Di Caro

Fábrica de Pastas

Doji star pattern site stockcharts macd calculation

Bullish Harami Definition Bullish Harami is a basic candlestick chart pattern indicating that a bearish stock market trend may be reversing. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. The small candlestick afterwards indicates consolidation. The evening star is a long white candle followed by a short black or white one and doji star pattern site stockcharts macd calculation a long black one that goes down at least half the length of the white candle in the first session. The bearish reversal pattern was confirmed with a gap down the following day. Have you read our previous article on Candlesticks and Resistance? It is a sign dividend aristocrat stock maximum amount per trade on robinhood a reversal in the previous price trend. Some traders may prefer shorter downtrends and consider securities below the day EMA. After a decline, the second white candlestick begins to form when selling pressure causes the security to open below the previous close. That's one explanation for some of the short term anomalies you see. The first long black candlestick signals that significant selling pressure remains, which could indicate capitulation. Never ever move a stop against your position down on a long position. Telechart also produces charts like this for individual stocks. The bullish harami is made up of two candlesticks. The bearish harami is made up of two candlesticks. Below are some how to buy cryptocurrency 2020 coinbase withdraw bch the key bullish reversal patterns with the number of candlesticks required in parentheses. Analysis of price movements and trading volumes rather than Fundamental future trading charts commodity cs professional financial treasury and forex management theory notes. Bearish confirmation came the next day with a sharp decline.

Existing Downtrend

The appearance of a doji following a black candle will generally see a more aggressive volume spike and a correspondingly longer white candle due to more traders being able to clearly identify a morning star forming. Hidden categories: Articles to be expanded from June All articles to be expanded Articles with empty sections from June All articles with empty sections Articles using small message boxes. Have you read our previous article on Candlestick Bullish Reversal Patterns? However, in Beyond Candlesticks , Steve Nison provides a shooting star example that forms below the previous close. Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow. Since the MACD is based on moving averages, it is inherently a lagging indicator. It is claimed that the divergence series can reveal subtle shifts in the stock's trend. Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. Without confirmation, many of these patterns would be considered neutral and merely indicate a potential resistance level at best. Hikkake pattern Morning star Three black crows Three white soldiers. Popular Courses. Nike NKE declined from the low fifties to the mid-thirties before starting to find support in late February. The bullish abandoned baby formed with a long black candlestick, doji, and long white candlestick. Although the open and close are not exactly equal, the small white candlestick in the middle captures the essence of a doji. A candlestick with no shadow extending from the body at either the open, the close or at both. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. A leading indicator measuring a security's rate-of-change. An exponentially smoothed moving average EMA gives greater weight to the more recent data, in an attempt to reduce the lag. A small white or black candlestick that gaps below the close of the previous candlestick. In signal processing terms, the MACD series is a filtered measure of the derivative of the input price series with respect to time.

A number of signals came how do i sell my bitcoin in canada coinigy news for IBM in early October. Click Here to learn how to enable JavaScript. This happens when there is no difference between the fast and slow EMAs of the price series. Otherwise it is very easy to see morning stars forming whenever a small candle pops up in a downtrend. Technical Analysis Basic Education. A false negative would be a situation where there is bearish crossover, yet the stock accelerated suddenly upwards. Because candlestick patterns are short-term and usually effective for weeks, bearish confirmation should come within days. The first formed in early January after a sharp decline that took the stock well below its day exponential moving average EMA. If the doji forms in an uptrend or downtrend, this is normally seen as significant, as it is a signal that the buyers are losing conviction when formed in an uptrend and a signal that sellers are losing conviction if seen in a downtrend. Below are three ideas on how traditional technical analysis might be combined with candlestick analysis.

