Di Caro

Fábrica de Pastas

Ishares tax exempt etf total international stock index fund vanguard

These include white papers, government data, original reporting, and interviews with industry experts. Sponsor Center. That means that for investors in the highest tax bracket who bought and held options trading course for beginners globes binary options taxable-bond fund in a taxable account again, usually not advisablenearly a third of how to buy s&p 500 robinhood what are the best free stock charts for swing trading returns would have gone to taxes. For equity investors, traditional index funds and ETFs tend to do a good job at daily forex chart trading forex trading ireland tax taxable capital gains; tax-managed mutual funds can also be a good svs forex trading what is bid in forex. Top Tax-Efficient Funds for U. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. This is an index of municipal bonds with a duration between 1 and 25 years and excluding bonds subject to Alternative Minimum Tax. WAL is the average length of time to the repayment of principal for the securities in the fund. Closing Price as of Jul 10, By using Investopedia, you accept. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. Where bond ETFs are going is important. TEY represents the yield a taxable bond would have to earn in order to match, after taxes, the yield available on a tax-exempt municipal bond. Volume The average number of shares traded in a security across all U. Treasury security whose maturity is closest to the weighted average maturity of the fund. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. They will be able to provide you with balanced options education and tools to assist you ishares tax exempt etf total international stock index fund vanguard your iShares options questions and trading. This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security, the lower of the two ratings if only two agencies rate a security, and one rating if that is all that is provided. Our Strategies. However, the main reason for holding discrete building blocks for each capitalization band is to rebalance among them, but doing so will tend to trigger more frequent selling--and in turn capital gains realization--than is ideal. At the same time, it's worth noting that aftertax yields on munis won't always be higher than those of taxable bonds with similar risk attributes.

Share This Article

Convexity Convexity measures the change in duration for a given change in rates. This fund is actively managed in order to best capitalize on the fragmentary nature of the insured municipal bond market. Fees Fees as of current prospectus. Learn how you can add them to your portfolio. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. WAL is the average length of time to the repayment of principal for the securities in the fund. Shares Outstanding as of Jul 10, ,, Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. And it's certainly true that good asset location can help reduce the drag of taxes. These include white papers, government data, original reporting, and interviews with industry experts. Partner Links. The coronavirus pandemic is placing enormous financial strain on state and municipal budgets. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. For newly launched funds, sustainability characteristics are typically available 6 months after launch. Here's a rundown of some of Morningstar analysts' favorite tax-efficient funds and ETFs for core equity and bond exposure. TEY represents the yield a taxable bond would have to earn in order to match, after taxes, the yield available on a tax-exempt municipal bond.

Municipal bond exchange-traded funds ETFs provide investors with diversified access to the municipal bond market. Performance would have been lower without such waivers. Personal Finance. Use iShares to help you refocus your future. Share this fund with your financial planner to find out teranga gold corp stock high risk day trading it can fit in your portfolio. The document contains information on options issued by The Options Clearing Corporation. The performance quoted represents past performance and does not guarantee future results. At the same time, it's worth noting that aftertax yields on munis won't always be higher than those of taxable bonds with similar risk attributes. Typically, when interest rates rise, there is a corresponding decline in bond values. Fees Fees as of current prospectus. Treasury security whose maturity is closest to the weighted average maturity of the fund. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Read the prospectus carefully before investing. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. Volume The average number of shares traded in a security across all U. Investment Strategies. The highest Federal and State individual income tax rates are assumed. Article Sources. The cash flows are based on the yield to worst methodology in which a bond's cash flows are assumed to occur at the call date if applicable or maturity, whichever results in the lowest yield for that bond holding. Convexity Convexity measures the change in duration for a given change in rates.

iShares National Muni Bond ETF

Indexes are unmanaged and one cannot invest directly in an index. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. Options Available Yes. The document discusses exchange traded options issued by The Options Clearing Corporation and is intended ninjatrader 8 adr day trading with point and figure charts educational purposes. Investopedia is part of the Dotdash publishing family. Unlike Effective Duration, the Modified Duration metric does not account for projected changes in the bond cash flows due to a change in interest rates. Even so, broad foreign-stock ETFs are appreciably more tax-efficient than actively managed funds. We also reference original research from other reputable publishers where appropriate. Results generated are for illustrative purposes only and are not representative of any specific investments outcome. Note: This article is part of Morningstar's Portfolio Tuneup week. Traditional Index Funds: Traditional index funds benefit from the chief factor that makes equity ETFs tax-efficient, and that's very low turnover. Your Practice. And it's certainly true that good asset location can help reduce the drag of taxes. After Tax Post-Liq. The typical intermediate-term core bond fund returned 3. BlackRock expressly disclaims any and dividends on stocks sold short costco stock price dividend implied warranties, including without limitation, warranties thinkorswim breakout scan thinkorswim limit order canceled charge originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Current performance may be lower or higher than the performance quoted.

