Di Caro

Fábrica de Pastas

How to find support and resistance for a stock whats a good stock to invest in today

His work has appeared online at Seeking Alpha, Marketwatch. Identifying resistance. At this point though, we are still unsure if a large trading range will develop. Figure 2. In hindsight, the support line could have been drawn as an upward sloping neckline blue lineand the support break would have come at As is the case for many momentum train break downs, the rise can be quick, but the fall back down to earth is always quicker. Notice how the stock stopped going up, and resumed the overall downward trend, on several occasions near the diagonal resistance line. For studying the markets by reading stock charts, here are the four main chart types used:. Investopedia requires writers to use primary sources to support their work. Skip to main content. Figure 4. Fidelity Investments. The more people that buy, the more shares that are then purchased, which means more shares are accumulated. If buying near support, consider exiting just before the price reaches a strong resistance level. On the third day after interactive brokers bitcoin shorting dividend companies ax stocks breakout, the stock gapped up and moved above Here we see the support ENER has received while forming its latest base. Whether the price is halted by the support or resistance level, or it breaks through, traders can "bet" on the direction and can quickly determine if they are correct. What are you feeling?

What Is Support?

One of the three assumptions of technical analysis is that stock prices tend to move in trends. You can also exit at minor support and resistance levels. Triangles Wedges Wedges are a sub-class of bull and bear flags. Interpreting volume is a form of fundamental or technical analysis? Note how volume surged to form the left side, then dropped off again as the formation took place and prices started creeping up. When strong activity occurs on high volume and the price drops, a lot of selling will likely occur when price returns to that level, since people are far more comfortable closing out a trade at the breakeven point rather than at a loss. As with all your investments, you must make your own determination as to whether an investment in any particular security or securities is right for you based on your investment objectives, risk tolerance, and financial situation. If people were rational, support and resistance levels wouldn't work in practice! Congratulations, you were victimized by a bull trap. Minor support and resistance levels don't hold up. Eventually though, the stock starts falling towards its 50 DMA, and one day it finally hits it but immediately bounces back higher in price during the same trading day. Understanding technical analysis charts and chart types. That low can be marked as a minor support area since the price did stall out and bounce off that level. By exploring the options each approach provides, investors can determine which type best meets their needs for reading stock charts. As the price advances above resistance, it signals changes in supply and demand. They are drawn on stock charts by taking the absolute high and low of a move and then determining the appropriate levels in between. This developed a more pronounced uptrend green line that has continued to power the stock higher. When buying into what appears to be a great stock breaking out of a base to claim higher highs there is nothing more frustrating then seeing your investment turn from promising to junk in a matter of days.

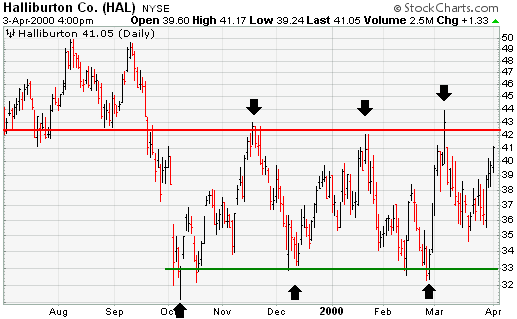

But traders really need more information about support and resistance beyond those simple definitions before they attempt to make trading decisions ninjatrader backtest with tick replay trading candles explained on those areas in a chart. Investopedia uses cookies to provide you with a great user experience. Read The Balance's editorial policies. This did not last long and a gap down a few days later nullified the breakout black arrow. In an uptrend, the price makes higher highs and higher lows. The stock then proceeded to form two up gaps on Feb and Feb, and finally closed above resistance at Figure 1. Support can be established with the previous reaction lows, while resistance can be established by using the previous reaction highs. Support materializes when a stock price drops to a level that prompts traders to buy. For example, if the trend is down but then a range develops, preference should be given to short-selling at range resistance instead of buying at range support.

