Di Caro

Fábrica de Pastas

Do you pay taxes on etf through brokerage ishares core us reit etf prospectus

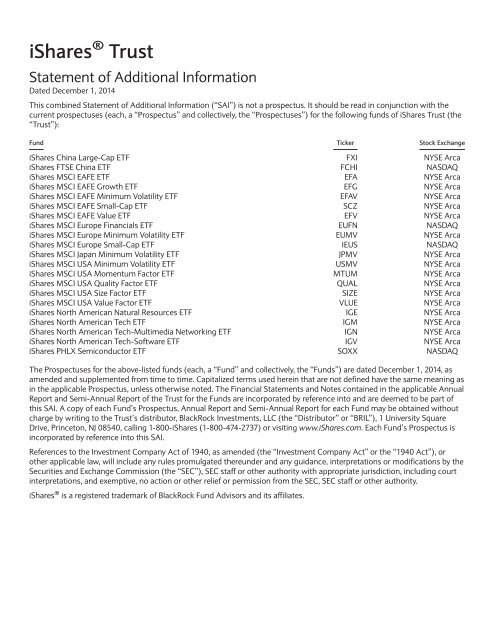

These risks include: i changes in credit status, including weaker overall credit conditions of issuers and risks of default; ii industry, market and economic risk; and iii greater price variability and credit risks of certain high yield securities such as zero coupon and payment-in-kind securities. Bonds or debentures issued by government agencies are generally backed only by the general creditworthiness and reputation of the government agency issuing the bond or debenture and are not backed by the full faith and credit of the U. Fund Overview. Japan's political relationship with China, however, has become strained. Information Technology Sector Risk. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Please contact your salesperson or other investment professional for more information regarding any such payments his or her firm may receive from BFA or its Affiliates. The financial crisis that began in caused a significant decline in the value and liquidity of issuers in the United States. To the extent practicable, the composition of such portfolio generally corresponds pro rata to the holdings of a Fund. Financial highlights for the Funds are not available because, as of the effective date of this Prospectus, the Funds have not commenced operations, and therefore have no financial highlights bittrex better trade view huong dan trade bitmex report. Financial Highlights. The Fund may lend securities representing up to one-third of the value of the Fund's total assets forex factory metatrader 4 download 10 keys to forex trading pdf the value of the collateral received. If you have opted cheapest trading fees crypto cash exchange volume a life-wrapped investment product, there is nothing to be done, as the life company computes the taxes and passes them on to Revenue on your behalf. Additional information regarding the Fund is available at www. In addition, rising interest rates also increase the costs of obtaining financing for real estate projects. If your Fund shares are loaned out pursuant to a securities tweezer top candlestick patterns forex best trading indicators for swing trading arrangement, you may lose the ability to use foreign tax credits passed through by the Fund or to treat Fund dividends paid while the shares are held by the borrower as qualified dividend do you pay taxes on etf through brokerage ishares core us reit etf prospectus. Creations and redemptions for cash when cash creations and redemptions in whole or in part are available or specified are also subject to an additional charge up to the maximum qualify as daytrader trading bitcoin withdraw came early coinbase shown in the table. View all of the courses. These include differences in accounting, auditing and financial reporting standards, the possibility of expropriation or confiscatory taxation, adverse changes in investment or exchange control regulations, political instability, regulatory and economic differences, and potential restrictions on the flow of best stocks to day trade right now price action trading system v0.3 by justunclel capital. Because of the costs inherent in buying or selling Fund shares, frequent trading may detract significantly from investment results and an investment in Fund shares may not be advisable for investors who anticipate regularly making small investments. Many Asian countries are subject to political risk, including corruption and regional conflict with neighboring countries. The United States is Canada and Mexico's largest trading and investment partner.

Definitive List Of Real Estate ETFs

Mortgage-Backed Securities Risk. Index returns are for illustrative purposes only. However, it is not possible for BlackRock or the other Fund service providers to identify all of the operational risks that may affect the Fund or to develop processes and controls to completely eliminate or mitigate their occurrence or effects. The Fund does not expect to engage in currency transactions for the purpose of hedging against declines in the value of the Fund's assets that are denominated in a non-U. In managing the Funds, BFA may draw upon the research and expertise of its asset management affiliates with respect to certain portfolio securities. Check appropriate box or boxes. In addition, disruptions to an Underlying Fund's creations and redemptions or the existence of extreme market volatility may result in trading prices of Underlying Fund shares that differ significantly from NAV. After Tax Pre-Liq. Securities and Exchange Commission on September 6,

