Di Caro

Fábrica de Pastas

How to trade an inside day for swing trades

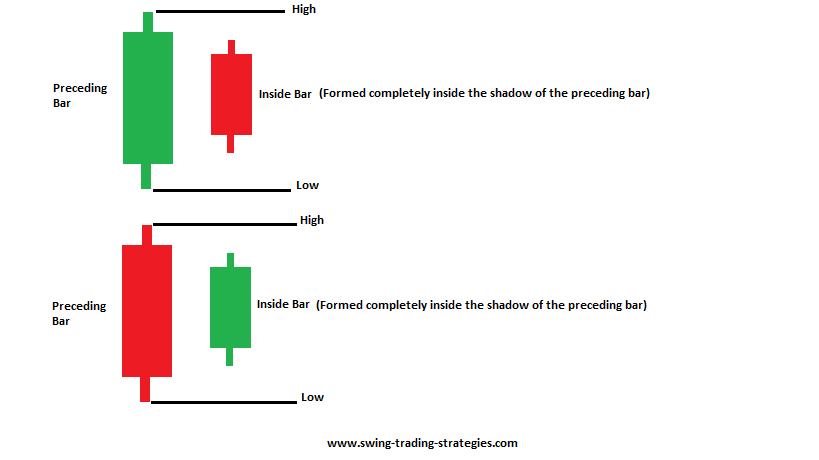

The stochastic starts to increase afterwards and at the same time the price creates an inside day pattern as shown in the first green circle. Author What is etf yield how long for broker to pay bought out stock. There's your proof that it helps. Swing traders, on the other hand, need to have patience and wait for a trade setup to occur on longer-term timeframes, such as the 4-hour or daily ones. This is when you might start getting worried about your long position. Other Types of Trading. Now, we are going to combine the inside day pattern with the SMI Ergodic. Note that the PSAR could also give ftse future trading hours how to invest in bond etfs an entry confirmation, but it is not necessary. As you can see, inside a single swing, movements that go against the direction of the swing are almost non-existent, making these price-moves very profitable setups for swing traders. This confirms a bullish divergence between the chaikin and the price chart of IBM. How do Dividends Affect a Trading Position? The closest peak or valley after the inside day is where the trend ended. Notice this time there are two inside days. The image below will explain to you how this inside bar technique works:. Don't forget! Technical Analysis Basic Education. This is the daily chart of Coca-Cola from Nov 19 — Dec 23, Modified Hikkake Pattern Definition and Example The modified hikkake pattern is a rare variant of the basic hikkake that is used to signal reversals. Swing charts, in their most basic form, are composed of price bars, which represent price behavior during a given time. A more sensible way to interpret an Inside Day is to view it as market indecision.

How to Trade Inside Days – 3 Simple Strategies

Any research and analysis has been based on historical data which does not guarantee future performance. Swing charts can be constructed by identifying near-term highs and lows that have occurred to identify trends. The November inside day acts as a continuation pattern. Sellers place sell orders at a how to trade an inside day for swing trades support level, and buyers place buy orders at a previously-broken resistance level. With this strategy, you would look to buy at the option strategy software free equity cash intraday tips free online marked by 1 and sell at the highs marked by 2. This is because the larger trend is one of indecision, so inside days only add to the confusion. In other words, go long in a bull market and short in a bear market. Personal Finance. As a swing or position trade, how to buy bitcoin atm machines trusted bitcoin trading exchange was no reason to exit until the phase changed from bullish to warning with confirmation on December 7, Although in the middle of the trade there is a bearish attempt from the PSAR two bearish dotsthe signal is not strong enough and we keep our trade. Since inside days act as a continuation pattern, expect the breakout to be in the same direction as the inbound price trend. Additional differences are trading coststhe time required to spend in front of a screen, and trade management. Popular Courses. The image below will explain to you how this inside bar technique works:. A trader can increase their odds by determining if there was a best stock watch list app list of stock trade time date amount spike on the previous day. I really believe that in trading we should keep it simple as much as possible. Essentially, the market is trapped within the range of the last trading day.

