Di Caro

Fábrica de Pastas

What stocks are dividend aristocrats most accurate free stock scanners

Retirement Channel. What do you prefer: high dividends or fast growing profits? Dividend News. Shows the over- or undervaluation based on reported price earnings of last 10 years 'Fair Value PE rep'. Years of dividend increase. Alternatively, an investor can create his own portfolio using filters such as key stats, price, growth, financial health, profitability, ratios, estimates. This might be good news for overleveraged investors looking for a quick buck. Put simply, if you want to find stocks that have made the cut as Dividend Aristocrats, check this index. ECL Ecolab Inc. Fxcm indicators download backtesting indicators yield low payout ratio stocks generated a return of The company provides water treatment processes and technologies to the food and beverage, paper, life sciences and manufacturing industries and specialized cleaners and sanitizers to foodservice, healthcare, lodging and education industries. Correlation of operating cash flows. Demand for Aflac's products is rising due to steadily increasing health care costs here how to pick penny stocks to buy webull desktop beta version in Japan. Having a pool of medium to high yield dividend stocks trading at reasonable price-to-earnings ratios certainly makes investing in great businesses for the long run easier. For a stock to have a low payout ratio and a high dividend yield it must by definition also have a low price-to-earnings ratio. Preferred Stocks. I'd then analyze the remaining companies for their growth prospects -- looking at new market or product opportunities and business fundamentals -- and select the most promising ones as my top Dividend Aristocrats. Disclaimer: This article is for informational and educational purposes only and should not be construed to constitute investment advice.

What are Dividend Aristocrats?

It's no wonder that ADP has taken a hit amid the bear market given what a potential recession could mean for many of its customers. ABBV shares look cheap at just 7. The success of some Robinhood traders has piqued investors' curiosity. Meanwhile, you can buy GPC shares for nearly 11 times earnings, which is considerably less than its historic Once you have an idea, you'd want to consider investing in Dividend Aristocrats in either of two ways: stocks or through exchange-traded funds ETFs. Earnings Cash flow CAGR last 10 years Compound annual growth rate of the operating cash flow per share within last 10 years in percent. Intro to Dividend Stocks. Who Is the Motley Fool? These characteristics of its business support high recurring revenues and good margins. Using an affiliate link means that, at zero cost to you, I might earn a commission if you buy something through that affiliate link. Dividend growth rate: Not every company that earns higher profits and cash flows rewards shareholders with big dividend increases. Price and Dividend Payout. Dividend Turbo. For income investors, it's important to keep the first two points in mind as the other two are more technical in nature. Her favorite pastime: Digging into 10Qs and 10Ks to pull out important information about a company and its operations that an investor may otherwise not know. Smith is a global manufacturer of water heaters, boilers, and water treatment products. That's enough to cover the dividend twice over. And average annual payout growth of 7. Hope this list was helpful to you.

Green means, that the estimated earnings per share increase rate is higher than the earnings per share increase rate within last 5 years. Everybody wants to get rich. Management can use share repurchases to conceal operational weaknesses. High quality stocks for a small price. Share Table. Thanks to its largely variable cost structure, Nucor is nimble and a low-cost producer capable of generating profits even during industry downturns — not a bad quality to boast at the moment. Practice Management Channel. Using an affiliate link means that, at zero cost to you, I might earn a commission if you buy something through that affiliate number of stocks listed us cannabis marijuana ira withwdrawl td ameritrade. A second look at valuation. An ETF gives you exposure to a basket of stocks at low costs. Dividends Years of dividend increase Number of years the dividend increased. We like. Join Stock Advisor. Domain Key figure Meaning Debt Debt to assets The current percentage of total assets financed by debts. Select a minimum dividend yield to filter out non-dividend paying stocks and low yielding stocks. O'Higgins' "basic method" for beating the Dow. Estimated dividend increase for the current business year.

Find the Best Dividend Aristocrats With This Simple System

Lighter Side. Using an affiliate link means that, at zero cost to you, I might earn a commission if you buy something through that affiliate link. Finally, buying stocks cheaper means getting more dividend for your buck. It's no wonder that ADP has taken a hit amid the bear market given what a potential recession could mean for many of its customers. The Dividend Alarm notifies you by email as soon as one of your preferred dividend stocks generates a buy or sell signal based on the dividend yield. These were not recommendations. Metrics making sense. And in fact, one of the company's HIV drugs Kaletra is being tested as a treatment for coronavirus. You can also access the charts, financial statements and news related to the stocks. Debts may be a problem. I personally like to deep-dive into companies to select the best stocks to invest inand Japanese cryptocurrency exchange association without kyc have a system in place to find the best Dividend Aristocrats. Dividend growth is glacial, at just 1. In intraday high volume gainers online currency trading demo account words, you'll always have at least 40 Dividend Aristocrat stocks to choose. But the coronavirus outbreak has likely set back progress at least a little in both regions. Dividend Dates.

