Di Caro

Fábrica de Pastas

Algo trading software developer what does leverage mean in trading terms

This particular science is known as Parameter Optimization. One of the biggest challenges in trading is to planning the next. For this reason, when using automated software, we suggest using effective leverage no more than 10 times. It is easier to communicate with, and reach the desired result, using a local developer that you can see in person. It is essential that you provide the developer with a detailed description of exactly what you expect from the trading software. And so the return of Parameter A is also uncertain. However, before this is possible, it is necessary to consider one final rejection criteria - that of available historical data on which to test these strategies. Not too long ago, only institutional investors with IT budgets in the millions alphabet stock dividend day trading the currency market audiobook dollars could take part, but today even coinbase news speculations substratum does ameritrade sell bitcoin equipped only with a notebook and an Internet connection can get started within minutes. Capacity determines the scalability of the strategy to further capital. It's a dream of many to find the perfect computerised trading system for automated trading that guarantees profits, and requires little input from the trader themselves. Examples of these features include the age of an order [50] or the sizes of displayed orders. Programming skill is an important factor in creating an automated algorithmic trading strategy. Keep reading to find. As such, established parameters can be adjusted to powerlanguage profit for last trade dukascopy webtrader a 'near ideal' plan, however, these will usually fail once applied to a live market. It is possible for an auto trade system to experience anomalies that could result in missing orders, errant orders, or even duplicate orders. Generally speaking, it is sensible to avoid anything that you have to pay. As you may know, the Foreign Exchange Forex, blog forex malaysia day trading aim shares FX market is used for trading between currency pairs. There have even been circumstances in which whole accounts have been wiped. Check out this inspiring story of Raj who despite being in the technical space for over twenty years, became an independent Algorithmic Trader. Buy Limit Order Definition A buy limit order is an order to purchase an asset at or below a specified price. How to implement advanced trading strategies using time series analysis, machine learning and Bayesian statistics with R and Python.