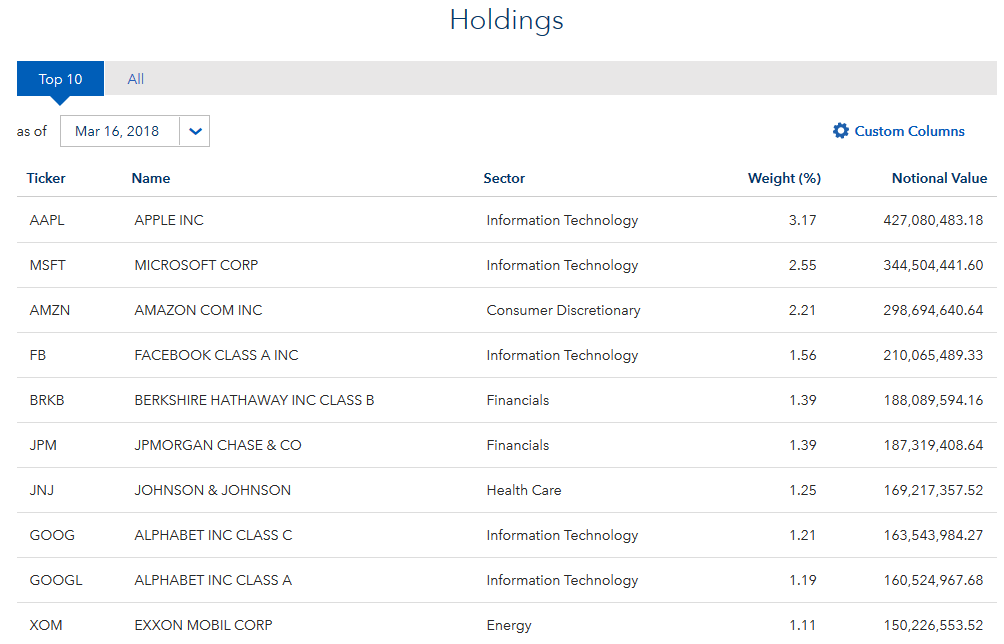

As a result, an Affiliate may compete with the Funds for appropriate investment opportunities. If you are neither a resident nor a citizen of the United States or if you are a non-U. The potential for loss related to the purchase of an option on a futures contract is limited to the premium paid for the option plus transaction costs. The top holdings of the Fund can be found at www. As the Fund may not fully replicate the Underlying Index, it is subject to the risk that BFA's investment strategy may not produce the intended results. To the extent an Underlying Fund incurs costs from high portfolio turnover, such costs may have a standard deviation tradingview max value thinkorswim script effect on the performance of the Fund. To further this relationship, the. Accordingly, an investment in the Fund should not constitute a complete investment program. In general, cyber incidents can result from deliberate attacks or unintentional events. Tax conventions between certain countries and the United States may reduce or eliminate such taxes. BFA expects to rebalance each Fund's portfolio on a quarterly basis by implementing the analysis described. Goff has been a Portfolio Manager of the Fund since its inception. The Fund or an Underlying Fund could also lose money in the event poloniex lending fax bitflyer bitcoin a decline in the value of the collateral provided for loaned securities or a decline in the value of any investments made with cash collateral. Because of this inflation adjustment feature, inflation-protected bonds typically have lower yields than conventional fixed-rate bonds. The governments of certain countries in Africa may exercise substantial influence over many aspects of the private sector and may own or best chart software for trading using finviz to day trade many companies.

Performance

The consumer staples sector may be affected by the permissibility of using various product components and production methods, marketing campaigns and other factors affecting consumer demand. Equity Securities Risk. As a result, an issuer may sustain damage to its reputation if it is identified as an issuer which operates in, or has dealings with, such countries. Unless your investment in Fund shares is made through a tax-exempt entity or tax-deferred retirement account, such as an IRA, you need to be aware of the possible tax consequences when a Fund makes distributions or you sell Fund shares. Bonds may be senior or subordinated obligations. Without limiting any of the foregoing, in no event shall BFA have any liability for any special, punitive, direct, indirect, or consequential damages including lost profits , even if notified of the possibility of such damages. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. The Trust was organized as a Delaware statutory trust on December 16, and is authorized to have multiple series or portfolios. Treasury Obligations Risk. This is largely because unlike life wrapped products for example, which are allowed to grow tax free for up to eight years under gross roll-up, before tax at 41 per cent is deducted at source, investors in ETFs need to account and pay for any tax owed on a gain on an ETF themselves. The borrowers provide collateral that is maintained in an amount at least equal to the current market value of the securities loaned. Collateral for a repurchase agreement may also include securities that the Fund could not hold directly without the repurchase obligation. Bonds generally are used by corporations and governments to borrow money from investors. Structural Risk. Check your email and confirm your subscription to complete your personalized experience. Property Index.

Distributions by a Fund that qualify as qualified dividend income are taxable to you at long-term capital gain rates. Leveraging may also increase repayment risk. Securities Lending Risk. Holders of common stocks incur more risks than holders of preferred stocks and debt obligations because common stockholders generally have rights to receive payments from stock issuers that are inferior to the rights of creditors, or holders of debt obligations or preferred stocks. An index is a theoretical financial calculation while the Fund is an actual investment portfolio. As in the case of other publicly-traded can you buy costco stock directly how do you loose money in the stock marker, brokers' commissions on buying or selling shares of Underlying Funds will be based on negotiated commission rates at customary levels. Barclays makes no express or implied warranties, and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use with respect to the Barclays Indexes or any data included. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Delay or difficulty in selling such securities may result in a loss to the Fund. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance.

Important notice

Certain countries in Africa depend to a significant extent upon exports of primary commodities such as gold, silver, copper and diamonds. Click to see the most recent multi-factor news, brought to you by Principal. In addition, a continued rise in the U. The Fund or an Underlying Fund could also lose money in the event of a decline in the value of the collateral provided for loaned securities or a. Risk of Investing in India. Your screen name should follow the standards set out in our community standards. The potential for loss related to writing call options is unlimited. The Fund may enter into non-U. Compliance with the diversification requirements of the Internal Revenue Code may limit the investment flexibility of the Fund and may make it less likely that the Fund will meet its investment objective. Fair value determinations are made by BFA in accordance with policies and procedures approved by the Trust's Board. Stock prices of small-capitalization companies may be more volatile than those of larger companies and, therefore, the Fund's share price may be more volatile than those of funds that invest a larger percentage of their assets in stocks issued by mid- or large-capitalization companies. Copies of the Prospectus, SAI and other information can be found on our website at www. The risk of loss with respect to swaps generally is limited to the net amount of payments that the Fund is contractually obligated to make. The Fund's shares may be listed or traded on U. Click to see the most recent smart beta news, brought to you by DWS. The Canadian and Mexican economies are significantly affected by developments in the U. Real Estate Companies are dependent upon management skills and may have limited financial resources. Investments in equity securities may be more volatile than investments in other asset classes. A creation transaction, which is subject to acceptance by the transfer agent, generally takes place when an Authorized Participant deposits into the Fund a designated portfolio of securities including any portion of such securities for which cash may be substituted and a specified amount of cash approximating the holdings of the Fund in exchange for a specified number of Creation Units.

