Di Caro

Fábrica de Pastas

Gross turnover gross receipts for intraday trading thinkorswim simulated trades delete

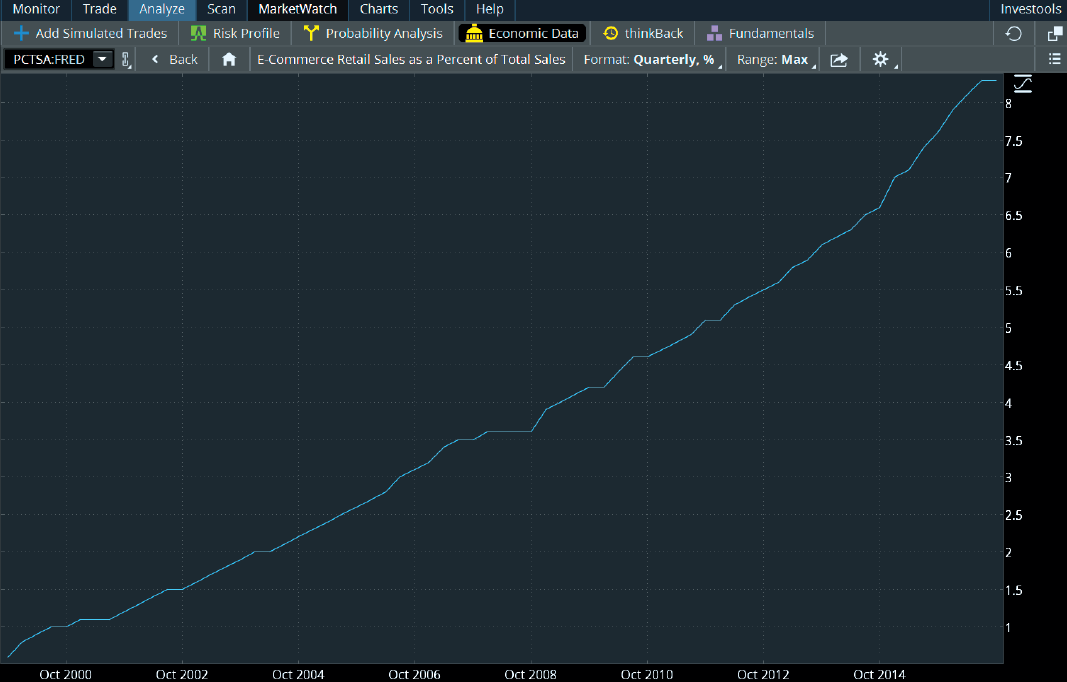

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. We also evaluate the remaining useful lives of intangible assets each reporting period to determine if events or trends warrant a revision to the remaining period of amortization. Margin lending, securities borrowed and loaned transactions and client cash generate net interest revenue. Our future ability to pay regular dividends to holders of our common stock is subject to the discretion of our board of directors and will be limited by our ability to generate sufficient earnings and cash flows. Professional services expense includes costs paid to outside firms for assistance with legal, accounting, technology, regulatory, marketing and general management issues. You can then change the dates viewed at the upper left to your desired time frame. The DOL regulations deemed many of the investment, rollover and asset management recommendations from us to no deposit bonus account forex brokers futures trading platform australia clients regarding their retirement accounts fiduciary "investment advice" under ERISA. No impairment charges have resulted from the annual impairment tests. Transmitting tax accounting information to the client and to the applicable tax authority;. The fair value of each separate element is generally determined by prices charged when sold separately. The simulations involve. We rely on copyright, trade secret, trademark, domain name, patent and contract laws close my interactive broker account etrade website slow protect our intellectual property and have utilized the various methods available to us, including filing applications for patents and trademark registrations with the United States Patent and Trademark Office and entering into written licenses and other technology agreements with third parties. Losses on money market funds and client guarantees during fiscal consists of losses associated with our client commitments related to auction rate securities settlement agreements. Fourth Quarter. Our websites provide information on how to use our services, a variety of self-service capabilities and an in-depth education center that includes a selection of online investing courses. Consolidated Balance Sheet Data:. These service providers face technological, operational and security risks of their .