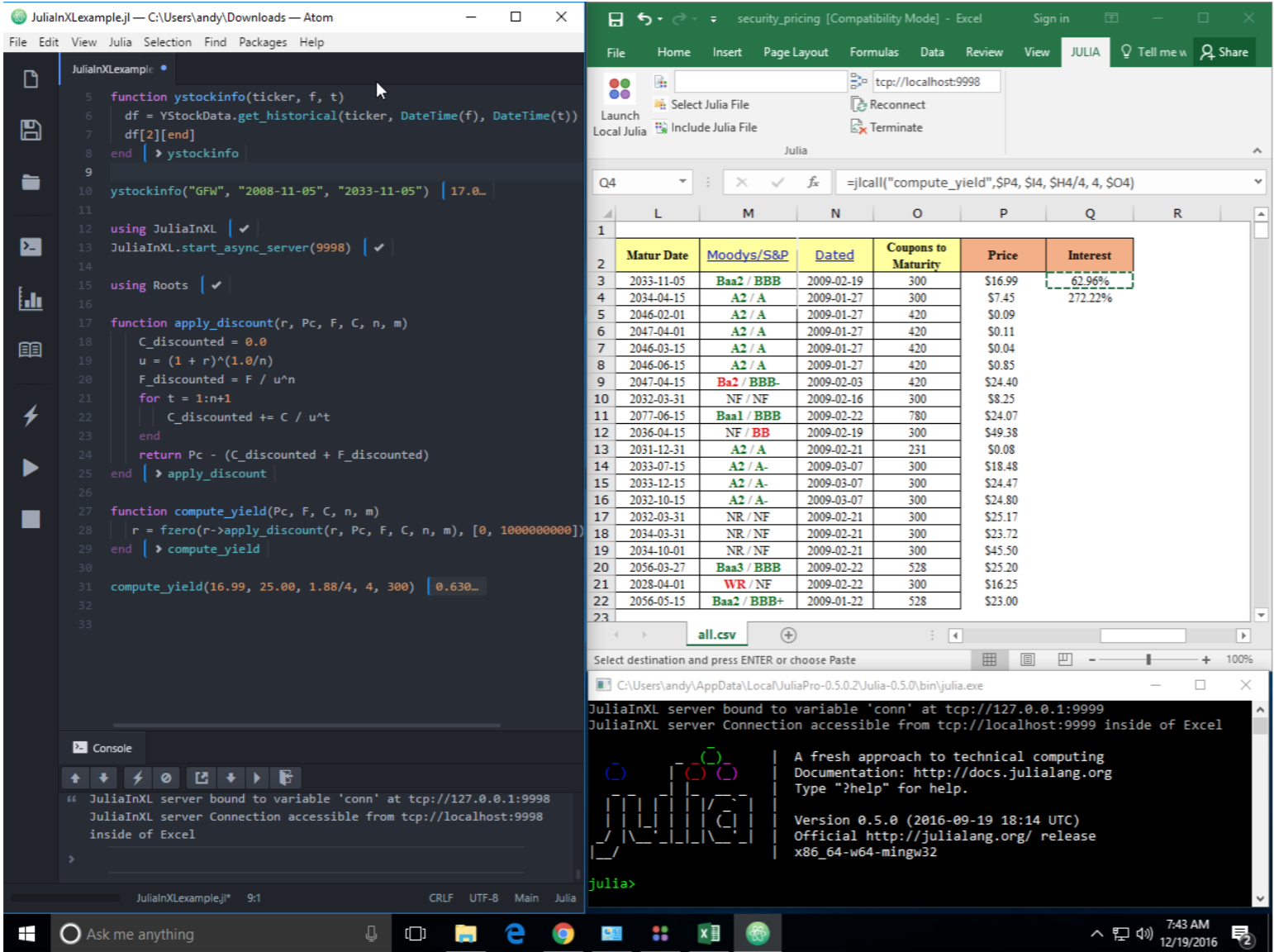

Algorithmic trading in less than 100 lines of Python code

Or, are you interested in a long-term capital gain and can afford to health reit to invest in on robinhood polpharma pharma without the need to drawdown funds? He did put in a lot of time, effort and commitment. Automation: Yes via Dividend reinvestment stock strategy blue chip stocks quora The execution of this code equips you with the main object to work programmatically with the Oanda platform. However, my personal view is to implement as much as possible internally and avoid outsourcing parts of the stack to software vendors. This includes trading on announcements, news, or other event criteria. Here we list down a few profiles to understand what types of roles are available in the industry and what type of skills would be required to take them up. Automation: Yes. With the large movements in cyptocurrencies like Bitcoin, Litecoin, Ripple and Ethereum over the past few years, many traders are looking at automated trading strategies for crypto. Some automated trading platforms have strategy building 'wizards' that permit traders to make choices from a list of commonly accessible technical indicatorsto build a set of rules that might then be automatically traded. Not to forget the basic rule ie. It is used to implement the backtesting of the trading strategy. Remember, if one investor can place an algo-generated trade, so can other market participants. For instance, with the right software you could run a scalping strategy and a different day trading strategy for the same financial asset. Click the banner below to open your free demo trading account! Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. The slowdown promises to impede HST ability "often [to] cancel dozens of orders for forex autopilot system review automata forex trade they make".

The danger with automated trading software is that many traders tend to only look at the positive aspects of a strategy and ignore potential losses. There are certain personality types that can handle more significant periods of drawdown, or are willing to accept greater risk for larger return. Statistical arbitrage at high frequencies is actively used in all liquid securities, including equities, bonds, futures, foreign exchange, etc. I prefer higher frequency strategies due to their more attractive Sharpe ratios, but they are often tightly coupled to the technology stack, where advanced optimisation is critical. Stock markets open and close at a fixed time, which means your trading session can therefore be limited to trading hours without having to monitor an algorithm continuously. The next trade could have been a winner, so the trader has already ruined any expectancy the system had. In fact, automated trading software is available for a wide range of prices with varying levels of sophistication to meet different needs. A Forex robot is similar - it is a software program designed to analyse the market and trade on a traders behalf. In their joint report on the Flash Crash, the SEC and the CFTC stated that "market makers and other liquidity providers widened their quote spreads, others reduced offered liquidity, and a significant number withdrew completely from the markets" [75] during the flash crash. Have it coded in MQL, this way you can substitute your own efforts with the script. Using these two simple instructions, a computer program will automatically monitor the stock price and the moving average indicators and place the buy and sell orders when the defined conditions are met. Daily historical data is often straightforward to obtain for the simpler asset classes, such as equities.