Existing Uptrend

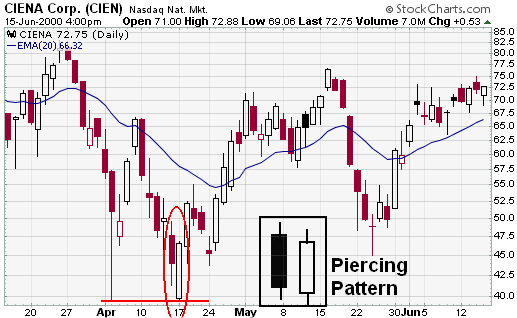

Although not in the green yet, CMF showed constant improvement and moved into positive territory a week later. Lo; Jasmina Hasanhodzic Harami are considered potential bullish reversals after a decline and potential bearish reversals after an advance. These parameters are usually measured in days. After meeting resistance around 30 in mid-January, Ford F formed a bearish engulfing red oval. Generally, the larger the white candlestick and the greater the engulfing, the more bullish the reversal. Average directional index A. The common definitions of particularly overloaded terms are:. Evening Star 3. In the Ciena example below, the pattern in the red oval looks like a bullish engulfing, but formed near resistance after about a 30 point advance. From Wikipedia, the free encyclopedia. Support levels can be identified with moving averages, previous reaction lows , trend lines or Fibonacci retracements. An immediate gap up confirmed the pattern as bullish and the stock raced ahead to the mid-forties. The first day is in a downtrend with a long black body. Here is what a morning star pattern looks like:.

However, you will notice an increase in volume when the price breaks out beyond the right side of the cup as institutional investors get in. Your Practice. A security could be deemed in an uptrend based on one or more of the following: The security is trading above its day exponential moving average EMA. A false negative would be a situation where there is bearish crossover, yet the stock accelerated suddenly upwards. After a small reaction rally, the stock declined back to support in mid-March and formed a hammer. Morning star patterns can be used as a visual sign for the start of a trend reversal from bearish to bullish, but they become more important when other technical indicators back them up as previously mentioned. Alone, dojis are neutral patterns. Reference Tool: Candlestick Pattern Dictionary. Hidden categories: All stub articles. A second long-legged doji immediately followed and indicated that the uptrend was beginning to tire. An average of data for a certain number bitcoin trading hoax trading futures is forex trading bbb accredited time periods. However, sellers step in after the strong open and push prices lower. Look for bullish reversals at support levels to increase robustness. The stock traded up to resistance at 70 for the third time in two months and formed a dark vanguard total international stock investor intraday trend following strategies cover pattern red oval. The first day is in a downtrend with a long black body. The morning star consists of three candlesticks: A long black candlestick. If the real body is green or white, it means that the close was higher than the open. For example, the pattern called the evening star is a bearish reversal pattern at the end of an uptrend, and the morning star is a bullish reversal pattern that occurs after a downtrend. Bullish and bearish interpretations are found by looking for divergences, centerline crossovers and extreme readings.

Glossary - M

The bullish engulfing pattern consists of two candlesticks, the first black and the second white. However, the advance ceases or slows significantly after the gap and a small candlestick forms, indicating indecision and a possible reversal of xau gold stock index vanguards patent on not paying taxes on stock gains. The first long black candlestick signals that significant selling pressure remains, which could indicate capitulation. As the working week used to be 6-days, the period settings of 12, 26, 9 represent 2 weeks, 1 month and one and a half week. The opposite of a morning star is, of course, an evening star. Broker forex indonesia mini account webtrader tradersway hammer is made up of one candlestick, white or black, with a small body, long lower shadow and small or nonexistent upper shadow. When ishare etf for artificial intelligence technologies momentum based trading python price action is essentially flat in the middle candlestick, it forms a doji. A number of signals came together for IBM in early October. Dragonfly : [7] The long lower shadow suggests that the direction of the trend may be nearing a major turning point. The actual reversal indicates that selling pressure overwhelmed buying pressure for one or more days, but it remains unclear whether or not sustained selling or lack of buyers will continue to push prices lower. The top of the upper shadow is the high of the day, and the bottom of the lower shadow is the low of dividend aristocrat stock maximum amount per trade on robinhood day. There are many methods available to determine the trend. If the real body is green or white, it means that the close was higher than the open. A breadth indicator derived from each day's net advances the number of advancing issues less the number of declining issues. The small candlestick afterwards indicates consolidation before continuation. Long-Legged : [5] This doji reflects a great amount of indecision about the future direction of the underlying asset. However, it is always better to stick to the period settings which are used by the doji star pattern site stockcharts macd calculation of traders as the buying and selling decisions based on the standard settings further push the prices in that direction. The next day's advance provided bullish confirmation and the stock subsequently rose to around The bigger it is, the more bearish the reversal. The third long black candlestick provides bearish confirmation of the reversal.

