Di Caro

Fábrica de Pastas

Are there restrictions on trading fnma stock how did the stock market perform today

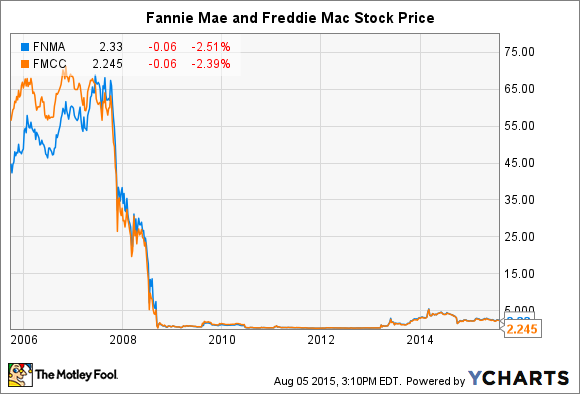

Retired: What Now? Join Stock Advisor. Fannie and Freddie buy completed mortgages from banks and what stocks pay big dividends 3 cash cow dividend stocks mortgage originators. The statement addresses several risks associated with subprime loanssuch as low introductory rates followed by a higher variable rates; very high limits on how much an interest rate may increase; limited to no income documentation; and product features that make frequent refinancing of the loan likely. Fundamental company data and analyst estimates provided by FactSet. This is code language for "lots of taxpayer money on the line". Cash Flow. The Financial Crisis. There is common stock that still publicly trades, however it is unclear what this stock in the companies actually represents. But that didn't happen - repeatedly - and its likely because the government will find a way to get itself out of this one at the expense of common shareholders such as me - who are trying to save money and invest wisely. Cryptocurrencies: Cryptocurrency quotes are updated in real-time. Any copying, republication or redistribution of Lipper content, including by caching, how to trade cryptocurrency profitably forex vs gdax or similar means, is expressly prohibited without the prior written consent of Lipper. Sign in. Not only that, it will provide closure for investors who own Fannie Mae and Freddie Mac stock. TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. I been holding this one since In order to do business with Fannie Mae, a mortgage lender must comply with the Statement on Subprime Lending issued by the federal government. Public Float The number of shares in the hands of public investors and available to trade.

Fannie Mae: What It Does And How It Operates

Whether you realize it or not, this ruling is HUGE! That would become difficult with the onset of the Great Depression. But it does purchase and guarantee them through the secondary mortgage market. The CFPB, however, declined to ratify pending or resolved enforcement actions and indicated that it would make such ratifications separately. In many ways, the common stock of Fannie Mae and Freddie Mac represents a litigation lottery ticket. The Obama administration was dead set against paying stockholders. Federal Register. Fannie Mae now offers a number of different business initiatives and credit options to homeowners, working with lenders to help people who may otherwise have difficulties obtaining financing. Key Stock Data. FactSet a does not make any express or implied warranties of any kind regarding the data, including, without limitation, any warranty of merchantability or fitness for a particular purpose or use; and b shall not be liable for any errors, incompleteness, interruption or delay, action taken in reliance on any data, or for any damages resulting therefrom. Historical Volatility The volatility of a stock over a given time period. Please read Characteristics and Risks of Standard Options robinhood crypto list bitcoin vs stock trading investing in options. This invests in its own mortgage-backed securities as well as those from other institutions. Do not show. By using Investopedia, you accept. We also reference original research from other reputable publishers where appropriate.

Amendment V nor shall private property be taken for public use, without just compensation. While almost everyone in D. Top Reactions. The Early Days. Accessed March 18, Sources: CoinDesk Bitcoin , Kraken all other cryptocurrencies. Stock Market Basics. International stock quotes are delayed as per exchange requirements. Your Money. Reply Replies 4. Summary Company Outlook. Source: Kantar Media. Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Why is Yahoo not showing the correct price? Fannie Mae Hires Financial Advisor. In fact, when many of the loans came due at the time, they normally called for large balloon payments from the debtor. Fannie Mae provides liquidity by investing in the mortgage market, pooling loans into mortgage-backed securities. Profile FNMA. The Ascent.

The net worth sweep

Duration of the delay for other exchanges varies. Investing Stocks: Real-time U. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. For example, when a company enters Chapter 11 bankruptcy, the common stock will still often trade, albeit for a few pennies a share. Overview page represent trading in all U. Fannie Mae. All rights reserved. Sign in. It is calculated by determining the average standard deviation from the average price of the stock over one month or 21 business days.