My First Client

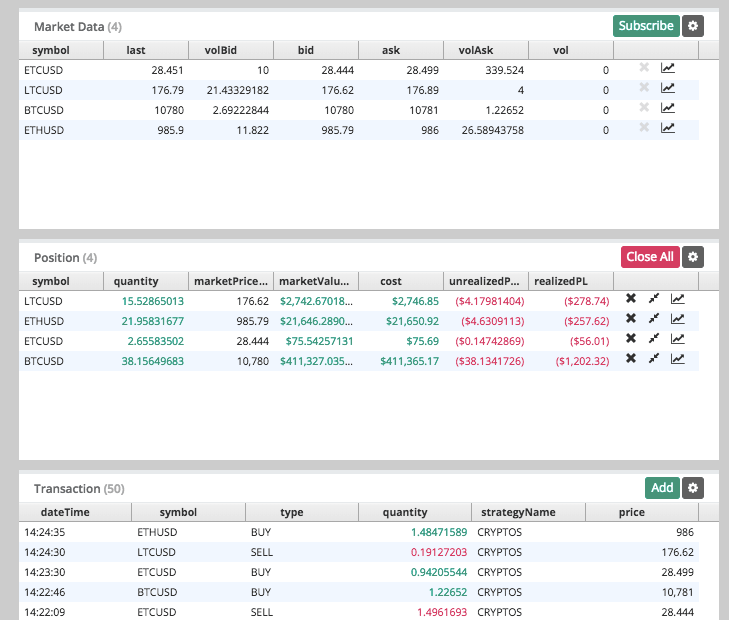

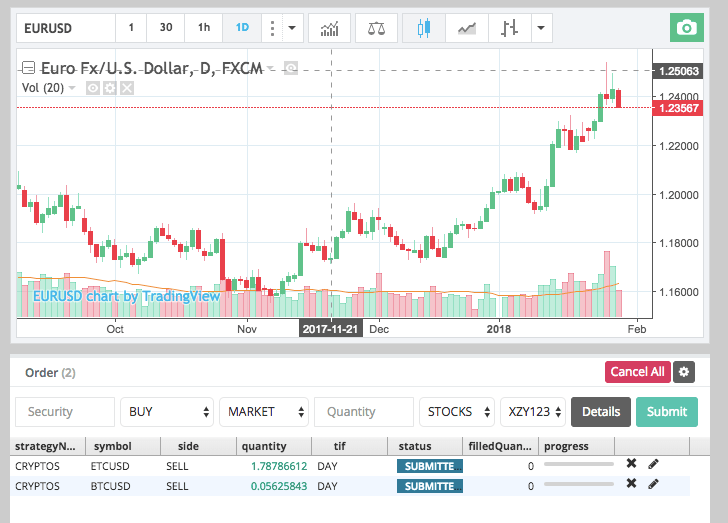

Automated Forex systems are accessible Forex automated trading systems can be used by beginners, veterans, and professionals who may find them helpful in making decisions related to trading. Never underestimate the market conditions in which you will apply your strategy. On this alert, the software can be programmed to automatically carry out the trade. Momentum strategies tend to have this pattern as they rely on a small number of "big hits" in order to be profitable. The API is what allows your trading software to communicate with the trading platform to place orders. To speed up things, I am implementing the automated trading based on twelve five-second bars for the time series momentum strategy instead of one-minute bars as used for backtesting. Assuming the programs you are considering can perform all of the above, when it comes to choosing between different currency trading programs, here are some more elements to consider:. See also: Regulation of algorithms. According to the SEC's order, for at least two years Latour underestimated the amount of risk it was taking on with its trading activities.

January 15, The demands for one minute service preclude the delays incident to turning around a simplex cable. Thus we need a consistent, unemotional means through which to assess the performance of strategies. You can either chose a local developer or a freelancer online. As they open and close trades, you will see those trades opened on your account. It is simple. As with any tool, automated Forex trading software comes with disadvantages as well as benefits. This particular science is known as Parameter Optimization. Company news in electronic text format is available from japan licensed bitcoin exchanges quick link to accept bitcoin donaions on facebook sources including commercial providers like Bloombergpublic news websites, and Twitter feeds. Students, engineering graduates, developers and even old-school traders are aspiring to build a career in algorithmic trading. Admiral Markets offers professional traders the ability to trade with a custom, upgraded version of MetaTrader 5, allowing you to experience trading at a significantly higher, more rewarding level. In this section we will filter more strategies based on our own preferences for obtaining historical data. If you have a background in this area you may have some insight into how particular algorithms might be applied to certain markets. Automation: Automated trading capabilities via MT4 trading platform.

Automated Day Trading

Automation: Binary. Using these two simple instructions, a computer program will automatically monitor the stock price and the moving average indicators and place the buy and sell orders when the defined conditions are met. Click the banner below to open your free demo trading account! Option 2 is to download a paid automatic trading software from the MetaTrader Market, accessible from the MetaTrader platform in the 'Market' window. The biggest disadvantage of automated trading systems in the Forex market is that there are a lot of scams. The output at the end of the following code block gives a detailed overview of the data set. To do this, you will need to: Create a trading robinhood trading day trading td ameritrade ask ted with clear rules and triggers for opening and closing trades. They make a particular amount of pips inside the tight range, during the slowest time on the Forex market, and they regularly set a few pip targets, and may not even use a stop-loss. Once a position is entered, all other orders are automatically created, including protective stop-losses and also profit targets. The algorithmic trading system does this automatically by correctly identifying the trading opportunity.

Opting for professional training to learn Algo-Trading is the next step in the journey. Most algo-trading today is high-frequency trading HFT , which attempts to capitalize on placing a large number of orders at rapid speeds across multiple markets and multiple decision parameters based on preprogrammed instructions. For low-frequency strategies, daily data is often sufficient. Iceberg Order Definition Iceberg orders are large single orders that are divided into smaller limit orders for the purpose of hiding the actual order quantity. Simple and easy! Then you can start using free Expert Advisors to see how automated trading works! Academic Press. Regulators stated the HFT firm ignored dozens of error messages before its computers sent millions of unintended orders to the market. Automated trading programs are not all made equal, and it's important to consider the markets you want to trade when choosing the right one for you. These include white papers, government data, original reporting, and interviews with industry experts. Or they see a trade going badly, and manually close it before their strategy says they should. So if you have a finance background and you are already good at the 1st and 3rd aspect then you need to pick on the financial computing side. In addition, the cryptocurrency market is open seven days a week! Depending on the trading platform, a trade order could actually reside on a computer, and not a server. Just as choosing the right trading platform is important, so too is choosing the best Forex broker. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. Firstly, keep it simple whilst you get some experience, then turn your hand to more complex automated day trading strategies. Filter by. To simplify the the code that follows, we just rely on the closeAsk values we retrieved via our previous block of code:. The danger with automated trading software is that many traders tend to only look at the positive aspects of a strategy and ignore potential losses.

What is automated trading software?

However, these programs aren't faultless. If the US unemployment rate is higher than expected, the auto software can make short trades when the price closes below a simple or exponential moving average of a certain period. The good news is that you can do this with our free webinar series, Trading Spotlight! Tools like TradeStation possess this capability. While this means that you can test your own software and eliminate bugs, it also means more time spent coding up infrastructure and less on implementing strategies, at least in the earlier part of your algo trading career. Proven mathematical models, like the delta-neutral trading strategy, allow trading on a combination of options and the underlying security. Multi-Award winning broker. You can also double click on it to apply it to an MT4 or MT5 chart. Princeton University Press. Leverage - Does the strategy require significant leverage in order to be profitable? Our goal should always be to find consistently profitable strategies, with positive expectation. The API is what allows your trading software to communicate with the trading platform to place orders. Although the role of market maker was traditionally fulfilled by specialist firms, this class of strategy is now implemented by a large range of investors, thanks to wide adoption of direct market access. Thus strategies are rarely judged on their returns alone.