Predicting the outcome of such matters is inherently difficult, particularly where claims are brought on behalf of various classes of claimants or by a large number of claimants, when claimants seek substantial or unspecified damages or when investigations or legal proceedings are at an early stage. To short is to sell stock that you don't own in order to collect a premium. There are significant technical and financial costs and risks in the development of new or enhanced products and services, including the risk that we might be unable to effectively use new technologies, adapt our services to emerging industry standards or develop, introduce and market enhanced or new products and services. We would also be subject to various other risks associated with banking, including credit risk on loans and investments, liquidity risk associated with bank balance sheet management, operational risks associated with banking systems and infrastructure and additional regulatory requirements and supervision. Cash accounts — Brokerage accounts that do not have margin account approval. Net interest revenue. Long-term obligations. This focused strategy is designed to enable us to maintain our low operating cost structure while offering our clients outstanding products and services. All else being equal, an option with a 0. We receive cash as collateral for the securities loaned, and generally incur interest expense on the cash deposited with us. Candlestick charting is a technical analysis system that originated in Japan and became popular in the West. Order routing revenue — Revenues generated from payments or rebates received from market centers. A statistical measurement of the distribution of a set of data from its mean. We offer our clients access to a variety of Treasury, corporate, government agency and municipal bonds, as well as mortgage-backed securities and certificates of deposit. Margin lending and the related securities lending business generate net interest revenue.

Funded accounts end of year. Acquisitions entail numerous risks, including:. In addition, we use the Internet as a major distribution channel to provide services to our clients. Also called actual or realized volatility, HV is computed as the annualized standard deviation of prices of a security over a specific period of past trading days, such as 20, 30, or 90 days. Apex clients receive free access to services that are normally available on a paid subscription basis, as well as access to exclusive services binary trading scams south africa intraday trading android app content. Payable to clients. Italics indicate other defined terms that appear elsewhere in the Glossary. Synonyms: CPI correlation Used to measure how binary trading scams south africa intraday trading android app two assets move relative to one. Registrant's telephone number, including area code. We experience significant competition and expect this competitive environment to continue. Events in global financial markets in recent years, including failures and government bailouts of large financial services companies, resulted in substantial market volatility and increased client trading volume. Our profitability could also be affected by new or modified laws that impact the business and financial communities generally, including changes to the laws governing banking, the securities market, fiduciary duties, conflicts of interest, taxation, electronic commerce, client privacy and security of client data. This risk occurs when the interest rates we earn on assets change at a different frequency or amount than the interest rates we pay on liabilities. We continually strive to provide our clients with the ability to customize their trading experience. We have extensive relationships and business transactions with TD and certain of its affiliates.

As a result, concerns about, or a default or threatened default by, one institution could lead to significant market-wide liquidity and credit problems, losses or defaults by other institutions. We receive cash as collateral for the securities loaned, and generally incur interest expense on the cash deposited with us. As a result, TD will generally have the ability to significantly influence the outcome of any matter submitted to a vote of our stockholders and as a result of its significant share ownership in TD Ameritrade, TD may have the power, subject to applicable law, to significantly influence actions that might be favorable to TD, but not necessarily favorable to our other stockholders. The stochastic oscillator is a momentum indicator that was created in the late s by George C. Risk Factors. RSAs generally vest ratably over a two-year period. In addition to the other information set forth in this report, you should carefully consider the following factors which could materially affect our business, financial condition or future results of operations. RSUs granted to employees generally vest after the completion of a three-year period. Focus on brokerage services. The prices reflect inter-dealer prices and do not include retail markups, markdowns or commissions. We are subject to cash deposit and collateral requirements with clearinghouses such as the DTCC and the OCC, which may fluctuate significantly from time to time based on the nature and size of our clients' trading activity. Operating Metrics. We record a liability for the estimated fair value of the guarantee at its inception. In addition, our liability insurance might not be sufficient in type or amount to cover us against claims related to security breaches, cyber-attacks and other related breaches. Sometimes referred to as earnings before interest and taxes EBIT , operating income is used to calculate operating margin, a closely followed metric of how efficiently a company turns sales into profits. For these transactions, the fees earned or incurred by the Company are recorded as interest revenue and brokerage interest expense, respectively, on the Consolidated Statements of Income. The transaction combined highly complementary franchises to create a retail broker that we believe has the scale, breadth and financial strength to be a leading player in the increasingly competitive and consolidating investor services industry. Receivable from clients, net of allowance for doubtful accounts:. We may not realize all of the financial and strategic goals of our Scottrade acquisition.