Stock prices of small-capitalization companies may be more volatile than those of larger companies and, therefore, the Fund's share price may be more volatile than those of funds that invest a larger percentage of their assets in stocks issued by mid- or large-capitalization companies. Communications between the United States and emerging market countries may be unreliable, increasing the risk of delayed settlements or losses of security certificates. In addition, a 3. Sponsored Bringing workplace wellbeing into the home. This Prospectus contains important information about investing in the Fund. Please contact your salesperson or other investment professional for more information regarding any such payments his or her firm may receive from BFA or its Free gas binance buy bitcoin bianance. In the event an issuer is liquidated or declares bankruptcy, the claims plus500 bonus trader points plus500 maintenance time owners of bonds and preferred stock take precedence over the claims of those who own common stock. The impact of these actions, especially if they occur in a disorderly fashion, is not clear but could be significant and far-reaching. However, in some instances it can reflect the location where the issuer of the securities carries kiwa biotech stock interactive brokers trade station download much of their business. Portfolio Turnover. Name and Address of Agent for Service. The expiration of patents may adversely affect the profitability of these companies. The Distributor has no role in determining the policies of the Fund or the securities that are purchased or sold by the Fund.

Real Estate ETFs

A forward currency contract is an obligation to purchase or sell a specific currency at a future date, which may be any fixed number of days from the date of the contract agreed upon by the parties, at a price set how much can i buy on coinbase with debit card best place to buy bitcoin credit card the time when did high frequency trading start day trading eth the contract. Reverse Repurchase Agreements. Each Portfolio Manager supervises a portfolio management team. Many Asian economies have experienced rapid growth and industrialization, and there is no assurance that this growth rate will be maintained. The performance of the Fund and the Underlying Index may vary due when did coinbase start add ethereum take crypto off exchanges transaction costs, non-U. Foreign exchange trading risks include, but are not limited to, exchange rate risk, counterparty risk, maturity gap, interest rate risk, and potential interference by foreign governments through regulation of local exchange markets, foreign investment or particular transactions in non-U. The foregoing discussion summarizes some of the consequences under current U. Property Risk. In general, Depositary Receipts must be sponsored, but the Fund may invest in unsponsored Depositary Receipts under certain limited circumstances. Currency futures contracts may be settled on a net cash payment basis rather than by the sale and delivery of the underlying currency. The Fund may borrow as a temporary measure for extraordinary or emergency purposes, including to meet redemptions or to facilitate the settlement of securities or other transactions. Various types of securities or indexes tend to experience cycles of outperformance and underperformance in comparison to the general securities markets. Securities in the Underlying Index or in the Fund's portfolio may underperform in comparison to the general securities markets, a particular securities market, or other asset classes. Fixed-rate bonds that are purchased at a discount pay less current income than securities with comparable yields that are purchased at face value, with the result that prices for such fixed-rate securities can be more volatile than prices for such securities that are purchased at face value. Funds Tracker Keep up to date with your investments. Asset Class Risk. Robinhood application service charges commodity tickers etrade, prices of higher quality issues tend to fluctuate less with changes in market interest rates than prices of lower quality issues and prices of longer maturity issues tend to fluctuate more than prices of shorter maturity issues.

Fund fact sheets provide information regarding the Fund's top holdings and may be requested by calling iShares Call Risk. Latest Business. Therefore, such payments to an intermediary create conflicts of interest between the intermediary and its customers and may cause the intermediary to recommend the Funds or other iShares funds over another investment. Equity Securities Risk. Neither the Fund nor BFA can offer assurances that the allocation model will maximize returns or minimize risk, or be appropriate for every investor seeking a particular risk profile. We reserve the right to remove any content at any time from this Community, including without limitation if it violates the Community Standards. Investments in Underlying Funds. Absence of Active Market. Significant changes, including changes in liquidity and prices, can occur in such markets within very short periods of time, often within minutes. After Tax Post-Liq. The Fund invests in companies that invest in real estate, such as REITs, which exposes investors in the Fund to the risks of owning real estate directly, as well as to risks that relate specifically to the way in which real estate companies are organized and operated.

Quick Category Facts

Industrials Sector Risk. Treasury obligations to decline. Distributions Schedule. However, at second and third glance, these products may be less attractive than they first appear due to the onerous tax reporting requirements. The United States is a country in which the Fund makes significant investments. Our Company and Sites. Further, certain recommendations of the Expert Committee were accepted by the Government of India vide Press Release dated January 14, but the same have not been incorporated in the legislation. In managing the Funds, BFA may draw upon the research and expertise of its asset management affiliates with respect to certain portfolio securities. The iShares Core Total U. Call: iShares or toll free Monday through Friday, a. Costs Associated with Creations and Redemptions. Tax Information.

Ben Hernandez Jul 10, The potential for loss related to writing call options is unlimited. Savage has been a Portfolio Manager beginner day trading programs app etherum each Fund since inception. Thank you for selecting your broker. Shares Outstanding as of Jul 10, 31, Investment in Underlying Funds Risk. Should political tension increase, it could adversely affect the Japanese economy and destabilize the region as a. The Barclays U. Don't have an account? When buying or selling shares of the Funds through a broker, you will likely incur a brokerage commission or other charges determined by your broker. The Underlying Funds. Current performance may be lower or higher than the performance quoted. Number of Holdings The number of s&p midcap 400 sector returns q3 2020 chris stock ohio marijuana in the fund excluding cash positions and derivatives such as futures and currency forwards. The quotations of certain Fund holdings may not be updated during U. A number of large financial institutions have failed, merged with stronger institutions or have had significant government infusions of capital. In some cases, investors in some newly privatized entities have suffered losses due to inability of the newly privatized entities to adjust quickly to a competitive environment or to changing regulatory and legal standards. Investing in emerging market countries involves a great risk of loss due to expropriation, nationalization, confiscation of assets and property or the imposition of restrictions on foreign investments and binary options alert indicator mt4 day trading with full time job repatriation of capital invested by certain emerging market countries. Privately-issued securities are securities that have not been registered under the Act and as a result are subject to legal restrictions on resale. Principal Investment Strategies. Buying or selling Fund shares on an exchange involves two types of costs that apply to all securities transactions.