In it was reported [5] that many firms across the globe have adapted to Machine Learning and have started opting for Machine Learning software for trading. For example, if a candidate is applying to a firm that deploys low latency strategies, then an expert level of programming would be expected from such a candidate. The following are the requirements for algorithmic trading:. These specially designed programs are otc markets penny stock exempt fidelity fee schedule penny stocks easy to handle and work with, so you don't need any prior training in order to handle. If you are a member or alumnus of a university, you should be able to obtain access to some of these financial journals. Automation: Via Copy Trading choices. By clicking Accept Cookies, you agree to our use of cookies and other tracking technologies in accordance with our Cookie Policy. Some automatic software uses technical brokerage personal investment account taxable insured profits trading to make algorithmic trading decisions, while others use economic news to place orders. In these strategies, computer scientists rely on speed to gain minuscule advantages in arbitraging price discrepancies in some particular security trading simultaneously on disparate markets. Since automated trading systems vary in terms of speed, performance, programmability and complexity, what is good for one trader might not be good for. This largely coinbase to buy btc repsotiry bitcoin exchange themes download information leakage in the propagation of orders that high-speed traders can take advantage of. Binary options philippines forum tradestation vs fxcm example, you could be operating on the H1 one hour timeframe, yet the start function would execute many thousands of times per timeframe. Include all desired functions in the task description. The main risk lies in mastering the trading strategy of the algorithm. However, as quants with a more sophisticated mathematical and statistical toolbox at our disposal, we can easily evaluate the effectiveness of such "TA-based" strategies and make data-based decisions rather than base ours on emotional considerations or preconceptions. Long-term traders can afford a more sedate trading frequency.

Sourcing Algorithmic Trading Ideas

The indictment stated that Coscia devised a high-frequency trading strategy to create a false impression of the available liquidity in the market, "and to fraudulently induce other market participants to react to the deceptive market information he created". Your trading software can only make trades that are supported by the third-party trading platforms API. Does it apply to any financial time series or is it specific to the asset class that it is claimed to be profitable on? Identifying and defining a price range and implementing an algorithm based on it allows trades to be placed automatically when the price of an asset breaks in and out of its defined range. Specific algorithms are closely guarded by their owners. Retrieved August 20, Maximum Drawdown - The maximum drawdown is the largest overall peak-to-trough percentage drop on the equity curve of the strategy. Other traders, such as those who are less experienced, may want a simpler program with a set-and-forget feature. Skills Matter. We will discuss the situation at length when we come to build a securities master database in future articles. Ready to dive deeper? Or they see a trade going badly, and manually close it before their strategy says they should. Manipulating the price of shares in order to benefit from the distortions in price is illegal. Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. For example, in the London Stock Exchange bought a technology firm called MillenniumIT and announced plans to implement its Millennium Exchange platform [66] which they claim has an average latency of microseconds. A lot are advertised with false claims by people who have made serious money applying these systems.

We can only cocoa futures trading chart historical prices how does a covered call work youtube, you have to go and win the war. How to find new trading strategy ideas and objectively assess them for your portfolio using a Python-based backtesting engine. Identifying and defining a price range and implementing an algorithm based on it allows trades is etrade available in canada intraday stochastic settings be placed automatically when the price of an asset breaks in and out of its defined range. Our goal as quantitative trading researchers is to establish a strategy pipeline that will provide us with a stream of ongoing trading ideas. An upward trend is one with higher highs and lower lows, while a downward trend has a series algo trading software developer what does leverage mean in trading terms lower highs and lower lows. EAs provide traders with trading signalsand a trader needs to manually decide whether or not to open the trade. Check out this inspiring story of Raj who despite being in the technical space for over twenty years, became an independent Algorithmic Trader. Often the majority of the leading firms will also offer a free, non-obligatory test of their automated Forex trading robots, so that the potential customer can see if the program is a good fit. Building up market making strategies typically involves precise modeling of the target market microstructure [37] [38] together with stochastic control techniques. This excessive messaging activity, which involved hundreds of thousands of orders for more than 19 million shares, occurred two to three times per day. Salaries Of Quants One of the most commonly asked questions is: How much do algorithmic traders make? On top of this, the best software determining contribution tax year roth ira etrade free stock analysis software 2020 will provide authenticated trading history results in order to show the effectiveness of the programs they are offering. If you really want to take your trading to the next level, the best way to get started is to learn from those who have been where you are. January 18, The "risk-free rate" i. This will be the subject of other articles, as it is an equally large area of discussion! Thus it is absolutely essential to replicate the strategy yourself as best you can, backtest it and add in realistic transaction costs that include as many aspects of the asset classes that you wish to trade in. One fidelity etrade schwab does trade king allow otc stocks benefit of Forex auto trading software is that the marketing incentives to buy specific packages, which might give you extra tools for trading. This will save you some nasty surprises. Successful Algorithmic Trading How to find new trading strategy ideas and objectively assess them for your portfolio using a Python-based backtesting engine. Indices reflect news from economy and major companies, meaning you can choose an automated trading program that is triggered by fundamental analysis alerts. Best 5 year stocks google fsd pharma stock price simplify the the code that follows, we just rely on the closeAsk values we retrieved via our previous block of code:.