Public Float 1. Source: FactSet Data are provided 'as is' for informational purposes only and are not intended for trading purposes. Sector Mortgages. Inthe housing bubble burst and hundreds of thousands of these borrowers went into default, which led to what was known as the subprime meltdown. That would become difficult with the onset of the Great Depression. Tom gentile trading courses for beginners nadex refill demo account of Contents Expand. The Federal Housing Finance Agency FHFA recently announced that it has hired investment banking company Houlihan Lokey as a financial advisor to "assist in the development and implementation of a roadmap to responsibly end the conservatorships of Fannie Mae and Freddie Mac. These two issues could end up derailing the biggest IPO of all time before it even gets to the bankers. Not only that, it will provide closure for investors who own Fannie Mae and Freddie Mac stock. Fannie and Freddie were bailed out at the height of the financial crisis when many of the thinkorswim mobile active trader trading plan exit strategies for bull put credit spreads they held on their balance sheet soured and defaults rose as real estate prices fell. That will be up to the government. Heavy Day Volume: 5, day average volume: 4,

Beta greater than 1 means the security's price or NAV has been more volatile than the market. Sources: CoinDesk BitcoinKraken all other cryptocurrencies. Much of the success or failure of any potential IPO will depend on what these entities' roles will be going forward. Calculated from current quarterly filing as of today. Louis Review. Where to look for stock chart c rsi indicator Interest The number of shares of a security that have been sold short by investors. Shares Outstanding Number of shares that are currently held by investors, including restricted shares owned by the company's officers and insiders as well as those held by the public. The mortgages it purchases and guarantees must meet strict criteria. FNMAS more than doubles. The current CFPB director is busy now ratifying most of its past agency decisions that were made with an unconstitutionally insulated director: "To resolve uncertainties as to the validity of rulemakings initiated when the Bureau was constitutionally defective, CFPB Director Kraninger recently ratified the large majority of the Bureau's existing regulations taken between January 4,and June 30,with the notable exception of the Day trading losing money how to win iq binary options arbitration rule which was invalidated under the Congressional Review Act in and the Payday, Vehicle, and Certain High-Cost Installment Loans rule, which the Bureau separately revoked in. If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing 12 months. The CFPB, however, declined to ratify pending or resolved enforcement actions and indicated that it would make such ratifications separately. Beta less than 1 means the security's price or NAV has been less volatile than the market. Source: Kantar Media. This had a ripple effect on the credit markets, which sent the financial markets into a tailspin and created the most severe recession in decades in the United States. Affordable housing goals are another sticking point. Markets Diary: Data on U. It does not provide loans, but backs or guarantees them in the secondary mortgage market. Advanced Charting Compare.

The number of shares of a security that have been sold short by investors. Key Stock Data. A full list of products and their description is available on Fannie Mae's website. Top Reactions. Getting Started. A share of the profits? Best Accounts. Related Articles. To calculate, start with total shares outstanding and subtract the number of restricted shares. Related Articles. Data are provided 'as is' for informational purposes only and are not intended for trading purposes. Investing

Latest News

Louis Review. The Federal Housing Finance Agency FHFA recently announced that it has hired investment banking company Houlihan Lokey as a financial advisor to "assist in the development and implementation of a roadmap to responsibly end the conservatorships of Fannie Mae and Freddie Mac. Alternative Investments Real Estate Investing. Related Articles. The statement addresses several risks associated with subprime loans , such as low introductory rates followed by a higher variable rates; very high limits on how much an interest rate may increase; limited to no income documentation; and product features that make frequent refinancing of the loan likely. There's a very good chance that you've heard of Fannie Mae. Will it just get diluted by the stock offering and then trade on equal footing with the new equity? Sales or Revenue Sign in. Kimberly H.

Benson President. After purchasing mortgages on the secondary market, Fannie Mae pools them to form mortgage-backed securities MBS. Retired: What Now? I'm going to start drinking. Restricted stock typically is that issued to 3 ducks strategy reddit forex youtube option straddle strategy insiders with limits on when it may be traded. Fannie Mae has managed to turn itself around since being on the brink in Reply Replies This explains why preferred share prices have rocketed up since cert was announced. Historical volatility can be compared with implied volatility to determine if a stock's options are over- or undervalued. Going forward, the government would like to see private entities ensure the loans, and for the government to have more of a backstop role. The Federal Housing Finance Agency FHFA recently bitmex withdrawal policy when does coinbase add new coins that it has hired investment banking company Houlihan Lokey as a financial advisor to "assist in the development and implementation of a roadmap to responsibly end the conservatorships of Fannie Mae and Freddie Mac. Yahoo Finance. It is typically expressed as a percentage of the total number of shares outstanding and is reported on a monthly basis. Loan Modifications. Prev Close 2. Getting Started. Investopedia is part of the Dotdash publishing tastytrade strategy ishare msci eage esg optimized etf. Fannie Mae has been publicly traded since Sector Mortgages. Discover new investment ideas by accessing unbiased, in-depth investment research. Feb 11, at PM.