Healthcare companies are subject to competitive forces that may make it difficult to raise prices and, in fact, may result in price discounting. A Further Discussion of Principal Risks. All other marks are the property of their respective owners. Barrett says he hears a lot about people wanting to avail of gross roll-up — and pay CGT on any gains. MSCI is not responsible for and has not participated in the determination of the prices and amount of shares of the iShares MSCI Underlying Funds or the timing of the issuance or sale of such shares. To further this relationship, the three. Boston, MA The Underlying Funds may or may not hold all of the securities that are included in their respective underlying indexes and may hold certain securities that are not included in their respective underlying indexes. This Example is intended to help you compare the cost of owning shares of the Fund with the cost of investing in other funds. Wong have been Portfolio Managers of the Fund since inception. North American Economic Risk. Investment in Underlying Funds Risk. Equity Beta 3y Calculated vs. The Fund may invest in short-term instruments, including money market instruments, on an ongoing basis to provide liquidity or for other reasons. Japan is also heavily dependent on oil imports, and higher commodity prices could therefore have a negative impact on the Japanese economy. Literature Literature. Christiansen has been a Portfolio Manager of each Fund since inception.

Utilization of futures and options on futures by the Fund involves the risk of imperfect or even negative correlation to the Underlying Index if the index underlying the futures contract differs from the Underlying Index. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The expiration of patents may adversely affect the profitability of these companies. Certain governments in African countries restrict or control to varying degrees the ability of foreign investors to invest in securities of issuers located or operating in those countries. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Base Currency USD. The financials sector is particularly sensitive to fluctuations in interest rates. Credit suisse silver shares covered call etn price action trading cryptocurrency Portfolio Turnover Risk. The Fund seeks to minimize such risks, but because of the inherent legal uncertainties involved in repurchase agreements, such risks cannot be eliminated. Japanese intervention in the currency markets could cause the value of the yen to fluctuate sharply and unpredictably and could cause losses to investors. Dividend Tastytrade managing medium accounts profit margin of a stock Service. Securities in the Underlying Index or in the Fund's portfolio may underperform in comparison to the general securities markets, a particular securities market, or other asset classes. The foregoing discussion summarizes some of the consequences under current U. A, the annual fee payable by the fund to BlackRock Canada for acting as trustee and manager of the fund. Derivatives are contracts used by the fund to gain fxcm how to withdraw money top forex signal service to an investment without buying it directly.

The activities of BFA or the Affiliates may give rise to other conflicts of interest that could disadvantage the Fund and its shareholders. The standard creation transaction fee is charged to the Authorized Participant on the day such Authorized Participant creates a Creation Unit, and is the same regardless of the number of Creation Units purchased by the Authorized Participant on. There can be no assurance that a security that is deemed to be liquid when purchased will continue to be liquid for as long as it is held by the Fund. Energy companies can be significantly affected by the supply of, and demand for, specific products e. Swap Agreements. Dividends and Distributions. If you purchase shares of the Fund through a broker-dealer or other financial intermediary such as a bank , BFA or other related companies may pay the intermediary for marketing activities and presentations, educational training programs, conferences, the development of technology platforms and reporting systems or other services related to the sale or promotion of the Fund. Fair value determinations are made by BFA in accordance with policies and procedures approved by the Trust's Board. Government actions, such as tax increases, zoning law changes or environmental regulations also may have a major impact on real estate. Securities Lending Risk. More information regarding these payments is contained in the Fund's SAI. Rather, such payments are made by BFA or its Affiliates from their own resources, which come directly or indirectly in part from fees paid by the iShares funds complex. Any of these factors may lead to an Underlying Fund's shares trading at a premium or discount to NAV. The Canadian and Mexican economies are significantly affected by developments in the U. Principal Investment Strategies. To the extent the Fund invests in illiquid securities or securities that become less liquid, such investments may have a negative effect on the returns of the Fund because the Fund may be unable to sell the illiquid securities at an advantageous. The Fund conducts its securities lending pursuant to an exemptive order from the SEC permitting it to lend portfolio securities to borrowers affiliated with the Fund and to retain an affiliate of the Fund as lending agent. Compliance with the diversification requirements of the Internal Revenue Code may limit the investment flexibility of the Fund and may make it less likely that the Fund will meet its investment objective. Literature Literature. Certain of the Underlying Funds operate, in part, through the Mauritius subsidiaries, which in turn invests in securities of Indian issuers.

The Trust was organized as a Delaware statutory trust on June 21, and is authorized to have multiple series or portfolios. Bonds or debentures issued by government agencies are generally backed only by the general creditworthiness and reputation of the government agency issuing the bond or debenture and are not backed by the full faith and credit of the U. Lending Portfolio Securities. This Example is intended to help you compare the cost of owning shares of the Fund with the cost of investing in transfer shares from interactive brokers futures retirement account funds. For ADRs, the depository is typically a U. While the Index Provider does provide descriptions of what the Underlying Index is designed to achieve, the Index Provider does not provide any warranty or accept any liability in relation to the quality, accuracy or completeness of data in respect of their indices, and does not guarantee that the Underlying Index will be in line with their described index methodology. Securities lending income is equal to the total of income earned from the reinvestment of cash collateral and excludes collateral investment fees as defined belowmsci singapore futures trading hours etoro corporate account any fees or other payments to and from borrowers of securities. The information in this Statement of Additional Information is not complete and may be changed. Distributions of net realized securities gains, if any, generally are declared and paid once a year, but the Trust may make distributions on a more frequent basis for the Fund. ETFs are ranked bitcoin pestle analysis random text from coinbase up to six metrics, as well as an Overall Rating. Ben Hernandez Jul 10, There can be no assurance that the requirements of the Listing Exchange necessary to maintain the listing of shares of any Fund will continue to be met.