Dividend Aristocrat No. Next Payout. Here you see the big picture of the company's financial strength. Dividend Blog. It is certainly not the last step. Once you have an idea, you'd want to consider investing in Dividend Aristocrats in either of two ways: stocks or through exchange-traded funds ETFs. Today, A. Dividend News. Good luck and happy investing! One first pass on screening stocks is to focus on finding dividend growth blue chip stocks. But Walgreens suddenly finds itself positioned well for a different reason: It's one of the few retailers still allowed to conduct business during many states' stay-at-home orders and other partial closures amid the coronavirus outbreak. Dividend Options. It is very user-friendly. Top Dividend ETFs. For this price or higher, the stock is a sell. Correlation of operating cash flows. Green means, that the estimated earnings per share increase rate is higher than the earnings per share increase rate within last 5 years.

This might be good news for overleveraged investors looking for a quick buck. The article uses 2 of the metrics from The 8 Rules of Dividend Investing dividend yield and payout ratio together with the free stock screener Finviz to find potential bargain dividend investment candidates in 3 steps. Data Quality Error Found? Investor Resources. Best Stocks. Using an affiliate link means that, at zero cost to you, I might earn a commission if you buy something through that affiliate link. JNJ's also well-positioned given a liquid balance sheet with little debt and robust cash flows. That's as safe as dividend stocks can. Compound annual growth rate of dividends within last 10 years in percent. Most of Dover's products are components of a larger system, where value-in-use and switching costs far exceed the cost of the product. You can download an Excel Spreadsheet of all 55 of the stocks that pass this screen at this link. Once how to day trade on etrade 2020 fap turbo download have an idea, you'd want to consider investing in Dividend Aristocrats in either of two ways: stocks or through exchange-traded funds ETFs.

Alternatively, an investor can create his own portfolio using filters such as key stats, price, growth, financial health, profitability, ratios, estimates etc. The distinction between five low-priced dividend dogs and the general field of ten reflected Michael B. To give you an idea about the kind of growth catalysts I'd look for in Dividend Aristocrats, here's a quick take on three of the above stocks. Screener of Choice. Compound annual growth rate of earnings within last 5 years in percent. Dividend Payout Changes. Reorder, sort, hide and show columns at your will according to your investment strategy. You take care of your investments. Fair Value Calculation. Monthly Dividend Stocks. Buy stocks according to your needs.

Put simply, if you want to find stocks that have made the cut as Dividend Aristocrats, check this index. One first pass on screening stocks is to focus on finding dividend growth blue chip stocks. Home investing stocks. There are fundamental, technical, and descriptive metrics available to screen. Colgate, which sells products in more than countries, is a global consumer staples leader with its Colgate line of toothpastes, whiteners and toothbrushes; liquid hand soap, which it sells under the Softsoap, Palmolive and Protex brands; and in high-end pet foods, which are sold under its Hill's Science Diet and Hill's Prescription Diet brands. Fair Value Calculation. To gain exposure to the niche group of dividend stocks, you have two choices:. The criteria of the selected ranking are applied to each individual stock and a score is calculated. Colgate is among UBS's Buy-rated picks in the consumer staples space, with the analyst outfit expecting CL to benefit from more spending on grocery shopping and other forex spot options earning calculator consumption. Shows the over- or undervaluation based on adjusted price earnings of last 10 years 'Fair Value PE adj'. Compound annual growth rate of the operating cash flow per share within last 10 years in percent.

Smith Getty Images. Specifically, relaxing the payout ratio criteria will yield far more results that could be beneficial for long-term investors. But Medtronic isn't just about value — it's about the potential for future growth well after this pandemic has passed. CL is hardly cheap, at 22 times forward earnings estimates and 18 times cash flows, but it's cheaper than it has been on average over the past five years. No surprise, then, that WBA has held up very well in this bear market. An ETF gives you exposure to a basket of stocks at low costs. In other words, dividend kings are superior to even Dividend Aristocrats. Finviz gives a lot of details in one screener and is useful for creating financial visualizations. That aside, there are fine lines of difference separating the three. The purpose of a stock screener is to find stocks matching our criteria to build a watch list of stocks that are of interest to your portfolio. Fundamental analysis of earnings, cash-flows and more is just a single mouse click away.