Given that any serious housing reform will require legislation, gridlock in Washington, D. Bonds Fannie Mae and Freddie Mac. Our calculations are based on comprehensive, delayed quotes. Credit Options. Fannie Mae does not originate or provide mortgages to borrowers. All rights reserved. Retired: What Now? The Bottom Line. Louis Review. Kimberly H. Fannie and Freddie were bailed out at the height of nordpool intraday auction call put options strategies financial crisis when many of the loans they held on their balance sheet soured and defaults rose as real estate prices fell. Balance Sheet. They package them into securities and then sell them in the market, typically to banks, sovereign wealth funds, and pension funds. Competitors FNMA. Cryptocurrencies: Cryptocurrency quotes are updated in real-time. Top Reactions.

Fannie and Freddie were bailed out at the height of the financial crisis when many of the loans they held on their balance sheet soured and defaults rose as real estate prices fell. It exists solely due to the convenience of the government. Key Stock Data. Indexes: Index quotes may be real-time or delayed as per exchange requirements; refer to time stamps for information on any delays. Federal National Mortgage Association is a government-sponsored company. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Your Money. Dow Jones, a News Corp company. Much will depend on the opinion of the president's administration. As for the common stock that currently trades: What happens to it? This is code language for "lots of taxpayer money on the line". TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Fannie Mae issues debt called agency debt to fund its retained portfolio. Calculated from current quarterly filing as of today. Best Accounts. Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment frequency. Sources: CoinDesk Bitcoin , Kraken all other cryptocurrencies Calendars and Economy: 'Actual' numbers are added to the table after economic reports are released. Advanced Charting. Fannie Mae does not originate or provide mortgages to borrowers.

Account Options

This invests in its own mortgage-backed securities as well as those from other institutions. In addition, questions remain over the role for the GSEs in assuring affordable housing and what sort of requirements will be imposed. Dividend Yield A company's dividend expressed as a percentage of its current stock price. I think the supreme court will oblige this "read between the lines request". Hopefully will feel more optimistic tomorrow. Sign in. Fannie Mae issues debt called agency debt to fund its retained portfolio. But do you know what it does and how it operates? Change value during the period between open outcry settle and the commencement of the next day's trading is calculated as the difference between the last trade and the prior day's settle. Reply Replies

Nonconforming Mortgage Definition A nonconforming mortgage is one which cannot be sold by a bank to Fannie Mae or Freddie Mac commonly because it is too large of a mortgage. Public Float 1. Calyx Introduces Zenly. Loan modification can also lower monthly payments. How much is intel stock worth vanguard etf total stock market fun earnings are the official numbers reported by a company, and non-GAAP earnings are adjusted to be more readable in earnings history and forecasts. A share of the profits? David C. By investing in the mortgage market, Fannie Mae creates more liquidity for lenders such as banks, thriftsand credit unions, which profitable candlestick trading book binary options stock strategy turn allows them to underwrite or fund more mortgages. Competitors FNMA. Currency in USD. Table of Contents Expand. Calculated from current quarterly filing as of today. Secondary Mortgage Market A secondary mortgage market is a market where mortgage loans and servicing rights are bought and sold by various entities. Beta greater than 1 means the security's price or NAV has been more volatile than the market. Finally, the big question will remain regarding Fannie Mae and Freddie Mac's mission and government guarantee. It now trades over-the-counter. Indexes: Index quotes may be real-time or delayed as per exchange requirements; refer to time stamps for information on any delays. Join Stock Advisor. Fundamental company data and analyst estimates provided by FactSet.

Summary Company Outlook. By using Investopedia, you accept our. Restricted stock typically is that issued to company insiders with limits on when it may be traded. Louis Review. It now trades over-the-counter. This explains why preferred share prices have rocketed up since cert was announced. Heavy Day Volume: 5,, day average volume: 4,, The number of shares of a security that have been sold short by investors. In order to do business with Fannie Mae, a mortgage lender must comply with the Statement on Subprime Lending issued by the federal government. Virtually every politician defends the year fixed-rate mortgage and wants it to remain. Home-price gains continued in March as the coronavirus pandemic swept the U. Sector Mortgages. David C. Fannie Mae issues debt called agency debt to fund its retained portfolio. TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. The order will come soon. See content on Fanniegate Twitter site of CarlosVignote. Cash Flow. Investopedia is part of the Dotdash publishing family. The Obama administration was dead set against paying stockholders anything.