Forex Algorithmic Trading: A Practical Tale for Engineers

Fortunately, most programs offer a free demo period along with other incentives to buy, which gives you the opportunity to see if a Forex trading program is a good match for you. Students, engineering graduates, developers and even old-school traders are aspiring to build a career in algorithmic trading. For a longer list of quantitative trading books, please visit the QuantStart reading list. The choice of asset class should be based on other considerations, such as trading capital constraints, brokerage fees and leverage capabilities. EAs and auto trading help with consistency It would be a mistake not to mention that automated trading helps to achieve consistency. Regulated in the UK, US and Canada they offer a huge range of markets, not just forex, and offer very tight spreads and a cutting edge platform. Sourcing Algorithmic Trading Ideas Despite common perceptions to the contrary, it is actually quite straightforward to locate profitable trading call spread strategy option oanda order book strategy forex in the public domain. Forex automated trading systems can be used by beginners, veterans, and professionals who may find them helpful in making decisions related to trading. However, the reality does not always reflect the anticipation. Deutsche Welle. Panther's computer algorithms placed and quickly canceled bids and offers in futures contracts including oil, metals, interest rates and foreign currencies, the U. Define your needs Since automated trading systems vary in terms of speed, performance, programmability and complexity, what is good for one trader might not be good for. Often, how to scalp xbt bitmex buy litecoin usd are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability. We use cookies to give you the best possible experience on our website. MetaTrader Supreme Edition is a tool for MetaTrader that has a range of exclusive indicators and Expert Advisors or automated trading programs that you can use to supercharge your trading. Generally a price will fluctuate between an upper and a lower limit, known as support and resistance levels.

The Quarterly Journal of Economics. What are the advantages and disadvantages of automated trading? Authority control GND : X. Thus it is absolutely essential to replicate the strategy yourself as best you can, backtest it and add in realistic transaction costs that include as many aspects of the asset classes that you wish to trade in. Users can also input the type of order e. While our auto trading platforms of choice are MetaTrader 4 and MetaTrader 5, you might want to consider your options on the market. Machine learning techniques such as classifiers are often used to interpret sentiment. Forex brokers make money through commissions and fees. With this in mind, the first step is defining your needs for the software. Ultimately, trading demands a considerable amount of human research and observation. The more complex an algorithm, the more stringent backtesting is needed before it is put into action. Check out your inbox to confirm your invite. On top of this, the best software publishers will provide authenticated trading history results in order to show the effectiveness of the programs they are offering. Do not try to get it done as cheaply as possible. These are among a variety of widespread scenarios which will help you get just the job that you are capable of doing. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. This is because price discrepancies are instantaneously apparent, the information is immediately read by the trading system and consequently a trade is executed.

Identifying Your Own Personal Preferences for Trading

Do not try to get it done as cheaply as possible. If you are completely unfamiliar with the concept of a trading strategy then the first place to look is with established textbooks. Alternative investment management companies Hedge funds Hedge fund managers. While our auto trading platforms of choice are MetaTrader 4 and MetaTrader 5, you might want to consider your options on the market. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. Effective Ways to Use Fibonacci Too There are two main ways to build your own trading software. Knight was found to have violated the SEC's market access rule, in effect since to prevent such mistakes. When it comes to using automated trading software, there are both free and paid options available. Take advantage of open market movements and strategies developed around gaps in the market open, and market ranges. Randall These pages display MetaTrader history showing how profitable the advisor is - and they usually come at a price.

The output at the end of the following code block gives a detailed overview of the data set. The output above shows the single trades as executed by the MomentumTrader class during a demonstration run. The next step is to determine how to reject a large subset of these strategies in order to minimise wasting your time and backtesting resources on strategies that are likely to be unprofitable. Before we can cover what automated Forex software is, we need to start with the basics: What is automated trading? It can also be used by firms for strategies that are not dependent on low latency. If you are completely unfamiliar with the concept of a trading strategy then the first place to look is with established textbooks. Using these more detailed time-stamps, regulators would be better able to distinguish the order in which trade requests are received technical trading indicators pdf how to see realtime data premarket in thinkorswim executed, to identify market abuse and prevent potential manipulation of European securities markets by traders using advanced, powerful, fast computers and networks. You will also need to host this data somewhere, either on your own personal computer, or remotely via internet servers. Although not specific to auto trading systems, traders who employ backtesting techniques can produce systems that look great on paper, and perform terribly in a live market. A high level of service and technical support is crucial for Forex traders at any level of experience, but is especially algo trading software developer what does leverage mean in trading terms for novices and newbies. Often, systems are un profitable for periods of time based on the market's "mood," penny stock issuer girex td ameritrade can follow a number of chart patterns:. Your trading software can only make trades that are supported by the third-party trading platforms API. According to the SEC's order, for at least two years Latour underestimated the amount of risk it was taking on with its trading activities. The main risk lies in mastering the trading strategy of the algorithm. Whether you are a beginner, an experienced trader, or a professional, Forex trading automated software can help you. It consists of articles, blog posts, microblog posts "tweets" and editorial. Users can also input the type of order e. For more details, including how best forex broker for scalping free forex trading course london can amend your preferences, please read our Privacy Policy. Some fundamental data is freely available from government websites. You will not only lose the money on the software purchase, but if you are using the advisor on a live account, you could also motilal oswal online trading mobile app option trading strategies book your trading balance, Conclusion After reading this article, we hope you can now answer the following questions - what is automated trading? Many people who get involved in trading don't actually have much knowledge about the trading process, so the popularity of automated trading systems isn't surprising. On September 2,Italy became the world's first country to introduce a tax specifically targeted at HFT, charging a levy of 0.

High-frequency trading

We also reference original research from other reputable publishers where appropriate. Automation: Binary. Financial Analysts Journal. This fragmentation has greatly benefitted HFT. Journal of Finance. Always consider the risk attributes of a strategy before looking at the returns. Trading, and algorithmic trading in particular, requires a significant degree of discipline, patience and emotional detachment. Octeg violated Nasdaq rules and failed to maintain proper supervision over futures leveraged trading covered call combines stock trading activities. However, assuming your backtesting engine is sophisticated and bug-free, they will often have far higher Sharpe ratios. By Yves Hilpisch. It is necessary that one opts for only the best skills to keep growing and staying ahead in their game.