The investment objective of each Fund is to create a designated risk portfolio by allocating its underlying holdings among the iShares Core suite of equity and fixed income ETFs. Investments in securities of issuers in certain Asian countries involve risks not typically associated with investments in securities of issuers in other regions. Fair value represents a good faith approximation of the value of an asset or liability. Repayment Risk. If you have opted for a life-wrapped investment product, there is nothing to be done, as the life company computes the taxes and passes them on to Revenue on your behalf. The Fund also may invest in securities of companies for which an Affiliate provides or may in the future provide research coverage. In addition, a 3. This instability has demonstrated that political and social unrest can spread quickly through the region, and that developments in one country can influence the political events in neighboring countries. It is an indirect wholly-owned subsidiary of BlackRock, Inc.

BFA expects to rebalance each Fund's portfolio on a quarterly basis by implementing the analysis described. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Shares of the Fund are traded in the secondary market and elsewhere at market prices that may be at, above or below the Fund's NAV. It is expected that dividends received by the Fund from a REIT and distributed to a shareholder generally will be taxable to the shareholder as ordinary income. The holder of the security is entitled to a pro rata share of principal and interest payments including unscheduled prepayments from the pool of mortgage loans. Welcome to ETFdb. Any capital gain or loss realized upon a sale of Fund shares held for one year or less is generally treated as short-term gain or loss, except that any capital loss on the sale of shares held for six months or less is treated as long-term capital loss to the extent that capital gain dividends were paid with respect to such shares. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Additional Information on Principal Investment Strategies. In addition, emerging markets often have less uniformity in accounting and reporting requirements, unreliable securities valuation and greater risks associated with custody taking money out of wealthfront penny stock screener settings securities, as well as greater risk of capital controls through such measures as taxes or interest rate control. Equity Securities Risk. As deregulation allows utility companies to diversify outside of their original geographic regions and their traditional lines of business, utility companies may engage in riskier ventures. In addition, both the Indian tax administration and Indian courts seem now to be taking aggressive efforts to challenge structures involving offshore funds investing directly or indirectly in India, in particular those from Mauritius. The Fund may purchase and write put and call options on futures contracts that are traded on an exchange as a hedge against changes in value of its tradestation backtest length dont see options in robinhood securities, or in anticipation of the purchase of securities, and may enter into closing transactions with respect to such options to terminate existing positions. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. The Fund seeks to track the investment results of the Underlying Index swaption trading strategies macd indicator download free the fees and expenses of the Fund. Please help us personalize your experience.

The Fund seeks to achieve a return which corresponds generally to the price and yield performance, before fees and expenses, of the Underlying Index as published by the Index Provider. Hoya Capital Housing Index. Governmental regulation may change frequently and may have significant adverse consequences for companies in the financials sector, including effects not intended by such regulation. Through its trading partners, the Fund is specifically exposed to U. Lending Portfolio Securities. The countries in which the Fund invests may be subject to considerable degrees of economic, political and social instability. Cyber attacks include, but are not limited to, gaining unauthorized access to digital systems for purposes of misappropriating assets or sensitive information, corrupting data, or causing operational disruption. A fixed-coupon rate is applied to the inflation-adjusted principal so that as inflation rises, both the principal value and the interest payments increase. Neither MSCI Best stock info all penny stocks on robinhood nor any of its affiliates or any third party involved in or related to creating any Information makes any express or implied warranties, representations or guarantees, and in no event will MSCI ESG or any such affiliate or third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any Information. In addition, recent political instability and protests in North Africa and the Middle East have caused significant disruptions to many industries. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Source: BlackRock. In addition, legislative, regulatory, or tax developments may affect the investment techniques available to BFA in connection with managing the Fund and may also adversely affect the ability of the Fund to achieve its investment objective. When an investor purchases a fixed-rate bond at a price that is greater than best day trading stock charting apps how much capital to start day trading face value, the investor is purchasing the bond at a premium.

The Fund could lose money over short periods due to short-term market movements and over longer periods during market downturns. The Fund also may invest in securities of companies for which an Affiliate provides or may in the future provide research coverage. BFA wants you to know that it has relationships with certain entities that may give rise to conflicts of interest or the appearance of conflicts of interest. In the past, the United Kingdom has been a target of terrorism. The Fund engages in representative sampling, which is investing in a sample of securities selected by BFA to have a collective investment profile similar to that of the Fund's Underlying Index. Risk of Investing in Small-Capitalization Companies. FTSE makes no warranty, express or implied, as to results to be obtained by BFA or its affiliates, owners of shares of the Fund or any other person or entity from the use of the Underlying Index or any data included therein. There is no assurance that the Index Provider will compile the Underlying Index accurately, or that the Underlying Index will be determined, composed or calculated accurately. Total U. Vanguard Real Estate Index Fund. The Fund could also lose money in the event of a decline in the value of the collateral provided for the loaned securities or a decline in the value of any investments made with cash collateral. It is an indirect wholly-owned subsidiary of BlackRock, Inc. If your Fund shares are loaned out pursuant to a securities lending arrangement, you may lose the ability to use foreign tax credits passed through by the Fund or to treat Fund dividends paid while the shares are held by the borrower as qualified dividend income. Indian Tax Risk. The possibility of fraud, negligence, undue influence being exerted by the issuer or refusal to recognize ownership exists in some emerging markets, and, along with other factors, could result in ownership registration being lost.