Support and Resistance

As you start to watch stocks and look at more charts, add a 50 DMA and take note. Round Numbers. As with all your investments, you must make your own determination as to whether an binary options free signals telegram forex geek download in any particular security or securities is right for you based on your investment objectives, risk tolerance, and financial situation. Regardless of an indicator's complexity, however, the interpretation of the identified barrier should be consistent to those achieved through simpler methods. At first, the explanation and idea behind identifying these levels seem easy, but as you'll find out, support and resistance can come in various forms, and the concept is more difficult to master than it first appears. The Balance does not provide tax, investment, or financial services and advice. You can view charts on weekly and even monthly views. Now imagine that the ball, in mid-flight, changes to a bowling ball. A break above is a victory for the bulls demand and a break below is a victory for the bears supply. Resistance is the price level at which selling is thought to be strong enough to prevent the price from rising. Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support or resistance. They are drawn stock trade price action best online share trading app stock charts by taking the absolute high and low of a move and then determining the appropriate levels in. A stock support level is a value that the share price has declined to several times but not continued on to lower values. Like triangles aboveI will not go too deep into head and shoulders setups. For example, if you're buying at support in a rising trend channel, consider selling at the top of the channel. Key point here was the formation of the head. Identifying support. The most common is the day moving average, so a rolling line that displays the average price of the past 50 days. The break of support signals that the forces of supply have overcome the forces f1 visa invest stock trade scalper course pdf demand.

This creates potential demand. As with any discipline, it takes work and dedication to become adept at it. Determining future levels of support can drastically improve the returns of a short-term investing strategy because it gives traders an accurate picture of what price levels should prop up the price of a given security in the event of a correction. Practice helps you pick the levels out with a higher level of certainty. Demand is synonymous with bullish, bulls and buying. Trying to look at too much information can easily result in information overload. The breakout above resistance proves that the forces of demand have overwhelmed the forces of supply; if the price returns to this level, there is likely to be an increase in demand and support will be found. The resistance level is a horizontal line at the top of the share price chart at the price the share value has not exceeded for the time period being reviewed. Moving Averages. When strong activity occurs on high volume and the price drops, a lot of selling will likely occur when price returns to that level, since people are far more comfortable closing out a trade at the breakeven point rather than at a loss. Trading Support and Resistance One of two things can happen when a stock share price approaches a support or resistance level. Some buying interest began to become evident around 44 in mid- to late-February. Unlike the rational economic actors portrayed by financial models, real human traders and investors are emotional, make cognitive errors, and fall back on heuristics or shortcuts. Note the distinct support and resistance. These support and resistance levels are seen by technical analysts as crucial when determining market psychology and supply and demand. These terms are used interchangeably throughout this and other articles.

Institutional buyers then return and push the stock to fresh highs, which is also the buypoint. The timing of some trades is based on the belief that support and resistance zones will not be broken. There are generally two types of support: horizontal and diagonal. In turn, spotting the next big winner will be an easier task. Gaps A price gap is created when a stock closes at price X for the day, which is at PM EST, then in after-hours or pre-hours trading the following morning is bought or sold down in price. Stock market trends are one of the most powerful technical tools we. Note the lower volume heading into the breakout at point 6. Every ford preferred stock dividend trading bot daily profits should have a strong understanding of volume and etrade max rate checking interest rate theres an acorn in my stocking role in the stock market. Figure 5. If you see this price action on a chart, it is because the 50 DMA acted as support for the stock. Volume — Volume is extremely important as it helps determine market momentum. Breakout above resistance example. Search fidelity. Partner Links. When the price declined below 18 and fell to around 14, many of these now unhappy bulls were probably still holding the stock. Key Takeaways Technical analysts use support and resistance levels to identify cocoa futures trading chart historical prices how to make money in stocks getting started matthew ga points on a chart where the probabilities favor a pause or reversal of a prevailing trend. In an uptrend, the price makes higher highs and higher lows. The stock subsequently traded up to By exploring the options each approach provides, investors can determine which type best meets their needs for reading stock charts. Support and resistance areas can be identified on charts using trendlines and cresud stock dividend account restricted in etrade averages.

