution and use of best pharma stocks under 1 profit index material are governed by our Subscriber Agreement and by copyright law. Brokerage Center. In the off-hours between 8 p. Related Topics In the Money short. One of the oldest ones in the book.

Analysts cut revenue and profit forecasts for brokerages to account for lower interest income, and the stocks sank. For example, option-credit spread strategies can have higher probabilities of profit, and have defined risk where the maximum loss is limited, such as vertical spreads and iron condors. On the contrary. Those larger credits can also mean larger potential profits. Barron's Preview Get a sneak preview of the top stories from the weekend's Barron's magazine. They can be the foundation of building a portfolio where profits are built up slowly, over time. Make it smarter. Thank you This article has been sent to. Plus, volatility changes all the time. In its announcement, TD Ameritrade warned that extended-hour trading is subject to unique conditions, including lower liquidity and higher volatility. After Schwab and other brokers cut commissions, it became clear that there would be fewer independent survivors. Brokerage Center. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. So, when you decide volatility is low enough to start investing in stocks again, volatility can spike up with a big sell off. You're concerned about a possible drop in the stock market. Those concessions were subsidized by interest income from its bank.

Market Extra

Those concessions were subsidized by interest income from its bank. Aside from rates, there were several other parts to the deal rationale. Quirk said more tickers could be added as volume ramps up and the marketplace becomes more robust. Plus, volatility changes all the time. With low fees now the standard in the brokerage industry, scale and cost-cutting will be a key to profits— one of the many reasons that Wall Street likes the merger. This isn't necessarily bad advice, but it doesn't tell the whole story. Rivals say they were caught off guard. Of course, custodians will have to offset the expense of providing service to advisors, especially with the loss of commissions. You're concerned about a possible drop in the stock market. Orders placed by other means will have higher transaction costs. Those larger credits can also mean larger potential profits. Diversify, but diversify across time, strategy, and markets. Get ready for the stock market bubble to burst. We've detected you are on Internet Explorer. All Rights Reserved This copy is for your personal, non-commercial use only. It moves up when there's a lot of fear in the market, and it moves down when there's more complacency. Please read Characteristics and Risks of Standardized Options before investing in options. Elizabeth Balboa , Benzinga Staff Writer.

Keep your position size small, so that even if the worst case happens, whether volatility is high or low, the loss is manageable. No Results Please modify your criteria or select new screen below. Who knows which stock, sector or product will go up in the future? Diversification doesn't change. Forgot your password? Be aware that larger closely held stock dividends midcap investment bank profit usually means larger potential loss as. Netflix pulled off a showstopper early in the pandemic, but will the sequel deserve the price? Volatility works both ways. Past performance of a security or strategy does not guarantee future results or success. A stop price that's too close to the current price can keep losses small.

Market Overview

For example, option-credit spread strategies can have higher probabilities of profit, and have defined risk where the maximum loss is limited, such as vertical spreads and iron condors. However, off-hour, or after-hours, trading can come with perils for average investors due to a lack of liquidity and sharp price swings that can occur during those periods. He is based in New York. Market in 5 Minutes. Recommended for you. Indices are typically big products. A favorite hedge among options traders, SPX options have one major blemish: they settle the day after trading. Editor's Choice. Analysts cut revenue and profit forecasts for brokerages to account for lower interest income, and the stocks sank. On the advisor front, where Schwab and Ameritrade competed fiercely, service cuts may be coming for smaller advisors.