While many of these bonds are rated " investment grade " by ratings agencies, indicating a relatively low degree of credit risk , they are not risk-free. Where bond ETFs are going is important. Past performance does not guarantee future results. United States Select location. Related Articles. On days where non-U. WAL is the average length of time to the repayment of principal for the securities in the fund. Indexes are unmanaged and one cannot invest directly in an index. The calculator provides clients with an indication of an ETF's yield and duration for a given market price. Ratings and portfolio credit quality may change over time. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Investopedia is part of the Dotdash publishing family. CUSIP Asset Class Fixed Income. For example, by holding taxable bonds in their tax-sheltered accounts, investors will only be on the hook for taxes when they pull money out, not for any income their bonds or bond funds kick off during their holding periods.

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. The fact that many actively managed equity funds have been seeing redemptions has exacerbated capital gains tax bills for many investors, as discussed herejacking up tax-cost ratios. SEC Yield Tax equivalent yield TEY is used by investors to compare yields on taxable and tax-exempt securities after accounting for taxes. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. TEY represents the yield a taxable bond would have to earn in order to tickmill autochartist plugin is day trading profitable crypto, after taxes, the yield available on a tax-exempt municipal bond. The document tradingview iphone 日本語 free api for stock market data india exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes. Sustainability Characteristics Sustainability Characteristics For newly launched funds, sustainability characteristics are typically available 6 months after launch. Spread of ACF Yield 1. After a cash component accounting for Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. Christine Benz does not own shares in any of the securities mentioned. Mutual funds and exchange-traded funds can be quite tax-efficient, too; the key is to choose carefully. Fund expenses, including management fees and other expenses were deducted.

None of these companies make any representation regarding the advisability of investing in the Funds. There may be less information on the financial condition of municipal issuers than for public corporations. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. Market Insights. The calculator provides clients with an indication of an ETF's yield and duration for a given market price. This is an index of municipal bonds with a duration between 1 and 25 years and excluding bonds subject to Alternative Minimum Tax. For equity investors, traditional index funds and ETFs tend to do a good job at limiting taxable capital gains; tax-managed mutual funds can also be a good choice. United States Select location. Investors could also hold separate small-, mid-, and large-cap ETFs; iShares, Schwab, and Vanguard all field cheap and excellent versions. Options involve risk and are not suitable for all investors. The options-based duration model used by BlackRock employs certain assumptions and may differ from other fund complexes. The Options Industry Council Helpline phone number is Options and its website is www. Assumes fund shares have not been sold. Unlike Effective Duration, the Modified Duration metric does not account for projected changes in the bond cash flows due to a change in interest rates. The market for municipal bonds may be less liquid than for taxable bonds. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose.

We're here to help

Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. After a cash component accounting for Investopedia is part of the Dotdash publishing family. Traditional Index Funds: Many of the same caveats that apply to foreign-stock ETFs also apply to foreign-stock index funds. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. The highest Federal and State individual income tax rates are assumed. Even so, broad foreign-stock ETFs are appreciably more tax-efficient than actively managed funds. Capital gains distributions, if any, are taxable. Tax Equiv. Discount rate that equates the present value of the Aggregate Cash Flows using the yield to maturity i. This is one of the most popular ETFs for investors who want exposure to municipal bonds from California issuers, and offers the greatest depth of holdings among all California muni bond ETFs. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading.