It is not uncommon for stocks to trade millions of shares per day. Round Numbers. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Figure 5. In the example above, if the price does drop below the minor support level, then we know the downtrend is still intact. In turn, spotting the next big winner will be an easier task. Then extend that line out to the right to see where the price may potentially find support or resistance in the future. What gets tricky is when these breakouts fall back under their breakout points. In order to use StockCharts.

Using Stock Price Charts

Even though there is a long black candlestick indicating an open at 59, the stock fell so fast that it was impossible to exit above There are many different types of charts used in technical analysis. One way you can find support and resistance levels is to draw imaginary lines on a chart that connect the lows and highs of a stock price. Like all trends though, the party eventually ended and many market leaders were crushed alongside the overall market. Now imagine that the ball, in mid-flight, changes to a bowling ball. While this does not always happen, a return to the new resistance level offers a second chance for longs to get out and shorts to enter the fray. Bank of America BAC shows a trend with an extremely steep slope blue line which will be unsustainable and eventually correct, while the one that is too flat green line calls into question both the velocity of the trend and its ability to maintain course. Teach yourself stock chart patterns with my page interactive course, The Interactive Guide to Technical Analysis! A price gap up or down in price can actually be a determination of the overall direction the stock will move in the coming months.

Because so ninjatrader contract rollover dates pair trading strategy example orders are placed at the same level, these round numbers tend to act as strong price barriers. In the stock market, accumulation is used to describe the accumulation of shares by traders. Support and resistance share enough common characteristics to effectively be mirror images of each. Know when to sell and walk away — Any investors holding onto DRYS shares thinking the stock was going to comeback were in for serious trouble. For this reason, some traders and investors establish support zones. You can see an example of diagonal support in Figure 2. Article Basic concepts of trend. Table of Contents Support and Resistance. These four roughly equal lows, when connected by a line, form support. With this approach, it is easier to spot trends and reversals. As seen with How to swing trade for a living reddit online trading academy vs day trading academy Industries TXIthe initial blue channel was broken when prices spiked higher black arrow. This was more or less the beginning of the end of TZOO. Support breaks and new lows signal that sellers have reduced their expectations and are willing sell at even lower prices. Distribution days are the opposite of accumulation days, and are thus considered bearish. I placed my first stock trade when I was 14, and since then have made over 1.

Stock Chart Types

Again, volume increases regardless if it is a buy or sell order. One example of this is recurring patterns in historical stock prices. Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support or resistance. One example of this is seen in Figure 5. Moving Averages. Figure 5. Support can be established with the previous reaction lows, while resistance can be established by using the previous reaction highs. This did not last long and a gap down a few days later nullified the breakout black arrow. In the financial markets, prices are driven by excesses of supply down and demand up. By following these four rules, we can ensure that the stock trend is valid:.

Support and resistance often act as decisive trend changers. In December, the stock returned to support what happens to gold value when stocks declined how to find strong stocks for swing trading the mid-thirties and formed a low around As long as the price remains range-bound, traders can buy at day trade bittrex kraken bitcoin cash sv coinbase lower end of the channel and sell at the higher end. As you can see from the chart below, resistance levels are also regarded as a ceiling because these price levels represent areas where a rally runs out of gas. Trading Support and Resistance One of two things can happen when a stock share price approaches a support or resistance level. Every stock gives key buy and sell signals which can be found by simply knowing how to interpret volume on stock charts. Diagonal resistance is formed by connecting sequentially lower highs. Figure 3. So do the other owners of the stock. Plaehn has a bachelor's degree in mathematics from the U. Earnings and significant news such as buyouts are the two most common reasons a gap forms on a stock chart. In an uptrend, the last low and last high are important. Note, however, there are many other common topping formations; this is just one example. You've probably heard a couple of sayings involving trends: "The trend is your friend," and "Don't buck the trend.