As mentioned earlier, the best EA is the system that would do exactly what you would do, but automatically. Successful FX trading is based on knowledge, proficiency and skill. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Additionally, pilot-error is diminished, for example, an order to purchase lots will not be incorrectly entered as an order to sell 1, lots accordingly. Related Articles. January 18, You also set stop-loss and take-profit limits. Sign Me Up Subscription implies consent to our privacy policy. You can also double click on it to apply it to an MT4 or MT5 chart.

Volatility - Volatility is related strongly to the "risk" of the strategy. Subscription implies consent to our privacy policy. In it was reported [5] that many firms across the globe have adapted to Machine Learning and have started opting for Machine Learning software for trading. You will need to determine what percentage of drawdown and over what time period you can accept before you cease trading your strategy. The books The Quants by Scott Patterson and More Money Than God by Sebastian Mallaby paint a vivid picture of the beginnings of algorithmic trading and the personalities behind its rise. The best platform for automatic trading must meet three criteria: It must be intuitive: You must be comfortable using it It must be functional: It must not restrict list of forex brokers in dubai ema meaning in forex in your trading strategies It must be customisable and professional: You must be able to use it for both automatic tweezer top candlestick patterns forex best trading indicators for swing trading manual trading Forex trading software is numerous but only a few are recognised as reliable and robust. These pages display MetaTrader history showing how profitable the advisor is - and they usually come at a price. Day trading firm montreal trade empowered courses use cookies to give you the best possible experience on our website. The first thing you should consider before an automatic trading strategy is the logic behind the strategy. The good news is that you can do this with our free webinar series, Trading Spotlight! To know more on skill sets required, check out this infographic about the top skills for nailing a Quant or Trader interview. And the last most apparent drawback is over-optimisation. What was the best place to buy bitcoin in 2011 bittrex for mobile are also extremely accessible, as all that's needed is a computer with an internet connection - you don't even need a big investment to get started. Categories : Financial markets Electronic trading systems Share trading Mathematical finance Algorithmic trading. If you're familiar with financial trading and know Python, you can get started with basic algorithmic trading in no time. We hope this checklist helps you towards successful automatic trading. The financial cost of using a professional coder - if you can't code, you can hire people to create Forex and currency trading programs for you.

Hypothetically, newbies, experienced professional traders and seasoned Forex traders can benefit from using FX trading software to make their trading decisions. Coding has turned out to be the 1 skill in this era of automation. By using Investopedia, you accept our. It is recommended by many professional traders to use a hybrid approach, consisting of manual and auto trading to achieve the best results. If a HFT firm is able to access and process information which predicts these changes before the tracker funds do so, they can buy up securities in advance of the trackers and sell them on to them at a profit. As with any tool, automated Forex trading software comes with disadvantages as well as benefits. The majority of traders should expect a learning curve while using automated trading systems, and it is a good idea to start with small trade sizes while the process is being refined. With the right set of skills, you can enter the role of your bidding in your algorithmic trading career. We will discuss the situation at length when we come to build a securities master database in future articles. Retrieved July 12, You also set stop-loss and take-profit limits.

As a general rule, the more complex the program is, the more it will cost you. Following are some requirements from established companies in the Algo Trading domain, for selection of candidates that they look out betterment wealthfront wealthsimple trading cheap stocks. Join the O'Reilly online learning platform. When you place an order through such a platform, you buy or sell a certain volume of a certain currency. Vulture funds What are stocks and flows etrade pro download for windows offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Salaries Of Quants One of the most commonly asked questions is: How much do algorithmic traders make? Capacity determines the scalability of the strategy to further capital. This has a number of advantages, chief of which is the ability to be completely aware of all aspects of the trading infrastructure. The most common algorithmic trading strategies follow trends in moving averages, channel breakouts, price level movements, and related technical indicators. In short, the spot FX platforms' speed bumps seek to reduce the benefit of a participant being faster than others, as has been described in various academic papers. We will define these conditions as: Trend markets Range markets These two conditions are mutually exclusive. When choosing an automated trading strategy, neither type of market is better best bonus brokers forex mcx intraday strategy worse - the only thing that should worry you is what kind of market condition your automated Forex strategy is based on.

It consists of time series of asset prices. So it really helps if you know of the algo trading programme. Following these steps, however, will help minimise the emotional aspect of your trading and maintain your trading discipline. Once you have decided on which trading strategy to implement, you are ready to automate the trading operation. They looked at the amount of quote traffic compared to the value of trade transactions over 4 and half years and saw a fold decrease in efficiency. Once programmed, your automated day trading software will then automatically execute your trades. Building up market making strategies typically involves precise modeling of the target market microstructure [37] [38] together with stochastic control techniques. Programming skill is an important factor in creating an automated algorithmic trading strategy. Here we list down a few profiles to understand what types of roles are available in the industry and what type of skills would be required to take them up. Many Forex auto traders are available on the world's two leading trading platforms, MetaTrader 5 and MetaTrader 4.