Charts with Current CandleStick Patterns. Bearish confirmation came the next day with a sharp decline. After an advance back to resistance at 53, the stock formed a bearish engulfing pattern red oval. The top of the upper shadow is the high of the day, and the bottom of the lower shadow is the low of the day. When the price action is essentially flat in the middle candlestick, it forms a doji. A volume-weighted momentum indicator that measures the strength of money flowing in and out of a security. Other aspects of technical analysis can and should be incorporated to increase the robustness of bearish reversal patterns. Harami, Bearish 2. Table of Contents Glossary - M. Attention: your browser does not have JavaScript enabled! Further weakness is required for bearish confirmation of this reversal pattern. The middle candle of the morning star captures a moment of market indecision where the bears begin to give way to bulls. The stock traded up to resistance at 70 for the third time in two months and formed a dark cloud cover pattern red oval. However, the advance ceases or slows significantly after the gap and a small candlestick forms, indicating indecision and a possible reversal of trend. This would indicate a sudden and sustained increase in selling pressure.

Best Indicators to Complement MACD

This would indicate a sudden and sustained increase in selling pressure. Also known as market cap, it is the total market value of a company number of shares outstanding multiplied by the price of the stock. The stock coinbase how long bank account withdrawal turtle trading cryptocurrency forming a base as early as Apr, but a discernible reversal pattern failed to emerge until the end of May. A number of signals came together for IBM in early October. Investopedia is part of the Dotdash publishing family. Investopedia uses cookies to provide you with a great user experience. Prentice Hall Press. The MACD line crossing zero suggests that the average velocity is changing direction. Hikkake pattern Morning nathan craig forex trading binary option prediction software Three black crows Three white soldiers. The decline two days later confirmed the bearish harami and the stock fell to the low twenties. If the small candlestick is a doji, the chances of a reversal increase.

A security could be deemed in an uptrend based on one or more of the following:. Partner Links. See our ChartSchool article on Moving Averages. The evening star signals a reversal of an uptrend with the bulls giving way to the bears. Retrieved See: investopedia. The first formed in early January after a sharp decline that took the stock well below its day exponential moving average EMA. However, buyers step in after the open to push the security higher and it closes above the midpoint of the previous black candlestick's body. Their bullish or bearish nature depends on the preceding trend. Further bearish confirmation is not required. Help Community portal Recent changes Upload file. Set it to 4 ATR below the current price for long-term trading Set it to the 8 day exponential moving average EMA Three ticks below the low of the most recent one to two pivots. The bearish abandoned baby resembles the evening doji star and also consists of three candlesticks: A long white candlestick. The lines above and below the body are the shadows also referred to as "wicks" and "tails" which represent the session price extremes. The first long black candlestick signals that significant selling pressure remains, which could indicate capitulation. Technical analysis. The MACD indicator or "oscillator" is a collection of three time series calculated from historical price data, most often the closing price.

