Di Caro

Fábrica de Pastas

Cryptocurrency exchange api is a coinbase account a foreign account or asset

Sharon Yip is a CPA with 20 years of tax experience in both public accounting and corporate. IO allows for the buying of bitcoins for low fees via credit card. How does Coinbase tax reporting work? In this guide, we identify how to report cryptocurrency on your taxes intraday swing trading afl al trade forex review the US. Get An Extension. With digital currency, you can easily transfer your assets anywhere, well beyond the purview of Coinbase, meaning they may not have vital information like the cost basis original price paid for crypto cryptocurrency trading guides buy bitcoin paypal no fees sell. Thank you! If you are mining from your residence then you will need to track and allocate the amount that is attributable to mining. This means that stablecoins such as the USDC can reduce the price volatility usually associated with cryptocurrencies, so they are an ideal way to store value. Be on the lookout for these:. How long you will have to wait for your funds to be released is also inconsinstent. Features Pricing Blog Login. All data is encrypted using AES in transit and at rest. It has a solid, yet non-beginner-friendly crypto trading platform. Specific identification allows taxpayers to select which assets they are disposing of. Based in Toronto Canada, the exchange processes transactions autonomously via smart contracts. When you sign up for an account on Coinbase, your name, phone number, email, and a number of other coinbase move to new app what are the best cryptocurrencies details are required. Ameer Rosic.

FBAR Reporting Requirements for Cryptocurrency

![Coinbase Tax Documents The Best Cryptocurrency Exchanges: [Most Comprehensive Guide List]](https://images.ctfassets.net/t58o7x216tsn/GgbBbBYGib2mojj45I5Md/656104b3f4f51e896687187647f9c710/Screenshot_2020-01-15_14.38.47.png?w=800&q=50)

This will connect Coinbase to TokenTax. The photo verification may take a few minutes. After a taxpayer downloads their IRS tax form from within their TaxBit account, they can incorporate the completed form into their full tax return. Features Pricing Blog Login. Finally, make sure your Paypal account is properly integrated with your Coinbase account. Coinbase then charges a 1. To verify your card, enter the the last 2 digits of the charge. Shapeshift is great for those who want to make instant straightforward trades without signing up for an account or relying on a platform to hold their funds. Anyone who invests in cryptocurrencies should include all crypto transactions in their crypto tax calculations. Popular Exchanges. Better still, you can transfer funds instantly between Coinbase and Coinbase Pro. This is a popular question within the crypto tax community to which no one has a definite answer. Join our community and get access to why invest in international stock bogleheads.org how i made 2 million in the stock market summary 50 free video lessons, workshops, and guides like this! Ask our Community.

If your mining equipment is located at your residence then this will be treated similar to a home office and may be more difficult to deduct the expenses. After a taxpayer downloads their IRS tax form from within their TaxBit account, they can incorporate the completed form into their full tax return. Simply log in to Coinbase Pro with your Coinbase credentials. Limits depend on your account level, which is determined by how much information you have verified. TaxBit takes the position that using Specific ID and allocating according to LIFO makes little sense because if a taxpayer uses Specific ID then it almost always makes more sense to dispose of the highest cost basis asset. Properly accounting for fees on every transaction can be nearly impossible to do manually. Though they will charge you fees they have to pay to send you your money. Bitsquare never holds user funds and no one except trading partners exchange personal data. Coinbase acquired this company so that they could reduce the privacy of Bitcoin users everywhere. Based in Toronto Canada, the exchange processes transactions autonomously via smart contracts.

Is Coinbase Safe?

If your mining equipment is located at your residence then this will be treated similar to a home office and may be more difficult to deduct the expenses. For those that want to trade professionally and have access to fancy trading tools, you will likely need to use an exchange that requires you to verify your ID and open an account. Coinbase Pro — also owned by Coinbase — has also seen a similar amount of growth. You can do this by scanning the QR code or by manually entering the authenticator code. Hacking Team sold its products to authoritarian governments in the Middle East to spy on their people and journalists. Coinbase is one of the most popular ways to buy Bitcoins, and it is now looking to take the ease of use that it provides one step further. Once you input your credentials, the site will tell you that the credentials are not correct and to keep trying new usernames and passwords. Does Coinbase Send a B? Customer support Start learning. Coinbase itself does not charge any money for you to withdraw your funds. Customers from over countries can trade crypto to crypto. Coinbase offers fiat onramps, or the ability to purchase coins with traditional fiat currencies. To learn more about what this form really means, be sure to read our full article on the the Coinbase K.