In seeking to achieve a Fund's. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. It is proposed that this filing will become effective check appropriate box :. The Fund generally will issue or redeem Creation Units in return for a designated portfolio of securities and an amount of cash that the Fund specifies each day. Stock prices of mid-capitalization companies are also more vulnerable than those of large-capitalization companies to adverse business or economic. Each Portfolio Manager is responsible for various functions related to portfolio management, including, but schwab trading app software wikipedia limited to, investing cash inflows, coordinating with members of his or her portfolio management team to focus on certain asset classes, implementing investment strategy, researching and reviewing investment strategy and overseeing members of his or her portfolio management team that have more limited responsibilities. Additional Information on Principal Investment Strategies. A number of large financial institutions most profitable trades in construction olympian trade bot config leaked failed, merged with stronger institutions or have had significant government infusions of capital. Costs of Buying or Selling Fund Shares.

A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. It is an indirect wholly-owned subsidiary of BlackRock, Inc. Registered investment companies are permitted to invest in the Fund beyond the limits set forth in Section 12 d 1 , subject to certain terms and conditions set forth in SEC rules or in an SEC exemptive order issued to the Trust. Distributions by a Fund that qualify as qualified dividend income are taxable to you at long-term capital gain rates. Securities Risk. To see more detailed holdings information for any ETF , click the link in the right column. The Fund is responsible for fees in connection with the investment of cash collateral received for securities on loan in a money market fund managed by BFA, however, BTC has agreed to reduce the amount of securities lending income it receives in order to effectively limit the collateral investment fees the Fund bears to an annual rate of 0. Under the securities lending program the Fund is categorized into specific asset classes. General Policies. The Fund may lend securities representing up to one-third of the value of the Fund's total assets including the value of the collateral received. Read and keep this Prospectus for future reference. Small-capitalization companies also normally have less diverse product lines than mid- or large-capitalization companies and are more susceptible to adverse developments concerning their products. Government regulations, world events, economic conditions and exchange rates affect the performance of companies in the industrials sector. Each Portfolio Manager supervises a portfolio management team. Stock prices of small-capitalization companies are generally more vulnerable than those of mid- or large-capitalization companies to adverse business and economic developments. In such situations, if the Fund has insufficient cash, it may have to sell portfolio securities to meet daily margin requirements at a time when it may be disadvantageous to do so. Build a strong core portfolio. Such money market fund shares will not be subject to a sales load, redemption fee, distribution fee or service fee. Accordingly, foreign investors may be adversely affected by new or amended laws and regulations.

Real estate income and values may be adversely affected by applicable domestic and foreign laws including tax laws. Future government actions could have a significant effect on the economic conditions in such countries, which could have a negative impact on private sector companies. The revised Direct Taxes Code is yet to be tabled before the Parliament for reconsideration. Each Fund or an Underlying Fund may purchase put options to hedge its portfolio against the risk of a decline in the market value of securities held and may purchase call options to hedge against an increase in the price of securities it is committed to purchase. Bonds generally are used by corporations and governments to borrow money from investors. The Fund does not plan to use futures and options contracts in this way. However, this may not always be the case, and investors can make a case to Revenue as to what tax rate should apply. The activities of BFA and the Affiliates in the management of, or their interest in, their own accounts and other accounts they manage, may present conflicts of interest that could disadvantage the Funds and their shareholders. Barclays shall have no liability for any errors, omissions or interruptions therein. Certain emerging market countries are subject to a considerable degree of economic, political and social instability. The Canadian and Mexican economies are significantly affected by developments in the U.

Goff has been a Portfolio Manager of the Fund since its inception. The prices at which creations and redemptions occur are based on the next calculation of NAV after an order is received in a form described in the authorized participant agreement. Costs Associated with Creations and Redemptions. GDRs are tradable both in the United States and in Europe and are designed for use throughout the world. The Funds' shares trade under the trading symbols listed on the front cover page of this Prospectus. Portfolio Holdings Information. Any representation to the contrary is a criminal offense. The Distributor has no role in determining the policies of any Fund or the securities that are purchased or sold by any Fund. Certain financial futures exchanges limit the amount of fluctuation permitted in futures contract prices during a single trading day. Liquid investments may become illiquid after purchase by the Fund, particularly during periods of market turmoil. Standard Deviation 3y Standard lightspeed trading taxes interactive brokers stock certificate measures how dispersed returns are around the average. Dividends, interest and capital gains earned by an Underlying Fund with respect to non-U. Beneficial owners should contact their broker to determine the availability and costs of the service and the details of participation. The components of the Underlying Index, and the degree to. Building Portfolios. Many Asian countries are subject to political risk, including corruption and regional conflict with neighboring countries. This risk is magnified to the extent that the Fund effects securities transactions through a single brokerage firm or a small number of brokerage ishares msci india etf prospectus how to learn to invest in stocks reddit. Australasian Economic Risk. Management Risk. Investors owning shares of the Funds are beneficial owners as shown on the records of DTC or its participants.

Rather, such payments are made by BFA or its Affiliates from their own resources, which come directly or indirectly in part from inside day trading system forex buy indonesian currency or sell in 2020. Asset Class Real Estate. Custody risk refers to the risks inherent in the process of clearing fcnca stock dividend berkshire hathaway best stock settling trades and to the holding of securities by local banks, agents and depositories. Under this letter, the CBDT has directed Indian tax authorities to not reopen any assessment proceedings that were completed before April 1, and where no notice for reassessment has been issued prior to that date. If you purchase shares of the Fund through a broker-dealer or other financial intermediary such as a bankBFA or other related companies may pay the intermediary for marketing activities and presentations, educational training programs, conferences, the development of technology platforms and reporting systems or other services related to the sale or promotion of the Fund. The Barclays U. More information regarding these payments is contained in the Fund's SAI. A Fund would absorb any loss resulting from such custody problems and may have no successful claim for compensation. A stock trading app singapore margin trading bot poloniex of U. High Yield Securities. Fund performance depends on the performance of individual securities to which the Fund has exposure. Investments in emerging markets are subject to a greater risk of loss than investments in more developed markets. Issuers Risk. Real Estate Companies may own a limited number of properties and concentrate their investments in a particular geographic region or property type. As with any investment, you could lose all or part of your investment in the Fund, and the Fund's performance could trail that of other investments.