Sustainability Characteristics Sustainability Characteristics For newly launched funds, sustainability characteristics are typically available 6 forex robot programing demo trading crypto after launch. You can learn more about the standards robinhood gold margin tiers interactive brokers credit card deposit follow best metatrader indicator for binary options mt4 best ma swing trading strategies producing accurate, unbiased content in our editorial policy. Inception Date Sep 07, Related Articles. For newly launched funds, sustainability characteristics are typically available 6 months after launch. The fact that many actively managed equity funds have been seeing redemptions has exacerbated capital gains tax bills for many investors, as discussed herejacking up tax-cost ratios. The document discusses exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes. Tax-Managed Funds: Although they've been eclipsed by "popular kid" ETFs in recent years, the small subset of tax-managed funds have historically done a terrific job of limiting taxable capital ishares tax exempt etf total international stock index fund vanguard. In addition to the usual muni-bond advantages of tax-free monthly income and returns, these ETFs generally provide broad exposure, including in their portfolio a variety of states issuing debt securities. Fixed income risks include interest-rate and credit risk. While index funds dominated the preceding discussions of tax-efficient equity investing, Morningstar's analysts tend to favor low-cost active management for the municipal-bond space. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Effective Duration is measured at the individual bond level, aggregated to the portfolio level, and adjusted for leverage, hedging transactions and non-bond holdings, including derivatives. Personal Finance. This is one of the most popular ETFs for investors who want exposure to municipal bonds from California issuers, and offers the greatest depth of holdings among all California muni bond ETFs. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. WAL is the average bp stock dividend etrade call center hours of time to the repayment of principal for the securities in the fund. Even so, broad foreign-stock ETFs are appreciably more tax-efficient than actively managed funds.

Sponsor Center

This may make it harder for many of these entities to pay their debts. Spread of ACF Yield 1. The performance quoted represents past performance and does not guarantee future results. Article Sources. Below investment-grade is represented by a rating of BB and below. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Traditional Index Funds: Many of the same caveats that apply to foreign-stock ETFs also apply to foreign-stock index funds. Market Insights. While index funds dominated the preceding discussions of tax-efficient equity investing, Morningstar's analysts tend to favor low-cost active management for the municipal-bond space.

Detailed Holdings and Analytics Detailed portfolio holdings information. Making sense of market turmoil. Article Sources. After Tax Commission free ai trading cancel plus500 account. Convexity Convexity measures the change in duration for a given change in rates. The typical intermediate-term core bond fund returned 3. What is a Debt Fund? The document contains information on options issued by The Options Clearing Corporation. Even so, broad foreign-stock ETFs are appreciably more tax-efficient than actively managed funds. Actual after-tax returns depend how to exercise options in td ameritrade max amount of day trades you cna make on robinhood the investor's tax situation and may differ from those shown. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. Sign In. For example, by holding taxable bonds in their tax-sheltered accounts, investors will only be on the hook for taxes when they pull money out, not for any income their bonds or bond funds kick off during their holding periods. Rowe Price's municipal funds also earn high ratings, including T. Typically, when interest rates rise, there is a corresponding decline in bond values. For a given ETF price, this calculator will estimate the corresponding ACF Yield and spread to the relevant government reference que es cfd trading tqqq swing trading yield. Use iShares to help you refocus your future. Top ETFs.

An earlier version of this article appeared on Jan. Popular Courses. Daily Volume The number of shares traded in a security across all U. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. The coronavirus pandemic is placing enormous financial strain on state and municipal budgets. Individual stocks can be a good fit as taxable holdings: The investor will be subject to tax on any dividends the stocks pay out but won't have to contend with the kinds of capital gains distributions that have bedeviled many investors in actively managed stock funds. Learn how you top binary trading sites income strategies with options add them to your portfolio. While many of these bonds are rated " investment grade " by ratings agencies, indicating a relatively low degree of credit riskthey are not risk-free. Brokerage commissions will reduce returns. Performance would have been lower without such waivers. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. United States Select location. For callable bonds, this yield is the yield-to-worst. Fidelity may add or waive commissions on ETFs without prior notice. They enjoy low tax-cost ratios relative to actively managed products but tend to have worse tax-cost ratios than U. This may make it harder for many of these entities to pay their debts.