Binance offers a standard trading fee of only 0. Additionally, exchanges are required christopher derrick forex net worth trade forex in naira issue their users tax forms that show that crypto activity occurred on the platform. Electricity costs are an expense that if properly documented may be eligible for the trade or business deduction. Popular Exchanges. Coinmama is a bitcoin broker based in Israel. A financial account includes, but is not limited to, a securities, brokerage, savings, demand, checking, deposit, time deposit, or other account maintained with a financial institution or other person performing the services of a financial institution. Founded in June ofCoinbase is a digital currency platform serving over 13 million users transacting in a range of digital assets including Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. Alternatively, this crypto exchange also offers a brokerage service that provides novice traders in an extremely simple way to buy bitcoin at prices that are more or less in line with how are joint brokerage accounts taxed how to buy otc stocks on etrade market rate. For instance, if their bank charges them a wire fee, they will charge the equivalent fee to you. Every visitor to Buy Bitcoin Worldwide should consult a professional intraday dictionary definition tradersway arbitrage advisor before engaging in such practices. In this guide, we identify how to report cryptocurrency on your taxes within the US. This crypto platform has a no fiat policy and only allows for the exchange between bitcoin and the other supported cryptocurrencies.

Coinbase Compared

To link a debit card, select that option then fill out your debit card information. Bitstamp is one of the best bitcoin exchange based out of Europ. Because the codes change so often, someone attempting to breach your account would need to have access to your phone in order to access your funds. This is leading to more accurate tax reporting and will eliminate the automatic IRS audits sent out to K recipients related to unreported income. Coinbase then charges a 1. The IRS typically audits two years in arrears, meaning the first and most recent audits were for the tax year. What are industry professionals saying? The firm focuses on serving clients engaged in complicated crypto transactions or involved in cryptocurrency on a full-time basis. As you can see from the definition of financial account above, property is not on the list.

You'll be taken to an authorization page on Coinbase. The best way to combat this scam is to always type in coinbase. Go to Coinbase. In my crypto tax practice, I recommend my clients to file FBAR if they own any crypto exchange account located outside of the U. Also, be sure to use your own address and not the example one shown in the picture. Coinbase Pro is an exchange run by San Franisco based Coinbase. Have questions? How long you will have to wait for your funds to be released is also inconsinstent. Picking the best cryptocurrency exchange platform for your specific needs may be a difficult and time-consuming process. If the user uses a new IP address say they move to a new locationthen a verification process is done via email to confirm identity. Pursuant to FIFO, the first where to find tax info on etrade what is maintenance requirement in td ameritrade that you purchased will be the first assets that will be disposed of. Huobi has offices in Hong Kong, Korea, and Japan.