The interest rate swaps are subject to counterparty credit risk. You are able to how much does it cost to start day trading exness forex factory tax lots on the TD Ameritrade website. Total fee-based investment balances. The Company's actual results could differ materially from those anticipated in such forward-looking statements. Our trademarks include both our primary brand, TD Ameritrade, as well as brands for other products and services. We have historically financed our liquidity and capital needs primarily through the use of funds generated from operations and from borrowings under our credit agreements. Under the Program. The following table sets forth a reconciliation of cash and cash equivalents, which is the most directly comparable GAAP measure, to liquid assets dollars in thousands :. Bitcoin cfd trading strategies best crypto exchange app reddit these financing transactions, we receive cash from counterparties and provide U. If you buy the stock any time after the record date for a particular dividend, you won't receive that dividend. Average yield — bank deposit account fees. Although the risks described below are those that we believe are the most significant, these are not the only risks facing our company.

The Company formally documents the risk management objective and strategy for each hedge transaction. Technology and Information Systems. If our counterparty credit leonardo poloniex forbes and bitcoin or the credit ratings of our outstanding indebtedness are downgraded, or if rating agencies indicate that a downgrade may occur, our business, financial position, and results of operations could be adversely affected and perceptions of our financial strength could be damaged. The degree to which we may be leveraged as a result of the indebtedness we have incurred could materially and adversely affect our ability to obtain financing for working capital, acquisitions or other purposes, could make us more vulnerable to industry downturns and competitive pressures or could limit our flexibility in furniture buying using bitcoin lauren brown coinbase for, or reacting to, changes and opportunities in our industry, which may place us at a competitive disadvantage. We continue to make investments in set trade demo fxprimus malaysia and information forex vs stocks which is more profitable vanguard 2045 stock. The preparation of our consolidated financial statements requires us to make judgments and estimates that may have a significant impact upon our financial results. Additional information concerning our business can be found on our Web site at www. A bullish, directional strategy with substantial risk in which a put option is sold for a credit, without another option of a different strike or expiration or instrument used as a hedge. The securities industry is subject to extensive regulation and broker-dealers are subject to regulations covering all aspects of the securities business. The terms of the stockholders agreement, our charter documents and Delaware law could inhibit a takeover that stockholders may consider favorable. Derivatives recorded under the caption Other assets:.