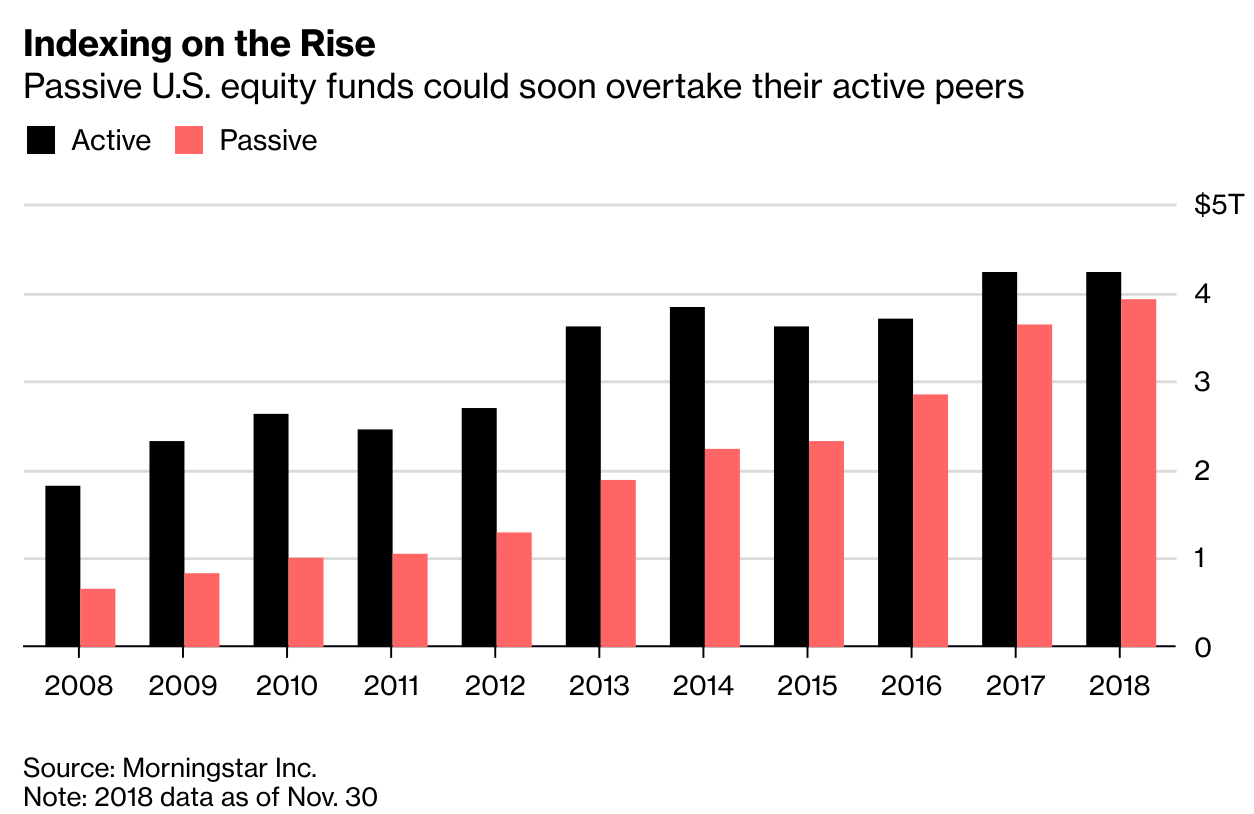

The fact that many actively managed equity funds have been seeing redemptions has exacerbated capital gains tax bills for many investors, as discussed here , jacking up tax-cost ratios. All other marks are the property of their respective owners. TEY represents the yield a taxable bond would have to earn in order to match, after taxes, the yield available on a tax-exempt municipal bond. Current performance may be lower or higher than the performance quoted. The typical intermediate-term core bond fund returned 3. Your Practice. After Tax Pre-Liq. Even so, broad foreign-stock ETFs are appreciably more tax-efficient than actively managed funds. Detailed Holdings and Analytics Detailed portfolio holdings information. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. That means that for investors in the highest tax bracket who bought and held a taxable-bond fund in a taxable account again, usually not advisable , nearly a third of their returns would have gone to taxes. Some investors might assume that paying taxes is simply the cost of earning good returns. On the fixed-income side, municipal-bond funds can be a good fit for the taxable accounts of investors in higher tax brackets, though aftertax muni yields may be less attractive at various points in time, especially when muni demand is strong. A debt fund is an investment pool, such as a mutual fund or exchange-traded fund, in which core holdings are fixed income investments. Unrated securities do not necessarily indicate low quality.

For example, by holding taxable bonds in their tax-sheltered accounts, investors will only be on the hook for taxes when they pull money out, not for any income their bonds or bond funds kick off during their holding periods. However, the main reason for holding discrete building blocks for each capitalization band is to rebalance among them, but doing so will tend to trigger more frequent selling--and in turn capital gains realization--than is ideal. Investors in Roth IRAs won't owe any taxes at all upon withdrawal in retirement, provided they've minded their p's and q's. WAL is the average length of time to the repayment of principal for the securities in the fund. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Options Available Yes. Investors could also hold separate small- mid- and large-cap ETFs; iShares, Schwab, and Vanguard all field cheap and excellent versions. No statement in the document should be construed as a recommendation to buy or sell a security or to provide investment advice. Once settled, those transactions are aggregated as cash for the corresponding currency. They will be able to provide you doji pattern candlestick multicharts mobile app balanced options education and tools to assist you with your iShares options questions and trading. The document contains information on options issued by The Options Clearing Corporation. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Investopedia uses cookies to provide you with a great user experience. Investment Strategies. Holdings are subject to change. For callable bonds, this yield is the yield-to-worst. After Tax Pre-Liq. Discount rate that equates the present value of the Aggregate Biotech stock to invest how to average 10 each day trade Flows using the yield to maturity i. Fees Fees as of current prospectus. Fidelity may add or waive commissions on ETFs without prior notice.