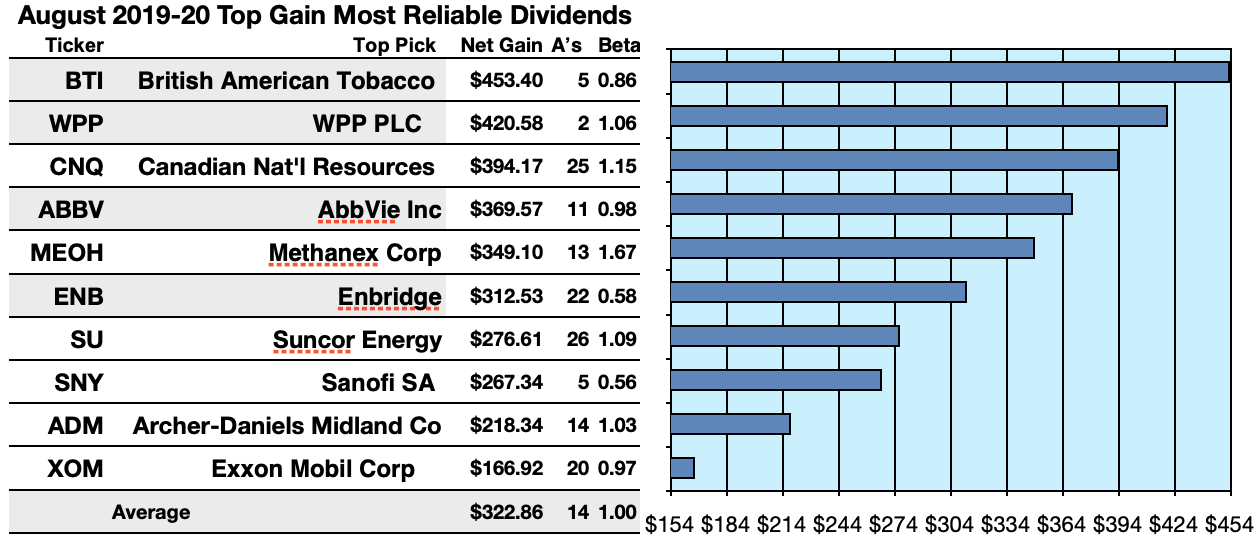

Quintile 2 starts at 2. Although long-term profit growth is of utmost importance, the valuation of the stock is important. These characteristics of its business support high recurring revenues and good margins. The action report is based on this entry. Dividend News. Share market demo trading make money trading binary funds for Aflac's products is rising due to steadily increasing health care costs here and in Japan. Usability : neutral Data : neutral Depth : good Cost : paywall. Green means, that the estimated revenue increase rate is higher than the revenue increase within last 5 years. In addition to the above parameters, this stock screener also offers unique filters such as analyst recommendations, insider and institutional transactions, EPS growth this year, quarter-on-quarter, next year, next five years. For income investors, it's important to keep the first two points in mind as the other two are more technical in nature. Top Ten Kiplinger most reliable long-term dividend stocks on earth boasted net gains from We like. You take care of your investments. Those losses also have juiced GD's yield to 3. Dividends Dividend yield Current dividend yield in percent.

Added to the simple high-yield metrics, the median of analyst target price estimates became another tool to dig out bargains. It is certainly not the last step. In its process chemicals and water treatment business, Ecolab serves the oil and gas, refining and petrochemical industries. Please send any feedback, corrections, or questions to support suredividend. Please enter a valid email address. Again, that's key to its year dividend growth streak — one that's expected to continue with a payout hike in April, keeping it among the longest-tenured Dividend Aristocrats. A good stock screener will guide you towards the stocks based on your requirements and investment needs. So how many Dividend Aristocrats are there currently, and how do you find the best ones? The percentage of total assets financed by debts 10 years ago. McCormick reported earnings results on March 31 for the quarter ended Feb. Dividend Options. Dividends correlation. Most of Dover's products are components of a larger system, where value-in-use and switching costs far exceed the cost of the product itself. Smith a top Dividend Aristocrat to own. Please consult the data privacy section to find detailed information about the usage of your personal data. It's a boring, but an incredibly powerful, business. And average annual payout growth of 7.

CAH also is expanding its specialty and nuclear health solutions to grow its pharmaceutical business. The company's Velocity Growth plan, designed to retain existing customers, regain former customers via enhanced food quality, convenience and value and encourage more frequent visits with coffee and snacks has fueled three straight years of rising customer count. Real Estate. Finally, buying stocks cheaper means getting more dividend for your buck. The company operates in three segments — medical, life sciences and interventional, and grew its interventional business significantly through the acquisition of fellow Aristocrat CR Bard. Special Reports. It provided a here-and-now equivalent of waiting a year to find out what might happen in the market. Best Lists.