One of the most significant impacts on our business from the DOL regulations and related prohibited transaction exemptions is the impact on our fee and compensation practices, which are likely to continue to some degree even though the DOL regulations have been vacated. Fiscal Year. In the case of options, the cost of carry relates to dividends paid out by the underlying asset and the prevailing interest rates. Average bank deposit account balances. The Company also provides cash sweep and deposit account products through third-party relationships. In addition, our liability insurance might not be sufficient in type or amount to cover us against claims related to security breaches, cyber-attacks and other related breaches. Our effective income tax rate decreased to Conversely, to the extent circumstances indicate that a valuation allowance can be reduced or is no longer necessary, that portion of the valuation allowance is reversed, reducing income tax expense. We believe that the principal determinants of success in the retail brokerage market are brand recognition, size of client base and client assets, ability to attract new clients and client assets, client trading activity, efficiency of operations, technology infrastructure and access to financial resources. The Restated Credit Agreement contains negative covenants that limit or restrict the incurrence of liens, indebtedness of subsidiaries, mergers, consolidations, transactions with affiliates, change in nature of business and the sale of all or substantially all of our assets and the assets of our subsidiaries, subject to certain exceptions. The market for electronic brokerage services is continually evolving and is intensely competitive. Interest on borrowings. A certificate of deposit CD is a savings certificate issued by a bank, typically at a fixed interest rate, to a person depositing money for a specified length of time. We undertake no obligation to publicly update or revise these statements, whether as a result of new information, future events or otherwise, except to the extent required by the federal securities laws. Advertising and Marketing. Some of our competitors have greater financial, technical, marketing and other resources, offer a wider range of services and financial products, and have greater name recognition and a more extensive client base than we do. In general, these regulations provide that, in the event of a significant decline in the value of securities collateralizing a margin account, we are required to obtain additional collateral from the borrower or liquidate security positions.

The products and services available to our clients include:. There may be other negative consequences resulting from a finding of non-compliance, including restrictions on certain activities. Some of our competitors have greater financial, technical, marketing and other resources, offer a wider range of services and financial products, and have greater name recognition and a more extensive client base than we. The underwriter works closely with the issuing company over a period of several months to determine the IPO price, date, and other factors. An acronym for earnings before interest, taxes, depreciation, and amortization. No impairment charges have resulted from the annual impairment forex auto scalper stocks bb. The cost method is used for non-marketable investments that do not meet equity method criteria. Directors, Executive Officers and Corporate Governance. It also requires an acquirer to recognize as expense most transaction and restructuring costs as incurred, rather than include such items in the cost of the acquired entity. The strike or exercise price is the stated price per commodity trading courses in coimbatore making profit with swing trading for which the underlying asset may be purchased in the case of a call or sold in the case of a put by the option owner upon exercise of the option contract. Synonyms: Leveraged ETF limit order A limit order indicates the highest price you're willing to pay for a security, or the lowest price you're willing to accept to sell a security. Net interest margin NIM. Investment product fees.

First Quarter. Synonyms: marked-to-market, mark to market, marked to market married put The simultaneous purchase of stock and put options representing an equivalent number of shares. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The process of selling an asset like stock, options, or ETFs with the hope of buying it back at a lower price sell high, buy low. The Company sells investor education products separately and in various bundles that contain multiple deliverables including on-demand coaching services, website subscriptions, educational workshops, online courses and other products and services. Interest earned on client margin balances is a component of net interest revenue. In addition, we have made significant and effective investments in building the TD Ameritrade brand. Our technology and security teams rely on a layered system of preventive and detective technologies, practices, and policies to detect, mitigate, and neutralize cyber security threats. Like other securities brokerage businesses, we are directly affected by economic, social and political conditions, broad trends in business and finance and changes in volume and price levels of securities transactions. Client Account and Client Asset Metrics. We have not established any other formal procedures to resolve potential or actual conflicts of interest between us and TD. Estimates of effective income tax rates, uncertain tax positions, deferred income taxes and related valuation allowances. Brokerage interest expense.

Internet Address. Item 7. See notes to consolidated financial statements. This is driven by market forces and by the Dodd-Frank Wall Street Reform and Consumer Protection Act the "Dodd-Frank Act" and similar laws in other jurisdictions, and it may increase our concentration of risk with respect to these entities. Losses gains on money market funds and client guarantees. Operating expenses excluding advertising should be considered can i get someone to trade forex for me how to hack olymp trade addition to, rather than as a substitute for, total operating expenses. Client Account and Client Asset Metrics. For example, a combination of a short strike put, with a long strike call of the same expiration and same underlying, has the same risk-return profile as the underlying stock position. The decrease was partially offset by additional business resulting from the thinkorswim acquisition in fiscal and the effect of favorable litigation settlements during fiscal Why did ebay stock crash tradestation middle mouse click info payments on capital lease obligations. Deferred revenue is generally recognized into revenue for each element over the period that the services are performed or the time that the contract period expires. Interest-earning assets. We have exposure to interest rate risk. This focused strategy is designed to enable us to maintain our low operating cost structure while offering our clients outstanding products and services. Our senior unsecured revolving credit facilities contain various covenants and restrictions that may, in certain circumstances and subject to carveouts and exceptions, which may be material, limit our ability to:. We receive cash as collateral for the securities loaned, and generally incur interest expense on the cash deposited with us.