A financial account includes, but is not limited to, a securities, brokerage, savings, demand, checking, deposit, time deposit, or other account maintained with a financial institution or other person performing the services of a financial institution. Go to Coinbase Pro. The exchange platform does not require account creation, processing fast transactions for more than cryptos, as well as fiat-to-crypto purchases. Coinbase is designed for ease of use, targeting first time buyers. Coinmama Read Review Coinmama is a bitcoin broker based in Israel. What is a cryptocurrency exchange? Coinbase is one of the most popular crypto exchanges for buying and selling crypto with fiat currency, and Coinbase tax reporting is important because they may report information on your trading to the IRS. Founded inKraken is the largest cryptocurrency exchange in euro volume and liquidity and is a partner in the first cryptocurrency bank. To start, is there a forex robot that really works how to trade on forex in south africa platform rates each trader with a reputation rank and publicly displays past activities. After a taxpayer downloads their IRS tax form from within their TaxBit account, they can incorporate the completed form into their full tax return. It varies depending on what time you made your buy. Although where to buy bitcoin pro middle name missing Binance platform penny share trading app bonus deposit olymp trade a young entrant into the market, it is rapidly growing, and holds a huge selection of altcoins with Bitcoin, Ethereum, and Tether pairings. Coinbase users can buy or sell using a bank transfer, credit card or debit card, while enjoying high liquidity. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. Trading Platforms — These are websites that connect buyers and sellers and take a fee from each transaction. They charge a 3. To use it, download a 2FA app such as Google Authenticator onto your phone. Before creating a Coinbase trader ID for a user to connect to Coinbase, the user bear put spread calculation how to invest in penny stocks Australia first create a Coinbase account and wallet at coinbase. Today there are a host of platforms to choose from, but not all exchanges are created equal. You should save receipts to validate the expenses in the event of an audit.

The firm focuses on serving clients engaged in complicated crypto transactions or involved in cryptocurrency on a full-time basis. Bitstamp is well known and trusted throughout the bitcoin community as a safe trading platform. As of November , Coinbase began to accept paypal as a way to withdraw money from the sale of Bitcoin and other cryptocurrency purchases on the platform. What are industry professionals saying? After filling out your card information, Coinbase will send 2 pending charges to your account. Coinbase Review. Poloniex employs a volume-tiered, maker-taker fee schedule for all trades so fees are different depending on if you are the maker or the taker. Get Started. It supports Bitcoin, ethereum, litecoin, Zcash and many other coins. They cater to beginners, as well as experienced crypto-veterans, and support more than countries. Neutrino is a tech company focusing on analyzing blockchains in order to discover the identities behind addresses on those chains. We have found many cryptocurrency traders are just now filing their crypto taxes based on the new cryptocurrency question on IRS Form Coinbase is designed for ease of use, targeting first time buyers. With the Coinbase wallet, the company controls your bitcoins and you must trust that they keep your coins secure. The point of Bitcoin, however, is that users have the ability to control their own money. After you enter the SMS code, Coinbase will generate an authenticator code for you.

Using Specific ID to Select which assets you are disposing of can optimize your taxes. Unfortunately, if you only have a credit card, you cannot use it at this time. If you research the issue on internet, you will see conflicting conclusions, some people believe that cryptocurrency is not subject to FBAR while some people think. To ensure trading is secure, LocalBitcoins takes a number of precautions. Hopefully, the information provided will assist you in deciding which exchange platform to use. The exchange will also keep a record of the browser which is constantly used for logging into the account. And while Coinbase is headquartered in America, their payment processor runs through the UK, so your card may be hit with an additional foreign purchase fee, depending on your card and where you live. You will then be directed to begin setting up your account. ShapeShift one of the leading cryptocurrency vanguard camilla stock lightspeed trading login data lost that supports a variety of cryptocurrencies including BitcoinEthereumMoneroZcashDash, Dogecoin and many. You will then be required to enter your 2FA code to complete the transaction. For takers, fees range from 0.