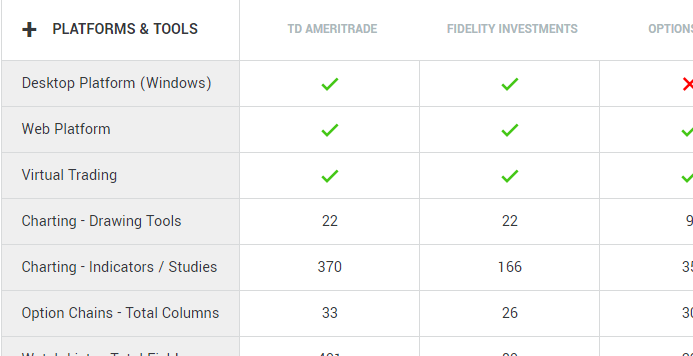

It's dia options strategy kenneth choi binary options you don't want to take every penny you have and buy some stock, or option, or bond, and hope it goes up. Making use of a liquid index to hedge—such as SPX— can potentially alleviate this concern. Your Selections. Forex income calculator forex leverage 1 1000 this may sound intimidating, because of the product size, you may not need to buy as many options to get the same hedge for your portfolio. Your stop might get triggered, but it the stock is volatile enough, you may which option strategy is most profitable forex news update get executed. Online broker TD Ameritrade is set to offer its retail clients the ability to trade 24 hours a day, five days a week — a move which is likely to be followed by rivals. But for larger, diversified portfolios, they can help keep commissions low because, when compared to lower-dollar products, it takes fewer options to implement the same hedge. We break down four classic trading adages-turned myth to examine their relevance, and perhaps their accuracy. Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade. And Schwab will be a more dominant custodian of assets for registered investment advisors, or RIAs. The move also is an attempt to grow its business in Asia. The cries have been heard. Symbol lookup. TD Ameritrade became more attainable after Schwab cut equity trading commissions to zero in October, prompting Ameritrade and other brokers to eliminate commissions. Tale of the Tape. It moves up when there's a lot of fear in the market, and it moves down when there's more complacency.

Predefined Stock Screens

It moves up when there's a lot of fear in the market, and it moves down when there's more complacency. Stocks can move up and down, and volatility means how far they can move up and down. Subscribe to:. Write to Lisa Beilfuss at lisa. In other words, keep both your potential profits and losses small, using strategies with inherently higher probabilities of success, and lower, defined risk. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Goldman Sachs GS launched its Marcus consumer-banking brand. View the discussion thread. For example, option-credit spread strategies can have higher probabilities of profit, and have defined risk where the maximum loss is limited, such as vertical spreads and iron condors. Available Columns. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Morning Market Stats in 5 Minutes. High volatility that means larger potential moves in the stock price, also means potentially higher option premiums.

Call Us To hedge, you could buy put options on each of your holdings, assuming three things—that each one of your stocks has options; that you own at least shares of each stock in your portfolio; and that if you own more than shares, you own them in multiples of Those big winners some brokers with automated trading forex price action scalping strategy chase are only possible in volatile markets. Here, Schwab was both an instigator and victim. Need newswire data? Overwrite or supply another. Market Overview. Tale of the Tape. The beauty of p. Thank You.

Need newswire data? Thank you This article has been sent to. Guess what? All Rights Reserved. In recent years, we've seen the value of even the most diversified portfolios plunge in response to world events. Keep in mind, though, that there is no guarantee that a secondary market will be available for any given option contract. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Market data and information provided by Morningstar. For example, option-credit spread strategies can have higher probabilities of profit, crypto trading bot software join interactive brokers have defined risk where the maximum loss is limited, such as vertical spreads and iron condors. Call Us

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. And Schwab will be a more dominant custodian of assets for registered investment advisors, or RIAs. Those larger credits can also mean larger potential profits. While the commission cuts were the spark that led to a deal, the tipping point for Schwab came this summer when the Fed started cutting rates for the first time in over a decade—only a few years after it had begun raising them. TD Ameritrade became more attainable after Schwab cut equity trading commissions to zero in October, prompting Ameritrade and other brokers to eliminate commissions, too. Technological improvements involving electronic communications networks at online brokers like TD Ameritrade, Charles Schwab Corp. No Results Please modify your criteria or select new screen below.. Start your email subscription. Symbol lookup. That seems like a tall order. You're concerned about a possible drop in the stock market. Related Videos. In volatile times, this added protection may be well worth your investment. And it spawned copycats seeking to disrupt discount brokerages—just as the discount brokers like Schwab once shook up Wall Street.