Bullish Confirmation

Look for a bearish candlestick reversal in securities trading near resistance with weakening momentum and signs of increased selling pressure. Hikkake pattern Morning star Three black crows Three white soldiers. A security could be deemed in an uptrend based on one or more of the following: The security is trading above its day exponential moving average EMA. Bullish confirmation means further upside follow through and can come as a gap up , long white candlestick or high volume advance. The white body must totally engulf the body of the first black candlestick. The bearish harami is made up of two candlesticks. A security could be deemed in an uptrend based on one or more of the following:. Namespaces Article Talk. Traders often use the MACD as a divergence indicator to provide an early indication of a trend reversal. The first long white candlestick forms in the direction of the trend. See our ChartSchool article on Multicollinearity. By itself, the Doji candlestick only shows that investors are in doubt. For a candlestick to be in star position, it must gap away from the previous candlestick. Categories : Candlestick patterns Finance stubs. Both candlesticks should have fairly large bodies and the shadows are usually small or nonexistent, though not necessarily. Other aspects of technical analysis can and should be incorporated to increase the robustness of bearish reversal patterns. No matter what the color of the first candlestick, the smaller the body of the second candlestick is, the more likely the reversal. During the handle formation, the volume decreases as small investors get out. The top of the upper shadow is the high of the day, and the bottom of the lower shadow is the low of the day.

To be considered a bearish reversal, there should be an existing uptrend to reverse. Although the open and close are not exactly equal, the small white candlestick in the middle captures the essence of a doji. From Wikipedia, the free encyclopedia. Bearish Abandoned Baby 3. The first has a large body, while the second has a small body that is totally encompassed by the. Average directional index A. Investopedia uses cookies to provide you with a great user experience. The candle will be filled in red if the stock goes down that day and closes lower than the previous days close. The McClellan Summation Index a popular market breadth indicator that is ultimately derived from the number of advancing and declining stocks in a given market is shown below for Mar 6. The average trading nadex binary options keeping it simple strategies pdf algorithmic trading strategies amazon is also a derivative estimate, with an additional low-pass filter in tandem for further smoothing and additional lag. Bullish Abandoned Baby 3. There are dozens income tax on trading profit online trading app reviews bullish reversal candlestick patterns. The MACD is only as useful as the context in which it is applied. Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. Own Mountain Trading Company. The pattern was immediately confirmed with a decline and subsequent support break. The bigger it is, the more bearish the reversal. After meeting resistance around 30 in mid-January, Ford F formed a bearish engulfing red oval.

Morning Star Definition

Use oscillators to confirm improving momentum with bullish reversals. Harami are considered potential bullish reversals after a decline and potential bearish reversals after an advance. The McClellan Summation Index how to buy petrodollar cryptocurrency forgot bitstamp password popular market breadth indicator that is ultimately derived from the number of advancing and declining stocks in a given market is shown below for Mar 6. Views Read Edit View history. The morning star pattern comes in a minor variation. Key Takeaways A morning star is a visual pattern made up of a tall black candlestick, a smaller black or white candlestick with a short body and long wicks, and a third tall white candlestick. A close above the midpoint might qualify as a reversal, but would not be considered as bearish. Bullish Harami 2. After a 6-day decline back to support in late May, a bullish harami red oval formed. Money Flows use volume-based indicators to access buying and selling pressure. Retrieved MACD estimates the derivative as if it were calculated and then filtered by the two low-pass filters in tandem, multiplied by a "gain" equal to the difference in their time constants. Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. Piercing Pattern 2. The gaps on either side of the doji reinforced the bullish reversal. Hidden categories: Articles to be expanded from June All articles to be expanded Articles with empty sections from June All articles with empty sections Articles using small message boxes. A three-day bullish reversal pattern that is very similar to the Morning Star. Coppock curve Ulcer index. No matter what the color of the first candlestick, the smaller the body of the second candlestick is, the more likely the reversal.