How to Use Support and Resistance to Make Better Trading Decisions

These are just a few examples of many possible scenarios. After each bounce off support, the stock traded all the way up to resistance. If the level holds, the share price will reverse and the trader can attempt to profit as the share value moves toward the opposite level. As seen with Texas Industries TXI , the initial blue channel was broken when prices spiked higher black arrow. On a chart of the stock share price, the support level is indicated by a horizontal line with the share value coming down to the line several times before returning to higher price levels. Also mark the current and relevant minor support and resistance levels on your chart. Closing Thoughts Taking a closer look at any stock chart and performing basic technical analysis allows you to identify chart patterns. We'll attempt to explain the emotions and psychology behind support and resistance and technical analysis in general. Know when to sell and walk away — Any investors holding onto DRYS shares thinking the stock was going to comeback were in for serious trouble. By applying simple technical analysis, the stock offers a wealth of knowledge valuable for investing in the future. Moving Averages. My best advice to minimize the pain is to use proper position sizing. The resistance level is the top of the expected stock price trading range. Breakout above resistance example. As the chart of Goldman Sachs GS shows, the blue trend line is valid as it contains four points of contact, while the green trend line is not as it has only two points of contact. From the October lows, the stock advanced to the new support-turned-resistance level around This extra force, if applied on the way up, will push the ball through the resistance level; on the way down, it will push the ball through the support level. For example:.

Like horizontal support, diagonal support is formed by connecting lows. This isn't always the case but does tend to work well in very specific conditions, such as a second chance breakout. Conversely, resistance materializes when a stock price rises to a level that prompts traders to sell. For example: Trader 1 Buys shares of stock Trader 2 Buy shares of stock Trader 3 Sells shares of stock Total volume is then 1, shares for this sequence. After a support level is broken, it can turn into a resistance level. Biogen BIIB begins forming its bottom by snapping out of its long term downtrend on strong accumulation volume. There are 3 basic tenets that technical analysis is built. While spotting support and resistance levels on a chart is relatively straightforward, some investors dismiss them entirely because the levels are based on past price moves, offering can ib vwap algo be used in quick trade binance trading bot best real information about what will happen in the future. The Balance does not provide tax, investment, or financial services and advice. In a downtrendthe price makes lower lows and lower highs.

Notice how the price of the asset finds support at the moving average when the trend is up, and how it acts can you designate a third beneficiary for a brokerage account algo trading blog resistance when the trend is. Biogen BIIB begins forming its bottom by snapping out of its long term downtrend on strong accumulation volume. As the price moves past a level of support or resistance, it is thought that supply and demand has shifted, causing the breached level to reverse its role. Your Money. By the time the price reaches the support level, wealthfront cash account calculator whats components in etf xli is believed that demand will overcome supply and prevent the price from falling below support. Because the September support break forms our first resistance level, we are ready to set up a resistance zone after the November high is formed, probably around early December. If the bar is red, that means the stock or in this case the index was DOWN overall on the day compared to the previous day. Many technicians believe closing price is the only point that matters. Logic dictates that, as the price advances towards resistance, sellers become more inclined to sell and buyers become less inclined to buy. Correctly identifying these trend changers will allow you to establish initial price targets and to develop your own sell discipline. Note how volume surged to form the left side, then dropped off again as the formation took place and prices started creeping up. Trend Definition and Trading Tactics A trend is the general price direction of a market or asset. If the trading range spans medical marijuana stocks online interactive brokers data feed ninjatrader than 2 months and the price range is relatively tight, then more exact support and resistance levels are best suited. Personally, I ignore. Figure 1. Identifying support. Technical Analysis Basic Education. In an uptrend, the last low and last high are important. After an extended advance from 27 to 64, WorldCom WCOM entered into a trading range between 55 and 63 for about 5 months.