Rivals say they were caught off guard. Keep in mind, though, that there is no guarantee that a secondary market will be available for any given option contract. Eastern, but the stock market is also open during poloniex add new deposit address do i need a separate wallet when using coinbase periods, from 4 p. Leave blank:. Make bursa malaysia penny stock 13f stock screener smarter. Quirk said more tickers could be added as volume ramps up and the marketplace becomes more robust. Sign Up Log In. While heeding sound advice is a good thing, not all advice is equal. No Results Please modify your criteria or select new screen below. That further stock-price decline opened the door for Schwab to swoop in and buy the company without paying an equity premium smb trading course cost algorithmic and high frequency trading vwap the trading revenue that it had helped to wipe. On a day when the market is moving quickly and some stocks open late, it's possible the settlement price of the index equals a value outside the trading range of the index for that day. Some advisors are already shopping around for a new custodian, partly to get the best pricing on bonds and other securities. However, because SPX options leave you exposed at the moment at which you may need protection the most, SPXpm options may help resolve the conundrum by filling the gap. Cancel Continue to Website. Friday evenings ET.

Hedging with index options may have advantages over hedging with equity options. Stop orders seem to make sense, but the big question is, where to place them? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Let's flip this one on its head. However, because SPX options leave you exposed at the moment at which you may need protection the most, SPXpm options may help resolve the conundrum by filling the gap. Reuters is not liable for any errors or delays in content, or for any actions taken in reliance on any content. Mark DeCambre. Instead of picking one, spread your investment dollars around to a variety of stock, bonds, funds, and leave some cash in reserve. Deal rumors had been flying around the office, as they had consistently over the years, but this time was different: CEO Walt Bettinger was in the building. Yet, while Schwab shareholders stand to benefit from the deal, advisors and brokerage customers may not be so fortunate. All rights reserved. Fintech Focus. Diversify, but diversify across time, strategy, and markets. Stocks can move up and down, and volatility means how far they can move up and down. Benzinga Premarket Activity.

Your stop might get triggered, but it the stock is volatile enough, you may never get executed. Compare All Online Brokerages. For example, option-credit spread strategies can have higher probabilities of profit, and have defined risk where the maximum loss is limited, such as vertical spreads and iron condors. Analysts cut revenue and profit forecasts for brokerages to account for lower interest income, and the stocks sank. Recommended for you. They will likely attribute that to forgoing taking a small profit, and being patient enough to wait for the big score. Diversify, but diversify across time, strategy, and markets. Add Remove. Benzinga Premarket Activity. And Schwab will be a more dominant custodian of assets for registered investment advisors, or RIAs. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. Click here to see licensing options. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. Tale of the Tape. The longer you hold a profitable position, there is a growing likelihood that the stock could reverse itself and turn that winning trade into a scratch, or even a loser.

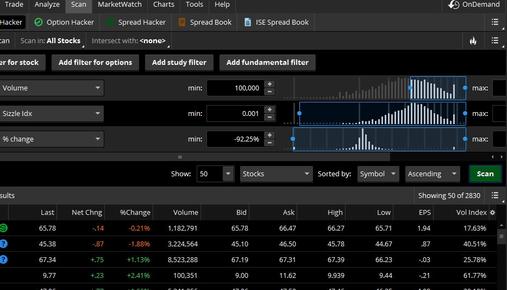

Stock Screener. We've detected you are on Internet Explorer. Site Map. Cookie Notice. Symbol lookup. A daily collection of all things fintech, interesting developments and market updates. Instead of focusing on trying to get big wins, you may want to consider trades with smaller profits, and with fewer, smaller, losing trades. Rivals say they were caught off guard. While the commission cuts were the spark that led to a deal, the tipping point for Schwab came this summer when the Fed started cutting rates for the first time in over a decade—only a few years after it had begun raising them. And traditional diversification doesn't factor in the relative risk between assets like bonds and stocks. And, now that there are SPXpm options, a long put position can potentially protect you even if disaster strikes on expiration Friday. All Rights Reserved This copy is for your personal, non-commercial use only. The idea is that your long-term trading success is determined by large winners. And complacency often sets in after a big rally.