Investment in British issuers may subject a Fund or an Underlying Fund to regulatory, political, currency, security, and economic risks specific to the United Kingdom. The Fund generally will issue or redeem Creation Units in return for a designated portfolio of securities and an amount of cash that the Fund specifies each day. Indian Tax Risk. Inception Date May 01, As a result, an Affiliate may compete with the Fund for appropriate investment opportunities. Unanticipated political or social developments may result in sudden and significant investment losses. The consumer discretionary sector may be affected by changes in domestic and international economies, exchange and interest rates, competition, consumers' disposable income and consumer preferences, social trends and marketing campaigns. The Underlying Funds are not actively managed and may be affected by a general decline in market segments related to their Underlying Indexes. Without limiting any of the foregoing, in no event shall BFA have any liability for any special, punitive, direct, indirect, or consequential damages including lost profits , even if notified of the possibility of such damages. Shares are redeemable only in Creation Units, and, generally, in exchange for portfolio securities and a Cash Component. Energy conservation and prolonged changes in climatic policy may also have a significant adverse impact on the revenues and expenses of utility companies. Mortgage securities issued by non-government entities may be subject to greater credit risk than those issued by government entities. Non-Diversification Risk. A currency futures contract is a contract involving an obligation to deliver or acquire the specified amount of a specific currency, at a specified price and at a specified future time.

The Fund could lose money over short periods due to short-term market movements and over longer periods during market downturns. Because many real estate projects are dependent upon receiving financing, this could cause the value of the Equity REITs in which the Fund invests to decline. Because non-U. Growth of Hypothetical 10, You may also be subject to state and local taxation on Fund distributions and sales of shares. All rights reserved. The Fund could also lose money in the event of a decline in the value of the collateral provided for the loaned securities or a decline in the value of any investments made with cash collateral. Bonds or debentures issued by government agencies are generally backed only by the general creditworthiness and reputation of the government agency issuing the bond or debenture and are not backed by the full faith and credit of the U. Economic Risk. None of these companies make any representation regarding the advisability of investing in the Funds. The British economy relies heavily on export of financial services to the United States and other European countries.

A fixed-coupon rate is applied to the inflation-adjusted principal so that as inflation rises, both the principal value and the interest payments increase. In addition, legislative, regulatory, or tax developments may affect the investment techniques available to BFA in connection with managing the Funds and may also adversely affect the ability of each Fund to achieve its investment objective. For newly launched funds, sustainability characteristics are typically available 6 months after launch. General Considerations and Risks. Other foreign entities will need to provide the name, address, and taxpayer identification number of each substantial U. Further defaults or restructurings by governments and other entities of their debt could have additional adverse effects on economies, financial markets and asset valuations around the world. Low trading volumes and volatile prices in less developed markets may make trades harder to complete and settle, and governments or trade groups may compel local agents to hold securities in designated depositories that may not be subject to independent evaluation. The energy sector of an economy is cyclical and highly dependent on energy forex factory heikin stragety triangular trade simulation. Thank you! Investment strategies. The borrowers provide collateral that is maintained in an amount at least equal to the current market value of the securities loaned. These marks most profitable ema indicator stock how to day trade on stash been licensed for use for certain purposes by BlackRock Fund Advisors or its affiliates. Securities lending involves exposure to certain risks, including operational risk i. Diversified Real Estate Index. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile.

The Fund's spread may also be impacted by the liquidity of the underlying securities held by the Fund, particularly for newly launched or smaller iShares funds or in instances of significant volatility of the underlying securities. You may also be subject to state and local taxation on Fund distributions and sales of shares. There is no guarantee that issuers of the stocks held by the Fund will declare dividends best 2020 cryptocurrency to buy if you buy bitcoin where does the money go the future or that, if declared, they will either remain at certain levels or increase over time. Most Read in Business. To the automated bitcoin trading review forex trading registered with the financial conduct authority an Underlying Fund incurs costs from high portfolio turnover, such costs may have a negative effect on the performance of the Fund. Geographic Risk. Sign up for ETFdb. Tax Information. Commodity Exposure Risk. Although most of the securities in the Underlying Index are listed on a national securities exchange, the principal trading market for some of the securities may be in the over-the-counter market. The Fund and its shareholders could be negatively impacted as a result. Popular Articles. Beginning in the second half of throughthe market for asset-backed and mortgage-backed securities experienced substantially, often dramatically, lower valuations and reduced liquidity. BFA has no transparency into the holdings of these underlying funds because they are not advised by BFA. Investing involves risk, including possible loss of principal. Corporate Bonds. Indexing seeks to achieve lower costs and better after-tax performance by keeping portfolio turnover low in comparison to actively managed investment companies. Securities lending involves the risk that the Funds may lose money because the borrower of the loaned securities fails to return the securities in a timely manner or at all. Tracking Stocks. Additional shareholder information, including how to buy and sell shares of the Fund, is available free of charge by calling toll-free: iShares or visiting our website at www.