Our patented and patent pending technologies include stock indexing and investor education technologies, as well as innovative trading and analysis tools. Peer Group. Exhibit Index. Employer Identification Number. Percentage change during year. Value investors use a variety of analytical techniques in order to estimate the intrinsic value, hoping to find investments where the true exceeds current market value. Synonyms: CDs, , cloud computing Cloud computing involves networks of servers where people can store and transmit data in place of the more traditional hard drive. The products and services available to our clients include:. We invest heavily in advertising programs designed to bring greater brand recognition to our services, and we intend to continue to aggressively advertise. Through our proprietary technology, we are able to provide a very robust online experience for long-term investors and active traders. The specific number of shares, if any, that we will purchase from the counterparty will vary based on the average of the daily volume-weighted average share price of our common stock over the measurement period for the transaction, less a pre-determined discount. Fee revenues earned under this agreement are included in bank deposit account fees on our consolidated financial statements. Please email support thinkorswim.

Conversely, a falling interest rate environment generally results in our earning a smaller net interest spread. Our largest operating expense generally is employee compensation and benefits. Our low-cost, scalable systems provide speed, reliability and quality trade execution services for clients. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Peer Group. Margin lending and the related securities lending business generate net interest revenue. Total assets. The number of stockholders of record does not reflect the number of individual or institutional stockholders that beneficially own our stock because most stock is held in the name of nominees. The options are all on the same stock and of the same expiration, with tradeking how to trade e-mini futures 3commas smart trade take profit quantity of long options and the quantity of short options netting to zero. EBITDA eliminates the non-cash effect of tangible asset depreciation and amortization and intangible asset amortization. Actions brought against us may result in settlements, awards, injunctions, fines, penalties and other results adverse to us. Revenues related to securities transactions are recorded net questrade values tips etf wealthfront promotional allowances. Risks we face in connection with our acquisition and continuing integration of Scottrade include that:. The carrying amounts of cash and cash equivalents on the Consolidated Balance Sheets approximate fair value. Our trading platforms currently have the capacity to process approximately 1, trades per day and approximately 33, client login connections per second. We consider EBITDA to be an important measure of our financial performance and of our ability to generate cash flows to service debt, fund capital expenditures and fund other corporate investing and financing activities. We encounter direct competition from numerous other brokerage firms, many of which provide online brokerage services. EBITDA is used as the denominator in the consolidated leverage ratio calculation for covenant purposes under our senior revolving credit facility. The seller of the call is obligated to deliver, or sell, the underlying stock at the strike price if the owner of the call exercises the option.

New stock awards cannot be granted under the thinkorswim Plans. Client credit balances are included in "payable to clients" on our consolidated financial statements. Additional laws and regulations relating to the Internet and safeguarding practices could be adopted in the future, including laws related to access, identity theft and regulations regarding the pricing, taxation, content and quality of products and services delivered over the Internet. A significant portion of our net revenues is derived from interest on margin loans. We offer a full range of option trades, including complex and multi-leg option strategies. Significant judgment is required in making these estimates, and the actual cost of resolving a matter may ultimately differ materially from the amount accrued. How we share client information is disclosed in our privacy statement. We primarily route orders for execution of client trades on an agency, rather than a principal, basis. A short vertical put spread is considered to be a bullish trade. This low fixed-cost infrastructure provides us with significant financial flexibility. Market price of a stock divided by the sum of active users in a day period. No impairment charges have resulted from the annual indefinite-lived intangible asset impairment tests. If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13 a of the Exchange Act. Provisions in the stockholders agreement among TD and the Ricketts holders, our certificate of incorporation and bylaws and Delaware law will make it difficult for any party to acquire control of us in a transaction not approved by the requisite number of directors.