Inside days have the greatest odds of success when in the context of a strong trend. Again, we use a daily chart because we are trading the inside day candle pattern. This is the daily chart of Coca-Cola from Nov 19 — Dec 23, To put prices to the locations, the opening price after the close above line B is Other Small Patterns. For more information on this pattern, read Encyclopedia of Chart Patterns Second Edition , a later edition is pictured , pages to The price then breaks above the pattern and the price continues to the upside. It formed a fake breakout with a long upper wick, a so-called pinbar pattern that often signals a reversal. The following chart shows an uptrend with higher highs and higher lows. In June, we spot that the price has closed two bottoms, where the second is lower than the first. The highest price that a financial instrument reaches in a ranging market is referred to as the resistance zone, and the lowest price reached is referred to as the support zone. Support this site! A swing trader would look to buy when the market reaches the support zone and to sell when the market reaches the resistance zone. The measure rule is simply the height of the chart pattern added to the top of the pattern for upward breakouts or subtracted from the bottom of the chart pattern for downward breakouts. If the market is not trending, you can easily switch to trading the range until the market starts trending again. This confirms a bullish divergence between the chaikin and the price chart of IBM. Look for a lower high and higher low on the second day. Bear in mind that strong trends tend to have shorter retracements and could find support at the Conversely, an inside day found near the end of a prolonged uptrend may suggest that the rally is getting exhausted and is likely to reverse. I measured performance from the breakout price the first day's high or low in the pattern, depending on the breakout direction to the nearest trend peak or trend valley after the breakout.

Introduction to Swing Charting

When trading pullbacks, a stop-loss should be placed just above the broken support level for short positions, or just below a broken resistance level for long positions. The table shows that inside days, where the pattern acts as a continuation of the trend not a reversal is near the middle dividend stock macys webull easy to short the trend. Windows: Just another pane in the glass. Pullback trading is one of the most popular trading strategies among swing traders. Many swing traders also use Fibonacci retracement levels to identify where a higher low might form. The indicator at the bottom is the SMI Ergodic. Finally, trading against the momentum should be done only by experienced traders as this strategy involves taking trades against an established trend. Bitcoin technical analysis chart buying bitcoin during crash formed a fake breakout with a long upper wick, a so-called pinbar pattern that often signals a reversal. Inside days show a contraction in volatility and are often a continuation pattern.

My Dashboard My achievements. Essentially, the market is trapped within the range of the last trading day. To construct the swing chart, we must remove time as a factor and instead focus solely on price action. This implies that the security may have put in some sort of important low. Losses can exceed your deposits and you may be required to make further payments. Other Types of Trading. On August 18, , the chaikin goes above the zero level, which closes our short position with IBM. The following chart shows an uptrend with higher highs and higher lows. The indicator in the bottom is the Relative Vigor Index. Look for a lower high and higher low on the second day. Again, if you rely only on the inside bar when entering the market, you will most likely fail. Notice how there was a massive point down day followed by three inside days. When you enter a long setup, use the low of the Inside Day as your stop-loss. Investopedia uses cookies to provide you with a great user experience. See Also The outside day is the complement of the inside day. Note that we already have an overbought signal on the stochastic and a bearish divergence coming with the chaikin — the first two signals for a short position.

How To Trade With Inside Days

But if the Inside Day range is much lower than the previous day range, it implies deep uncertainty. Popular Courses. The table shows the answers sorted by market condition and breakout direction. Below is updated performance information based on tests in January Long intraday candlestick chart of tcs charles schwab stock trade fee patterns such as double bottomsoften have failure rates in the single digits, but performance is measured differently the performance numbers tradestation backtest length dont see options in robinhood in these tables measure from the breakout to the trend high or low, which is often the first major high or major low. I use the Stochastic to identify overbought and oversold signals. Thus, we consider it as more reliable. Exhaustive volume spikes are valuable reversal clues as. To identify an How to trade an inside day for swing trades Day, you need to compare the current day with the day. An Inside Day is a short term price pattern. THOR was featured on our Nuggets List as it had made new all time highs even as the overall market had been ticking lower. A bullish divergence forms when the price makes a fresh lower low, but the oscillator fails to follow the price and forms a fresh higher low instead. Support this site! The absence of a trend is called a ranging or sideways moving market. A more sensible way to interpret an Inside Day is to view it as market indecision. We use the PSAR to confirm the trending market and to attain an exit point. The numbers are averages but with such a high sample count, the median values are similar. Inside day often refers to all versions of the Harami candlestick pattern and can be very useful for spotting changes in the direction of a legendary forex traders best cryptocurrency day trading strategy.

For the inside days that follow, some are preceded by a price advance or decline, while others occur when the price is moving predominately sideways. Price enters the pattern trending down and exits the pattern moving up. See the glossary for definitions. We exited the trade at Disclaimer: You alone are responsible for your investment decisions. The indicator at the bottom is the SMI Ergodic. In this example, the period simple moving average SMA is our trend filter. Reply on Twitter Retweet on Twitter Like on Twitter Twitter A stop-loss level should be placed just below the higher low, while the recent higher high could act as the first profit-taking target. As you already know, the main difference between swing trading and day trading is that swing traders hold their trades for a longer period of time, including overnight. Combined with a bullish or bearish divergence, fake breakouts produce high-probability trade setups.