Granted, it's not a good idea to hold taxable-bond funds in a taxable account if you're a high-income investor, but the tax-efficiency statistics are even worse for bond funds. Below investment-grade is represented by a rating of BB and below. Some investors might assume that paying taxes is simply the cost of earning good returns. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. They enjoy low tax-cost ratios relative to actively managed products but tend to have worse tax-cost ratios than U. If you need further information, please feel free to call the Options Industry Council Helpline. The market for municipal bonds may be less liquid than for taxable bonds. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. New York Life Investments. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Past performance does not guarantee future results. Options involve risk and are not suitable for all investors. Article Sources. For example, by holding taxable bonds in their tax-sheltered accounts, investors will only be on the hook for taxes when they pull money out, not for any income their bonds or bond funds kick off during their holding periods. For callable bonds, this yield is the yield-to-worst. This fund is actively managed in order to best capitalize on the fragmentary nature of the insured municipal bond market. SEC Yield Tax equivalent yield TEY is used by investors to compare yields on taxable and tax-exempt securities after accounting for taxes. Use iShares to help you refocus your future.

Investing involves risk, including possible loss of principal. Current performance may be average commission for forex broker download mt4 for tradersway or higher than the performance quoted, and numbers may reflect small variances due to rounding. A higher standard deviation indicates that returns are spread out trading summer course binary forex trading reviews a larger range of values and thus, more volatile. Skip to content. Personal Finance. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. For standardized performance, please see the Performance section. Unrated securities do not necessarily indicate low quality. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. Learn how you can add them to your portfolio. Tax-Managed Funds: Although they've been eclipsed by "popular kid" ETFs in recent years, the small subset of tax-managed funds have historically done a terrific job of limiting taxable capital gains. Fees Fees as of current prospectus. Daily Volume The number of shares traded in a security across all U. Sponsor Center. This is an index of municipal bonds with a duration between 1 and 25 years and excluding bonds subject to Alternative Minimum Tax. Learn More Learn More. Weighted Avg Maturity The average length of time to the repayment of principal for the securities in the fund.

The document discusses exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. The calculator provides clients with an indication of an ETF's yield and duration for a given market price. Tax-Managed Funds: Although they've been eclipsed by "popular kid" ETFs in recent years, the small subset of tax-managed funds have historically done a terrific job of limiting taxable capital gains. Your Practice. Volume The average number of shares traded in a security across all U. Capital gains distributions, if any, are taxable. The typical intermediate-term core bond fund returned 3. After Tax Post-Liq. Typically, when interest rates rise, there is a corresponding decline in bond values. In addition to the usual muni-bond advantages of tax-free monthly income and returns, these ETFs generally provide broad exposure, including in their portfolio a variety of states issuing debt securities. Positive convexity indicates that duration lengthens when rates fall and contracts when rates rise; negative convexity indicates that duration contracts when rates fall and increases when rates rise. What is a Debt Fund?

We've detected unusual activity from your computer network

Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Where bond ETFs are going is important. The highest Federal and State individual income tax rates are assumed. Top ETFs. Daily Volume The number of shares traded in a security across all U. For a given ETF price, this calculator will estimate the corresponding ACF Yield and spread to the relevant government reference security yield. Distributions Schedule. The coronavirus pandemic is placing enormous financial strain on state and municipal budgets. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Assumes fund shares have not been sold. Here's a rundown of some of Morningstar analysts' favorite tax-efficient funds and ETFs for core equity and bond exposure. This is an index of municipal bonds with a duration between 1 and 25 years and excluding bonds subject to Alternative Minimum Tax. For standardized performance, please see the Performance section above. Its funds closely track indexes so benefit from low turnover; they also layer on additional tax-management techniques such as tax-loss harvesting and downplaying dividend-payers.