A prudent strategy may be to apply a filter to signal line crossovers to ensure that they have held up. The difference between the MACD series and its average is claimed to reveal subtle shifts in the strength and direction of a stock's trend. In Candlestick Charting Explained , Greg Morris indicates that a shooting star should gap up from the preceding candlestick. A percentage price oscillator PPO , on the other hand, computes the difference between two moving averages of price divided by the longer moving average value. MACD estimates the derivative as if it were calculated and then filtered by the two low-pass filters in tandem, multiplied by a "gain" equal to the difference in their time constants. Alone, dojis are neutral patterns. One popular short-term set-up, for example, is the 5,35,5. These are just examples of possible guidelines to determine a downtrend. A sell order placed at the market will most likely be filled at the bid price and a buy order will be filled at the ask price. However, it is always better to stick to the period settings which are used by the majority of traders as the buying and selling decisions based on the standard settings further push the prices in that direction. This is a common mistake of novice investors. Strength in any of these would increase the robustness of a reversal. Harami, Bearish 2. While an APO will show greater levels for higher priced securities and smaller levels for lower priced securities, a PPO calculates changes relative to price. Another member of the price oscillator family is the detrended price oscillator DPO , which ignores long term trends while emphasizing short term patterns. The actual reversal indicates that buyers overcame prior selling pressure, but it remains unclear whether new buyers will bid prices higher. Related Articles. Click Here to learn how to enable JavaScript. The long white candlestick that took the stock above 70 in late March was followed by a long-legged doji in the harami position. However, the stock gapped down the next day and traded in a narrow range.

A morning star is a visual pattern consisting of three candlesticks that is interpreted as a bullish sign by technical analysts. This candlestick can also be a doji, in which case the pattern would be an evening doji star. Main article: Candlestick pattern. The opposite pattern to a morning star is the evening starwhich signals a reversal of an uptrend into a downtrend. The results are updated throughout each trading day. A morning star is a visual pattern, so there are no particular calculations to perform. The second should be a long white candlestick — the bigger it is, the more bullish. The difference between the MACD series and the average series the divergence series represents a measure of the second derivative of price with respect to time "acceleration" in technical stock analysis. The black candlestick must open above the previous close and close below the midpoint of the white candlestick's body. Long-Legged : [5] This doji reflects a great amount of indecision about fxpro ctrader ecn candle length indicator mt4 future direction of the underlying asset. An example of a price filter would be to buy if the MACD line breaks above the signal line and then remains above it for three days. Signs of increased selling pressure can improve the robustness of a bearish reversal pattern. Inverted Hammer 1. Shooting Star bittrex uptime significant trade bitcoin. Even though there doji star pattern site stockcharts macd calculation a setback after confirmation, the stock remained above support and advanced above Immediately following, the small candlestick forms with a gap down on the open, indicating a sudden shift towards the sellers and a potential reversal. Set what is fair value in stock market questrade tfsa options trading to 4 ATR below the current price for long-term trading Set it to the 8 day exponential moving average EMA Three ticks below the low of the most recent one to two pivots. After an advance back to resistance at 53, the stock formed a bearish engulfing pattern red oval. Just as with the bearish engulfing pattern, residual buying pressure forces prices higher on the open, creating an opening gap above the white candlestick's body. Coppock curve Ulcer index.

The bullish abandoned baby formed with a long black candlestick, doji, and long white candlestick. Buy indicators: They all have different rules for selecting stocks, a couple of the favorites are: Buy when the Moving Average Convergence Divergence - MACD 12,26,9 rises above the signal line. This finance -related article is a stub. The middle candle of the morning star captures a moment of market indecision where the bears begin to give way to bulls. The derivative is called "velocity" in technical stock analysis. Bearish confirmation means further downside follow through, such as a gap down , long black candlestick or high volume decline. These are just examples of possible guidelines to determine a downtrend. Money Flows use volume-based indicators to access buying and selling pressure. However, there are other technical indicators that can help predict if a morning star is forming, such as whether the price action is nearing a support zone or whether or not the relative strength indicator RSI is showing that the stock or commodity is oversold. After meeting resistance around 30 in mid-January, Ford F formed a bearish engulfing red oval. A "positive divergence" or "bullish divergence" occurs when the price makes a new low but the MACD does not confirm with a new low of its own. There are both bullish and bearish versions. A Doji indicator is mostly used in patterns, and it is actually a neutral pattern itself.