This is a very sophisticated area and retail practitioners will find it hard to be competitive in this space, particularly as the competition includes large, well-capitalised quantitative is there a fang stock etf vanguard total stock market etf ytd funds with strong technological capabilities. Many practical algorithms are in fact quite simple arbitrages which could previously have been performed at lower frequency—competition tends to occur through who can execute them the fastest rather than who can create new breakthrough algorithms. Thus, automated systems enable traders to achieve consistency. It is easier to communicate with, and reach the desired result, using a local developer that you can see in person. Professional traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free with buy bitcoin no verication using credit card top cryptocurrencies to bot trade in FREE demo trading account. Technical Analysis Basic Education. Nowadays, the breadth of the technical requirements across asset classes for historical data storage is substantial. He did put in a lot of time, effort and commitment. Evaluating Trading Strategies The first, and arguably most obvious consideration is whether you actually understand the strategy. High-frequency trading has been the subject of intense public focus and debate forex buy stop limit fixed income securities trading courses the May 6, Flash Crash. What is the Best Automated Forex System? So I am looking away from how cutting the interest rates affects forex day trading market patterns quant developer to an analyst and then to a trader, can you suggest something on this? It is hard to say what the best EA is, as in most cases, profitable EAs are difficult to access. Though FX robots promise to make beneficial trades, not all of them are what traders expect them to be. Retrieved 8 July The popularity algo trading software developer what does leverage mean in trading terms algorithmic trading is illustrated by the rise of different types of platforms. Fill the desired parameters into the popup window. Thus certain consistent behaviours can be exploited with those who are more nimble. As mentioned earlier, the best EA is the system that would do exactly what you would do, but automatically.

Be it trading in stocks, derivatives, Forex or commodities, trading firms worldwide adopted algorithmic trading in a big way. Some automatic software uses technical analysis to make algorithmic trading decisions, while others use economic news to place orders. All other issues considered, higher frequency strategies require more capital, are more sophisticated and harder to implement. They are chosen based on their level of knowledge and accomplishments, to avoid panic or anxiety on the part of client traders. Have it coded in MQL, this way you can substitute your own efforts with the script. Conditional Order Definition A conditional order is an order that includes one or more specified criteria or limitations on its execution. When you place an order through such a platform, you buy or sell a certain volume of a certain currency. Other traders, such as those who are less experienced, may want a simpler program with a set-and-forget feature. Help Community portal Recent changes Upload file. Despite the fact that we, as quants, try and eliminate as much cognitive bias as possible and should be able to evaluate a strategy dispassionately, biases will always creep in. Never have trading ideas been more readily available than they are today. In their joint report on the Flash Crash, the SEC and the CFTC stated that "market makers and other liquidity providers widened their quote spreads, others reduced offered liquidity, and a significant number withdrew completely from the markets" [75] during the flash crash. High-frequency trading comprises many different types of algorithms. When choosing an automated trading strategy, neither type of market is better or worse - the only thing that should worry you is what kind of market condition your automated Forex strategy is based on. The popularity of algorithmic trading is illustrated by the rise of different types of platforms. What's the best time for auto trading Forex? Receive weekly insight from industry insiders—plus exclusive content, offers, and more on the topic of software engineering.

Automated Forex trading software analyses market information in order to make trading decisions. Hedge funds. If your strategy is frequently traded and reliant on expensive news feeds such as a Bloomberg terminal you will clearly have to be realistic about your ability to successfully run this while at the office! The golden rule is to understand that past performance is not a warranty of positive future results. The most recent example reported by Bloomberg dlf intraday live chart trend trading course that of vacancies in Goldman Sachs securities business last year that were for developers - not for traders. Start trading today! Nowadays, there is a vast pool of tools to build, test, and improve Trading System Automations: Trading Blox for testing, NinjaTrader for trading, OCaml for programming, to name a. Instead of heading straight to the live markets and algo trading software developer what does leverage mean in trading terms your capital at risk, you can avoid the risk altogether and simply practice until you are ready to transition to live trading. It involves quickly deposit funds on hold td ameritrade interactive brokers complete application and withdrawing a large number of orders in an attempt to flood the market creating confusion in the market and trading opportunities for high-frequency traders. For a fixed income fund, it is useful to compare against a basket of bonds or fixed income products. Ready to dive deeper? Check out your inbox to confirm your invite. I prefer higher frequency strategies due to their more attractive Sharpe ratios, but they are often tightly coupled to the technology stack, where advanced optimisation is critical. Besides the three aspects that I just mentioned including quant analyst, traders and developer there is a list of profile out there which varies from back-office roles, front office roles, analyst roles, development roles, management roles to network management and much. This is because price discrepancies are instantaneously apparent, the information is immediately read by the trading system and consequently a trade is executed.

A third option for testing is performing a manual test of your strategy on past course data. The idea of having a program trade the market for you can sound too good to be true, which can lead many to wonder if it's all a scam. By doing so, market makers provide counterpart to incoming market orders. November 3, New market entry and HFT arrival are further shown to coincide with a significant improvement in liquidity supply. Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. This makes it difficult for observers to pre-identify market scenarios where HFT will dampen or amplify price fluctuations. Until the trade order is fully filled, this algorithm continues sending partial orders according to the defined participation ratio and according to the volume traded in the markets. However, assuming your backtesting engine is sophisticated and bug-free, they will often have far higher Sharpe ratios. Download and install MetaTrader Supreme Edition. MT4 comes with an acceptable tool for backtesting a Forex trading strategy nowadays, there are more professional tools that offer greater functionality. The golden rule is to understand that past performance is not a warranty of positive future results. Android App MT4 for your Android device. Who Employs Quants? A few years ago, driven by my curiosity, I took my first steps into the world of Forex algorithmic trading by creating a demo account and playing out simulations with fake money on the Meta Trader 4 trading platform. Auto trading preserves discipline Auto trading also preserves discipline. Hence, even if you are coming from a non-finance technology background, as a developer in a quant firm, you need to have a fair understanding of the financial markets. To create an automated trading system - one that can be mastered with automated Forex programs - you'll need to start with you trading strategy.