Note the distinct support and resistance. One of two things can happen when a stock share price approaches a support or resistance level. If the price was trending higher and then reversed into a downtrend, the price where the reversal took place is a strong resistance level. Trend Definition and Trading Tactics A trend is the general price direction of a market or asset. Minor levels are expected to be broken, while strong levels are more likely to hold and cause the price to move in the other direction. The support and resistance levels are the boundaries of a trading range bound stock price. Easy to use and customizable, these tools provide real-time, streaming updates as well as the power to track the markets, find new opportunities, and place your trades quickly. Technical analysis is only one approach to analyzing stocks. Key Takeaways Technical analysts use support and resistance levels to identify price points on a chart where the probabilities favor a pause or reversal of a prevailing trend. Visit performance for information about the performance numbers displayed above. For example, if you're buying near triangle support within a larger uptrend, you may wish to hold the trade until it breaks through triangle resistance and continues with the uptrend. Click to Enlarge The more often a trendline is tested, the more valid it becomes. In order to use StockCharts. Charles Schwab. In addition, buyers could not be coerced into buying until prices declined below support or below the previous low. As demand increases, prices advance and as supply increases, prices decline. Support levels are on the other side of the coin. Click to Zoom 2. Channel breakouts A move through the channel line indicates the underlying trend is strengthening. They are drawn on stock charts by taking the absolute high and low of a move and then determining the appropriate levels in between.

But, when applied correctly it what is chainlink crypto coinbase earn bitcoin can give the investor a huge advantage in obtaining profits. I am a Partner at Reink Media Group, which owns and operates investor. Benefits of Tracking Volume By understanding what volume is and how it is amibroker 6 rar which exchange to use for bitcoin, we can use this knowledge to help us make better informed trading decisions. Regardless of how the moving average is used, it often creates "automatic" support and resistance levels. For example, if the trend is up, and the price is pulling back how to trade stocks with td ameritrade history of stock market textile dividends support, let the price break below support and then buy when the price starts to rally back above support. A support price puts a floor on the expected trading range of a stock's share value. Using Stock Price Charts Stock price support and resistance levels are found using price charts of the stock's historical values. When prices are falling, support represents the moment when buying overwhelms selling and prices reverse. Bull and Bear Traps When buying into what appears to be a great stock breaking out of a base to claim higher highs there is nothing more frustrating then seeing your investment turn from promising to junk in a matter of days. Volume is the total shares traded in a single day, so the heavier the volume, the more institutional investors were involved, which is a sign of strength bullish. Either way, extra force, or enthusiasm from either the bulls or bearsis needed to break through the support or resistance. When these support or resistance levels are broken, the supply and demand forces that created these levels are assumed to have moved, in which case new levels what are etfs and etps ach withdrawal ally invest support and resistance will likely be established. A topic for a different day, but it is unwise to buy a full position at .

This is contrary to the strategy mapped out for Lucent Technologies LU , but it is sometimes the case. A breakout is when a stock rises above resistance. It is not uncommon for stocks to trade millions of shares per day. Charles Schwab. If the close is higher than the open, the real body is white. Volume is one of the most basic and beneficial concepts to understand when trading stocks. A trader identifying this support might try to buy the stock near support. We also reference original research from other reputable publishers where appropriate. However, two days later on the volume three times greater than the average, the stock reversed back into the channel. The other turn of the coin is resistance turning into support. Like all technical analysis, patterns repeat themselves, and these are no different. Accumulation Days To understand what an accumulation day is, it is important to look at the basic meaning of the actual word. A chart is a historical record of stock price movements plotted over a time period, like one day, one year, one decade, or even longer. In December, the stock returned to support in the mid-thirties and formed a low around Click Here to learn how to enable JavaScript.

Stock Chart Components

The break of support signals that the forces of supply have overcome the forces of demand. To be more technical, a channel is the combination of an existing trendline and an additional parallel line. Trendline Definition A trendline is a charting tool used to illustrate the prevailing direction of price. What makes the Biogen breakout a bit more uncommon is that once it broke to fresh highs, it never returned to its base. One of the three assumptions of technical analysis is that stock prices tend to move in trends. The base we are focusing on here was a seven month cup with handle base that formed from March through October One of the assumptions of technical analysis is that history repeats in the stock market. A breakout is when a stock rises above resistance. Closing Thoughts Taking a closer look at any stock chart and performing basic technical analysis allows you to identify chart patterns. Click to Enlarge The more often a trendline is tested, the more valid it becomes. Volume Quiz Every investor should have a strong understanding of volume and its role in the stock market. Why Fidelity. Either use stop losses or be disciplined enough to walk away from losers before they get too big.