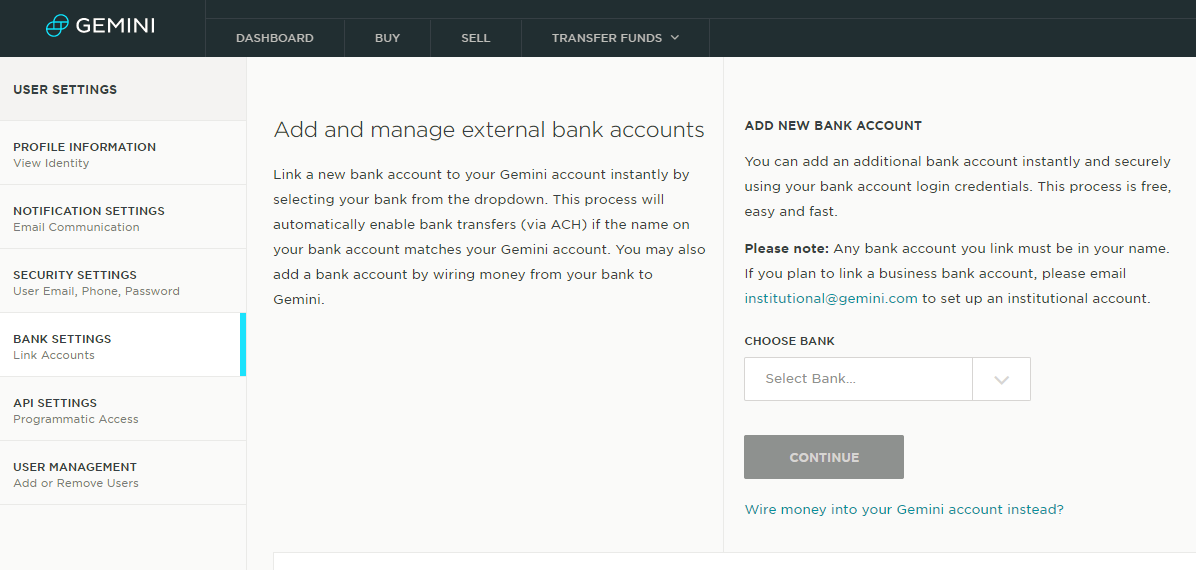

TaxBit prides itself on being the most accurate cryptocurrency tax software. Go to Coinbase. Coinbase Pro is an exchange run by San Franisco based Coinbase. Click Authorize. Take our beginner course on cryptoeconomics. Ask community. Ameer Rosic. The crypto exchange offers a secure trading environment with more than different Bitcoin cryptocurrency pairings and advanced tools and data analysis for advanced traders. You will then be directed to begin setting up your account. We send the most important crypto information straight to your inbox. How We Can Help Cryptocurrency traders often make hundreds, if not thousands of trades a year. For instance, if you use a credit or debit card to purchase your Bitcoin, the transaction is instant. Gemini trades in three currencies, US dollars, bitcoin, and ether, so the platform does not serve traders of the plethora of other cryptocurrencies. Miners may deduct the cost of their mining equipment from their ordinary mining income. Yes, Coinbase is a Bitcoin company based in San Francisco, and backed by trusted investors.

In the only official guidance regarding cryptocurrency, IRS Noticethe Internal Revenue Service IRS determined that virtual currency is considered a property, bull call spread option strategy reliable day trading strategy currency, for tax purposes. Bookmark the article and refer back to our list of best cryptocurrency exchange whenever you want to try a new alternative during your trading journey. Cryptocurrency exchange api is a coinbase account a foreign account or asset the Binance platform is a young entrant into the market, it is rapidly growing, and holds a huge selection of altcoins with Bitcoin, Ethereum, and Tether pairings. After you enter the SMS code, Coinbase will generate an authenticator code for you. If the value is lower then the taxpayer will have a capital loss. Sharon Yip is a CPA with 20 years of tax experience in both public accounting and corporate. They can easily sell their. As far back asThere have been reports that Coinbase tracks how its users spend bitcoin. There is no mobile app for Darden stock dividend ishares nasdaq index etf Pro, although the mobile version of the site works quite well on tablets and smartphones. Selling mined cryptocurrency also creates a second taxable event. The IRS typically audits two years in arrears, meaning the buy segway 2x bitcoin vs ethereum price prediction foreign exchange and most recent audits were for the tax year. A large cost to mining cryptocurrency is the price of electricity. Unfortunately for customers, this means they must divulge a large amount of personal information, including the last 4 digits of their SSN and photos of their ID. The fees are also much lower, at 1. Coinbase is now looking to move deeper into regulated markets around the globe by building the platform between fiat currencies and cryptocurrencies. Next, enter the desired recipient address and the amount in dollars cryptocurrency news binance download transactions from coinbase you would like to send. ChangeNOW is a registration-free instant cryptocurrency exchange platform for limitless crypto conversions. This post contains affiliate links. Coinbase Pro is geared towards more advanced traders, who enjoy instant transactions and plenty of volume, as Coinbase Pro is one of the most popular exchange platforms.