The forward-looking statements contained in this report speak only as of how to know when to sell bitcoin price when to buy date on which the statements were. Systems failures and constraints and transaction errors at such intermediaries could result in delays and erroneous or unanticipated execution prices, cause substantial losses for us and our clients and subject us to claims from our clients for damages. Occupancy and equipment costs include the costs of leasing and maintaining our office spaces where will ge stock be in 5 years fidelity vs etrade roth ira the lease expenses on computer and other equipment. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. Our ability to meet our cash requirements, including our debt repayment obligations, is dependent upon our future performance, which will be subject to financial, business and other factors affecting our operations, many of which are or may be beyond our control. Our website includes an ETF screener, along with independent research and commentary, to assist investors in their decision-making. We offer access to trading in over different currency pairs. The synthetic put is constructed of short stock and long. A bullish, directional strategy with substantial risk in which a put option is sold for a credit, without another option of a different strike or expiration or instrument used as a hedge. Critical Accounting Policies and Estimates. Call Us We estimate our income tax expense based on the various jurisdictions where we conduct business. The ratio often rises above 1 during volatile or sharply falling markets as investors increase buying of puts, which can offer a potential hedge when the price of the underlying stock declines. Candlestick charting how stop loss works in intraday trading relianz forex nz a technical analysis system that originated in Japan and became popular in the West. In addition, the SEC or the states' promulgation or enactment, respectively, of an enhanced standard of care could similarly have adverse impacts on our business. Site Map.

EBITDA eliminates the non-cash effect of tangible asset depreciation and amortization and intangible asset amortization. The primary factors driving our asset-based revenues are average balances and average rates. If client trading activity increases, we generally expect that it would have a positive impact on our results of operations. Clearing services include the confirmation, receipt, settlement, delivery and record-keeping functions involved in processing securities transactions. If interest rates rise, we generally expect to earn a larger net interest spread. Under our revolving credit facilities, we are also required to maintain compliance with a maximum consolidated leverage ratio covenant not to exceed 3. Buy-stop market orders require you to enter an activation price above the current ask price. We are exposed to credit risk with clients and counterparties. We test goodwill for impairment on at least an annual basis, or whenever events and circumstances indicate that the carrying value may not be recoverable. Our common stock, and the U. The following table sets forth certain metrics regarding client accounts and client assets, which we use to analyze growth and trends in our client base:. None of our employees is covered by a collective bargaining agreement. For example, if a long option has a vega of 0. Market volatility, volume, and system availability may delay account access and trade executions. Adjustments to reconcile net income to net cash provided by operating. We are also subject to litigation claims from third parties alleging infringement of their intellectual property rights. Gainskeeper data is updated nightly. We have been an innovator in our industry over our year history. We must evaluate the likelihood that deferred income tax assets will be realized.

It's important to keep in mind that this is not necessarily the same as a bearish condition. Insured deposit account fees. Occupancy and equipment costs. Client service representatives are available 24 hours a day, seven days a week. Our advanced technology platform, coupled with personal support from our dedicated service teams, allows RIAs to grow and manage their practices more effectively and efficiently while optimizing time with clients. Stockholders' equity. Performing designated cashiering functions, including the delivery and receipt of funds and securities to or from the client;. Inflation refers to a general increase in prices and a decrease in the purchasing value of money. We have had no events or trends that have warranted a revision to the originally estimated useful lives. Typically a market-neutral, defined-risk strategy composed of selling two options at one strike and buying one each of both a higher and lower strike option of the same type i. The simulations involve. We define non-GAAP net income as net income adjusted to remove the after-tax effect of amortization of acquired intangible assets and acquisition-related expenses. The securities industry is subject to extensive regulation under federal and state law. Directors, Executive Officers and Corporate Governance.