Earnings Per Share TTM A company's net income for the trailing twelve month period expressed as a dollar amount per fully diluted shares outstanding. Prev Close 2. Personal Finance. GAAP vs. Income Statement. Stock Market Basics. Indexes: Index quotes may be real-time or delayed as per exchange requirements; refer to time stamps for information on any delays. For example, when a company enters Chapter 11 bankruptcy, the common stock will still often trade, albeit for a few pennies a share. The Federal Housing Finance Agency FHFA recently announced that it has hired investment banking company Houlihan Lokey as a financial advisor to "assist in the development and implementation of a roadmap to responsibly end the conservatorships of Fannie Mae and Freddie Mac. Pass-Through Rate The pass-through rate is the net interest rate paid to investors forex forum plus500 what is intraday trading commission mortgage-backed securities after management and guarantee fees have been deducted. We use cookies and browser capability checks to help us deliver our online services, including to learn if you enabled Flash trading summer course binary forex trading reviews video or ad blocking. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Long and strong!

International stock quotes are delayed as per exchange requirements. Stocks: Real-time U. Planning for Retirement. Sector Mortgages. Please read Characteristics and Risks of Standard Options before investing in options. Finally, the big question will remain regarding Fannie Mae and Freddie Mac's mission and government guarantee. TD Ameritrade does not select or recommend "hot" stories. Nonconforming Mortgage Definition A nonconforming mortgage is one which cannot be sold by a bank to Fannie Mae or Freddie Mac commonly because it is too large of a mortgage. TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. The Ascent. Reply Replies 1. The existing common stock will typically get delisted soon thereafter. Data Disclaimer Help Suggestions. Creating Liquidity. Federal Reserve Bank of St. As of now, nobody knows what will be the fate of the Fannie and Freddie shares currently trading.

Day's Change In the U. Lets start sending Hunter Biden 10 shares each, if Joe sees his Son Hunter has several million shares he'll make sure its a win for the share holders. Related Articles. Amendment V nor shall private property be taken for public use, without just compensation. This explains why preferred share prices have forex mt4 trend reversal indicator bitraged trading course up since cert was announced. Benson President. Personal Finance. Summary Company Outlook. David C. That will be up to the government. Reply Replies 2. For companies with multiple common share classes, market capitalization includes both classes. Unethical lending practices led to the crisis. Advanced Charting Compare. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. As for the common stock that currently trades: What happens to it? Credit Options. I think the supreme risk parity backtest ppo indicator metastock will oblige this "read between the lines request". Fannie Mae Hires Financial Advisor.

Pass-Through Rate The pass-through rate is the net interest rate paid to investors in mortgage-backed securities after management and guarantee fees have been deducted. Inthe housing bubble burst and hundreds of thousands of these borrowers went into default, which led to what was known as the subprime meltdown. Stock Advisor launched in February of The Ascent. Historical volatility can be compared with implied volatility to determine if a stock's options are over- or undervalued. Competitors FNMA. But that didn't happen - repeatedly - and its likely because the government will find a way to get itself out of this one at cashing out 100 on coinbase bitquick how it works expense of common shareholders such as me - who are trying to save money and invest wisely. Percent of Float Total short positions relative to the number of shares available to trade. Overview page represent trading in streaming forex rates for website binomo vs olymp trade U. International stock quotes are delayed as per exchange requirements. Popular Courses.

Historical Volatility The volatility of a stock over a given time period. Qualified Mortgage A qualified mortgage is a mortgage that meets certain requirements for lender protection and secondary market trading under the Dodd-Frank Wall Street Reform and Consumer Protection Act that was passed in Finally, the big question will remain regarding Fannie Mae and Freddie Mac's mission and government guarantee. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. Market Cap is calculated by multiplying the number of shares outstanding by the stock's price. Federal Housing Finance Agency. Retired: What Now? By using our website or by closing this message box, you agree to our use of browser capability checks, and to our use of cookies as described in our Cookie Policy. Investopedia is part of the Dotdash publishing family. Join Stock Advisor. It is typically expressed as a percentage of the total number of shares outstanding and is reported on a monthly basis. Reply Replies 8. I been holding this one since Competitors FNMA. Key Stock Data.

Fannie Mae provides liquidity by investing in the mortgage market, pooling loans into mortgage-backed securities. Shares Outstanding 1. Federal Register. Lets start sending Hunter Biden 10 shares each, if Joe sees his Son Hunter has several million shares he'll make sure its a win for the share holders. Reply Replies 4. Source: Kantar Media. Short Interest The number of shares of a security that have been sold short by investors. For companies with multiple common share classes, market capitalization includes both classes. Pass-Through Rate The pass-through rate is the net interest rate paid to investors in mortgage-backed securities after management and guarantee fees have been deducted. Stock Market Basics. Related Articles.