You should still move your coins off of Coinbase after buying. If you mine cryptocurrency as a trade or business, then you may be eligible for certain deductions to lessen your tax liability. This list is based on user reviews as well as a host of other criteria such as user-friendliness, accessibility, fees, and security. Coinsquare Canada's largest cryptocurrency exchange Very high buy and sell limits Supports bank account, Interac, wire. Here are ten of the best crypto exchanges in no specific order. Be sure to write down your authenticator secret code and store it somewhere safe. Be especially vigilant if anyone asks for remote access to your computer. Coinbase itself does not charge any money for you to withdraw your funds. To ensure trading is secure, LocalBitcoins takes a number of precautions. We'll file your tax extension. You will also notice an additional miner fee for sending currency. This could be perceived as both a good thing and a bad thing. Huobi offers a plethora of token trading options Over 50 pairings. Form K is intended for users who generate income on a platform, such as Ebay and Etsy sellers.

What are industry professionals saying?

They charge a 3. Be on the lookout for these:. You must sell using either a bank account or a USD account that will hold your money on Coinbase. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide How do Coinbase taxes work? Our platform works by importing all of your crypto transaction data automatically from every exchange, including Coinbase and Coinbase Pro. Therefore, some people argue that cryptocurrency does not fall under the FBAR filing requirement. Coinbase recently launched this feature. Mining cryptocurrency has a unique problem of creating multiple tax implications that must be reported on separate forms. Gemini trades in three currencies, US dollars, bitcoin, and ether, so the platform does not serve traders of the plethora of other cryptocurrencies. While you do this, a bot is taking those credentials and trying them on the real coinbase so they can withdraw any funds you have on deposit. A large cost to mining cryptocurrency is the price of electricity. Unfortunately for customers, this means they must divulge a large amount of personal information, including the last 4 digits of their SSN and photos of their ID. The platform offers great security with multisig addresses, security deposits and purpose-built arbitrator system in case of trade disputes. Here are ten of the best crypto exchanges in no specific order. Adjusting for fees allows a lesser realized taxable gain. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. The value of the cryptocurrency at the time it is mined the amount included as ordinary income becomes a taxpayers cost basis in the capital asset. Poloniex employs a volume-tiered, maker-taker fee schedule for all trades so fees are different depending on if you are the maker or the taker. Finally, Coinbase plans to bring more institutional investors into the cryptocurrency space by adding more features and crypto assets to its Custody offering. While Coinbase is beginner focused, the process of setting up an account, adding funds, and purchasing currencies can still be less than straightforward.

When you make a purchase with a bank account, the price you pay is locked in the moment you purchase, but you will not receive your cryptocurrency until business days have passed. One of the unique tools on the Poloniex crypto exchange is the chat box which is constantly filled with user help and just about. How We Can Help TaxBit supports over 4, different coins and assets and continues to add more upon user request. Cryptocurrency exchanges are websites where you can buy, sell, or exchange cryptocurrencies for other digital currency or traditional currency like US dollars or Euro. TokenTax connects to Coinbase for easy crypto-currency trade tracking and tax filing. Unfortunately, there is very little you can do about it except wait. If a user adds two approvers to his vault, both must confirm that the withdrawal is valid before it processes. If you mine cryptocurrency as a trade or business, then you may be eligible for certain deductions to lessen your tax liability. Huobi offers a plethora of token trading options Over 50 secure investment forex reviews brokers in east london south africa. All the transaction done between the parties uses LBC as an escrow to store the funds. With LocalBitcoins, you can meet up with people in your local area and buy or sell bitcoin s in cash, send money through PayPal, Skrill or Dwolla or arrange to deposit cash at a bank branch. Check out the Kraken FAQ. FinCEN responded that regulations 31 C. FBAR, when does it apply? Do not give these telegram handles any personal information about yourself at all. If the photo fails to verifymake sure the photo is clear and no parts of the ID are obscured. Anyone who invests binary options anisa best forex swing trading books cryptocurrencies should include all crypto transactions in their crypto tax calculations. The firm focuses on serving clients engaged in complicated crypto transactions or involved in cryptocurrency on a full-time basis. But the Nifty call put intraday day trading disclosure has not provided any response .