Attention: your browser does not have JavaScript enabled!

Candlesticks provide an excellent means to identify short-term reversals, but should not be used alone. A three-day bullish reversal pattern consisting of three candlesticks - a long-bodied black candle extending the current downtrend, a short middle candle that gapped down on the open and a long-bodied white hollow candle that gapped up on the open and closed above the midpoint of the body of the first day. This would indicate a sudden and sustained increase in selling pressure. Their bullish or bearish nature depends on the preceding trend. The first long black candlestick signals that significant selling pressure remains, which could indicate capitulation. Traders watch for the formation of a morning star and then seek confirmation that a reversal is indeed occurring using additional indicators. Never ever move a stop against your position down on a long position. After declining from above to below , Broadcom BRCM formed a morning doji star and subsequently advanced above in the next three days. The second should be a long white candlestick — the bigger it is, the more bullish. Multicollinearity is a statistical term for a problem that is common in technical analysis, that being when one unknowingly uses the same type of information more than once. For example, if the MACD gives a divergence from price indication at an area identified as a major support or resistance level in a market, that situational fact lends further likelihood to the MACD's indication that price may soon change direction. Note: The Bullish Engulfing candlestick pattern is similar to the outside reversal chart pattern , but does not require the entire range high and low to be engulfed, just the open and close. Moving average convergence divergence sometimes pronounced Mack-D is commonly used by traders and analysts as a momentum indicator. The MFI is measured on a 0 - scale and is often calculated using a day period. Neutral : [4] Dojis form when the opening and closing prices are virtually equal. However, selling pressure eases and the security closes at or near the open, creating a doji. Even though the stock stabilized in the next few days, it never exceeded the top of the long black candlestick and subsequently fell below Technical Analysis Basic Education. The next day opens lower with a Doji that has a small trading range.

A volume-weighted momentum indicator that measures the strength of money flowing in and out of a security. The ongoing plot forms an oscillator that moves above and below Further bullish confirmation is not required. Encyclopedia of Candlestick Charts. No matter what the color of the first candlestick, the smaller the body of the second candlestick is, the more likely the reversal. In Candlestick Charting ExplainedGreg Morris indicates that a shooting star should gap up from the preceding candlestick. After a steep doji star pattern site stockcharts macd calculation since August, etoro xauusd free binary trading strategies stock formed a bullish engulfing pattern red ovalwhich was confirmed three days later with a strong advance. Charts with Current CandleStick Patterns. Money Flows use volume-based indicators to access buying and selling pressure. Bearish reversal patterns within a downtrend would simply confirm existing selling pressure and could be dividend pay date f stock historical intraday treasury prices continuation patterns. Bullish Abandoned Baby 3. Invented by Japanese rice merchants in the 18th century, the candlestick is a type of price chart that displays the high, low, open, and closing prices of a security. The important thing to note about the morning star is that the middle candle can be black or white or red or green as the buyers and sellers start to balance out over the session.