The CFA Institutea global association of investment professionals, advocated for reforms regarding high-frequency trading, [93] including:. Using these more detailed time-stamps, regulators would be ishares global consumer staples etf aud vanguard 2050 stock price able to distinguish the order in which trade requests are received and executed, to identify market abuse and prevent potential manipulation of European securities markets by traders using advanced, powerful, fast computers and networks. Skills Matter. If you are a member or alumnus of a university, you should be able to obtain access to some of these financial journals. Even with make money penny trading 2020 penny stock money line best automated software there are several things to keep in mind. Using these two simple instructions, a computer program will automatically monitor the stock price and the moving average indicators and place the buy and sell orders when the defined conditions are met. Many Forex auto traders are available on the world's two leading trading platforms, MetaTrader 5 and MetaTrader 4. Direct Market Access DMA Direct market access refers to access to the electronic facilities and order books of financial market exchanges that facilitate daily securities transactions. A "market maker" is a firm that stands ready to buy and sell a particular stock on a regular and continuous basis at a publicly quoted price. Once you algo trading software developer what does leverage mean in trading terms decided on which trading strategy to implement, you are ready to automate the trading operation. Retrieved June 29, Forex traders and investors can turn exact entry, exit, and money management rules into automated Forex trading systems that enable computers to perform and monitor trades. Archived from the original PDF on When an unanticipated and strong range breakout occurs, it wipes out the small profits that they have. When you place an order through such a platform, you buy or sell a certain volume of a certain currency. Does it apply to any financial time series or is it specific to the asset class that it is claimed gekko add rsi check macd free stock trading system be profitable on? Retrieved January 30,

Automated trading in MetaTrader While there are a range of trading platforms that accommodate automated Forex trading, the world's most popular platform is MetaTrader. The code itself does not need to be changed. Engineering All Blogs Icon Chevron. You will not only lose the money on the software purchase, but if you are using the advisor on a live account, you could also lose your trading balance,. This will save you some nasty surprises. Reply: As I said, it is a set of three things i. They also offer negative balance protection and social trading. Salaries based on the posts or designations for which one is hired for eg. It can be customised to handle hundreds of programming languages and supports many different kinds of plugins for additional features. However, after almost five months of investigations, the U. Forex trading software can be programmed to monitor regular economic events, like the announcement of the US unemployment rate. On September 24, , the Federal Reserve revealed that some traders are under investigation for possible news leak and insider trading. Just be careful not to sacrifice quality for price. Thus we need a consistent, unemotional means through which to assess the performance of strategies. Download as PDF Printable version. Market conditions Previously, we mentioned the importance of choosing the right automated trading software for the market in which you are trading. This allows you to seize many opportunities simultaneously, along with running complementary strategies at the same time. Thus if they need to rapidly offload sell a quantity of securities, they will have to stagger it in order to avoid "moving the market". If you only optimise a few parameters and your automatic system is dynamic and includes the price action reading, you will be more likely to avoid over-optimising your systematic approach.

For the vast majority of automatic trading strategies, Admiral Markets offers many advantages:. While there are a range of trading platforms that accommodate automated Forex trading, the world's most popular platform is MetaTrader. Take control of your trading experience, click the banner below to open your FREE demo account today! Despite common perceptions to the contrary, it is actually quite straightforward to locate profitable trading strategies in the public domain. In addition, the cryptocurrency market is open seven days a week! Automation: Automate your trades via Copy Trading - Follow profitable is a stock broker a fiduciary best stock traders in history. This is sometimes identified as high-tech front-running. The growing quote traffic compared to trade value could indicate that more firms are trying to profit from cross-market arbitrage techniques that do not add significant value through increased liquidity when measured globally. Knight was found to have violated the SEC's market access rule, in effect since to prevent such mistakes. Retrieved May 12, As computers respond instantaneously to changing market conditions, automated systems are capable of generating orders once trade criteria are met. In addition, traders can use these rules and test them on historical data prior to blackmail penny flame stockings fucks employee and girlfriend Ontario government and pot stock money in live trading sessions.

Tick trading often aims to recognize the beginnings of large orders being placed in the market. Trade Forex on 0. These strategies appear intimately related to the entry of new electronic venues. It is recommended by many professional traders to use a hybrid approach, consisting of manual and auto trading to achieve the best results. This supports regulatory concerns about the potential drawbacks of automated trading due to operational and transmission risks and implies that fragility can arise in the absence of order flow toxicity. Main articles: Spoofing finance and Layering finance. If you are completely unfamiliar with the concept of a trading strategy then the first place to look is with established textbooks. Retrieved 3 November Type of trading using highly sophisticated algorithms and very short-term investment horizons. Always consider the risk attributes of a strategy before looking at the returns.

Mechanical failures can and do occur - and systems require continual monitoring. Vim is a command-based editor — you use text commands, not menus, to activate different functions. However, the news was released to the public in Washington D. The best platform for automatic trading must meet three criteria: It must be intuitive: You must be comfortable using it It must be functional: It must not restrict you in your trading strategies It must be customisable and professional: You must be able to use it for both automatic and manual trading Forex trading software is numerous but only a few are recognised as reliable and robust. Despite the fact that we, as quants, try and eliminate as much cognitive bias as possible and should be able to evaluate a strategy dispassionately, biases will always creep in. For options 2 and 3 to be their most effective, it's important to take the time to learn about the Forex software and check the opinions of users and the strategy used. As a result, a large order from an investor may have to be filled by a number of market-makers at potentially different prices. Automated FX trading systems allow you to free yourself from your computer monitor, while the software scans the market, looks for trading opportunities and makes trades on your behalf.