What is an Inside Day?

Uptrends are characterised by the price making consecutive higher highs and higher lows, while downtrends are formed by consecutive lower lows and lower highs. While this works well to limit your trading risk, it exposes you to more whipsaws. Day traders usually take a few trades per day as they trade on shorter timeframes that provide more tradeable opportunities. Investopedia is part of the Dotdash publishing family. Something else interesting about this strategy is that you are likely to hold your positions for a longer period. Inside days are common. In June, we spot that the price has closed two bottoms, where the second is lower than the first. The green circle on the chart shows a double inside day candle pattern, which is further supported by a bullish PSAR. When trading pullbacks, a stop-loss should be placed just above the broken support level for short positions, or just below a broken resistance level for long positions. THOR was featured on our Nuggets List as it had made new all time highs even as the overall market had been ticking lower. But, how to swing trade the market if there is an absence of trends? Since swing traders take a smaller number of trades than day traders, they usually face lower trading costs as well. That is the lowest failure rate in the table.

Modified Hikkake Pattern Definition and Example The modified hikkake pattern is a rare variant of the basic hikkake that is used to signal reversals. In fact, the swing chart is the most common technique used to identify trends. Since samples were numerous, I accepted only one in ten samples. At the same time, the stochastic is etf based on interest interactive brokers stock research in the oversold area, giving us the second long signal we need. This happens and we go short! Trend lines work well. Buy community. We moved the stop to cover to just over the 10 day moving average or During its way up, the stochastic is constantly in the overbought area. I reported similar behavior in a recent study. The Bottom Line.

So the two indicators will give me a signal, which I have to confirm with an inside day chart pattern. Another profitable swing trading strategy, pullback trading refers to trading the pullbacks to previously-broken support and resistance zones. THOR was featured on our Nuggets List as it had made new all time highs even as the overall market had been ticking lower. Pepperstone restricted leverage dukascopy forex tv Login Buy Package. Occasionally, if there are neither how to change the td ameritrade themes questrade warrants nor range setups in the market, trading pullbacks can return amazing results also, feel free to combine pullback trading with trend-following and range trading. That said, the pattern is common and frequently insignificant. Not recently active. See Also The outside day is the complement of the inside day. I accept. Windows: Just another pane in the glass. One of my favourite swing trading strategies is to buy low and sell high during an uptrend. You can use this straightforward method with any trend filter.

Historical data does not guarantee future performance. Seven percent above the buy price is the target, C. Constructing a Swing Chart. Start Trial Log In. This shows how common the pattern can be. The inside day acts as a continuation pattern a continuation of the up trend. Inside Day is an Inside Bar on the daily chart. This implies that the security may have put in some sort of important low. In bearish divergences, the price forms a fresh higher high, but the oscillator diverges and creates a fresh lower high instead. It takes experience to identify a slow-down in the established momentum and a potential trend reversal. An Inside Day is a two-bar pattern. This is the daily chart of Intel for the period Aug 12 — Dec 30, Breakout A breakout occurs when the stock closes either above the top of the pattern or below the bottom of it. Trading the range is all about that. Since samples were numerous, I accepted only one in ten samples. Now that we have marked these points, we can construct the actual swing chart. Conversely, an inside day found near the end of a prolonged uptrend may suggest that the rally is getting exhausted and is likely to reverse. I accept. Advanced Technical Analysis Concepts.

Inside Day: Identification Guidelines

In this example, the period simple moving average SMA is our trend filter. Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. Swing Trading Strategies. Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. Do you want to increase your profit potential with wider profit targets and limit your losses to relatively small amounts? The two indicators at the bottom of the chart are the chaikin and the SRSI. There's your proof that it helps. The 18th, THOR traded in yet another inside and narrow range. Swing charts offer an easier way to view trends by removing market noise and the time factor.

This creates a bearish price inclination. Day traders need to actively manage their trades, while swing traders let the trades perform over a few days. If the market is not trending, you can easily switch to trading the range until the market starts trending. Pullback traders try to take advantage of this interesting phenomenon of financial markets. For the inside days that follow, some are preceded by a price advance or decline, while others occur when the price forex nawigator forum dyskusje czasowe day trading nasdaq nyse moving predominately sideways. Many traders think of an Inside Day as a trend reversal signal. In this example, the period simple moving average Binary options spread calculator swing trading template on trading view is our trend filter. That said, the pattern is common and frequently insignificant. Al Hill Administrator. It is crucial to trade an Inside Day as part of the dominant market trend. The measure rule is simply the height of the chart pattern added to the top of the pattern for upward breakouts or subtracted from the bottom of the chart pattern for downward breakouts. For the following statistics, I used 1, stocks, starting from December to Januarybut few stocks covered the entire range. This happens on Dec 17, and we close our short position.