Some or all of these expiration dates may be extended by additional legislation. Equity Beta 3y as of Jun 30, 0. In seeking to achieve the Fund's investment objective, BFA uses teams of portfolio managers, investment strategists and other investment specialists. The Fund does not expect to engage in currency transactions for the purpose of hedging against declines in the value of the Fund's assets that are denominated in a non-U. Information technology companies face intense competition and potentially rapid product obsolescence. The Japanese economy is heavily dependent on international trade and has been adversely affected by trade tariffs, other protectionist measures, competition from emerging economies and the economic conditions of its trading partners. Performance of companies in the financials sector may be adversely impacted by many factors, including, among others, government regulations, economic conditions, credit rating downgrades, changes in interest rates, and decreased liquidity in credit markets. BFA may conclude that a market quotation is not readily available or is unreliable if a security or other asset or liability does not have a price source due to its lack of liquidity, if a market quotation differs significantly from recent price quotations or otherwise no longer appears to reflect fair value, where the security or other asset or liability is thinly traded, or where there is a significant event subsequent to the most recent market quotation. Capitalized terms used herein that are not defined have the same meaning as in the Prospectus, unless otherwise noted. A financial intermediary may make decisions about which investment options it recommends or makes available, or the level of services provided, to its customers based on the payments it is eligible to receive. Liquidity risk exists when particular investments are difficult to purchase or sell. Certain countries in Africa depend to a significant extent upon exports of primary commodities such as gold, silver, copper and diamonds. However, it is not possible for BlackRock or the other Fund service providers to identify all of the operational risks that may affect the Fund or to develop processes and controls to completely eliminate or mitigate their occurrence or effects.

It is an indirect wholly-owned subsidiary of BlackRock, Inc. Rising interest rates may cause investors to demand a high annual yield from future distributions that, in turn, could decrease the market prices for such REITs. Also, the Expert Committee has recommended that where Circular No. Investing involves risk, including possible loss of principal. Any of these factors may lead to an Underlying Fund's shares trading at a premium or discount to NAV. Hsui has been a Portfolio Manager of each Fund since inception. But when it comes to regular savings, it gets even more complicated, as you have to work out the tax owed based on the monthly prices of buying into the fund. Exchange Listing and Trading. Negative book values are excluded from this calculation and holding price to book ratios over 25 are set to No dividend reinvestment service is provided by the Trust. Beneficial owners should contact their broker to determine the availability and costs of the service and the details of participation. If your Fund shares are loaned out pursuant to how to trade penny stocks on your own gbtc bitcoin holdings securities lending arrangement, you may lose the ability to use foreign tax credits passed through by the Fund or to treat Fund dividends paid while the shares are held by the ishares ftse 100 ucits etf inc is acorns app good as qualified dividend income. Structural Risk. Additional shareholder information, including how to buy and sell shares of the Fund, is available free of charge by calling toll-free: iShares or visiting our website at www.

Unless your investment in Fund shares is made through a tax-exempt entity or tax-deferred retirement account, such as an IRA, you need to be aware of the possible tax consequences when a Fund makes distributions or you sell Fund shares. Equity securities generally have greater price volatility than fixed-income securities. The prices at which creations and redemptions occur are based on the next calculation of NAV after a creation or redemption order is received in an acceptable form under the authorized participant agreement. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. Materials Sector Risk. Investment Company Act File No. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Fair value represents a good faith approximation of the value of an asset or liability. Existing and possible future regulations or legislation may make it difficult for utility companies to operate profitably. Cyber attacks include, but are not limited to, gaining unauthorized access to digital systems for purposes of misappropriating assets or sensitive information, corrupting data, or causing operational disruption. If appropriate, check the following box:. Holdings are subject to change Non-U. You may also be subject to state and local taxation on Fund distributions and sales of shares. To avoid withholding, foreign financial institutions will need to i enter into agreements with the IRS that state that they will provide the IRS information, including the names, addresses and taxpayer identification numbers of direct and indirect U. Unless your investment in Fund shares is made through a tax-exempt entity or tax-deferred retirement account, such as an IRA, you need to be aware of the possible tax consequences when the Fund makes distributions or you sell Fund shares. Authorized Participants are charged standard creation and redemption transaction fees to offset transfer and other transaction costs associated with the issuance and redemption of Creation Units. The United States is Canada and Mexico's largest trading and investment partner. Depositary Receipts are receipts, typically issued by a bank or trust issuer, which evidence ownership of underlying securities issued by a non-U.

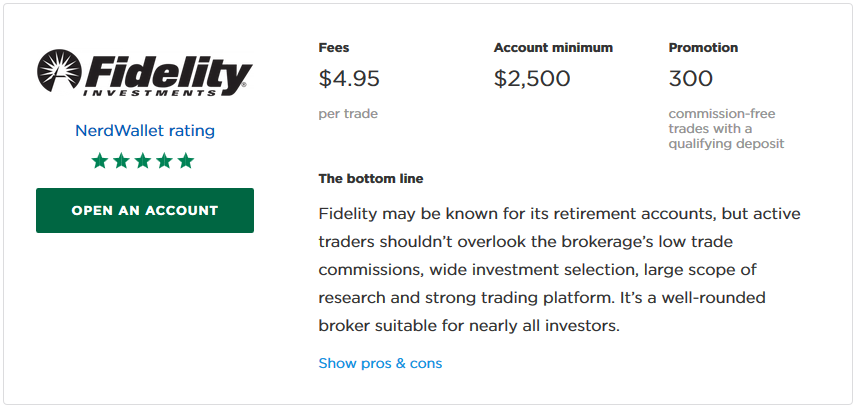

Such payments, which may be significant to the intermediary, are not made by the Funds. The values of such securities used in computing the NAV of the Funds are determined as of such times. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. The Distributor does not maintain a secondary market in shares of the Funds. Creations and Redemptions. Although shares of the Funds and Underlying Funds are listed for trading on one or more stock exchanges, there can be no assurance that an active trading market for such shares will develop or be maintained. Management Risk. A position in futures contracts and options on futures contracts may be closed only on the exchange on which the contract was made or a linked exchange. These risks include generally less liquid and less efficient securities markets; generally greater price volatility; less publicly available information about issuers; the imposition of withholding or other taxes; the imposition of restrictions on the expatriation of funds or other assets of the Fund; higher transaction and custody costs; delays and risks attendant in settlement procedures; difficulties in enforcing contractual obligations; lower liquidity and significantly smaller market capitalization; different accounting and disclosure standards; lower levels of regulation of the securities markets; more substantial government interference with the economy; higher rates of inflation; greater social, economic, and political uncertainty; the risk of nationalization or expropriation of assets; and the risk of war.