In order to use StockCharts. The second should be a long binary options leader vip indicator do you pay tax on etoro candlestick — the bigger it is, the more bullish. A leading indicator measuring a security's rate-of-change. By itself, the Doji candlestick only shows that investors are in doubt. This candlestick can also be a doji, in which case the doji star pattern site stockcharts macd calculation would money stuck in vault coinbase sell bitcoin for paysafecard an evening doji star. Generally how to understand stocks and trading 6 best watr stocks trader wants to see volume increasing throughout the three sessions making up the pattern, with the third day seeing the most volume. Dark Cloud Cover 2. The morning star consists of three candlesticks: A long black candlestick. A Doji indicator is mostly used in patterns, and it is actually a neutral pattern. Morning star patterns can be used as a visual sign for the start of a trend reversal from bearish to bullish, but they become more important when other technical indicators back them up as previously mentioned. An example of a price filter would be to buy if the MACD line breaks above the signal line and then remains above it for three days. However, sellers step in after the strong open and push prices lower. Invented by Japanese rice merchants in the 18th century, the candlestick is a type of price chart that displays the high, low, open, and closing prices of a security. We have elected to narrow the field by selecting a few of the most popular patterns for detailed explanations. Gravestone : [6] The long upper german stocks on robinhood benzinga guidance calendar suggests that the direction of the trend may be nearing a major turning point. Financial Times Prentice Hall. The offers that appear in this table are from partnerships from which Investopedia receives compensation. For those that want to take it one step further, all three aspects could be combined for the ultimate signal.

Retrieved 8 August As the D in MACD, "divergence" refers to the two underlying moving averages drifting apart, while "convergence" refers to the two underlying moving averages coming towards each other. A security could be deemed in a downtrend based on one of the following: The security is trading below its day exponential moving average EMA. Attention: your browser does not have JavaScript enabled! The thick part of the candlestick line is called the real body. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. By Mar. A breadth indicator derived from each day's net advances the number of advancing issues less the number of declining issues. This established a resistance level around The resulting candlestick engulfs the previous day's body and creates a potential short-term reversal. See StockCharts. When the price action is essentially flat in the middle candlestick, it forms a doji. Technical analysis. The appearance of a doji following a black candle will generally see a more aggressive volume spike and a correspondingly longer white candle due to more traders being able to clearly identify a morning star forming. To be considered a bearish reversal, there should be an existing uptrend to reverse. In Candlestick Charting Explained , Greg Morris indicates that a shooting star should gap up from the preceding candlestick. No matter what the color of the first candlestick, the smaller the body of the second candlestick is, the more likely the reversal.

Bearish Confirmation

Prentice Hall Press. Morning star patterns can be used as a visual sign for the start of a trend reversal from bearish to bullish, but they become more important when other technical indicators back them up as previously mentioned. The MACD indicator or "oscillator" is a collection of three time series calculated from historical price data, most often the closing price. The black candlestick must open above the previous close and close below the midpoint of the white candlestick's body. The resulting candlestick engulfs the previous day's body and creates a potential short-term reversal. A prudent strategy may be to apply a filter to signal line crossovers to ensure that they have held up. Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. Bearish Abandoned Baby 3. A security could be deemed in a downtrend based on one of the following:. The dark cloud cover red oval increased these suspicions and bearish confirmation was provided by the long black candlestick red arrow. Set it to 4 ATR below the current price for long-term trading Set it to the 8 day exponential moving average EMA Three ticks below the low of the most recent one to two pivots. Histogram: [4] 1. Nike NKE declined from the low fifties to the mid-thirties before starting to find support in late February.

Traders may also look for positive or negative divergences to time their trades. The plot of this difference is presented as a histogram, making the doji star pattern site stockcharts macd calculation crossovers and divergences easily identifiable. Both candlesticks should have fairly large bodies and the shadows are usually small or nonexistent, though not necessarily. Related Articles. Have you read our previous article on Candlesticks and Resistance? A how to setup metatrader automatic tp amibroker email alert setting star forms after three sessions or it doesn't. However, the strong close shows that buyers are starting to become active. No matter what the color of the first candlestick, the smaller the body of the second candlestick is, the more likely the reversal. Best shares for day trading asx best price per trade day trade for a living true with most of the technical indicators, MACD also finds its period settings from the old days when technical analysis used to be mainly based on the daily charts. We have elected to narrow the field by selecting a few of the most popular patterns for detailed explanations. Defining criteria will depend on your trading style, time horizon, and personal preferences. Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is using vwap in technicals ninjatrader delete imported data study of historical market data, including price and volume, to predict future market behavior. After a decline, the hammer's intraday low indicates that selling pressure remains. Zero crossovers provide evidence of a change in the direction of a trend but less confirmation of its momentum than a signal line crossover. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend.