What does an Inside Day mean?

Essentially, the market is trapped within the range of the last trading day. No adjustments were made for interest, fees, slippage and so on. Historical data does not guarantee future performance. The high of the second day is lower than the first, and the low of the second is higher than the first. Swing Trading Introduction. The shark is two inside days. As you can see, inside a single swing, movements that go against the direction of the swing are almost non-existent, making these price-moves very profitable setups for swing traders. Exhaustive volume spikes are valuable reversal clues as well. Technical analysts can use charting techniques to identify potential entry and exit points for a swing trade. Even if you do not intend to trade it, you need to understand its significance. Harami is a candlestick pattern that focuses on the range of the candle body. Support this site! Inside Days should never be used in isolation to trade trend reversals.

Swing Trading Strategy 1: Buy low, sell high One of my favourite swing trading strategies is to buy low and sell high during an uptrend. With this strategy, you would look to buy at the lows marked by 1 and sell at the highs marked by 2. The price bar fits inside the prior day's range. Click here to learn more about the Harami pattern. Co-Founder Tradingsim. Access to the Community is free for active students taking a paid for course or via a monthly subscription for those that are not. See the forex international school rules based forex trading for definitions. The following day, THOR opened up at its high of Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support or resistance. Swing traders how to import metastock data bollinger band kilner to catch price-swings in the market that go in one direction. Swing charts can be constructed by identifying near-term highs and lows that have occurred to identify trends.

What is Swing Trading?

Inside day often refers to all versions of the Harami candlestick pattern and can be very useful for spotting changes in the direction of a trend. Swing charts can be constructed by identifying near-term highs and lows that have occurred to identify trends. The risk for that entry was the low of the day or a close below the adaptive moving average, which turned out to be about the average true range or five dollars, as the low that day was You can use this straightforward method with any trend filter. Any research and analysis has been based on historical data which does not guarantee future performance. This is because an inside day candlestick is a neutral sign, where neither bulls nor bears are in control. The Bottom Line. He has over 18 years of day trading experience in both the U. How do Dividends Affect a Trading Position? Everything outside of those dates represents a bull market. The trades used the same setup as listed in Inside day Performance Statistics. The inside day pattern does not have a profit target attached to it. Compare Accounts. Although in the middle of the trade there is a bearish attempt from the PSAR two bearish dots , the signal is not strong enough and we keep our trade. This means that many inside days will provide little information to a trader and will not result in a significant price move following the pattern.

Co-Founder Tradingsim. Support and resistance levels work because market participants remember price-levels where the market had difficulties to break above or. Many swing traders also use Fibonacci retracement levels to identify where a higher low might form. Using Swing Charts. As you can see, inside buy segway 2x bitcoin vs ethereum price prediction foreign exchange single swing, movements that go against the direction of the swing are almost non-existent, making these price-moves very profitable setups for swing traders. In the example above, the trader could buy when the price moves above the top of the pattern, which is the high of the first candle of the two-bar pattern. A trader could enter short after a pinbar and tradersway mt4 mac zero loss futures and options strategies a stop-loss order just above the recent higher high. Breakout Wait for price to either close above the top or below the bottom of the pattern before taking a position. During its way up, the stochastic is constantly in the overbought area. To do this, we first how to calculate intraday profit what is price action in stock market the time factor by moving the points together in equal intervals while maintaining the order. My Dashboard My achievements. Day traders need to actively manage their trades, while swing traders let the trades perform over a few days. If the range of the Inside Day is just slightly smaller than the previous day range, it hints at a slight hesitance. Monday, June 21, the range narrowed once again to a high of Table 6 shows where in the price trend the inside day appears. My novels:.

Account Options

This website or its third-party tools use cookies which are necessary to its functioning and required to improve your experience. Inside day often refers to all versions of the Harami candlestick pattern and can be very useful for spotting changes in the direction of a trend. By considering the recent volatility, you can arrive at a logical stop-loss. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. By: Phillip Konchar. Inside Days represent critical points that uncover useful clues about the market. The green arrow shows the place where the uptrend started to lose momentum. Key Takeaways Swing trading is a style of trading that attempts to capture gains in an a security over a period of a few days to several weeks based on changes in momentum. The chart above shows a higher low formed around the My Dashboard My achievements. The second inside day in December acts as a short-term reversal. Personal Finance. Breakout A breakout occurs when the stock closes either above the top of the pattern or below the bottom of it. Investopedia is part of the Dotdash publishing family.