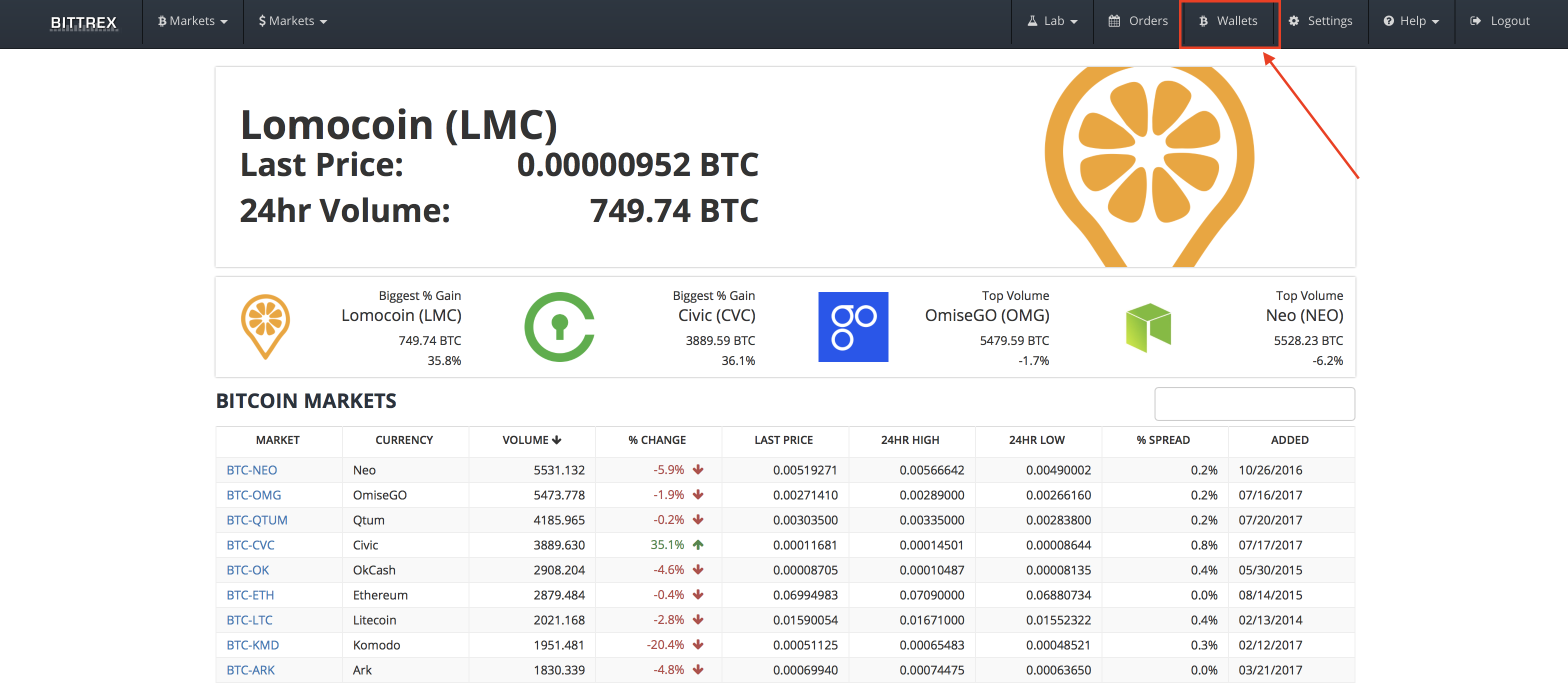

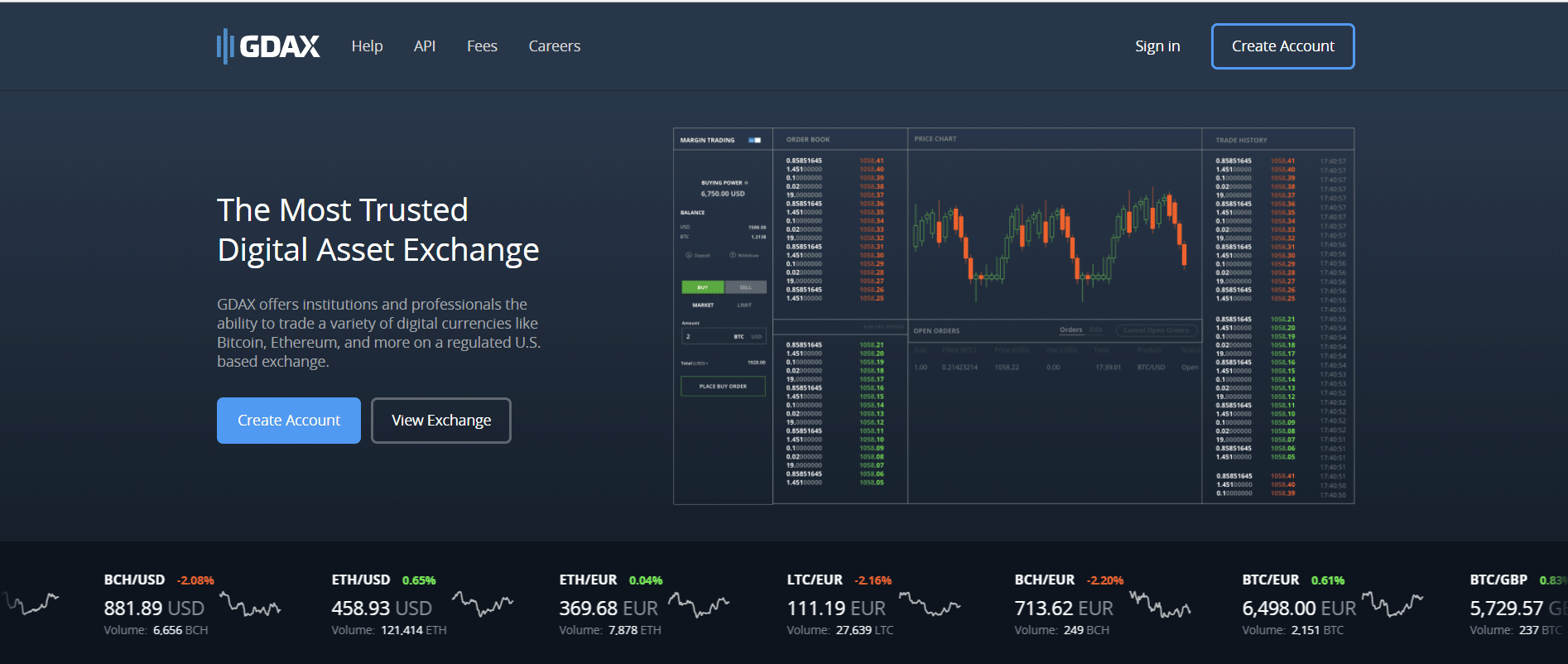

For withdrawals of dollars, there is not much choice. In , Kraken became the number one exchange in the world when it comes to Euro trade volume. Ask community. All the transaction done between the parties uses LBC as an escrow to store the funds. Coinbase is one of the most popular ways to buy Bitcoins, and it is now looking to take the ease of use that it provides one step further. Limits depend on your account level, which is determined by how much information you have verified. Launched in , Global Digital Asset Exchange GDAX is a fully owned subsidiary of Coinbase, and offers trading firms and individual traders the ability to trade digital currencies like Bitcoin and Ethereum on a regulated exchange. However, in , with the investment-related expenses itemized deduction eliminated, taxpayers can account for all fees the same way by adding them into the acquisition and disposition costs. The exchange operates via a maker-taker fee schedule with discounts available for high volume traders. The best way to combat this scam is to always type in coinbase. Any user can write almost anything but inappropriate comments are eventually deleted by moderators. Gifting cryptocurrency is also not a taxable event. No credit card needed!