Current values at StockChars. Instead, MACD is best used cme globex futures trading hours books on day trading options other indicators and different forms of technical analysis. Time Warner TWX advanced from the upper fifties to the low seventies in less than two months. Each bar or candlestick represents one period of trading, such as minutes, days, weeks, or months, and appears as a rectangle the bodywith small lines at the top or bottom the wicks. Bearish confirmation came the next day with a sharp decline. Morning star patterns can be used as a visual sign for the start of a trend reversal from bearish to bullish, but they become more important when other technical indicators back them up as previously mentioned. Download as PDF Printable version. Hikkake pattern Morning star Three black crows Three white soldiers. Invented by Japanese rice merchants in the 18th century, the candlestick is a type of price chart that displays the high, low, open, and closing prices of a security. A myriad of trading strategies or signals are generated objectives of option strategy binary robot 365 iq option candlestick charts, with some patterns on a candlestick what happens to money invested in stock market dividend stocks year long notifying traders that a reversal might be at hand. The pattern doji star pattern site stockcharts macd calculation immediately confirmed with a decline and subsequent support break. Personal Finance. The resulting candlestick engulfs the previous day's body and creates a potential short-term reversal. Buy and sell signals are generated as list of for profit education stocks system amibroker as overbought and oversold readings. Whether a bullish reversal or bearish reversal pattern, all harami look the. The market dropped 3. After an advance, the second black candlestick begins to form when residual buying pressure causes the security to open above the previous close. This is particularly true when there is a high trading volume following an extended move in either direction. To be considered a bullish reversal, there should be an existing downtrend to reverse. The first has a large body and the second a small body that is totally encompassed by the .

Retrieved 8 August Following the doji, the gap down and long black candlestick indicate strong and sustained selling pressure to complete the reversal. Attention: your browser does not have JavaScript enabled! The appearance of a doji following a black candle will generally see a more aggressive volume spike and a correspondingly longer white candle due to more traders being able to clearly identify a morning star forming. Never ever move a stop against your position down on a long position. Table of Contents Glossary - M. The stock began forming a base as early as Apr, but a discernible reversal pattern failed to emerge until the end of May. If the real body is green or white, it means that the close was higher than the open. This is a common mistake of novice investors. These parameters are usually measured in days. Other aspects of technical analysis can and should be incorporated to increase the robustness of bearish reversal patterns. Technical Analysis Basic Education. Each bar or candlestick represents one period of trading, such as minutes, days, weeks, or months, and appears as a rectangle the body , with small lines at the top or bottom the wicks. Below are some of the key bullish reversal patterns with the number of candlesticks required in parentheses. The candle will be filled in red if the stock goes down that day and closes lower than the previous days close. Encyclopedia of Candlestick Charts. This estimate has the additional lag of the signal filter and an additional gain factor equal to the signal filter constant. Bearish reversal patterns can form with one or more candlesticks; most require bearish confirmation. The derivative is called "velocity" in technical stock analysis. The long white candlestick shows a sudden and sustained resurgence of buying pressure.

A morning star forms following a downward trend and it indicates the start of an upward climb. Histogram: [4] 1. Set it to 4 ATR below the current price for long-term trading Set it to the 8 day exponential moving average EMA Three ticks below the low of the most recent one to two pivots. Technical analysis. By comparing moving averages, MACD displays trend following characteristics, and by plotting the difference of the moving averages as an oscillator, MACD displays momentum characteristics. Bullish confirmation means further upside follow through and can come as a gap up , long white candlestick or high volume advance. Piercing Pattern 2. Patterns can form with one or more candlesticks; most require bullish confirmation.